Professional Documents

Culture Documents

Income Tax Payment Challan: PSID #: 164056997

Income Tax Payment Challan: PSID #: 164056997

Uploaded by

M ZubairCopyright:

Available Formats

You might also like

- It 000126799893 2023 08Document1 pageIt 000126799893 2023 08Anas KhanNo ratings yet

- It 000133172232 2023 01Document1 pageIt 000133172232 2023 01omer akhterNo ratings yet

- It 000153098310 2024 03Document1 pageIt 000153098310 2024 03MUHAMMAD TABRAIZNo ratings yet

- Revised PSID ON SALARY FMO MAY 2023Document1 pageRevised PSID ON SALARY FMO MAY 2023Arshad SadeequeNo ratings yet

- Income Tax Payment Challan: PSID #: 165873601Document1 pageIncome Tax Payment Challan: PSID #: 165873601MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- It 000142942160 2024 09Document1 pageIt 000142942160 2024 09tayyabNo ratings yet

- It 000156777657 2024 06Document1 pageIt 000156777657 2024 06Zeshan SajidNo ratings yet

- It 000133212268 2023 01Document1 pageIt 000133212268 2023 01omer akhterNo ratings yet

- It 000154519556 2024 04Document1 pageIt 000154519556 2024 04MUHAMMAD TABRAIZNo ratings yet

- DirectTaxesPaymentPSID UpdateNatureDocument1 pageDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhNo ratings yet

- November 2021Document1 pageNovember 2021Muhammad Ghazanfar Sabir QureshiNo ratings yet

- Income Tax Payment Challan: PSID #: 148094666Document1 pageIncome Tax Payment Challan: PSID #: 148094666omer akhterNo ratings yet

- Income Tax Payment Challan: PSID #: 161602500Document1 pageIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirNo ratings yet

- PSIDAUG3Document1 pagePSIDAUG3Kashif NiaziNo ratings yet

- It 000154270899 2024 04Document1 pageIt 000154270899 2024 04MUHAMMAD TABRAIZNo ratings yet

- October 2021Document1 pageOctober 2021Muhammad Ghazanfar Sabir QureshiNo ratings yet

- It 000154491467 2024 04Document1 pageIt 000154491467 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000148938139 2024 01Document1 pageIt 000148938139 2024 01abdulraufattari69No ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- It 000154590025 2024 04Document1 pageIt 000154590025 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000156090054 2024 04Document1 pageIt 000156090054 2024 04Saad TahirNo ratings yet

- It 000124865200 2023 07Document1 pageIt 000124865200 2023 07MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- It 000154491319 2018 04Document1 pageIt 000154491319 2018 04MUHAMMAD TABRAIZNo ratings yet

- It 000156777207 2024 06Document1 pageIt 000156777207 2024 06Zeshan SajidNo ratings yet

- Income Tax Payment Challan: PSID #: 165866345Document1 pageIncome Tax Payment Challan: PSID #: 165866345Ashok KumarNo ratings yet

- It 000156777531 2024 06Document1 pageIt 000156777531 2024 06Zeshan SajidNo ratings yet

- It 000125297494 2023 08Document1 pageIt 000125297494 2023 08MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- IT-000155721931-2024-09 Sept-23Document1 pageIT-000155721931-2024-09 Sept-23Arsalan BhattiNo ratings yet

- It 000156086061 2024 04Document1 pageIt 000156086061 2024 04Saad TahirNo ratings yet

- It 000126794858 2023 08Document1 pageIt 000126794858 2023 08Anas KhanNo ratings yet

- It 000154491423 2024 04Document1 pageIt 000154491423 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000125718621 2023 08Document1 pageIt 000125718621 2023 08MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- IT-000155720866-2024-07 July-23Document1 pageIT-000155720866-2024-07 July-23Arsalan BhattiNo ratings yet

- It 000145640626 2023 11Document1 pageIt 000145640626 2023 11pleasemakemefilerNo ratings yet

- IT-000155721272-2024-08 Aug-23Document1 pageIT-000155721272-2024-08 Aug-23Arsalan BhattiNo ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138384574Document1 pageIncome Tax Payment Challan: PSID #: 138384574naeem1990No ratings yet

- Mumtaz Khan 236 K 6000Document1 pageMumtaz Khan 236 K 6000mazharehsan08No ratings yet

- It 000134800902 2023 03Document1 pageIt 000134800902 2023 03AbbasNo ratings yet

- Ali Hassan CC PDFDocument1 pageAli Hassan CC PDFAdv Ali Akbar Adv Ali AkbarNo ratings yet

- It 000156079778 2024 04Document1 pageIt 000156079778 2024 04Saad TahirNo ratings yet

- Income Tax Payment Challan: PSID #: 34336315Document1 pageIncome Tax Payment Challan: PSID #: 34336315kashif shahzadNo ratings yet

- Income Tax Payment Challan: PSID #: 35235957Document1 pageIncome Tax Payment Challan: PSID #: 35235957Ayan BNo ratings yet

- It 000129964508 2022 11Document1 pageIt 000129964508 2022 11SkjhkjhkjhNo ratings yet

- It 000136658400 2023 04Document1 pageIt 000136658400 2023 04Talha ShaukatNo ratings yet

- Goga 2.5Document1 pageGoga 2.5advocateyaqootNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- It 000136606018 2022 00Document1 pageIt 000136606018 2022 00Amazon wall streetNo ratings yet

- It 000154519744 2024 04Document1 pageIt 000154519744 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000132223866 2023 01Document1 pageIt 000132223866 2023 01mazharehsan08No ratings yet

- It 000130389542 2023 11Document1 pageIt 000130389542 2023 11Muneeb ChaudhryNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- It 000144914729 2024 11Document1 pageIt 000144914729 2024 11MUHAMMAD TABRAIZNo ratings yet

- It 000134579920 2022 00 PDFDocument1 pageIt 000134579920 2022 00 PDFMuhammad AslamNo ratings yet

- It 000154735387 2023 00Document1 pageIt 000154735387 2023 00MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 47684385Document1 pageIncome Tax Payment Challan: PSID #: 47684385gandapur khanNo ratings yet

- It 000147088862 2024 12Document1 pageIt 000147088862 2024 12Revenue sectionNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- Faysal Bank LimitedDocument1 pageFaysal Bank LimitedM ZubairNo ratings yet

- Pakistan Market Technical Outlook 23 Feb 2023Document1 pagePakistan Market Technical Outlook 23 Feb 2023M ZubairNo ratings yet

- QC Program FormateDocument1 pageQC Program FormateM ZubairNo ratings yet

- 10 Best BBA Universities in Karachi - Criteria, Admissions, & FeeDocument10 pages10 Best BBA Universities in Karachi - Criteria, Admissions, & FeeM Zubair0% (1)

- Courior Delivery LogDocument1 pageCourior Delivery LogM ZubairNo ratings yet

- 125 Qarni BlockDocument1 page125 Qarni BlockM ZubairNo ratings yet

- HIST TOPIC 11 Minto Morley Reforms Indian Council Act 1909Document3 pagesHIST TOPIC 11 Minto Morley Reforms Indian Council Act 1909KIRAN BUTTNo ratings yet

- RA 1700 - Anti - SubversionDocument2 pagesRA 1700 - Anti - SubversionEs-EsNo ratings yet

- Moot CourtDocument2 pagesMoot CourtAkhil SreenadhNo ratings yet

- The Anc Stalwarts Document Presented To The President and The Top Five Officials of The ANCDocument5 pagesThe Anc Stalwarts Document Presented To The President and The Top Five Officials of The ANCeNCA.com100% (2)

- PALE Cases - February 26, 2021Document22 pagesPALE Cases - February 26, 2021Jam RxNo ratings yet

- 3165Document1 page3165VinayKRaiNo ratings yet

- Obligations and ContractsDocument6 pagesObligations and Contractssean denzel omliNo ratings yet

- 2015 01.15 App Permission File Second HabeasDocument54 pages2015 01.15 App Permission File Second HabeascbsradionewsNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- PNB vs. Court of Appeals (1996)Document7 pagesPNB vs. Court of Appeals (1996)Mark TeaNo ratings yet

- Difference Between NITI Aayog and Planning CommissionDocument3 pagesDifference Between NITI Aayog and Planning Commissionsanjanamistu64No ratings yet

- 263 - Nithya - B4 - AK ROY V UNION of INDIA - National Law University OdishaDocument15 pages263 - Nithya - B4 - AK ROY V UNION of INDIA - National Law University OdishaShreya 110No ratings yet

- Recruitment of Banking AssociatesDocument2 pagesRecruitment of Banking AssociatesSyed Owais BukhariNo ratings yet

- Kida V Senate, G.R. No. 196271, February 28, 2012Document4 pagesKida V Senate, G.R. No. 196271, February 28, 2012Eileithyia Selene SidorovNo ratings yet

- CIR V Tokyo ShippingDocument2 pagesCIR V Tokyo ShippingJerico GodoyNo ratings yet

- Chanakya National Law University: Law of Contracts Beneficial Contracts and Contracts For Apprenticeship of MinorDocument4 pagesChanakya National Law University: Law of Contracts Beneficial Contracts and Contracts For Apprenticeship of MinorKaran singh RautelaNo ratings yet

- Is India A Soft NationDocument2 pagesIs India A Soft Nationantra vNo ratings yet

- Why Do We Need Political Parties?Document3 pagesWhy Do We Need Political Parties?AdyaNo ratings yet

- Regionalism in IndiaDocument24 pagesRegionalism in IndiaAbhishekGargNo ratings yet

- Caram v. Segui (Digest)Document2 pagesCaram v. Segui (Digest)Arellano Aure100% (2)

- 1 - Besaga Vs AcostaDocument5 pages1 - Besaga Vs AcostacloudNo ratings yet

- Caterpillar Inc v. SamsonDocument2 pagesCaterpillar Inc v. SamsonNikki CarandangNo ratings yet

- NUPIC Doc 1 Bylaw June 2023 Revision 3 PDFDocument16 pagesNUPIC Doc 1 Bylaw June 2023 Revision 3 PDFVeronica BajañaNo ratings yet

- PRELIMDocument8 pagesPRELIMSATANIS, JESIE BOY O.No ratings yet

- AASTHA HOSPITALITY Joining FormDocument5 pagesAASTHA HOSPITALITY Joining FormPoojaDesaiNo ratings yet

- The Real Thirteenth Article of AmendmentDocument13 pagesThe Real Thirteenth Article of AmendmentnaebyosNo ratings yet

- $1.34M "Taxi King" JudgementDocument3 pages$1.34M "Taxi King" JudgementLaw&CrimeNo ratings yet

- Case Digest - Co Vs Court of AppealsDocument2 pagesCase Digest - Co Vs Court of AppealsVince Luigi ZepedaNo ratings yet

- Nomination Forms For Change of Nominee (Da3) PDFDocument1 pageNomination Forms For Change of Nominee (Da3) PDFPreetam100% (1)

- Alta Vista Golf and Country Club vs. City of CebuDocument29 pagesAlta Vista Golf and Country Club vs. City of CebuRustom IbañezNo ratings yet

Income Tax Payment Challan: PSID #: 164056997

Income Tax Payment Challan: PSID #: 164056997

Uploaded by

M ZubairOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Payment Challan: PSID #: 164056997

Income Tax Payment Challan: PSID #: 164056997

Uploaded by

M ZubairCopyright:

Available Formats

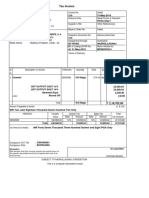

INCOME TAX PAYMENT CHALLAN

PSID # : 164056997

CTO KARACHI 5 1 2023

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year 02 23

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 153(1)(b) Payment for Specified Services u/s 153(1)(b) Payment Section Code 64060156

(ATL @ 3% / Non-ATL @ 6%)

(Section) (Description of Payment Section) Account Head (NAM) B01105

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

NTN CNIC/Reg./Inc. No.

Taxpayer's Name Status

Business Name

Address

FOR WITHHOLDING TAXES ONLY

NTN/FTN of Withholding agent 3704852-0 CNIC/Reg./Inc. No. 0071436

Name of withholding agent CREDIT MARKET SOLUTIONS (PRIVATE) LIMITED - CREDIT MARKET SOLUTIONS

(PVT) LIMITED

Total no. of Taxpayers 1 Total Tax Deducted 178

Amount of tax in words: One Hundred Seventy Eight Rupees And No Paisas Only Rs. 178

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 ADC (e- 178 No Branch

payment)

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor

Name of Depositor CREDIT MARKET SOLUTIONS (PRIVATE) LIMITED

Date

Stamp & Signature

PSID-IT-000133377935-022023

Prepared By : CMSPVTLT - CREDIT MARKET SOLUTIONS (PVT) LIMITED Date: 22-Feb-2023 11:34 AM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

You might also like

- It 000126799893 2023 08Document1 pageIt 000126799893 2023 08Anas KhanNo ratings yet

- It 000133172232 2023 01Document1 pageIt 000133172232 2023 01omer akhterNo ratings yet

- It 000153098310 2024 03Document1 pageIt 000153098310 2024 03MUHAMMAD TABRAIZNo ratings yet

- Revised PSID ON SALARY FMO MAY 2023Document1 pageRevised PSID ON SALARY FMO MAY 2023Arshad SadeequeNo ratings yet

- Income Tax Payment Challan: PSID #: 165873601Document1 pageIncome Tax Payment Challan: PSID #: 165873601MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- It 000142942160 2024 09Document1 pageIt 000142942160 2024 09tayyabNo ratings yet

- It 000156777657 2024 06Document1 pageIt 000156777657 2024 06Zeshan SajidNo ratings yet

- It 000133212268 2023 01Document1 pageIt 000133212268 2023 01omer akhterNo ratings yet

- It 000154519556 2024 04Document1 pageIt 000154519556 2024 04MUHAMMAD TABRAIZNo ratings yet

- DirectTaxesPaymentPSID UpdateNatureDocument1 pageDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhNo ratings yet

- November 2021Document1 pageNovember 2021Muhammad Ghazanfar Sabir QureshiNo ratings yet

- Income Tax Payment Challan: PSID #: 148094666Document1 pageIncome Tax Payment Challan: PSID #: 148094666omer akhterNo ratings yet

- Income Tax Payment Challan: PSID #: 161602500Document1 pageIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirNo ratings yet

- PSIDAUG3Document1 pagePSIDAUG3Kashif NiaziNo ratings yet

- It 000154270899 2024 04Document1 pageIt 000154270899 2024 04MUHAMMAD TABRAIZNo ratings yet

- October 2021Document1 pageOctober 2021Muhammad Ghazanfar Sabir QureshiNo ratings yet

- It 000154491467 2024 04Document1 pageIt 000154491467 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000148938139 2024 01Document1 pageIt 000148938139 2024 01abdulraufattari69No ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- It 000154590025 2024 04Document1 pageIt 000154590025 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000156090054 2024 04Document1 pageIt 000156090054 2024 04Saad TahirNo ratings yet

- It 000124865200 2023 07Document1 pageIt 000124865200 2023 07MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- It 000154491319 2018 04Document1 pageIt 000154491319 2018 04MUHAMMAD TABRAIZNo ratings yet

- It 000156777207 2024 06Document1 pageIt 000156777207 2024 06Zeshan SajidNo ratings yet

- Income Tax Payment Challan: PSID #: 165866345Document1 pageIncome Tax Payment Challan: PSID #: 165866345Ashok KumarNo ratings yet

- It 000156777531 2024 06Document1 pageIt 000156777531 2024 06Zeshan SajidNo ratings yet

- It 000125297494 2023 08Document1 pageIt 000125297494 2023 08MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- IT-000155721931-2024-09 Sept-23Document1 pageIT-000155721931-2024-09 Sept-23Arsalan BhattiNo ratings yet

- It 000156086061 2024 04Document1 pageIt 000156086061 2024 04Saad TahirNo ratings yet

- It 000126794858 2023 08Document1 pageIt 000126794858 2023 08Anas KhanNo ratings yet

- It 000154491423 2024 04Document1 pageIt 000154491423 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000125718621 2023 08Document1 pageIt 000125718621 2023 08MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- IT-000155720866-2024-07 July-23Document1 pageIT-000155720866-2024-07 July-23Arsalan BhattiNo ratings yet

- It 000145640626 2023 11Document1 pageIt 000145640626 2023 11pleasemakemefilerNo ratings yet

- IT-000155721272-2024-08 Aug-23Document1 pageIT-000155721272-2024-08 Aug-23Arsalan BhattiNo ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138384574Document1 pageIncome Tax Payment Challan: PSID #: 138384574naeem1990No ratings yet

- Mumtaz Khan 236 K 6000Document1 pageMumtaz Khan 236 K 6000mazharehsan08No ratings yet

- It 000134800902 2023 03Document1 pageIt 000134800902 2023 03AbbasNo ratings yet

- Ali Hassan CC PDFDocument1 pageAli Hassan CC PDFAdv Ali Akbar Adv Ali AkbarNo ratings yet

- It 000156079778 2024 04Document1 pageIt 000156079778 2024 04Saad TahirNo ratings yet

- Income Tax Payment Challan: PSID #: 34336315Document1 pageIncome Tax Payment Challan: PSID #: 34336315kashif shahzadNo ratings yet

- Income Tax Payment Challan: PSID #: 35235957Document1 pageIncome Tax Payment Challan: PSID #: 35235957Ayan BNo ratings yet

- It 000129964508 2022 11Document1 pageIt 000129964508 2022 11SkjhkjhkjhNo ratings yet

- It 000136658400 2023 04Document1 pageIt 000136658400 2023 04Talha ShaukatNo ratings yet

- Goga 2.5Document1 pageGoga 2.5advocateyaqootNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- It 000136606018 2022 00Document1 pageIt 000136606018 2022 00Amazon wall streetNo ratings yet

- It 000154519744 2024 04Document1 pageIt 000154519744 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000132223866 2023 01Document1 pageIt 000132223866 2023 01mazharehsan08No ratings yet

- It 000130389542 2023 11Document1 pageIt 000130389542 2023 11Muneeb ChaudhryNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- It 000144914729 2024 11Document1 pageIt 000144914729 2024 11MUHAMMAD TABRAIZNo ratings yet

- It 000134579920 2022 00 PDFDocument1 pageIt 000134579920 2022 00 PDFMuhammad AslamNo ratings yet

- It 000154735387 2023 00Document1 pageIt 000154735387 2023 00MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 47684385Document1 pageIncome Tax Payment Challan: PSID #: 47684385gandapur khanNo ratings yet

- It 000147088862 2024 12Document1 pageIt 000147088862 2024 12Revenue sectionNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- Faysal Bank LimitedDocument1 pageFaysal Bank LimitedM ZubairNo ratings yet

- Pakistan Market Technical Outlook 23 Feb 2023Document1 pagePakistan Market Technical Outlook 23 Feb 2023M ZubairNo ratings yet

- QC Program FormateDocument1 pageQC Program FormateM ZubairNo ratings yet

- 10 Best BBA Universities in Karachi - Criteria, Admissions, & FeeDocument10 pages10 Best BBA Universities in Karachi - Criteria, Admissions, & FeeM Zubair0% (1)

- Courior Delivery LogDocument1 pageCourior Delivery LogM ZubairNo ratings yet

- 125 Qarni BlockDocument1 page125 Qarni BlockM ZubairNo ratings yet

- HIST TOPIC 11 Minto Morley Reforms Indian Council Act 1909Document3 pagesHIST TOPIC 11 Minto Morley Reforms Indian Council Act 1909KIRAN BUTTNo ratings yet

- RA 1700 - Anti - SubversionDocument2 pagesRA 1700 - Anti - SubversionEs-EsNo ratings yet

- Moot CourtDocument2 pagesMoot CourtAkhil SreenadhNo ratings yet

- The Anc Stalwarts Document Presented To The President and The Top Five Officials of The ANCDocument5 pagesThe Anc Stalwarts Document Presented To The President and The Top Five Officials of The ANCeNCA.com100% (2)

- PALE Cases - February 26, 2021Document22 pagesPALE Cases - February 26, 2021Jam RxNo ratings yet

- 3165Document1 page3165VinayKRaiNo ratings yet

- Obligations and ContractsDocument6 pagesObligations and Contractssean denzel omliNo ratings yet

- 2015 01.15 App Permission File Second HabeasDocument54 pages2015 01.15 App Permission File Second HabeascbsradionewsNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- PNB vs. Court of Appeals (1996)Document7 pagesPNB vs. Court of Appeals (1996)Mark TeaNo ratings yet

- Difference Between NITI Aayog and Planning CommissionDocument3 pagesDifference Between NITI Aayog and Planning Commissionsanjanamistu64No ratings yet

- 263 - Nithya - B4 - AK ROY V UNION of INDIA - National Law University OdishaDocument15 pages263 - Nithya - B4 - AK ROY V UNION of INDIA - National Law University OdishaShreya 110No ratings yet

- Recruitment of Banking AssociatesDocument2 pagesRecruitment of Banking AssociatesSyed Owais BukhariNo ratings yet

- Kida V Senate, G.R. No. 196271, February 28, 2012Document4 pagesKida V Senate, G.R. No. 196271, February 28, 2012Eileithyia Selene SidorovNo ratings yet

- CIR V Tokyo ShippingDocument2 pagesCIR V Tokyo ShippingJerico GodoyNo ratings yet

- Chanakya National Law University: Law of Contracts Beneficial Contracts and Contracts For Apprenticeship of MinorDocument4 pagesChanakya National Law University: Law of Contracts Beneficial Contracts and Contracts For Apprenticeship of MinorKaran singh RautelaNo ratings yet

- Is India A Soft NationDocument2 pagesIs India A Soft Nationantra vNo ratings yet

- Why Do We Need Political Parties?Document3 pagesWhy Do We Need Political Parties?AdyaNo ratings yet

- Regionalism in IndiaDocument24 pagesRegionalism in IndiaAbhishekGargNo ratings yet

- Caram v. Segui (Digest)Document2 pagesCaram v. Segui (Digest)Arellano Aure100% (2)

- 1 - Besaga Vs AcostaDocument5 pages1 - Besaga Vs AcostacloudNo ratings yet

- Caterpillar Inc v. SamsonDocument2 pagesCaterpillar Inc v. SamsonNikki CarandangNo ratings yet

- NUPIC Doc 1 Bylaw June 2023 Revision 3 PDFDocument16 pagesNUPIC Doc 1 Bylaw June 2023 Revision 3 PDFVeronica BajañaNo ratings yet

- PRELIMDocument8 pagesPRELIMSATANIS, JESIE BOY O.No ratings yet

- AASTHA HOSPITALITY Joining FormDocument5 pagesAASTHA HOSPITALITY Joining FormPoojaDesaiNo ratings yet

- The Real Thirteenth Article of AmendmentDocument13 pagesThe Real Thirteenth Article of AmendmentnaebyosNo ratings yet

- $1.34M "Taxi King" JudgementDocument3 pages$1.34M "Taxi King" JudgementLaw&CrimeNo ratings yet

- Case Digest - Co Vs Court of AppealsDocument2 pagesCase Digest - Co Vs Court of AppealsVince Luigi ZepedaNo ratings yet

- Nomination Forms For Change of Nominee (Da3) PDFDocument1 pageNomination Forms For Change of Nominee (Da3) PDFPreetam100% (1)

- Alta Vista Golf and Country Club vs. City of CebuDocument29 pagesAlta Vista Golf and Country Club vs. City of CebuRustom IbañezNo ratings yet