Professional Documents

Culture Documents

Way of Reply ITC On Tax Invoice Air Transport Tickets

Way of Reply ITC On Tax Invoice Air Transport Tickets

Uploaded by

CA Sriram KumarCopyright:

Available Formats

You might also like

- The Case of Lemonade Isnurance PDFDocument18 pagesThe Case of Lemonade Isnurance PDFFrancesco Bologni50% (2)

- Y Broadband Bill Feb2020 PDFDocument1 pageY Broadband Bill Feb2020 PDFvijaya lakshmiNo ratings yet

- Del BLRDocument1 pageDel BLRaravindabnNo ratings yet

- Buyer Details Seller Details: Scan To Download Mobile App. Currently Available Only For General Scrap AuctionsDocument3 pagesBuyer Details Seller Details: Scan To Download Mobile App. Currently Available Only For General Scrap AuctionsPurohit RajNo ratings yet

- Address:-MRO-CIDCO Mansarovar Station, Navi Mumbai - 410209, Maharashtra, IndiaDocument4 pagesAddress:-MRO-CIDCO Mansarovar Station, Navi Mumbai - 410209, Maharashtra, IndiaNikhil PatilNo ratings yet

- Gmail - GoAir Itinerary PDFDocument2 pagesGmail - GoAir Itinerary PDFTuhin ChakrabortyNo ratings yet

- Maheshwari Sales (G) Debit NoteDocument1 pageMaheshwari Sales (G) Debit NoteAAKARNo ratings yet

- Raj Construction Kanpur Invoice-1Document1 pageRaj Construction Kanpur Invoice-1Khajan SinghNo ratings yet

- Invoice B202201222Document1 pageInvoice B202201222Rakesh KumarNo ratings yet

- Demarcation Pillars KA Bill PDFDocument1 pageDemarcation Pillars KA Bill PDFradha gNo ratings yet

- BHD 23 24 007606Document1 pageBHD 23 24 007606rajugoud6231No ratings yet

- Creative BillsDocument5 pagesCreative BillsTcm HaridwarNo ratings yet

- DKSH Po 52 DT 06.09.2022Document1 pageDKSH Po 52 DT 06.09.2022Nova TransfersNo ratings yet

- PIIX00260 Dev AutomationDocument1 pagePIIX00260 Dev AutomationSabhyaNo ratings yet

- Booking Invoice M06ai23i05834999Document2 pagesBooking Invoice M06ai23i05834999Rohan DesaiNo ratings yet

- Adobe Scan Dec 17, 2022Document1 pageAdobe Scan Dec 17, 2022Thiru ArasuNo ratings yet

- MRT Tours and Travels PVT LTD: MR Praveen Kumar B C - BMRCLDocument4 pagesMRT Tours and Travels PVT LTD: MR Praveen Kumar B C - BMRCLPraveen KumarNo ratings yet

- Signed DO MSTC LKO 23-24 3195Document2 pagesSigned DO MSTC LKO 23-24 3195Mahendra KumarNo ratings yet

- Aryan Ventures - Queries and RequirementsDocument10 pagesAryan Ventures - Queries and RequirementsnavinNo ratings yet

- My Invoice JULY 2023Document1 pageMy Invoice JULY 2023Ch JEEVANA SANDHYANo ratings yet

- RW16EC3412Document1 pageRW16EC3412Vishal Tambe 0146No ratings yet

- URMILADocument1 pageURMILApuja9015709658No ratings yet

- BBL372506B003088Document3 pagesBBL372506B003088chethankrgowda8570No ratings yet

- Adobe Scan 16-Mar-2023Document1 pageAdobe Scan 16-Mar-2023SHASHI COMUNICATIONNo ratings yet

- Export PolicyDocument5 pagesExport PolicyghelilundNo ratings yet

- BLR 2 SepDocument1 pageBLR 2 SepSarah WilliamsNo ratings yet

- SHIVANYA BILL 11.07.2024Document1 pageSHIVANYA BILL 11.07.2024Ashish BansalNo ratings yet

- Ledger 3464988 0Document1 pageLedger 3464988 0adarshdubeyNo ratings yet

- Sharekhan Morning Tiger (Pre Market Insight) 12 Sep 2022Document8 pagesSharekhan Morning Tiger (Pre Market Insight) 12 Sep 2022Aashutosh RathodNo ratings yet

- Tax Invoice: E Waybill - NoDocument1 pageTax Invoice: E Waybill - NoPRAMOD S NNo ratings yet

- Jac JW 23241549Document3 pagesJac JW 23241549Jugal mahatoNo ratings yet

- booking-invoice-m06ai23i02827970Document3 pagesbooking-invoice-m06ai23i02827970thinkaboutpadNo ratings yet

- 01 Sep 2022 To 26 Sep 2023-MinDocument33 pages01 Sep 2022 To 26 Sep 2023-MinRuloans VaishaliNo ratings yet

- BookingSummary2312220099957 PDFDocument1 pageBookingSummary2312220099957 PDFSagar BiswasNo ratings yet

- Original Purchase OrderDocument3 pagesOriginal Purchase Orderamit1003_kumarNo ratings yet

- 200-300 ET 500 Company List 2022Document6 pages200-300 ET 500 Company List 20220000000000000000No ratings yet

- Ganga Sagar, BairganiyaDocument1 pageGanga Sagar, Bairganiya27032007hitenguptaNo ratings yet

- D8Kbmj: Payment InformationDocument2 pagesD8Kbmj: Payment Informationsunder vermaNo ratings yet

- Rakesh ChandraDocument1 pageRakesh ChandraBAJAJNo ratings yet

- Safari Xza+ RDK 7STRDocument1 pageSafari Xza+ RDK 7STRBandari GoverdhanNo ratings yet

- BTI-434 Machine JamnagarDocument2 pagesBTI-434 Machine Jamnagareducationgarima9No ratings yet

- KD67MK: Date Flight From / Terminal To / Terminal Stops Departs Arrives Baggage Allowance ClassDocument1 pageKD67MK: Date Flight From / Terminal To / Terminal Stops Departs Arrives Baggage Allowance ClassSmarttNo ratings yet

- Report TableDocument2 pagesReport TablePrem PatelNo ratings yet

- Amrit RajDocument3 pagesAmrit Rajajaykmr2728No ratings yet

- GoAir - SUBBA RADocument2 pagesGoAir - SUBBA RASatish MandapetaNo ratings yet

- Losd00935400 In37230002813 B 16062023 0613071Document1 pageLosd00935400 In37230002813 B 16062023 0613071Rajesh MaddiNo ratings yet

- Gofirst NBRRXDDocument2 pagesGofirst NBRRXDShreyasi PatelNo ratings yet

- Account Ledger Inquiry: Menu Show Memo Pad Background Menu CCY ConverterDocument2 pagesAccount Ledger Inquiry: Menu Show Memo Pad Background Menu CCY Convertersarwan kumarNo ratings yet

- Tirupati Builcon 55Document1 pageTirupati Builcon 55pawan singhNo ratings yet

- Ka C 23 1380973 PDFDocument5 pagesKa C 23 1380973 PDFHarsh PatelNo ratings yet

- Trident To ChandigarhDocument1 pageTrident To Chandigarhnift.mahimaaroraNo ratings yet

- Data Services: Your Account SummaryDocument3 pagesData Services: Your Account Summarychethankrgowda8570No ratings yet

- Flight Ticket 2Document2 pagesFlight Ticket 2sssasehnfdtgnNo ratings yet

- NF44GKW8NPT7PQ0N5421Document1 pageNF44GKW8NPT7PQ0N5421Sanjay DarjiNo ratings yet

- Reliance General Insurance Company LimitedDocument8 pagesReliance General Insurance Company LimitedBhavesh RavalNo ratings yet

- Screenshot 2022-10-26 at 5.48.55 PMDocument2 pagesScreenshot 2022-10-26 at 5.48.55 PMSaloni SandhuNo ratings yet

- Jac JW 23241548Document3 pagesJac JW 23241548Jugal mahatoNo ratings yet

- MR 4152Document1 pageMR 4152Candy AvinashNo ratings yet

- HDI Generalinsurance, Policy 070524Document2 pagesHDI Generalinsurance, Policy 070524ashishrahangdale1675No ratings yet

- Miscellaneous Invoice (EU00001032) Passport LifestyleDocument1 pageMiscellaneous Invoice (EU00001032) Passport LifestyleindiatoursNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- FTWZ FAQsDocument4 pagesFTWZ FAQsCA Sriram KumarNo ratings yet

- 10 Reverse Charge IGST 01.12.2019Document11 pages10 Reverse Charge IGST 01.12.2019CA Sriram KumarNo ratings yet

- Vouchers - GST Implication - Taxguru - inDocument5 pagesVouchers - GST Implication - Taxguru - inCA Sriram KumarNo ratings yet

- Exemption From IGST & Compensation Cess To EOUs On Imports Extended Till 30.06.2022 - Taxguru - inDocument1 pageExemption From IGST & Compensation Cess To EOUs On Imports Extended Till 30.06.2022 - Taxguru - inCA Sriram KumarNo ratings yet

- Thermal Control Magazine January 2023 PreviewDocument5 pagesThermal Control Magazine January 2023 PreviewABHISHEK KUMAR SHARMANo ratings yet

- Textbook Methods in Consumer Research Volume 1 New Approaches To Classic Methods 1St Edition Gaston Ares Ebook All Chapter PDFDocument53 pagesTextbook Methods in Consumer Research Volume 1 New Approaches To Classic Methods 1St Edition Gaston Ares Ebook All Chapter PDFrobert.ward523100% (10)

- Bba G Unit-II Pm-302 E-NotesDocument13 pagesBba G Unit-II Pm-302 E-Notesbba01624201719No ratings yet

- Amazon-PREMIUM-Product - Oneplus 8 Pro 5G (Glacial Green 12GB RAM+256GB Storage) - 1593194641Document1 pageAmazon-PREMIUM-Product - Oneplus 8 Pro 5G (Glacial Green 12GB RAM+256GB Storage) - 1593194641LIz LagundayNo ratings yet

- Business Model Innovation of Startups Developing Multisided Digital PlatformsDocument6 pagesBusiness Model Innovation of Startups Developing Multisided Digital PlatformsErno van der MerweNo ratings yet

- 7 Mini Case Studies - Successful Supply Chain Cost Reduction and ManagementDocument16 pages7 Mini Case Studies - Successful Supply Chain Cost Reduction and ManagementBidyut Bhusan PandaNo ratings yet

- Ecological BricksDocument3 pagesEcological BricksSebastian Tovar GarciaNo ratings yet

- Accounting For Corporation - Retained EarningsDocument50 pagesAccounting For Corporation - Retained EarningsAlessandraNo ratings yet

- Invoices CR - Sale 129 VDPM Lnd4nTfROp4mieDocument1 pageInvoices CR - Sale 129 VDPM Lnd4nTfROp4mieAcer UserNo ratings yet

- SCO Refinery TTT ProcedureDocument3 pagesSCO Refinery TTT ProceduresunlogosenergygroupNo ratings yet

- Forklift Driver ResumeDocument6 pagesForklift Driver Resumejcipchajd100% (2)

- TCC A ReportDocument50 pagesTCC A Reportsavitha satheesanNo ratings yet

- Advertisement of EnergexDocument6 pagesAdvertisement of EnergexSagar A Baver100% (1)

- Bus 5102 Group AssignmentDocument10 pagesBus 5102 Group AssignmenthamisNo ratings yet

- Chapter 4Document24 pagesChapter 4Tanzeel HussainNo ratings yet

- Assignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreDocument2 pagesAssignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreKris Tine100% (1)

- CSIT 310 Design ProjectDocument392 pagesCSIT 310 Design ProjectAgodza EricNo ratings yet

- Financial Accounting Reporting - Partnership DissolutionDocument3 pagesFinancial Accounting Reporting - Partnership DissolutionlcNo ratings yet

- II.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Document1 pageII.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Jin AghamNo ratings yet

- Khazaf CatalogueDocument34 pagesKhazaf CataloguewailgibreelNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Kisan FoodsDocument7 pagesKisan FoodsKhanzada Wajahat100% (1)

- FTC Takes Action To Stop Credit Karma From Tricking Consumers With Allegedly False "Pre-Approved" Credit OffersDocument5 pagesFTC Takes Action To Stop Credit Karma From Tricking Consumers With Allegedly False "Pre-Approved" Credit OffersMary Claire PattonNo ratings yet

- Administrative and Office Manager RolesDocument2 pagesAdministrative and Office Manager RolesMohamed NasseerNo ratings yet

- Internship Report - Muskan BohraDocument32 pagesInternship Report - Muskan BohraMuskan BohraNo ratings yet

- Mis Assignment: Sharing/Subscription Economy ExampleDocument3 pagesMis Assignment: Sharing/Subscription Economy ExampleSakshi ShardaNo ratings yet

- Monopolistic CompetitionDocument27 pagesMonopolistic CompetitionRawat Renu71% (7)

- Chapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingDocument54 pagesChapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingnikkaaaNo ratings yet

- 364 Promo Table Test DocDocument2 pages364 Promo Table Test Docsheikhsaab60No ratings yet

Way of Reply ITC On Tax Invoice Air Transport Tickets

Way of Reply ITC On Tax Invoice Air Transport Tickets

Uploaded by

CA Sriram KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Way of Reply ITC On Tax Invoice Air Transport Tickets

Way of Reply ITC On Tax Invoice Air Transport Tickets

Uploaded by

CA Sriram KumarCopyright:

Available Formats

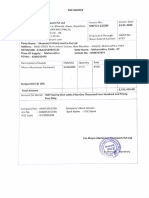

Fw: Invoices Pending for Accounting - Mar'22

CA. Sriram Kumar M <sriram@hiregange.com>

Mon 01-08-2022 16:11

To: Chandru <chandru@jayanti.com>

Cc: CA RoopaNayak <roopa@hiregange.com>;CA Jatin Nagpal <jatinnagpal@hiregange.com>;P Amarnatha Raju <amarnath@hiregange.com>;Anumula Sumanth Kumar <sumanthkumar@hiregange.com>

5 attachments (3 MB)

Annexure 1 Air Asia - Rajiv Palicha.pdf; Annexure 2 Air Asia - Ridhun.pdf; RajivPalicha.pdf; Rithun and Praveen.pdf; Sachin.pdf;

Dear Chandru Sir,

We reply to you as under

Query:

Below are the transactions invoices are not available. After thorough verification the attached tickets are available towards these transactions and verified that

credit on these tickets not claimed. However, there is a small amount of difference in tax amount due to other charges appear on invoice.

However, if we do not claim credit the complete amount of credit will be lost. Please suggest if we can claim credit on these transactions since they are appearing in

GSTR2A and tickets are available but not invoices. We have tried all the ways to get the invoices but no response from Airlines:

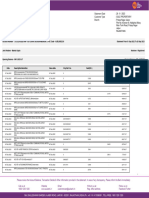

Invoice Invoice Taxable

MSD Name GSTIN of supplier Invoice number Date type Value IGST CGST SGST

Travel booking

confirmation of

Sachidanandan from C

AIR INDIA EXPRESS 28-11- to Delhi for GST credit

LIMITED 33AABCA0522B1ZR TN4FQ1121/AAA033 2021 R 10752.38 0 268.81 268.81 Rs. 490/- is available

31-01-

AIR INDIA LIMITED 23AACCN6194P1ZX 232212BP01AAA089 2022 R 4050 203 0 0 Not Applicable

28-02-

AIR INDIA LIMITED 23AACCN6194P1ZX 232232BP02AAA017 2022 CN -4050 -203 0 0 Not Applicable

20-10-

Airasia (India) Ltd 29AALCA4699P1ZJ IBLR211000049838 2021 R 10240 512 0 0

Travel Ticket of Mr.

Rajivpalicha with tax

31-01- credit of Rs. 145/- is

Airasia (India) Ltd 32AALCA4699P1ZW ICOK220100008365 2022 R 3591.43 179.57 0 0 avialable

Travel Ticket of Mr.

Ridhun VM, Praveen

Kumar from

Visakhapatnam to

Hyderabad is

21-10- available for tax credi

AIRASIA INDIA LIMITED 37AALCA4699P1ZM IVTZ211000005824 2021 R 10335.26 516.74 0 0 Rs. 450/-

IBIBO GROUP PRIVATE 25-02-

LIMITED 33AAHCP1178L1Z7 RTN22-A000881229 2022 R 700 0 17.5 17.5

MakeMyTrip(India)Private 27-10-

Limited 06AADCM5146R1ZZ M06AI22I05527124 2021 R 491.53 88.47 0 0

28-01-

YATRA ONLINE LIMITED 06AAACY2602D1ZW HO2206/1398434 2022 R 264.34 47.58 0 0

1344.36 286.31 286.31

H&A comments:

We understand that in the instant case invoices are pertaining to FY 2021-22

Sec 16(2) of CGST Act 2017 provides certain conditions to avail credit of GST paid on the goods/services procured.

The conditions are as follows:

Jayanti should have a valid tax invoice issued by the Vendors of goods or services.

Jayanti should have received the goods or services

The details of ITC with respect to the said supplies are not restricted in FORM GSTR-2B – To be notified. [Finance Act 2022 proposal]

The taxes with respect to the said supplies have been remitted by the supplier to the Government

Jayanti should have filed return u/s 39 (i.e., GSTR-3B)

Additional condition for availment of ITC

The period from 01.04.2021 to 31.12.2021

Rule 36(4) of CGST Rules was inserted which provides restriction on availment of eligible ITC wherein the recipient could avail eligible ITC in GSTR-3B lower of the

following

eligible ITC appearing in GSTR-2A + 5%* or

eligible ITC as per books of accounts

The period from 01.02.2022 to till date

The details of the Tax invoice issued by the Vendor shall be furnished by the supplier in his GSTR-1 and the same has been communicated to Jayanti in GSTR-

2B.- w.e.f. 01.01.22

We understand that Jayanti wishes us to comment on ITC on airline tickets based on the document shared with us.

In terms of Rule 36(1) ITC would be eligible to Jayanti on the basis of an invoice issued by the supplier of goods or services or both in accordance with the

provisions of section 31;

Further as per proviso to rule 36(2) which provides that Jayanti would be eligible to avail ITC even if all particulars of Tax invoice not mentioned provided

minimum details as follows are mentioned

the details of the amount of tax charged,

description of goods or services,

total value of supply of goods or services or both,

GSTIN of the supplier and recipient and

place of supply in case of inter-State supply

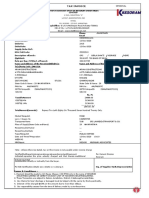

A. Air Asia

The details of the Tax Invoice of Air Asia would be available in official mail registered with Air Asia, alternately Jayanti could download it from the official

website of Air Asia [https://www.airasia.co.in/gst-tax-invoice] with Booking ID and Airport code

(i) Rajiv Palicha - IGST 179.57

PFA as Annexure 1 - Tax invoice downloaded from the above website - Jayanti is suggested to re-check/re-confirm the authenticity of invoice downloaded,

thereafter it could avail ITC based on such tax invoice provided satisfied all conditions above as discussed

(ii) Ridhun and Praveen - IGST 516.74

PFA as Annexure 2 - Tax invoice downloaded from the above website - Jayanti is suggested to re-check/re-confirm the authenticity of invoice downloaded,

thereafter it could avail ITC based on such tax invoice provided satisfied all conditions above as discussed

B. Air India Express

Sachidanandan - The document issued by Air India Express Ltd clearly is not a Tax Invoice further the document declares in its General note as follows "This

is an itinerary receipt and not a GST/VAT Invoice."

Jayanti is not eligible to avail ITC as it is not in possession of the Tax Invoice

It is suggested to avail ITC based on the tax invoice issued by Air India Express

Please revert for further clarifications.

CA Harish P Devda

AssistantManager

HIREGANGE & ASSOCIATES LLP

Chartered Accountants

1010, II Floor, 26th Main, 4th T Block, Jayanagar, Bengaluru - 560041

Tel: 080-26536404/05 / 080-41210703

M: +91 9741050696

www.hiregange.com

Our Locations:

Bengaluru | Hyderabad | Visakhapatnam | Gurugram (NCR) | Mumbai | Pune | Chennai | Guwahati | Noida | Vijayawada | Kolkata | Raipur | Kochi | Indore | Faridabad

https://hiregange.com/about-us/firm-profile

"Please do not print unless required, save paper, save trees, save the planet"

This email and any files transmitted with it are confidential and intended solely for the use of the individual or entity to whom they are addressed. If you have received this email in

error please notify the system manager. This message contains confidential information and is intended only for the individual named. If you are not the named addressee you

should not disseminate, distribute or copy this e-mail. Please notify the sender immediately by e-mail if you have received this e-mail by mistake and delete this e-mail from your

system. If you are not the intended recipient you are notified that disclosing, copying, distributing, or taking any action in reliance on the contents of this information is strictly

prohibited. The information contained in this mail is propriety and strictly confidential

From: Chandru <chandru@jayanti.com>

Sent: Tuesday, July 26, 2022 11:58 AM

To: CA Jatin Nagpal <jatinnagpal@hiregange.com>; P Amarnatha Raju <amarnath@hiregange.com>

Cc: CA RoopaNayak <roopa@hiregange.com>

Subject: RE: Invoices Pending for Accounting - Mar'22

Dear Jatin

Below are the transactions invoices are not available. After thorough verification the attached tickets are available towards these transactions and verified that credit on these tickets not

claimed. However, there is a small amount of difference in tax amount due to other charges appear on invoice.

However, if we do not claim credit the complete amount of credit will be lost. Please suggest if we can claim credit on these transactions since they are appearing in GSTR2A and tickets are

available but not invoices. We have tried all the ways to get the invoices but no response from Airlines:

Invoice Invoice Taxable

MSD Name GSTIN of supplier Invoice number Date type Value IGST CGST SGST

Travel booking confirmation of Sachida

28-11- from CBE to Delhi for GST credit of Rs.

AIR INDIA EXPRESS LIMITED 33AABCA0522B1ZR TN4FQ1121/AAA033 2021 R 10752.38 0 268.81 268.81 available

31-01-

AIR INDIA LIMITED 23AACCN6194P1ZX 232212BP01AAA089 2022 R 4050 203 0 0 Not Applicable

28-02-

AIR INDIA LIMITED 23AACCN6194P1ZX 232232BP02AAA017 2022 CN -4050 -203 0 0 Not Applicable

20-10-

Airasia (India) Ltd 29AALCA4699P1ZJ IBLR211000049838 2021 R 10240 512 0 0

31-01- Travel Ticket of Mr. Rajivpalicha with ta

Airasia (India) Ltd 32AALCA4699P1ZW ICOK220100008365 2022 R 3591.43 179.57 0 0 Rs. 145/- is avialable

Travel Ticket of Mr. Ridhun VM, Pravee

21-10- from Visakhapatnam to Hyderabad is a

AIRASIA INDIA LIMITED 37AALCA4699P1ZM IVTZ211000005824 2021 R 10335.26 516.74 0 0 for tax credit of Rs. 450/-

25-02-

IBIBO GROUP PRIVATE LIMITED 33AAHCP1178L1Z7 RTN22-A000881229 2022 R 700 0 17.5 17.5

MakeMyTrip(India)Private 27-10-

Limited 06AADCM5146R1ZZ M06AI22I05527124 2021 R 491.53 88.47 0 0

28-01-

YATRA ONLINE LIMITED 06AAACY2602D1ZW HO2206/1398434 2022 R 264.34 47.58 0 0

1344.36 286.31 286.31

Chandru

+91 8884418862

www.jayanti.com Follow us on LinkedIn

From: Gayathri A <gayathri.a@jayanti.com>

Sent: 25 July 2022 23:00

To: Seema <seema@jayanti.com>; Gopala A <gopala.a@jayanti.com>

Cc: Komal Shah <komal@jayanti.com>; Chandru <chandru@jayanti.com>; Kavitha <kavitha@jayanti.com>

Subject: RE: Invoices Pending for Accounting - Mar'22

Thank you seema mam for swift response.

Dear Chandru – at this case, what do you want us to do – It is paid through credit card already.

Option 1- account the entry without bill, forego the GST and book it as expenses

Option 2 – account the entry without bill with GST credit in books.

Pls advise if there is any other feasible option too in order to complete the entry asap.

Gayathri A

+91 848 991 8807

www.jayanti.com Follow us on LinkedIn

From: Seema <seema@jayanti.com>

Sent: 25 July 2022 22:57

To: Gayathri A <gayathri.a@jayanti.com>; Gopala A <gopala.a@jayanti.com>

Cc: Komal Shah <komal@jayanti.com>; Chandru <chandru@jayanti.com>; Kavitha <kavitha@jayanti.com>

Subject: RE: Invoices Pending for Accounting - Mar'22

Dear Gayathri,

We do not have pending invoices mentioned in the list. We will not be able to get them from vendors as none of them have responded.

Thanks

Seema Joshi

From: Gayathri A <gayathri.a@jayanti.com>

Sent: 25 July 2022 22:54

To: Seema <seema@jayanti.com>; Saranya <saranya.r@jayanti.com>; Jayaprakash <jp@jayanti.com>; Gopala A <gopala.a@jayanti.com>

Cc: Komal Shah <komal@jayanti.com>; Chandru <chandru@jayanti.com>

Subject: FW: Invoices Pending for Accounting - Mar'22

Dear seema mam

Dear Saranya

Dear JP

Attached the final list from Gopala for pending invoices to receive for Mar 22 closure.

Can you pls give us a final call on receipt of bill. We need to finalise book closure soon with stat. auditors.

Thank you in advance. An early reply will be great help.

Gayathri A

+91 848 991 8807

www.jayanti.com Follow us on LinkedIn

From: Gopala A <gopala.a@jayanti.com>

Sent: 25 July 2022 20:33

To: Gayathri A <gayathri.a@jayanti.com>

Subject: Invoices Pending for Accounting - Mar'22

Dear Gayathri,

Please find attached details of Invoices not accounted in MSD for want of bills and do the needful.

Gopala A

+91 8884000163

www.jayanti.com Follow us on LinkedIn

You might also like

- The Case of Lemonade Isnurance PDFDocument18 pagesThe Case of Lemonade Isnurance PDFFrancesco Bologni50% (2)

- Y Broadband Bill Feb2020 PDFDocument1 pageY Broadband Bill Feb2020 PDFvijaya lakshmiNo ratings yet

- Del BLRDocument1 pageDel BLRaravindabnNo ratings yet

- Buyer Details Seller Details: Scan To Download Mobile App. Currently Available Only For General Scrap AuctionsDocument3 pagesBuyer Details Seller Details: Scan To Download Mobile App. Currently Available Only For General Scrap AuctionsPurohit RajNo ratings yet

- Address:-MRO-CIDCO Mansarovar Station, Navi Mumbai - 410209, Maharashtra, IndiaDocument4 pagesAddress:-MRO-CIDCO Mansarovar Station, Navi Mumbai - 410209, Maharashtra, IndiaNikhil PatilNo ratings yet

- Gmail - GoAir Itinerary PDFDocument2 pagesGmail - GoAir Itinerary PDFTuhin ChakrabortyNo ratings yet

- Maheshwari Sales (G) Debit NoteDocument1 pageMaheshwari Sales (G) Debit NoteAAKARNo ratings yet

- Raj Construction Kanpur Invoice-1Document1 pageRaj Construction Kanpur Invoice-1Khajan SinghNo ratings yet

- Invoice B202201222Document1 pageInvoice B202201222Rakesh KumarNo ratings yet

- Demarcation Pillars KA Bill PDFDocument1 pageDemarcation Pillars KA Bill PDFradha gNo ratings yet

- BHD 23 24 007606Document1 pageBHD 23 24 007606rajugoud6231No ratings yet

- Creative BillsDocument5 pagesCreative BillsTcm HaridwarNo ratings yet

- DKSH Po 52 DT 06.09.2022Document1 pageDKSH Po 52 DT 06.09.2022Nova TransfersNo ratings yet

- PIIX00260 Dev AutomationDocument1 pagePIIX00260 Dev AutomationSabhyaNo ratings yet

- Booking Invoice M06ai23i05834999Document2 pagesBooking Invoice M06ai23i05834999Rohan DesaiNo ratings yet

- Adobe Scan Dec 17, 2022Document1 pageAdobe Scan Dec 17, 2022Thiru ArasuNo ratings yet

- MRT Tours and Travels PVT LTD: MR Praveen Kumar B C - BMRCLDocument4 pagesMRT Tours and Travels PVT LTD: MR Praveen Kumar B C - BMRCLPraveen KumarNo ratings yet

- Signed DO MSTC LKO 23-24 3195Document2 pagesSigned DO MSTC LKO 23-24 3195Mahendra KumarNo ratings yet

- Aryan Ventures - Queries and RequirementsDocument10 pagesAryan Ventures - Queries and RequirementsnavinNo ratings yet

- My Invoice JULY 2023Document1 pageMy Invoice JULY 2023Ch JEEVANA SANDHYANo ratings yet

- RW16EC3412Document1 pageRW16EC3412Vishal Tambe 0146No ratings yet

- URMILADocument1 pageURMILApuja9015709658No ratings yet

- BBL372506B003088Document3 pagesBBL372506B003088chethankrgowda8570No ratings yet

- Adobe Scan 16-Mar-2023Document1 pageAdobe Scan 16-Mar-2023SHASHI COMUNICATIONNo ratings yet

- Export PolicyDocument5 pagesExport PolicyghelilundNo ratings yet

- BLR 2 SepDocument1 pageBLR 2 SepSarah WilliamsNo ratings yet

- SHIVANYA BILL 11.07.2024Document1 pageSHIVANYA BILL 11.07.2024Ashish BansalNo ratings yet

- Ledger 3464988 0Document1 pageLedger 3464988 0adarshdubeyNo ratings yet

- Sharekhan Morning Tiger (Pre Market Insight) 12 Sep 2022Document8 pagesSharekhan Morning Tiger (Pre Market Insight) 12 Sep 2022Aashutosh RathodNo ratings yet

- Tax Invoice: E Waybill - NoDocument1 pageTax Invoice: E Waybill - NoPRAMOD S NNo ratings yet

- Jac JW 23241549Document3 pagesJac JW 23241549Jugal mahatoNo ratings yet

- booking-invoice-m06ai23i02827970Document3 pagesbooking-invoice-m06ai23i02827970thinkaboutpadNo ratings yet

- 01 Sep 2022 To 26 Sep 2023-MinDocument33 pages01 Sep 2022 To 26 Sep 2023-MinRuloans VaishaliNo ratings yet

- BookingSummary2312220099957 PDFDocument1 pageBookingSummary2312220099957 PDFSagar BiswasNo ratings yet

- Original Purchase OrderDocument3 pagesOriginal Purchase Orderamit1003_kumarNo ratings yet

- 200-300 ET 500 Company List 2022Document6 pages200-300 ET 500 Company List 20220000000000000000No ratings yet

- Ganga Sagar, BairganiyaDocument1 pageGanga Sagar, Bairganiya27032007hitenguptaNo ratings yet

- D8Kbmj: Payment InformationDocument2 pagesD8Kbmj: Payment Informationsunder vermaNo ratings yet

- Rakesh ChandraDocument1 pageRakesh ChandraBAJAJNo ratings yet

- Safari Xza+ RDK 7STRDocument1 pageSafari Xza+ RDK 7STRBandari GoverdhanNo ratings yet

- BTI-434 Machine JamnagarDocument2 pagesBTI-434 Machine Jamnagareducationgarima9No ratings yet

- KD67MK: Date Flight From / Terminal To / Terminal Stops Departs Arrives Baggage Allowance ClassDocument1 pageKD67MK: Date Flight From / Terminal To / Terminal Stops Departs Arrives Baggage Allowance ClassSmarttNo ratings yet

- Report TableDocument2 pagesReport TablePrem PatelNo ratings yet

- Amrit RajDocument3 pagesAmrit Rajajaykmr2728No ratings yet

- GoAir - SUBBA RADocument2 pagesGoAir - SUBBA RASatish MandapetaNo ratings yet

- Losd00935400 In37230002813 B 16062023 0613071Document1 pageLosd00935400 In37230002813 B 16062023 0613071Rajesh MaddiNo ratings yet

- Gofirst NBRRXDDocument2 pagesGofirst NBRRXDShreyasi PatelNo ratings yet

- Account Ledger Inquiry: Menu Show Memo Pad Background Menu CCY ConverterDocument2 pagesAccount Ledger Inquiry: Menu Show Memo Pad Background Menu CCY Convertersarwan kumarNo ratings yet

- Tirupati Builcon 55Document1 pageTirupati Builcon 55pawan singhNo ratings yet

- Ka C 23 1380973 PDFDocument5 pagesKa C 23 1380973 PDFHarsh PatelNo ratings yet

- Trident To ChandigarhDocument1 pageTrident To Chandigarhnift.mahimaaroraNo ratings yet

- Data Services: Your Account SummaryDocument3 pagesData Services: Your Account Summarychethankrgowda8570No ratings yet

- Flight Ticket 2Document2 pagesFlight Ticket 2sssasehnfdtgnNo ratings yet

- NF44GKW8NPT7PQ0N5421Document1 pageNF44GKW8NPT7PQ0N5421Sanjay DarjiNo ratings yet

- Reliance General Insurance Company LimitedDocument8 pagesReliance General Insurance Company LimitedBhavesh RavalNo ratings yet

- Screenshot 2022-10-26 at 5.48.55 PMDocument2 pagesScreenshot 2022-10-26 at 5.48.55 PMSaloni SandhuNo ratings yet

- Jac JW 23241548Document3 pagesJac JW 23241548Jugal mahatoNo ratings yet

- MR 4152Document1 pageMR 4152Candy AvinashNo ratings yet

- HDI Generalinsurance, Policy 070524Document2 pagesHDI Generalinsurance, Policy 070524ashishrahangdale1675No ratings yet

- Miscellaneous Invoice (EU00001032) Passport LifestyleDocument1 pageMiscellaneous Invoice (EU00001032) Passport LifestyleindiatoursNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- FTWZ FAQsDocument4 pagesFTWZ FAQsCA Sriram KumarNo ratings yet

- 10 Reverse Charge IGST 01.12.2019Document11 pages10 Reverse Charge IGST 01.12.2019CA Sriram KumarNo ratings yet

- Vouchers - GST Implication - Taxguru - inDocument5 pagesVouchers - GST Implication - Taxguru - inCA Sriram KumarNo ratings yet

- Exemption From IGST & Compensation Cess To EOUs On Imports Extended Till 30.06.2022 - Taxguru - inDocument1 pageExemption From IGST & Compensation Cess To EOUs On Imports Extended Till 30.06.2022 - Taxguru - inCA Sriram KumarNo ratings yet

- Thermal Control Magazine January 2023 PreviewDocument5 pagesThermal Control Magazine January 2023 PreviewABHISHEK KUMAR SHARMANo ratings yet

- Textbook Methods in Consumer Research Volume 1 New Approaches To Classic Methods 1St Edition Gaston Ares Ebook All Chapter PDFDocument53 pagesTextbook Methods in Consumer Research Volume 1 New Approaches To Classic Methods 1St Edition Gaston Ares Ebook All Chapter PDFrobert.ward523100% (10)

- Bba G Unit-II Pm-302 E-NotesDocument13 pagesBba G Unit-II Pm-302 E-Notesbba01624201719No ratings yet

- Amazon-PREMIUM-Product - Oneplus 8 Pro 5G (Glacial Green 12GB RAM+256GB Storage) - 1593194641Document1 pageAmazon-PREMIUM-Product - Oneplus 8 Pro 5G (Glacial Green 12GB RAM+256GB Storage) - 1593194641LIz LagundayNo ratings yet

- Business Model Innovation of Startups Developing Multisided Digital PlatformsDocument6 pagesBusiness Model Innovation of Startups Developing Multisided Digital PlatformsErno van der MerweNo ratings yet

- 7 Mini Case Studies - Successful Supply Chain Cost Reduction and ManagementDocument16 pages7 Mini Case Studies - Successful Supply Chain Cost Reduction and ManagementBidyut Bhusan PandaNo ratings yet

- Ecological BricksDocument3 pagesEcological BricksSebastian Tovar GarciaNo ratings yet

- Accounting For Corporation - Retained EarningsDocument50 pagesAccounting For Corporation - Retained EarningsAlessandraNo ratings yet

- Invoices CR - Sale 129 VDPM Lnd4nTfROp4mieDocument1 pageInvoices CR - Sale 129 VDPM Lnd4nTfROp4mieAcer UserNo ratings yet

- SCO Refinery TTT ProcedureDocument3 pagesSCO Refinery TTT ProceduresunlogosenergygroupNo ratings yet

- Forklift Driver ResumeDocument6 pagesForklift Driver Resumejcipchajd100% (2)

- TCC A ReportDocument50 pagesTCC A Reportsavitha satheesanNo ratings yet

- Advertisement of EnergexDocument6 pagesAdvertisement of EnergexSagar A Baver100% (1)

- Bus 5102 Group AssignmentDocument10 pagesBus 5102 Group AssignmenthamisNo ratings yet

- Chapter 4Document24 pagesChapter 4Tanzeel HussainNo ratings yet

- Assignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreDocument2 pagesAssignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreKris Tine100% (1)

- CSIT 310 Design ProjectDocument392 pagesCSIT 310 Design ProjectAgodza EricNo ratings yet

- Financial Accounting Reporting - Partnership DissolutionDocument3 pagesFinancial Accounting Reporting - Partnership DissolutionlcNo ratings yet

- II.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Document1 pageII.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Jin AghamNo ratings yet

- Khazaf CatalogueDocument34 pagesKhazaf CataloguewailgibreelNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Kisan FoodsDocument7 pagesKisan FoodsKhanzada Wajahat100% (1)

- FTC Takes Action To Stop Credit Karma From Tricking Consumers With Allegedly False "Pre-Approved" Credit OffersDocument5 pagesFTC Takes Action To Stop Credit Karma From Tricking Consumers With Allegedly False "Pre-Approved" Credit OffersMary Claire PattonNo ratings yet

- Administrative and Office Manager RolesDocument2 pagesAdministrative and Office Manager RolesMohamed NasseerNo ratings yet

- Internship Report - Muskan BohraDocument32 pagesInternship Report - Muskan BohraMuskan BohraNo ratings yet

- Mis Assignment: Sharing/Subscription Economy ExampleDocument3 pagesMis Assignment: Sharing/Subscription Economy ExampleSakshi ShardaNo ratings yet

- Monopolistic CompetitionDocument27 pagesMonopolistic CompetitionRawat Renu71% (7)

- Chapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingDocument54 pagesChapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingnikkaaaNo ratings yet

- 364 Promo Table Test DocDocument2 pages364 Promo Table Test Docsheikhsaab60No ratings yet