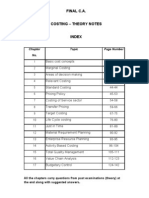

Professional Documents

Culture Documents

MS3 Cost Concepts: Accountants

MS3 Cost Concepts: Accountants

Uploaded by

Six Paths ItachiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MS3 Cost Concepts: Accountants

MS3 Cost Concepts: Accountants

Uploaded by

Six Paths ItachiCopyright:

Available Formats

MS3

COST CONCEPTS

Accountants

Financial accountants provide information to external parties

•Creditors - ang gapautang

•Regulators - the govt.

•Investors

•Donors

- provide infos through financial statement

- outside/ external organization

Managerial accountants provide information to internal users

•Managers

•Decision makers

- users inside the organization

Cost accountants provide information to both internal and external users

• Product cost information

- both outside and inside, cost information about product

Accounting Differences

Financial

- External focus

- Whole Organization

- Historical

- Quantitative

- Nonetary

- Verifiable

- GAAP

- Formal recordkeeping

Managerial

- Internal focus

- Segments or divisions

- Current/ Projected

- Quantitative/ qualitative

- Monetary and nonmonetary

- Timely/ reasonable estimate

- Benefits exceed costs

- Formal and informal recordkeeping

GAAP- General Accepted Accounting Principle

Formal recordkeeping- journal entry for financial

Product Cost Information

• External Parties - stockholders, creditors, regulators, and donors

- For investment and credit decisions

- Complies with GAAP

- Enterprise focus

• Internal Parties - managers

- Planning, controlling, nd decision making

- Evaluating performance

- Includes upstream nd downstream costs

- Disaggregated

Assigning Costs to Cost Objects

Direct Costs

- costs that can be easily and conveniently traced to a unit of product or other cost object.

Example:

* direct material

* direct labor

Indirect Costs

- costs that cannot be easily and conveniently traced to a unit of product or other cost object.

Example:

* manufacturing overhead

Notes:

Unexpired Cost - seen in the balance sheet

Supply Expense or Expired Cost - seen in income statement

Cost Objects

eg. finished products

- classify cost according to its association according to its cost objects.

- where we accumulate (tipon ang) cost

eg. finished goods ( pila ang nagasto)

Classification of Manufacturing Costs

Manufacturing or production cost - overall cost

Direct Materials

- raw materials that become an integral part of the product and that can be conveniently traced

directly to it.

Example: A radio installed in an automobile

Direct Labor

- labor costs that can be easily traced to individual units of product

Example: Wages paid to automobile assembly workers

* carpenter 'manual production' (direct), supervisor (indirect)

Manufacturing (Factoring) Overhead

- manufacturing costs that cannot be easily traced directly to specific units produced.

Examples: indirect materials and indirect labor

Indirect Materials - materials used to upport the production process.

Examples: lubricants and cleaning supplies used in the automobile assembly plant.

Indirect Labor - wages paid to employees who re not directly involved in production work.

Examples: maintenance workers, janitors, and security guards.

Nonmanufacturing Costs

• Selling costs - costs necessary to secure the order and deliver the product.

• Administrative costs - all executive, organizational and clerical costs.

- costs not related to production

eg. selling price (shipping fee)

Product Costs include direct materials, direct labor and manufacturing overhead

Period Costs include all selling costs and administrative costs.

Classification of Costs

Manufacturing costs are often classified as follows:

Cost Classifications for Predicting Cost Behaviour

- cost behavior refers to how a cost will react to changes in the level of activity. The most common

classifications are:

• Variable costs- as consumption increase, total cause also increases

Variable Cost per unit - constant

• Fixed costs - constant in fixed cost because you're still paying it at the same price

eg. wifi

Fixed cost per unit - as production increases, the fixed cost per unit decreases

• Mixed costs

Types of Fixed Costs

Commited - long term, cannot be significantly reduced in short term.

Examples: Depreciation on Buildings and Equipment and Real Estate Taxes

Discretionary - may be altered in the short-term by current managerial decisions.

Examples: Advertising and Research and Develolment.

You might also like

- 01 Cost Acounting12 (Autosaved)Document89 pages01 Cost Acounting12 (Autosaved)Haryson NyobuyaNo ratings yet

- Cost and ManagementDocument310 pagesCost and ManagementWaleed Noman100% (1)

- New SBI PAF - Supervisor - Corporate - Regional - Fransiska MDocument9 pagesNew SBI PAF - Supervisor - Corporate - Regional - Fransiska MTheresia dyah sagitaNo ratings yet

- Purchasing Training Introduction and Working RulesDocument29 pagesPurchasing Training Introduction and Working RulesBirlan AdrianNo ratings yet

- Management Accounting: Basic Terms and ConceptsDocument30 pagesManagement Accounting: Basic Terms and ConceptsHooria KhanNo ratings yet

- Cost AccountingDocument316 pagesCost Accountinghassan100% (1)

- Cost Concepts & Classification ShailajaDocument30 pagesCost Concepts & Classification ShailajaPankaj VyasNo ratings yet

- Element of CostDocument16 pagesElement of CostcwarekhaNo ratings yet

- Cost Accounting 1Document89 pagesCost Accounting 1Isaack MgeniNo ratings yet

- Chapter 1 ACCOUNTING FOR MANUFACTURING OPERATIONDocument36 pagesChapter 1 ACCOUNTING FOR MANUFACTURING OPERATIONMaimoona AsadNo ratings yet

- Chapter Two: Cost Terms, Concepts and ClassificationsDocument14 pagesChapter Two: Cost Terms, Concepts and ClassificationsalyNo ratings yet

- Introduction To Cost & Management AccountingDocument25 pagesIntroduction To Cost & Management AccountingNokutenda K GumbieNo ratings yet

- An Orientation To Cost AccountingDocument41 pagesAn Orientation To Cost AccountingDeepak BajpaiNo ratings yet

- Meaning of CostDocument8 pagesMeaning of CostSwarup Singh DeoNo ratings yet

- Lecturer: Diana Weekes-Marshall Bsc. (Hons), Fcca, FcaDocument26 pagesLecturer: Diana Weekes-Marshall Bsc. (Hons), Fcca, FcaNella KingNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingSanta-ana Jerald JuanoNo ratings yet

- Cost Sheet of HPCLDocument18 pagesCost Sheet of HPCLDeejay ChinmayNo ratings yet

- Jewish Wisdom For BusinessDocument11 pagesJewish Wisdom For Businessvanvic93No ratings yet

- Cost ConceptsDocument24 pagesCost ConceptsAshish MathewNo ratings yet

- COSTING1Document97 pagesCOSTING1namratasacNo ratings yet

- Cost and Management AccountingDocument29 pagesCost and Management AccountingAks SinhaNo ratings yet

- Costs Terms, Concepts and ClassificationsDocument32 pagesCosts Terms, Concepts and Classificationsjeela1No ratings yet

- Cost Accounting - BasicsDocument44 pagesCost Accounting - Basicsprayank jainNo ratings yet

- Cost Sheet Project Tata and HPCLDocument15 pagesCost Sheet Project Tata and HPCLmonish14785267% (3)

- Costing of Apparel Products: Introduction To Cost AccountingDocument50 pagesCosting of Apparel Products: Introduction To Cost AccountingNeelesh MishraNo ratings yet

- Ba 115Document36 pagesBa 115Paul Rainer De VillaNo ratings yet

- Topic 1Document4 pagesTopic 1Jane Luna RueloNo ratings yet

- Final Cost SheetDocument21 pagesFinal Cost Sheetneerajmgoyal100% (1)

- HMCost1e STPPT ch02Document12 pagesHMCost1e STPPT ch02AndroniNo ratings yet

- Project Cost Management - CHAPTER 5-Part IDocument29 pagesProject Cost Management - CHAPTER 5-Part IYonas AbebeNo ratings yet

- M Acc Spring 2017Document383 pagesM Acc Spring 2017Awais MehmoodNo ratings yet

- Hum 2217 (Acc) CostingDocument6 pagesHum 2217 (Acc) CostingNourin TasnimNo ratings yet

- Xcostcon Chapter 2Document48 pagesXcostcon Chapter 2abrylle opinianoNo ratings yet

- Cost Concepts: Basic Concepts Classification of Costs Elements of Cost and Cost SheetDocument43 pagesCost Concepts: Basic Concepts Classification of Costs Elements of Cost and Cost SheetFaraz SiddiquiNo ratings yet

- 02 Basic Cost Management Concept 1Document49 pages02 Basic Cost Management Concept 1DALUMPINES, John EverNo ratings yet

- Cost Sheet AnalysisDocument37 pagesCost Sheet Analysismanjeetkumar93544No ratings yet

- Cost Accounting: S.ClementDocument97 pagesCost Accounting: S.Clementshrav888No ratings yet

- Costing Theory by Indian AccountingDocument48 pagesCosting Theory by Indian AccountingIndian Accounting0% (1)

- Cost Accounting: Concepts and Terminologies By: Sir Ralph Dimaala, CPA/MBADocument21 pagesCost Accounting: Concepts and Terminologies By: Sir Ralph Dimaala, CPA/MBASamantha DionisioNo ratings yet

- Cost and Management AccountingDocument23 pagesCost and Management Accountingsexi_dilip100% (1)

- Cost Concepts and ClassificationDocument3 pagesCost Concepts and ClassificationPrincess PilNo ratings yet

- Cost Concepts and ClassificationDocument3 pagesCost Concepts and ClassificationPrincess PilNo ratings yet

- Chapter 2 Managerial Accounting PowerPointDocument42 pagesChapter 2 Managerial Accounting PowerPointOmar Bani-KhalafNo ratings yet

- Introduction To Cost Accounting Final With PDFDocument19 pagesIntroduction To Cost Accounting Final With PDFLemon EnvoyNo ratings yet

- Unit 10 - Cost Accounting - ESP Int - L Banking and FinanceDocument35 pagesUnit 10 - Cost Accounting - ESP Int - L Banking and FinanceDamMayXanhNo ratings yet

- Cost ClassificationDocument17 pagesCost Classificationsyed mohdNo ratings yet

- Cost & Management Accounting - Lec 3Document34 pagesCost & Management Accounting - Lec 3Agnes JosephNo ratings yet

- Meaning and Scope of Cost AccountingDocument53 pagesMeaning and Scope of Cost AccountingAviral GuptaNo ratings yet

- Bus 215 NotesDocument18 pagesBus 215 Notesctyre34No ratings yet

- Cost Concepts and TerminologiesDocument13 pagesCost Concepts and TerminologiesAprile AnonuevoNo ratings yet

- Cost and Classification 1Document15 pagesCost and Classification 118FB014 Hridoy PalNo ratings yet

- Cost Sheet Final DocumentDocument26 pagesCost Sheet Final Documentabhi96% (27)

- Cost AccountingDocument4 pagesCost AccountingClarivelle NonesNo ratings yet

- Topic 2 - Cost and Cost SystemDocument65 pagesTopic 2 - Cost and Cost Systemnguyennauy25042003No ratings yet

- Job Order Costing: Managerial AccountingDocument27 pagesJob Order Costing: Managerial AccountingMaria Maganda MalditaNo ratings yet

- Costing and OverheadsDocument80 pagesCosting and OverheadsDevesh KankariyaNo ratings yet

- Ankita ProjectDocument17 pagesAnkita ProjectRaman NehraNo ratings yet

- Cost ClassificationDocument12 pagesCost ClassificationAjay VatsavaiNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Process Costing-EupDocument4 pagesProcess Costing-EupSix Paths ItachiNo ratings yet

- ST THDocument2 pagesST THSix Paths ItachiNo ratings yet

- Fa1 Quiz4 ProblemDocument1 pageFa1 Quiz4 ProblemSix Paths ItachiNo ratings yet

- COMP 1 InfographicsDocument1 pageCOMP 1 InfographicsSix Paths ItachiNo ratings yet

- Business Plan i-WPS OfficeDocument9 pagesBusiness Plan i-WPS OfficeSix Paths ItachiNo ratings yet

- Essay PNoy & DU30 AdminDocument2 pagesEssay PNoy & DU30 AdminSix Paths ItachiNo ratings yet

- Political Dynasty (Essay)Document3 pagesPolitical Dynasty (Essay)Six Paths ItachiNo ratings yet

- Unit 1 Lesson 1 ContentDocument7 pagesUnit 1 Lesson 1 ContentSix Paths ItachiNo ratings yet

- Project Integration Management: Shwetang Panchal Sigma Institute of Management StudiesDocument32 pagesProject Integration Management: Shwetang Panchal Sigma Institute of Management StudiesShwetang PanchalNo ratings yet

- A FMEA-based Approach To Prioritize Waste Reduction in Lean ImplementationDocument22 pagesA FMEA-based Approach To Prioritize Waste Reduction in Lean ImplementationLi NearNo ratings yet

- Contoh CV ATSDocument1 pageContoh CV ATSAbraham YongHweNo ratings yet

- GRC OverviewDocument17 pagesGRC OverviewTrinadh Bokka0% (1)

- Water StrategyDocument7 pagesWater StrategyAnup MahakudNo ratings yet

- ACIPA 2008 and 2009 Audit and AssuranceDocument35 pagesACIPA 2008 and 2009 Audit and AssuranceSara BautistaNo ratings yet

- BBA 01206023 Mohammad Faisal Alam - Internship Report FinalDocument54 pagesBBA 01206023 Mohammad Faisal Alam - Internship Report FinalnowmonnawazNo ratings yet

- ISO 9001 Awareness PDFDocument1 pageISO 9001 Awareness PDFAnand Chavan Projects-QualityNo ratings yet

- Tutorial 6 SolutionsDocument5 pagesTutorial 6 SolutionsMustolih Hery SaputroNo ratings yet

- Managerial EconomicsDocument19 pagesManagerial EconomicsChaitanya ShahareNo ratings yet

- Understanding The Attitude of Generation Z Towards WorkplaceDocument10 pagesUnderstanding The Attitude of Generation Z Towards WorkplaceKeeks MaveNo ratings yet

- 2724610Document2 pages2724610alpeshrptlNo ratings yet

- Chapter 4 The Revenue CyclesDocument23 pagesChapter 4 The Revenue CyclesHassanNo ratings yet

- Acctg 402Document9 pagesAcctg 402Marriah Izzabelle Suarez RamadaNo ratings yet

- HRP 111Document3 pagesHRP 111Piyush SoniNo ratings yet

- Marketing For Hospitality and Tourism: Dr. John V. PaduaDocument22 pagesMarketing For Hospitality and Tourism: Dr. John V. Paduarhon magtalas100% (1)

- HBRDocument2 pagesHBRjyoti.bharadwaj1484No ratings yet

- Modern Auditing: Modern AuditingDocument31 pagesModern Auditing: Modern AuditingNur AiniNo ratings yet

- Resume - Niroshan Lakmal Senarathne - UpdatedDocument2 pagesResume - Niroshan Lakmal Senarathne - Updatedapi-598893716No ratings yet

- Kerala Infrastructure Investment Fund Board (Kiifb)Document4 pagesKerala Infrastructure Investment Fund Board (Kiifb)Samseer R HNo ratings yet

- Cass Toes For The Overall Safety Lifecycle Assessment (Iec 61508-1: 2010)Document3 pagesCass Toes For The Overall Safety Lifecycle Assessment (Iec 61508-1: 2010)Mohamed AmerNo ratings yet

- Managerial Accounting 4th Edition by Wild and Shaw Solution ManualDocument81 pagesManagerial Accounting 4th Edition by Wild and Shaw Solution ManualsidtufaNo ratings yet

- I. Background: Case Study: TNT ExpressDocument3 pagesI. Background: Case Study: TNT ExpressApril Jane EvangelistaNo ratings yet

- Seminar On ISO 45001 For ClientsDocument40 pagesSeminar On ISO 45001 For ClientsMiguel ValenciaNo ratings yet

- Legal Form:: Brief Description of The Project Name of BusinessDocument20 pagesLegal Form:: Brief Description of The Project Name of BusinessMuktar jiboNo ratings yet

- Vice President Human Resources in Atlanta GA Resume Peter DucoffeDocument1 pageVice President Human Resources in Atlanta GA Resume Peter DucoffePeterDucoffeNo ratings yet

- Cognitive Readiness in Project Teams Reducing Project Complexity and Increasing Success in Project ManagementDocument253 pagesCognitive Readiness in Project Teams Reducing Project Complexity and Increasing Success in Project ManagementAbel Silva100% (1)

- Project Report Ramraj Singh Tomar PDFDocument50 pagesProject Report Ramraj Singh Tomar PDFpankaj vermaNo ratings yet