Professional Documents

Culture Documents

CASESTUDYXWISKWDK

CASESTUDYXWISKWDK

Uploaded by

Shaira Mae E. Pacis0 ratings0% found this document useful (0 votes)

623 views9 pagesThe document discusses a case study involving Cruz's department store. In 20x5, the store's net income decreased sharply. Cruz anticipated needing a bank loan in 20x6. Late in 20x5, Cruz instructed the accountant to record a P26,000 sale of furniture to Cruz's family that would not be delivered until January 20x6. Cruz also told the accountant not to make adjusting entries for P18,000 in salaries owed and P5,300 in expired prepaid insurance. This would overstate 20x5 income by P49,300. Cruz took this unethical action to improve the store's financial position for obtaining the anticipated bank loan, harming the accountant, employees, and

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses a case study involving Cruz's department store. In 20x5, the store's net income decreased sharply. Cruz anticipated needing a bank loan in 20x6. Late in 20x5, Cruz instructed the accountant to record a P26,000 sale of furniture to Cruz's family that would not be delivered until January 20x6. Cruz also told the accountant not to make adjusting entries for P18,000 in salaries owed and P5,300 in expired prepaid insurance. This would overstate 20x5 income by P49,300. Cruz took this unethical action to improve the store's financial position for obtaining the anticipated bank loan, harming the accountant, employees, and

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

623 views9 pagesCASESTUDYXWISKWDK

CASESTUDYXWISKWDK

Uploaded by

Shaira Mae E. PacisThe document discusses a case study involving Cruz's department store. In 20x5, the store's net income decreased sharply. Cruz anticipated needing a bank loan in 20x6. Late in 20x5, Cruz instructed the accountant to record a P26,000 sale of furniture to Cruz's family that would not be delivered until January 20x6. Cruz also told the accountant not to make adjusting entries for P18,000 in salaries owed and P5,300 in expired prepaid insurance. This would overstate 20x5 income by P49,300. Cruz took this unethical action to improve the store's financial position for obtaining the anticipated bank loan, harming the accountant, employees, and

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 9

ACCA109

CASE STUDY #3

Fidelson, Guinoo, Inacay and Pacis

CASE 3

The net income of Cruz’, a department store,

decreased sharply during 20x5. Mark Cruz, owner of

the store anticipates the need for bank loan in 20x6.

Late in 20x5, he instructed the accountant to record a

P26,000 of furniture to the Cruz family, even though

the goods will not be shipped from the manufacturer

until January 20x6. Cruz also told the accountant not

to make the following December 31, 20x5 adjusting

entries:

Salaries owed to employees- P18,000

Prepaid Insurance that has expired- P5,300

01 02 03

Why did Cruz take this

Compute the action? Is this action As a personal friend,

overall effect of ethical? Give your what advice would

these transactions reason identifying the you give the

on the store’s parties helped and accountant?

reported income for parties harmed by

20x5. Cruz’ action.

1. Compute the overall effect of

these transactions on the

store’s reported income for

20x5.

The overall effect of the transaction on the store’s income for

20x5 is an overstatement of P49,300.

● Expense (understated) - P5,300

● Liabilities (understated) - P18,000

These understatements will lead to the understatement of the

operating expenses. The P26,000 furniture increases the income

as well as the asset, as it is a sale from the furniture that the Cruz

family bought from their store.

2. Why did Cruz

The department store’s income

take this action? ●

decreased sharply in 20x5, Mr. Cruz

was desperate to rise back from its

loss

Is this action ethical? Give

● Personal interest to get a loan from

your reason identifying the

the bank

parties helped and parties

harmed by Cruz’ action. ● Since Mr. Cruz was anticipating a

bank loan, he opted to take this

unethical action considering that

the amount of bank loan that will be

given depends on the capabilities of

the company to return the loan with

its interest.

The actions were UNETHICAL

2. Why did Cruz

take this action?

Parties harmed

● Accountant

Is this action ethical? Give ● Employees, and

your reason identifying the ● The stakeholders/ investors

parties helped and parties

harmed by Cruz’ action.

Parties helped

● Mr. Cruz alone and

● The company itself in the short run

3. As a personal friend, what

advice would you give the

accountant?

The accountant is facing a moral dilemma since

he/she is facing a two conflicting options, it is to follow

his/her boss or to do what is right in which either way is

a hard option.

● For the first option: if the accountant follows the boss,

he/she will get involve for commiting a fraud by falsifying

the financial statements.

● For the second option: the accountant could disagree

with the boss and do what is right however this could led

to the company's downfall or worst to bankruptcy.

As an accountant, it is your

ethical responsibility to be

honest in preparing accurate

financial information, should not

allow bias and conflict of interest

of others to override professional

or business judgement.

That is all, thank you!

Group 3

You might also like

- Aerotek Contractor HandbookDocument13 pagesAerotek Contractor Handbookjoshua.mendez2No ratings yet

- Daria Danley Lawsuit Against Montana State UniversityDocument31 pagesDaria Danley Lawsuit Against Montana State UniversityThe College FixNo ratings yet

- Service Manual TSP6500 GB NBO Preliminary VersionDocument748 pagesService Manual TSP6500 GB NBO Preliminary VersionmohammedNo ratings yet

- Quiz (6 Items X 5 Points) : Problem Solving For Management Science Name: Section: Date: ScoreDocument1 pageQuiz (6 Items X 5 Points) : Problem Solving For Management Science Name: Section: Date: Scorephillip quimenNo ratings yet

- 40 Credit Repair SecretsDocument8 pages40 Credit Repair Secretswlingle11755% (20)

- Cortez Practice Set JanuaryDocument5 pagesCortez Practice Set JanuaryChristian LapidNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- 2nd Quarter Exam Community Engagement Solidarity and Citizenship 12Document5 pages2nd Quarter Exam Community Engagement Solidarity and Citizenship 12Eph FurNo ratings yet

- Coursework Assignment 3 Answer Template: Submission RulesDocument14 pagesCoursework Assignment 3 Answer Template: Submission RulesDon FabloNo ratings yet

- Venture Capital Firms MCQDocument8 pagesVenture Capital Firms MCQShuvro Rahman75% (12)

- Chapter 9 - Auditing ResourcesDocument10 pagesChapter 9 - Auditing ResourcesSteffany RoqueNo ratings yet

- Defined Benefit Plan-Midnight CompanyDocument2 pagesDefined Benefit Plan-Midnight CompanyDyenNo ratings yet

- 8.1 Cost HWDocument3 pages8.1 Cost HWJune Maylyn MarzoNo ratings yet

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocument12 pagesCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNo ratings yet

- 09 X07 C ResponsibilityDocument8 pages09 X07 C ResponsibilityJune KooNo ratings yet

- Chapter 17Document3 pagesChapter 17Michael CarlayNo ratings yet

- ACC 139 SAS Day 17 EXAM JLDDocument20 pagesACC 139 SAS Day 17 EXAM JLDmarili ZarateNo ratings yet

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Accounting Textbook Solutions - 52Document19 pagesAccounting Textbook Solutions - 52acc-expert0% (1)

- For DiscussionDocument41 pagesFor DiscussionKianah Shanelle MAGNAYENo ratings yet

- STDM Sample QuestionsDocument6 pagesSTDM Sample QuestionsAyra PelenioNo ratings yet

- Case 3Document5 pagesCase 3Anna Marie Andal RanilloNo ratings yet

- Score:: (The Following Information Applies To The Questions Displayed Below.)Document5 pagesScore:: (The Following Information Applies To The Questions Displayed Below.)Srikanth PothiraajNo ratings yet

- Drill#1Document5 pagesDrill#1Leslie BustanteNo ratings yet

- 4 Activity 5 PPEDocument9 pages4 Activity 5 PPEDaniella Mae ElipNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- CostAccountingModule FinalPeriod2022Document25 pagesCostAccountingModule FinalPeriod2022Jr Reyes PedidaNo ratings yet

- ReviewrDocument3 pagesReviewrChristine SalvadorNo ratings yet

- Problem 1 #1.: Statement of AffairsDocument7 pagesProblem 1 #1.: Statement of AffairsAlizah BucotNo ratings yet

- TOA03 04 Leases Income Tax Employee Benefits CharlenesDocument3 pagesTOA03 04 Leases Income Tax Employee Benefits CharlenesMerliza JusayanNo ratings yet

- Standard Costing and Analysis of VarianceDocument13 pagesStandard Costing and Analysis of VarianceRuby P. Madeja100% (1)

- Compre ExamDocument11 pagesCompre Examena20_paderangaNo ratings yet

- Financial Accounting Questions and Solutions Chapter 3Document7 pagesFinancial Accounting Questions and Solutions Chapter 3bazil360No ratings yet

- Mas 1 QuizDocument7 pagesMas 1 Quizsean justin EspinaNo ratings yet

- MA CUP PracticeDocument9 pagesMA CUP PracticeFlor Danielle Querubin100% (1)

- Acctg 4 Quiz 3 Debt Restructuring Payables 1Document11 pagesAcctg 4 Quiz 3 Debt Restructuring Payables 1Competente, Jhonna W.No ratings yet

- Business Combination Module 3Document8 pagesBusiness Combination Module 3TryonNo ratings yet

- ExamView Pro - DEBT FINANCING - TST PDFDocument15 pagesExamView Pro - DEBT FINANCING - TST PDFShannon ElizaldeNo ratings yet

- Econ2 - No.1Document2 pagesEcon2 - No.1Junvy AbordoNo ratings yet

- This Study Resource Was: Return It After Use. Thank You and GODBLESS!Document6 pagesThis Study Resource Was: Return It After Use. Thank You and GODBLESS!Stephanie LeeNo ratings yet

- Assignment 4 - CVPDocument12 pagesAssignment 4 - CVPAlyssa BasilioNo ratings yet

- MS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingDocument4 pagesMS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingMarchelle CaelNo ratings yet

- Standard Costs and Variance Analysis Standard Costs and Variance AnalysisDocument26 pagesStandard Costs and Variance Analysis Standard Costs and Variance Analysischiji chzzzmeowNo ratings yet

- The University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16Document5 pagesThe University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16ana rosemarie enaoNo ratings yet

- Module #6Document20 pagesModule #6Joy RadaNo ratings yet

- 064 PDFDocument9 pages064 PDFWe WNo ratings yet

- Rezy Pablio Mabao - SAS 3Document7 pagesRezy Pablio Mabao - SAS 3Reymark BaldoNo ratings yet

- ManAcc Chap 16 19Document84 pagesManAcc Chap 16 19Arsenio N. RojoNo ratings yet

- MAS Review CVP and Variable CostingDocument7 pagesMAS Review CVP and Variable CostingAizzy ManioNo ratings yet

- Saint Joseph College of Sindangan Incorporated College of AccountancyDocument18 pagesSaint Joseph College of Sindangan Incorporated College of AccountancyRendall Craig Refugio0% (1)

- Final Examination Problem Solving (Ae 106)Document4 pagesFinal Examination Problem Solving (Ae 106)Robin Chris KapaliNo ratings yet

- Audit Fot Liability Problem #10Document2 pagesAudit Fot Liability Problem #10Ma Teresa B. CerezoNo ratings yet

- Revaluation QUIZ PDFDocument12 pagesRevaluation QUIZ PDFMina LouveryNo ratings yet

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- The Purchasing/ Accounts Payable/ Cash Disbursement (P/AP/CD) ProcessDocument17 pagesThe Purchasing/ Accounts Payable/ Cash Disbursement (P/AP/CD) ProcessJonah Mark Tabuldan DebomaNo ratings yet

- Audit of Inventory 2021 - ExamDocument9 pagesAudit of Inventory 2021 - ExammoreNo ratings yet

- Assignment For Accounting Policies, Estimate and Errors: Problem 3Document3 pagesAssignment For Accounting Policies, Estimate and Errors: Problem 3Fria Mae Aycardo AbellanoNo ratings yet

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDocument5 pagesPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNo ratings yet

- Chapter 10 - Cash To Accrual Basis of AccountingDocument3 pagesChapter 10 - Cash To Accrual Basis of AccountingXienaNo ratings yet

- Chapter 3 Warranty LiabilityDocument24 pagesChapter 3 Warranty LiabilityRolan Lavadia II100% (1)

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- Intacc Cash Flow SolutionDocument3 pagesIntacc Cash Flow SolutionMila MercadoNo ratings yet

- AP-04 Order To Cash and Purchase To Pay Processes - Audit of CashDocument7 pagesAP-04 Order To Cash and Purchase To Pay Processes - Audit of CashKate NuevaNo ratings yet

- CH 12 Irrecoverable Debts and AllowanceDocument6 pagesCH 12 Irrecoverable Debts and AllowanceBuntheaNo ratings yet

- CH 12 Irrecoverable Debts and Allowance v3Document8 pagesCH 12 Irrecoverable Debts and Allowance v3BuntheaNo ratings yet

- FABM1 Q1 W1.2 UsersofAccountingInformationDocument45 pagesFABM1 Q1 W1.2 UsersofAccountingInformationLovely TaupoNo ratings yet

- Budget and Save MoneyDocument6 pagesBudget and Save MoneyShaira Mae E. PacisNo ratings yet

- SAMPLESKCQISJAXSDocument7 pagesSAMPLESKCQISJAXSShaira Mae E. PacisNo ratings yet

- Market IntegrationDocument55 pagesMarket IntegrationShaira Mae E. PacisNo ratings yet

- MCOxSoYe3p CMTDocument2 pagesMCOxSoYe3p CMTShaira Mae E. PacisNo ratings yet

- Quiz Bee Final 2Document101 pagesQuiz Bee Final 2joshNo ratings yet

- Apc Ups RS 500 PDFDocument4 pagesApc Ups RS 500 PDFtoshi000100% (1)

- 2890.1 2004 - A1 2005Document3 pages2890.1 2004 - A1 2005Tony PedaNo ratings yet

- Bedand Breakfast SchemeDocument14 pagesBedand Breakfast SchemeJasmeet DhamijaNo ratings yet

- Double Lives - Stephen Koch (Resenha)Document6 pagesDouble Lives - Stephen Koch (Resenha)Paulo Bento0% (1)

- Legal Technique and Logic - Assignment No. 1Document3 pagesLegal Technique and Logic - Assignment No. 1Syd Geemson ParrenasNo ratings yet

- A Butterfly Smile: Author: Mathangi Subramanian Illustrator: Lavanya NaiduDocument22 pagesA Butterfly Smile: Author: Mathangi Subramanian Illustrator: Lavanya NaiduNeyda EspínNo ratings yet

- DD EssayDocument8 pagesDD EssayJoycelyn NgNo ratings yet

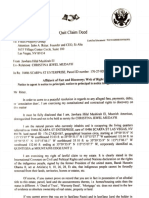

- Quit Claim Deed - FOCUS PROPERTY GROUP Et Alia 30jan2020Document4 pagesQuit Claim Deed - FOCUS PROPERTY GROUP Et Alia 30jan2020empress_jawhara_hilal_el100% (1)

- Case #5 Republic vs. Quinonez G.R. No. 237412, January 6, 2020 FactsDocument1 pageCase #5 Republic vs. Quinonez G.R. No. 237412, January 6, 2020 FactsJoan Pauline PimentelNo ratings yet

- Full Ebook of Thomas Jeffersons Bible With Introduction and Critical Commentary 1St Edition M Andrew Holowchak Online PDF All ChapterDocument69 pagesFull Ebook of Thomas Jeffersons Bible With Introduction and Critical Commentary 1St Edition M Andrew Holowchak Online PDF All Chaptereinaananaz86100% (4)

- Thelma Katzman v. Lillian Hoffman, Arnold Blumberg, and Benjamin Sork, 242 F.2d 354, 3rd Cir. (1957)Document5 pagesThelma Katzman v. Lillian Hoffman, Arnold Blumberg, and Benjamin Sork, 242 F.2d 354, 3rd Cir. (1957)Scribd Government DocsNo ratings yet

- Bibliography: Primary SourceDocument5 pagesBibliography: Primary Sourcejk8176No ratings yet

- Bahamian History Synopsis and LessonsDocument16 pagesBahamian History Synopsis and LessonsR. Cecilia AskewNo ratings yet

- Supreme Court of India: National Human Rights Commission Vs State of Gujarat & Ors On 1 May, 2009Document17 pagesSupreme Court of India: National Human Rights Commission Vs State of Gujarat & Ors On 1 May, 2009Ankur BhattNo ratings yet

- Heat and Mass Transfer PDFDocument267 pagesHeat and Mass Transfer PDFAngel RoyNo ratings yet

- Company Law: The Institute of Chartered Accountants of PakistanDocument2 pagesCompany Law: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- ProntoPro OG 5230814614 - Edn 1 PDFDocument21 pagesProntoPro OG 5230814614 - Edn 1 PDFroshan mungurNo ratings yet

- The Bloody CodeDocument25 pagesThe Bloody CodeDafydd Humphreys100% (20)

- Presumption - Person Possession A Falsified Document and Be Made Use of It, He Is The Material Author of The FalsificationDocument3 pagesPresumption - Person Possession A Falsified Document and Be Made Use of It, He Is The Material Author of The FalsificationbeabineneNo ratings yet

- Basic Engineering MechanicsDocument1 pageBasic Engineering MechanicsAditya BhattacharayaNo ratings yet

- MU121 Lesson Plan 4Document3 pagesMU121 Lesson Plan 4Hilmi HusinNo ratings yet

- Unibis Leaflet EnglishDocument6 pagesUnibis Leaflet EnglishShna KawaNo ratings yet

- Intangible Asset Valuation Approaches and MethodsDocument22 pagesIntangible Asset Valuation Approaches and MethodsJihane AdnaneNo ratings yet