Professional Documents

Culture Documents

Module 2.1 - Cash and Cash Equivalents

Module 2.1 - Cash and Cash Equivalents

Uploaded by

Chelsea PagcaliwaganCopyright:

Available Formats

You might also like

- Citi Bank Statement PDFDocument6 pagesCiti Bank Statement PDFblack bird100% (1)

- Soto Melendez V Banco Popular de Puerto RicoDocument45 pagesSoto Melendez V Banco Popular de Puerto RicoErick A. Velázquez Sosa100% (2)

- Bitwala KontoauszugDocument3 pagesBitwala KontoauszugDieter WellernNo ratings yet

- Audit of Cash: Darrell Joe O. Asuncion, Cpa MbaDocument17 pagesAudit of Cash: Darrell Joe O. Asuncion, Cpa MbaKaila Salem100% (1)

- Module 004 Accounting For Cash: Definition, Nature and Composition of Cash and Cash Equivalents CashDocument12 pagesModule 004 Accounting For Cash: Definition, Nature and Composition of Cash and Cash Equivalents CashLee-chard EboeboNo ratings yet

- 05 Cash Cash EquivalentsDocument54 pages05 Cash Cash EquivalentsFordan Antolino85% (13)

- Cash - TeachersDocument12 pagesCash - TeachersJustin ManaogNo ratings yet

- Cash PDFDocument10 pagesCash PDFGabriel JonNo ratings yet

- Your Annual Summary - 08092016 PDFDocument2 pagesYour Annual Summary - 08092016 PDFAnonymous r9H4ebc100% (1)

- SIP Report On Credit Appraisals at Indian Overseas BankDocument48 pagesSIP Report On Credit Appraisals at Indian Overseas BankPriyanka Dwivedi0% (2)

- Module 1.1Document13 pagesModule 1.1Althea mary kate MorenoNo ratings yet

- Cashand Cash Equivalents101Document38 pagesCashand Cash Equivalents101Wynphap podiotanNo ratings yet

- W6 Module 9 Cash and Cash Equivalents Part 1Document11 pagesW6 Module 9 Cash and Cash Equivalents Part 1haven AvyyNo ratings yet

- W6 Module 9 Cash and Cash Equivalents Part 1Document7 pagesW6 Module 9 Cash and Cash Equivalents Part 1leare ruazaNo ratings yet

- Cash and Cash EquivalentsDocument31 pagesCash and Cash EquivalentsMark LouieNo ratings yet

- Reviewer Accounting - CrisaDocument12 pagesReviewer Accounting - Crisamiracle123No ratings yet

- Chapter 7Document11 pagesChapter 7Louie Ann CasabarNo ratings yet

- Cash and Cash EquivalentsDocument15 pagesCash and Cash EquivalentsVon Rother Celoso DiazNo ratings yet

- Chapter 1 Cash and Cash Equivalents AutoRecoveredDocument44 pagesChapter 1 Cash and Cash Equivalents AutoRecoveredJhonielyn Regalado RugaNo ratings yet

- Ia - Chapter 1Document16 pagesIa - Chapter 1Layla MainNo ratings yet

- Ia - Module 1Document6 pagesIa - Module 1MARY IZABELLE L. DIZONNo ratings yet

- Week 02 - 01 - Module 04 - Accounting For CashDocument12 pagesWeek 02 - 01 - Module 04 - Accounting For Cash지마리No ratings yet

- A101 Financial Accounting and Reporting XFARDocument61 pagesA101 Financial Accounting and Reporting XFARCristina TayagNo ratings yet

- Chapter 2 - Cash and Cash EquivalentsDocument11 pagesChapter 2 - Cash and Cash EquivalentsAyessa Joy TajaleNo ratings yet

- Cash Cash Equivalents - Part 1Document35 pagesCash Cash Equivalents - Part 1Lily of the ValleyNo ratings yet

- Lecture No.1 Cash Cash Equiv TheoriesDocument3 pagesLecture No.1 Cash Cash Equiv TheoriesbsasociondaisyremarieNo ratings yet

- Cash and Cash Equivalents: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument66 pagesCash and Cash Equivalents: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument9 pagesModule 1 - Cash and Cash Equivalentsjay classroomNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document15 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsKate CamachoNo ratings yet

- 2-1 AE111 NOTES Unit-2Document29 pages2-1 AE111 NOTES Unit-2Gab IgnacioNo ratings yet

- IA For Prelims FinalDocument438 pagesIA For Prelims FinalCeline Therese BuNo ratings yet

- 1 - Chapter 1 Cash and Cash EquivalentsDocument9 pages1 - Chapter 1 Cash and Cash EquivalentsKing Nufayl Sendad100% (1)

- Cash & Cash EquivalentsDocument34 pagesCash & Cash EquivalentsStudent Core GroupNo ratings yet

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- Cash and Cash Equivalents - SCDocument33 pagesCash and Cash Equivalents - SCKaren Estrañero LuzonNo ratings yet

- Financial Accounting and Reporting - Cash and Cash EquivalentsDocument6 pagesFinancial Accounting and Reporting - Cash and Cash EquivalentsLuisitoNo ratings yet

- Intermediate AccountingDocument33 pagesIntermediate AccountingHannah Baniqued100% (1)

- Audit of AdvancesDocument29 pagesAudit of AdvancesHemanshu SolankiNo ratings yet

- ACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Document76 pagesACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Christel Oruga100% (1)

- Cash and Cash EquivalentsDocument37 pagesCash and Cash EquivalentsReiner Jan AlcantaraNo ratings yet

- IA1 Cash and Cash EquivalentsDocument20 pagesIA1 Cash and Cash EquivalentsJohn Rainier QuijadaNo ratings yet

- CHAPTER 1-Cash and Cash EquivalentsDocument43 pagesCHAPTER 1-Cash and Cash EquivalentsMarriel Fate CullanoNo ratings yet

- Statement of Financial PositionDocument9 pagesStatement of Financial PositionJEAN YVES BRAVONo ratings yet

- CCE HeheDocument19 pagesCCE HeheJam SurdivillaNo ratings yet

- Cash and Cash EquivalentsDocument27 pagesCash and Cash EquivalentsPatOcampoNo ratings yet

- REO With Theories AnwerDocument21 pagesREO With Theories AnweraceNo ratings yet

- 2 Cash and Cash Equivalents Summary ReviewerDocument4 pages2 Cash and Cash Equivalents Summary ReviewerRey HandumonNo ratings yet

- Cash and Cash EquivalentsDocument23 pagesCash and Cash EquivalentsGennelyn Grace Penaredondo100% (1)

- Chapter 2 Cash and Cash EquivalentsDocument12 pagesChapter 2 Cash and Cash EquivalentslorieferpaloganNo ratings yet

- Cash Cash EquivalentDocument92 pagesCash Cash EquivalentInzaghi CruiseNo ratings yet

- Assessment Task 1 (IA)Document4 pagesAssessment Task 1 (IA)Jonalyn BañegaNo ratings yet

- Accouting For Cash and Cash Equivalents CASH IncludesDocument4 pagesAccouting For Cash and Cash Equivalents CASH IncludesSecurity Bank Personal LoansNo ratings yet

- AUDT03 1 Cash Cash Equivalents PDFDocument2 pagesAUDT03 1 Cash Cash Equivalents PDFAngeline VergaraNo ratings yet

- Nature of Cash AccountDocument10 pagesNature of Cash AccountLorena PernatoNo ratings yet

- Income Recognition and Asset ClassificationDocument21 pagesIncome Recognition and Asset Classificationsagar7No ratings yet

- Cash and Cash Equivalents (Chapter 1)Document171 pagesCash and Cash Equivalents (Chapter 1)chingNo ratings yet

- Cash Part1Document7 pagesCash Part1cuaresmamonicaNo ratings yet

- Bank ManagementDocument50 pagesBank ManagementApoorva GuptaNo ratings yet

- Cashandcashequivalent 150620153356 Lva1 App6892 PDFDocument27 pagesCashandcashequivalent 150620153356 Lva1 App6892 PDFMary Ann BaguioNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument10 pagesModule 1 - Cash and Cash EquivalentsGRACE ANN BERGONIONo ratings yet

- Module 1Document12 pagesModule 1bhettyna noayNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- FM 101 Chapter 2 (Cabrera)Document17 pagesFM 101 Chapter 2 (Cabrera)Chelsea PagcaliwaganNo ratings yet

- 2nd Batch All CasesDocument4 pages2nd Batch All CasesChelsea PagcaliwaganNo ratings yet

- Topic 1 - Audit of Cash Transactions and BalancesDocument6 pagesTopic 1 - Audit of Cash Transactions and BalancesChelsea PagcaliwaganNo ratings yet

- Module 2.2 - Bank Reconciliation and Proof of CashDocument24 pagesModule 2.2 - Bank Reconciliation and Proof of CashChelsea PagcaliwaganNo ratings yet

- Standard Charted - SaadiqDocument16 pagesStandard Charted - SaadiqkirshanlalNo ratings yet

- Wells Fargo Everyday CheckingDocument1 pageWells Fargo Everyday CheckingKeenen New ManleyNo ratings yet

- Bank Jan23Document9 pagesBank Jan23Diviyan MacNo ratings yet

- Chequing Statement-1200 2023-05-15Document5 pagesChequing Statement-1200 2023-05-15lauramartinez2313No ratings yet

- FeeInformation BarclaysBasicAccountDocument2 pagesFeeInformation BarclaysBasicAccountkagiyir157No ratings yet

- MBE - BFAR (1st Sem, 2021-2022)Document11 pagesMBE - BFAR (1st Sem, 2021-2022)Bai Dianne BagundangNo ratings yet

- Retail BankingDocument103 pagesRetail BankingRamesh BabuNo ratings yet

- Working Capital Unit 1 To 4Document103 pagesWorking Capital Unit 1 To 4tarunNo ratings yet

- GST 223, Q&a (Kadung Samuel For Sossa 001 2019)Document66 pagesGST 223, Q&a (Kadung Samuel For Sossa 001 2019)Japhet Gajere100% (1)

- WellsFargo-2Document4 pagesWellsFargo-2itsoueNo ratings yet

- ShivaniDocument74 pagesShivaniRahul MehtaNo ratings yet

- APACS Cheques Facts LeafletDocument54 pagesAPACS Cheques Facts Leafletnikiwin78No ratings yet

- Assignment of PartnerShip DeedDocument6 pagesAssignment of PartnerShip DeedYeasin Aziz100% (1)

- Money and Banking NotesDocument14 pagesMoney and Banking NotesKOECH VINCENTNo ratings yet

- Lecture 3 - Loans - AdvancesDocument16 pagesLecture 3 - Loans - AdvancesYvonneNo ratings yet

- E .Services in Banks: Keywords: Communication Technology, Banking, ServicesDocument10 pagesE .Services in Banks: Keywords: Communication Technology, Banking, ServicesDr.K.BaranidharanNo ratings yet

- Service Charges: An Easy Guide To Banking FeesDocument24 pagesService Charges: An Easy Guide To Banking FeesolimNo ratings yet

- Business Studies Financial StatementsDocument3 pagesBusiness Studies Financial StatementsSusanna NgNo ratings yet

- ACCA Fundamentals Level Paper F3 Financial Accounting (International) Course Test 2Document16 pagesACCA Fundamentals Level Paper F3 Financial Accounting (International) Course Test 2Seng Cheong KhorNo ratings yet

- Public BankDocument14 pagesPublic BankKong Hung Ng0% (1)

- Account Statement Greendot PDFDocument4 pagesAccount Statement Greendot PDFBaris MironNo ratings yet

- Theory of Accounts Cash and Cash EquivalentsDocument9 pagesTheory of Accounts Cash and Cash Equivalentsida_takahashi43% (14)

- In Re Clifton J SpearsDocument9 pagesIn Re Clifton J SpearswstNo ratings yet

- Loans and Advances 2016Document128 pagesLoans and Advances 2016Anonymous kyvLgSREMNo ratings yet

- English Form 1Document13 pagesEnglish Form 1adancade562No ratings yet

Module 2.1 - Cash and Cash Equivalents

Module 2.1 - Cash and Cash Equivalents

Uploaded by

Chelsea PagcaliwaganOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 2.1 - Cash and Cash Equivalents

Module 2.1 - Cash and Cash Equivalents

Uploaded by

Chelsea PagcaliwaganCopyright:

Available Formats

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

Module 2.1

CASH and CASH EQUIVALENTS

Week 2

This module discusses the concept of cash. It will help the users of this module to also understand the

concept of cash equivalents. This will also aid the users to determine which items shall be considered as

cash and/or cash equivalents. An addition to the identified focus topics, this module will also discuss

accounting treatments for petty cash fund.

INTENDED LEARNING OBJECTIVES

ILO 1 – Identify the applicable accounting standards for the recognition and measurement of cash and

cash equivalents

ILO 2 – Compute for the amount appropriate for the presentation in the financial statements

ILO 3 – Understand the concept of petty cash fund, its accounting treatments and presentation in the

financial statements

CASH

DEFINITION OF CASH

From the point of view of a layman, “cash” simply means money.

Money is the standard medium of exchange in business transactions. Money refers to the currency and

coins which are in circulation and legal tender1. However, in the accounting parlance, the term “cash” has

a special and broader meaning. It connotes more than money.

As contemplated in accounting, cash includes money and any other negotiable instrument2 that is payable

in money and acceptable by the bank for deposit and immediate credit.

Accordingly, cash includes checks, bank drafts, and money orders because these are acceptable by the

bank for deposit or immediate encashment. For example, when checks are received in full settlement of

an account receivable, cash is immediately debited. But postdated checks received cannot be considered

1

Legal tender means such currency which in a given jurisdiction can be used for the payment of debts, public and

private, and which cannot be refused by the creditor (Tolentino, Obligations and Contracts, 2002). These are coins

or banknotes that must be accepted if offered in payment of a debt.

2

Negotiable instrument is any document in writing and signed by the maker or drawer which contains an

unconditional promise or order to pay a sum certain in money and payable on demand, or at a fixed or

determinable future time payable to order or to bearer (so called badges of negotiability). If addressed to a

drawee, he must be named or otherwise indicated with reasonable certainty. (Sec. 1 of R.A. 2031)

PREPARED BY JADE SILVA, CPA Page 1 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

as cash yet because these checks are unacceptable by the bank for deposit and immediate credit or

outright encashment.

UNRESTRICTED CASH

There is no specific standard dealing with cash. The only guidance is found in PAS 1, paragraph 66, which

provides that an entity shall classify an asset as current when the asset is cash or a cash equivalent unless

it is restricted to settle a liability for more than twelve months after the end of the reporting period.

Accordingly, to be reported as cash, an item must be unrestricted in use. This means that the cash must

be readily available in the payment of current obligations and not be subject to any restrictions,

contractual or otherwise.

CASH ITEMS INCLUDED IN CASH

1. Cash on hand – this includes undeposited cash collections and other cash items awaiting deposit

such as customer’s checks, cashier’s or manager’s checks, traveler’s checks, bank drafts and

money orders.

2. Cash in bank – this includes demand deposit or checking account and saving deposit which are

unrestricted as to withdrawal

3. Cash fund set aside for current purposes such as petty cash fund, payroll fund, and dividend fund.

CASH EQUIVALENTS

PAS 7, paragraph 6, defines cash and cash equivalents as short-term and highly liquid investments that

are readily convertible into cash and so near their maturity that they present insignificant risk of changes

in value because of changes in interest rates.

The standard further states that only highly liquid investments that are acquired three months before

maturity can qualify as cash equivalents.

DATE OF PURCHASE

Examples of cash equivalents are:

1. Three-month BSP treasury bills

2. Three-year BSP treasury bill purchased three months before date of maturity

3. Three-month time deposit

4. Three-month money market instrument or commercial paper issuer: private companies

EQUITY SECURITIES PREFERENCE SHARES

cannot qualify as cash equivalents because shares can qualify as cash if with specified redemption

do not have a maturity date date AND acquired three months before

redemption date

it connoted ownership

redeemable preference share: from the time na ginawa sya ng corp ay may maturity date

in form - sya ay share pero dahil may maturity date therefore sya ay liability

PREPARED BY JADE SILVA, CPA Page 2 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

Note that what is important is the date of purchase which should be three months or less before maturity.

Thus, a BSP treasury bill that was purchased one year ago cannot qualify as cash equivalent even if the

remaining maturity is three months or less.

INVESTMENT OF EXCESS CASH

The control and proper use of cash is an important aspect of cash management. Basically, the entity must

maintain sufficient cash for use in current operations.

Any cash accumulated in excess of that needed for current operations should be invested even

temporarily in some type of revenue earning investment.

Accordingly, excess cash may be invested in time deposits, money market instruments and treasury bills

for the purpose of earning interest income.

CLASSIFICATION OF INVESTMENT OF EXCESS CASH

Investment in time deposit, money market instruments and treasury bills should be classified as follows:

• If the term is three months or less, such instruments are classified as cash equivalents and

therefore included in the caption “cash and cash equivalents”

• If the term is more than three months but within one year, such investments are classified as

short-term financial assets or temporary investments and presented separately as current assets

• If the term is more than one year, such investments are classified as noncurrent or long-term

investments.

However, if such investments become due within one year from the end of the reporting period, they are

reclassified as current or temporary investments.

MEASUREMENT OF CASH

Cash is measured at face value. Cash in foreign currency is measured at the current exchange rate.

If a bank or financial institution holding the funds of an entity is in bankruptcy or financial difficulty, cash

should be written down to estimated realizable value if the amount recoverable is estimated to be lower

than the face value.

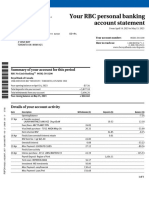

FINANCIAL STATEMENT PRESENTATION AND CLASSIFICATION OF CCE

FINANCIAL POSITION NOTES TO FINANCIAL STATEMENT

should be shown as the line item among the details comprising the "cash and cash equivalents"

current assets which reflects the total cash items should be disclosed here which may include all

cash items, such as cash on hand, cash in bank,

petty cash fund and cash equivalents which are

unrestricted in use for current operations.

PREPARED BY JADE SILVA, CPA Page 3 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

In financial position:

In notes to financial statements:

PREPARED BY JADE SILVA, CPA Page 4 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

CLASSIFICATION OF TIME DEPOSIT, MONEY MARKET INSTRUMENT AND TREASURY BILLS

If the term is

3 months or less more than 3 months but within more than one year

one year

Current Asset (CA) Current Asset (CA) Noncurrent Asset (NCA)

Cash Equivalents Short-term Investment Long-term Investment

under CCE separate from CCE separate from CA

If such long-term investment becomes due within one year from the end of the reporting period, they

are reclassified as temporary investments; from NCA to CA.

FOREIGN CURRENCY

Deposits in foreign countries which are

not subject to any foreign exchange restriction subject to foreign exchange restriction

Current Asset (CA) Noncurrent Asset (NCA)

Cash Restricted Cash in Foreign Bank

CASH FUND FOR A CERTAIN PURPOSE

If the cash fund is set aside for

USE IN CURRENT OPERATIONS FOR NONCURRENT PURPOSES

Current Asset (CA) Noncurrent Asset (NCA)

Cash and Cash Equivalents Long-Term Investment

petty cash fund, payroll fund, travel sinking fund, preferred redemption

fund, interest fund, dividend fund and tax fund fund, contingent fund, insurance fund and fund

for acquisition or construction of property, plant

and equipment

GENERAL RULE:

Classification of a cash fund as current or noncurrent should parallel the classification of the related

liability.

EXCEPTION:

A cash fund set aside for acquisition of noncurrent should be classified as noncurrent regardless of

the year

CLASSIFICATION OF CASH FUND

The classification of a cash fund as current or noncurrent should parallel the classification of the related

liability.

For example, a sinking fund that is set aside to pay a bond payable shall be classified as current asset when

the bond payable is already due within one year after the end of the reporting period.

However, a cash fund set aside for the acquisition of a noncurrent asset should be classified as noncurrent

regardless of the year of disbursement.

PREPARED BY JADE SILVA, CPA Page 5 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

BANK OVERDRAFT

When the cash in bank account has a credit balance, it is said to be an overdraft. The credit balance in the

cash in bank account results from the issuance of checks in excess of the deposits.

General Rule:

A bank overdraft is classified as a current liability and should not be offset against other bank accounts

with debit balances.

For example, an entity maintains two bank accounts:

• Cash in bank – First Bank, which is overdrawn by P10,000

• Cash in bank – Second Bank, with a debit balance of P100,000

The net cash balance is P90,000. The proper statement classification of the two accounts is as follows:

Current Asset:

Cash in bank – Second Bank 100,000

Current Liability:

Bank overdraft – First Bank 10,000

Note that it is not necessary to adjust and open a bank overdraft account in the ledger. In other words,

Cash in Bank – First Bank account is maintained in the ledger with a credit balance. It is to be stated that

generally overdrafts are not permitted in the Philippines.

Exceptions:

1. When the entity maintains two or more accounts in one bank and one account results in an

overdraft, such overdraft may be offset against the other bank account with a debit balance.

2. Moreover, an overdraft may also be offset against the other bank account if the amount is not

material.

3. Under IFRS, bank overdraft can be offset against other bank account when payable on demand

and often fluctuates from positive to negative as an integral part of cash management.

COMPENSATING BALANCE

A compensating balance generally takes the form of minimum checking or demand deposit account

balance that must be maintained in connection with a borrowing arrangement with a bank.

For example, an entity borrows P5,000,000 from a bank and agrees to maintain a 10% or P500,000

minimum compensating balance in a demand deposit account.

In effect, this arrangement results in the reduction of the amount borrowed because the compensating

balance provides a source of fund to the bank as partial compensation for the loan extended.

PREPARED BY JADE SILVA, CPA Page 6 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

CLASSIFICATION OF COMPENSATING BALANCE

If the deposit, as to withdrawal, is

NOT LEGALLY RESTRICTED LEGALLY RESTRICTED

and the loan is short-term and the loan is long-term

Current Asset (CA) Current Asset (CA) Noncurrent Asset (NCA)

Cash and Cash Equivalent Cash Held as Compensating Noncurrent Investment or Long-

Balance term Investment

UNDELIVERED OR UNRELEASED CHECK

An undelivered or unreleased check is one that is merely drawn and recorded but not given to the payee

before the end of the reporting period. There is no payment when the check is pending delivery to the

payee at the end of the reporting period.

The reason is that undelivered check is still subject to the entity’s control and may thus be canceled

anytime before delivery at the discretion of the entity. Accordingly, an adjusting entry is required to

restore the cash balance and set up the liability.

Journal Cash xx

Entry: Accounts payable or appropriate account xx

In practice, the foregoing adjustment is sometimes ignored because the amount is not very substantial

and there is no evidence of actual cancelation of the check in the subsequent period.

POSTDATED CHECK DELIVERED

A postdated check delivered is a check drawn, recorded and already given to the payee but it bears a

date subsequent to the end of the reporting period. The original entry recording a delivered postdated

check shall also be reversed and therefore restored to the cash balance.

Journal Cash xx

Entry: Accounts payable or appropriate account xx

The reason is that there is no payment until the check can be presented to the bank for encashment or

deposit.

STALE CHECK OR CHECK LONG OUTSTANDING

A stale check is a check not encashed by the payee within a relatively long period of time. The question

is how long a time must the check remain outstanding?

PREPARED BY JADE SILVA, CPA Page 7 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

The Negotiable Instruments Law provides that where the instrument is payable on demand,

presentment must be made within a reasonable time after issue. In determining reasonable time,

consideration should be made regarding the nature of the instrument, the usage of trade or business, if

any, with respect to such instrument and the facts of the particular case.

Clearly, the law does not specify a definite period within checks must be presented for encashment.

Reference is made to usage of trade or business practice. In banking practice, a check becomes stale if

not encashed within six months from the time of issuance. Of course, this is a matter of entity policy.

Thus, even after three months only, the entity may issue a stop payment order to the bank for the

cancelation of a previously issued check.

If the amount of stale check is immaterial, it is simply accounted for as miscellaneous income.

Journal Cash xx

Entry: Miscellaneous Income xx

However, if the amount is material and liability is expected to continue, the cash is restored and the

liability is again set up.

Journal Cash Xx

Entry: Accounts payable or appropriate account xx

ACCOUNTING FOR CASH SHORTAGE

like an expense account

Cash count < balance per book = SHORTAGE

Initial entry:

Journal Cash short or over xx

Entry: Cash xx

The cash short or over account is only a temporary or suspense account. When financial statements are

prepared, the same should be deposited.

Adjustment:

If the cashier or cash custodian is held responsible for the cash shortage:

Journal Due from cashier xx

Entry: Cash short or over xx

PREPARED BY JADE SILVA, CPA Page 8 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

If reasonable efforts fail to disclose the cause of the shortage, and amount is material:

Journal Loss from cash shortage xx

Entry: Cash short or over xx

If reasonable efforts fail to disclose the cause of the shortage, and amount is immaterial:

Journal Miscellaneous Expense xx

Entry: Cash short or over xx

ACCOUNTING FOR CASH OVERAGE

Cash count > the balance per book there = OVERAGE

Initial entry:

Journal Cash xx

Entry: Cash short or over xx

Note that whether it is a cash shortage or cash overage, the offsetting account is cash short or over

account. Such account should be adjusted when statements were made.

Adjustment:

If claimed by cashier:

Journal Cash short or over xx

Entry: Payable to cashier xx

If the responsible personnel cannot be traced and amount is material:

Journal Cash short or over xx

Entry: Gain from cash overage xx

If the responsible personnel cannot be traced and amount is immaterial:

Journal Cash short or over xx

Entry: Miscellaneous income xx

PREPARED BY JADE SILVA, CPA Page 9 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

IMPREST SYSTEM

The imprest system is a system of control of cash which requires that all cash receipts should be

deposited intact and all cash disbursements should be made by means of check. Small disbursements

are paid out of the petty cash fund.

While internal control ideally requires that all payments should be made by means of check, this is

sometimes impossible. There are occasions when the issuance of checks becomes impractical or

inconvenient such as when small amounts are paid or things are hurriedly bought or customers are

entertained.

Consequently, in such instances, it may be more economical and convenient to pay in cash rather than

issue checks.

PETTY CASH FUND included in cash ( Cash Fund)

The petty cash fund is money set aside to pay small expenses which cannot be paid conveniently by

means of check. There are two methods of handling the petty cash, namely:

IMPREST FUND SYSTEM FLUCTUATING FUND SYSTEM

Pretty cash expenses are recorded upon Petty cash expenses. are immediately recorded.

replenishment. The amount of replenishment may be equal to,

more or less than, the petty cash disbursements.

IMPREST FUND SYSTEM

The imprest fund system is the one usually followed in handling petty cash transactions.

Accounting Procedures:

a. A check is drawn to establish the fund:

Petty cash fund xx

Cash in bank xx

b. Payment of expenses out of fund

No formal journal entries are made.

petty cash custodian

The petty cashier generally requires a signed petty cash voucher for such payments and simply

prepares memorandum entries in the petty cash journal.

c. Replenishment of petty cash payments

Whenever the petty cash fund runs low, a check is drawn to replenish the fund. The

replenishment check is usually equal to the petty cash disbursements. It is at this time that the

petty cash disbursements are recorded.

PREPARED BY JADE SILVA, CPA Page 10 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

Expenses xx

Cash in bank xx

It is pointed out that the petty cash disbursements should be replenished only by means of

check and not from undeposited collections.

d. At the end of the accounting period, it is necessary to adjust the unreplenished expenses in

order to state the correct petty cash balance.

Expenses xx

Petty cash fund xx

The adjustment is to be reversed at the beginning of the next accounting period.

The reversal is made in order that the normal replenishment procedures may be followed by

simply debiting expenses and crediting cash in bank without distinguishing whether the

expenses pertain to the current period or prior period.

e. An increase in the fund is recorded as

Petty cash fund xx

Cash in bank xx

f. A decrease in the fund is recorded as

Cash in bank xx

Petty cash fund xx

ILLUSTRATION

2020

Nov 10 The entity established an imprest fund of P10,000

Petty cash fund 10,000

Cash in bank 10,000

Nov 29 Replenished the fund. The petty cash items include the following:

Currency and coin 2,000

Supplies 5,000

Telephone 1,800

Postage 1,200

The journal entry to record the replenishment:

Supplies 5,000

Telephone 1,800

Postage 1,200

PREPARED BY JADE SILVA, CPA Page 11 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

Cash in bank 8,000

Dec 31 The fund was not replenished

The fund is composed of the following: currency and coins – P7,000, supplies – P1,500, postage –

P500, miscellaneous expense P1,000.

Supplies 1,500

Postage 500

Miscellaneous expense 1,000

Petty cash fund 3,000

2021

Jan 1 The adjustment made on December 31, 2020 is reversed.

Petty cash fund 3,000

Supplies 1,500

Postage 500

Miscellaneous expense 1,000

Feb 1 The fund is replenished and increased to P15,000

The composition of the fund:

Currency and coins 1,000

Supplies 4,500

Postage 3,000

Miscellaneous expense 1,500

Total 10,000

The journal entry for the replenishment and increase is:

Petty cash fund 5,000

Supplies 4,500

Postage 3,000

Miscellaneous expense 1,500

Cash in bank 14,000

The total amount of the check drawn is P14,000 representing the petty cash disbursements of

P9,000 and the fund increase is P5,000.

FLUCTUATING FUND SYSTEM

The system is called “fluctuating fund system” because the checks drawn to replenish the fund do not

necessarily equal the petty cash disbursements. The replenishment checks are simply drawn upon the

request of the petty cashier.

Moreover, petty cash disbursements are immediately recorded thus resulting in a fluctuating petty cash

balance per book from time to time.

PREPARED BY JADE SILVA, CPA Page 12 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

Accounting Procedures:

a. Establishment of the fund

Petty cash fund xx

Cash in bank Xx

b. Payment of expenses out of the petty cash fund

Expenses xx

Petty cash fund xx

Under this system, the disbursements from the petty cash fund are immediately recorded in

contradistinction with the imprest fund system where the disbursements are recorded upon the

replenishment of the fund.

c. Replenishment or increase of fund

Petty cash fund xx

Cash in bank xx

The replenishment check may or may not be the same as the petty cash disbursements.

d. At the end of the reporting period, no adjustment is necessary because the petty cash expenses

are recorded outright.

e. Decrease of the fund is reverted to the general cash

Cash in bank xx

Petty cash fund xx

ILLUSTRATION

Nov 10 The entity established a petty cash fund of P10,000

Petty cash fund 10,000

Cash in bank 10,000

Nov 11-28 Petty cash disbursements amounted to P8,000

Expenses 8,000

Petty cash fund 8,000

Nov 29 Issued a check for P10,000 to replenish the fund.

Petty cash fund 10,000

Cash in bank 10,000

At this point, the petty cash balance per book is P12,000.

PREPARED BY JADE SILVA, CPA Page 13 of 14

ACC 205 | INTERMEDIATE ACCOUNTING 1

BATANGAS STATE UNIVERSITY – MAIN 1

Dec 1-30 Petty cash expenses amounted to P9,000

Expenses 9,000

Petty cash fund 9,000

Dec 31 Issued a check for P15,000 to replenish the fund

Petty cash fund 15,000

Cash in bank 15,000

At this point, the petty cash balance is P18,000.

- END OF MODULE –

References

Ayala Land, Inc. (2020). Consolidated Audited Financial Statements.

Valix, C. T., Peralta, J. F., & Valix, C. A. (2020). Intermediate Accounting (Vol. 1). Manila City: GIC

Enterprises & Co., Inc. .

PREPARED BY JADE SILVA, CPA Page 14 of 14

You might also like

- Citi Bank Statement PDFDocument6 pagesCiti Bank Statement PDFblack bird100% (1)

- Soto Melendez V Banco Popular de Puerto RicoDocument45 pagesSoto Melendez V Banco Popular de Puerto RicoErick A. Velázquez Sosa100% (2)

- Bitwala KontoauszugDocument3 pagesBitwala KontoauszugDieter WellernNo ratings yet

- Audit of Cash: Darrell Joe O. Asuncion, Cpa MbaDocument17 pagesAudit of Cash: Darrell Joe O. Asuncion, Cpa MbaKaila Salem100% (1)

- Module 004 Accounting For Cash: Definition, Nature and Composition of Cash and Cash Equivalents CashDocument12 pagesModule 004 Accounting For Cash: Definition, Nature and Composition of Cash and Cash Equivalents CashLee-chard EboeboNo ratings yet

- 05 Cash Cash EquivalentsDocument54 pages05 Cash Cash EquivalentsFordan Antolino85% (13)

- Cash - TeachersDocument12 pagesCash - TeachersJustin ManaogNo ratings yet

- Cash PDFDocument10 pagesCash PDFGabriel JonNo ratings yet

- Your Annual Summary - 08092016 PDFDocument2 pagesYour Annual Summary - 08092016 PDFAnonymous r9H4ebc100% (1)

- SIP Report On Credit Appraisals at Indian Overseas BankDocument48 pagesSIP Report On Credit Appraisals at Indian Overseas BankPriyanka Dwivedi0% (2)

- Module 1.1Document13 pagesModule 1.1Althea mary kate MorenoNo ratings yet

- Cashand Cash Equivalents101Document38 pagesCashand Cash Equivalents101Wynphap podiotanNo ratings yet

- W6 Module 9 Cash and Cash Equivalents Part 1Document11 pagesW6 Module 9 Cash and Cash Equivalents Part 1haven AvyyNo ratings yet

- W6 Module 9 Cash and Cash Equivalents Part 1Document7 pagesW6 Module 9 Cash and Cash Equivalents Part 1leare ruazaNo ratings yet

- Cash and Cash EquivalentsDocument31 pagesCash and Cash EquivalentsMark LouieNo ratings yet

- Reviewer Accounting - CrisaDocument12 pagesReviewer Accounting - Crisamiracle123No ratings yet

- Chapter 7Document11 pagesChapter 7Louie Ann CasabarNo ratings yet

- Cash and Cash EquivalentsDocument15 pagesCash and Cash EquivalentsVon Rother Celoso DiazNo ratings yet

- Chapter 1 Cash and Cash Equivalents AutoRecoveredDocument44 pagesChapter 1 Cash and Cash Equivalents AutoRecoveredJhonielyn Regalado RugaNo ratings yet

- Ia - Chapter 1Document16 pagesIa - Chapter 1Layla MainNo ratings yet

- Ia - Module 1Document6 pagesIa - Module 1MARY IZABELLE L. DIZONNo ratings yet

- Week 02 - 01 - Module 04 - Accounting For CashDocument12 pagesWeek 02 - 01 - Module 04 - Accounting For Cash지마리No ratings yet

- A101 Financial Accounting and Reporting XFARDocument61 pagesA101 Financial Accounting and Reporting XFARCristina TayagNo ratings yet

- Chapter 2 - Cash and Cash EquivalentsDocument11 pagesChapter 2 - Cash and Cash EquivalentsAyessa Joy TajaleNo ratings yet

- Cash Cash Equivalents - Part 1Document35 pagesCash Cash Equivalents - Part 1Lily of the ValleyNo ratings yet

- Lecture No.1 Cash Cash Equiv TheoriesDocument3 pagesLecture No.1 Cash Cash Equiv TheoriesbsasociondaisyremarieNo ratings yet

- Cash and Cash Equivalents: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument66 pagesCash and Cash Equivalents: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument9 pagesModule 1 - Cash and Cash Equivalentsjay classroomNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document15 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsKate CamachoNo ratings yet

- 2-1 AE111 NOTES Unit-2Document29 pages2-1 AE111 NOTES Unit-2Gab IgnacioNo ratings yet

- IA For Prelims FinalDocument438 pagesIA For Prelims FinalCeline Therese BuNo ratings yet

- 1 - Chapter 1 Cash and Cash EquivalentsDocument9 pages1 - Chapter 1 Cash and Cash EquivalentsKing Nufayl Sendad100% (1)

- Cash & Cash EquivalentsDocument34 pagesCash & Cash EquivalentsStudent Core GroupNo ratings yet

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- Cash and Cash Equivalents - SCDocument33 pagesCash and Cash Equivalents - SCKaren Estrañero LuzonNo ratings yet

- Financial Accounting and Reporting - Cash and Cash EquivalentsDocument6 pagesFinancial Accounting and Reporting - Cash and Cash EquivalentsLuisitoNo ratings yet

- Intermediate AccountingDocument33 pagesIntermediate AccountingHannah Baniqued100% (1)

- Audit of AdvancesDocument29 pagesAudit of AdvancesHemanshu SolankiNo ratings yet

- ACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Document76 pagesACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Christel Oruga100% (1)

- Cash and Cash EquivalentsDocument37 pagesCash and Cash EquivalentsReiner Jan AlcantaraNo ratings yet

- IA1 Cash and Cash EquivalentsDocument20 pagesIA1 Cash and Cash EquivalentsJohn Rainier QuijadaNo ratings yet

- CHAPTER 1-Cash and Cash EquivalentsDocument43 pagesCHAPTER 1-Cash and Cash EquivalentsMarriel Fate CullanoNo ratings yet

- Statement of Financial PositionDocument9 pagesStatement of Financial PositionJEAN YVES BRAVONo ratings yet

- CCE HeheDocument19 pagesCCE HeheJam SurdivillaNo ratings yet

- Cash and Cash EquivalentsDocument27 pagesCash and Cash EquivalentsPatOcampoNo ratings yet

- REO With Theories AnwerDocument21 pagesREO With Theories AnweraceNo ratings yet

- 2 Cash and Cash Equivalents Summary ReviewerDocument4 pages2 Cash and Cash Equivalents Summary ReviewerRey HandumonNo ratings yet

- Cash and Cash EquivalentsDocument23 pagesCash and Cash EquivalentsGennelyn Grace Penaredondo100% (1)

- Chapter 2 Cash and Cash EquivalentsDocument12 pagesChapter 2 Cash and Cash EquivalentslorieferpaloganNo ratings yet

- Cash Cash EquivalentDocument92 pagesCash Cash EquivalentInzaghi CruiseNo ratings yet

- Assessment Task 1 (IA)Document4 pagesAssessment Task 1 (IA)Jonalyn BañegaNo ratings yet

- Accouting For Cash and Cash Equivalents CASH IncludesDocument4 pagesAccouting For Cash and Cash Equivalents CASH IncludesSecurity Bank Personal LoansNo ratings yet

- AUDT03 1 Cash Cash Equivalents PDFDocument2 pagesAUDT03 1 Cash Cash Equivalents PDFAngeline VergaraNo ratings yet

- Nature of Cash AccountDocument10 pagesNature of Cash AccountLorena PernatoNo ratings yet

- Income Recognition and Asset ClassificationDocument21 pagesIncome Recognition and Asset Classificationsagar7No ratings yet

- Cash and Cash Equivalents (Chapter 1)Document171 pagesCash and Cash Equivalents (Chapter 1)chingNo ratings yet

- Cash Part1Document7 pagesCash Part1cuaresmamonicaNo ratings yet

- Bank ManagementDocument50 pagesBank ManagementApoorva GuptaNo ratings yet

- Cashandcashequivalent 150620153356 Lva1 App6892 PDFDocument27 pagesCashandcashequivalent 150620153356 Lva1 App6892 PDFMary Ann BaguioNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument10 pagesModule 1 - Cash and Cash EquivalentsGRACE ANN BERGONIONo ratings yet

- Module 1Document12 pagesModule 1bhettyna noayNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- FM 101 Chapter 2 (Cabrera)Document17 pagesFM 101 Chapter 2 (Cabrera)Chelsea PagcaliwaganNo ratings yet

- 2nd Batch All CasesDocument4 pages2nd Batch All CasesChelsea PagcaliwaganNo ratings yet

- Topic 1 - Audit of Cash Transactions and BalancesDocument6 pagesTopic 1 - Audit of Cash Transactions and BalancesChelsea PagcaliwaganNo ratings yet

- Module 2.2 - Bank Reconciliation and Proof of CashDocument24 pagesModule 2.2 - Bank Reconciliation and Proof of CashChelsea PagcaliwaganNo ratings yet

- Standard Charted - SaadiqDocument16 pagesStandard Charted - SaadiqkirshanlalNo ratings yet

- Wells Fargo Everyday CheckingDocument1 pageWells Fargo Everyday CheckingKeenen New ManleyNo ratings yet

- Bank Jan23Document9 pagesBank Jan23Diviyan MacNo ratings yet

- Chequing Statement-1200 2023-05-15Document5 pagesChequing Statement-1200 2023-05-15lauramartinez2313No ratings yet

- FeeInformation BarclaysBasicAccountDocument2 pagesFeeInformation BarclaysBasicAccountkagiyir157No ratings yet

- MBE - BFAR (1st Sem, 2021-2022)Document11 pagesMBE - BFAR (1st Sem, 2021-2022)Bai Dianne BagundangNo ratings yet

- Retail BankingDocument103 pagesRetail BankingRamesh BabuNo ratings yet

- Working Capital Unit 1 To 4Document103 pagesWorking Capital Unit 1 To 4tarunNo ratings yet

- GST 223, Q&a (Kadung Samuel For Sossa 001 2019)Document66 pagesGST 223, Q&a (Kadung Samuel For Sossa 001 2019)Japhet Gajere100% (1)

- WellsFargo-2Document4 pagesWellsFargo-2itsoueNo ratings yet

- ShivaniDocument74 pagesShivaniRahul MehtaNo ratings yet

- APACS Cheques Facts LeafletDocument54 pagesAPACS Cheques Facts Leafletnikiwin78No ratings yet

- Assignment of PartnerShip DeedDocument6 pagesAssignment of PartnerShip DeedYeasin Aziz100% (1)

- Money and Banking NotesDocument14 pagesMoney and Banking NotesKOECH VINCENTNo ratings yet

- Lecture 3 - Loans - AdvancesDocument16 pagesLecture 3 - Loans - AdvancesYvonneNo ratings yet

- E .Services in Banks: Keywords: Communication Technology, Banking, ServicesDocument10 pagesE .Services in Banks: Keywords: Communication Technology, Banking, ServicesDr.K.BaranidharanNo ratings yet

- Service Charges: An Easy Guide To Banking FeesDocument24 pagesService Charges: An Easy Guide To Banking FeesolimNo ratings yet

- Business Studies Financial StatementsDocument3 pagesBusiness Studies Financial StatementsSusanna NgNo ratings yet

- ACCA Fundamentals Level Paper F3 Financial Accounting (International) Course Test 2Document16 pagesACCA Fundamentals Level Paper F3 Financial Accounting (International) Course Test 2Seng Cheong KhorNo ratings yet

- Public BankDocument14 pagesPublic BankKong Hung Ng0% (1)

- Account Statement Greendot PDFDocument4 pagesAccount Statement Greendot PDFBaris MironNo ratings yet

- Theory of Accounts Cash and Cash EquivalentsDocument9 pagesTheory of Accounts Cash and Cash Equivalentsida_takahashi43% (14)

- In Re Clifton J SpearsDocument9 pagesIn Re Clifton J SpearswstNo ratings yet

- Loans and Advances 2016Document128 pagesLoans and Advances 2016Anonymous kyvLgSREMNo ratings yet

- English Form 1Document13 pagesEnglish Form 1adancade562No ratings yet