Professional Documents

Culture Documents

Kotak - Transaction Slip

Kotak - Transaction Slip

Uploaded by

JephiasCopyright:

Available Formats

You might also like

- 4 X 4Document2 pages4 X 4muhammad ali0% (1)

- Lamborghini AventadorSVJRoadster AC37EZ 19.05.17Document16 pagesLamborghini AventadorSVJRoadster AC37EZ 19.05.17Lucian NicolaeNo ratings yet

- Sae J1344 Marking of Plastic Parts 070197 PDFDocument25 pagesSae J1344 Marking of Plastic Parts 070197 PDFmpedraza-1100% (2)

- Canara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormDocument2 pagesCanara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormSudhansuSekharNo ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Fidelity TransactionformDocument2 pagesFidelity TransactionformPankaj BothraNo ratings yet

- SBI SIP Registration FormDocument3 pagesSBI SIP Registration FormPrakash JoshiNo ratings yet

- Annual KYC Updation Form - IndividualDocument2 pagesAnnual KYC Updation Form - IndividualJoy T100% (1)

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- IIFL MF Common Transaction Unit Holders 022819Document2 pagesIIFL MF Common Transaction Unit Holders 022819Sabyasachi ChatterjeeNo ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- Equity SIP Application Form April 2022Document8 pagesEquity SIP Application Form April 2022Selva KumarNo ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- HDFC Sip CancellationDocument1 pageHDFC Sip CancellationMaluNo ratings yet

- Transaction Form For STP & SWP: 1. Applicant InformationDocument2 pagesTransaction Form For STP & SWP: 1. Applicant InformationChintan JainNo ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- Family Solutions Transaction FormDocument2 pagesFamily Solutions Transaction FormSelva KumarNo ratings yet

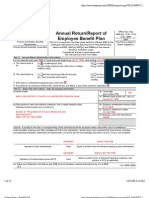

- US Internal Revenue Service: f5500 - 2001Document4 pagesUS Internal Revenue Service: f5500 - 2001IRSNo ratings yet

- HDFC Sip Nach FormDocument6 pagesHDFC Sip Nach FormPraveen KumarNo ratings yet

- Vendor CA 587 - Non-ResidentDocument3 pagesVendor CA 587 - Non-ResidentЛена КиселеваNo ratings yet

- COM0004057712 REG Dist SIP ApplicationDocument1 pageCOM0004057712 REG Dist SIP Applicationraj tripathiNo ratings yet

- Av Birla Sip FormDocument1 pageAv Birla Sip FormVikas RaiNo ratings yet

- SIP Facility Appl Form V 1Document4 pagesSIP Facility Appl Form V 1DBCGNo ratings yet

- 1702642454-Common Transaction Form Dec 2023Document2 pages1702642454-Common Transaction Form Dec 2023KaushalNo ratings yet

- QCD For RMD 2021Document9 pagesQCD For RMD 2021Rod BushmanNo ratings yet

- Common Transaction Request - Non Financial Transaction: A+B+I A+C+I A+D+I A+E+I A+G+I A+F+I A+H+C+IDocument2 pagesCommon Transaction Request - Non Financial Transaction: A+B+I A+C+I A+D+I A+E+I A+G+I A+F+I A+H+C+IChintan JainNo ratings yet

- Carpenters Annuity Fund 2007Document19 pagesCarpenters Annuity Fund 2007Latisha WalkerNo ratings yet

- Carpenters Annuity Fund 2006Document20 pagesCarpenters Annuity Fund 2006Latisha WalkerNo ratings yet

- Computation of Adjusted Profit For Self EmployedDocument8 pagesComputation of Adjusted Profit For Self EmployedCindyNo ratings yet

- LLP Form No. 8: Statement of Account & SolvencyDocument5 pagesLLP Form No. 8: Statement of Account & SolvencyPadmini VasanthNo ratings yet

- Retirement Plan of Trustees 2007Document14 pagesRetirement Plan of Trustees 2007Latisha WalkerNo ratings yet

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Document3 pagesSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikNo ratings yet

- Exempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )Document16 pagesExempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )greenwellNo ratings yet

- (ANNEX-I To A.P. (DIR Series) Circular No.110 of 12.06.2013) FC-GPRDocument7 pages(ANNEX-I To A.P. (DIR Series) Circular No.110 of 12.06.2013) FC-GPRNavneetNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument6 pagesRequest For Taxpayer Identification Number and CertificationTaj R.100% (1)

- 2007 Form 5500 Carpenter Pension PlanDocument21 pages2007 Form 5500 Carpenter Pension PlanLatisha WalkerNo ratings yet

- HSBC Common Transaction Form EditableDocument2 pagesHSBC Common Transaction Form EditableadwanidsNo ratings yet

- Carpenters Welfare Fund 2007Document18 pagesCarpenters Welfare Fund 2007Latisha WalkerNo ratings yet

- Tax-Free Savings Plan: Redemption FormDocument5 pagesTax-Free Savings Plan: Redemption FormThio CurlsNo ratings yet

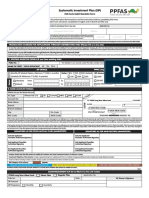

- Ppfas Sip FormDocument2 pagesPpfas Sip FormAmol ChikhalkarNo ratings yet

- GembaWalk ENDocument3 pagesGembaWalk ENVinay PatelNo ratings yet

- Multi Scheme CSIP Facility Application FormatDocument6 pagesMulti Scheme CSIP Facility Application FormatKiranmayi UppalaNo ratings yet

- FORM 23-B: Statement of Changes in Beneficial Ownership of SecuritiesDocument4 pagesFORM 23-B: Statement of Changes in Beneficial Ownership of SecuritiesMartin Lewis KoaNo ratings yet

- Carpenters Welfare Fund 2006Document16 pagesCarpenters Welfare Fund 2006Latisha WalkerNo ratings yet

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationDocument2 pagesSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVNo ratings yet

- SIP Registration Cum Mandate - EditableDocument2 pagesSIP Registration Cum Mandate - EditableKaushalNo ratings yet

- Groww Stock Account Opening Form-1Document20 pagesGroww Stock Account Opening Form-1SHIV KUSHWAHANo ratings yet

- NonIndividual 1Document12 pagesNonIndividual 1samyakparekh2004No ratings yet

- US Internal Revenue Service: f5500sr - 1999Document2 pagesUS Internal Revenue Service: f5500sr - 1999IRSNo ratings yet

- Unit Holder Information: Web FormDocument2 pagesUnit Holder Information: Web FormDibyaranjan SahooNo ratings yet

- Sole / First Applicant Second Applicant Third ApplicantDocument2 pagesSole / First Applicant Second Applicant Third ApplicantAnkur KaushikNo ratings yet

- Commen Trasaction FormDocument1 pageCommen Trasaction Formsandip vishwakarmaNo ratings yet

- GP0766Document2 pagesGP0766Hans WongNo ratings yet

- Transaction SlipDocument2 pagesTransaction SlipCavikram JainNo ratings yet

- Common Transaction Form: Mutual FundsDocument2 pagesCommon Transaction Form: Mutual FundsAjith JainNo ratings yet

- US Internal Revenue Service: f5500sb - 1999Document8 pagesUS Internal Revenue Service: f5500sb - 1999IRSNo ratings yet

- 2006 Form 5500 Carpenter Pension PlanDocument22 pages2006 Form 5500 Carpenter Pension PlanLatisha WalkerNo ratings yet

- FATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For EntitiesDocument6 pagesFATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For Entitiesvikas9saraswatNo ratings yet

- Common Transaction Slip 12 06 2017 PDFDocument3 pagesCommon Transaction Slip 12 06 2017 PDFvenkatnimmsNo ratings yet

- Company Secretary.: Ashwani K. VermaDocument52 pagesCompany Secretary.: Ashwani K. VermaContra Value BetsNo ratings yet

- 57826Document37 pages57826JephiasNo ratings yet

- Lec 5-Harmonization of Acc StandardsDocument22 pagesLec 5-Harmonization of Acc StandardsJephiasNo ratings yet

- SI 2021-023 Broadcasting (Listener's Licenses) (Fees) Notice, 2021Document2 pagesSI 2021-023 Broadcasting (Listener's Licenses) (Fees) Notice, 2021JephiasNo ratings yet

- Account Related Common Request FormDocument2 pagesAccount Related Common Request FormJephiasNo ratings yet

- Internet Banking FormDocument1 pageInternet Banking FormJephiasNo ratings yet

- Engine ClasificationDocument13 pagesEngine Clasificationvasanth9046No ratings yet

- Aqua 55-9622-14-CMV1: Technical CharacteristicsDocument3 pagesAqua 55-9622-14-CMV1: Technical CharacteristicsJavier LeonisNo ratings yet

- Direct-Hit - Schedules PlanDocument2 pagesDirect-Hit - Schedules PlangabotoyoNo ratings yet

- Get Growing Packages 15k CommercialDocument10 pagesGet Growing Packages 15k CommercialRodrigo Urcelay MontecinosNo ratings yet

- Fire Dampers Installation Instructions: (Static and Dynamic)Document4 pagesFire Dampers Installation Instructions: (Static and Dynamic)sbalu12674No ratings yet

- Current Diagnosis & Treatment in Otolaryngology-Head & Neck SurgeryDocument4 pagesCurrent Diagnosis & Treatment in Otolaryngology-Head & Neck SurgeryIhwan Ukhrawi AliNo ratings yet

- TP Link TL R480T+ ManualDocument85 pagesTP Link TL R480T+ ManualKennith PottsNo ratings yet

- Road Tanker Safety - Design, Equipment, and The Human Factor - SafeRackDocument8 pagesRoad Tanker Safety - Design, Equipment, and The Human Factor - SafeRackSultan MohammedNo ratings yet

- R80CR-9 Electrical SystemDocument57 pagesR80CR-9 Electrical SystemMhh AutoNo ratings yet

- 2014 Australian Mathematics Competition AMC Middle Primary Years 3 and 4Document8 pages2014 Australian Mathematics Competition AMC Middle Primary Years 3 and 4Dung Vô ĐốiNo ratings yet

- Industrial Co-Operative Hard Copy... !!!Document40 pagesIndustrial Co-Operative Hard Copy... !!!vikastaterNo ratings yet

- Water Knowledge No.03Document10 pagesWater Knowledge No.03Kyaw Myint NaingNo ratings yet

- TFP321 03 2021Document4 pagesTFP321 03 2021Richard TorresNo ratings yet

- Three Stages Sediment Filter and Uv Light Purifier: A Water Treatment SystemDocument36 pagesThree Stages Sediment Filter and Uv Light Purifier: A Water Treatment SystemMark Allen Tupaz MendozaNo ratings yet

- DN Diametre Nominal-NPS Size ChartDocument5 pagesDN Diametre Nominal-NPS Size ChartSankar CdmNo ratings yet

- The Theory of EverythingDocument4 pagesThe Theory of EverythingAfrin HasanNo ratings yet

- Qualification Verification Visit Report - 3022846 - NVQ2Work - 482 - 22032019-1 PDFDocument7 pagesQualification Verification Visit Report - 3022846 - NVQ2Work - 482 - 22032019-1 PDFanthony jamesNo ratings yet

- MCQ Surgery 1Document6 pagesMCQ Surgery 1Abdallah GamalNo ratings yet

- ACUSON Sequoia 512 Ultrasound System TransducersDocument114 pagesACUSON Sequoia 512 Ultrasound System TransducersMarcos ZanelliNo ratings yet

- UntitledDocument9 pagesUntitled박준수No ratings yet

- Frederick Jackson Turners Thesis Argued That Americas Frontier QuizletDocument7 pagesFrederick Jackson Turners Thesis Argued That Americas Frontier Quizletbufukegojaf2100% (1)

- DSM V PDFDocument33 pagesDSM V PDFRizky YantoroNo ratings yet

- 15001-Fanny CrosbyDocument16 pages15001-Fanny CrosbySharjin AuthorNo ratings yet

- Astro 429 Assignment 3Document2 pagesAstro 429 Assignment 3tarakNo ratings yet

- Unit 8 Earth, Space and BeyondDocument19 pagesUnit 8 Earth, Space and Beyondulianavasylivna2022No ratings yet

- Camille Moço: Contact Last Work ExperiencesDocument1 pageCamille Moço: Contact Last Work ExperiencesCamille MoçoNo ratings yet

- ReadiGASS Bro 1709Document4 pagesReadiGASS Bro 1709arunkumar277041No ratings yet

Kotak - Transaction Slip

Kotak - Transaction Slip

Uploaded by

JephiasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kotak - Transaction Slip

Kotak - Transaction Slip

Uploaded by

JephiasCopyright:

Available Formats

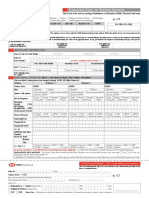

Investment Advisors Name & Code Sub-Brokers Name & Code EUIN (Mandatory) FOLIO NO.

DATE

DD / MM / YYYY

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship

manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales

person of the distributor/sub broker.

SIGNATURE(S)

Sole/First Holder Second Holder Third Holder

(To be signed by All Unitholders if mode of operation is Joint)

Upfront commission shall be paid directly by the investor to the AMFI registered distributors based on the investor's assessment of various factors including the service rendered by

the distributor.

NAME OF SOLE/ FIRST HOLDER :

NAME OF SECOND HOLDER :

NAME OF THIRD HOLDER :

PAN Sole / First Holder Second Holder Third Holder

MOBILE NO. This mobile no. will not get updated in the folio.

APPLICANTS OTHER DETAILS (Mandatory)

A) Place of Birth B) Country of Tax Residency other than India

C) Occupation Details [Please tick ü] Service Private Sector Public Sector Government Services Student Business

Agriculture Proprietorship Professional Retired Housewife Others (please specify)

D) Gross Annual Income (Rs.) [Please tick ü ] <1 Lac 1 - 5 Lacs 5 - 10 Lacs 10 - 25 Lacs >25 Lacs <1 Crore >1 Crore

E) Net worth (Mandatory for Non-individual) Rs. as on DD / MM / YYYY (Not older than 1 year)

F) Politically Exposed Person (PEP) Status (Also applicable for authorised signatories/ Promoters/ Karta/ Trustee/ Whole-time Directors)

I am PEP I am Related to PEP Not Applicable

PURCHASE Refer Checklist I

Option (Pleasea) Dividend Payout OR Reinvestment

Scheme

Dividend Frequency

Plan Growth Bonus

Plan your Life Goal. You can assign this investment for your lifes important milestones. Your Dream House Child Education Child Wedding Retirement

Investment Mode Cheque / DD / Pay order RTGS/NEFT/Fund Transfer/ Online Transfer

Investment : Rs. Chq./ DD No. dated DD MM YYYY

drawn on Name of Bank Branch City

(Please mention your folio on the face of your investment cheque)

We hereby confirm having initiated the Transfer/RTGS for transfer of Rs. __________________ from our account no. _________________________

with _____________________________________________________ Bank to your account no. _______________________________________ with

____________________________________ _________________________________________ Bank.

REDEMPTION Refer Checklist II

Scheme Plan Option (Pleasea)

Dividend Payout OR Reinvestment

Amount (Rs.) No. Of Units All Units (a) All Units Free from Exit Load (a) Dividend Frequency

OR OR OR Growth Bonus

SWITCH Refer Checklist III

Option (Pleasea) Dividend Payout OR Reinvestment

From: Scheme Plan

Dividend Frequency

Growth Bonus

To: Scheme Plan

Dividend Payout OR Reinvestment

Amount (Rs.) No. Of Units All Units (a) All Units Free from Exit Load (a)

OR OR OR Dividend Frequency

Growth Bonus

For investors who have REGISTERED FOR MULTIPLE BANK ACCOUNTS FACILITY in the above folio

The redemption should be processed into the following bank account as per the payout mechanism indicated by me/us:

Name of Bank Bank A/c No.

Branch Bank City

Important Note: If the bank account mentioned above is different from those already registered in your folio, prescribed supporting documents have to be submitted. If

bank account details are not filled above OR incorrect /incomplete supporting documents are submitted for a new bank account, the redemption will be processed into

the Default bank account registered for the aforesaid folio. Kotak Mutual Fund or Kotak Mahindra Asset Management Company Ltd. will not be liable for any loss

arising to the unitholder(s) due to the credit of redemption proceeds into any of the bank accounts registered with us for the aforesaid folio.

Declaration: I/We have read and understood the contents of the Statement of Additional Information/ Scheme Information Document/ offer Document(s). I/We

have neither received nor been induced by any rebate or gifts, directly or indirectly in executing this transaction.

SIGNATURE(S)

Sole/First Holder Second Holder Third Holder

(To be signed by All Unitholders if modr of operation is Joint)

Important Alert: In case there is any change to your KYC information please update the same by using the prescribed KYC Change Request Form and submit the same at the

Point of Service of any KYC Registration Agency.

KOTAK MAHINDRA MUTUAL FUND

6th Floor, Kotak Infiniti, Building No. 21, Infinity Park, Off W. E. Highway, Gen. A. K. Vaidya Marg, Malad (East), Mumbai 400097

assetmanagement.kotak.com 1800-222-626 or (022) 6638 4400 mutual@kotak.com

This Account Statement is a record of your transaction(s) and unit balances in the schemes of Kotak Mahindra Mutual Fund. This is not a document of title and is not transferable.

If you find any discrepancy in your Account Statement, please bring it to our notice within 30 days.

Options** Dividend Initial Investment Min Addl. Cheque(s)/ DD(s) to Min.

Scheme Plan Frequency* / Min. Balance (Rs.) Investment (Rs.) be drawn in favor of Redemption

Kotak 50 - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak 50

Kotak Balance - DP & DR Half yearly Rs. 5,000 Rs. 1,000 Kotak Balance

Kotak Bond Plan A DP, DR, G & B Quarterly, Half Yearly, Annual Rs. 5,000 Rs. 1,000 Kotak Bond

Kotak Bond Short Term - DP, DR & G Monthly, Half Yearly Rs. 5,000 (Rs. 50,000 - Monthly DP) Rs. 1,000 Kotak Bond Short Term

Kotak Classic Equity - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak Classic Equity

Kotak Equity Arbitrage Fund - DP, DR & G Monthly Rs. 5,000 Rs. 1,000 Kotak Equity Arbitrage

Kotak Asset Allocator Fund - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak Asset Allocator Fund

Kotak Flexi Debt Plan A DP, DR & G (DP only Quarterly) Daily, Weekly, Quarterly Rs. 5,000 Rs. 1,000 Kotak Fexi Debt

Kotak Treasury Advantage Fund - DP, DR & G (DP only Weekly) Daily, Weekly, Monthly Rs. 5,000 (Rs. 1,00,00,000 - Weekly DP) Rs. 1,000 Kotak Treasury Advantage Fund

Rs. 1,000/- or 100 units for all schemes

Kotak Floater Short Term - DR & G Daily, Weekly, Monthly Rs. 5,000 (Rs. 1,00,000 - Daily DR) Rs. 1,000 Kotak Floater Short Term

SCHEMES - SNAPSHOT

Kotak Gilt Investment PF & Trust DP, DR & G Quarterly Rs. 5,000 Rs. 1,000 Kotak Gilt Investment

Kotak Gilt Investment Regular DP, DR & G Quarterly Rs. 5,000 Rs. 1,000 Kotak Gilt Investment

Kotak Banking and PSU Debt Fund - DP, DR & G Monthly, Annual Rs. 5,000 Rs. 1,000 Kotak Banking and PSU Debt Fund

Kotak Monthly Income Plan - DP, DR & G Monthly, Quarterly Rs. 5,000 (Rs. 50,000 - Monthly DP) Rs. 1,000 Kotak Monthly Income Plan

Kotak Liquid Plan A DP, DR, G & B (DP only Weekly) Daily, Weekly Rs. 5,000 Rs. 1,000 Kotak Liquid

Kotak Mid-Cap - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak Mid-Cap

Kotak Opportunities - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak Opportunities

Kotak Tax-Saver - DP, DR & G Trustee's Discretion Rs. 500 & in multiples of Rs. 500 Rs. 500 & in multiples of Rs. 500 Kotak Tax-Saver

Kotak Select Focus Fund - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak Select Focus Fund

Kotak Emerging Equity - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak Emerging Equity

Kotak Global Emerging Market Fund - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak Global Emerging Market Fund

Kotak Gold Fund - DP, DR & G Trustee's Discretion Rs. 5,000 Rs. 1,000 Kotak Gold Fund

Kotak Income Opportunities Fund - DP, DR & G Weekly, Monthly, Quarterly, Annual Rs. 5,000 Rs. 1,000 Kotak Income Opportunities Fund

Kotak Multi Asset Allocation Fund - DP, DR & G Monthly, Quarterly, Annual Rs. 10,000 Rs. 1,000 Kotak Multi Asset Allocation Fund

Kotak Infrastructure & Economic Reform Fund - DP, DR & G Trustees Discretion Rs. 5000 Rs. 1000 Kotak Infrastructure & Economic Reform Fund

Kotak World Gold Fund - DP, DR & G Trustees Discretion Rs. 5000 Rs. 1000 Kotak World Gold Fund

Kotak US Equity Fund - DP, DR & G Trustees Discretion Rs. 5000 Rs. 1000 Kotak US Equity Fund

Kotak Low Duration Fund - DP, DR & G Weekly & Monthly Rs. 5000 Rs. 1000 Kotak Low Duration Fund

Kotak Corporate Bond Fund - DP, DR & G Monthly & Quarterly Rs. 5000 Rs. 1000 Kotak Corporate Bond Fund

** DP - Dividend Payout; DR - Dividend Reinvestment; G - Growth; B - Bonus.

* Dividend distribution subject to availability & adequacy of distributor surplus

INSTRUCTIONS & INFORMATION: CHECKLIST I (FOR PURCHASE)

1. Before investing please refer the SAI/ SID/ Offer Document of the respective scheme(s)

Is the Purchase amount >= Minimum Investment / Minimum Additional Investment amount?

2. PERMANENT ACCOUNT NUMBER (PAN) (MANDATORY): Have the following particulars been clearly filled in the Purchase / Additional Purchase Request?

With effect from January 1, 2009 , it is mandatory for all existing and new investors (including Scheme, Plan & Option.

joint holders, guardians of minors and NRIs) to enclose a copy of PAN card to the application for If Dividend Option is chosen, the choice between Payout or Re-investment of Dividend.

investing in mutual fund Schemes.

If Dividend Option is chosen, the Dividend Frequency sought.

3. Know Your Client (KYC): Investment Amount. Doses this match with the Cheque / DD Amount?

With reference to SEBI Circular MIRSD/Cir-26/2011 dated December 23, 2011, investors may Instrument Details (Cheque DD No. , Date of Instrument, Drawee Bank & Branch)

kindly note w.e.f. January 1, 2012, it is mandatory for all individual/ non individual investors to be Permanent Account Number (PAN) of all Applicants is mentioned and Acknowledgment copy of the

KYC Compliant. Investors can approach any SEBI registered KRA for doing KYC. KYC is enclosed.

In the event of KYC Form being subsequently rejected for lack of information/ Is the investment Cheque /Demand Draft drawn in favour of Scheme / Plan and payable at the location

deficiency/insufficiency of mandatory documentation, the investment transaction will be where this request is being submitted?

cancelled and the amount may be redeemed at applicable NAV, subject to payment of exit load,

wherever applicable.

CHECKLIST II [FOR REDEMPTION]

4. REDEMPTION/ SWITCH OUT OF UNITS WHERE THERE IS A LIEN MARKED ON UNITS:

Is the redemption for an amount >= minimum redemption size (100 unit or Rs. 1,000/-)?

If a lien has been marked on your units, please furnish along with your redemption/ switch out

request, a Release of Lien letter from the financier/ other person in whose favor the lien has been Have the following been indicated clearly in the redemption request?

marked. Scheme, Plan & Option from which the redemption is required.

The amount or the number of units to be redeemed. (For entire unit balance redemption in a

5. DIRECT CREDIT FACILITY: scheme, please tick the All Unit box in the redemption panel. Units or Amount need not

We shall directly credit your dividend/redemption payments into your bank account if your bank is be indicated in this case)

included in bank list with which we have tie-up for direct credit facility.

If the redemption payout is required in a different bank account or in a different mode/ mechanism, has

Note: Investor can register multiple bank account by submitting bank registration form, please

read the scheme information document of the respective scheme. the same been indicated. In the absence of any indication, redemption proceeds would be paid out in

the Bank Account registered in the folio against the respective scheme. In case of multiple bank

6. CHANGE IN AUTHORISED SIGNATURES: If there is a change in the list of Authorised mandate, redemption proceed shall be paid in the default bank account.

Signatories since the date of your purchase/ switch in and the same has not been intimated to us,

please enclose a certified copy of your latest Board Resolution and Authorised Signatories List CHECKLIST III [FOR SWITCH]

with your transaction request.

Is the present value of investment in the scheme from which the switch out is requested >= to the

7. EMPLOYEE UNIQUE IDENTIFICATION NUMBER (EUIN): SEBI has made it compulsory for minimum investment / minimum addition investment requirement of the scheme to which the

every employee/relationship manager/ sales person of the distributor of mutual fund products to investment is proposed to be switched in?

quote the EUIN obtained by him/her from AMFI in the Application Form. EUIN would assist in Have the following been indicated clearly in the switch request?

addressing any instance of mis-selling even if the employee/relationship manager/sales person Scheme, Plan & Option from which the redemption to be switched out.

later leaves the employment of the distributor. Hence, if your investments are routed through a Scheme, Plan & Option to which the investment to be switched in.

distributor please ensure that the EUIN is correctly filled up in the Application Form. If Dividend Option is chosen for the scheme in which the investment is being switched in the choice

between Payout or Re-investment of dividend and the Dividend frequency.

However, if your distributor has not given you any advice pertaining to the investment, the EUIN

box may be left blank. In this case you are required to provide the declaration to this effect as Permanent Account Number (PAN) of all Applicants is mentioned and Acknowledgment copy of the

given in the form. KYC is enclosed.

REGISTRAR : COMPUTER AGE MANAGEMENT SERVICES PVT. LTD. No 178/10 M G R Salai, Nungambakkam, Chennai - 600 034

CAMS INVESTOR SERVICE CENTERS

Ahmedabad: 111-113, 1st Floor, Devpath Building, Off C G Road, Behind Lal Bungalow, Ellis Bridge, Ahmedabad - 380006. Bangalore: Trade Centre, 1st Floor, 45, Dikensen Road, ( Next to Manipal

Centre ), Bangalore - 560042. Bhubaneswar: 3rd Floor, Plot No - 111, Varaha Complex Building, Station Square, Kharvel Nagar, Unit 3, Bhubaneswar - 751001. Chandigarh: Deepak Tower, SCO 154-

155, 1st Floor, Sector 17-C, Chandigarh - 160017. Chennai: Ground Floor No.178/10, Kodambakkam High Road, Opp. Hotel Palmgrove, Nungambakkam, Chennai - 600034. Cochin: Ittoop's Imperial

Trade Center, Door No. 64/5871 D, 3rd Floor, M. G. Road (North), Cochin 682035. Coimbatore: Ground Floor, Old No. 66 New No. 86, Lokamanya Street (West), R.S.Puram, Coimbatore - 641002.

Durgapur: 3rd Floor, City Plaza Building, City Centre, Durgapur - 713 216. Goa: No.108, 1st Floor, Gurudutta Bldg, Above Weekender, M G Road, Panaji, Goa - 403001. Hyderabad: 208, 2nd Floor, Jade

Arcade, Paradise Circle, Secunderabad - 500003. Indore: 101, Shalimar Corporate Centre, 8-B, South tukogunj, Opp.Greenpark, Indore - 452001. Jaipur: R-7, Yudhisthir Marg ,C-Scheme, Behind Ashok

Nagar Police Station, 63/ 2, The Mall, Jaipur - 302001. Kanpur: 1st Floor 106 to 108, CITY CENTRE Phase - II, Kanpur - 208001. Kolkata: Saket Building, 44 Park Street, 2nd Floor, Kolkata 700016.

Lucknow: Off No 4,1st Floor,Centre Court Building, 3/c, 5 - Park Road, Hazratganj, Lucknow - 226001. Ludhiana: U/ GF, Prince Market, Green Field, Near Traffic Lights, Sarabha Nagar Pulli, Pakhowal

Road, Ludhiana - 141002. Madurai: 1st Floor, 278, North Perumal Maistry street, Nadar Lane, Madurai - 625001. Mangalore: No. G 4 & G 5, Inland Monarch, Opp. Karnataka Bank, Kadri Main Road,

Kadri, Mangalore - 575003. Mumbai: Rajabahdur Compound, Ground Floor, Opp Allahabad Bank, Behind ICICI Bank, 30, Mumbai Samachar Marg, Fort, Mumbai - 400023. Nagpur: 145 Lendra, New

Ramdaspeth, Nagpur - 440010. New Delhi: 7-E, 4th Floor, Deen Dayaal Research Institute Building, Swami Ram Tirath Nagar, Near Videocon Tower, Jhandewalan Extension, New Delhi 110055. Patna:

G-3, Ground Floor, Om Vihar Complex, SP Verma Road, Patna - 800001. Pune: Nirmiti Eminence, Off No. 6, 1st Floor, Opp Abhishek Hotel Mehandale Garage Road, Erandawane, Pune - 411004. Surat:

Plot No.629, 2nd Floor, Office No.2-C/2-D, Mansukhlal Tower, Beside Seventh Day Hospital, Opp.Dhiraj Sons, Athwalines, Surat - 395001. Vadodara: 103 Aries Complex, BPC Road, Off R.C. Dutt Road,

Alkapuri, Vadodara - 390007. Vijayawada: 40-1-68, Rao & Ratnam Complex, Near Chennupati Petrol Pump, M.G Road, Labbipet, Vijayawada - 520010. Visakhapatnam: 47/ 9 / 17, 1st Floor, 3rd Lane ,

Dwaraka Nagar, Visakhapatnam - 530016.

You might also like

- 4 X 4Document2 pages4 X 4muhammad ali0% (1)

- Lamborghini AventadorSVJRoadster AC37EZ 19.05.17Document16 pagesLamborghini AventadorSVJRoadster AC37EZ 19.05.17Lucian NicolaeNo ratings yet

- Sae J1344 Marking of Plastic Parts 070197 PDFDocument25 pagesSae J1344 Marking of Plastic Parts 070197 PDFmpedraza-1100% (2)

- Canara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormDocument2 pagesCanara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormSudhansuSekharNo ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Fidelity TransactionformDocument2 pagesFidelity TransactionformPankaj BothraNo ratings yet

- SBI SIP Registration FormDocument3 pagesSBI SIP Registration FormPrakash JoshiNo ratings yet

- Annual KYC Updation Form - IndividualDocument2 pagesAnnual KYC Updation Form - IndividualJoy T100% (1)

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- IIFL MF Common Transaction Unit Holders 022819Document2 pagesIIFL MF Common Transaction Unit Holders 022819Sabyasachi ChatterjeeNo ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- Equity SIP Application Form April 2022Document8 pagesEquity SIP Application Form April 2022Selva KumarNo ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- HDFC Sip CancellationDocument1 pageHDFC Sip CancellationMaluNo ratings yet

- Transaction Form For STP & SWP: 1. Applicant InformationDocument2 pagesTransaction Form For STP & SWP: 1. Applicant InformationChintan JainNo ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- Family Solutions Transaction FormDocument2 pagesFamily Solutions Transaction FormSelva KumarNo ratings yet

- US Internal Revenue Service: f5500 - 2001Document4 pagesUS Internal Revenue Service: f5500 - 2001IRSNo ratings yet

- HDFC Sip Nach FormDocument6 pagesHDFC Sip Nach FormPraveen KumarNo ratings yet

- Vendor CA 587 - Non-ResidentDocument3 pagesVendor CA 587 - Non-ResidentЛена КиселеваNo ratings yet

- COM0004057712 REG Dist SIP ApplicationDocument1 pageCOM0004057712 REG Dist SIP Applicationraj tripathiNo ratings yet

- Av Birla Sip FormDocument1 pageAv Birla Sip FormVikas RaiNo ratings yet

- SIP Facility Appl Form V 1Document4 pagesSIP Facility Appl Form V 1DBCGNo ratings yet

- 1702642454-Common Transaction Form Dec 2023Document2 pages1702642454-Common Transaction Form Dec 2023KaushalNo ratings yet

- QCD For RMD 2021Document9 pagesQCD For RMD 2021Rod BushmanNo ratings yet

- Common Transaction Request - Non Financial Transaction: A+B+I A+C+I A+D+I A+E+I A+G+I A+F+I A+H+C+IDocument2 pagesCommon Transaction Request - Non Financial Transaction: A+B+I A+C+I A+D+I A+E+I A+G+I A+F+I A+H+C+IChintan JainNo ratings yet

- Carpenters Annuity Fund 2007Document19 pagesCarpenters Annuity Fund 2007Latisha WalkerNo ratings yet

- Carpenters Annuity Fund 2006Document20 pagesCarpenters Annuity Fund 2006Latisha WalkerNo ratings yet

- Computation of Adjusted Profit For Self EmployedDocument8 pagesComputation of Adjusted Profit For Self EmployedCindyNo ratings yet

- LLP Form No. 8: Statement of Account & SolvencyDocument5 pagesLLP Form No. 8: Statement of Account & SolvencyPadmini VasanthNo ratings yet

- Retirement Plan of Trustees 2007Document14 pagesRetirement Plan of Trustees 2007Latisha WalkerNo ratings yet

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Document3 pagesSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikNo ratings yet

- Exempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )Document16 pagesExempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )greenwellNo ratings yet

- (ANNEX-I To A.P. (DIR Series) Circular No.110 of 12.06.2013) FC-GPRDocument7 pages(ANNEX-I To A.P. (DIR Series) Circular No.110 of 12.06.2013) FC-GPRNavneetNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument6 pagesRequest For Taxpayer Identification Number and CertificationTaj R.100% (1)

- 2007 Form 5500 Carpenter Pension PlanDocument21 pages2007 Form 5500 Carpenter Pension PlanLatisha WalkerNo ratings yet

- HSBC Common Transaction Form EditableDocument2 pagesHSBC Common Transaction Form EditableadwanidsNo ratings yet

- Carpenters Welfare Fund 2007Document18 pagesCarpenters Welfare Fund 2007Latisha WalkerNo ratings yet

- Tax-Free Savings Plan: Redemption FormDocument5 pagesTax-Free Savings Plan: Redemption FormThio CurlsNo ratings yet

- Ppfas Sip FormDocument2 pagesPpfas Sip FormAmol ChikhalkarNo ratings yet

- GembaWalk ENDocument3 pagesGembaWalk ENVinay PatelNo ratings yet

- Multi Scheme CSIP Facility Application FormatDocument6 pagesMulti Scheme CSIP Facility Application FormatKiranmayi UppalaNo ratings yet

- FORM 23-B: Statement of Changes in Beneficial Ownership of SecuritiesDocument4 pagesFORM 23-B: Statement of Changes in Beneficial Ownership of SecuritiesMartin Lewis KoaNo ratings yet

- Carpenters Welfare Fund 2006Document16 pagesCarpenters Welfare Fund 2006Latisha WalkerNo ratings yet

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationDocument2 pagesSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVNo ratings yet

- SIP Registration Cum Mandate - EditableDocument2 pagesSIP Registration Cum Mandate - EditableKaushalNo ratings yet

- Groww Stock Account Opening Form-1Document20 pagesGroww Stock Account Opening Form-1SHIV KUSHWAHANo ratings yet

- NonIndividual 1Document12 pagesNonIndividual 1samyakparekh2004No ratings yet

- US Internal Revenue Service: f5500sr - 1999Document2 pagesUS Internal Revenue Service: f5500sr - 1999IRSNo ratings yet

- Unit Holder Information: Web FormDocument2 pagesUnit Holder Information: Web FormDibyaranjan SahooNo ratings yet

- Sole / First Applicant Second Applicant Third ApplicantDocument2 pagesSole / First Applicant Second Applicant Third ApplicantAnkur KaushikNo ratings yet

- Commen Trasaction FormDocument1 pageCommen Trasaction Formsandip vishwakarmaNo ratings yet

- GP0766Document2 pagesGP0766Hans WongNo ratings yet

- Transaction SlipDocument2 pagesTransaction SlipCavikram JainNo ratings yet

- Common Transaction Form: Mutual FundsDocument2 pagesCommon Transaction Form: Mutual FundsAjith JainNo ratings yet

- US Internal Revenue Service: f5500sb - 1999Document8 pagesUS Internal Revenue Service: f5500sb - 1999IRSNo ratings yet

- 2006 Form 5500 Carpenter Pension PlanDocument22 pages2006 Form 5500 Carpenter Pension PlanLatisha WalkerNo ratings yet

- FATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For EntitiesDocument6 pagesFATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For Entitiesvikas9saraswatNo ratings yet

- Common Transaction Slip 12 06 2017 PDFDocument3 pagesCommon Transaction Slip 12 06 2017 PDFvenkatnimmsNo ratings yet

- Company Secretary.: Ashwani K. VermaDocument52 pagesCompany Secretary.: Ashwani K. VermaContra Value BetsNo ratings yet

- 57826Document37 pages57826JephiasNo ratings yet

- Lec 5-Harmonization of Acc StandardsDocument22 pagesLec 5-Harmonization of Acc StandardsJephiasNo ratings yet

- SI 2021-023 Broadcasting (Listener's Licenses) (Fees) Notice, 2021Document2 pagesSI 2021-023 Broadcasting (Listener's Licenses) (Fees) Notice, 2021JephiasNo ratings yet

- Account Related Common Request FormDocument2 pagesAccount Related Common Request FormJephiasNo ratings yet

- Internet Banking FormDocument1 pageInternet Banking FormJephiasNo ratings yet

- Engine ClasificationDocument13 pagesEngine Clasificationvasanth9046No ratings yet

- Aqua 55-9622-14-CMV1: Technical CharacteristicsDocument3 pagesAqua 55-9622-14-CMV1: Technical CharacteristicsJavier LeonisNo ratings yet

- Direct-Hit - Schedules PlanDocument2 pagesDirect-Hit - Schedules PlangabotoyoNo ratings yet

- Get Growing Packages 15k CommercialDocument10 pagesGet Growing Packages 15k CommercialRodrigo Urcelay MontecinosNo ratings yet

- Fire Dampers Installation Instructions: (Static and Dynamic)Document4 pagesFire Dampers Installation Instructions: (Static and Dynamic)sbalu12674No ratings yet

- Current Diagnosis & Treatment in Otolaryngology-Head & Neck SurgeryDocument4 pagesCurrent Diagnosis & Treatment in Otolaryngology-Head & Neck SurgeryIhwan Ukhrawi AliNo ratings yet

- TP Link TL R480T+ ManualDocument85 pagesTP Link TL R480T+ ManualKennith PottsNo ratings yet

- Road Tanker Safety - Design, Equipment, and The Human Factor - SafeRackDocument8 pagesRoad Tanker Safety - Design, Equipment, and The Human Factor - SafeRackSultan MohammedNo ratings yet

- R80CR-9 Electrical SystemDocument57 pagesR80CR-9 Electrical SystemMhh AutoNo ratings yet

- 2014 Australian Mathematics Competition AMC Middle Primary Years 3 and 4Document8 pages2014 Australian Mathematics Competition AMC Middle Primary Years 3 and 4Dung Vô ĐốiNo ratings yet

- Industrial Co-Operative Hard Copy... !!!Document40 pagesIndustrial Co-Operative Hard Copy... !!!vikastaterNo ratings yet

- Water Knowledge No.03Document10 pagesWater Knowledge No.03Kyaw Myint NaingNo ratings yet

- TFP321 03 2021Document4 pagesTFP321 03 2021Richard TorresNo ratings yet

- Three Stages Sediment Filter and Uv Light Purifier: A Water Treatment SystemDocument36 pagesThree Stages Sediment Filter and Uv Light Purifier: A Water Treatment SystemMark Allen Tupaz MendozaNo ratings yet

- DN Diametre Nominal-NPS Size ChartDocument5 pagesDN Diametre Nominal-NPS Size ChartSankar CdmNo ratings yet

- The Theory of EverythingDocument4 pagesThe Theory of EverythingAfrin HasanNo ratings yet

- Qualification Verification Visit Report - 3022846 - NVQ2Work - 482 - 22032019-1 PDFDocument7 pagesQualification Verification Visit Report - 3022846 - NVQ2Work - 482 - 22032019-1 PDFanthony jamesNo ratings yet

- MCQ Surgery 1Document6 pagesMCQ Surgery 1Abdallah GamalNo ratings yet

- ACUSON Sequoia 512 Ultrasound System TransducersDocument114 pagesACUSON Sequoia 512 Ultrasound System TransducersMarcos ZanelliNo ratings yet

- UntitledDocument9 pagesUntitled박준수No ratings yet

- Frederick Jackson Turners Thesis Argued That Americas Frontier QuizletDocument7 pagesFrederick Jackson Turners Thesis Argued That Americas Frontier Quizletbufukegojaf2100% (1)

- DSM V PDFDocument33 pagesDSM V PDFRizky YantoroNo ratings yet

- 15001-Fanny CrosbyDocument16 pages15001-Fanny CrosbySharjin AuthorNo ratings yet

- Astro 429 Assignment 3Document2 pagesAstro 429 Assignment 3tarakNo ratings yet

- Unit 8 Earth, Space and BeyondDocument19 pagesUnit 8 Earth, Space and Beyondulianavasylivna2022No ratings yet

- Camille Moço: Contact Last Work ExperiencesDocument1 pageCamille Moço: Contact Last Work ExperiencesCamille MoçoNo ratings yet

- ReadiGASS Bro 1709Document4 pagesReadiGASS Bro 1709arunkumar277041No ratings yet