Professional Documents

Culture Documents

Partnership Dissolution From Prof. Cecilia Mercado

Partnership Dissolution From Prof. Cecilia Mercado

Uploaded by

Chitz PobarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Dissolution From Prof. Cecilia Mercado

Partnership Dissolution From Prof. Cecilia Mercado

Uploaded by

Chitz PobarCopyright:

Available Formats

2nd Flr, GF Partners Bldg, 139 H.V. dela Costa, Salcedo Village, Makati City 3rd Flr.

EPCIB Bldg. 2070 Claro M. Recto, Manila

Practical Accounting 2 PARTNERSHIP DISSOLUTION

Prof. Cecilla Mercado

R. Costelo, a partner in BRC Partnership, assigns its partnership interest to R. Serapion , who is not made a partner . After the assignment, R. Serapion asserts the right to I Participate in the management of BRC II R. Costelos partnership profits 1. R. Serapion is correct as to which of these rights? a. I only b. II only c. I and II d. Neither I nor II

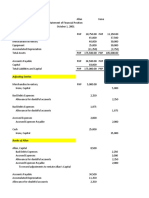

D. Jose and E. Andres are partners with capital balances of P30,000 and P40,000 and sharing profits and losses 40% and 60% respectively. If F. Apolinario is admitted as partner paying P20,000 in exchange for 50% of Joses equity. 2. The entry in the partnership books should be as follows: a. D. Jose, Capital 15,000 F. Apolinario, Capital b. Cash F. Apolinario, Capital c. Cash Goodwill F. Apolinario, Capital d.. Cash D. Jose, Capital F. Apolinario, Capital 20,000 20,000 20,000 5,000 25,000 20,000 5,000 15,000

15,000

The capital accounts of the partnership of G. Silang, H. Del Pilar, and I.Aguinaldo are presented below with their respective profit and loss ratios: Silang Del Pilar Aguinaldo P278,000 418,000 192,000 (1/2) (1/3) (1/6)

J. Quezon was admitted to the partnership when he purchased directly, for P264,000, a proportionate interest from Silang and Del Pilar in the net assets and profits of the partnership. As a result , Quezon acquired a one-fifth interest in the net assets and profits of the firm.

3. Assuming implied goodwill is not to be recorded, what is the combined gain realized by Silang and Del Pilar upon the sale of a portion of their interests in the partnership to Quezon? a. P 0 c. P122,800 b. P86,400 d. P164,000 P. Lina and Q. Mina are partners with a profit and loss ratio of 75:25 and capital balances of P100,000 and P50,000 respectively. R. Nina is to be admitted into the partnership by purchasing a 20% interest in the capital, profits and losses for P60,000. 4. Assuming goodwill is not recorded, the capital balances of Lina and Mina after the admission of Nina are: a. Lina, P 80,000 and Mina, P40,000 b. Lina, P120,000 and Mina, P60,000 c. Lina, P112,000 and Mina, P38,000 d. Lina, P100,000 and Mina, P50,000 5. Assuming goodwill is to be recorded, the capital balances of Lina, Mina and Nina are: a. P170,000; P70,000; P60,000 b. P 80,000; P40,000; P30,000 c. P192,500; P77,500; P30,000 d. P100,000; P50,000; P60,000 M. Feliz contributed P24,000 and N. Eliz contributed P48,000 to form a partnership, and they agreed to share profits in the ratio of their original capital contributions. During the first year of operations, they made a profit of P16,290; Feliz withdrew P5,050 and Eliz P8,000. At the start of the following year, they agreed to admit O. Deliz into the partnership. He was to receive a one - fourth interest in the capital and profits upon payment of P30,000 to Feliz and Eliz, whose capital accounts were to be reduced by transfers to Deliz s capital account of amount sufficient to bring them back to their original capital ratio. 6. How should the P30,000 paid by Deliz be divided between Feliz and Eliz: a. Feliz P9,825; Eliz, P20,175 b. Feliz, P15,000; Eliz, P15,000 c. Feliz, P10,000; Eliz, 20,000 d. Feliz, P 9,300; Eliz, 20,700 In the Quirino-Aquino Partnership, L. Quirino and M. Aquino had a capital ratio of 3:1 and a profit and loss ratio of 2:1, respectively. The bonus method was used to record N. Macapagals admittance as a new partner. 7. What ratio should be used to allocate, to Quirino and Aquino, the excess of Macapagals contribution over the amount credited to macapagals capital account? a. Quirino and Aquinos new relative capital ratio. b. Quirino and Aquinos new relative profit and loss ratio. c. Quirino and Aquinos old capital ratio. d. Quirno and Aquinos old profit and loss ratio. R. Palma, S. Antonio, and T. David are partners with capital balances of P100,000, P60,000, P40,000, respectively. The partners share income and loss equally. For an investment of P100,000 cash, V. Baluyot is to be admitted as a partner with a one -fourth interest in capital and income.

8. Which of the following can best justify the amount of Baluyots investment? a. Baluyot will receive a bonus from the other partners upon his admission to the partnership. b. Assets of the partnership were overvalued immediately prior to Baluyots investment. c. The book value of the partnerships net assets was less than their fair value immediately prior to Baluyots investment . d. Baluyot is apparently bringing goodwill into the partnership, and his capital account will be credited for the appropriate amount. The partnership of Y. Linsao and S. Mison provides for equal sharing of profits and losses. Prior to the admission of a third partner (C. Zamora), the capital accounts are Linsao, P75,000 and Mison, P105,000. Zamora invests P90,000 for a P75,000 interest and partners agreed that the net assets of the new partnership would be P270,000. 9. How much is Misons capital in the new partnership? a. P112,500 c. P110,000 b. P105,000 d. P120,000 R. Volante and F. Asuncion are partners having capital balances of P150,000 and P180,000, respectively, and sharing profits and losses equally. They admit J. De Leos to a one-third interest in partnership capital and profits for an investment of P195,000. 10. If the goodwill procedure is used in recording the admission of J. De Leos to the partnership a. J. De Leos capital will be P175,000 b. Total capital will be P525,000 c. F. Asuncion capital will be P210,000 d. Goodwill will be recorded at P45,000 J. Olson, L. Quizon and N. Dizon are partners with capital balances of P224,000, P260,000 and P116,000 respectively, sharing profits and losses in the ratio of 3:2:1. D. Sison is admitted as a new partner bringing with him expertise and reputation. He is to invest cash for a 25% interest in the assets of the partnership which includes a credit of P70,000 for goodwill that is recognized upon his admission. 11. How much cash should Sison contribute? a. P130,000 b. P185,000 c. P200,000 d. P150,000

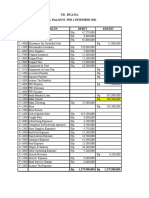

Presented below is the balance sheet of the partnership of Rivera, Sanchez and Torres, who share income and loss in the ratio of 6:3:1 respectively. Cash Other assets Total assets P170,000 830,000 P1,000,000

Liabilities P160,000 R. Rivera, capital 504,000 S. Sanchez, capital 252,000 T. Torres, capital 84,000 Total liabilities and capital P1,000,000

12. Assume that the partners agree to sell R. Vidal 20% of their respective interests in the partnership for a total payment of P180,000. The payment by Vidal is to be made directly to the individual partners. The partners agree that goodwill is to be recorded prior to the admission of Vidal. What are the capital balances of Rivera, Sanchez, and Torres, respectively, immediately after the admission of Vidal? a. P396,000; b. P403,200; c. P432,000; d. P511,200; P198,000; P201,600; P216,000; P255,600; P66,000 P67,200 P72,000 P85,200

13. Assuming the assets and liabilities of the partnership are fairly valued and the partnership wishes to admit Vidal with a 25%interest without recording goodwill or bonus. How much should Vidal invest in the partnership? a. P140,000 c. P250,000 b. P210,000 d. P280,000

M. Julian, M. Keno, and M. Lanuza are partners sharing profits in the ratio of 5:3:2, respectively. As of December 31, 2002, their capital balances were P95,000 for Julian, P80,000 for Keno, P60,000 for Lanuza. On January 1, 2003, the partners admitted V. Manalo as a new partner and according to their agreement, Manalo will contribute P80,000 in cash to the partnership and also pay P10,000 for 15% of Kenos share. Manalo will be given a 20% share in profits, while the original partners share will be proportionately the same as before. After the admission of Manalo, the total capital will be P330,000 and Manlos capital will be P70,000. 14. The total amount of goodwill to the old partners, upon admission of Manalo, would be: a. P 7,000 c. P22,000 b. P15,000 d. P37,000 15. The balance of Kenos capital, after the admission of Manalo, would be: a. P72,600 c. P79,100 b. P74,600 d. P81,000

On April 30,2003, the firm W. Juan, X. Kalibo and Y. Luna presents the following data from its balance sheet: Cash Other current assets Fixed assets P21,000 42,000 702,000 P765,000 Accounts payable Mortgage payable Juan, capital Kalibo, capital Luna, capital P15,000 30,000 360,000 225,000 135,000 P765,000

At this time, Z. Magsanoc is admitted to the firm when he purchases a one-sixth interest in the firm for P82,500. The old partners equalize their capital investments. Afterwards, all the partners agree to divide profits and losses equally.

The new firm closes its books on June 30, 2003 reporting profit of P12,600 for the two months. The partners made the following withdrawals: Juan and Luna , P750 per month; Kalibo and Magsanoc, P1,000 per month. On June 30,2003, Magsanoc invests enough cash to increase his capital to a one-fourth interest in the partnership. 16. On June 30, 2003, the capital balances of Juan, Kalibo, and Luna before the investment of Magsanoc are a. Juan, P121,250; Kalibo, P201,650; b. Juan, P201,650; Kalibo, P201,150; c. Juan, P200,000; Kalibo, P200,000; d. Juan, P360,000; Kalibo, P225,000; Luna, P200,000 Luna, P201,650 Luna, P200,000 Luna, P135,000

17. The cash to be invested by Magsanoc on June 30, 2003 (rounded to the nearest peso) is: a. P80,333 c. P60,333 b. P20,000 d. P121,150 S. Galang and T. Hizon are partners who have capitals of P600,000 and P480,000 sharing profits in the ratio of 3:2. V. Isleta is admitted as a partner upon investing P500,000 for a 25% intrerest in the firm, profits to be shared equally. 18. Given the choice between goodwill and bonus methods, Isleta will a. prefer bonus method due to Isletas gain of P35,000 b. prefer bonus method due to Isletas gain of P140,000 c. prefer goodwill method due to Isletas gain of P140,000 d. be indifferent because the goodwill and bonus methods are the same The partnership of A. Rizal, B. Bonifacio and C. Mabini have capital account balances as follows: Rizal, P35,000; Bonifacio, P50,000; Mabini, P40,000. Their profit and loss ratios are 30%, 50%, and 20% respectively. With the consent and knowledge of Rizal and Bonifacio, Mabini sold his full interest to D. Roxas, Mabini was paid P46,000 in cash. 19. The new capital balances would be: Rizal a. P35,000 b.P36,800 c.P35,000 d.P35,000 Bonifacio P50,000 P53,000 P50,000 P50,000 Roxas P46,000 P41,200 P40,000 P 6,000

When O. Martinez retired from the partnership of Martinez, Lopez and Hilario, the final settlement of Martinezs interest exceeded his capital balance. 20. Under the bonus method, the excess a. was recorded as goodwill b. was recorded as an expense c. reduced the capital balances of Lopez and Hilario d. had no effect on the capital balances of Lopez and Hilario

Prieto, Norberto and Moncada are partners and share profits and losses equally. Each has a capital balance of P1,800,000. Noberto retires from the partnership and receives P1,500.000. The partnership assets are fairly stated. 21. What is the entry to record Norbertos retirement? a. B. Norbero, capital P1,800,000 (dr) Goodwill 300,000 (cr) Cash 1,500,000 (cr) b. B. Norberto, capital Partnership assets Cash c. B. Norberto, capital Cash d. B. Norberto, capital C. Moncada, capital A. Prieto, capital Cash P1,800,000 (dr) 300,000 (cr) 1,500,000 (cr) P1,500,000 (dr) P1,500,000 (cr) P1,800,000 150,000 150,000 P1,500,000 (dr) (cr) (cr) (cr)

Dansalan, Evangelista and Floresca share partnership profits in the ratio of 2:3:5. On September 30, Floresca opted to retire from the partnership. The capital balances on this date follow: L. Dasalan, capital M. Evangelista, capital N. Floresca, capital P25,000 P40,000 P35,000

22. How many is to debited from Dansalan, assuming Floresca is paid P39,000 in full settlement of his partnership interest? a. b. P2,400 P4,000 c. d. P3,000 P1,600

E. Salgado, F. Tiangco and G. Umali are partners. Umali is permitted to withdraw from the partnership on December 31. It was agreed that the settlement is to be maid by payments from the personal funds of the remaining partners to Umali. Capital balances on December 31, show: Capital Balances Salgado Tiangco Umali P30,000 25,000 45,000 Profit Ratio 30% 30% 40%

23. If Salgado and Tiangco paid Umali P48,000, how much is the undervaluation of assets if the transaction will be recorded using the revaluation of assets method? a. P500 c. P5,000 b. P3,000 d.P7,500 H. Vicente, I. Walde and J. Yson are partners with capital balances on December 31, 2003 of P300,000, P300,000 and P200,000 respectively. Profits are shared equally. Yson wishes to Withdraw and it is agreed that he is to take certain furniture and fixtures at their second-hand value of P12,000 and note for the balance of his

interest . The furniture and fixtures are carried on the books as fully depreciated. Brand new, furniture and fixtures may cost P20,000. 24. Ysons acquisition of the second-hand furniture will result to a. increase in the capital of P4,000 each for Vicente, Walde and Yson b. increase in the capital of P6,000 each for Vicente and Walde c. increase in the capital of P10,000 each for Vicente and Walde d. increase in the capital of P8,000 for Yson The balance sheet as of June 30, 2003 for the partnership of R. Vasquez, J.Watson, and L. Ylagan shows the following information: Total Assets R. Vasquez, Loan R. Vasquez, Capital J. Watson , Capital L. Ylagan, Capital P360,000

P20,000 83,000 77,000 180,000 P360,000 It was agreed among the partners that Vasquez retires from the partnership and it was further agreed that the assets be adjusted to their fair value of P408,000 as of June 30, 2003. The partnership would pay Vasquez, P121,000 cash for his partnership interest and includes the payment of loan to him. No goodwill is to be recorded. Vasquez, Watson and Ylagan share profits and losses , 25%, 25%, and 50% respectively. 25. What is Ylagans capital balance after the retirement of Vasquez? a. P120,000 c. P200,000 b. P180,000 d. P560,000 The total of the partners capital accounts was P110,000 before the recognition of partnership goodwill in preparation for the withdrawal of a partner whose income-andloss sharing ratio is 2/10. He was paid P28,000 by the firm in final settlement for his interest . The remaining partners capital accounts, excluding their share of goodwill, totaled P90,000 after his withdrawal. 26. The total goodwill of the firm agreed upon was a. P40,000 c. P20,000 b.P28,000 d. P 8,000

You might also like

- 73 - Monthly Performance Report DashboardDocument20 pages73 - Monthly Performance Report DashboardMarcelo BuchNo ratings yet

- Department of Education Republic of The PhilippinesDocument15 pagesDepartment of Education Republic of The PhilippinesWhyljyne Glasanay100% (2)

- Practice Exercis1Document1 pagePractice Exercis1Joana TrinidadNo ratings yet

- Liquidation Problem Partnership and Corporation AccountingDocument3 pagesLiquidation Problem Partnership and Corporation AccountingChichoNo ratings yet

- Prelim AFAR 1Document6 pagesPrelim AFAR 1Chris Phil Dee75% (4)

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- PARCORDocument1 pagePARCORRhea Royce Cabuhat43% (7)

- Chris Norton Is A Young Hollywood Writer Who Is WellDocument2 pagesChris Norton Is A Young Hollywood Writer Who Is WellAmit PandeyNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Partnership HCC CttoDocument7 pagesPartnership HCC CttoKenncy100% (1)

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- MC 5 Dissolution P2Document3 pagesMC 5 Dissolution P2Jenny BernardinoNo ratings yet

- Module 4-Lump Sum Liquidation-Faculty VersionDocument22 pagesModule 4-Lump Sum Liquidation-Faculty VersionJan Ian Greg M. GangawanNo ratings yet

- MARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsDocument5 pagesMARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsMoon YoungheeNo ratings yet

- Suggested AnswersDocument18 pagesSuggested AnswersEl YangNo ratings yet

- Partnership Operation 004Document2 pagesPartnership Operation 004John GacumoNo ratings yet

- AssignmentDocument9 pagesAssignmentBaekhunnie ByunNo ratings yet

- 2021 Act130 Prelim ExaminationDocument13 pages2021 Act130 Prelim ExaminationMica R.No ratings yet

- Take-Home No. 3Document1 pageTake-Home No. 3John Alfred CastinoNo ratings yet

- Chapter 11 SampleDocument6 pagesChapter 11 SamplePattraniteNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- Partnership Operations ActivityDocument2 pagesPartnership Operations ActivityNedelyn PedrenaNo ratings yet

- Partnership Q4Document2 pagesPartnership Q4Lorraine Mae Robrido100% (1)

- Activity Partnership DissolutionDocument2 pagesActivity Partnership DissolutionKaren Joy Jacinto ElloNo ratings yet

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

- Partnership 1 PDFDocument12 pagesPartnership 1 PDFShane TorrieNo ratings yet

- FORMATIONDocument2 pagesFORMATIONBianca IyiyiNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- AC - IntAcctg-A LSLiquidation.Document41 pagesAC - IntAcctg-A LSLiquidation.Janesene SolNo ratings yet

- 2601 PartnershipsDocument57 pages2601 PartnershipsMerdzNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- Partnership Operation 003Document12 pagesPartnership Operation 003John GacumoNo ratings yet

- Accounting For Special TransactionsDocument1 pageAccounting For Special TransactionsKc SevillaNo ratings yet

- Chapter 2 Problem 9 in Win Ballada ParcorDocument4 pagesChapter 2 Problem 9 in Win Ballada ParcorKatrina PetracheNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationCjhay MarcosNo ratings yet

- Incorporation of A PartnershipDocument8 pagesIncorporation of A PartnershipKathleenNo ratings yet

- Answer Prob 1 and 2Document3 pagesAnswer Prob 1 and 2machelle franciscoNo ratings yet

- Partnership ReviewerDocument11 pagesPartnership Reviewerbae joohyun0% (1)

- Partnership AccountingDocument3 pagesPartnership AccountingDan RyanNo ratings yet

- Chapter 3 Partnership DissolutionDocument32 pagesChapter 3 Partnership DissolutionmochiNo ratings yet

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- Afar I. Partnership FormationDocument4 pagesAfar I. Partnership FormationIrish SantiagoNo ratings yet

- Partnership Liquidation: Problem MDocument8 pagesPartnership Liquidation: Problem MMiko ArniñoNo ratings yet

- Partneship Handout Without Answer KeyDocument10 pagesPartneship Handout Without Answer KeyAirah Manalastas0% (1)

- Partnership Liquidation QuizDocument5 pagesPartnership Liquidation QuizAlexis TRADIO100% (1)

- ActivityDocument9 pagesActivityKimberlie Jane GableNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocument19 pagesMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNo ratings yet

- Allan and Irene Answer KeyDocument9 pagesAllan and Irene Answer KeyApril NaidaNo ratings yet

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- Proof of Cash SolutionsDocument4 pagesProof of Cash SolutionsyowatdafrickNo ratings yet

- SET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyDocument19 pagesSET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyJomar RabiaNo ratings yet

- Orca Share Media1579219923157Document10 pagesOrca Share Media1579219923157leejongsuk44% (9)

- X 3Document8 pagesX 3Max Dela Torre0% (1)

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- Dissolution Reviewees Copy1100Document6 pagesDissolution Reviewees Copy1100Jose Mariano Melendez0% (1)

- Quiz MidtermDocument4 pagesQuiz MidtermKyla DizonNo ratings yet

- Dissolution LiquidationDocument9 pagesDissolution LiquidationCha FeudoNo ratings yet

- Dissolution LiquidationDocument9 pagesDissolution LiquidationCha FeudoNo ratings yet

- PartnershipDocument9 pagesPartnershipGrace A. ManaloNo ratings yet

- Partnership ActivityDocument2 pagesPartnership ActivityRowena GayasNo ratings yet

- Week 15 Q1Document11 pagesWeek 15 Q1Carlo AgravanteNo ratings yet

- Discovering A Wealth Creator Portfolio: Article by Maneesh NathDocument4 pagesDiscovering A Wealth Creator Portfolio: Article by Maneesh NathCen ParNo ratings yet

- Beml Project Print OUTDocument144 pagesBeml Project Print OUTanon_196360629100% (1)

- Accounting and Its Environment - PowerPoint PresentationDocument30 pagesAccounting and Its Environment - PowerPoint PresentationBhea G. ManaloNo ratings yet

- IAS 16 Notes.Document8 pagesIAS 16 Notes.Arsalan AliNo ratings yet

- Ukk 2023 P2-Kunci Jawaban RevDocument47 pagesUkk 2023 P2-Kunci Jawaban RevSaepul RohmanNo ratings yet

- Law Flow ChartsDocument7 pagesLaw Flow ChartsmauliksanghaviNo ratings yet

- FM Examiner's Report M20Document10 pagesFM Examiner's Report M20Isavic AlsinaNo ratings yet

- SML and CMLDocument16 pagesSML and CMLABHISHEK VARSHNEYNo ratings yet

- Slide 1Document1 pageSlide 1Hazel CorralNo ratings yet

- Jawaban 8 - Accounting For Income TaxDocument2 pagesJawaban 8 - Accounting For Income TaxBie SapuluhNo ratings yet

- Chapter 6 Ge Financial Management Test Bank - CompressDocument49 pagesChapter 6 Ge Financial Management Test Bank - CompressKaycee StylesNo ratings yet

- Memo 2023 003 Scope of Qualifying ExamsDocument4 pagesMemo 2023 003 Scope of Qualifying ExamsSara ChanNo ratings yet

- Theory and Practice of Venture Capital FDocument121 pagesTheory and Practice of Venture Capital FKeval Darji0% (1)

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- HbomaxDocument16 pagesHbomaxgastmathis8No ratings yet

- Functions of Stock ExchangesDocument5 pagesFunctions of Stock Exchangesgkvimal nathanNo ratings yet

- Chapter 6 For CUP Financial AccountingDocument15 pagesChapter 6 For CUP Financial Accountingratanak_kong1-9No ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelnotes 1No ratings yet

- HistoryDocument2 pagesHistoryQS OH OladosuNo ratings yet

- Quiz No. 2Document2 pagesQuiz No. 2Nayra DizonNo ratings yet

- Reconstitution Admission of A PartnerDocument12 pagesReconstitution Admission of A PartneranuhyaextraNo ratings yet

- Company Information: Fecto Sugar Mills LimitedDocument30 pagesCompany Information: Fecto Sugar Mills LimitedSyeda Kainat AqeelNo ratings yet

- Portfolio Management An OverviewDocument15 pagesPortfolio Management An OverviewahmedNo ratings yet

- Quiz No. 1 Accounting PrinciplesDocument4 pagesQuiz No. 1 Accounting PrinciplesElla Feliciano100% (1)

- What Is DepreciationDocument6 pagesWhat Is DepreciationDaley NangasNo ratings yet

- Cost Accounting Discussion Transcript Part 2Document5 pagesCost Accounting Discussion Transcript Part 2kakimog738No ratings yet

- CAPE Accounting 2016 U1 P1Document10 pagesCAPE Accounting 2016 U1 P1DinaNo ratings yet