Professional Documents

Culture Documents

Baddebt&doubtful Debts

Baddebt&doubtful Debts

Uploaded by

Usman AttiqueCopyright:

Available Formats

You might also like

- Chapter 2 Audit of Receivables and SalesDocument19 pagesChapter 2 Audit of Receivables and SalesKez MaxNo ratings yet

- TE040 GL ... Test Script On General LedgerDocument22 pagesTE040 GL ... Test Script On General Ledgersanjayapps100% (10)

- Journal Entry To Trial BalanceDocument10 pagesJournal Entry To Trial Balanceruthmae bumanglag100% (7)

- Unit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodDocument6 pagesUnit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodRealGenius (Carl)No ratings yet

- ACC 200 Tutorial QuestionsDocument72 pagesACC 200 Tutorial Questionsherueux67% (3)

- Dynamics GP Tables PDFDocument10 pagesDynamics GP Tables PDFadalbertopolanco5305No ratings yet

- 8.7.1 Allowance MethodDocument5 pages8.7.1 Allowance MethodAkkamaNo ratings yet

- Acc CH 4Document16 pagesAcc CH 4Tajudin Abba RagooNo ratings yet

- ACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Document18 pagesACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Hans MosquedaNo ratings yet

- Chapter 5 Estimation of Doubtful Accounts 5 PDF FreeDocument8 pagesChapter 5 Estimation of Doubtful Accounts 5 PDF FreeryseNo ratings yet

- Acc CH 4Document15 pagesAcc CH 4Bicaaqaa M. AbdiisaaNo ratings yet

- Report - FinanceDocument1 pageReport - FinanceWilbert PascualNo ratings yet

- Chapter # 17: Valuation of Accounts ReceivableDocument24 pagesChapter # 17: Valuation of Accounts ReceivableHakim JanNo ratings yet

- Theory BAD AND DOUBTFUL DEBTSDocument4 pagesTheory BAD AND DOUBTFUL DEBTSJahanzaib ButtNo ratings yet

- RecivablesDocument12 pagesRecivablesGizaw BelayNo ratings yet

- Financial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesDocument2 pagesFinancial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesMay Grethel Joy PeranteNo ratings yet

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- Chapter 9 - Accounting For ReceivablesDocument10 pagesChapter 9 - Accounting For ReceivablesMajan Kaur100% (1)

- Irrecoverable Debts & Provision For Irrecoverables DebtsDocument5 pagesIrrecoverable Debts & Provision For Irrecoverables DebtsYomi AmvNo ratings yet

- 11 ReceivablesDocument4 pages11 ReceivablesuncianojhezrhyllemhaeNo ratings yet

- 2022 - 05 - Bad and Doubtful DebtsDocument39 pages2022 - 05 - Bad and Doubtful DebtsSafi UllahNo ratings yet

- Principles of Financial AccountingDocument14 pagesPrinciples of Financial AccountingSakshiNo ratings yet

- Provision For Doubtful Debts 1Document1 pageProvision For Doubtful Debts 1mbaliiii.maNo ratings yet

- Fas Asc 310 30 Loan Accounting White Paper 1Document33 pagesFas Asc 310 30 Loan Accounting White Paper 1Muhammad Umar FarooqNo ratings yet

- Acc. For Receivables-1Document5 pagesAcc. For Receivables-1Kamrul HasanNo ratings yet

- POA Topic 12Document3 pagesPOA Topic 12Ian ChanNo ratings yet

- ADJUSTING ENTRIES Part 3Document5 pagesADJUSTING ENTRIES Part 3MOCHI SSABELLENo ratings yet

- Bad Debts and Doubtful Debts PDFDocument4 pagesBad Debts and Doubtful Debts PDFSanjiv KubalNo ratings yet

- Chapter 5 (3) - Bad Debts, Allowance For Doubtful Debts and Discount AllowableDocument43 pagesChapter 5 (3) - Bad Debts, Allowance For Doubtful Debts and Discount AllowableIrsamNo ratings yet

- 08 - Receivables PDFDocument2 pages08 - Receivables PDFJamie ToriagaNo ratings yet

- Lecture-10 Bad Debts and Allowance For Doubtful DebtsDocument13 pagesLecture-10 Bad Debts and Allowance For Doubtful DebtsAzeemNo ratings yet

- 8 Debtors, Creditors, and Promisory NotesDocument30 pages8 Debtors, Creditors, and Promisory NotesERICK MLINGWANo ratings yet

- 8 Debtors, Creditors, and Promisory Notes UDDocument41 pages8 Debtors, Creditors, and Promisory Notes UDERICK MLINGWANo ratings yet

- 05 ReceivablesDocument15 pages05 ReceivablesJean BritoNo ratings yet

- VU Accounting Lesson 24Document6 pagesVU Accounting Lesson 24ranawaseemNo ratings yet

- JAIIB / Diploma in Banking & Finance Accounting and Finance For BankersDocument89 pagesJAIIB / Diploma in Banking & Finance Accounting and Finance For BankerssagarjpatelNo ratings yet

- Chapter 8 Feb.5Document51 pagesChapter 8 Feb.5AaaNo ratings yet

- Cash To Inventory Reviewer 1Document15 pagesCash To Inventory Reviewer 1Patricia Camille AustriaNo ratings yet

- Financial Accounting, 4eDocument47 pagesFinancial Accounting, 4eEka Aliyah FauziNo ratings yet

- Unit 9Document5 pagesUnit 9Anonymous Fn7Ko5riKTNo ratings yet

- Account Receivable ManagementDocument24 pagesAccount Receivable ManagementMaKayla De JesusNo ratings yet

- INTACC 1: Trade and Other ReceivablesDocument6 pagesINTACC 1: Trade and Other Receivablesdanica rozelNo ratings yet

- CH 9 - Intermediate AccountingDocument28 pagesCH 9 - Intermediate Accountinghana osmanNo ratings yet

- Bad Debts and Provision For Doubtful DebtDocument22 pagesBad Debts and Provision For Doubtful DebtNauman HashmiNo ratings yet

- Acc 106 Account ReceivablesDocument40 pagesAcc 106 Account ReceivablesAmirah NordinNo ratings yet

- Chap 009Document27 pagesChap 009Ali SaloNo ratings yet

- Bad Debts and Provision For Bad Debt - Principles of AccountingDocument7 pagesBad Debts and Provision For Bad Debt - Principles of AccountingAbdulla MaseehNo ratings yet

- ACCY901 Accounting Foundations For Professionals: Topic 5 ReceivablesDocument30 pagesACCY901 Accounting Foundations For Professionals: Topic 5 Receivablesvenkatachalam radhakrishnan100% (1)

- Stern CorporationsDocument30 pagesStern CorporationsShubham MallikNo ratings yet

- CH09Document28 pagesCH09Will TrầnNo ratings yet

- Demo TeachingDocument40 pagesDemo TeachingNichole Angel LeiNo ratings yet

- Chapter 9 NotesDocument15 pagesChapter 9 NotesMohamed AfzalNo ratings yet

- ACC 124 HO 7 Estimation of Doubtful AccountsDocument3 pagesACC 124 HO 7 Estimation of Doubtful AccountsJames Cañada GatoNo ratings yet

- Adv Acc - BankingDocument13 pagesAdv Acc - Bankingrshyams165No ratings yet

- Receivables: Created By: Origen, Janiene / Palma, Jennelyn, Cabi Gting, Ela. Artiza, EmmanDocument44 pagesReceivables: Created By: Origen, Janiene / Palma, Jennelyn, Cabi Gting, Ela. Artiza, Emmandeleonjaniene bsaNo ratings yet

- Chapter 4.3 Accounts ReceivableDocument5 pagesChapter 4.3 Accounts ReceivableCABRERA ABIGAIL P.No ratings yet

- Account Recivable Bet Teacher NoteDocument39 pagesAccount Recivable Bet Teacher NoteHaftom YitbarekNo ratings yet

- ch05 ReceivablesDocument51 pagesch05 ReceivableszedingelNo ratings yet

- AttachmentDocument8 pagesAttachmentchintya milathania100% (1)

- 3 Trade - Receivables FinalDocument15 pages3 Trade - Receivables FinalNadjib KilardjNo ratings yet

- ARSOP 2.0 Allowance For Doubtful AccountsDocument5 pagesARSOP 2.0 Allowance For Doubtful AccountsSelenge DaaduuNo ratings yet

- Accounts ReceivableDocument21 pagesAccounts ReceivableMurtaza Hussain SyedNo ratings yet

- HK MA: The Hong Kong Management Association Hong Kong Polytechnic Joint Diploma in Management StudiesDocument12 pagesHK MA: The Hong Kong Management Association Hong Kong Polytechnic Joint Diploma in Management StudiesSinoNo ratings yet

- From Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsFrom EverandFrom Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsNo ratings yet

- Understand Financial Postings On Sales and Purchase OrdersDocument8 pagesUnderstand Financial Postings On Sales and Purchase OrdersFreed NixonNo ratings yet

- Provisional BSPL 2017-18 PDFDocument239 pagesProvisional BSPL 2017-18 PDFshashank mokashiNo ratings yet

- E-Circular: All The Offices/ Branches of State Bank of India Project: Hrms Roll-Out of New ServicesDocument6 pagesE-Circular: All The Offices/ Branches of State Bank of India Project: Hrms Roll-Out of New ServicesMithun SinghNo ratings yet

- Flowchart of Cash Receipt System: Mail Room Cash ReceiptsDocument17 pagesFlowchart of Cash Receipt System: Mail Room Cash ReceiptsStephanie Diane SabadoNo ratings yet

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDocument28 pagesYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNo ratings yet

- ITR3 - 2019 - PR1.1 Example FileDocument208 pagesITR3 - 2019 - PR1.1 Example FilePrateek SharmaNo ratings yet

- EmilioDocument16 pagesEmilioRonNo ratings yet

- 2015 Bar Examination Questionnaire For Mercantile LawDocument4 pages2015 Bar Examination Questionnaire For Mercantile LawJamaica Cabildo Manaligod100% (1)

- 02-09-2013Document2 pages02-09-2013Portia ShilengeNo ratings yet

- Chapter 6Document19 pagesChapter 6Trayle HeartNo ratings yet

- P1.001 InventoriesDocument5 pagesP1.001 InventoriesPatrick Kyle AgraviadorNo ratings yet

- Coop Chart of AccountsDocument30 pagesCoop Chart of AccountsAmalia Dela Cruz100% (17)

- ch11 SolutionsDocument36 pagesch11 Solutionsaboodyuae2000No ratings yet

- Reynaldo Adjusment EntryDocument5 pagesReynaldo Adjusment EntryAra HasanNo ratings yet

- Basic Accounting Process PDFDocument317 pagesBasic Accounting Process PDFObey SitholeNo ratings yet

- This Study Resource Was: Profit Loss Profit LossDocument9 pagesThis Study Resource Was: Profit Loss Profit LossrogealynNo ratings yet

- Using Sage 50 Accounting 2017 Canadian 1st Edition Purbhoo Test BankDocument13 pagesUsing Sage 50 Accounting 2017 Canadian 1st Edition Purbhoo Test Bankmungoosemodus1qrzsk100% (31)

- EAM CostDocument43 pagesEAM CostAymen HamdounNo ratings yet

- Chapter 8 - Receivables Lecture Notes - StudentsDocument43 pagesChapter 8 - Receivables Lecture Notes - StudentsKy Anh NguyễnNo ratings yet

- ND SyllabusDocument179 pagesND SyllabusGoodnews AdeshinaNo ratings yet

- ACC 117 Group Assignment 1 UiTMK PDFDocument19 pagesACC 117 Group Assignment 1 UiTMK PDFaatynfarhanaNo ratings yet

- Dukascopy Bank StatementDocument2 pagesDukascopy Bank StatementshangkharajNo ratings yet

- GST Expenses ListDocument2 pagesGST Expenses ListaviNo ratings yet

- Assignment ProblemsDocument7 pagesAssignment ProblemsLowzil AJIMNo ratings yet

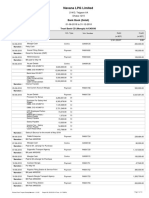

- Navana LPG Limited: Bank Book (Detail)Document13 pagesNavana LPG Limited: Bank Book (Detail)M. A. Alim SohelNo ratings yet

- Multiple Choice QuestionsDocument2 pagesMultiple Choice QuestionsRk BainsNo ratings yet

Baddebt&doubtful Debts

Baddebt&doubtful Debts

Uploaded by

Usman AttiqueOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Baddebt&doubtful Debts

Baddebt&doubtful Debts

Uploaded by

Usman AttiqueCopyright:

Available Formats

RIZWAN KARIM CHUGHTAI

O/A LEVEL ACCOUNTING 03017464500

Bad Debts/Irrecoverable debts and Provision for bad

debts/doubtful debts.

Bad debts/ Irrecoverable debts:

A bad debt is a debt that is not recoverable after all the efforts have been made for its

collection. This maybe arise for example, as a result of the,

➢ Insolvency of a credit customer

➢ Bankruptcy of a credit customer

Accounting treatment for bad debt/ Irrecoverable debts:

A bad debt is treated as an expense in the income statement and reduced the value of

receivables in the statement of financial position.

The general Journal entry is passed to record the write off accounts receivables as bad

debts.

DR-------------Bad Debts/Irrecoverable debts

CR--------------------Debtors/receivables

Transfer the balance of bad debts (Irrecoverable) account to the income statement the

journal entry,

DR------------- Income Statement

Cr-------------------- Bad Debts/Irrecoverable debts

Irrecoverable debts recovered/ Bad debts recovered:

A bad debts that has been written off as irrecoverable in previous years maybe recovered

at a later date If the customer become able to pay. The customer’s account will be debit

and irrecoverable debts account credited with the amount recovered. The amount

received from customer may then be credited to his account and debited to cash book.

Accounting treatment for bad debt/ Irrecoverable debts recovered:

The irrecoverable debts recovered treated as income in income statement.

The general Journal entry is passed to record the bad debts/irrecoverable debts

recovered. (cancelling previous written of trade receivables)

DR-------------Receivables

CR-------------------- bad debts/irrecoverable debts recovered

Transfer the balance of Irrecoverable debts recovered account to the income statement

the journal entry,

DR------------- bad debts/irrecoverable debts recovered

Cr-------------------- Income Statement

Provision for bad or doubtful debts:

Doubtful debt is a debt due from a customer where it is uncertain whether or not it will be

repaid by them.

Business usually creates a provision for doubtful debts to provide for doubtful debts.

Provision for doubtful debts therefore reflects the proportion of trade receivables that the

business expects may not be recovered. The provision is supposed to show the likely size

of future bad debts.

The provision for doubtful debts is estimated amount calculated on trade receivables and

this amount is subtracted from trade receivables value on the statement of financial

position so as to give a more realistic figure for the amount likely to be received.

General Provision for bad or doubtful debts:

When there is no clear evidence that which trade receivable will not clear his debt. This

usually estimated on the basis of past trend and future expectation about receivables and

expressed as a % of closing balance of receivables.

1

Specific Provision for bad or doubtful debts:

Page

RIZWAN KARIM CHUGHTAI

O/A LEVEL ACCOUNTING 03017464500

When there is clear evidence that the particular receivable might turn be bad. The

creation of this provision is based on appraising the trade receivables on individual basis.

Factors consider for calculation of provision for doubtful debts:

➢ Economic climate – frequency of business failure

➢ The amount of debts outstanding from each customers

➢ How long of each debt has been outstanding

➢ Past record of each trade receivable

Reasons for why business create doubtful debts?

➢ To show the receivables at more realistic value in statement of financial position

➢ To estimate the future possible bad debts

➢ To apply the matching concept

➢ To apply the prudence concept

➢ To show the financial statements true and fair view

➢ To avoid the overstating of profits

Creation of doubtful debts:

When business creates the provision for doubtful debts initial year journal entry will be,

DR--------------- Income Statement

CR--------------- Provision for doubtful debts

Increase in provision for doubtful debts:

The estimated amount increased from last year estimation.

For e.g. last year, the debtors were $2,000. The provision for doubtful debts was $100.

Scenario 1: During the year, the debtors are $3,000. If you remember Step 1 in the

previous post, we will need to calculate the provision of doubtful debts. In this case,

$3000 x 5% = $150Now, compare this $150 with previous year of $100. There is

an increase in provision for doubtful debts of $50.Because the amounts of debts have

increased, more bad debts will be expected in the future. This is an increase in expense

and treated as an expense in income statement. In the Balance Sheet, receivables are

reduced by the amount of provision for doubtful debts for the year, which is $150.

DR--------------- Income Statement

CR--------------- Provision for doubtful debts

Decrease in provision for doubtful debts:

The estimated amount decrease from last year provision

Scenario 2: The amount of debtors for the year totaled to $1000. The provision for

doubtful debts is $50. Note: We are comparing with the $100 previous year, not with

$150 in Scenario 1.

You can see that this year provision for doubtful debts have decreased by $50 (100-

50.) This decrease is an income for the business.

Scenario 2: The amount of debtors for the year totaled to $1000. The provision for

doubtful debts is $50. Note: We are comparing with the $100 previous year, not with

$150 in Scenario 1.

You can see that this year provision for doubtful debts have decreased by $50 (100-

50.) This decrease is an income for the business. In the Balance Sheet, receivables are

reduced by the amount of provision for doubtful debts for the year, which is $100

DR--------------- Provision for doubtful debts

CR--------------- Income Statement

2

Page

RIZWAN KARIM CHUGHTAI

O/A LEVEL ACCOUNTING 03017464500

Provision for doubtful debts and concepts:

Matching Concept:

Expenses are matched against revenues. Expenses against an income (e.g., bad debts are

an expense against sales income) should be recorded in the same accounting year, in

which that income is earned and recorded.

Prudence Concept:

Anticipated (future) losses should be recorded in the financial statements and anticipated

gains should not be recorded in the financial statements OR Incomes and assets

shouldn’t be overstated

Provision for bad debts is based on these two principles.

Note:

Increase in Provision for bad debts is recorded as an expense in income statement.

Decrease in Provision for bad debts is added in Gross Profit in income statement.

Total amount of provision for doubtful debts are subtracted from trade receivables in

statement of financial position.

The balance brought down (b/d) in provision account is always on credit side.

Ageing schedule:

The aging of trade receivables involves analyzing the individual accounts found in the

sales ledger.

Customers’ accounts categorised in an analysis sheet according to the length of time that

they have been outstanding.

A different percentage based on past experience and current market conditions is then

applied to each group.

The following is the ageing schedule for calculating for doubtful debts.

Age of debt Trade receivables % Doubtful debts

Up to 60days 20000 1 200

61 to 100days 15000 2 300

Over 100 days 10000 5 500

Provision for doubtful debts at the end of year 1000

3

Page

You might also like

- Chapter 2 Audit of Receivables and SalesDocument19 pagesChapter 2 Audit of Receivables and SalesKez MaxNo ratings yet

- TE040 GL ... Test Script On General LedgerDocument22 pagesTE040 GL ... Test Script On General Ledgersanjayapps100% (10)

- Journal Entry To Trial BalanceDocument10 pagesJournal Entry To Trial Balanceruthmae bumanglag100% (7)

- Unit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodDocument6 pagesUnit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodRealGenius (Carl)No ratings yet

- ACC 200 Tutorial QuestionsDocument72 pagesACC 200 Tutorial Questionsherueux67% (3)

- Dynamics GP Tables PDFDocument10 pagesDynamics GP Tables PDFadalbertopolanco5305No ratings yet

- 8.7.1 Allowance MethodDocument5 pages8.7.1 Allowance MethodAkkamaNo ratings yet

- Acc CH 4Document16 pagesAcc CH 4Tajudin Abba RagooNo ratings yet

- ACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Document18 pagesACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Hans MosquedaNo ratings yet

- Chapter 5 Estimation of Doubtful Accounts 5 PDF FreeDocument8 pagesChapter 5 Estimation of Doubtful Accounts 5 PDF FreeryseNo ratings yet

- Acc CH 4Document15 pagesAcc CH 4Bicaaqaa M. AbdiisaaNo ratings yet

- Report - FinanceDocument1 pageReport - FinanceWilbert PascualNo ratings yet

- Chapter # 17: Valuation of Accounts ReceivableDocument24 pagesChapter # 17: Valuation of Accounts ReceivableHakim JanNo ratings yet

- Theory BAD AND DOUBTFUL DEBTSDocument4 pagesTheory BAD AND DOUBTFUL DEBTSJahanzaib ButtNo ratings yet

- RecivablesDocument12 pagesRecivablesGizaw BelayNo ratings yet

- Financial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesDocument2 pagesFinancial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesMay Grethel Joy PeranteNo ratings yet

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- Chapter 9 - Accounting For ReceivablesDocument10 pagesChapter 9 - Accounting For ReceivablesMajan Kaur100% (1)

- Irrecoverable Debts & Provision For Irrecoverables DebtsDocument5 pagesIrrecoverable Debts & Provision For Irrecoverables DebtsYomi AmvNo ratings yet

- 11 ReceivablesDocument4 pages11 ReceivablesuncianojhezrhyllemhaeNo ratings yet

- 2022 - 05 - Bad and Doubtful DebtsDocument39 pages2022 - 05 - Bad and Doubtful DebtsSafi UllahNo ratings yet

- Principles of Financial AccountingDocument14 pagesPrinciples of Financial AccountingSakshiNo ratings yet

- Provision For Doubtful Debts 1Document1 pageProvision For Doubtful Debts 1mbaliiii.maNo ratings yet

- Fas Asc 310 30 Loan Accounting White Paper 1Document33 pagesFas Asc 310 30 Loan Accounting White Paper 1Muhammad Umar FarooqNo ratings yet

- Acc. For Receivables-1Document5 pagesAcc. For Receivables-1Kamrul HasanNo ratings yet

- POA Topic 12Document3 pagesPOA Topic 12Ian ChanNo ratings yet

- ADJUSTING ENTRIES Part 3Document5 pagesADJUSTING ENTRIES Part 3MOCHI SSABELLENo ratings yet

- Bad Debts and Doubtful Debts PDFDocument4 pagesBad Debts and Doubtful Debts PDFSanjiv KubalNo ratings yet

- Chapter 5 (3) - Bad Debts, Allowance For Doubtful Debts and Discount AllowableDocument43 pagesChapter 5 (3) - Bad Debts, Allowance For Doubtful Debts and Discount AllowableIrsamNo ratings yet

- 08 - Receivables PDFDocument2 pages08 - Receivables PDFJamie ToriagaNo ratings yet

- Lecture-10 Bad Debts and Allowance For Doubtful DebtsDocument13 pagesLecture-10 Bad Debts and Allowance For Doubtful DebtsAzeemNo ratings yet

- 8 Debtors, Creditors, and Promisory NotesDocument30 pages8 Debtors, Creditors, and Promisory NotesERICK MLINGWANo ratings yet

- 8 Debtors, Creditors, and Promisory Notes UDDocument41 pages8 Debtors, Creditors, and Promisory Notes UDERICK MLINGWANo ratings yet

- 05 ReceivablesDocument15 pages05 ReceivablesJean BritoNo ratings yet

- VU Accounting Lesson 24Document6 pagesVU Accounting Lesson 24ranawaseemNo ratings yet

- JAIIB / Diploma in Banking & Finance Accounting and Finance For BankersDocument89 pagesJAIIB / Diploma in Banking & Finance Accounting and Finance For BankerssagarjpatelNo ratings yet

- Chapter 8 Feb.5Document51 pagesChapter 8 Feb.5AaaNo ratings yet

- Cash To Inventory Reviewer 1Document15 pagesCash To Inventory Reviewer 1Patricia Camille AustriaNo ratings yet

- Financial Accounting, 4eDocument47 pagesFinancial Accounting, 4eEka Aliyah FauziNo ratings yet

- Unit 9Document5 pagesUnit 9Anonymous Fn7Ko5riKTNo ratings yet

- Account Receivable ManagementDocument24 pagesAccount Receivable ManagementMaKayla De JesusNo ratings yet

- INTACC 1: Trade and Other ReceivablesDocument6 pagesINTACC 1: Trade and Other Receivablesdanica rozelNo ratings yet

- CH 9 - Intermediate AccountingDocument28 pagesCH 9 - Intermediate Accountinghana osmanNo ratings yet

- Bad Debts and Provision For Doubtful DebtDocument22 pagesBad Debts and Provision For Doubtful DebtNauman HashmiNo ratings yet

- Acc 106 Account ReceivablesDocument40 pagesAcc 106 Account ReceivablesAmirah NordinNo ratings yet

- Chap 009Document27 pagesChap 009Ali SaloNo ratings yet

- Bad Debts and Provision For Bad Debt - Principles of AccountingDocument7 pagesBad Debts and Provision For Bad Debt - Principles of AccountingAbdulla MaseehNo ratings yet

- ACCY901 Accounting Foundations For Professionals: Topic 5 ReceivablesDocument30 pagesACCY901 Accounting Foundations For Professionals: Topic 5 Receivablesvenkatachalam radhakrishnan100% (1)

- Stern CorporationsDocument30 pagesStern CorporationsShubham MallikNo ratings yet

- CH09Document28 pagesCH09Will TrầnNo ratings yet

- Demo TeachingDocument40 pagesDemo TeachingNichole Angel LeiNo ratings yet

- Chapter 9 NotesDocument15 pagesChapter 9 NotesMohamed AfzalNo ratings yet

- ACC 124 HO 7 Estimation of Doubtful AccountsDocument3 pagesACC 124 HO 7 Estimation of Doubtful AccountsJames Cañada GatoNo ratings yet

- Adv Acc - BankingDocument13 pagesAdv Acc - Bankingrshyams165No ratings yet

- Receivables: Created By: Origen, Janiene / Palma, Jennelyn, Cabi Gting, Ela. Artiza, EmmanDocument44 pagesReceivables: Created By: Origen, Janiene / Palma, Jennelyn, Cabi Gting, Ela. Artiza, Emmandeleonjaniene bsaNo ratings yet

- Chapter 4.3 Accounts ReceivableDocument5 pagesChapter 4.3 Accounts ReceivableCABRERA ABIGAIL P.No ratings yet

- Account Recivable Bet Teacher NoteDocument39 pagesAccount Recivable Bet Teacher NoteHaftom YitbarekNo ratings yet

- ch05 ReceivablesDocument51 pagesch05 ReceivableszedingelNo ratings yet

- AttachmentDocument8 pagesAttachmentchintya milathania100% (1)

- 3 Trade - Receivables FinalDocument15 pages3 Trade - Receivables FinalNadjib KilardjNo ratings yet

- ARSOP 2.0 Allowance For Doubtful AccountsDocument5 pagesARSOP 2.0 Allowance For Doubtful AccountsSelenge DaaduuNo ratings yet

- Accounts ReceivableDocument21 pagesAccounts ReceivableMurtaza Hussain SyedNo ratings yet

- HK MA: The Hong Kong Management Association Hong Kong Polytechnic Joint Diploma in Management StudiesDocument12 pagesHK MA: The Hong Kong Management Association Hong Kong Polytechnic Joint Diploma in Management StudiesSinoNo ratings yet

- From Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsFrom EverandFrom Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsNo ratings yet

- Understand Financial Postings On Sales and Purchase OrdersDocument8 pagesUnderstand Financial Postings On Sales and Purchase OrdersFreed NixonNo ratings yet

- Provisional BSPL 2017-18 PDFDocument239 pagesProvisional BSPL 2017-18 PDFshashank mokashiNo ratings yet

- E-Circular: All The Offices/ Branches of State Bank of India Project: Hrms Roll-Out of New ServicesDocument6 pagesE-Circular: All The Offices/ Branches of State Bank of India Project: Hrms Roll-Out of New ServicesMithun SinghNo ratings yet

- Flowchart of Cash Receipt System: Mail Room Cash ReceiptsDocument17 pagesFlowchart of Cash Receipt System: Mail Room Cash ReceiptsStephanie Diane SabadoNo ratings yet

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDocument28 pagesYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNo ratings yet

- ITR3 - 2019 - PR1.1 Example FileDocument208 pagesITR3 - 2019 - PR1.1 Example FilePrateek SharmaNo ratings yet

- EmilioDocument16 pagesEmilioRonNo ratings yet

- 2015 Bar Examination Questionnaire For Mercantile LawDocument4 pages2015 Bar Examination Questionnaire For Mercantile LawJamaica Cabildo Manaligod100% (1)

- 02-09-2013Document2 pages02-09-2013Portia ShilengeNo ratings yet

- Chapter 6Document19 pagesChapter 6Trayle HeartNo ratings yet

- P1.001 InventoriesDocument5 pagesP1.001 InventoriesPatrick Kyle AgraviadorNo ratings yet

- Coop Chart of AccountsDocument30 pagesCoop Chart of AccountsAmalia Dela Cruz100% (17)

- ch11 SolutionsDocument36 pagesch11 Solutionsaboodyuae2000No ratings yet

- Reynaldo Adjusment EntryDocument5 pagesReynaldo Adjusment EntryAra HasanNo ratings yet

- Basic Accounting Process PDFDocument317 pagesBasic Accounting Process PDFObey SitholeNo ratings yet

- This Study Resource Was: Profit Loss Profit LossDocument9 pagesThis Study Resource Was: Profit Loss Profit LossrogealynNo ratings yet

- Using Sage 50 Accounting 2017 Canadian 1st Edition Purbhoo Test BankDocument13 pagesUsing Sage 50 Accounting 2017 Canadian 1st Edition Purbhoo Test Bankmungoosemodus1qrzsk100% (31)

- EAM CostDocument43 pagesEAM CostAymen HamdounNo ratings yet

- Chapter 8 - Receivables Lecture Notes - StudentsDocument43 pagesChapter 8 - Receivables Lecture Notes - StudentsKy Anh NguyễnNo ratings yet

- ND SyllabusDocument179 pagesND SyllabusGoodnews AdeshinaNo ratings yet

- ACC 117 Group Assignment 1 UiTMK PDFDocument19 pagesACC 117 Group Assignment 1 UiTMK PDFaatynfarhanaNo ratings yet

- Dukascopy Bank StatementDocument2 pagesDukascopy Bank StatementshangkharajNo ratings yet

- GST Expenses ListDocument2 pagesGST Expenses ListaviNo ratings yet

- Assignment ProblemsDocument7 pagesAssignment ProblemsLowzil AJIMNo ratings yet

- Navana LPG Limited: Bank Book (Detail)Document13 pagesNavana LPG Limited: Bank Book (Detail)M. A. Alim SohelNo ratings yet

- Multiple Choice QuestionsDocument2 pagesMultiple Choice QuestionsRk BainsNo ratings yet