Professional Documents

Culture Documents

6b.employee Benefits - Part 2

6b.employee Benefits - Part 2

Uploaded by

Tochi OotaCopyright:

Available Formats

You might also like

- Questionnaire On Effectiveness of Monetary Benefits On Motivation and Retention of EmployeesDocument1 pageQuestionnaire On Effectiveness of Monetary Benefits On Motivation and Retention of EmployeesSonali Arora88% (8)

- Employee Benefit 1 PDFDocument34 pagesEmployee Benefit 1 PDFbobo kaNo ratings yet

- Chapter 13 - Partnership Dissolution (Problem 3-Journal Entries)Document11 pagesChapter 13 - Partnership Dissolution (Problem 3-Journal Entries)Penelope Palcon75% (4)

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)admiral spongebobNo ratings yet

- Sol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsDocument13 pagesSol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsFery Ann100% (5)

- A. Fair Value of Plan Assets On December 31, 20x1Document9 pagesA. Fair Value of Plan Assets On December 31, 20x1MHARTIN DAENNIELLE ORSALNo ratings yet

- Intacc Employee BenefitDocument8 pagesIntacc Employee BenefitJoyce ManaloNo ratings yet

- ACC2001 Lecture 9 IllustrationDocument7 pagesACC2001 Lecture 9 Illustrationmichael krueseiNo ratings yet

- Employee Benefits: Defined Benefit PlansDocument4 pagesEmployee Benefits: Defined Benefit PlansMHARTIN DAENNIELLE ORSALNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document11 pagesChapter 6 - Consolidated Financial Statements (Part 3)Kim GarciaNo ratings yet

- BusinessCombi (Chapter 6)Document5 pagesBusinessCombi (Chapter 6)richmond naragNo ratings yet

- Employee Benefits (Part 2) : Problem 1: True or FalseDocument21 pagesEmployee Benefits (Part 2) : Problem 1: True or FalseChi Chi100% (1)

- Chapter 6 Employee Benefits 2Document16 pagesChapter 6 Employee Benefits 2Thalia Rhine AberteNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Postemployment Benefits Wendy CompanyDocument6 pagesPostemployment Benefits Wendy CompanyArmelen DeloyNo ratings yet

- Lecture 5-PostDocument52 pagesLecture 5-PostcoolirlbbNo ratings yet

- Far Module 21 27Document61 pagesFar Module 21 27ryanNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- Sol. Man. - Chapter 6 Employee Benefits 2Document17 pagesSol. Man. - Chapter 6 Employee Benefits 2Miguel Amihan100% (1)

- Consolidated Financial Statement-Part 3Document6 pagesConsolidated Financial Statement-Part 3JINKY TOLENTINONo ratings yet

- 1Document10 pages1Dan Shadrach DapegNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumNo ratings yet

- SM01 EmployeeBenefitsDocument1 pageSM01 EmployeeBenefitsJoan Rachel CalansinginNo ratings yet

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- ACCA F7 Mock Exam 1 AnswersDocument11 pagesACCA F7 Mock Exam 1 Answershunaid.ayeshaNo ratings yet

- Diara Po.Document7 pagesDiara Po.Rio Cyrel CelleroNo ratings yet

- Sol. Man. - Chapter 6 - Employee Benefits (Part 2) - 2021Document24 pagesSol. Man. - Chapter 6 - Employee Benefits (Part 2) - 2021Ventilacion, Jayson M.No ratings yet

- Employee Benefits Part 2 pROBLEM 3-8Document2 pagesEmployee Benefits Part 2 pROBLEM 3-8Christian QuidipNo ratings yet

- Chapter 18 Ia2Document18 pagesChapter 18 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- CA Inter FM - Nov 2018 Suggested AnswersDocument14 pagesCA Inter FM - Nov 2018 Suggested Answersrisavey693No ratings yet

- SBR Practice Questions 2019 - ADocument305 pagesSBR Practice Questions 2019 - AALEX TRANNo ratings yet

- Afm Long - Term Financing - LeveragesDocument8 pagesAfm Long - Term Financing - LeveragesDaniel HaileNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Sol. Man. Chapter 6 Employee Benefits Part 2 2021Document24 pagesSol. Man. Chapter 6 Employee Benefits Part 2 2021Kim HanbinNo ratings yet

- Loan Loss Provision TaxDocument13 pagesLoan Loss Provision TaxSabin YadavNo ratings yet

- Sem 7Document84 pagesSem 7Bình QuốcNo ratings yet

- Module 31 Employee Benefits ProblemDocument2 pagesModule 31 Employee Benefits ProblemThalia UyNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Go CompanyDocument3 pagesGo CompanyMaui100% (2)

- Activity Chapter 5Document3 pagesActivity Chapter 5Randelle James FiestaNo ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- Employee Benefits 2 Employee Benefits 2Document4 pagesEmployee Benefits 2 Employee Benefits 2XNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Sitti Ayesha HasimanNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- E-Book Perfect Practice BooksDocument36 pagesE-Book Perfect Practice BooksSavit Bansal100% (1)

- UEDocument1 pageUEfastslowerNo ratings yet

- L19 RC Problems On ROI and EVADocument8 pagesL19 RC Problems On ROI and EVAapi-3820619100% (2)

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- Quiz 1 SolutionsDocument4 pagesQuiz 1 SolutionsLJ BNo ratings yet

- Reviewer TAXDocument3 pagesReviewer TAXAnnabel MendozaNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Chapter 7 BusscomDocument65 pagesChapter 7 BusscomJM Valonda Villena, CPA, MBANo ratings yet

- CHAPTER6Document24 pagesCHAPTER6Lhica EsterasNo ratings yet

- Sol Man - Pas 19 Employee BenefitsDocument2 pagesSol Man - Pas 19 Employee BenefitsCatherine AcutimNo ratings yet

- IA2 Employee BenefitDocument4 pagesIA2 Employee BenefitCJ RianoNo ratings yet

- Review Materials For INTERM2Document10 pagesReview Materials For INTERM2Danna VargasNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- By Yash Institute, Nanded. (DR - Adv. MD - Ahmed Memon) (Institute For Mba, Mca Entrance & Banking Exams Since 2009)Document12 pagesBy Yash Institute, Nanded. (DR - Adv. MD - Ahmed Memon) (Institute For Mba, Mca Entrance & Banking Exams Since 2009)Akash GoreNo ratings yet

- Accounting For Labor ExercisesDocument6 pagesAccounting For Labor ExercisesNichole Joy XielSera TanNo ratings yet

- Republic Act No. 8291Document14 pagesRepublic Act No. 8291MerabSalio-anNo ratings yet

- MangementDocument21 pagesMangementshubham rathodNo ratings yet

- Nextcare Medical Reimbursement FormDocument1 pageNextcare Medical Reimbursement FormKunal NandyNo ratings yet

- SBI Life - Retire Smart - Brochure - Ver03Document16 pagesSBI Life - Retire Smart - Brochure - Ver03Vishal kaushalendra Kumar singhNo ratings yet

- Provident Fund: How Should Provident Fund Trust Deed and Rules Consist ofDocument3 pagesProvident Fund: How Should Provident Fund Trust Deed and Rules Consist ofAzhar Rana100% (1)

- TAX2601 LU3 Content 2023Document21 pagesTAX2601 LU3 Content 2023sibongileNo ratings yet

- Group Assignment: Pay For Performance and Financial IncentiveDocument24 pagesGroup Assignment: Pay For Performance and Financial IncentiveThiên KimNo ratings yet

- Components of CompensationDocument4 pagesComponents of CompensationAnil Kumar SinghNo ratings yet

- 1 Which of The Following Statements Is Incorrect A AnDocument2 pages1 Which of The Following Statements Is Incorrect A AnAmit PandeyNo ratings yet

- Form No. INC-33: Refer Instruction Kit For Filing The Form All Fields Marked in Are MandatoryDocument10 pagesForm No. INC-33: Refer Instruction Kit For Filing The Form All Fields Marked in Are Mandatoryayush.guptaNo ratings yet

- AFCA - Rules PDFDocument50 pagesAFCA - Rules PDFkkNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Director GGINo ratings yet

- Journalize The Transactions Journalize The FollowingDocument4 pagesJournalize The Transactions Journalize The FollowingDoreenNo ratings yet

- 158 Jaimin Arun Vasani TyBaf Indirect Tax AssigmentDocument17 pages158 Jaimin Arun Vasani TyBaf Indirect Tax AssigmentJaimin VasaniNo ratings yet

- Assessment Details and Submission Guidelines: Holmes Institute Faculty of Higher EducationDocument6 pagesAssessment Details and Submission Guidelines: Holmes Institute Faculty of Higher EducationMuhammad Sheharyar MohsinNo ratings yet

- Unit 8,9,10. Compensation, Rewards and BenefitsDocument85 pagesUnit 8,9,10. Compensation, Rewards and BenefitsPARTH RANANo ratings yet

- DeNisi Sarkar HR PPT Ch06Document31 pagesDeNisi Sarkar HR PPT Ch06SakshiNo ratings yet

- LDCE Notes/Solution of LGS/LGS2011Document31 pagesLDCE Notes/Solution of LGS/LGS2011R Sathish KumarNo ratings yet

- Prashant Priyadarshi A-20 Banking TermpaperDocument23 pagesPrashant Priyadarshi A-20 Banking TermpaperPrashantNo ratings yet

- (April 1)Document1 page(April 1)Nakul NagpureNo ratings yet

- Tax Computation and Applicable AttachmentDocument5 pagesTax Computation and Applicable AttachmentJermone MuaripNo ratings yet

- Itdf PDFDocument2 pagesItdf PDFskgaddeNo ratings yet

- J.B. Pritzker 2022 Federal ReturnDocument8 pagesJ.B. Pritzker 2022 Federal ReturnRobert Garcia100% (1)

- Annual Gross IncomeDocument4 pagesAnnual Gross IncomeMarilyn Perez OlañoNo ratings yet

- For Boi IncentivesDocument7 pagesFor Boi Incentiveskimberly fanoNo ratings yet

- Pru Life U.K.: Group SeminarDocument14 pagesPru Life U.K.: Group SeminarAda AdelineNo ratings yet

- Fillable How To Check Payslips Online As Fidelity Security Worker FormDocument20 pagesFillable How To Check Payslips Online As Fidelity Security Worker FormBang YehNo ratings yet

6b.employee Benefits - Part 2

6b.employee Benefits - Part 2

Uploaded by

Tochi OotaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6b.employee Benefits - Part 2

6b.employee Benefits - Part 2

Uploaded by

Tochi OotaCopyright:

Available Formats

PROGRAM: Bachelor of Science in Accountancy

LEVEL: 2

COURSE TITLE: INTERMEDIATE ACCOUNTING II

COURSE CODE: ATAE16

NO. OF UNITS: 6

PRE-REQUISITE: Intermediate Accounting I

MODULE TITLE: EMPLOYEE BENEFITS (PART 2)continuation

REFERENCE: Intermediate Accounting 2 by: Zeus Vernon B. Millan

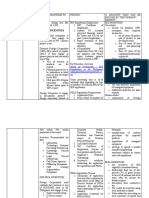

Illustration: Return and interest income on plan assets

Information on ABC Co.’s defined benefit plan on Jan 1, 20x1 is as follows:

Fair value of plan assets, Jan 1 120,000

Present value of the defined benefit obligation 180,000

Discount rate based on high quality corporate bonds 5%

Information on changes during the year:

Contributions to the fund, July 1, 20x1 200,000

Benefits paid to retirees, Sept. 30, 20x1 50,000

Fair value of plan assets, Dec 31 282,000

Present value of defined benefit obligation, Dec 31 360,000

Requirements: Compute the following:

a. Interest income on plan assets

b. Return on plan assets

c. Remeasurements to the net defined benefit liability (asset)

Solutions:

a. Interest income on plan assets

Interest income on the beginning balance of FVPA (120,000 x 5% x 12/12) 6,000

Interest income on the contributions made on July 1, 20x1 (200,000 x 5% x 6/12) 5,000

Reduction in interest income due to the benefits paid out of the plan assets

On Sept. 30, 20x1 (50,000 x 5% x 3/12) ( 625)

Interest income on plan assets 10,375

b. Return on plan assets

Fair value of plan assets

Jan 1 120,000

Return on plan assets (squeeze) 12,000 50,000 Benefits paid

Contributions to the fund 200,000

282,000 Dec 31

c. Remeasurement to net defined benefit liability/asset

Interest income on plan assets 10,375

Return on plan assets (12,000)

----------

Gain ( 1,625)

=======

Illustration: Return and interest income on plan assets

Fair value of plan assets, Jan 1 1,000,000

Interest income (actual) 200,000

Unrealized gains from fair value changes (actual) 100,000

Costs of managing plan assets 20,000

Tax on gross returns 10%

Discount rate 12%

Requirements: Compute the following:

a. Return on plan assets

b. Ending balance on the fair value of plan assets

c. Amounts recognized in profit and loss and other comprehensive income

Solutions:

a. Return on plan assets

Note: Costs of managing the fund and taxes are deducted when determining the return on plan

assets

Interest income (actual) 200,000

Unrealized gains from fair value changes (actual) 100,000

-----------

Gross return on plan assets 300,000

Less: Costs of managing plan assets ( 20,000)

Taxes (300,000 x 10%) (30,000)

------------

Return on plan assets 250,000

=======

b. FVPA

Fair value of plan assets

Jan 1 1,000,000

Return on plan assets 250,000 - Benefits paid

Contributions to the fund -

1,250,000 Dec 31

c. Amounts recognized in P/L and OCI

Fair value of plan assets, Jan 1 1,000,000

Multiply by: 12%

-------------

Interest income on plan assets recognized in P/L 120,000

========

Interest income on plan assets 120,000

Return on plan assets ( 250,000)

--------------

Remeasurement gain recognized in OCI (130,000)

========

Illustration: Remeasurement-Effect on asset ceiling

Fair value of plan assets, Jan 1 700,000

PV of defined benefit obligation, Jan 1 550,000

Fair value of plan assets, Dec 31 1,200,000

PV of defined benefit obligation 800,000

Discount rate 10%

The asset ceiling amounts are P100,000 and P250,000 on Jan 1 and Dec 31, respectively

Requirements: Compute the following:

a. Interest on the effect of asset ceiling

b. Difference between the change in the effect of the asset ceiling and interest on the effect of the

asset ceiling

Solutions:

a. Interest on the effect of asset ceiling

Jan 1 Dec 31 Change

FVPA 700,000 1,200,000

PV of DBO 550,000 800,000

Surplus 150,000 400,000

Asset ceiling 100,000 250,000

Effect of asset ceiling 50,000 150,000 100,000

Effect of the asset ceiling-Jan 1 50,000

Multiply by: Discount rate 10%

----------

Interest on the effect of the asset ceiling-P/L 5,000

======

b. Remeasurement-difference between interest and change

Interest on the effect of the asset ceiling 5,000

Less: Change in the effect of the asset ceiling 100,000

------------

Remeasurement recognized in OCI 95,000

========

Reconciliation:

Interest on the effect of the asset ceiling – P/L 5,000

Remeasurement (loss) – OCI 95,000

-------------

Total change in the effect of the asset ceiling 100,000

========

Illustration: Comprehensive

Information on the ABC Co.’s defined benefit plan is shown below:

The fair value of the plan assets on Jan 1, 20x1 was P1,800,000.

The actuarial valuation of the defined benefit obligation on Jan 1, 20x1 was P2,000,000.

The actuarial present value of future benefits earned by employees for services rendered in

20x1 amounted to P300,000.

During the year, ABC Co. amended its retirement plan. The amendment increased the present

value of the defined benefit obligation by P400,000, 20% of which relates to benefits that have

already vested. The remaining portion will vest in 5 years.

Changes in actuarial assumptions resulted to a decrease of P160,000 in the present value of the

defined benefit obligation. It was also determined that there was a P20,000 decrease in the fair

value of the plan assets due to changes in fair values.

The realized gains on the investments in the plan assets in 20x1 amounted to P280,000.

Benefits paid during 20x1 amounted to P50,000. No contributions were made to the fund

during 20x1.

The discount rate is 9%.

Requirements: Compute the following:

a. Net defined benefit liability/asset on Dec 31, 20x1

b. Defined benefit cost for 20x1

Solutions:

a. Net defined benefit liability (asset)-Dec 31

PV of defined benefit obligation

2,000,000 Jan 1

Benefits paid 50,000 300,000 Current service cost

Actuarial gain 160,000 400,000 Past service cost

180,000 Interest cost (2M x 9%)

Dec 31 2,670,000

Fair value of plan assets

Jan 1 1,800,000

Return on plan assets 260,000 50,000 Benefits paid

Contributions to the fund -

2,010,000 Dec 31

FVPA, Dec 31 2,010,000

PV of DBO, Dec 31 2,670,000

--------------

Net defined benefit liability-Dec 31 (deficit) ( 660,000)

=========

b. Defined benefit cost (Alternative computation)

Current service cost 300,000

Past service cost 400,000

Net loss on settlement of plan during the year -

Net interest on the net defined liability (asset) 18,000

Defined benefit cost recognized in profit or loss 718,000

Actuarial (gain) loss (160,000)

Diff. between interest income and return on PA ( 98,000)

Diff. between int. on effect and change in the -

Effect

Defined benefit cost recognized on OCI (258,000)

Total defined benefit cost 460,000

==============================================================================

You might also like

- Questionnaire On Effectiveness of Monetary Benefits On Motivation and Retention of EmployeesDocument1 pageQuestionnaire On Effectiveness of Monetary Benefits On Motivation and Retention of EmployeesSonali Arora88% (8)

- Employee Benefit 1 PDFDocument34 pagesEmployee Benefit 1 PDFbobo kaNo ratings yet

- Chapter 13 - Partnership Dissolution (Problem 3-Journal Entries)Document11 pagesChapter 13 - Partnership Dissolution (Problem 3-Journal Entries)Penelope Palcon75% (4)

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)admiral spongebobNo ratings yet

- Sol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsDocument13 pagesSol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsFery Ann100% (5)

- A. Fair Value of Plan Assets On December 31, 20x1Document9 pagesA. Fair Value of Plan Assets On December 31, 20x1MHARTIN DAENNIELLE ORSALNo ratings yet

- Intacc Employee BenefitDocument8 pagesIntacc Employee BenefitJoyce ManaloNo ratings yet

- ACC2001 Lecture 9 IllustrationDocument7 pagesACC2001 Lecture 9 Illustrationmichael krueseiNo ratings yet

- Employee Benefits: Defined Benefit PlansDocument4 pagesEmployee Benefits: Defined Benefit PlansMHARTIN DAENNIELLE ORSALNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document11 pagesChapter 6 - Consolidated Financial Statements (Part 3)Kim GarciaNo ratings yet

- BusinessCombi (Chapter 6)Document5 pagesBusinessCombi (Chapter 6)richmond naragNo ratings yet

- Employee Benefits (Part 2) : Problem 1: True or FalseDocument21 pagesEmployee Benefits (Part 2) : Problem 1: True or FalseChi Chi100% (1)

- Chapter 6 Employee Benefits 2Document16 pagesChapter 6 Employee Benefits 2Thalia Rhine AberteNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Postemployment Benefits Wendy CompanyDocument6 pagesPostemployment Benefits Wendy CompanyArmelen DeloyNo ratings yet

- Lecture 5-PostDocument52 pagesLecture 5-PostcoolirlbbNo ratings yet

- Far Module 21 27Document61 pagesFar Module 21 27ryanNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- Sol. Man. - Chapter 6 Employee Benefits 2Document17 pagesSol. Man. - Chapter 6 Employee Benefits 2Miguel Amihan100% (1)

- Consolidated Financial Statement-Part 3Document6 pagesConsolidated Financial Statement-Part 3JINKY TOLENTINONo ratings yet

- 1Document10 pages1Dan Shadrach DapegNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumNo ratings yet

- SM01 EmployeeBenefitsDocument1 pageSM01 EmployeeBenefitsJoan Rachel CalansinginNo ratings yet

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- ACCA F7 Mock Exam 1 AnswersDocument11 pagesACCA F7 Mock Exam 1 Answershunaid.ayeshaNo ratings yet

- Diara Po.Document7 pagesDiara Po.Rio Cyrel CelleroNo ratings yet

- Sol. Man. - Chapter 6 - Employee Benefits (Part 2) - 2021Document24 pagesSol. Man. - Chapter 6 - Employee Benefits (Part 2) - 2021Ventilacion, Jayson M.No ratings yet

- Employee Benefits Part 2 pROBLEM 3-8Document2 pagesEmployee Benefits Part 2 pROBLEM 3-8Christian QuidipNo ratings yet

- Chapter 18 Ia2Document18 pagesChapter 18 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- CA Inter FM - Nov 2018 Suggested AnswersDocument14 pagesCA Inter FM - Nov 2018 Suggested Answersrisavey693No ratings yet

- SBR Practice Questions 2019 - ADocument305 pagesSBR Practice Questions 2019 - AALEX TRANNo ratings yet

- Afm Long - Term Financing - LeveragesDocument8 pagesAfm Long - Term Financing - LeveragesDaniel HaileNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Sol. Man. Chapter 6 Employee Benefits Part 2 2021Document24 pagesSol. Man. Chapter 6 Employee Benefits Part 2 2021Kim HanbinNo ratings yet

- Loan Loss Provision TaxDocument13 pagesLoan Loss Provision TaxSabin YadavNo ratings yet

- Sem 7Document84 pagesSem 7Bình QuốcNo ratings yet

- Module 31 Employee Benefits ProblemDocument2 pagesModule 31 Employee Benefits ProblemThalia UyNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Go CompanyDocument3 pagesGo CompanyMaui100% (2)

- Activity Chapter 5Document3 pagesActivity Chapter 5Randelle James FiestaNo ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- Employee Benefits 2 Employee Benefits 2Document4 pagesEmployee Benefits 2 Employee Benefits 2XNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Sitti Ayesha HasimanNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- E-Book Perfect Practice BooksDocument36 pagesE-Book Perfect Practice BooksSavit Bansal100% (1)

- UEDocument1 pageUEfastslowerNo ratings yet

- L19 RC Problems On ROI and EVADocument8 pagesL19 RC Problems On ROI and EVAapi-3820619100% (2)

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- Quiz 1 SolutionsDocument4 pagesQuiz 1 SolutionsLJ BNo ratings yet

- Reviewer TAXDocument3 pagesReviewer TAXAnnabel MendozaNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Chapter 7 BusscomDocument65 pagesChapter 7 BusscomJM Valonda Villena, CPA, MBANo ratings yet

- CHAPTER6Document24 pagesCHAPTER6Lhica EsterasNo ratings yet

- Sol Man - Pas 19 Employee BenefitsDocument2 pagesSol Man - Pas 19 Employee BenefitsCatherine AcutimNo ratings yet

- IA2 Employee BenefitDocument4 pagesIA2 Employee BenefitCJ RianoNo ratings yet

- Review Materials For INTERM2Document10 pagesReview Materials For INTERM2Danna VargasNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- By Yash Institute, Nanded. (DR - Adv. MD - Ahmed Memon) (Institute For Mba, Mca Entrance & Banking Exams Since 2009)Document12 pagesBy Yash Institute, Nanded. (DR - Adv. MD - Ahmed Memon) (Institute For Mba, Mca Entrance & Banking Exams Since 2009)Akash GoreNo ratings yet

- Accounting For Labor ExercisesDocument6 pagesAccounting For Labor ExercisesNichole Joy XielSera TanNo ratings yet

- Republic Act No. 8291Document14 pagesRepublic Act No. 8291MerabSalio-anNo ratings yet

- MangementDocument21 pagesMangementshubham rathodNo ratings yet

- Nextcare Medical Reimbursement FormDocument1 pageNextcare Medical Reimbursement FormKunal NandyNo ratings yet

- SBI Life - Retire Smart - Brochure - Ver03Document16 pagesSBI Life - Retire Smart - Brochure - Ver03Vishal kaushalendra Kumar singhNo ratings yet

- Provident Fund: How Should Provident Fund Trust Deed and Rules Consist ofDocument3 pagesProvident Fund: How Should Provident Fund Trust Deed and Rules Consist ofAzhar Rana100% (1)

- TAX2601 LU3 Content 2023Document21 pagesTAX2601 LU3 Content 2023sibongileNo ratings yet

- Group Assignment: Pay For Performance and Financial IncentiveDocument24 pagesGroup Assignment: Pay For Performance and Financial IncentiveThiên KimNo ratings yet

- Components of CompensationDocument4 pagesComponents of CompensationAnil Kumar SinghNo ratings yet

- 1 Which of The Following Statements Is Incorrect A AnDocument2 pages1 Which of The Following Statements Is Incorrect A AnAmit PandeyNo ratings yet

- Form No. INC-33: Refer Instruction Kit For Filing The Form All Fields Marked in Are MandatoryDocument10 pagesForm No. INC-33: Refer Instruction Kit For Filing The Form All Fields Marked in Are Mandatoryayush.guptaNo ratings yet

- AFCA - Rules PDFDocument50 pagesAFCA - Rules PDFkkNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Director GGINo ratings yet

- Journalize The Transactions Journalize The FollowingDocument4 pagesJournalize The Transactions Journalize The FollowingDoreenNo ratings yet

- 158 Jaimin Arun Vasani TyBaf Indirect Tax AssigmentDocument17 pages158 Jaimin Arun Vasani TyBaf Indirect Tax AssigmentJaimin VasaniNo ratings yet

- Assessment Details and Submission Guidelines: Holmes Institute Faculty of Higher EducationDocument6 pagesAssessment Details and Submission Guidelines: Holmes Institute Faculty of Higher EducationMuhammad Sheharyar MohsinNo ratings yet

- Unit 8,9,10. Compensation, Rewards and BenefitsDocument85 pagesUnit 8,9,10. Compensation, Rewards and BenefitsPARTH RANANo ratings yet

- DeNisi Sarkar HR PPT Ch06Document31 pagesDeNisi Sarkar HR PPT Ch06SakshiNo ratings yet

- LDCE Notes/Solution of LGS/LGS2011Document31 pagesLDCE Notes/Solution of LGS/LGS2011R Sathish KumarNo ratings yet

- Prashant Priyadarshi A-20 Banking TermpaperDocument23 pagesPrashant Priyadarshi A-20 Banking TermpaperPrashantNo ratings yet

- (April 1)Document1 page(April 1)Nakul NagpureNo ratings yet

- Tax Computation and Applicable AttachmentDocument5 pagesTax Computation and Applicable AttachmentJermone MuaripNo ratings yet

- Itdf PDFDocument2 pagesItdf PDFskgaddeNo ratings yet

- J.B. Pritzker 2022 Federal ReturnDocument8 pagesJ.B. Pritzker 2022 Federal ReturnRobert Garcia100% (1)

- Annual Gross IncomeDocument4 pagesAnnual Gross IncomeMarilyn Perez OlañoNo ratings yet

- For Boi IncentivesDocument7 pagesFor Boi Incentiveskimberly fanoNo ratings yet

- Pru Life U.K.: Group SeminarDocument14 pagesPru Life U.K.: Group SeminarAda AdelineNo ratings yet

- Fillable How To Check Payslips Online As Fidelity Security Worker FormDocument20 pagesFillable How To Check Payslips Online As Fidelity Security Worker FormBang YehNo ratings yet