Professional Documents

Culture Documents

Module 3 - In-Class Problem 1

Module 3 - In-Class Problem 1

Uploaded by

ZoeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 3 - In-Class Problem 1

Module 3 - In-Class Problem 1

Uploaded by

ZoeCopyright:

Available Formats

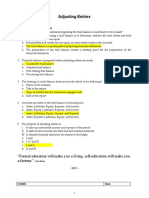

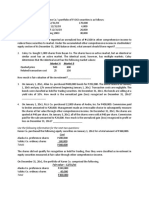

ACCT 5001 – Module 3

In-class Problem 1

Part A – Revenue Recognition

Let’s look at 3 different scenarios for Lucky Inc. Lucky Inc. sells vending machines to corporate clients.

The following transactions happened during the month of December, 20x2:

1) Lucky received an order for five vending machines from Company A. As the machines were a

custom order, Lucky required pre-payment before committing to the order. Company A sent in

payment for all five machines, a total of $10,000, on December 1, 20x2. The machines will be

delivered January 15, 20x3.

December 1, 20x2

DR Cash 10,000

CR Deferred Revenue 10,000

January 15, 20x3 (when the machines are delivered)

DR Deferred Revenue 10,000

CR Revenue 10,000

2) Lucky delivered one vending machine to Company B on December 15, 20x2. Upon delivery,

Company B paid $2,000 cash directly to the delivery person.

December 15, 20x2

DR Cash 2,000

CR Revenue 2,000

3) Lucky delivered three vending machines to Company C on December 22, 20x2. Company C is an

old client, and orders many machines throughout the year. As such, Lucky has offered Company

C the option to pay within 30 days. Company C takes them up on this offer and received an

invoice due January 20, 20x3 for $6,000.

December 22, 20x2

DR Accounts Receivable 6,000

CR Revenue 6,000

January 20, 20x3

DR Cash 6,000

CR Accounts Receivable 6,000

For each of the above scenarios write the journal entries. Prepare them in chronological order.

Part B – Matching Expenses

Let’s look at 3 different scenarios for Lucky Inc. Lucky Inc. sells vending machines to corporate clients.

The following transactions happened during the month of December, 20x2:

1) December 1, 20x2 Lucky paid its annual insurance policy which covers the period of December 1,

20x2 to November 30, 20x3 (12 months). The total cost of the policy was $1,200.

December 1, 20x2

DR Prepaid Insurance 1,2000

CR Cash 1,200

December 31, 20x2

I have to record the expense for 1 month (DEC)

DR Insurance Expense 100

CR Prepaid Insurance 100

2) December 15, 20x2 Lucky paid a cleaning company $250 cash to do a deep clean of its carpets in

their offices.

December 15, 20x2

DR Maintenance Expense 250

CR Cash 250

3) Lucky hired an advertising firm to develop a marketing campaign. The one-day blitz campaign

ran on December 22, 20x2 during a holiday special on local tv. The total cost of the campaign

was $5,000. The invoice will be paid January 21, 20x3, as they have 30 days to pay the invoice

from the date of service.

December 22, 20x2

DR Advertising Expense 5,000

CR Accounts Payable 5,000

When the payment is made

DR Accounts Payable 5,000

CR Cash 5,000

You might also like

- Metro Business and Commercial Account Opening Form & Mandate (Commercial & Private)Document19 pagesMetro Business and Commercial Account Opening Form & Mandate (Commercial & Private)SimonNo ratings yet

- Answer Key Inter Acctg 2Document66 pagesAnswer Key Inter Acctg 2URBANO CREATIONS PRINTING & GRAPHICS100% (2)

- Origination Costs and Fees: ExercisesDocument8 pagesOrigination Costs and Fees: ExercisesJanine IgdalinoNo ratings yet

- CMA Accelerated Program Test 2Document26 pagesCMA Accelerated Program Test 2bbry1No ratings yet

- Quiz - Chapter 13 - Basic DerivativesDocument5 pagesQuiz - Chapter 13 - Basic DerivativesJaymee Andomang Os-ag27% (11)

- RMIT FR Week 3 Solutions PDFDocument115 pagesRMIT FR Week 3 Solutions PDFKiabu ParindaliNo ratings yet

- Depreciation Test - Yr 10 - 23 Jan 2024Document4 pagesDepreciation Test - Yr 10 - 23 Jan 2024MUSTHARI KHANNo ratings yet

- Year Sales Actual Warranty ExpendituresDocument5 pagesYear Sales Actual Warranty ExpendituresMinie KimNo ratings yet

- Ia MCQ ComputationalDocument56 pagesIa MCQ ComputationalRomcel FlorendoNo ratings yet

- Quiz - Chapter 1 - Current Liabilities - 2021Document3 pagesQuiz - Chapter 1 - Current Liabilities - 2021Jennifer RelosoNo ratings yet

- Sa1 Reviewer PT.1Document8 pagesSa1 Reviewer PT.1Shenina ManaloNo ratings yet

- Handout No. 3 Accrev San BedaDocument10 pagesHandout No. 3 Accrev San BedaJustine CruzNo ratings yet

- PDF DocumentDocument6 pagesPDF DocumentCiara Abdulhamid BasirNo ratings yet

- Intermediate Accounting 2 Test BanksDocument14 pagesIntermediate Accounting 2 Test BankshwskbshgqxNo ratings yet

- CH7 - DiscussionDocument8 pagesCH7 - DiscussionRichell ArtuzNo ratings yet

- Txe-Zwe Exam 2019Document10 pagesTxe-Zwe Exam 2019Gift MoyoNo ratings yet

- Accounting PoliciesDocument8 pagesAccounting PoliciesJandyeeNo ratings yet

- Chapter 1 Liabilities ExercisesDocument3 pagesChapter 1 Liabilities ExercisesAwish FernNo ratings yet

- Assigment 14Document8 pagesAssigment 14cecilia angelNo ratings yet

- Adjusting Entries AssignmentDocument4 pagesAdjusting Entries AssignmentJynilou PinoteNo ratings yet

- Problems: Problem 1-1Document4 pagesProblems: Problem 1-1Gwen Cornet Pugal Alimo-ot0% (1)

- Questionpaper Test 1Document5 pagesQuestionpaper Test 1AishwaryaNo ratings yet

- The Statement of Financial Position As at 31 December 20x2Document2 pagesThe Statement of Financial Position As at 31 December 20x2Amit PandeyNo ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- Test 2 FarDocument3 pagesTest 2 FarMa Jodelyn RosinNo ratings yet

- Working 4Document8 pagesWorking 4Hà Lê DuyNo ratings yet

- Receivables - Additional ConceptsDocument4 pagesReceivables - Additional ConceptsZyrene Kei ReyesNo ratings yet

- Financial Accounting 1: Chapter 4 Special Journal EntriesDocument24 pagesFinancial Accounting 1: Chapter 4 Special Journal EntriesCabdiraxmaan GeeldoonNo ratings yet

- Balance Sheet Presentation of Liabilities: Problem 10.2ADocument4 pagesBalance Sheet Presentation of Liabilities: Problem 10.2AMuhammad Haris100% (1)

- Seatwork-Liabilities1st2023 StudentDocument5 pagesSeatwork-Liabilities1st2023 StudentpadayonmhieNo ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Accounts Notes Disposal and Depreciation AnswersDocument7 pagesAccounts Notes Disposal and Depreciation AnswersZaara AshfaqNo ratings yet

- ADJUSTING ENTRIES With Answers by AlagangWencyDocument3 pagesADJUSTING ENTRIES With Answers by AlagangWencyHello KittyNo ratings yet

- Department of Business Administration Group Assignment On Fundamental of Accounting IDocument5 pagesDepartment of Business Administration Group Assignment On Fundamental of Accounting IMohammed HassenNo ratings yet

- Receivables ProblemsDocument4 pagesReceivables ProblemsLarpii MonameNo ratings yet

- Midterm Exam - Ac-2Document7 pagesMidterm Exam - Ac-2Lyca ArcenaNo ratings yet

- Quiz Chapter-18 Govt-GrantsDocument2 pagesQuiz Chapter-18 Govt-Grantsjiachi.04212004No ratings yet

- Accounting MockDocument6 pagesAccounting MockGSNo ratings yet

- Current Liabilities: Redemption of Certificates Lapse of CertificatesDocument3 pagesCurrent Liabilities: Redemption of Certificates Lapse of CertificatesGrezel NiceNo ratings yet

- Inter-II QP 2008Document4 pagesInter-II QP 2008M JEEVARATHNAM NAIDUNo ratings yet

- Q1Document6 pagesQ1Ray Pop0% (2)

- JPIA Current LiabilitiesDocument7 pagesJPIA Current LiabilitiesKimboy Elizalde PanaguitonNo ratings yet

- Quiz On InvestmentDocument3 pagesQuiz On InvestmentDan Andrei BongoNo ratings yet

- Acctg 121 - Trade and Other ReceivablesDocument6 pagesAcctg 121 - Trade and Other ReceivablesYrica100% (2)

- Quiz - Provisions Cont. Liab. Cont. AssetsDocument3 pagesQuiz - Provisions Cont. Liab. Cont. AssetsJhanelle Marquez60% (5)

- Solved On January 1 Year 1 Luzak Company Issued A 120 000Document1 pageSolved On January 1 Year 1 Luzak Company Issued A 120 000Anbu jaromiaNo ratings yet

- Long Quiz in Intermediate Accounting 1 PART 1aDocument4 pagesLong Quiz in Intermediate Accounting 1 PART 1aGillian mae Garcia0% (2)

- Test Your Understanding 1Document4 pagesTest Your Understanding 1Michael Asiedu100% (1)

- Accounting WorksheetDocument9 pagesAccounting Worksheetsharlenearcelia26No ratings yet

- Chapter 1 None CompressDocument9 pagesChapter 1 None CompressiadcNo ratings yet

- Chapter 4 Bad DebtsDocument5 pagesChapter 4 Bad DebtsDeveender Kaur JudgeNo ratings yet

- 1b.chapter 1. Current LiabilitiesDocument7 pages1b.chapter 1. Current LiabilitiesDia rielNo ratings yet

- XI Account QPDocument7 pagesXI Account QPtanushsoni37No ratings yet

- Saminar 10Document1 pageSaminar 10Nam Phạm Lê NhậtNo ratings yet

- ICAB Question On Transfer PricingDocument2 pagesICAB Question On Transfer PricingSrikrishna DharNo ratings yet

- ICAB Question On Transfer PricingDocument2 pagesICAB Question On Transfer PricingSrikrishna DharNo ratings yet

- Mastering Credit - The Ultimate DIY Credit Repair GuideFrom EverandMastering Credit - The Ultimate DIY Credit Repair GuideRating: 1 out of 5 stars1/5 (1)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Module-2 NotesDocument4 pagesModule-2 NotesZoeNo ratings yet

- Module 1 To 3 Lecture SlidesDocument20 pagesModule 1 To 3 Lecture SlidesZoeNo ratings yet

- Module-3 NotesDocument5 pagesModule-3 NotesZoeNo ratings yet

- Trader Joe's Case Write Up Group 29Document1 pageTrader Joe's Case Write Up Group 29ZoeNo ratings yet

- Module SummaryDocument1 pageModule SummaryZoeNo ratings yet

- Module 5 - 2. Blue Ocean Strategy - From Theory To PracticeDocument17 pagesModule 5 - 2. Blue Ocean Strategy - From Theory To PracticeZoeNo ratings yet

- UBits Case Write UpDocument1 pageUBits Case Write UpZoeNo ratings yet

- Mica CurriculumDocument3 pagesMica Curriculumavowed_agnostic8129No ratings yet

- Engineering EconomyDocument7 pagesEngineering Economyelijah namomoNo ratings yet

- Polaris Brochure - CATALOGUEDocument11 pagesPolaris Brochure - CATALOGUEKarthikeyan VisvakNo ratings yet

- Rotam Commercials LimitedDocument27 pagesRotam Commercials Limitedabhishek shuklaNo ratings yet

- F2y DatabaseDocument28 pagesF2y Databaseapi-272851576No ratings yet

- Mergers and Acquisition 02Document77 pagesMergers and Acquisition 02Anil Kumar Singh100% (2)

- Introduction To DatabaseDocument16 pagesIntroduction To DatabaseIke Aresta ヅNo ratings yet

- Maintenance Management & Engineering TrainingDocument19 pagesMaintenance Management & Engineering TrainingsaradeepsNo ratings yet

- Ashu CVDocument5 pagesAshu CVashwiniNo ratings yet

- Notice: Antidumping: Softwood Lumber Products From— CanadaDocument6 pagesNotice: Antidumping: Softwood Lumber Products From— CanadaJustia.comNo ratings yet

- Planning and Development ActDocument48 pagesPlanning and Development ActVishwajeet UjhoodhaNo ratings yet

- Form 10a, GPFDocument3 pagesForm 10a, GPFSnehasis KarmahapatraNo ratings yet

- How Market Makers Condition The MarketDocument18 pagesHow Market Makers Condition The MarketGuy Surrey100% (2)

- An Economic Snapshot of BrooklynDocument8 pagesAn Economic Snapshot of Brooklynahawkins8223No ratings yet

- SAP Purchase Order ProcessDocument36 pagesSAP Purchase Order ProcessRajiv Srivastava100% (1)

- As 19 LeasesDocument13 pagesAs 19 LeasesSubrat NandaNo ratings yet

- Debit Note FormatDocument2 pagesDebit Note FormatAnil MishraNo ratings yet

- Area Inventory ListDocument3 pagesArea Inventory ListOruganti SrikanthNo ratings yet

- HEI Report Awareness Session Apeejay 29 11 2022Document18 pagesHEI Report Awareness Session Apeejay 29 11 2022Priyanka PinkyNo ratings yet

- What Is New Public ManagementDocument6 pagesWhat Is New Public ManagementNahidul Islam100% (5)

- Report CaeDocument6 pagesReport CaemariacarlosmariaNo ratings yet

- Business Model CanvasDocument2 pagesBusiness Model Canvasagnes putriNo ratings yet

- Management Accounting Exam Paper May 2012Document23 pagesManagement Accounting Exam Paper May 2012MahmozNo ratings yet

- M Commerce SlideDocument13 pagesM Commerce Slideharibkp1985No ratings yet

- Chapter 2 Interest and DepreciationDocument32 pagesChapter 2 Interest and DepreciationJojobaby51714No ratings yet

- Parle Summer Internship Project ReportDocument58 pagesParle Summer Internship Project ReportAbhishek Katiyar33% (9)

- A Study On Hiring & Interview Processes at Deloitte, GurgaonDocument32 pagesA Study On Hiring & Interview Processes at Deloitte, GurgaonRohan MamtaniNo ratings yet

- Oracle PO Charge AccountDocument13 pagesOracle PO Charge AccountvenkatsssNo ratings yet

- Gantt ChartDocument21 pagesGantt ChartrishiNo ratings yet