Professional Documents

Culture Documents

BRS Class 11

BRS Class 11

Uploaded by

tarun aroraCopyright:

Available Formats

You might also like

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- Practice Set BRSDocument15 pagesPractice Set BRSvishwajeetnmoreNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- BRS Practice QuestionsDocument2 pagesBRS Practice Questionssyed ali raza kazmiNo ratings yet

- Adobe Scan 5 Oct 2023Document2 pagesAdobe Scan 5 Oct 2023pushbindersingh9No ratings yet

- Bank ReconcilationDocument1 pageBank ReconcilationddssNo ratings yet

- Assignment BRSDocument2 pagesAssignment BRSveydantsharma42No ratings yet

- Ch-3 BRSDocument8 pagesCh-3 BRSAFTAB KHANNo ratings yet

- Time:-01:00Hr. F.M.:-25Document2 pagesTime:-01:00Hr. F.M.:-25mishralakshay629No ratings yet

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- BRS WorksheetDocument8 pagesBRS WorksheetMayank VermaNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- BRS & Rectification of Errors SumsDocument7 pagesBRS & Rectification of Errors SumsGautam MehraNo ratings yet

- Question 1Document3 pagesQuestion 1Mohammad Tariq AnsariNo ratings yet

- Accounting RevisionDocument8 pagesAccounting RevisionAnish KanthetiNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- BRS PDFDocument8 pagesBRS PDFAnshumanNo ratings yet

- Cashbook and Brs ProblemsDocument3 pagesCashbook and Brs Problemsmaheshbendigeri5945No ratings yet

- Bank Reconciliation QuestionDocument2 pagesBank Reconciliation QuestionFinnNo ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- Problem 1Document7 pagesProblem 1tsegay169No ratings yet

- Unclaimed Money - Step by Step Guide how you claim your moneyFrom EverandUnclaimed Money - Step by Step Guide how you claim your moneyNo ratings yet

- Atoms and Molecules Class 9 Extra Questions Science Chapter 3Document13 pagesAtoms and Molecules Class 9 Extra Questions Science Chapter 3tarun aroraNo ratings yet

- Amonnia Class 10Document1 pageAmonnia Class 10tarun aroraNo ratings yet

- Algebric 7TH and Refraction of Light 10Document1 pageAlgebric 7TH and Refraction of Light 10tarun aroraNo ratings yet

- Accounting Ratios Analysis WorksheetDocument2 pagesAccounting Ratios Analysis Worksheettarun aroraNo ratings yet

- Class-9th Motion Force and Laws of Motion TestDocument1 pageClass-9th Motion Force and Laws of Motion Testtarun aroraNo ratings yet

- Class 7 Algebraic Expressions Class 8 Visualising Solid Shapes & GraphsDocument1 pageClass 7 Algebraic Expressions Class 8 Visualising Solid Shapes & Graphstarun aroraNo ratings yet

- Class-12th Economics Numericals TestDocument2 pagesClass-12th Economics Numericals Testtarun aroraNo ratings yet

- Class-Viii Mensuration TestDocument4 pagesClass-Viii Mensuration Testtarun arora100% (1)

- Production Function and Returns To A Factor Class 11Document2 pagesProduction Function and Returns To A Factor Class 11tarun aroraNo ratings yet

- Assignment 1Document4 pagesAssignment 1singhsaurabhh91No ratings yet

- CHN ReviewerDocument10 pagesCHN ReviewerAyessa Yvonne PanganibanNo ratings yet

- Criticism of Human Geography PDFDocument15 pagesCriticism of Human Geography PDFtwiceokNo ratings yet

- Name: Nadila Oktarina NIM:12203173033 Class: Tbi 4B: Westland Row Ophthalmologist and ENT SpecialistDocument6 pagesName: Nadila Oktarina NIM:12203173033 Class: Tbi 4B: Westland Row Ophthalmologist and ENT SpecialistNadila OktarinaNo ratings yet

- Criminal Law 1 Course OutlineDocument6 pagesCriminal Law 1 Course OutlineclvnngcNo ratings yet

- WEB Proof of Authorization Industry PracticesDocument4 pagesWEB Proof of Authorization Industry PracticesAnh Tuấn Nguyễn CôngNo ratings yet

- Euro Cup 2024 A Drive Through The Superb Euro 2024 Host ArenasDocument8 pagesEuro Cup 2024 A Drive Through The Superb Euro 2024 Host Arenasworldticketsandhospitality.11No ratings yet

- Profession Vs BusinessDocument7 pagesProfession Vs BusinessS.Abinith NarayananNo ratings yet

- CIV LTD - Sps. Jose Manuel and Maria Esperanza StilianopoulosDocument24 pagesCIV LTD - Sps. Jose Manuel and Maria Esperanza StilianopoulosDeon marianoNo ratings yet

- Coming HomeDocument1 pageComing HomenyashaNo ratings yet

- Active and Passive Voice DiscussionDocument11 pagesActive and Passive Voice DiscussionRol ParochaNo ratings yet

- I. Product Design II. Planning and Scheduling III. Production Operations IV. Cost AccountingDocument15 pagesI. Product Design II. Planning and Scheduling III. Production Operations IV. Cost Accountingوائل مصطفىNo ratings yet

- Pound-Jefferson and or MussoliniDocument125 pagesPound-Jefferson and or MussoliniTrad AnonNo ratings yet

- Bell Atlantic Corp v. TwomblyDocument4 pagesBell Atlantic Corp v. Twomblylfei1216No ratings yet

- Gimbel-Implementation of PotsdamDocument29 pagesGimbel-Implementation of PotsdammemoNo ratings yet

- Heritage Christian Academy Family Handbook: Able OF OntentsDocument37 pagesHeritage Christian Academy Family Handbook: Able OF OntentsNathan Brony ThomasNo ratings yet

- Production and Cost AnalysisDocument140 pagesProduction and Cost AnalysisSiddharth MohapatraNo ratings yet

- Prudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Document13 pagesPrudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Ebbe DyNo ratings yet

- Lgbtqi DefinitionsDocument2 pagesLgbtqi Definitionsapi-90812074No ratings yet

- Zensar Standalone Clause 33 Results Mar2023Document3 pagesZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaNo ratings yet

- IAP GuidebookDocument21 pagesIAP Guidebooksuheena.CNo ratings yet

- Brochure FDP On 5G Wireless CommunicationsDocument2 pagesBrochure FDP On 5G Wireless CommunicationsevolvingsatNo ratings yet

- A Quick Guide To The Employment Rights Act: OcumentationDocument4 pagesA Quick Guide To The Employment Rights Act: OcumentationGeorgia SimmsNo ratings yet

- Av4 SyllDocument3 pagesAv4 Syllapi-262711797No ratings yet

- Job Description Job Title: Restaurant Operations Manager Reporting To: Department: F & B OperationsDocument2 pagesJob Description Job Title: Restaurant Operations Manager Reporting To: Department: F & B OperationsVidhya HRNo ratings yet

- Acumen West Africa One PagerDocument2 pagesAcumen West Africa One PagertobointNo ratings yet

- Remember by Sarah Draget LyricsDocument2 pagesRemember by Sarah Draget LyricsKashmyr Faye CastroNo ratings yet

- Undecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3Document1 pageUndecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3AjayNo ratings yet

- Attendance Sheet MSA RasseaeDocument67 pagesAttendance Sheet MSA RasseaeRUFINO ARELLANONo ratings yet

- Customer Value ManagementDocument31 pagesCustomer Value ManagementP RAGHU VAMSYNo ratings yet

BRS Class 11

BRS Class 11

Uploaded by

tarun aroraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BRS Class 11

BRS Class 11

Uploaded by

tarun aroraCopyright:

Available Formats

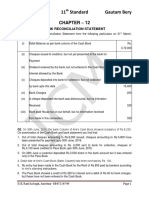

CLASS – 11TH Bank Reconciliation Statement TEST

1. On 31st December, 2014 my Cash Book showed a credit balance of ₹ 8,800. I had paid into Bank three

cheques amounting to ₹ 6,000 on 24th December of which I found ₹ 3,200 have been credited in the Pass

Book under date 5th January 2015. I had issued cheques amounting to ₹ 8,000 before 31st December of

which I found ₹ 2,500 have been debited in the Pass Book after 1st January 2015. I find a debit of ₹ 50 in

respect of bank charges in the Pass Book which I have adjusted in the Cash Book on 31st Dec. There is a

credit of ₹ 360 for interest on securities in the Pass Book which remains to be adjusted. A cheque of ₹ 1,200

deposited into bank has been dishonoured.

Prepare Bank Reconciliation Statement as on 31st Dec. 2014.

2. Prepare a Bank Reconciliation Statement on 31 December, 2014 from the following particulars:-

(a) A's overdraft as per Pass Book ₹ 20,000 as at 31st Dec.

(b) On 30th December, cheques had been issued for ₹ 80,000, of which cheques worth ₹ 15,000 only had

been encashed up to 31st December.

(c) Cheques amounting to ₹ 6,500 had been paid into the bank for collection but of these only ₹ 2,500 had

been credited in the Pass Book.

(d) The bank has charged ₹ 700 as interest on overdraft and the intimation of which has been received on

2nd January 2015.

(e) The Bank Pass Book shows credit for ₹ 2,000 representing ₹ 1,400 paid by debtor of A direct into the bank

and ₹ 600 collected direct by bank in respect of interest on A,s investment. A had no knowledge of these

items.

(f) A cheque for ₹ 3,600 has been debited in bank column of Cash Book by A, but it was not sent to bank at

all.

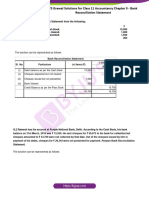

3. On 31st March, 2017, Pass Book showed a balance of ₹ 25,000. Prepare a Bank Reconciliation Statement

from the following particulars:

(i) Cheques of ₹ 20,000 were deposited in Bank on 27th March, 2017, out of which cheques of ₹ 5,000 were

cleared on 1st April, 2017. Rest are not cleared.

(ii) On 28th March, 2017, cheques were issued amounting to ₹ 15,000, out of which cheques of ₹ 3,000 were

presented in March, ₹ 4,000 on 2nd April and rest were not presented.

(iii) Cheques of ₹ 10,000 were deposited in Bank on 28th March, 2017, out of which cheques of ₹ 4,000 were

cleared on 2nd April, 2017 and rest are dishonoured.

(iv) Interest on investment collected by bank does not appear in the Cash Book ₹ 800.

(v) A B/R of ₹ 9,000 previously discounted from the bank was dishonoured on 30th March, 2017 but no

intimation was received from the bank till 31st March.

(vi) Bank has debited ₹ 1,500 and credited ₹ 1,200 in our account.

4. On 30th June 2014, the Cash Book of a trader shows a bank overdraft of ₹ 2,500. Following informations are

available:-

1. Cheques amounting to ₹ 14,600 had been paid to the bank, but of these only ₹ 12,200 were credited in the

Pass Book, up to 30th June, 2014.

2. He had also issued cheques amounting to ₹ 10,000, out of which only ₹ 3,600 had been presented for

payment.

3. A cheque of ₹ 500 which he had debited to the bank account was not sent to bank for collection by

mistake.

4. There is a debit in the Pass Book of ₹ 10 for Bank Charges and ₹ 50 for interest.

5. A customer directly paid into his bank ₹ 1,000, but it was not shown in the Cash Book.

6. Bank has paid insurance premium of ₹ 400 according to his instructions, but this is not recorded in the

Cash Book.

Prepare a Bank Reconciliation Statement.

You might also like

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- Practice Set BRSDocument15 pagesPractice Set BRSvishwajeetnmoreNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- BRS Practice QuestionsDocument2 pagesBRS Practice Questionssyed ali raza kazmiNo ratings yet

- Adobe Scan 5 Oct 2023Document2 pagesAdobe Scan 5 Oct 2023pushbindersingh9No ratings yet

- Bank ReconcilationDocument1 pageBank ReconcilationddssNo ratings yet

- Assignment BRSDocument2 pagesAssignment BRSveydantsharma42No ratings yet

- Ch-3 BRSDocument8 pagesCh-3 BRSAFTAB KHANNo ratings yet

- Time:-01:00Hr. F.M.:-25Document2 pagesTime:-01:00Hr. F.M.:-25mishralakshay629No ratings yet

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- BRS WorksheetDocument8 pagesBRS WorksheetMayank VermaNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- BRS & Rectification of Errors SumsDocument7 pagesBRS & Rectification of Errors SumsGautam MehraNo ratings yet

- Question 1Document3 pagesQuestion 1Mohammad Tariq AnsariNo ratings yet

- Accounting RevisionDocument8 pagesAccounting RevisionAnish KanthetiNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- BRS PDFDocument8 pagesBRS PDFAnshumanNo ratings yet

- Cashbook and Brs ProblemsDocument3 pagesCashbook and Brs Problemsmaheshbendigeri5945No ratings yet

- Bank Reconciliation QuestionDocument2 pagesBank Reconciliation QuestionFinnNo ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- Problem 1Document7 pagesProblem 1tsegay169No ratings yet

- Unclaimed Money - Step by Step Guide how you claim your moneyFrom EverandUnclaimed Money - Step by Step Guide how you claim your moneyNo ratings yet

- Atoms and Molecules Class 9 Extra Questions Science Chapter 3Document13 pagesAtoms and Molecules Class 9 Extra Questions Science Chapter 3tarun aroraNo ratings yet

- Amonnia Class 10Document1 pageAmonnia Class 10tarun aroraNo ratings yet

- Algebric 7TH and Refraction of Light 10Document1 pageAlgebric 7TH and Refraction of Light 10tarun aroraNo ratings yet

- Accounting Ratios Analysis WorksheetDocument2 pagesAccounting Ratios Analysis Worksheettarun aroraNo ratings yet

- Class-9th Motion Force and Laws of Motion TestDocument1 pageClass-9th Motion Force and Laws of Motion Testtarun aroraNo ratings yet

- Class 7 Algebraic Expressions Class 8 Visualising Solid Shapes & GraphsDocument1 pageClass 7 Algebraic Expressions Class 8 Visualising Solid Shapes & Graphstarun aroraNo ratings yet

- Class-12th Economics Numericals TestDocument2 pagesClass-12th Economics Numericals Testtarun aroraNo ratings yet

- Class-Viii Mensuration TestDocument4 pagesClass-Viii Mensuration Testtarun arora100% (1)

- Production Function and Returns To A Factor Class 11Document2 pagesProduction Function and Returns To A Factor Class 11tarun aroraNo ratings yet

- Assignment 1Document4 pagesAssignment 1singhsaurabhh91No ratings yet

- CHN ReviewerDocument10 pagesCHN ReviewerAyessa Yvonne PanganibanNo ratings yet

- Criticism of Human Geography PDFDocument15 pagesCriticism of Human Geography PDFtwiceokNo ratings yet

- Name: Nadila Oktarina NIM:12203173033 Class: Tbi 4B: Westland Row Ophthalmologist and ENT SpecialistDocument6 pagesName: Nadila Oktarina NIM:12203173033 Class: Tbi 4B: Westland Row Ophthalmologist and ENT SpecialistNadila OktarinaNo ratings yet

- Criminal Law 1 Course OutlineDocument6 pagesCriminal Law 1 Course OutlineclvnngcNo ratings yet

- WEB Proof of Authorization Industry PracticesDocument4 pagesWEB Proof of Authorization Industry PracticesAnh Tuấn Nguyễn CôngNo ratings yet

- Euro Cup 2024 A Drive Through The Superb Euro 2024 Host ArenasDocument8 pagesEuro Cup 2024 A Drive Through The Superb Euro 2024 Host Arenasworldticketsandhospitality.11No ratings yet

- Profession Vs BusinessDocument7 pagesProfession Vs BusinessS.Abinith NarayananNo ratings yet

- CIV LTD - Sps. Jose Manuel and Maria Esperanza StilianopoulosDocument24 pagesCIV LTD - Sps. Jose Manuel and Maria Esperanza StilianopoulosDeon marianoNo ratings yet

- Coming HomeDocument1 pageComing HomenyashaNo ratings yet

- Active and Passive Voice DiscussionDocument11 pagesActive and Passive Voice DiscussionRol ParochaNo ratings yet

- I. Product Design II. Planning and Scheduling III. Production Operations IV. Cost AccountingDocument15 pagesI. Product Design II. Planning and Scheduling III. Production Operations IV. Cost Accountingوائل مصطفىNo ratings yet

- Pound-Jefferson and or MussoliniDocument125 pagesPound-Jefferson and or MussoliniTrad AnonNo ratings yet

- Bell Atlantic Corp v. TwomblyDocument4 pagesBell Atlantic Corp v. Twomblylfei1216No ratings yet

- Gimbel-Implementation of PotsdamDocument29 pagesGimbel-Implementation of PotsdammemoNo ratings yet

- Heritage Christian Academy Family Handbook: Able OF OntentsDocument37 pagesHeritage Christian Academy Family Handbook: Able OF OntentsNathan Brony ThomasNo ratings yet

- Production and Cost AnalysisDocument140 pagesProduction and Cost AnalysisSiddharth MohapatraNo ratings yet

- Prudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Document13 pagesPrudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Ebbe DyNo ratings yet

- Lgbtqi DefinitionsDocument2 pagesLgbtqi Definitionsapi-90812074No ratings yet

- Zensar Standalone Clause 33 Results Mar2023Document3 pagesZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaNo ratings yet

- IAP GuidebookDocument21 pagesIAP Guidebooksuheena.CNo ratings yet

- Brochure FDP On 5G Wireless CommunicationsDocument2 pagesBrochure FDP On 5G Wireless CommunicationsevolvingsatNo ratings yet

- A Quick Guide To The Employment Rights Act: OcumentationDocument4 pagesA Quick Guide To The Employment Rights Act: OcumentationGeorgia SimmsNo ratings yet

- Av4 SyllDocument3 pagesAv4 Syllapi-262711797No ratings yet

- Job Description Job Title: Restaurant Operations Manager Reporting To: Department: F & B OperationsDocument2 pagesJob Description Job Title: Restaurant Operations Manager Reporting To: Department: F & B OperationsVidhya HRNo ratings yet

- Acumen West Africa One PagerDocument2 pagesAcumen West Africa One PagertobointNo ratings yet

- Remember by Sarah Draget LyricsDocument2 pagesRemember by Sarah Draget LyricsKashmyr Faye CastroNo ratings yet

- Undecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3Document1 pageUndecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3AjayNo ratings yet

- Attendance Sheet MSA RasseaeDocument67 pagesAttendance Sheet MSA RasseaeRUFINO ARELLANONo ratings yet

- Customer Value ManagementDocument31 pagesCustomer Value ManagementP RAGHU VAMSYNo ratings yet