Professional Documents

Culture Documents

Admin 18 Impact of Demonetization in The Indian Economy

Admin 18 Impact of Demonetization in The Indian Economy

Uploaded by

Harsh SrivastavaCopyright:

Available Formats

You might also like

- Linux Usage in Banking IndustriesDocument29 pagesLinux Usage in Banking IndustriesheythereyoppieNo ratings yet

- Economics ProjectDocument35 pagesEconomics ProjectRaviRamchandaniNo ratings yet

- Organizations Structure of EBLDocument35 pagesOrganizations Structure of EBLnasir mamunNo ratings yet

- Diagram of The Financial SystemDocument1 pageDiagram of The Financial SystemPersonified Ghost57% (7)

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesvinayNo ratings yet

- Impact of Demonetisation in IndiaDocument5 pagesImpact of Demonetisation in IndiaIJASRETNo ratings yet

- Demonetization Kicks in - India Is Reacting: 8, 2016 Midnight. This Scheme Has ReceivedDocument9 pagesDemonetization Kicks in - India Is Reacting: 8, 2016 Midnight. This Scheme Has ReceivedShiny SNo ratings yet

- Case Study C-42 Tanu RathiDocument5 pagesCase Study C-42 Tanu RathiTanu RathiNo ratings yet

- ProjectDocument3 pagesProjectTSA27 SYBScIT Priti Mohite.No ratings yet

- Essay On Demonetization and GSTDocument4 pagesEssay On Demonetization and GSTArindam AcharyaNo ratings yet

- Positive and Negative Effects of Currency Demonetization:-: SourceDocument6 pagesPositive and Negative Effects of Currency Demonetization:-: SourceMir AqibNo ratings yet

- DemotrizionDocument3 pagesDemotrizionAnand KashyapNo ratings yet

- IOSR PDFDocument5 pagesIOSR PDFVincent DirainNo ratings yet

- An Overview On Impact of Demonetization in The Current Scenario (2016-17) of Indian EconomyDocument3 pagesAn Overview On Impact of Demonetization in The Current Scenario (2016-17) of Indian EconomyZeeshanNo ratings yet

- Demonetization Essay PDF - Essay On Demonetization PDF IndiaDocument4 pagesDemonetization Essay PDF - Essay On Demonetization PDF IndiaKr Ish Na0% (1)

- DEMONYDocument2 pagesDEMONYSRIKRISHNANo ratings yet

- Demonetization of CurrencyDocument72 pagesDemonetization of CurrencyParikshitNo ratings yet

- Demonetization and Its Impact On Indian EconomyDocument29 pagesDemonetization and Its Impact On Indian EconomyHukum RestroNo ratings yet

- Sample Research Paper PDFDocument27 pagesSample Research Paper PDFSANYA JAINNo ratings yet

- 500 Words Essay On DemonetizationDocument6 pages500 Words Essay On DemonetizationaasaNo ratings yet

- DemonetisationDocument3 pagesDemonetisationKashreya JayakumarNo ratings yet

- Research Paper ON Effects of Demonetization in India: Submitted ToDocument7 pagesResearch Paper ON Effects of Demonetization in India: Submitted TobhawnaNo ratings yet

- File 27092021030637Document33 pagesFile 27092021030637SnehaNo ratings yet

- DemonetizationDocument60 pagesDemonetizationHenna LitinNo ratings yet

- Paper Presentaion On Demonetisation - For MergeDocument12 pagesPaper Presentaion On Demonetisation - For MergeRanjith GowdaNo ratings yet

- Demonetization FILEDocument13 pagesDemonetization FILEDamanjot KaurNo ratings yet

- Vanshika FileDocument59 pagesVanshika Filesinghalmuskan751No ratings yet

- Essay DemonetizationDocument4 pagesEssay DemonetizationRaj SharmaNo ratings yet

- Impact of DemonetizationDocument30 pagesImpact of DemonetizationKomal Pal100% (1)

- Demonatisation A Game of PredictionsDocument2 pagesDemonatisation A Game of PredictionsDr. Kaustubh JianNo ratings yet

- Aditya Eco Sem 2 Assign 2 FinalDocument8 pagesAditya Eco Sem 2 Assign 2 Finaludit rajNo ratings yet

- Effects of Demonetization On Banks - Law Times JournalDocument4 pagesEffects of Demonetization On Banks - Law Times JournalKhanak ChauhanNo ratings yet

- Report On De-Monetization On Indian Economy: Currency Legal Tender National CurrencyDocument4 pagesReport On De-Monetization On Indian Economy: Currency Legal Tender National Currencyshivam agrawalNo ratings yet

- Report On De-Monetization On Indian Economy: Currency Legal Tender National CurrencyDocument4 pagesReport On De-Monetization On Indian Economy: Currency Legal Tender National Currencyshivam agrawalNo ratings yet

- Efffect of DemonitizationDocument8 pagesEfffect of Demonitizationsaurav ghimireNo ratings yet

- Unit 4 DBDocument12 pagesUnit 4 DBDeepika. BabuNo ratings yet

- Demonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaDocument15 pagesDemonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaShalvi RanjanNo ratings yet

- Case Study 1Document6 pagesCase Study 1mashila arasanNo ratings yet

- EconomicsDocument10 pagesEconomicsSaloni ChoudharyNo ratings yet

- DemonitarsationDocument37 pagesDemonitarsationSTAR PRINTINGNo ratings yet

- Sharad Malhotra Impact of Cashless Society For The Economic Growth in IndiaDocument7 pagesSharad Malhotra Impact of Cashless Society For The Economic Growth in IndiaNAMAN CHANDANINo ratings yet

- CT ReportDocument3 pagesCT ReportishwaNo ratings yet

- "Future and Scope of Cashless Economy in India" 1462Document5 pages"Future and Scope of Cashless Economy in India" 1462BHARATHNo ratings yet

- Aditya Eco Sem 2 Assign 2 FinalDocument7 pagesAditya Eco Sem 2 Assign 2 Finaludit rajNo ratings yet

- Demonetisation: A SWOT AnalysisDocument3 pagesDemonetisation: A SWOT AnalysisYESHA DAVENo ratings yet

- DemonetisationDocument20 pagesDemonetisationMukti BarolaNo ratings yet

- Currency DemonetizationDocument13 pagesCurrency DemonetizationarjunNo ratings yet

- Research Paper On Effect of Demonetization On Indian EconomyDocument5 pagesResearch Paper On Effect of Demonetization On Indian EconomyAYUSH TAMRAKAR80% (5)

- Review Jurnal Internasional 4Document2 pagesReview Jurnal Internasional 4Yavishan NovindaNo ratings yet

- Impact of Demonetization On Retail Outlets - An Analytical Study R. Venkatesh & P. Sathiya PriyaDocument10 pagesImpact of Demonetization On Retail Outlets - An Analytical Study R. Venkatesh & P. Sathiya PriyaNgawang dorjeeNo ratings yet

- Cashless EconomyDocument27 pagesCashless EconomyOM GARGNo ratings yet

- Eco AssignmentDocument8 pagesEco AssignmentTushar BansalNo ratings yet

- Demonitisation (Report)Document41 pagesDemonitisation (Report)onlinebaijnathNo ratings yet

- Impact of DemonetizationDocument7 pagesImpact of DemonetizationPartha Sarathi BarmanNo ratings yet

- Economics Project Format: TitleDocument18 pagesEconomics Project Format: TitleKisha OswalNo ratings yet

- Effects of DemonitizationDocument5 pagesEffects of DemonitizationrohitkgangotiaNo ratings yet

- Demonetisation Thus Has Its Pros and Cons. These Are Listed BelowDocument8 pagesDemonetisation Thus Has Its Pros and Cons. These Are Listed BelowShoyebsheikhNo ratings yet

- Demonetization ProjectDocument8 pagesDemonetization ProjectFloydCorreaNo ratings yet

- Demonetization: Success & Failures: Presented By:-Harshvardhan Bartwal (Prof. R.C. Dangwal) DeanDocument17 pagesDemonetization: Success & Failures: Presented By:-Harshvardhan Bartwal (Prof. R.C. Dangwal) DeanDheeraj rawatNo ratings yet

- Effect of Demonetisation in India:: 3.43 Cite This Paper AsDocument5 pagesEffect of Demonetisation in India:: 3.43 Cite This Paper AsAanu GappaNo ratings yet

- Isha SinghDocument10 pagesIsha Singhskguddu2003No ratings yet

- Set 3Document144 pagesSet 3Arham TanvirNo ratings yet

- CLAT 2021 Previous Year Paper (Legal Section)Document12 pagesCLAT 2021 Previous Year Paper (Legal Section)Harsh SrivastavaNo ratings yet

- Online Betting Winnings Are They Taxed in IndiaDocument3 pagesOnline Betting Winnings Are They Taxed in IndiaHarsh SrivastavaNo ratings yet

- November 2020 Part 2Document13 pagesNovember 2020 Part 2Harsh SrivastavaNo ratings yet

- GamblingDocument3 pagesGamblingHarsh SrivastavaNo ratings yet

- DC DissertationDocument80 pagesDC DissertationHarsh SrivastavaNo ratings yet

- Anuj DissertationDocument103 pagesAnuj DissertationHarsh SrivastavaNo ratings yet

- Course Plan - Aviation Air & Space Law BA LLB HonsDocument15 pagesCourse Plan - Aviation Air & Space Law BA LLB HonsHarsh SrivastavaNo ratings yet

- Evidence - Unit 1 Interpretation ClauseDocument16 pagesEvidence - Unit 1 Interpretation ClauseHarsh SrivastavaNo ratings yet

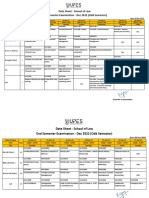

- SOL - (Odd Sem) Date Sheet - End Sem Exam Dec 2022Document7 pagesSOL - (Odd Sem) Date Sheet - End Sem Exam Dec 2022Harsh SrivastavaNo ratings yet

- Dissertation - Bhavya Thaman EDDocument52 pagesDissertation - Bhavya Thaman EDHarsh SrivastavaNo ratings yet

- Origin & DevelopmentDocument17 pagesOrigin & DevelopmentHarsh SrivastavaNo ratings yet

- Article 15Document39 pagesArticle 15Harsh SrivastavaNo ratings yet

- Kidnapping and AbductionDocument10 pagesKidnapping and AbductionHarsh SrivastavaNo ratings yet

- 01 Unit I Environmental Studies-A Multidisciplinary SubjectDocument50 pages01 Unit I Environmental Studies-A Multidisciplinary SubjectHarsh SrivastavaNo ratings yet

- My UPES SOPDocument8 pagesMy UPES SOPHarsh SrivastavaNo ratings yet

- Reply Filed On Behalf of Respondents To The Criminal Writ Petition Filed Under Article 32 of The Constitution of HimalDocument37 pagesReply Filed On Behalf of Respondents To The Criminal Writ Petition Filed Under Article 32 of The Constitution of HimalHarsh SrivastavaNo ratings yet

- Legal UpdatesDocument5 pagesLegal UpdatesHarsh SrivastavaNo ratings yet

- Vishakha Vs State of RajasthanDocument2 pagesVishakha Vs State of RajasthanHarsh SrivastavaNo ratings yet

- 02 EcosystemDocument80 pages02 EcosystemHarsh SrivastavaNo ratings yet

- Psle - Raise Your Voice, Each Vote CountDocument4 pagesPsle - Raise Your Voice, Each Vote CountHarsh SrivastavaNo ratings yet

- Sanitation in India Role of Women S EducDocument12 pagesSanitation in India Role of Women S EducHarsh SrivastavaNo ratings yet

- Culpable Homicide & MurderDocument16 pagesCulpable Homicide & MurderHarsh SrivastavaNo ratings yet

- Salient Provisions of The JJA 2015Document6 pagesSalient Provisions of The JJA 2015Harsh SrivastavaNo ratings yet

- Defence of Intoxication Judicial Confusion by Apeksha GuptaDocument17 pagesDefence of Intoxication Judicial Confusion by Apeksha GuptaHarsh SrivastavaNo ratings yet

- Sexual OffencesDocument10 pagesSexual OffencesHarsh SrivastavaNo ratings yet

- Document 1Document10 pagesDocument 1Harsh SrivastavaNo ratings yet

- Fam LawDocument9 pagesFam LawHarsh SrivastavaNo ratings yet

- India Health System Review: ISBN-13 978 92 9022 904 9Document328 pagesIndia Health System Review: ISBN-13 978 92 9022 904 9Harsh SrivastavaNo ratings yet

- Art 1-4Document26 pagesArt 1-4Harsh SrivastavaNo ratings yet

- FinalDocument28 pagesFinalHarsh SrivastavaNo ratings yet

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentShakikNo ratings yet

- Suraj Lums Edu PKDocument12 pagesSuraj Lums Edu PKshuguftarashidNo ratings yet

- Toaz - Info 4 First Comprehensive Test PRDocument11 pagesToaz - Info 4 First Comprehensive Test PRJade VillanuevaNo ratings yet

- Legal Issues FactoringDocument1 pageLegal Issues FactoringFaysal HaqueNo ratings yet

- Final Nancy121Document66 pagesFinal Nancy121Sahil SethiNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationAlexandria Ann FloresNo ratings yet

- Branch BankingDocument2 pagesBranch Bankingbeena antuNo ratings yet

- Iifl Gold LoanDocument52 pagesIifl Gold LoanuiopoiuyNo ratings yet

- The Resilience of Central and Eastern European Banking Systems During The Covid-19 CrisisDocument10 pagesThe Resilience of Central and Eastern European Banking Systems During The Covid-19 Crisis23.Nguyễn Mỹ Nghi 12A3No ratings yet

- CreditTrans - Case 44Document2 pagesCreditTrans - Case 44ces ereseNo ratings yet

- Trugo - Assignment Proof of CashDocument3 pagesTrugo - Assignment Proof of CashmoreNo ratings yet

- Financial Ratio Analysis As Determinant of Profitability in African Banking IndustryDocument10 pagesFinancial Ratio Analysis As Determinant of Profitability in African Banking IndustryjaneNo ratings yet

- Solution Manual For An Introduction To Mechanical Engineering 4th EditionDocument24 pagesSolution Manual For An Introduction To Mechanical Engineering 4th EditionDouglasWrightcmfa100% (34)

- Debt Relief ActDocument16 pagesDebt Relief ActVividh PawaskarNo ratings yet

- STT 2020 Annual ReportDocument290 pagesSTT 2020 Annual ReportEvgeniyNo ratings yet

- Why HITV FailedDocument5 pagesWhy HITV Failedsought out!No ratings yet

- UP Taxation Law Pre Week 2017Document28 pagesUP Taxation Law Pre Week 2017Robert Manto67% (3)

- Existing Relationships: Consumer Products Application FormDocument6 pagesExisting Relationships: Consumer Products Application Formshani908No ratings yet

- Universal BankDocument1 pageUniversal Bankhailene lorenaNo ratings yet

- E Commerce and Internet MarketingDocument78 pagesE Commerce and Internet MarketingMadrigal AnnalynNo ratings yet

- HDocument23 pagesHLila DeviNo ratings yet

- New Product DevelopmentDocument5 pagesNew Product DevelopmentMd Maruf HasanNo ratings yet

- St. Mary'S University Business Faculty Departement of AccountingDocument57 pagesSt. Mary'S University Business Faculty Departement of AccountingSingitan YomiyuNo ratings yet

- BankingDocument3 pagesBankingTamanna MulchandaniNo ratings yet

- Test Bank For Financial Management Core Concepts 2nd Edition by BrooksDocument36 pagesTest Bank For Financial Management Core Concepts 2nd Edition by Brooksrowdydow.shittimu4n3100% (48)

- 04 - COA SamplesDocument4 pages04 - COA SamplesJonalyn MalicdanNo ratings yet

Admin 18 Impact of Demonetization in The Indian Economy

Admin 18 Impact of Demonetization in The Indian Economy

Uploaded by

Harsh SrivastavaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Admin 18 Impact of Demonetization in The Indian Economy

Admin 18 Impact of Demonetization in The Indian Economy

Uploaded by

Harsh SrivastavaCopyright:

Available Formats

Impact of Demonetization in the Indian Economy:

A Review

*Ms. Paramjeet Kaur

People who change after change will survive, People who change with

the change will succeed, People who cause change will lead.

-- Prime Minister Narendra Modi

Abstract

Having a wallet full of highest denomination currency is like being at the

top of world, but one can't even imagine what will happen if the same

currency converts at once in normal blank papers. The boldest move of

Prime Minister Modi came up on 8th November in the form of

demonetization since he came into power in 2014. Demonetization is

tightening the regulatory system in the Indian economy, it is expected

change the odds of the game. The move seems to be an appreciable step by

the Modi government, as the intention is to stop tax evasion and to uproot

corruption. But the side effects in the form of public inconvenience, scams

of crores, slum in real estate and other sectors, security issues, effects on

GDP can't be overlooked. In the initial days of demonetization majority of

the people were supporting the drive, but as the new currency scams were

coming up and the length of queues in the banks was not reducing, people

were getting frustrated. It seems that demonetization has demoralized

Indians. The various scams involving nearly 300-400 crores of new

currency have made normal citizen depressed who standing in the long

queues was looking at the government with the eyes of hope. Whether

demonetization will take the country to new heights or it will snatch the tag

of developing country from India, it is still a question. The common man is

thinking whether the nation is demonetized or demoralized. The paper

discusses the bright as well as dull sides of demonetization drive. It tries to

identify the effects of this move on the Indian economy as a whole. The

paper is based on descriptive research design and tries to explore the

hidden realities.

Keywords: India, Demonetization, Economy, Impact, Government

*Assistant Professor, Khalsa College for Women, Civil Lines, Ludhiana. Email:

kalraparamjeet15@yahoo.com

RIJBR 255 ISSN : 2455-5959

I. Introduction

Having a wallet full of highest denomination currency is like being at the

top of world, but one can't even imagine what will happen if the same

currency converts at once in normal blank papers. One such jerk was given

to Indian citizens by Prime minister of the country recently. Narendra Modi

in a daring voice announced on 8th November 2016 the abolition of old high

denomination currency as a bolt from the blue. This move of Prime Minister

Modi is known as the boldest move since he came into power in 2014. He

differentiated his government from others with many new steps like Swatch

Bharat campaign, Adhaar card, opening of bank accounts, yoga day and

many more, but change of currency was really a shocking move for entire

India. It changed the perception of many overnight and made the currency

valueless. The entire process was kept a complete secret. A young team of

researchers were involved in this mission and the entire move was finalized

at Modi's residence at New Delhi.

II. Methodology and Objectives of Study

The study focuses on extensive study of secondary data collected from

various books, publications from various websites, which focused on

various aspects of Demonetization. The study has been made with the

following objectives:-

a) To know the meaning of Demonetization.

b) To study the position of India in the advent of Demonetization.

c) To assess whether Demonetization was actually required in Indian

economy.

d) To discuss the detrimental effects of Demonetization.

III. Literature Review

Annamalai and Iiakkuvan (2008) discussed about the acceptability on

electronic payments in the retail transactions. The authors discussed in

detail the problems a country faces during the acceptability phase along

with the bright future of using plastic money. Das and Agarwal (2010) put

forth his views on the idea of being cashless. They described the benefits in

the form of cutting down of costs and saving of tax and reduction in

fraudulent transactions. Roy et al. (2016) assessed the short run and long

term impacts of demonetization on the economies. The success of step

depends upon the intention of government, circulation of black money,

availability of credit and many other considerations. Kaur (2017) discussed

the role and economic status of electronic payments system. She added that

with increasing adoption of electronic payments, particularly those driving

e-commerce and m-commerce, there is a growing demand for faster

payment services which, in turn, facilitate ease in doing financial

RIJBR 256 ISSN : 2455-5959

transactions. Kumar (2017) Collected data from 100 respondents from

Coimbatore district and researched the variables which affect significantly

the outcomes of demonetization.

IV. Demonetization

A couple of days back many Indians did not even know what

demonetization stand for. The dictionary meaning of demonetization is

'ending, termination or conclusion of something' which may be gold, silver

or currency notes etc as no longer legal tender of a nation. Thus

demonetization involves a radical move which makes the old currency

relieved, as it is replaced by the new currency unit. In the process of

demonetization, either all together new notes or coins of same currency are

introduced or the old currency is entirely replaced by new currency. The

concept is not a new phenomenon. In the year 2002, European Monetary

Union nations demonetized their old currencies and took a step to introduce

Euro. Similar step of demonetizing the currency was taken in Zimbabwe in

the year 2015 to deal the problem of hyperinflation in the country. It took

nearly three months to revamp the Zimbabwean dollar and stabilize the

economy. Governments take the decision to demonetize the local units of

currency due to variety of reasons:

• To control black money

• To combat corruption and forgery

• To combat inflation

• To discourage a cash system

But demonetization is not a threat for all. Those who pay regular tax on the

incomes need not worry and hurry. People get full value of their money back

in the form of bank deposits. They can buy the things from past taxed

income.

V. Indian Scenario

On 8th November 2016 Indian Government decided to demonetize two of

the country's highest denomination currency and this decision scraped Rs

500 and 1000 notes. These two denominations account for nearly 86% of

the total money supply in circulation with the public of nation (nearly 16.6

lakh crore). Prime Minister Narendra Modi suggested this step to tackle

with certain major problems prevalent in the country, such as making the

value of fake currency as zero, making the country cashless economy,

blocking the terrorist financing programmes, elimination of black money,

restricting tax evasion etc. Individuals had to exchange these two

denominations from banks, while the bank accounts of customers would

provide the real picture of economic status of citizens. Some economists

RIJBR 257 ISSN : 2455-5959

believe that in India demonetization was need of the hour and was due since

long back. But the way demonetization is introduced in the economy, it has

resulted in complete unexpected immediate financial chaos and confusion

in the country. The nation is still in dilemma about the impact of this move,

whether it is going to be a bane or a boon. In the initial days of

demonetization nearly 51% people were supporting the demonetization

move, but as the new currency scams are coming up and the length of

queues in the banks are not reducing, people are getting frustrated. It seems

that demonetization has demoralized the Indians. The various scams

involving nearly 300-400 crores of new currency have made normal citizen

depressed who standing in the long queues was looking at the government

with the eyes of hope.

Rating of government's demonetization program conducted by Local

circles with 9039 respondents dated 17 November 2016

Bad

25%

Good

Average 51%

24%

Source: http://www.localcircles.com

VI. Was Demonetization Required?

Prime minister has proposed this move with certain motives.

Demonetization may result in tight in regulatory system in the Indian

economy, it is expected change the odds of the game. The move may offer

the following positives:

1. Cashless economy: In India the fashion of transacting with cash is quite

in. People feel comfortable to deal with cash. Many researchers have

concluded that more than 50% of the transaction in India are undertaken

with cash, thus cash hoarding is inevitable. According to Gurumurthy, till

2001 the growth of cash economy as a percentage of country's GDP was less

than 10%. This growth should have gone down as we as a nation are moving

towards e-economy with online banking transactions, internet money

transfers, automated payment through instruction etc. But currently this

percentage has increased to 12%, which is destroying quite alarming and is

a sign of insufficient banking efforts. Further this ratio has been given a

push by high denomination currency. Thus demonetization would be a

strong step for making India Card Economy.

RIJBR 258 ISSN : 2455-5959

2. Security aspects: The fake currency in circulation is a question mark on

the security of Indian economy. Taking the example of the state of Jammu

and Kashmir, out of total old currency deposited in banks all over India, 3%

are in this state. In spite of disturbance in the state, the citizens have stood up

in the long queues for exchanging, withdrawing and depositing money. The

instability in the state has declined to certain level, which is really a positive

sign in this disturbed state.

3. Terror funding: According to the government one of the basic aims of

demonetization is to control the terrorism in the country. It will make the

fake currency coming from Pakistan useless. The funds with which terror

agencies work are generally cash. Demonetization has made the currency

available with these agencies as null and void. Either they have to deposit

the funds in banks or the notes will carry no value. Many of these agencies

work with counterfeit currency and most of them are of high denomination.

Thus this fake currency will go out of the economy.

4. Positive Impact on economy: Undisclosed funds are primarily

responsible for many evils such as poverty in our country. Finance Minister

Arun Jaitley in his speech assured that demonetization will have far

reaching positive impacts on the economy especially on GDP. With the

huge amounts of deposits and flow of white money in the economy banks

will be able to lend more funds to the agriculture sector and social sector at

low interest rates. The money which was hidden in various sectors will

become a part of banking system and banks will be able to use these funds

for the development of economy. As the banks will have more funds at their

disposal, the interest rates on loans will also come down. Further the money

deposited in banks will be multiplied by the banks many times; this will

have far reaching positive impacts on the development of economy.

5. Enhanced Tax collection: Demonetization will offer another hidden

benefit of tax revenue to Indian economy. Due to advent of new currency,

the entire cash needs to be deposited with banking system. Reserve Bank of

India estimated that the total cash in circulation is nearly 12 lakh crores, out

of which 3 lakh crores will never come back, as it is tied in many other forms

of assets. But the money that will be deposited in the banks will be a great

source of revenue (nearly 2 lakh crores) for the government in the form of

tax payments. Thus willful tax evaders and defaulters may come on the right

track.

6. Lower land prices: It is being expected that the prices of lands will come

down by 30-40%. The property is such an investment area where most of the

black money used to lie. The prices will come down to a reasonable level.

Proper registration records will be maintained, which will make this sector

legal. Other initiatives of government such as Goods and Sales tax, Benami

transactions Amendment Act etc. will also facilitate the advancement of

real estate sector.

RIJBR 259 ISSN : 2455-5959

Thus the move is being appreciated by many as the idea was to uproot many

social evils. But the story has much darker side too. The side effects of

demonetization drive can't be overlooked.

VII. Side Effects of Demonetization

According to an article by Ahluwalia (2016), demonetization is doing only

half of the job, as it is targeting only the cash part of existing black money. It

is not giving any thrust on the core areas which generate black income and

the corruption/tax evasion. Thus demonetization has a darker side, part of

which is visible and part is still not vivid. Some of the side effects of

demonetization are:

1. Public Inconvenience: The nation is facing a major inconvenience by

waiting in long queues for hours and days outside banks and ATMs. Even

though the government and RBI has assured the countrymen many a times

that sufficient currency is printed, but to everyone wonder they all come

back homes empty wallets. Prime Minister promised people that the

problem of long queues will be resolved very soon, but even after one

month of the declaration of demonetization millions of people are still

waiting in the queues for withdrawing their hard earned money. The

harassment of people standing in queues and coming back empty wallets is

really unbearable. Many deaths have also been reported.

2. Scams vs. Limits on withdrawals: Income tax department conducted

more than 450 raids in the country and found that even the new currency has

been hoarded by the criminals without any intimations and recording.

Hundreds of cases are still unreported and crores of new currency has been

seized. The IT department recovered nearly 5.7 crores (2000 notes) from

Bengaluru, 76 lakh new currency notes from Surat, 10 lakh new currency

from Gurugram, 85 lakh new notes in Mumbai, 100 crore new noted in

Chennai. Has the country been able to eliminate black money, this is still a

doubtful question. The government and RBI have mentioned that required

currency is being printed, but the citizens are not getting it. The reason is

that again the black marketers have started piling up the new currency. But

the question is how this money in bulk quantity is going in the hands of

hoarders. Either the banks or the government officials are involved in the

scene and the unaccounted new currency is being transferred According to a

report more than 30 cases have been referred to CBI for detailed

investigation. Many other incidents are directing the attention for some

serious issues.

The government has put a limit on the amount of money for general public

that can be withdrawn. On the other side the scams of crores of new

currency have shed the hopes of public.. It shows the signals of certain

conspiracy on the part of banking sector and the government officials. The

RIJBR 260 ISSN : 2455-5959

living of a normal citizen like farmer, trucker, labourer and informal sector

individual is entirely based on cash which has been drastically affected.

Many poor citizens have lost their livelihood permanently.

3. Recalibration of ATMs: ATMs are crying without cash. The problem

has been further aggravated manifold as the new currency is not of the same

size as that of the retired one. Thus all the ATMs in the entire country

required recalibration. This creates the doubt whether the government

printed the currency without thinking of the recalibration requirements,

otherwise at least ATMs must have been updated well in advance or the new

currency with same size would have been introduced. Centre stated many

times that they have taken all necessary steps to reduce the inconvenience of

public, but is it really true. The answer is in the hearts and minds of public

only.

4. Secrecy of the mission: The Supreme Court has raised questions to the

central government about the secrecy of the demonetization mission. Many

people filed petitions against Narendra Modi that his demonetization

mission was known to some high class people. Some have questioned

whether such major decisions be left to the whim of central people.

5. Lack of foresighted steps: The centre ordered to grant a limit for people

upto Rs. 24000/- every week for each individual, but the condition has not

been complied with. The acceptance of old currency at specified places was

permitted till 15th November then shifted to 24th November, then to 30th

November, then to 5th December, then to 15th December……The way

entire process is being handled it seems that the government has not done

any analytical planning to deal with the challenges that are upcoming due to

demonetization. Issue of a currency note of Rs 2000 doesn't seem to achieve

the target sought to be achieved by the demonetization. The statements like

"chaos will be over in 10 to 15 days" seem to be quite irresponsible.

6. Long term impact on real estate: The real estate sector is going through

tough times since last some years. This sector contributes nearly11% of the

GDP to the nation and the maximum percentage of black unaccounted

money lies in this sector. If this money comes out of real estate, the GDP of

the nation may rise to higher level. The demonetization policy has given

another sudden shock to this sector especially to land brokers. People who

want to buy properties don't have cash to pay. The sellers are also not ready

to accept money, as they will be liable to pay huge taxes to the government.

Thus the prices of property are coming down like anything.

7. Effect on labourers: Demonetization has negatively influenced the

income of labourers. This class works at lowest level of work hierarchy.

They survive on minimum daily wages and generally deal with cash only.

They are not being paid for their work. Some of the factors owners have

relieved the workers with the promise that they will be called back when the

RIJBR 261 ISSN : 2455-5959

disturbed business environment will stabilize. The farmers are unable to sell

their produce in the market, as cash is not exchanging hands. Another

problem this class faced is standing in the bank queues for exchanging a

minute amount of cash and losing day's wages.

8. Effect on GDP: The major impact has been seen in the informal sector of

Indian economy. This sector contributes nearly 40% to the GDP of nation.

Estimates have come up with the dreadful figures that demonetization move

will slow down the country's growth by 0.5% in six months till the end of

March 2017. It means that the GDP of the full year will come down to 3.5%,

while the forecast for the year was 6.8%.

The effect of demonetization seems to be positive in the short run. But some

facts are really eye opening. According to Fitch report, the positive impacts

of demonetization will not be long term for the banking sector. These

benefits in the form of tax revenues would be soon set aside due to lowering

of GDP growth rate. This rating agency has also predicted the negative

impacts of this move on Indian banking sector. The negative effect on GDP

will go along with the disruption period. The longer this period continues,

more will be the impact on GDP.

VIII. Conclusion and Recommendations

The move seems to be an appreciable step by the Modi government, as the

intention is to stop tax evasion and to uproot corruption. But the smooth

transition of this move must have been facilitated. Government has given

plea that public may have to suffer short term pains for long term gains. The

public is ready to bear short term pains but there is a doubt that what types of

gains will accrue and when? Commonly raised question is whether

demonetization solely will be able to uproot corruption. The modern black

marketers have found new ways to tackle with the situation: the currency is

being replaced with 30-40% commission; people are saving tax by showing

their income as agricultural income, as it is exempted from tax u/s10 of

Income Tax Act. Another heart breaking issue came on the scene when RBI

announced that banks will be required to submit CCTV recordings for this

transition period. The surveys found that most of the banks don't have

CCTV cameras and where the cameras are installed they aren't working.

Such issues give birth to some serious questions: whether we were ready for

demonetization, some other aspects must have been taken in account before

this move.

The country is moving towards card economy, but this swipe and digital

system has put forth many security challenges. The crux is that

demonetization is not a magic wand, but it can be helpful as a part of

comprehensive strategy to deal with corruption and black money. The

government and the opposition parties are fighting on the issue of

RIJBR 262 ISSN : 2455-5959

demonetization, but no one is able to solve the practical problems. This cash

crunch may have long term impacts in various sectors and may also prove to

be constructive disruption.

References

Ahluwalia, M. S. (2016). Demonetization: The good, the bad and the ugly.

Retrievedfromhttp://www.livemint.com/Opinion/cA5tkx4L7E1MMkP8q

uR6xJ/Demonetization-The-good-the-bad-and-the-ugly.html

Annamalai, S. & Iiakkuvan R. M. (2008). Retail Transaction: Future Bright

for Plastic Money. Facts of You, May, 22-28.

Ashish D., & Rakhi A.,(2010). Cashless Payment System in India- A

Roadmap. Technical Report, IIT: Bombay, 3-14.

Financial Express (2016). Demonetization side effects: While you waited in

bank queues for hours, here is where your money truly was. Retrieved from

http://www.financialexpress.com/india-news/Demonetization-side-

effects-while-you-waited-in-bank-queues-for-hours-here-is-where-your-

money-truly-was/469628/

Gurumurthy, S. (2016). Why Demonetization was Needed and How It Will

H e l p T h e I n d i a G r o w t h S t o r y. R e t r i e v e d f r o m

https://swarajyamag.com/insta/why-Demonetization-was-needed-and-

how-it-will-greatly-help-the-india-growth-story

Hindustan Times (2016). Supreme Court questions Centre about

demonetization asks about secrecy. Retrieved from

http://www.hindustantimes.com/india-news/supreme-court-questions-

centre-about-Demonetization-asks-who-made-policy/story

-rBQFJ6iDDKBCrC60CSdCmJ.html

IANS (2016). Positive effects of demonetization may not be long term:

Fitch ratings. Retrieved from

http://indianexpress.com/article/business/economy/positive-effects-of-

Demonetization-may-not-be-long-term-fitch-ratings-4389839/

Kaur, M. (2017). Demonetization: Impact on cashless payment system.

International Journal of Science and Technology, 6 (1), 145-147. Retrieved

from http://data.conferenceworld.in/SGTB/P680-685.pdf

RIJBR 263 ISSN : 2455-5959

Kumar, A. (2016). Demonetization to have positive impact on economy:

F i n a n c e M i n i s t e r A r u n J a i t l e y. R e t r i e v e d f r o m

http://indiatoday.intoday.in/story/Demonetization-arun-jaitley-economy-

gdp-banks-positive-impact/1/818702.html

Roy K., Sacchidananda M., Kumar, S., Sengupta, D. P., Tandon, S., &

Nayudu, S. H. (2016). Tax Research Team. Demonetization: Impact on the

Economy. National Institute of Public Finance and Policy: New Delhi.

Retrieved from http://www.nipfp.org.in/publications/working-

papers/1772/

Swarajya (2016). India's top statistician: Demo impact on economy is made

out to be bigger than it actually was. Retrieved from

http://swarajyamag.com/insta/agustawestland-scam-former-air-force-

chief-tyagi-points-finger-at-manmohan-singhs-office

The Wire (2016). Five Reasons Why the Recent Demonetization May Be

Legally Unsound. Retrieved from

http://thewire.in/81325/Demonetization-legally-unsound/

Veerakumar (2017). A Study on People Impact on Demonetization.

International Journal of Interdisciplinary Research in Arts and

Humanities, 2(1), 9-12.

Vyawahare, M. (2016). Demonetization is Inconvenient, but there are some

blessings, Let's Count. Economy News. Retrieved from

https://in.news.yahoo.com/Demonetization-inconvenient-blessings-let-

count-052018757.html.

RIJBR 264 ISSN : 2455-5959

You might also like

- Linux Usage in Banking IndustriesDocument29 pagesLinux Usage in Banking IndustriesheythereyoppieNo ratings yet

- Economics ProjectDocument35 pagesEconomics ProjectRaviRamchandaniNo ratings yet

- Organizations Structure of EBLDocument35 pagesOrganizations Structure of EBLnasir mamunNo ratings yet

- Diagram of The Financial SystemDocument1 pageDiagram of The Financial SystemPersonified Ghost57% (7)

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesvinayNo ratings yet

- Impact of Demonetisation in IndiaDocument5 pagesImpact of Demonetisation in IndiaIJASRETNo ratings yet

- Demonetization Kicks in - India Is Reacting: 8, 2016 Midnight. This Scheme Has ReceivedDocument9 pagesDemonetization Kicks in - India Is Reacting: 8, 2016 Midnight. This Scheme Has ReceivedShiny SNo ratings yet

- Case Study C-42 Tanu RathiDocument5 pagesCase Study C-42 Tanu RathiTanu RathiNo ratings yet

- ProjectDocument3 pagesProjectTSA27 SYBScIT Priti Mohite.No ratings yet

- Essay On Demonetization and GSTDocument4 pagesEssay On Demonetization and GSTArindam AcharyaNo ratings yet

- Positive and Negative Effects of Currency Demonetization:-: SourceDocument6 pagesPositive and Negative Effects of Currency Demonetization:-: SourceMir AqibNo ratings yet

- DemotrizionDocument3 pagesDemotrizionAnand KashyapNo ratings yet

- IOSR PDFDocument5 pagesIOSR PDFVincent DirainNo ratings yet

- An Overview On Impact of Demonetization in The Current Scenario (2016-17) of Indian EconomyDocument3 pagesAn Overview On Impact of Demonetization in The Current Scenario (2016-17) of Indian EconomyZeeshanNo ratings yet

- Demonetization Essay PDF - Essay On Demonetization PDF IndiaDocument4 pagesDemonetization Essay PDF - Essay On Demonetization PDF IndiaKr Ish Na0% (1)

- DEMONYDocument2 pagesDEMONYSRIKRISHNANo ratings yet

- Demonetization of CurrencyDocument72 pagesDemonetization of CurrencyParikshitNo ratings yet

- Demonetization and Its Impact On Indian EconomyDocument29 pagesDemonetization and Its Impact On Indian EconomyHukum RestroNo ratings yet

- Sample Research Paper PDFDocument27 pagesSample Research Paper PDFSANYA JAINNo ratings yet

- 500 Words Essay On DemonetizationDocument6 pages500 Words Essay On DemonetizationaasaNo ratings yet

- DemonetisationDocument3 pagesDemonetisationKashreya JayakumarNo ratings yet

- Research Paper ON Effects of Demonetization in India: Submitted ToDocument7 pagesResearch Paper ON Effects of Demonetization in India: Submitted TobhawnaNo ratings yet

- File 27092021030637Document33 pagesFile 27092021030637SnehaNo ratings yet

- DemonetizationDocument60 pagesDemonetizationHenna LitinNo ratings yet

- Paper Presentaion On Demonetisation - For MergeDocument12 pagesPaper Presentaion On Demonetisation - For MergeRanjith GowdaNo ratings yet

- Demonetization FILEDocument13 pagesDemonetization FILEDamanjot KaurNo ratings yet

- Vanshika FileDocument59 pagesVanshika Filesinghalmuskan751No ratings yet

- Essay DemonetizationDocument4 pagesEssay DemonetizationRaj SharmaNo ratings yet

- Impact of DemonetizationDocument30 pagesImpact of DemonetizationKomal Pal100% (1)

- Demonatisation A Game of PredictionsDocument2 pagesDemonatisation A Game of PredictionsDr. Kaustubh JianNo ratings yet

- Aditya Eco Sem 2 Assign 2 FinalDocument8 pagesAditya Eco Sem 2 Assign 2 Finaludit rajNo ratings yet

- Effects of Demonetization On Banks - Law Times JournalDocument4 pagesEffects of Demonetization On Banks - Law Times JournalKhanak ChauhanNo ratings yet

- Report On De-Monetization On Indian Economy: Currency Legal Tender National CurrencyDocument4 pagesReport On De-Monetization On Indian Economy: Currency Legal Tender National Currencyshivam agrawalNo ratings yet

- Report On De-Monetization On Indian Economy: Currency Legal Tender National CurrencyDocument4 pagesReport On De-Monetization On Indian Economy: Currency Legal Tender National Currencyshivam agrawalNo ratings yet

- Efffect of DemonitizationDocument8 pagesEfffect of Demonitizationsaurav ghimireNo ratings yet

- Unit 4 DBDocument12 pagesUnit 4 DBDeepika. BabuNo ratings yet

- Demonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaDocument15 pagesDemonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaShalvi RanjanNo ratings yet

- Case Study 1Document6 pagesCase Study 1mashila arasanNo ratings yet

- EconomicsDocument10 pagesEconomicsSaloni ChoudharyNo ratings yet

- DemonitarsationDocument37 pagesDemonitarsationSTAR PRINTINGNo ratings yet

- Sharad Malhotra Impact of Cashless Society For The Economic Growth in IndiaDocument7 pagesSharad Malhotra Impact of Cashless Society For The Economic Growth in IndiaNAMAN CHANDANINo ratings yet

- CT ReportDocument3 pagesCT ReportishwaNo ratings yet

- "Future and Scope of Cashless Economy in India" 1462Document5 pages"Future and Scope of Cashless Economy in India" 1462BHARATHNo ratings yet

- Aditya Eco Sem 2 Assign 2 FinalDocument7 pagesAditya Eco Sem 2 Assign 2 Finaludit rajNo ratings yet

- Demonetisation: A SWOT AnalysisDocument3 pagesDemonetisation: A SWOT AnalysisYESHA DAVENo ratings yet

- DemonetisationDocument20 pagesDemonetisationMukti BarolaNo ratings yet

- Currency DemonetizationDocument13 pagesCurrency DemonetizationarjunNo ratings yet

- Research Paper On Effect of Demonetization On Indian EconomyDocument5 pagesResearch Paper On Effect of Demonetization On Indian EconomyAYUSH TAMRAKAR80% (5)

- Review Jurnal Internasional 4Document2 pagesReview Jurnal Internasional 4Yavishan NovindaNo ratings yet

- Impact of Demonetization On Retail Outlets - An Analytical Study R. Venkatesh & P. Sathiya PriyaDocument10 pagesImpact of Demonetization On Retail Outlets - An Analytical Study R. Venkatesh & P. Sathiya PriyaNgawang dorjeeNo ratings yet

- Cashless EconomyDocument27 pagesCashless EconomyOM GARGNo ratings yet

- Eco AssignmentDocument8 pagesEco AssignmentTushar BansalNo ratings yet

- Demonitisation (Report)Document41 pagesDemonitisation (Report)onlinebaijnathNo ratings yet

- Impact of DemonetizationDocument7 pagesImpact of DemonetizationPartha Sarathi BarmanNo ratings yet

- Economics Project Format: TitleDocument18 pagesEconomics Project Format: TitleKisha OswalNo ratings yet

- Effects of DemonitizationDocument5 pagesEffects of DemonitizationrohitkgangotiaNo ratings yet

- Demonetisation Thus Has Its Pros and Cons. These Are Listed BelowDocument8 pagesDemonetisation Thus Has Its Pros and Cons. These Are Listed BelowShoyebsheikhNo ratings yet

- Demonetization ProjectDocument8 pagesDemonetization ProjectFloydCorreaNo ratings yet

- Demonetization: Success & Failures: Presented By:-Harshvardhan Bartwal (Prof. R.C. Dangwal) DeanDocument17 pagesDemonetization: Success & Failures: Presented By:-Harshvardhan Bartwal (Prof. R.C. Dangwal) DeanDheeraj rawatNo ratings yet

- Effect of Demonetisation in India:: 3.43 Cite This Paper AsDocument5 pagesEffect of Demonetisation in India:: 3.43 Cite This Paper AsAanu GappaNo ratings yet

- Isha SinghDocument10 pagesIsha Singhskguddu2003No ratings yet

- Set 3Document144 pagesSet 3Arham TanvirNo ratings yet

- CLAT 2021 Previous Year Paper (Legal Section)Document12 pagesCLAT 2021 Previous Year Paper (Legal Section)Harsh SrivastavaNo ratings yet

- Online Betting Winnings Are They Taxed in IndiaDocument3 pagesOnline Betting Winnings Are They Taxed in IndiaHarsh SrivastavaNo ratings yet

- November 2020 Part 2Document13 pagesNovember 2020 Part 2Harsh SrivastavaNo ratings yet

- GamblingDocument3 pagesGamblingHarsh SrivastavaNo ratings yet

- DC DissertationDocument80 pagesDC DissertationHarsh SrivastavaNo ratings yet

- Anuj DissertationDocument103 pagesAnuj DissertationHarsh SrivastavaNo ratings yet

- Course Plan - Aviation Air & Space Law BA LLB HonsDocument15 pagesCourse Plan - Aviation Air & Space Law BA LLB HonsHarsh SrivastavaNo ratings yet

- Evidence - Unit 1 Interpretation ClauseDocument16 pagesEvidence - Unit 1 Interpretation ClauseHarsh SrivastavaNo ratings yet

- SOL - (Odd Sem) Date Sheet - End Sem Exam Dec 2022Document7 pagesSOL - (Odd Sem) Date Sheet - End Sem Exam Dec 2022Harsh SrivastavaNo ratings yet

- Dissertation - Bhavya Thaman EDDocument52 pagesDissertation - Bhavya Thaman EDHarsh SrivastavaNo ratings yet

- Origin & DevelopmentDocument17 pagesOrigin & DevelopmentHarsh SrivastavaNo ratings yet

- Article 15Document39 pagesArticle 15Harsh SrivastavaNo ratings yet

- Kidnapping and AbductionDocument10 pagesKidnapping and AbductionHarsh SrivastavaNo ratings yet

- 01 Unit I Environmental Studies-A Multidisciplinary SubjectDocument50 pages01 Unit I Environmental Studies-A Multidisciplinary SubjectHarsh SrivastavaNo ratings yet

- My UPES SOPDocument8 pagesMy UPES SOPHarsh SrivastavaNo ratings yet

- Reply Filed On Behalf of Respondents To The Criminal Writ Petition Filed Under Article 32 of The Constitution of HimalDocument37 pagesReply Filed On Behalf of Respondents To The Criminal Writ Petition Filed Under Article 32 of The Constitution of HimalHarsh SrivastavaNo ratings yet

- Legal UpdatesDocument5 pagesLegal UpdatesHarsh SrivastavaNo ratings yet

- Vishakha Vs State of RajasthanDocument2 pagesVishakha Vs State of RajasthanHarsh SrivastavaNo ratings yet

- 02 EcosystemDocument80 pages02 EcosystemHarsh SrivastavaNo ratings yet

- Psle - Raise Your Voice, Each Vote CountDocument4 pagesPsle - Raise Your Voice, Each Vote CountHarsh SrivastavaNo ratings yet

- Sanitation in India Role of Women S EducDocument12 pagesSanitation in India Role of Women S EducHarsh SrivastavaNo ratings yet

- Culpable Homicide & MurderDocument16 pagesCulpable Homicide & MurderHarsh SrivastavaNo ratings yet

- Salient Provisions of The JJA 2015Document6 pagesSalient Provisions of The JJA 2015Harsh SrivastavaNo ratings yet

- Defence of Intoxication Judicial Confusion by Apeksha GuptaDocument17 pagesDefence of Intoxication Judicial Confusion by Apeksha GuptaHarsh SrivastavaNo ratings yet

- Sexual OffencesDocument10 pagesSexual OffencesHarsh SrivastavaNo ratings yet

- Document 1Document10 pagesDocument 1Harsh SrivastavaNo ratings yet

- Fam LawDocument9 pagesFam LawHarsh SrivastavaNo ratings yet

- India Health System Review: ISBN-13 978 92 9022 904 9Document328 pagesIndia Health System Review: ISBN-13 978 92 9022 904 9Harsh SrivastavaNo ratings yet

- Art 1-4Document26 pagesArt 1-4Harsh SrivastavaNo ratings yet

- FinalDocument28 pagesFinalHarsh SrivastavaNo ratings yet

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentShakikNo ratings yet

- Suraj Lums Edu PKDocument12 pagesSuraj Lums Edu PKshuguftarashidNo ratings yet

- Toaz - Info 4 First Comprehensive Test PRDocument11 pagesToaz - Info 4 First Comprehensive Test PRJade VillanuevaNo ratings yet

- Legal Issues FactoringDocument1 pageLegal Issues FactoringFaysal HaqueNo ratings yet

- Final Nancy121Document66 pagesFinal Nancy121Sahil SethiNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationAlexandria Ann FloresNo ratings yet

- Branch BankingDocument2 pagesBranch Bankingbeena antuNo ratings yet

- Iifl Gold LoanDocument52 pagesIifl Gold LoanuiopoiuyNo ratings yet

- The Resilience of Central and Eastern European Banking Systems During The Covid-19 CrisisDocument10 pagesThe Resilience of Central and Eastern European Banking Systems During The Covid-19 Crisis23.Nguyễn Mỹ Nghi 12A3No ratings yet

- CreditTrans - Case 44Document2 pagesCreditTrans - Case 44ces ereseNo ratings yet

- Trugo - Assignment Proof of CashDocument3 pagesTrugo - Assignment Proof of CashmoreNo ratings yet

- Financial Ratio Analysis As Determinant of Profitability in African Banking IndustryDocument10 pagesFinancial Ratio Analysis As Determinant of Profitability in African Banking IndustryjaneNo ratings yet

- Solution Manual For An Introduction To Mechanical Engineering 4th EditionDocument24 pagesSolution Manual For An Introduction To Mechanical Engineering 4th EditionDouglasWrightcmfa100% (34)

- Debt Relief ActDocument16 pagesDebt Relief ActVividh PawaskarNo ratings yet

- STT 2020 Annual ReportDocument290 pagesSTT 2020 Annual ReportEvgeniyNo ratings yet

- Why HITV FailedDocument5 pagesWhy HITV Failedsought out!No ratings yet

- UP Taxation Law Pre Week 2017Document28 pagesUP Taxation Law Pre Week 2017Robert Manto67% (3)

- Existing Relationships: Consumer Products Application FormDocument6 pagesExisting Relationships: Consumer Products Application Formshani908No ratings yet

- Universal BankDocument1 pageUniversal Bankhailene lorenaNo ratings yet

- E Commerce and Internet MarketingDocument78 pagesE Commerce and Internet MarketingMadrigal AnnalynNo ratings yet

- HDocument23 pagesHLila DeviNo ratings yet

- New Product DevelopmentDocument5 pagesNew Product DevelopmentMd Maruf HasanNo ratings yet

- St. Mary'S University Business Faculty Departement of AccountingDocument57 pagesSt. Mary'S University Business Faculty Departement of AccountingSingitan YomiyuNo ratings yet

- BankingDocument3 pagesBankingTamanna MulchandaniNo ratings yet

- Test Bank For Financial Management Core Concepts 2nd Edition by BrooksDocument36 pagesTest Bank For Financial Management Core Concepts 2nd Edition by Brooksrowdydow.shittimu4n3100% (48)

- 04 - COA SamplesDocument4 pages04 - COA SamplesJonalyn MalicdanNo ratings yet