Professional Documents

Culture Documents

Learning Activity 7 - Variable & Fixed Costs

Learning Activity 7 - Variable & Fixed Costs

Uploaded by

Ara Joyce Permalino0 ratings0% found this document useful (0 votes)

14 views2 pagesTricia is tasked with budgeting payroll costs for the next quarter. Payroll information from the last 4 quarters shows work hours and costs ranging from 15,000-21,000 hours and PHP400,000-PHP500,000. Salaries increase 10% each 3rd quarter. To budget for the expected 23,000 hours next quarter, the document calculates the variable cost per unit at PHP10, fixed costs at PHP290,000, and total variable costs at PHP230,000 based on the payroll data and expected hours.

Original Description:

Original Title

Learning Activity 7_Variable & Fixed Costs

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTricia is tasked with budgeting payroll costs for the next quarter. Payroll information from the last 4 quarters shows work hours and costs ranging from 15,000-21,000 hours and PHP400,000-PHP500,000. Salaries increase 10% each 3rd quarter. To budget for the expected 23,000 hours next quarter, the document calculates the variable cost per unit at PHP10, fixed costs at PHP290,000, and total variable costs at PHP230,000 based on the payroll data and expected hours.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views2 pagesLearning Activity 7 - Variable & Fixed Costs

Learning Activity 7 - Variable & Fixed Costs

Uploaded by

Ara Joyce PermalinoTricia is tasked with budgeting payroll costs for the next quarter. Payroll information from the last 4 quarters shows work hours and costs ranging from 15,000-21,000 hours and PHP400,000-PHP500,000. Salaries increase 10% each 3rd quarter. To budget for the expected 23,000 hours next quarter, the document calculates the variable cost per unit at PHP10, fixed costs at PHP290,000, and total variable costs at PHP230,000 based on the payroll data and expected hours.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

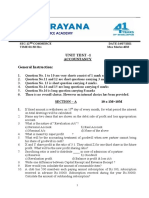

MANAGEMENT ACCOUNTING & CONTROL

VARIABLE COSTING

Lesson Activity 7. Variable & Fixed Costs

Tricia is a management accountant in an organization. She has been

assigned the task of budgeting payroll costs for the next quarter.

Payroll information of the last 4 quarters is as follows:

Quarte Work Hours Cost in Php

r

1 15,000 400,000

2 20,000 480,000

3 18,000 440,000

4 21,000 500,000

The organization increments salaries and wages by 10% at the start of the

3rd quarter each year. Twenty-three thousand (23,000) hours are expected to be

worked in the first quarter of the next year.

Required: Calculate the following:

1. Variable Cost per Unit

Answer: Php 10.00

2. Fixed Cost

Answer: Php 290,000

3. Total Variable Costs

Answer: Php 230,000

Computation:

Highest activity level is 21,000 hours in Q4

Lowest activity level is 15,000 hours in Q1

*Adjusted Payroll Cost of Q1: 400,000 x 1.10 = Php 440,000

Variable Cost per Unit:

= (500,000 – 440,000) ÷ (21,000 – 15,000)

= Php 10

Fixed Cost:

= 500,000 – (10 x 21,000)

= Php 290,000

Total variable cost:

= 10 x 23,000

= Php 230,000

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Case 3Document11 pagesCase 3kristel amada0% (1)

- 3tay1112 Jpia Finals E-Review - Actbas1Document3 pages3tay1112 Jpia Finals E-Review - Actbas1CGNo ratings yet

- Learning Activity 2 Variable Fixed Costs3Document1 pageLearning Activity 2 Variable Fixed Costs3summerginger27No ratings yet

- High Low MethodDocument4 pagesHigh Low MethodSamreen LodhiNo ratings yet

- TK3 M8S12 R0Document4 pagesTK3 M8S12 R0VianneyNo ratings yet

- Tutorial Chapter 15 - 16 Introduction To Budgets - Cost AllocationDocument37 pagesTutorial Chapter 15 - 16 Introduction To Budgets - Cost AllocationNaKib Nahri100% (1)

- Kumpulan Latihan Lab Sesi 12Document5 pagesKumpulan Latihan Lab Sesi 12ultra oilyNo ratings yet

- Additional Problems On BudgetingDocument3 pagesAdditional Problems On BudgetingRommel CruzNo ratings yet

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaNo ratings yet

- 18BBA041-Final-Business - Plan 5Document12 pages18BBA041-Final-Business - Plan 5ShivamNo ratings yet

- Profit and Loss StatementDocument4 pagesProfit and Loss Statementsofia mantolinoNo ratings yet

- Practice SetDocument4 pagesPractice SetRaquel Ann May DatoNo ratings yet

- Mockboard Ms 2014Document12 pagesMockboard Ms 2014Mark Lord Morales Bumagat100% (1)

- Afar Costing 2Document16 pagesAfar Costing 2JANUARY ANN C. BETENo ratings yet

- Budgetary Control and Responsibility Accounting CH 10 Revised March 1, 2010Document36 pagesBudgetary Control and Responsibility Accounting CH 10 Revised March 1, 2010ahmetkoseNo ratings yet

- Activity Sheet Business Math Week 1 2 Quarter 2Document12 pagesActivity Sheet Business Math Week 1 2 Quarter 2Frantiska FartelióNo ratings yet

- ABM FinalsDocument2 pagesABM FinalsMarilou PalmaNo ratings yet

- Simple InterestDocument58 pagesSimple InterestCleofeNo ratings yet

- Level 2 EasyDocument2 pagesLevel 2 EasySamuel FerolinoNo ratings yet

- Happy Camper Park Case StudyDocument24 pagesHappy Camper Park Case StudyKathleen BuneNo ratings yet

- Budgetary Control and Responsibility Accounting CH 10 Revised March 1, 2010Document36 pagesBudgetary Control and Responsibility Accounting CH 10 Revised March 1, 2010Vipra BhatiaNo ratings yet

- Afar - CVPDocument3 pagesAfar - CVPJoanna Rose Deciar0% (1)

- Business Finance Activity.: Problem 2: 1 3Document3 pagesBusiness Finance Activity.: Problem 2: 1 3André MendozaNo ratings yet

- Production Budgetting CompanyDocument5 pagesProduction Budgetting CompanyGusti Friday PalagunaNo ratings yet

- Activity 2Document3 pagesActivity 2LFGS Finals0% (1)

- Management Accounting Session 4Document10 pagesManagement Accounting Session 4Sameer Faisal0% (1)

- Integrated Review For MS 2023Document11 pagesIntegrated Review For MS 2023Joen SinamagNo ratings yet

- Problem SetDocument2 pagesProblem SetABDUL RAHIM G. ACOONNo ratings yet

- B. Sales Less Variable: Absorption CostingDocument3 pagesB. Sales Less Variable: Absorption CostingLaraNo ratings yet

- 05 Cost Volume Profit Analysis 2022Document7 pages05 Cost Volume Profit Analysis 2022Elle WoodsNo ratings yet

- Saint Vincent College of Cabuyao Job Order Costing Quiz No. 1Document2 pagesSaint Vincent College of Cabuyao Job Order Costing Quiz No. 1jovelyn labordoNo ratings yet

- Management Accounting Assignment Production Budgeting Company X in Year 2015 Ema 323 A1 ClassDocument4 pagesManagement Accounting Assignment Production Budgeting Company X in Year 2015 Ema 323 A1 ClassGusti Friday PalagunaNo ratings yet

- 30 12 22Document8 pages30 12 22vasanthgurusamynsNo ratings yet

- Manage Finances Within The BudgetDocument12 pagesManage Finances Within The BudgetEsteban BuitragoNo ratings yet

- Intermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa IiiDocument3 pagesIntermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa Iiimiljane perdizoNo ratings yet

- Saint Vincent College of Cabuyao Job Order Costing Quiz No. 1Document2 pagesSaint Vincent College of Cabuyao Job Order Costing Quiz No. 1Gennelyn Grace PenaredondoNo ratings yet

- Quiz No.1 - Job Order CostingDocument2 pagesQuiz No.1 - Job Order CostingDan RyanNo ratings yet

- LP 2ND QUARTER Business Math 2Document49 pagesLP 2ND QUARTER Business Math 2Don't mind me100% (1)

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- Fabm2-Module 2 - With ActivitiesDocument6 pagesFabm2-Module 2 - With ActivitiesROWENA MARAMBANo ratings yet

- Bep AccountsDocument10 pagesBep AccountskamsjaganNo ratings yet

- Taxation PDFDocument27 pagesTaxation PDFnanabaNo ratings yet

- 4 Cash Flow Diagram Equation of ValueDocument3 pages4 Cash Flow Diagram Equation of ValueKarl FaderoNo ratings yet

- Saint Vincent College of Cabuyao Job Order Costing Quiz No. 1Document2 pagesSaint Vincent College of Cabuyao Job Order Costing Quiz No. 1Gennelyn Grace PenaredondoNo ratings yet

- First Long Quiz COSMANDocument5 pagesFirst Long Quiz COSMANby ScribdNo ratings yet

- Q4 CVPDocument2 pagesQ4 CVPpdmallari12No ratings yet

- Principles of DeductionsDocument4 pagesPrinciples of DeductionsStanley Renz Obaña Dela CruzNo ratings yet

- Corporate Finance SolutionDocument10 pagesCorporate Finance SolutionshrawanerupaliNo ratings yet

- EE - L9 To L10 - Economic Evaluation of Alternatives - Present Worth MethodDocument39 pagesEE - L9 To L10 - Economic Evaluation of Alternatives - Present Worth MethodsankalpsriNo ratings yet

- Economics AssessmentDocument7 pagesEconomics AssessmentPalliNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Akuntansi Biaya Tenaga KerjaDocument5 pagesAkuntansi Biaya Tenaga KerjaNuurLaelaNo ratings yet

- Compound Interest 2Document7 pagesCompound Interest 2JORENCE PHILIPP ENCARNACIONNo ratings yet

- U3 Financi Forecting, Set AssignmentDocument7 pagesU3 Financi Forecting, Set Assignmentsereenraad1311No ratings yet

- First Reporter Compound Interest .2Document29 pagesFirst Reporter Compound Interest .2Golden Gate Colleges Main LibraryNo ratings yet

- Financial AspectDocument8 pagesFinancial AspectErnestNo ratings yet

- Budgeting and Responsibility AccountingDocument8 pagesBudgeting and Responsibility AccountingKathleenNo ratings yet

- Achievements and Skills Showcase Made Easy: The Made Easy Series Collection, #4From EverandAchievements and Skills Showcase Made Easy: The Made Easy Series Collection, #4No ratings yet

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsFrom EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo ratings yet

- 6 Matulungin 23-24 HptaDocument1 page6 Matulungin 23-24 HptaAra Joyce PermalinoNo ratings yet

- Enhancement Plan Mam ArahDocument3 pagesEnhancement Plan Mam ArahAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 10 - Sensitivity AnalysisDocument4 pagesPERMALINO - Learning Activity 10 - Sensitivity AnalysisAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 8 - BEP Sales With ProfitDocument2 pagesPERMALINO - Learning Activity 8 - BEP Sales With ProfitAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 12 - Short Term BudgetingDocument2 pagesPERMALINO - Learning Activity 12 - Short Term BudgetingAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 11 - Budget ProcessDocument4 pagesPERMALINO - Learning Activity 11 - Budget ProcessAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 9 - Composite BEP AnalysisDocument2 pagesPERMALINO - Learning Activity 9 - Composite BEP AnalysisAra Joyce PermalinoNo ratings yet

- Learning Activity 5 - Classification of CostsDocument1 pageLearning Activity 5 - Classification of CostsAra Joyce PermalinoNo ratings yet

- Learning Activity 6 - Variable Vs Absorption CostingDocument2 pagesLearning Activity 6 - Variable Vs Absorption CostingAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 17 - Make or Buy DecisionDocument3 pagesPERMALINO - Learning Activity 17 - Make or Buy DecisionAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 18 - Eliminate or Continue A Product LineDocument2 pagesPERMALINO - Learning Activity 18 - Eliminate or Continue A Product LineAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 19. Working Capital ManagementDocument3 pagesPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 20. Capital Budgeting TechniquesDocument2 pagesPERMALINO - Learning Activity 20. Capital Budgeting TechniquesAra Joyce PermalinoNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- Final Requirement - Permalino & ColladaDocument24 pagesFinal Requirement - Permalino & ColladaAra Joyce PermalinoNo ratings yet