Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsCapital Market Andinvestment Management, April 2018

Capital Market Andinvestment Management, April 2018

Uploaded by

Deva s1. The document is an exam for an undergraduate course in Investment Management. It contains questions about basic investment concepts.

2. Part A contains 10 multiple choice questions worth 1 mark each, testing terms like investment media, commercial banks, primary markets, stock exchanges and types of insurance policies.

3. Part B contains 8 short answer questions worth 2 marks each, defining terms like risk, investment, capital market, investment banks and types of financial markets.

4. Part C contains 6 short answer questions worth 4 marks each, explaining concepts like investment scope, differences between investment and speculation, types of capital markets, and how to open an online trading account.

5. Part D contains 2 long answer questions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Art of Scripting GuideDocument3 pagesArt of Scripting Guidesaminitsok100% (2)

- Sbi Reactivate FormDocument2 pagesSbi Reactivate FormRaja100% (2)

- Vallabhacharya - Shri Subodhini 1 10 1-4Document267 pagesVallabhacharya - Shri Subodhini 1 10 1-4Yury BelyayevNo ratings yet

- 5 Essential Steps For A Successful Strategic Marketing ProcessDocument18 pages5 Essential Steps For A Successful Strategic Marketing ProcessJack 123No ratings yet

- Roadworthiness Requirements AUDocument12 pagesRoadworthiness Requirements AUDrey GoNo ratings yet

- Lesson 1 - History of DanceDocument1 pageLesson 1 - History of DanceFA LopezNo ratings yet

- QP CODE: 18103380: Third SemesterDocument2 pagesQP CODE: 18103380: Third SemesterOnline Class, CAS KPLYNo ratings yet

- QP CODE: 21100520: Reg No: NameDocument2 pagesQP CODE: 21100520: Reg No: NameOnline Class, CAS KPLYNo ratings yet

- Lingaraj College, Bel Lingaraj College, Bel Lingaraj College, Bel Lingaraj College, Belagavi Agavi Agavi AgaviDocument2 pagesLingaraj College, Bel Lingaraj College, Bel Lingaraj College, Bel Lingaraj College, Belagavi Agavi Agavi AgaviShubhakeerti RaoNo ratings yet

- QP CODE: 19102080: Reg No: NameDocument2 pagesQP CODE: 19102080: Reg No: NameOnline Class, CAS KPLYNo ratings yet

- Bcom 3 Sem Financial Markets and Operations 22100580 Apr 2022Document2 pagesBcom 3 Sem Financial Markets and Operations 22100580 Apr 2022lightpekka2003No ratings yet

- Dimensions and Methodology of Business Studies - 0002 Dec 2018Document2 pagesDimensions and Methodology of Business Studies - 0002 Dec 2018Nallavenaaya UnniNo ratings yet

- Investment Management - MBA 4th SemDocument6 pagesInvestment Management - MBA 4th SemManasu Shiva Mysuru0% (1)

- NRED7E001 - ED (Qu Code-I001)Document2 pagesNRED7E001 - ED (Qu Code-I001)SamarNo ratings yet

- A2318 ECA44 (For Candidates Admitted From 2008) Ii Year - Iv Semester Major Paper Xvii - Financial Markets and Services Time: 3 Hours Max. Marks: 75Document2 pagesA2318 ECA44 (For Candidates Admitted From 2008) Ii Year - Iv Semester Major Paper Xvii - Financial Markets and Services Time: 3 Hours Max. Marks: 75kaviyaNo ratings yet

- Business Environment Questions BankDocument26 pagesBusiness Environment Questions BankPriyambada NayakNo ratings yet

- 12th E.M. 2&3 Marks Important QuestionsDocument7 pages12th E.M. 2&3 Marks Important Questionsganesh11102008No ratings yet

- Economics, Paper - I Model Question Paper: Part - IIIDocument3 pagesEconomics, Paper - I Model Question Paper: Part - IIINikitha TanetiNo ratings yet

- KKKKDocument2 pagesKKKKGURJARNo ratings yet

- 6th Sem Economics ECA 6218 - Financial Institutions and Markets April 2020 ADocument1 page6th Sem Economics ECA 6218 - Financial Institutions and Markets April 2020 APratiksha SinghNo ratings yet

- PM 4Document2 pagesPM 4balajieducationsocietyNo ratings yet

- Visit For Answers: Capital Market Budget ManagementDocument2 pagesVisit For Answers: Capital Market Budget ManagementSateeshNo ratings yet

- All Question PaperDocument4 pagesAll Question PaperMuzammil KhanNo ratings yet

- Vinayaka Missions University, Salem. MBA - 2008 Regulation - IV Semester Elective: International Finance Question Bank Unit 1 PART - A (2 Marks)Document8 pagesVinayaka Missions University, Salem. MBA - 2008 Regulation - IV Semester Elective: International Finance Question Bank Unit 1 PART - A (2 Marks)Tarun Kumar ThakurNo ratings yet

- 405-Sqp-Introduction To Financial Markets-XDocument3 pages405-Sqp-Introduction To Financial Markets-XPapa AgyemanNo ratings yet

- 12th E.M. 2&3 Marks Important QuestionsDocument5 pages12th E.M. 2&3 Marks Important Questionsvishwavarshan25No ratings yet

- Accounts Cec 2year Exam PaperDocument3 pagesAccounts Cec 2year Exam PaperMohammad MoinuddinNo ratings yet

- G XII FMM TEE 1 - QP Re ExamDocument2 pagesG XII FMM TEE 1 - QP Re ExamAAKASH BHATTNo ratings yet

- Chapter 26 and 27 Year 11 RevisionDocument3 pagesChapter 26 and 27 Year 11 RevisionKM61130No ratings yet

- Bussiness Economics BS IT F19Document1 pageBussiness Economics BS IT F19Waqas KhokharNo ratings yet

- Bba 706Document2 pagesBba 706api-3782519No ratings yet

- Financial Services (T)Document2 pagesFinancial Services (T)BISLY MARIAM BINSONNo ratings yet

- IPMNew Dec2012Document1 pageIPMNew Dec2012Umang ModiNo ratings yet

- Btech 7 Sem Entrepreneurship Development Noe 071 2018 19Document2 pagesBtech 7 Sem Entrepreneurship Development Noe 071 2018 19127 -ME 54-Sumit SinghNo ratings yet

- BEP Qn5hjgcDocument2 pagesBEP Qn5hjgcEuhdhd UdiffNo ratings yet

- 17E00312 Investment & Portfolio ManagementDocument4 pages17E00312 Investment & Portfolio ManagementBeedam BalajiNo ratings yet

- MBA II Semester 2023 Question Paper - CompressedDocument18 pagesMBA II Semester 2023 Question Paper - Compressedcsoni7991No ratings yet

- Introduction To Financial ServicesDocument2 pagesIntroduction To Financial ServicesDr.Pratixa JoshiNo ratings yet

- R17-Eee-Cse-Mefa QP 2Document2 pagesR17-Eee-Cse-Mefa QP 2kisnamohanNo ratings yet

- Review Questions Bank FOR MBA - Semester: IVDocument3 pagesReview Questions Bank FOR MBA - Semester: IVDr. Rakesh BhatiNo ratings yet

- ECS4122 - Monetary Economics - UG - 4th Sem - 2023Document1 pageECS4122 - Monetary Economics - UG - 4th Sem - 2023gamer 007No ratings yet

- Derivatives and Risk ManagementDocument2 pagesDerivatives and Risk ManagementAivin JosephNo ratings yet

- International Finance 2021-22Document3 pagesInternational Finance 2021-22NAITIK SHAHNo ratings yet

- Namma Kalvi 12th Commerce Important Questions em 217910Document6 pagesNamma Kalvi 12th Commerce Important Questions em 217910SANJAY KUMAR. BNo ratings yet

- EE Important Question For SemesterDocument2 pagesEE Important Question For SemesterRUTURAJ DASNo ratings yet

- 2016 Admission Onwards - Regular/Improvement/SupplementaryDocument7 pages2016 Admission Onwards - Regular/Improvement/SupplementaryAdarsh P SanilNo ratings yet

- Edpm ModelDocument2 pagesEdpm ModelAnish JohnNo ratings yet

- 2 Marks Questions: MODULE I: IntroductionDocument1 page2 Marks Questions: MODULE I: IntroductionGokul KarwaNo ratings yet

- (Answer All Questions. Each Question Carries 1 Mark) : Set - 1 15 Uco 461.1: Project FinanceDocument1 page(Answer All Questions. Each Question Carries 1 Mark) : Set - 1 15 Uco 461.1: Project FinanceTitus Clement100% (1)

- Bba 5th Sem Dec 2018Document13 pagesBba 5th Sem Dec 20188bhgp7bkjsNo ratings yet

- MP 502Document2 pagesMP 502ptgoNo ratings yet

- Karnataka II PUC ECONOMICS Sample Question Paper 2020Document6 pagesKarnataka II PUC ECONOMICS Sample Question Paper 2020Sangamesh AchanurNo ratings yet

- Exchange Traded Funds - A New Face of Investment in India - by DeepakDocument111 pagesExchange Traded Funds - A New Face of Investment in India - by Deepakapi-19459467No ratings yet

- Ed QBDocument12 pagesEd QBShia666No ratings yet

- InternationalMarketing Model III-1Document2 pagesInternationalMarketing Model III-1Mythili KarthikeyanNo ratings yet

- QP Financial Planning and Wealth ManagementDocument2 pagesQP Financial Planning and Wealth ManagementHarpreet KaurNo ratings yet

- MP 102 - 4Document3 pagesMP 102 - 4Emalu BonifaceNo ratings yet

- Bba 5 Sem Dec 2019Document17 pagesBba 5 Sem Dec 2019Tanmay SinghNo ratings yet

- SEM 6 - 10 - BA BSC - HONS - ECONOMICS - DSE A2 - MONEY AND FINANCIAL MARKETS 10426Document2 pagesSEM 6 - 10 - BA BSC - HONS - ECONOMICS - DSE A2 - MONEY AND FINANCIAL MARKETS 10426PranjalNo ratings yet

- CU-2021 B.A. B.Sc. (Honours) Economics Semester-VI Paper-DSE-A-2-1Document2 pagesCU-2021 B.A. B.Sc. (Honours) Economics Semester-VI Paper-DSE-A-2-1AshNo ratings yet

- 805 Financial Market Management MSDocument9 pages805 Financial Market Management MSajaydohre893No ratings yet

- Financial Markets and ServicesDocument12 pagesFinancial Markets and ServicessahadcptNo ratings yet

- Course - Government Finance Question Bank (Compiled)Document6 pagesCourse - Government Finance Question Bank (Compiled)soniahossain576No ratings yet

- Paper ID (B0137) : BBA (BB - 706) (S05) (LE) (Sem. - 6) Management of Financial InstitutionsDocument2 pagesPaper ID (B0137) : BBA (BB - 706) (S05) (LE) (Sem. - 6) Management of Financial InstitutionsGauravsNo ratings yet

- First Term Question Grade-XII EconomicsDocument1 pageFirst Term Question Grade-XII EconomicsTim_GnsNo ratings yet

- Innovation Systems in Emerging Economies: MINT (Mexico, Indonesia, Nigeria, Turkey)From EverandInnovation Systems in Emerging Economies: MINT (Mexico, Indonesia, Nigeria, Turkey)No ratings yet

- Bootcamp Invite Letter For Schools - Metro ManilaDocument4 pagesBootcamp Invite Letter For Schools - Metro ManilaMaryGraceBolambaoCuynoNo ratings yet

- E - L 7 - Risk - Liability in EngineeringDocument45 pagesE - L 7 - Risk - Liability in EngineeringJivan JayNo ratings yet

- Page - NBB ResearchDocument41 pagesPage - NBB ResearchToche DoceNo ratings yet

- Science and SocietyDocument1 pageScience and SocietyAhmad KeatsNo ratings yet

- Smash Hits 1979 10 18Document30 pagesSmash Hits 1979 10 18scottyNo ratings yet

- BrochureDocument7 pagesBrochureapi-596896646No ratings yet

- People v. GarciaDocument8 pagesPeople v. GarciaKharol EdeaNo ratings yet

- DM30L Steel TrackDocument1 pageDM30L Steel TrackWalissonNo ratings yet

- Foundations of Political ScienceDocument60 pagesFoundations of Political ScienceAvinashNo ratings yet

- 6.2 Making My First DecisionsDocument7 pages6.2 Making My First Decisionschuhieungan0729No ratings yet

- Villa Rey Transit Vs FerrerDocument2 pagesVilla Rey Transit Vs FerrerRia Kriselle Francia Pabale100% (2)

- Verma Committee ReportDocument170 pagesVerma Committee Reportaeroa1No ratings yet

- ScamDocument17 pagesScamprince goyalNo ratings yet

- Holy Eucharist - PotDocument19 pagesHoly Eucharist - PotMargie CalumpitNo ratings yet

- Apes Final ReviewDocument41 pagesApes Final ReviewirregularflowersNo ratings yet

- DunavskastrategijaEUu21 VekuDocument347 pagesDunavskastrategijaEUu21 VekuRadovi1231123No ratings yet

- AnyDocument35 pagesAnyAashutosh SinghalNo ratings yet

- 12 - Epstein Barr Virus (EBV)Document20 pages12 - Epstein Barr Virus (EBV)Lusiana T. Sipil UnsulbarNo ratings yet

- Findings and DiscussionsDocument25 pagesFindings and DiscussionsRAVEN O. LARONNo ratings yet

- (BARU) Manajemen SDM Strategis Dan Reformasi BirokrasiDocument34 pages(BARU) Manajemen SDM Strategis Dan Reformasi Birokrasibendahara pemb bend bengawansoloNo ratings yet

- List of Sotho-Tswana ClansDocument4 pagesList of Sotho-Tswana ClansAnonymous hcACjq850% (2)

- Art Journal - 2nd Version - MidtermDocument70 pagesArt Journal - 2nd Version - MidtermDizon Rhean MaeNo ratings yet

- New PPT mc1899Document21 pagesNew PPT mc1899RYAN JEREZNo ratings yet

- ECON 2610 Syllabus Fall 2016Document8 pagesECON 2610 Syllabus Fall 2016ZainabAmirNo ratings yet

Capital Market Andinvestment Management, April 2018

Capital Market Andinvestment Management, April 2018

Uploaded by

Deva s0 ratings0% found this document useful (0 votes)

11 views2 pages1. The document is an exam for an undergraduate course in Investment Management. It contains questions about basic investment concepts.

2. Part A contains 10 multiple choice questions worth 1 mark each, testing terms like investment media, commercial banks, primary markets, stock exchanges and types of insurance policies.

3. Part B contains 8 short answer questions worth 2 marks each, defining terms like risk, investment, capital market, investment banks and types of financial markets.

4. Part C contains 6 short answer questions worth 4 marks each, explaining concepts like investment scope, differences between investment and speculation, types of capital markets, and how to open an online trading account.

5. Part D contains 2 long answer questions

Original Description:

Original Title

Capital market andinvestment management, April 2018

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document is an exam for an undergraduate course in Investment Management. It contains questions about basic investment concepts.

2. Part A contains 10 multiple choice questions worth 1 mark each, testing terms like investment media, commercial banks, primary markets, stock exchanges and types of insurance policies.

3. Part B contains 8 short answer questions worth 2 marks each, defining terms like risk, investment, capital market, investment banks and types of financial markets.

4. Part C contains 6 short answer questions worth 4 marks each, explaining concepts like investment scope, differences between investment and speculation, types of capital markets, and how to open an online trading account.

5. Part D contains 2 long answer questions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views2 pagesCapital Market Andinvestment Management, April 2018

Capital Market Andinvestment Management, April 2018

Uploaded by

Deva s1. The document is an exam for an undergraduate course in Investment Management. It contains questions about basic investment concepts.

2. Part A contains 10 multiple choice questions worth 1 mark each, testing terms like investment media, commercial banks, primary markets, stock exchanges and types of insurance policies.

3. Part B contains 8 short answer questions worth 2 marks each, defining terms like risk, investment, capital market, investment banks and types of financial markets.

4. Part C contains 6 short answer questions worth 4 marks each, explaining concepts like investment scope, differences between investment and speculation, types of capital markets, and how to open an online trading account.

5. Part D contains 2 long answer questions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

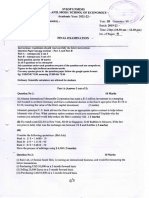

E2LO2 (tsages:2) Reg: N

F{arne..

T]I{DERGTTADUATE (C.B.C.S.S.) EXAMINATION, APRIL 2018

Fifth Semester

Open Course-INVESTMENT MANAGEMENT

(Oli'ered by the Board of Studies Management)

[2013 Admission onwards]

Time: Three Hours Maximum Marks : 80

Fart A

Answer a\l questinns.

Each question garrics \ marh.

1. How does economist understand Investment ?

2. What is iavestment media ? . '

3. What is Cornmercial Banks ?

4. What are prirnary markets ?

5. Expand OTCEI.

6" Expand BSE.

7 " IVlentron the kinds of life insurance policies'

8. Sihat are the different ways of Investing in Land ?

L Wtrat are the different schemes in investing in units ?

10. What is mutual funds ?

(10x1=10)

Part B

Answer uny ei'ght questians-

Eaeh, question carries 2 marks.

11. Srhat iS risk ?

12. Define investment.

l-E. What is capital market ?

L4. What are Investment banks ?

15. Irfention iny 2 rnajor stock exchanges in India.

16. Expand SEBL

Turn over

2 82L02

L7. What is the tax benefit in saving in national savings scheme ?

18. Why do people invest in diamonds ?

19. What are the major types of Financial markets ?

20. What is hedging ?

2L." What are the types of capital market ?

22. What is investment in units ?

(8x2=16)

Part C

. Answer any six questians-

Each question eanies 4 marh*

23. What is the scope of Investment ?

24. Differentiate Investrnent frorn speculation.

25. Differentiate capital markets from money markets.

26. Explain investment in antiques.

27. What is the benefit of post offrce saving scheme ?

28. How repurchase agreements work ?

29. How to open an online trading account ?

30. Explain about REPO rate.

31. Explain the difference between NSE and BSE.

(6x4=24)

Part D

Answer arry twa questions-

Each question carri,es 15 marks.

32. Why do people invest ? What are the factors.which are favourable for making investments in an

eeonomy ?

33. Discuss the functions of frnancial institutions in India.

34. Discuss the.procedure for trading in securities.

35. Explain the different kirids of life insurance policies in India.

(2x15=30)

You might also like

- Art of Scripting GuideDocument3 pagesArt of Scripting Guidesaminitsok100% (2)

- Sbi Reactivate FormDocument2 pagesSbi Reactivate FormRaja100% (2)

- Vallabhacharya - Shri Subodhini 1 10 1-4Document267 pagesVallabhacharya - Shri Subodhini 1 10 1-4Yury BelyayevNo ratings yet

- 5 Essential Steps For A Successful Strategic Marketing ProcessDocument18 pages5 Essential Steps For A Successful Strategic Marketing ProcessJack 123No ratings yet

- Roadworthiness Requirements AUDocument12 pagesRoadworthiness Requirements AUDrey GoNo ratings yet

- Lesson 1 - History of DanceDocument1 pageLesson 1 - History of DanceFA LopezNo ratings yet

- QP CODE: 18103380: Third SemesterDocument2 pagesQP CODE: 18103380: Third SemesterOnline Class, CAS KPLYNo ratings yet

- QP CODE: 21100520: Reg No: NameDocument2 pagesQP CODE: 21100520: Reg No: NameOnline Class, CAS KPLYNo ratings yet

- Lingaraj College, Bel Lingaraj College, Bel Lingaraj College, Bel Lingaraj College, Belagavi Agavi Agavi AgaviDocument2 pagesLingaraj College, Bel Lingaraj College, Bel Lingaraj College, Bel Lingaraj College, Belagavi Agavi Agavi AgaviShubhakeerti RaoNo ratings yet

- QP CODE: 19102080: Reg No: NameDocument2 pagesQP CODE: 19102080: Reg No: NameOnline Class, CAS KPLYNo ratings yet

- Bcom 3 Sem Financial Markets and Operations 22100580 Apr 2022Document2 pagesBcom 3 Sem Financial Markets and Operations 22100580 Apr 2022lightpekka2003No ratings yet

- Dimensions and Methodology of Business Studies - 0002 Dec 2018Document2 pagesDimensions and Methodology of Business Studies - 0002 Dec 2018Nallavenaaya UnniNo ratings yet

- Investment Management - MBA 4th SemDocument6 pagesInvestment Management - MBA 4th SemManasu Shiva Mysuru0% (1)

- NRED7E001 - ED (Qu Code-I001)Document2 pagesNRED7E001 - ED (Qu Code-I001)SamarNo ratings yet

- A2318 ECA44 (For Candidates Admitted From 2008) Ii Year - Iv Semester Major Paper Xvii - Financial Markets and Services Time: 3 Hours Max. Marks: 75Document2 pagesA2318 ECA44 (For Candidates Admitted From 2008) Ii Year - Iv Semester Major Paper Xvii - Financial Markets and Services Time: 3 Hours Max. Marks: 75kaviyaNo ratings yet

- Business Environment Questions BankDocument26 pagesBusiness Environment Questions BankPriyambada NayakNo ratings yet

- 12th E.M. 2&3 Marks Important QuestionsDocument7 pages12th E.M. 2&3 Marks Important Questionsganesh11102008No ratings yet

- Economics, Paper - I Model Question Paper: Part - IIIDocument3 pagesEconomics, Paper - I Model Question Paper: Part - IIINikitha TanetiNo ratings yet

- KKKKDocument2 pagesKKKKGURJARNo ratings yet

- 6th Sem Economics ECA 6218 - Financial Institutions and Markets April 2020 ADocument1 page6th Sem Economics ECA 6218 - Financial Institutions and Markets April 2020 APratiksha SinghNo ratings yet

- PM 4Document2 pagesPM 4balajieducationsocietyNo ratings yet

- Visit For Answers: Capital Market Budget ManagementDocument2 pagesVisit For Answers: Capital Market Budget ManagementSateeshNo ratings yet

- All Question PaperDocument4 pagesAll Question PaperMuzammil KhanNo ratings yet

- Vinayaka Missions University, Salem. MBA - 2008 Regulation - IV Semester Elective: International Finance Question Bank Unit 1 PART - A (2 Marks)Document8 pagesVinayaka Missions University, Salem. MBA - 2008 Regulation - IV Semester Elective: International Finance Question Bank Unit 1 PART - A (2 Marks)Tarun Kumar ThakurNo ratings yet

- 405-Sqp-Introduction To Financial Markets-XDocument3 pages405-Sqp-Introduction To Financial Markets-XPapa AgyemanNo ratings yet

- 12th E.M. 2&3 Marks Important QuestionsDocument5 pages12th E.M. 2&3 Marks Important Questionsvishwavarshan25No ratings yet

- Accounts Cec 2year Exam PaperDocument3 pagesAccounts Cec 2year Exam PaperMohammad MoinuddinNo ratings yet

- G XII FMM TEE 1 - QP Re ExamDocument2 pagesG XII FMM TEE 1 - QP Re ExamAAKASH BHATTNo ratings yet

- Chapter 26 and 27 Year 11 RevisionDocument3 pagesChapter 26 and 27 Year 11 RevisionKM61130No ratings yet

- Bussiness Economics BS IT F19Document1 pageBussiness Economics BS IT F19Waqas KhokharNo ratings yet

- Bba 706Document2 pagesBba 706api-3782519No ratings yet

- Financial Services (T)Document2 pagesFinancial Services (T)BISLY MARIAM BINSONNo ratings yet

- IPMNew Dec2012Document1 pageIPMNew Dec2012Umang ModiNo ratings yet

- Btech 7 Sem Entrepreneurship Development Noe 071 2018 19Document2 pagesBtech 7 Sem Entrepreneurship Development Noe 071 2018 19127 -ME 54-Sumit SinghNo ratings yet

- BEP Qn5hjgcDocument2 pagesBEP Qn5hjgcEuhdhd UdiffNo ratings yet

- 17E00312 Investment & Portfolio ManagementDocument4 pages17E00312 Investment & Portfolio ManagementBeedam BalajiNo ratings yet

- MBA II Semester 2023 Question Paper - CompressedDocument18 pagesMBA II Semester 2023 Question Paper - Compressedcsoni7991No ratings yet

- Introduction To Financial ServicesDocument2 pagesIntroduction To Financial ServicesDr.Pratixa JoshiNo ratings yet

- R17-Eee-Cse-Mefa QP 2Document2 pagesR17-Eee-Cse-Mefa QP 2kisnamohanNo ratings yet

- Review Questions Bank FOR MBA - Semester: IVDocument3 pagesReview Questions Bank FOR MBA - Semester: IVDr. Rakesh BhatiNo ratings yet

- ECS4122 - Monetary Economics - UG - 4th Sem - 2023Document1 pageECS4122 - Monetary Economics - UG - 4th Sem - 2023gamer 007No ratings yet

- Derivatives and Risk ManagementDocument2 pagesDerivatives and Risk ManagementAivin JosephNo ratings yet

- International Finance 2021-22Document3 pagesInternational Finance 2021-22NAITIK SHAHNo ratings yet

- Namma Kalvi 12th Commerce Important Questions em 217910Document6 pagesNamma Kalvi 12th Commerce Important Questions em 217910SANJAY KUMAR. BNo ratings yet

- EE Important Question For SemesterDocument2 pagesEE Important Question For SemesterRUTURAJ DASNo ratings yet

- 2016 Admission Onwards - Regular/Improvement/SupplementaryDocument7 pages2016 Admission Onwards - Regular/Improvement/SupplementaryAdarsh P SanilNo ratings yet

- Edpm ModelDocument2 pagesEdpm ModelAnish JohnNo ratings yet

- 2 Marks Questions: MODULE I: IntroductionDocument1 page2 Marks Questions: MODULE I: IntroductionGokul KarwaNo ratings yet

- (Answer All Questions. Each Question Carries 1 Mark) : Set - 1 15 Uco 461.1: Project FinanceDocument1 page(Answer All Questions. Each Question Carries 1 Mark) : Set - 1 15 Uco 461.1: Project FinanceTitus Clement100% (1)

- Bba 5th Sem Dec 2018Document13 pagesBba 5th Sem Dec 20188bhgp7bkjsNo ratings yet

- MP 502Document2 pagesMP 502ptgoNo ratings yet

- Karnataka II PUC ECONOMICS Sample Question Paper 2020Document6 pagesKarnataka II PUC ECONOMICS Sample Question Paper 2020Sangamesh AchanurNo ratings yet

- Exchange Traded Funds - A New Face of Investment in India - by DeepakDocument111 pagesExchange Traded Funds - A New Face of Investment in India - by Deepakapi-19459467No ratings yet

- Ed QBDocument12 pagesEd QBShia666No ratings yet

- InternationalMarketing Model III-1Document2 pagesInternationalMarketing Model III-1Mythili KarthikeyanNo ratings yet

- QP Financial Planning and Wealth ManagementDocument2 pagesQP Financial Planning and Wealth ManagementHarpreet KaurNo ratings yet

- MP 102 - 4Document3 pagesMP 102 - 4Emalu BonifaceNo ratings yet

- Bba 5 Sem Dec 2019Document17 pagesBba 5 Sem Dec 2019Tanmay SinghNo ratings yet

- SEM 6 - 10 - BA BSC - HONS - ECONOMICS - DSE A2 - MONEY AND FINANCIAL MARKETS 10426Document2 pagesSEM 6 - 10 - BA BSC - HONS - ECONOMICS - DSE A2 - MONEY AND FINANCIAL MARKETS 10426PranjalNo ratings yet

- CU-2021 B.A. B.Sc. (Honours) Economics Semester-VI Paper-DSE-A-2-1Document2 pagesCU-2021 B.A. B.Sc. (Honours) Economics Semester-VI Paper-DSE-A-2-1AshNo ratings yet

- 805 Financial Market Management MSDocument9 pages805 Financial Market Management MSajaydohre893No ratings yet

- Financial Markets and ServicesDocument12 pagesFinancial Markets and ServicessahadcptNo ratings yet

- Course - Government Finance Question Bank (Compiled)Document6 pagesCourse - Government Finance Question Bank (Compiled)soniahossain576No ratings yet

- Paper ID (B0137) : BBA (BB - 706) (S05) (LE) (Sem. - 6) Management of Financial InstitutionsDocument2 pagesPaper ID (B0137) : BBA (BB - 706) (S05) (LE) (Sem. - 6) Management of Financial InstitutionsGauravsNo ratings yet

- First Term Question Grade-XII EconomicsDocument1 pageFirst Term Question Grade-XII EconomicsTim_GnsNo ratings yet

- Innovation Systems in Emerging Economies: MINT (Mexico, Indonesia, Nigeria, Turkey)From EverandInnovation Systems in Emerging Economies: MINT (Mexico, Indonesia, Nigeria, Turkey)No ratings yet

- Bootcamp Invite Letter For Schools - Metro ManilaDocument4 pagesBootcamp Invite Letter For Schools - Metro ManilaMaryGraceBolambaoCuynoNo ratings yet

- E - L 7 - Risk - Liability in EngineeringDocument45 pagesE - L 7 - Risk - Liability in EngineeringJivan JayNo ratings yet

- Page - NBB ResearchDocument41 pagesPage - NBB ResearchToche DoceNo ratings yet

- Science and SocietyDocument1 pageScience and SocietyAhmad KeatsNo ratings yet

- Smash Hits 1979 10 18Document30 pagesSmash Hits 1979 10 18scottyNo ratings yet

- BrochureDocument7 pagesBrochureapi-596896646No ratings yet

- People v. GarciaDocument8 pagesPeople v. GarciaKharol EdeaNo ratings yet

- DM30L Steel TrackDocument1 pageDM30L Steel TrackWalissonNo ratings yet

- Foundations of Political ScienceDocument60 pagesFoundations of Political ScienceAvinashNo ratings yet

- 6.2 Making My First DecisionsDocument7 pages6.2 Making My First Decisionschuhieungan0729No ratings yet

- Villa Rey Transit Vs FerrerDocument2 pagesVilla Rey Transit Vs FerrerRia Kriselle Francia Pabale100% (2)

- Verma Committee ReportDocument170 pagesVerma Committee Reportaeroa1No ratings yet

- ScamDocument17 pagesScamprince goyalNo ratings yet

- Holy Eucharist - PotDocument19 pagesHoly Eucharist - PotMargie CalumpitNo ratings yet

- Apes Final ReviewDocument41 pagesApes Final ReviewirregularflowersNo ratings yet

- DunavskastrategijaEUu21 VekuDocument347 pagesDunavskastrategijaEUu21 VekuRadovi1231123No ratings yet

- AnyDocument35 pagesAnyAashutosh SinghalNo ratings yet

- 12 - Epstein Barr Virus (EBV)Document20 pages12 - Epstein Barr Virus (EBV)Lusiana T. Sipil UnsulbarNo ratings yet

- Findings and DiscussionsDocument25 pagesFindings and DiscussionsRAVEN O. LARONNo ratings yet

- (BARU) Manajemen SDM Strategis Dan Reformasi BirokrasiDocument34 pages(BARU) Manajemen SDM Strategis Dan Reformasi Birokrasibendahara pemb bend bengawansoloNo ratings yet

- List of Sotho-Tswana ClansDocument4 pagesList of Sotho-Tswana ClansAnonymous hcACjq850% (2)

- Art Journal - 2nd Version - MidtermDocument70 pagesArt Journal - 2nd Version - MidtermDizon Rhean MaeNo ratings yet

- New PPT mc1899Document21 pagesNew PPT mc1899RYAN JEREZNo ratings yet

- ECON 2610 Syllabus Fall 2016Document8 pagesECON 2610 Syllabus Fall 2016ZainabAmirNo ratings yet