Professional Documents

Culture Documents

Partnership Class Exercises

Partnership Class Exercises

Uploaded by

PetrinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Class Exercises

Partnership Class Exercises

Uploaded by

PetrinaCopyright:

Available Formats

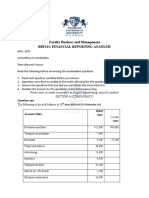

Partnerships AFE 3691 Class Exercises

Questions

Q1.1 Theory

a) Name and briefly discuss five factors which should be outlined in a partnership agreement.

b) Discuss the circumstances under which it would be equitable to introduce interest on capital in a partnership agreement.

c) Explain the purpose of a current account for each partner.

d) Explain the purpose of a statement of changes in equity.

Q1.2 Distribution of partnership profits

Loo, Moo and Soo are in partnership trading as LMS Traders. The balances in their capital accounts are as follows:

Loo N$ 60 000

Moo N$ 80 000

Soo N$ 100 000

The profit for the past year was N$ 48 000

You are required to divide the profit among the partners in each of the following unrelated cases:

a) There is no agreement regarding the ratio in which profit is to be divided.

b) Loo gets a salary of N$ 30 000 per annum. The rest of the profit is divided equally among the three partners

c) Loo gets a salary of N$ 30 000 per annum. The rest of the profit is divided in relation to the capital contributed by each partner.

d) Loo gets a salary of N$ 10 000 per annum. Each partner is entitled to 8% interest per annum on their capital. The balance is divided

among Loo, Moo and Soo in the ratio 2:3:5.

Q1.3 Distribution of partnership profits

Andy and Brad have been in partnership since 01 January 2012. Andy made an initial capital investment of N$ 80 000 on 01 January 2012. He

invests a further N$ 20 000 on 01 April 2012. On 01 January 2012 Brad invested N$ 160 000, N$ 10 000 of which he withdrew on 01 October

2012. The partnership agreement stipulates that each partner may draw N$ 1 000 as an advance on expected profits at the end of each month.

(NB: such drawings have no influence on the profit for the period distribution- it is simply debited against the partners’ current or withdrawal

accounts). The profit earned by the firm for the year ended 31 December 2012 amounts to N$ 60 000.

You are required to divide the profit in each of the following situations:

a) Profit is shared in the ratio Andy 60% and Brad 40%

b) Profits are shared based on the initial capital ratio.

c) Profits are shared based on closing balances of capital accounts

d) Profits are shared equally between the partners

Q1.4 Financial Statements of partnerships

Mutt and Jeff are equal partners in a sport shop called Born Losers. The following balances appeared in the pre-adjustment trial balance at 28

February 2011:

Account details Amount/N$

Capital : Mutt 71 500

Capital: Jeff 71 500

Current account: Mutt (Cr) 500

Current account: Jeff (Dr) 2 000

Drawings: Mutt 7 100

Drawings: Jeff 7 100

Office equipment at cost 126 000

Land and building at cost 150 000

Accumulated depreciation: Land and buildings 40 000

Accumulated depreciation: office equipment 19 200

Fixed deposit 14 900

Loan from City Bank 45 000

Debtors 28 500

Provision for bad debts 1 150

Creditors 22 100

Bank overdraft 25 250

Inventory (01/03/2010) 8 400

Sales 83 400

Sales returns 4 600

Purchases 33 600

Purchases returns 2 300

Rent paid 7 200

Rent income 58 800

Interest on loan 2 700

Bad debts 2 800

Railage inwards 2 500

Salaries and wages 38 750

Insurance 2 400

Stationery 990

Custom duties 1 160

Adjustments:

1) Depreciation on land and building must be provided for at 8% p.a. on the straight-line-basis.

2) Depreciation on office equipment must be provided for on the reducing-balance method at 10% p.a.

3) The loan from City Bank was negotiated on 01/03/2010 and interest is payable six-monthly at 12% p.a.

4) An additional amount of N$ 1 500 must be written off from debtors as irrecoverable and the provision for debtors must be adjusted to

equal to 5% of good debtors.

5) The balance on the insurance account represent two premiums paid as follows:

N$ 900 on a one-year fire policy effective from 01 May 2010.

N$ 1 500 on a one-year theft policy effective from 01 August 2010.

6) Stationery costing N$ 180 was still on hand at 28/02/2011.

7) An account of N$ 240 dated 01/02/2011 for customs duties was only received on 03/03/2011.

8) Inventory costing N$ 6 000 was still on hand at 28/02/2011

9) According to Mutt, advertisements costing N$ 4 100 were placed before 28/02/2011.

10) Interest on current accounts must be calculated at 6% p.a.

11) Interest on drawings came to N$ 125 for Mutt and N$ 100 for Jeff.

You are required to prepare for Born Losers for the year ending 28 February 2011 the following statements:

1) A statement of profit or loss and other comprehensive income.

2) A statement of profit distribution for the partners.

3) A statement of financial position.

4) A statement of changes in equity.

Q1.5 Financial Statement of Partnerships

Jack and Jill are in business as partners with a formal Agreement. Their Trial Balance at the year- end appears as shown below. During the year

Jack’s drawings amounted to N$ 35 000 and Jill’s drawings amounted to N$ 16 000. Interest on capital is calculated at 5% of the opening

balance of capital. Interest on drawings to be calculated at 6% p.a. profits are shared in relation to capital contributed.

JACK AND JILL

TRIAL BALANCE AS AT 30 JUNE 2011

Account details Dr/N$ Cr/N$

Non-current assets 840 000

Accumulated depreciation 30/06/2011 380 000

Inventory 30/06/2011 648 000

Receivable 584 000

Payables 596 000

Profit for the year 260 000

Partners drawings 51 000

Capital accounts: Jack 600 000

Capital account: Jill 30 000

Cash at bank 13 000

2 136 000 2 136 000

Required:

1) Prepare the partners’ capital and current ledger accounts

2) Prepare the Statement of Financial Position (equity section only) and Statement of Changes in Equity of the partnership as at 30 June

2011.

You might also like

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- CES Wrong Answer Summary 1e18da38 A505 48c1 b100 8cddd2b264e7Document4 pagesCES Wrong Answer Summary 1e18da38 A505 48c1 b100 8cddd2b264e7Sridharan Narasingan75% (4)

- Trumpf Slat Cleaner TSC1 ManualDocument26 pagesTrumpf Slat Cleaner TSC1 ManualMümin ÇimNo ratings yet

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Financial StatementsDocument3 pagesFinancial StatementsSoumendra RoyNo ratings yet

- P2Document40 pagesP2Michiko Kyung-soonNo ratings yet

- Hot Qus Class 12thDocument13 pagesHot Qus Class 12thNaveen ShahNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- Incomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Document5 pagesIncomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Tawanda Tatenda Herbert100% (1)

- 11 Accountancy t2 Sp01Document19 pages11 Accountancy t2 Sp01Lakshy BishtNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- TS1307 Financial Reports: Test 2 - Question BookDocument4 pagesTS1307 Financial Reports: Test 2 - Question Bookirma febianNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- Grade 10 Provincial Case Study QP 2023Document5 pagesGrade 10 Provincial Case Study QP 2023kwazy dlaminiNo ratings yet

- Adobe Scan 17-Dec-2022Document18 pagesAdobe Scan 17-Dec-2022unnuNo ratings yet

- AccountingDocument8 pagesAccountingktong0121No ratings yet

- Question 1Document2 pagesQuestion 1Charles MachuvaireNo ratings yet

- 2024 TERM 2 GRD11 ProjectDocument4 pages2024 TERM 2 GRD11 Projectmishomabunda20No ratings yet

- Single Entry Ques.Document6 pagesSingle Entry Ques.Garima GarimaNo ratings yet

- Final Account ExamplesDocument4 pagesFinal Account Examplespranaylanjewar644No ratings yet

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Sy Final AccountDocument8 pagesSy Final Accountsmit9993No ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Final AccountsDocument7 pagesIgcse - Extented Tutoring - 2023 - 2024 - Final AccountsMUSTHARI KHANNo ratings yet

- CHP 6 Partnership Exercise 1-4Document5 pagesCHP 6 Partnership Exercise 1-4jasongojinkai2007No ratings yet

- Bac 101Document6 pagesBac 101Ishak IshakNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- Assignment Bballb BDocument4 pagesAssignment Bballb BTavnish SinghNo ratings yet

- BT C1 - kttcqt1Document13 pagesBT C1 - kttcqt1Thảo NguyễnNo ratings yet

- Partnership Accounts QuestionsDocument4 pagesPartnership Accounts QuestionsKaleli RockyNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- DBM 611 Question Papers 2022Document3 pagesDBM 611 Question Papers 2022julierienyeNo ratings yet

- N5 Financial Accounting June 2018Document18 pagesN5 Financial Accounting June 2018Anil HarichandreNo ratings yet

- Lat. Soal Completing Accounting Cycle 1Document1 pageLat. Soal Completing Accounting Cycle 1Cindy Cornelia Wahyu WardaniNo ratings yet

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsENKK 25No ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- Manan Aggarwal - FINAL ACCOUNT-questionsDocument10 pagesManan Aggarwal - FINAL ACCOUNT-questionsManan AggarwalNo ratings yet

- In The Books of Evergreen Sports ClubDocument1 pageIn The Books of Evergreen Sports Clubponnada sairamNo ratings yet

- 4120504Document3 pages4120504m_gadhvi6840No ratings yet

- FINANCIALREPORTINGand Analysis ExamDocument7 pagesFINANCIALREPORTINGand Analysis ExamKizito KizitoNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Final Accounts Wbut QP SumDocument7 pagesFinal Accounts Wbut QP Sumsiddhartha RajNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- BAAB1014 Assignment EliteDocument5 pagesBAAB1014 Assignment Elitejinosini ramadasNo ratings yet

- PPE Disclosure 2023Document2 pagesPPE Disclosure 2023Liwena DelinNo ratings yet

- Faculty Business and Management Bbf211: Financial Reporting AnanlsisDocument7 pagesFaculty Business and Management Bbf211: Financial Reporting AnanlsisMichael AronNo ratings yet

- Civil and Water Individual Assignment Sept 2013Document6 pagesCivil and Water Individual Assignment Sept 2013tinoNo ratings yet

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- (Revised) - EL: BalanceDocument1 page(Revised) - EL: BalanceGopika G NairNo ratings yet

- CACell Intermediate Account Full Book-201-250Document50 pagesCACell Intermediate Account Full Book-201-250kalyanikamineniNo ratings yet

- 11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentDocument4 pages11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentSandeep NehraNo ratings yet

- 12 Accountancy Lyp 2012 Set1Document9 pages12 Accountancy Lyp 2012 Set1SeasonNo ratings yet

- Adobe Scan 27-Feb-2023Document9 pagesAdobe Scan 27-Feb-2023SudeepNo ratings yet

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Document5 pagesMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- O Level Important Questions PDFDocument55 pagesO Level Important Questions PDFibraho100% (1)

- Unit 1 ActvitiesDocument6 pagesUnit 1 ActvitiesLeslie Mae Vargas ZafeNo ratings yet

- Part Form-DissoDocument11 pagesPart Form-DissoMisana ElbancolNo ratings yet

- Final Accounts - Igcse - Yr 10.Document3 pagesFinal Accounts - Igcse - Yr 10.MUSTHARI KHANNo ratings yet

- Partnership Accounting ChangesDocument3 pagesPartnership Accounting ChangesTariro NjanikeNo ratings yet

- Final Ac P2Document5 pagesFinal Ac P2SudeepNo ratings yet

- River LTD (External Tutorial Question)Document1 pageRiver LTD (External Tutorial Question)PetrinaNo ratings yet

- Business Entities 3Document13 pagesBusiness Entities 3PetrinaNo ratings yet

- General Deductions NotesDocument47 pagesGeneral Deductions NotesPetrinaNo ratings yet

- Auditing AssignmentDocument12 pagesAuditing AssignmentPetrinaNo ratings yet

- AAM3691Consolidated Semester AssessmentsDocument8 pagesAAM3691Consolidated Semester AssessmentsPetrinaNo ratings yet

- Specific Inclusions 24Document46 pagesSpecific Inclusions 24PetrinaNo ratings yet

- Oxygen CareDocument4 pagesOxygen CarePetrinaNo ratings yet

- Summarized Notes On Close-CooperativesDocument31 pagesSummarized Notes On Close-CooperativesPetrinaNo ratings yet

- Unit 4 Exam 2021 JuneDocument3 pagesUnit 4 Exam 2021 JunePetrinaNo ratings yet

- Class Excercise 1management AccountingDocument3 pagesClass Excercise 1management AccountingPetrinaNo ratings yet

- Partnership - Changes in Ownership Structures (Galaxy Sports - Exercise)Document6 pagesPartnership - Changes in Ownership Structures (Galaxy Sports - Exercise)PetrinaNo ratings yet

- Unit 2 Interval Estimation-1Document31 pagesUnit 2 Interval Estimation-1PetrinaNo ratings yet

- Assignment 1 and 2 AFE3692 2023Document23 pagesAssignment 1 and 2 AFE3692 2023Petrina0% (1)

- Manufacturing Accounts (Study Guide)Document17 pagesManufacturing Accounts (Study Guide)PetrinaNo ratings yet

- AAM3692 Assignment 1 and 2Document17 pagesAAM3692 Assignment 1 and 2PetrinaNo ratings yet

- Management Accounting ExercisesDocument82 pagesManagement Accounting ExercisesPetrinaNo ratings yet

- Assignments 1 and 2 ACL 3632Document16 pagesAssignments 1 and 2 ACL 3632PetrinaNo ratings yet

- Manufacturing Accounts in AccountingDocument32 pagesManufacturing Accounts in AccountingPetrinaNo ratings yet

- Partnership - Liquidation (Powerpoint Presentation)Document21 pagesPartnership - Liquidation (Powerpoint Presentation)PetrinaNo ratings yet

- Study Guide For Close CorporationsDocument25 pagesStudy Guide For Close CorporationsPetrinaNo ratings yet

- UNIT 1 Partnerships - Question Bank (2020)Document13 pagesUNIT 1 Partnerships - Question Bank (2020)PetrinaNo ratings yet

- Companies NotesDocument40 pagesCompanies NotesPetrinaNo ratings yet

- UNIT 2 Partnerships - Question Bank (2020)Document20 pagesUNIT 2 Partnerships - Question Bank (2020)Petrina100% (1)

- B33C7F3C-F7A0-4F42-B984-CB921072326CDocument2 pagesB33C7F3C-F7A0-4F42-B984-CB921072326CPetrinaNo ratings yet

- Unit 1 - Introduction To PartnershipsDocument26 pagesUnit 1 - Introduction To PartnershipsPetrinaNo ratings yet

- UNIT 2 - Partnerships - Changes in Ownership StructursDocument19 pagesUNIT 2 - Partnerships - Changes in Ownership StructursPetrinaNo ratings yet

- Chapter 4 - Microbiology and BiotechnologyDocument68 pagesChapter 4 - Microbiology and BiotechnologyPetrinaNo ratings yet

- BSC410S-Basic Science 1 - 1ST Opp-Nov 17Document11 pagesBSC410S-Basic Science 1 - 1ST Opp-Nov 17PetrinaNo ratings yet

- UNIT 4 Companies - Question Bank (2020)Document41 pagesUNIT 4 Companies - Question Bank (2020)PetrinaNo ratings yet

- 9 - Property, Plant and EquipmentDocument17 pages9 - Property, Plant and EquipmentPetrinaNo ratings yet

- PMC Composites:,, Are Generally SmallDocument13 pagesPMC Composites:,, Are Generally SmallharnoorNo ratings yet

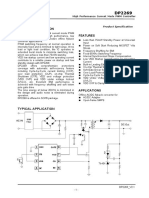

- DP2269Document7 pagesDP2269GABRIEL AMORIM ARAUJONo ratings yet

- Catálogo ErdemirDocument334 pagesCatálogo ErdemirveraNo ratings yet

- Glossarium Graeco Barbarum PDFDocument741 pagesGlossarium Graeco Barbarum PDFdrfitti1978No ratings yet

- University U1 U2 U3 U4 U5Document2 pagesUniversity U1 U2 U3 U4 U5Jian KarloNo ratings yet

- War Diary - Jan. 1943 PDFDocument89 pagesWar Diary - Jan. 1943 PDFSeaforth WebmasterNo ratings yet

- Ethics in Engineering Profession - IES General StudiesDocument16 pagesEthics in Engineering Profession - IES General StudiesSandeep PrajapatiNo ratings yet

- STP Review Benitez - June 10 2013 Brahms PDFDocument2 pagesSTP Review Benitez - June 10 2013 Brahms PDFcoolth2No ratings yet

- World Health OrganizationDocument13 pagesWorld Health OrganizationVincent Ranara Sabornido100% (1)

- FLIX Ticket 1069511041 PDFDocument2 pagesFLIX Ticket 1069511041 PDFAngela RedeiNo ratings yet

- Heirs of Jose Lim vs. Lim, 614 SCRA 141, March 03, 2010Document13 pagesHeirs of Jose Lim vs. Lim, 614 SCRA 141, March 03, 2010raikha barraNo ratings yet

- Calculation of Natural Gas Isentropic ExponentDocument8 pagesCalculation of Natural Gas Isentropic ExponentsekharsamyNo ratings yet

- F0606 Application For EmploymentDocument3 pagesF0606 Application For EmploymentIhwan AsrulNo ratings yet

- Toaz - Info Solution Manual For Physical Metallurgy Principles 4th Edition by Abbaschian Sam PRDocument12 pagesToaz - Info Solution Manual For Physical Metallurgy Principles 4th Edition by Abbaschian Sam PRbunnysanganiNo ratings yet

- 9426 ATS Planning Manual Part 1 Modul PDFDocument75 pages9426 ATS Planning Manual Part 1 Modul PDFwahyu armiikoNo ratings yet

- Death or Physical Injuries Inflicted Under Exceptional CircumstancesDocument7 pagesDeath or Physical Injuries Inflicted Under Exceptional CircumstancestimothymaderazoNo ratings yet

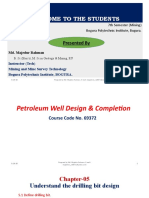

- Drilling Bit DesignDocument14 pagesDrilling Bit DesignMajedur Rahman100% (1)

- Master of Information Technology and Systems (973AA)Document4 pagesMaster of Information Technology and Systems (973AA)kira_suziniNo ratings yet

- Prepositions and ConjunctionsDocument10 pagesPrepositions and ConjunctionsPhạm Đức ThịnhNo ratings yet

- In The Supreme Court of Guam: Vasudev B. HemlaniDocument12 pagesIn The Supreme Court of Guam: Vasudev B. HemlaniJudiciary of GuamNo ratings yet

- Chapter 7 - Strategy Implementation - NarrativeDocument14 pagesChapter 7 - Strategy Implementation - NarrativeShelly Mae SiguaNo ratings yet

- Ang Tibuok Mong KinabuhiDocument6 pagesAng Tibuok Mong KinabuhiJuliet PanogalinogNo ratings yet

- Shock 2022 SeminarDocument17 pagesShock 2022 Seminarrosie100% (2)

- Digital Media Project Proposal: Submitted To: DR Sawera ShamiDocument3 pagesDigital Media Project Proposal: Submitted To: DR Sawera ShamiJaveria JanNo ratings yet

- Wind Turbine ComponentsDocument3 pagesWind Turbine ComponentssayedNo ratings yet

- 2020 21 RGICL Annual ReportDocument113 pages2020 21 RGICL Annual ReportShubrojyoti ChowdhuryNo ratings yet

- The Balkan RailwaysDocument45 pagesThe Balkan Railwaysvanveen1967100% (3)

- Iwc DumpDocument28 pagesIwc DumpSendy Rubio bonilla96No ratings yet