Professional Documents

Culture Documents

Ts Grewal Class 12 Volume 3

Ts Grewal Class 12 Volume 3

Uploaded by

sakshi50%(4)50% found this document useful (4 votes)

3K views448 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

50%(4)50% found this document useful (4 votes)

3K views448 pagesTs Grewal Class 12 Volume 3

Ts Grewal Class 12 Volume 3

Uploaded by

sakshiCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 448

© Statement of Profit and Loss

© Format of Statement of Profit and Loss

© Explanation of Heads and Contents of Statement of Profit and Loss

© Objectives of Financial Statements

© Essentials of Financial Statements

© Parties Interested in Financial Statements or Users of Financial Statements

© Limitations of Financial Statements

OT

accounting standards. Section 129 of the Companies Act, 2013 prescribes that Balance

Sheet and Profit and Loss Account (Statement of Profit and Loss) are prepared im form

prescribed in Schedule III of the Companies Act, 2013. A set of financial statements as per:

Section 2(40) of the Companies Act, 2013 includes:

1. Balance Sheet: It is a statement of Assets, Liabilities and Equity (i.e, Shareholders’

1 given date. It shows the financial position of a business

Funds) of the company a

and liabilities. It is also known as Position Statement:

by detailing its assets, equity

2. Profit and Loss Account: It shows the financial performance, i.e., result of business operation

during an accounting period. It is described as Statement of Profit and Loss in Part)

of Schedule III of the Companies Act, 2013 and is also known as Income Statement:

Balance Sheet and Statement of Profit and Loss are supported by i

n the Balance Sheet and Statement of Profit and Loss

t nt prepared in accordance with AS-3, Cash Fle

4. Cash Flow Statement: It is a statemer

Statement, to show inflows and outflows of Cash and Cash Equivalents:

3. Notes to Accounts:

notes giving det

lal Statements of a Company

Accounting Concepts: Pinancial Statements are prepared by following, the aves

concepts. For example, under the Going Concern Concept, it is assumed thal

business shall continue for a foreseeable future, i.c., indefinitely. Fixed

are shown in the Balance Sheet at their historical value ri than their market

value. The use of accounting concepts also makes the financial statements reliable,

understandable and comparable.

(ie) Accounting Standards; Accounting standards prescribed in the Companies Act, 2019

are mandatory in nature and are the guidelines for preparing the financial statements.

They are followed by the companies. If they are not followed, the financial statements

do not give a true and fair view.

(0) Selection of Accounting Policies: Selection of Accounting Policies have important

bearing on financial statements. For example, the choice of selecting a method of

depreciation (Straight Line Method or Written Down Value Method) lies with the

management which has a bearing on financial performance and position. Another

example is selection of a method of inventory valuation (Weighted Average or LIFO).

(vi) Estimates: Estimates are necessary for preparing, the financial statements and have

a bearing on the financial statements. For example, useful life of a fixed asset is

estimated to provide depreciation, estimating expenses to make provision, etc.

(vii) Source of Financial Information: Financial Statements are the source of financial

information on the basis of which conclusions are drawn about the profitability

and the financial position of a company.

annual report of a company, as per law, should disclose the prescribed information to

ble the users to make informed judgments and decisions. The information is disclosed

n the Financial Statements, Board Report and by a separate statement being, part of the

ual report.

set of Annual Report of a company has:

. A Report by the Board of Directors containing: Report in terms of Section 134 of

the Companies Act, 2013; Directors’ Responsibility Statement; Report on Corporate

Governance; and Management Discussion and Analysis.

Auditors’ Report to the Shareholders.

Financial Statements:

(i) Balance Sheet as at the end of the financial year;

(ii) Statement of Profit and Loss for the year ended;

(iii) Note to Accounts; and

" (iv) Cash Flow Statement.

Notes to Accounts has different parts as follows:

(Accounting Policies followed by the company;

- (ii) Details of line items in Balance Sheet and Statement o

‘Reserves and Surplus

‘Money Received against Share Warrants

2. Share Application Money Pending Allotment

3. Non-Current Liabilities

(a) Long-term Borrowings

(b) Deferred Tax Liabilities (Net)

(€) Other Long-term Liabilities

(d) Long-term Provisions

4. Current Liabilities

(a) Short-term Borrowings

(0) Trade Payables

(€) Other Current Liabilities

(d) Short-term Provisions

Total

Ml. ASSETS

1, Non-Current Assets

(0) Fixed Assets

(i) Tangible Assets

(id) Intangible Assets

(i) Capital Work-in-Progress

(iv) Intangible Assets under Development

(6) Non-current investments

(€)_ Deferred Tax Assets (Net

(d) Long-term Loans and Advances

(e) Other Non-current Assets

2. Current Assets

(@) Current Investments

(6) Inventories

(c). Trade Receivables

(@) Cash and Cash Equivalents

(e) Short-term Loans and Advances

(f) Other Current Assets

‘Authorised Capital

1,00,000 Equity Shares of % 10 each

10,000 Preference Shares of & 100 each

Issued Capital

90,000 Equity Shares of & 10 each

9,000; 99% Preference Shares* of € 100 each

Subscribed Capital

Subscribed and Fully Paid-up

80,000 Equity Shares of & 10 each

Subscribed but Not Fully Paid-up

10,000 Equity Shares of 10 each

Less: Calls-in-Arrears (10,000 x & 3)

9,000; 9% Preference Share

Less: Calls-in-Arrears (500

Total (To be shown against’Share Capital’)

of & 100 each, 90 called-up

710)

means dividend on Preference Shares

*The use of 9%’ before Preference Shar

paid @ 99

een made to two terms, i.e. “Called-up” and ”

Tn the above discussion ference

Called-ur

Calle

share capital. For example

%10 each against which the compz

In this case, 10,00,000 (7.e., 2,00,000 x & 5) is the Called-up Capital.

| by the company to be paid by the shareholder

company’s Subscribed Capital is 2,00,000 Equity's

y has called % 5 per share to be paid by the SI

p Capital me

d ‘Share Capital Account witho

example, company purchases machinery ‘of % 10,00,000,

to the vendor, The company will credit % 10,00,000 to Share

‘a company reissues forfeited shares at a discount (say % 3 per

credit the amount of discount ( 3 per share) to Share Capital

ies Act, 2013]

Share Capital” or “Share Capital Paid-up” means ©

up as is equivalent to the amount received |

‘0 includes any amount credited as pai j-up it

mount received in respe

as paid

shares issued and als

a company, but does not include any other ar

by whatever name called:

Calls-in-Arrears

ount not received by the company’ against tl

called-up by it towards share capital. Shares against which the calls ar

are shown under “Subscribed but not fully paid-up” at the amount receivec

company against those shares. For example, DBH International Ltd. issued 1,

Equity Shares of ~ 10 each. All calls had been made and received except tit

% 2 per share on 10,000 Equity Shares.

shown in the Note to Accounts on Share Capital under Subscribed Capital

Calls-in-Arrears means the ami

Itis

Subscribed and fully paid-up: z

1,40,000 Equity Shares of € 10 each

Subscribed but not fully paid-up:

10,000 Equity Shares of % 10 each 1,00,000

Less: Calls-in-Arrears (10,000 x ® 2 20,000

Total

Calls-in-Advance

A company, if its Articles of Association permits, may receive amount age

yet made. The amount so received is called ‘Calls-in-Advance’. It is c oa

in the Balance Sheet as ‘Other Current Liabilities’ under the main head ‘Ci

/ which are not earmarked in any way to meet any part

Analysts of Financial Statements—cos,

«Reserve means amount set aside out of profits and other sup,

ticular liability, known t0 exist on gar”

ey

the Balance Sheet.” Thus, reserves mean amount set aside out of profits and surpluses tg

nancial position. meet

future uncertainties, prospective losses or to strengthen fi

and Loss means accumulated profits

balance of profit remaining after st

aly

‘ecording to William Pickels,

Surplus, i.c., Balance in Statement of Profit

appropriated or distributed as dividend, i.e.

appropriations towards reserves and dividend.

amount on the face of the Balance Sheet again

nds. Detail of Reserves and Surplus is shown in ;

Reserves and Surplus is shown as single

opening balance, additions/deductions guy

Reserves and Surplus under Shareholders’ Fu'

Note to Accounts on Reserves and Surplus giving

closing balance for each item under Reserves and Surplus.

Schedule III of the Companies Act, 2013 prescribes the heads of Reserves and Surplus to be

() Capital Reserve;

(i Capital Redemption Reserve;

(iii) Securities Premium Reserve;

(iv) Debentures Redemption Reserve Synch Furst.

(0) Revaluation Reserve;

(vi) Shares Options Outstanding Account;

(vit) Other Reserves (to specify the nature and purpose of each reserve); and

(viii) Surplus, ie., Balance in Statement of Profit and Loss.

‘A company is required to show the reserves that are in the nature of reserves at serial () to (ui)

above under the prescribed head. For example, if a company has Securities Premium Reserve,

it is shown in the Note to Accounts on Reserves and Surplus as Securities Premium Reserye,

Schedule III of the Companies Act, 2013 allows companies to have reserves other

at serial numbers (i) to (vi) say, Workmen Compensation Reserve, Investments Fluct

Reserve, Subsidy Reserve, etc. Each such reserve is shown separately in the lote t

Accounts on Reserves and Surplus.

Surplus, ie,, Balance in Statement of Profit and Loss is shown as a separate

Reserves and Surplus. It is accumulated balance of profits of the past years and al

year remaining after appropriations towards reserves and dividend. It may h

balance or debit balance. Current year’s profit or loss is added to the balance

_wansferred to Capital Redemption Reserve. The reserve may be

issue fully-paid bonus shares. 7

Section 55 of the Companies Act, 2013, requires that wher

redeemed out of profits which would be otherwise available for d

sum equal to Nominal (Face) Value of the shares redeemed must be

trans

Redemption Reserve’

Securities Premium Reserve

Securities Premium Reserve is a reserve to which amount received in excess 6

(face) value of securities (shares, debentures, etc.) is credited. It can be used,

for the purposes stated in Section 52(2) of.the Companies Act, 2013.

Debentures Redemption Reserve (DRR)

Debentures Redemption Reserve is a reserve credited by the amount pI

Section 71(4) of the Companies Act, 2013 and Rule 18(7)(b) of the Companies (St

of debentures.

DRR is not required for debentures issued by Banking Companies, All India|

Institutions (AIFls) regulated by Reserve Bank of India and National Housing Bankes

Revaluation Reserve)

Revaluation Reserve is a reserve v

of an asset. It is debited when th

beused for payment of dividend or issuing bonus shares.

Shares Options Outstanding Account

Shares Options Outstanding Account is a reserve to which difference

value and issue price of shares issued to employees is credited

the market price of the share is € 75 and is to be iss

= 26 , = 75 - % 50) should be credited to

Statements of aCompany Ww

imple I. Sony Ltd. has an opening debit balance of € 1,00,000 in Surplus, i,, Balas

‘Statement of Profit and Loss. During the year ended 31st March, 2019, it earned a

€ 3.00,000, Prepare Note to Accounts on Reserves and Surplus showing the amount to

carried to Balance Sheet

€e of € 2,00,000 in Surplus, ie, Balance in Statement of Profit and Loss

shown uncer Reserves and Surplus in the Balance Sheet.

ample 2, HP Computers Ltd, has an opening credit balance of Surplus, i.c., Balance in

tatement of Profit and Loss and Securities Premium Reserve of % 1,00,000 and % 2,00,000

respectively. During the year, it incurred a loss of & 1,50,000.

fow will it be shown in Note to Accounts on Reserves and Surplus?

(Opening Balance)

‘Surplus, /e., Balance in Statement of Profit and Loss (Opening Balance)

‘Add: Profit (Loss) for the year

Balance

(a+ b) (To be shown in the Balance Sheet against Reserves and Surplus)

Example 3. Casio Machines Ltd. has an opening balance of % 5,00,000 in Securities Premium

eserve and also debit balance of € 10,00,000 in Surplus, i.e., Balance in Statement of

Profit and Loss under Reserves and Surplus. During the year ended 31st March, 2019, it incurred.

a loss of & 15,00,000. How will it be shown in Note to Accounts on Reserves and Surplus?

olution:

ncial Statements of a Company

1s Share Application Money a Current Liability?

Application Money received by the company and which is refundable to the applicants,

i, against which shares will not be allotted, is shown as ‘Other Current Liabilities’ under

rent Liabilities’ in the Equity and Liabilities part of the Balance Sheet

Application Money becomes refundable in the following circumstances:

i) When the Issue is Oversubscribed: The amount received in excess of issued capital being

refundable to the applicants is classified or shown under major head ‘Current Liabilities’

and sub-head “Other Current Liabilities’ in the Equity and Liabilities part of the

Balance Sheet.

ii) When the issue is oversubscribed and the amount is payable in instalments, the amount

retained by the company to be adjusted against calls is shown as ‘Other Current

Liabilities’ under Current Liabilities. r

iii) When the company receives amount against calls yet to be made, i.., Calls-in-Advance.

iv) In case the Company has not received Minimum Subscription: In such a situation, it is

classified or shown under major head ‘Current Liabilities’, and sub-head ‘Other

Current Liabilities’ in the Equity and Liabilities part of the Balance Sheet because

the share application money received is refundable to the applicants.

bilities «9°

abilities are claSsified or shown as Non-current Liabilities and Current Liabilities

the Balance Sheet. The two terms have been defined in Schedule III of the

companies Act, 2013.

ie term ‘Current Liabilities’ is defined in Schedule III of the Companies Act, 2013

follows:

rent Liability is that liability which is:

(i) expected to be settled in compan)

ii) due to be settled within 12 months after the reporting date, i.e,

normal operating cycl

(iv) there is no unconditional right to defer settlement for at least 12 months after the

reporting date.

a liability meets any of the above four conditions, it is classified | or

t liability. ae .

Statements of a Company

of Debentures Issued as Collateral Security

ntures issued as Collateral Security can be disclosed in any of the fallowing man

When Entry is not Passed for Debentures Issued us Collateral Security

In the Note to Accounts on Borrowings (Long-term or Short-term), in the partleulars

column below the borrowings, it is disclosed that the loan is collaterally secured by

issue of debentures as follows:

Loan from Bank (say) ——

(Secured by issue of 12,000, 9% Debentures

of © 100 each as Collateral Security)

When an Entry is Passed for Debentures Isswed us Collateral Security:

The entry passed for issue of debentures as Collateral Security is

7 t

Debentures Suspense A/c Or. 12,00,000

To 9% Debentures A/c ee

(12,000; 9% Debentures & 100 each issued as

Collateral Security against loan of € 10,00,000)

Debentures issued as Collateral Security are shown in the Note to Accounts on

Long-term/Short-term Borrowings as follows:

e ®

Loan from Bank (say) 10,00,000

12,000; 9% Debentures of & 100 each 12,00,000

Less: Debentures Suspense A/c

urrent Maturities of Long-term Debts

‘A part of long-term borrowing may become due for repayment within 12 months from the

date of Balance Sheet or within the period of Operating Cycle. In such a case, part of the

rowing that becomes due for repayment is shown under major head ‘Current Liabilities’

and sub-head ‘Other Current Liabilities’ as ‘Current Maturities of Long-term Debts’,

For example, term loan taken by the company from a bank, Instalments falling due for

payments within 12 months from the Balance Sheet date (assuming Operating Cycle period

‘to be less than 12 months) will be shown as ‘Current Maturities of Long-term Debts’.

Deferred Tax Liabilities (Net): Every year Accounting Income is compared with Taxable

Income and if the difference between the two exists which is temporary in nature, income tax on

the difference amount is termed as deferred tax. 3a ‘

STR es.

26 (Classip , hedule IL We

the following items under (iit) Goodwin, m

(ei) Debtors

(ix) Stocksincty

(i) Le

Equipment

marks, ) Bi

) Building te a

i ; i ae (xi) Vehictes,

and Spare Part i) Pur

ce to bibeidtont (xiv) Cash at Bank \tndtinean

(@P) Cash in Hand. (xvi) Work-in-Prog ; : ieee

(vei!) Plant (awit) Interest Accrued On S, and

(X) Deposits with Electricity Supply Company

Solution;

Jing, Furniture, Vehiel

(0 Fixed Assets (Tangible): Office Equipment, Land, Build

(i) Fixed Assets (Intangible); Goodwill, Trademarks

(ii) Capital Work-in-Progress: Work-in-Progress (Machinery). a

(i) Long-term Loans and Advances: Advance to Subsidiaries, Deposits with:

Supply Company,

(®) Inventories: Loose Tools, Stock-in-Trade, Stores and Spare Parts,

(@/) Trade Receivables: Bills Receivable, Debtors.

{Pii) Cash and Cash Equivalents: Cash at Bank, Cash in Hand

(@iti) Other Current Assets: Interest Accrued on Investments.

Mustration 27.

Give the heads under which following items are shown in a company’s Balay

Per Schedule Il, Part 1 of the Companies Act, 2013?

(i) Mortgage Loan, (ii) Patents,

(iti) Investments, (iv) General Reserve,

(@) Bills Receivable, and (vi) 10% Debentures,

Will the following items appear

‘Shedule I Pa Tof the Companies Act, 2013?

=A. Loos Tools, (iii) Calls-in-

ae ——

of a Con 139 "

Under what heads and sub-heads the following items will appear in the Balance Sheet of 3

Per Schedule

Ill of the Companies Act, 20137

emium on Redemption of Debentures

(i) Loose Tools:

(ii) Balances with Banks. (Delhi 2013, Modified)

Solution

‘Mustration 30.

d what heads and sub-heads the following items will appear in the Balance Sheet of

a /company as per Schedule IIL, Part I of the Companies Act. 2013?

i -

i wa

the

Be,

0 Inv . (i) Fixed Assets—Intangible Assets;

(i) Current L yrt-term Borrowings; (iv) Long-term Provisions;

(o) Non Current Investmenta; (v/) Other Current Assets,

f a5,

I) ul

State

which major

@ cony

lings the following items will be presented in the Balance

ly a8 per Schedule I of Companies Act, 2013:

(ii) Capital Redemption Reserve

» Received in Advance (iv) Stores and Spares

(©) Office Equipments (al) Chareen Teviletaieee

(AI 2014 C, Modified)

() Trad

(iii) Incon

Solu

Major Headings;

(i) Non-Current Assets; (ii) Shareholders’ Funds;

(ii) Current Liabilities; (iv) Current Assets;

(») Non-Current Asseta; (vi) Current Assets,

Ilustration 36.

Under what main heads and sub-heads of Assets part are the following items classified

or shown in the Balance Sheet of a company as per Schedule III?

(i) Bills Receivable, (ii) Sundry Debtors,

(iii) Long-term Investments, (iv) Shares in Listed Companies

_ (v) Prepaid Insurance, (vi) Deposit with Customs Authorities, and

(vii) Building.

items will be presented in the

of the Companies Act, 2013?

f Financial

of .

jatement of Profit and Loss is a statement that shows the financial performance of a

jompany, ie, profit earned or loss incurred during the accounting, period.

format of Statement of Profit and Loss

Format of the Statement of Profit and Loss is prescribed in Part Il of Schedule Ill of the

‘Companies Act, 2013, as follows

STATEMENT OF PROFIT AND LOSS for the years ended ..

Financial Statements of a Company

Peoreurkee tia

\. REVENUE

4. Revenue trom Operations — Salt

evenue from Operations means revenue earned by the company from its operating

. activities carried on by the company to earn profit. Commonly, it is Net

S i Sales Return) for a manufacturing company or trading company, fee

med by a service company and interestand-dividend.eamed by a financial company,

and Total Revenue for a finan,

Calculate Revenue from Operations, Other Income

ee pany from the following information:

laneous Income % 5,000; Interest on Lo:

(Profit) on Sale of Building € 15,00,000.

ans © 8,00,000; Dividend @ 1,00,000; Gay

ancial Statements of a Company

Compute Cost of Materials Consumed from the following:

‘ning Inventory of Materials & 2,50,000; Materials Purchased % 20,00,000; and Closing

Inventory of Materials & 3,00,000.

Golution:

‘Cost of Materials Consumed = Opening Inventory of Materials + Purchases of Materials

~ Closing Inventory of Materials

= % 2,50,000 + & 20,00,000 ~ % 3,00,000 = & 19,50,000.

fllustration 47.

ompute Cost of Materials Consumed from the following: s

550,000

Finished Goods 2,50,000

of Materials Consumed = Opening Inventory of Materials + Purchases of

Materials ~ Closing Inventory of Materials ;

= © 5,50,000 + % 22,50,000 — & 4,50,000 = % 23,50,000.

ing Inventory of Finished Goods, i.e., € 2,50,000 and Closing Inventory of

ie 1,50,000 will not be considered to compute Cost of Materials Consumed

to calculate Changes in Inventories of Finished Goods,

tion 48,

Financial Statements

Men,

5,50,000, On 1) © |

in,

Jas

Prog gaounten of Axis Monutacturin a

Faapemeaes showing Coto Maia seman tt

Ai Saoieg Inventory of Materials end pee Aa dnd Stock-it nTraae

Trade — Closing 1A OT ed ae Ki

mined the Cost of Materials

=

Purchases of Stock-in-Trade eth

~ eselling. If the company

i ed for reselling: Y ca

in eans goods pur for reset i.

Trade means goods pu! ase ain Seinen

‘out further i

Processing on the goods purchased, the

Part of the Cost of Materials eps For example, if a comPANY purchases pape,

ear tM B Conse ror cx incTrade’- But, JE PARE BUbsitoag

ame wn as ‘Purchases of Stoc! ost of Materials Consumed’, "

(sa ' :

(Say) manufacturing copies, it will be shown under ‘C

3. :

eae In Inventories of Finished Goods, Work-in-P'

Pea ra ives tasien of Finished Goods, Work-in-Proste’s ©" St0S METAS he,

jock) of Finished Gj,

a

rogress and Stock-in-Trage

the difference between the Opening and Closing Inventories (St

ventory (Stock) less Closing

Progress and Stock-in-Trade, i.e., Opening lv

ae i.e, Opening Inventory (Stock) is more

negative, ie., Opening Inventory (Stock) is less than the Closing Im

to Accounts on Changes in Inventories of Fi r

each item of Inventory is shown separately and the

dded to show one amount against the entry in the

jple (with imaginary data) illustrates how it

Inventories of Finished Goods, WIP

ancial Statements of a Company

4 is6

Are opening and closing inventories considered in the amount shown against

Purchases of Stock-in-Trade? Give reasons.

Mlustration 50 ‘

Seg ay unts for Change in Inventories of Bakers Ltd. for the year on

7 3ist March, 2019 from the following information and determine the amount that wil shed

ora in the’ Statement of Proft tad Lane sonkat Charter ty Levnatiael GP BKe

7 Goods, WIP and Stock-in-Trade:

a aie “Tr

1.52 : Financial 5! 8:

E nefit Expenses May be 4,

*XPenses de ia example (With imaginary | Fina

ieee 28 direct expenses an joyees Benefit Expens,

ORs haw tt bone

Note to Accounts f 3

} bor

| Fir

| fer

ei

a

)

.

i

|

=e

Mlustration 51,

Out of the following, identify the items that are shown in the

Benefit Expenses:

(® Wages; (ii) Salaries; (iii) Entertainment Expenses; (iv) Bonus; (0) Gratuity Paid; ang

(2!) Conveyance Expenses.

Solution:

Items to be shown in Note to Accounts on Employees Benefit Expenses are:

(® Wages; (ii) Salaries; (iv) Bonus and (v) Gratuity Paid.

Mlustration 52. :

From the following information for the year ended 31st March, 2019, prepare

Accounts on Employees Benefit Expenses:

( Wages % 2,40,000; (ii) Salaries % 3,60,000; (iii) Entertainment Expenses:

gellasrae ; (0) Gratuity Paid % 1,20,000; (vi) Conveyance Expenses & 25,0

Expenses % 40,000.

Note to Accounts on Employe,

ents of a Company

© Costs mean costs incurred by the company on the borrowings, i.e., loans taken by

it, It therefore, includes interest-paid on borrowings (such as term loans, bank overdraft

and_cash-credit limit) from banks and from others (such as public deposits, debentures,

bonds, etc.)

Finance Costs also include expenses incurred for the borrowings such as loan processing,

eof debentures and premium payable on redemption of debentures,

are incurred by the company for borrowings. However, Bank Charges

i Costs but are shown under ‘Other Expenses’, they being an expense

"ices availed from the bank.

Illustration 53.

Out of the following, identify the items that are shown in the Notes to Accounts on

Finance Co:

(DAnterest paid on Term Loan; (ii) Interest paid on Bank Overdraft; (iii) Discount on Issue

of Debentures Written off; (iv) Interest Received on Fixed Deposits and (v) Bank Charges.

Solution:

Items that will be shown in the Notes to Accounts on Finance Costs ar

(@ Interest Paid on Term Loan; (ii) Interest Paid on Bank Overdraft and (iii) Discount on

Issue of Debentures Written off.

"Illustration 54.

From the following information of Abacus Ltd. for the year ended 31st March, 2019,

pare Note to Accounts on Finance Costs:

terest paid on Term Loan % 2,50,000; (ji) Interest paid on Bank Overdraft &

ount on Issue of Debentures Written off € 10,000; (jv) Interest Received on]

s & 25,000; (2) Bank Charges % 9,500 and (vi) Interest paid on Deposits '

sie ce oe

ee ee

cial ‘a Company

Items that will be shown in the Note to Accounts on Other Expenses are:

(ii) Courier Expenses; (iif) Internet Expenses; (iv) Rent for factory; (v) Carriage Outwards;

(vif) Rent for warehouse; (viii) Rent for office and (ix) Audit fee.

Let us now discuss, Statement of Profit and Loss being prepared as a statement:

Illustration 56.

| Following is the Trial Balance of Perfect Solutions Ltd. as at 31st March, 2019;

‘Machinery

Land and Building

“Depreciation on Machinery

Purchases of Raw Materials (Adjusted)

ing Stock

‘of ® 100 each (Fully paid)

-1,000; 6% Preference Shares of% 100 each (Fully paid)

4, Long-term Bor

10% Debent

5, Short-term Borrowings

Bank Overds

6, Other Current Liabilities

Interest on Debentur

Dividend Payable: On

ity

On Preference Shares

7. Tangible Assets

Machinery

Land and Building

Notes: 1. Proposed Dividend for the year ended 31st March, 2019 is X 20,000 (9% on Equity Shares) and

© 6,000 (6% on Preference Shares),

2, Transfer to Debentures Redemption Reserve and General Reserve and proposed Dividend on Equity

Shares and Preference Shares for the year ended 31st March, 2018 are items of appropriation from

Surplus, .e., Balance in Statement of Profit and Los

ES TO ACCOUNTS

Notes to Accounts is the statement attached to the financial statements and is a part of

the financial statements. It has details of items of Balance Sheet and Statement of Profit

and Loss besides Significant Accounting Policies and additional information required to

be disclosed as per Schedule III of the Companies Act, 2013 and Explanatory Notes.

Cash Flow Statement is a statement showing the flow of cash and cash equivalents —inflows and

outflows, during an accounting period. This statement is important for better understanding,

of financial statements. It is an essential tool for short-term financial analysis. It has been

discussed in a separate chapter.

Objectives of Financial Statements are:

To provide financial data on economic resources and obligations of an enterprise

. To show implications of operating profit on the financial position of an enterprise.

. To provide information about cash flow to investors and creditors for assessing, comparing

_ and evaluating, potential cash flow in terms of amount.

To provide sufficient and reliable information to various parties interested in

1 e and fair view of the business.

activities of business affecting the society.

*s followed in the accounting process

Financial Statements of a Company

Name the major heads under which the Equity and Liabilities part of a cor

organised and presented.

‘4. What is a contingent liability? Where is it shown in the Balance Sheet? Give:

liabilities.

5. Name the major heads which appear in the Assets part of the Balance Sheet.

"6. Name the major heads which appear in the Equity and Liabilities part of th

2 Name the head under which lo

Name the head under which G

2013. Reserves

State any fve items which are shown under the head Ma

‘ company as per Schedule I, Part I of the Companies ASN" ities,

® Give two examples each of Non-current Assets and Non-

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Form 80Document19 pagesForm 80sakshiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

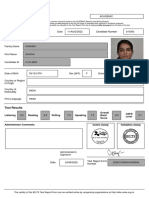

- TRF IeltsDocument1 pageTRF IeltssakshiNo ratings yet

- Guru Nanak Timber StoreDocument1 pageGuru Nanak Timber StoresakshiNo ratings yet

- Star Engg CorpDocument1 pageStar Engg CorpsakshiNo ratings yet

- Rajan VermaDocument1 pageRajan VermasakshiNo ratings yet

- Appeal LetterDocument2 pagesAppeal LettersakshiNo ratings yet

- Annual ReceiptDocument1 pageAnnual ReceiptsakshiNo ratings yet

- Credit Card ExpensesDocument44 pagesCredit Card ExpensessakshiNo ratings yet

- Asf CoverDocument2 pagesAsf CoversakshiNo ratings yet

- Accounting Basics & GSTDocument8 pagesAccounting Basics & GSTsakshiNo ratings yet