Professional Documents

Culture Documents

Sas #24 - Accounting Information System

Sas #24 - Accounting Information System

Uploaded by

Euli Mae SomeraCopyright:

Available Formats

You might also like

- Quickbooks Advanced Certification Part 3Document54 pagesQuickbooks Advanced Certification Part 3Ahmed Rajput75% (8)

- Quickbooks Advanced Certification Part 2Document43 pagesQuickbooks Advanced Certification Part 2Ahmed Rajput50% (6)

- Skrillex Lost Settlement SheetsDocument11 pagesSkrillex Lost Settlement Sheetsapi-302693310100% (2)

- Oracle Test CasesDocument7 pagesOracle Test Casessanjeev19_ynr0% (1)

- Remita PDFDocument1 pageRemita PDFJoyNo ratings yet

- Auditing The Revenue CycleDocument63 pagesAuditing The Revenue CycleJohn Lexter MacalberNo ratings yet

- Buslaw3 VATDocument58 pagesBuslaw3 VATVan TisbeNo ratings yet

- Sas #25 - Accounting Information SystemDocument5 pagesSas #25 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- Daily Chores in QuickbooksDocument8 pagesDaily Chores in QuickbooksPrincess Nicole Posadas OniaNo ratings yet

- Lesson 5: Customers and Sales Part 1Document30 pagesLesson 5: Customers and Sales Part 1Not Going to Argue Jesus is KingNo ratings yet

- A. QB Lesson 6Document28 pagesA. QB Lesson 6Shena Mari Trixia Gepana100% (1)

- SuiteAcademy - Accounting Module 3Document17 pagesSuiteAcademy - Accounting Module 3Chan Yi LinNo ratings yet

- Chapter 3Document18 pagesChapter 3Severus HadesNo ratings yet

- Sas #23 - Accounting Information SystemDocument4 pagesSas #23 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- Learning Sage 50 Accounting 2016 A Modular Approach 1st Edition Freedman Solutions ManualDocument25 pagesLearning Sage 50 Accounting 2016 A Modular Approach 1st Edition Freedman Solutions ManualColtonCunninghamacgn100% (53)

- Chapter 5 - Revenue CycleDocument6 pagesChapter 5 - Revenue Cycleviox reyesNo ratings yet

- FY19 - QBDT Client - Lesson-6 - Enter Sales Information - BDB - v2Document37 pagesFY19 - QBDT Client - Lesson-6 - Enter Sales Information - BDB - v2Nyasha MakoreNo ratings yet

- QuickBooks SyllabusDocument10 pagesQuickBooks SyllabusNot Going to Argue Jesus is KingNo ratings yet

- The Big ListDocument16 pagesThe Big ListHemanth KumarNo ratings yet

- Acc-106 TG 6Document9 pagesAcc-106 TG 6leisky3.07No ratings yet

- Instuctor Lesson 03Document38 pagesInstuctor Lesson 03Ramen NoodlesNo ratings yet

- Accounts - Accounts Receivable Process - Process - STDocument10 pagesAccounts - Accounts Receivable Process - Process - STmatthew mafaraNo ratings yet

- Daily Chores in Quickbook 2Document4 pagesDaily Chores in Quickbook 2Princess Nicole Posadas OniaNo ratings yet

- Fabm2 ActivitiesDocument13 pagesFabm2 ActivitiesNorlaica TAURAKNo ratings yet

- Tanauan Institute, Inc.: PurchasesDocument9 pagesTanauan Institute, Inc.: PurchasesHanna CaraigNo ratings yet

- IT Audit 4ed SM Ch9Document62 pagesIT Audit 4ed SM Ch9randomlungs121223No ratings yet

- IT Audit 4ed SM Ch9Document62 pagesIT Audit 4ed SM Ch9randomlungs121223No ratings yet

- FABM 1 Q2 Weeks 3 4Document11 pagesFABM 1 Q2 Weeks 3 4Maria Hannahlyn Batumbakal DimakulanganNo ratings yet

- M4 Assign No 1 Qtn-1Document2 pagesM4 Assign No 1 Qtn-1Aliah RomeroNo ratings yet

- Quickbooks 2006 Score Student Guide Tracking and Paying Sales TaxDocument16 pagesQuickbooks 2006 Score Student Guide Tracking and Paying Sales TaxRamen NoodlesNo ratings yet

- SuiteAcademy - Accounting Module 4Document18 pagesSuiteAcademy - Accounting Module 4Chan Yi LinNo ratings yet

- F-90 Asset Acquisition With VendorDocument5 pagesF-90 Asset Acquisition With Vendorsunil23456100% (2)

- Exam Preparation QuickbooksDocument29 pagesExam Preparation QuickbooksSyed ShafanNo ratings yet

- 1 Accounting IntroductionDocument16 pages1 Accounting Introductiontmskannan1967No ratings yet

- Accounting 1Document7 pagesAccounting 1Rommel Angelo AgacitaNo ratings yet

- Menu Message: Textbook ProblemDocument10 pagesMenu Message: Textbook ProblemMeilani Irma SalesNo ratings yet

- Introduction To Accounting Transcript 0Document9 pagesIntroduction To Accounting Transcript 0mohsrourNo ratings yet

- in Asset Accounting (FI-AA) in Integration With Accounts Payable (FI-AP), But Without Reference To A Purchase OrderDocument5 pagesin Asset Accounting (FI-AA) in Integration With Accounts Payable (FI-AP), But Without Reference To A Purchase OrdersiddharthNo ratings yet

- Training Program For Store KeepersDocument7 pagesTraining Program For Store KeepersOlalekan PopoolaNo ratings yet

- Class 11 Account Solution For Session (2023-2024) Chapter-4 Recording of Transaction-IIDocument104 pagesClass 11 Account Solution For Session (2023-2024) Chapter-4 Recording of Transaction-IIsyed mohdNo ratings yet

- FABM2 Module 2. Statement of Comprehensive IncomeDocument13 pagesFABM2 Module 2. Statement of Comprehensive IncomeSITTIE RAYMAH ABDULLAHNo ratings yet

- Sales Management SystemDocument13 pagesSales Management Systemtayyaba malikNo ratings yet

- Sas8 Acc100Document12 pagesSas8 Acc100XieNo ratings yet

- Quickbooks 2006 Score Student Guide Entering and Paying BillsDocument11 pagesQuickbooks 2006 Score Student Guide Entering and Paying BillsRamen NoodlesNo ratings yet

- Chap 05 - Merchandising Operations and The Multiple-Step Income Statement (ICA)Document7 pagesChap 05 - Merchandising Operations and The Multiple-Step Income Statement (ICA)Mohamed DiabNo ratings yet

- XK01 - Create Vendor Master: Cost Center Accounting Accounts PayableDocument5 pagesXK01 - Create Vendor Master: Cost Center Accounting Accounts PayableseenusrinivasNo ratings yet

- Q1 LAS Business Finance 12 Week 4 3Document6 pagesQ1 LAS Business Finance 12 Week 4 3Paulo AragonNo ratings yet

- Q1 LAS Business Finance 12 Week 4Document6 pagesQ1 LAS Business Finance 12 Week 4Gerlie BorneaNo ratings yet

- Assignment-1 Aryan Dhir A00157541 GaganSir WaliDocument12 pagesAssignment-1 Aryan Dhir A00157541 GaganSir WaliDeepanshu SHarmaNo ratings yet

- SABTLECTURE07Document26 pagesSABTLECTURE07namudajiyaNo ratings yet

- Expenditure Cycle: For Each Document Listed: 1. Highlight The Important Information 2. Describe Why It Is SignificantDocument13 pagesExpenditure Cycle: For Each Document Listed: 1. Highlight The Important Information 2. Describe Why It Is SignificantRizza L. MacarandanNo ratings yet

- Chapter 4Document17 pagesChapter 4Severus HadesNo ratings yet

- Quickbooks DashboardDocument3 pagesQuickbooks Dashboardvanosoy19No ratings yet

- Lesson 4 Expenditure Cycle PDFDocument19 pagesLesson 4 Expenditure Cycle PDFJoshua JunsayNo ratings yet

- F-90 Asset Acquisition With VendorDocument8 pagesF-90 Asset Acquisition With VendorYTB ResearcherNo ratings yet

- RansaDocument15 pagesRansaNan Ngwe Lar SanNo ratings yet

- (FABM 2) Interactive Module Week 2Document12 pages(FABM 2) Interactive Module Week 2Krisha FernandezNo ratings yet

- Senior High School Department: Quarter 3 - Module 8: Merchandising Concern (Part 1)Document9 pagesSenior High School Department: Quarter 3 - Module 8: Merchandising Concern (Part 1)Jaye RuantoNo ratings yet

- Republic of The Philippines Department of Education Public Technical - Vocational High SchoolsDocument10 pagesRepublic of The Philippines Department of Education Public Technical - Vocational High SchoolsKristel AcordonNo ratings yet

- 005 Caaccst Ch03 Amndd Hs SecDocument20 pages005 Caaccst Ch03 Amndd Hs SecshubratadigitalNo ratings yet

- Transactions NotesDocument6 pagesTransactions NotesHang DauNo ratings yet

- Quickbooks NotesDocument21 pagesQuickbooks NotesWaivorchih Waibochi GiterhihNo ratings yet

- Business and Transfer TaxationDocument16 pagesBusiness and Transfer TaxationEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - ProblemsDocument3 pagesBusiness and Transfer Taxation - ProblemsEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - T or FDocument3 pagesBusiness and Transfer Taxation - T or FEuli Mae SomeraNo ratings yet

- ACC 100 Test BanksDocument15 pagesACC 100 Test BanksEuli Mae SomeraNo ratings yet

- Sas #23 - Accounting Information SystemDocument4 pagesSas #23 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - Multiple ChoiceDocument7 pagesBusiness and Transfer Taxation - Multiple ChoiceEuli Mae SomeraNo ratings yet

- MODULE 12 The Conversion CycleDocument6 pagesMODULE 12 The Conversion CycleEuli Mae SomeraNo ratings yet

- MODEL 13 The Conversion CycleDocument4 pagesMODEL 13 The Conversion CycleEuli Mae SomeraNo ratings yet

- Sas #25 - Accounting Information SystemDocument5 pagesSas #25 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- p2 Exam With AnsDocument8 pagesp2 Exam With AnsEuli Mae SomeraNo ratings yet

- MODULE 14 The Conversion CycleDocument4 pagesMODULE 14 The Conversion CycleEuli Mae SomeraNo ratings yet

- Somera Sas#6Document3 pagesSomera Sas#6Euli Mae SomeraNo ratings yet

- MODULE 16 Financial Reporting and ManagementDocument7 pagesMODULE 16 Financial Reporting and ManagementEuli Mae SomeraNo ratings yet

- MODULE 15 Financial Reporting and ManagementDocument5 pagesMODULE 15 Financial Reporting and ManagementEuli Mae SomeraNo ratings yet

- Somera Sas#7Document3 pagesSomera Sas#7Euli Mae SomeraNo ratings yet

- BAM 031 Part 1 - HandoutDocument25 pagesBAM 031 Part 1 - HandoutEuli Mae SomeraNo ratings yet

- Somera Sas#5Document2 pagesSomera Sas#5Euli Mae SomeraNo ratings yet

- Somera Sas#8Document3 pagesSomera Sas#8Euli Mae SomeraNo ratings yet

- Module 1-4Document3 pagesModule 1-4Euli Mae SomeraNo ratings yet

- IPC PA28-161 REV Mayo 10 2021Document383 pagesIPC PA28-161 REV Mayo 10 2021jarrisonNo ratings yet

- BMBE SeminarDocument60 pagesBMBE SeminarBabyGiant LucasNo ratings yet

- Petty Cash ReplenishmentDocument2 pagesPetty Cash Replenishmentashu tarekegnNo ratings yet

- Sales Order and Purchase OrderDocument1 pageSales Order and Purchase OrderAarti GuptaNo ratings yet

- OSHC - Claims FormDocument3 pagesOSHC - Claims FormMr AkashNo ratings yet

- Materials Management - Step by Step ConfigurationDocument223 pagesMaterials Management - Step by Step Configurationvinay kumar gedelaNo ratings yet

- Roman V ABC Digest - Warehouse ReceiptsDocument1 pageRoman V ABC Digest - Warehouse ReceiptsLook ArtNo ratings yet

- Pizza Online Exercise DFDDocument2 pagesPizza Online Exercise DFD5ladyNo ratings yet

- Primary Registration Index For Application For Taxpayer Identification Number (TIN)Document43 pagesPrimary Registration Index For Application For Taxpayer Identification Number (TIN)Chit ComisoNo ratings yet

- Revised Bharat Kosh Refund FormDocument2 pagesRevised Bharat Kosh Refund Formrd meshramNo ratings yet

- Tiago EVDocument1 pageTiago EVdash155No ratings yet

- Application SummaryDocument14 pagesApplication SummaryIradukunda MarcelNo ratings yet

- PHP Point of SaleDocument52 pagesPHP Point of SalemabnuxNo ratings yet

- ECA Deviation Management CAPADocument4 pagesECA Deviation Management CAPATaniparthy Madhusudhana ReddyNo ratings yet

- Bir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxDocument2 pagesBir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxkehlaniNo ratings yet

- Delhi Excise - BarcodesDocument14 pagesDelhi Excise - BarcodesApoorvAgarwalNo ratings yet

- Karnataka Milk Federation Deepak MB 1 Report 1Document37 pagesKarnataka Milk Federation Deepak MB 1 Report 1nithinnick66No ratings yet

- AE231Document6 pagesAE231Mae-shane SagayoNo ratings yet

- University of The Punjab, Lahore, Pakistan Two Months Training Course On Oracle Financials R12Document6 pagesUniversity of The Punjab, Lahore, Pakistan Two Months Training Course On Oracle Financials R12Zeshan NasirNo ratings yet

- Fabm2 Lesson10 Accounting Practice SetDocument9 pagesFabm2 Lesson10 Accounting Practice SetTrisha TorresNo ratings yet

- Tax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Document1 pageTax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Durga Charan PradhanNo ratings yet

- Fee Receipt - 1000661867 - 21-12-2023 20 - 37 - 01Document1 pageFee Receipt - 1000661867 - 21-12-2023 20 - 37 - 01Keshav Agarwal 11A1No ratings yet

- RA 8424 and Revisions 1997-2011Document280 pagesRA 8424 and Revisions 1997-2011heraroseNo ratings yet

- Sheridan Av Ltd. Sales Process: Sales Order Taken Through Telephone by The Sales Asst. Daisy SinclaireDocument5 pagesSheridan Av Ltd. Sales Process: Sales Order Taken Through Telephone by The Sales Asst. Daisy SinclaireCarmel YparraguirreNo ratings yet

- 23 Cir Vs Mindanao Sanitarium and HospitalDocument5 pages23 Cir Vs Mindanao Sanitarium and HospitalSecret Secret0% (1)

- PT213 Printer User ManualDocument92 pagesPT213 Printer User ManualaravindNo ratings yet

Sas #24 - Accounting Information System

Sas #24 - Accounting Information System

Uploaded by

Euli Mae SomeraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sas #24 - Accounting Information System

Sas #24 - Accounting Information System

Uploaded by

Euli Mae SomeraCopyright:

Available Formats

ACC 100: Accounting Information System

Students Activity Sheet #24

Name: Class number:

Section: BSMA - SJ3 Schedule: Date:

Lesson title: Daily Chores in Quickbooks Materials:

Lesson Objectives: FLM Student Activity Sheets

1. Recording a Sales Receipt

References:

QuickBooks Simple Start for

Dummies

“Try not to become a man of success. Rather become a man of value.”

― Albert Einstein

A. LESSON PREVIEW / REVIEW

1) Introduction

You record a sales receipt when a customer pays you in full for the goods or services at the

point of sale. Sales receipts work similarly to regular invoiced sales (for which you first invoice

a customer and then later receive payment on the invoice). In fact, the big difference between

the two types of sales is that sales receipts are recorded in a way that changes your cash

balance rather than your accounts receivable balance

Please read the learning targets before you proceed to the succeeding activities. The learning

targets are your goals. Remember, you need to achieve your learning targets at the end of

the lesson.

2) Activity 1: What I Know Chart

What do you know about Recording a Sales Receipt in Quickbooks? Try answering the

questions below by writing your ideas under the What I Know column. You may use key words

or phrases that you think are related to the questions.

What I Know Questions: What I Learned (Activity 4)

How do you record sales receipt 1. Click the Sales Receipts New

using Quickbooks? hyperlink

2. identify the customer

3. date the sales reciept

4. enter a sale number

5. fix the Sol To address.

6. record the check number

7. specify the payment method

8. describe each item that you're

selling

This document is the property of PHINMA EDUCATION

ACC 100: Accounting Information System

Students Activity Sheet #24

Name: Class number:

Section: Schedule: Date:

B. MAIN LESSON

1) Activity 2: Content Notes

Recording a Sales Receipt

You record a sales receipt when a customer pays you in full for the goods or services at the point of sale.

Sales receipts work similarly to regular invoiced sales (for which you first invoice a customer and then

later receive payment on the invoice). In fact, the big difference between the two types of sales is that

sales receipts are recorded in a way that changes your cash balance rather than your accounts receivable

balance.

In the following steps, I describe how to record sales receipts for products, which are the most

complicated type of cash sale. Recording sales receipts for services works basically the same way,

however. You simply fill in fewer fields.

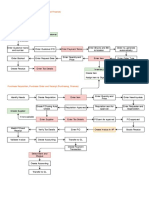

1. Click the Sales Receipts New hyperlink.

Alternatively, click the Sales Receipts icon and choose New.

The Enter Sales Receipts window appears, as shown in the figure below.

Your Enter Sales Receipts window might not look exactly like mine for a couple of reasons. QuickBooks

Simple Start slightly customizes its forms to fit your particular type of business.

Customizing sales receipt forms works in a similar way to customizing invoices and credit memos. For

example, you can add a logo. You can also make other modest changes.

2. Identify the customer.

Click the down arrow to the right of the Customer drop-down list. Scroll through the Customer List until

you see the customer name that you want and then click it. Note that unlike invoices, the Customer field

is not required for cash sales.

3. Date the sales receipt.

Press Tab to move the cursor to the Date text box. Then type the correct date in MM/DD/YY format. You

can change the date by using any of the date-editing codes.

4. (Optional) Enter a sale number.

QuickBooks Simple Start suggests a cash sale number by adding 1 to the last cash sale number you

used. Use this number, or tab to the Sale No. text box and change the number to whatever you want.

5. Fix the Sold To address, if necessary.

QuickBooks Simple Start grabs the billing address from the Customer List and uses the billing address

as the Sold To address. You can change the address for the cash sale, however, by replacing the

appropriate part of the usual billing address.

2

This document is the property of PHINMA EDUCATION

ACC 100: Accounting Information System

Students Activity Sheet #24

Name: Class number:

Section: Schedule: Date:

6. Record the check number.

Enter the customer’s check number in the Check No. text box. If the customer is paying you with cold

hard cash, you can leave the Check No. text box empty.

7. Specify the payment method.

To specify the payment method, click the Payment Method drop-down list and select something from it:

cash, check, VISA, MasterCard, or whatever. If you don’t see the payment method that you want to use,

you can add the method to the Payment Method List. Choose Add New to display the New Payment

Method dialog box. Enter a description of the payment method in the text box and click OK.

8. Describe each item that you’re selling.

Move the cursor to the first row of the Item/Description/Qty/Rate/

Amount/Tax list box. When you do, QuickBooks Simple Start turns the Item field into a drop-down list

box. Click the Item drop-down list of the first empty row in the list box and then select the item. When you

do, QuickBooks Simple Start fills in the Description and Rate text boxes with whatever sales description

and sales price you entered in the Item List. (You can edit this information if you want, but that probably

isn’t necessary.) Enter the number of items sold in the Qty text box. (QuickBooks Simple Start then

calculates the amount by multiplying the quantity by the rate.) Describe each of the other items you’re

selling by filling in the next empty rows of the list box.

If you’ve already read the chapter on invoicing customers, what I’m about to tell will seem very familiar:

You can put as many items on a sales receipt as you want. If you don’t have enough room on a single

page, QuickBooks Simple Start adds as many pages as you need to the receipt. The sales receipt total,

of course, goes on the last page.

9. Describe any special items that the sales receipt should include.

If you didn’t set up the QuickBooks Simple Start item file, you have no idea what I’m talking about. But

here’s the scoop: QuickBooks Simple Start thinks that anything that you stick on a receipt (or an invoice,

for that matter) is something that you’re selling. If you sell blue, yellow, and red thingamajigs, you

obviously need to add each of these items to the Item List. But if you add a subtotal to your receipt,

QuickBooks Simple Start thinks that the subtotal is just another thingamajig and requires you to enter

another item in the list. The same is true for a volume discount that you want to stick on the receipt. And

if you add sales tax to your receipt, well, guess what? QuickBooks Simple Start thinks that the sales tax

is just another item that needs to be included in the Item List.

To include one of these special discount or subtotal items, move the cursor to the next empty row in the

Item box, click the arrow on the right side of the drop-down and then select the special item. After

QuickBooks Simple Start fills in the Description and Rate text boxes, you might need to edit this

information. Enter each special item — subtotals or discounts — that you’re itemizing on the receipt by

filling in the next empty rows of the list box.

This document is the property of PHINMA EDUCATION

ACC 100: Accounting Information System

Students Activity Sheet #24

Name: Class number:

Section: Schedule: Date:

If you selected the Taxable check box when you added the item to the Item List, the word Tax appears

in the Tax column to indicate that the item will be taxed.

If you want to include a discount item (so that all the listed items are discounted), you need to stick a

subtotal item on the receipt after the inventory items or other items you want to discount. Then stick the

discount item directly after the subtotal item. In this way, QuickBooks Simple Start calculates the discount

as a percentage of the subtotal.

10. Specify the sales tax.

If you specified tax information when you created your company file during the EasyStep Interview,

remember how QuickBooks Simple Start asked whether you charge sales tax? QuickBooks Simple Start

fills in the default tax information by adding together the taxable items (which are indicated by the word

Tax in the Tax column) and multiplying by the percentage you indicated when you created your company

file. If the information is okay, move on to Step 13. If not, move the cursor to the Tax box that’s to the

right of the Customer Message box, activate the drop-down list box, and select the correct sales tax.

11. (Truly optional and probably unnecessary for cash sales) Add a memo in the Memo text

box.

You can include a memo description with the cash sale information. This memo isn’t for your customer.

It doesn’t even print on the cash receipt, should you decide to print one. The memo is for your eyes only.

Memo descriptions give you a way to store information that’s related to a sale with the sales receipt

information.

12. Decide whether you’re going to print the receipt.

If you’re not going to print the receipt, make sure that the Print Later check box is empty — if not, deselect

it.

The figure below shows a completed Enter Sales Receipts window.

13. Click Save & Close to save the sales receipt.

QuickBooks Simple Start saves the sales receipt that’s on-screen.

Activity 3: Skill Building

List down the summary of steps on how to record Sales Receipt using Quickbooks into 5 steps.

Step 1

Click the Sales Receipts New hyperlink.

Step 2 Identify the customer.

Step 3 Date the sales receipt.

Step 4

(Optional) Enter a sale number.

This document is the property of PHINMA EDUCATION

ACC 100: Accounting Information System

Students Activity Sheet #24

Name: Class number:

Section: BSMA - SJ3 Schedule: Date:

Step 5 5. Fix the Sold To address, if necessary

Activity 4: What I know Chart, Part 2

Now let’s check your final understanding of Flexible Learning. I hope that everything about the

topic is clear to you. This time you must fill out the What I Learned column.

Activity 5: Check for Understanding and Keys to Correction

Independent Practice

Write TRUE if the statement is correct, otherwise write FALSE.

1. QuickBooks Simple Start grabs the billing address from the Customer List and uses the

billing address as the Sold To address.

2. You can change the address for the cash sale, however, by replacing the appropriate part of

the usual billing address.

3. If the customer is paying you with cold hard cash, you can leave the Check No. text box

empty.

C. LESSON WRAP-UP

1) Activity 6: Thinking about Learning

A. Work Tracker

You are done with this session! Let’s track your progress. Shade the session number you just

completed.

P1 P2 P3

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

B. Think about your Learning

1. Please read again the learning targets for the day. Were you able to achieve those learning

targets? If yes, what helped you achieve them? If no, what is the reason for not achieving them?

___________________________________________________________________________

___________________________________________________________________________

YES

___________________________________________________________________________

2. What question(s) do you have as we end this lesson?

___________________________________________________________________________

NONE

___________________________________________________________________________

__________________________________________________________________________

KEY TO CORRECTIONS:

Activity 3:

Answers may vary.

This document is the property of PHINMA EDUCATION

ACC 100: Accounting Information System

Students Activity Sheet #24

Name: Class number:

Section: Schedule: Date:

Activity 5:

1. TRUE

2. TRUE

3. TRUE

FAQs

What is the purpose of QuickBooks Point of Sale system?

You might want to look at the QuickBooks Point of Sale system. The QuickBooks Point of Sale system

makes it easy to quickly record cash register sales. In fact, the more expensive version of the

QuickBooks Point of Sale system comes with a scanner, a receipt printer, and a cash drawer. When

you use the QuickBooks Point of Sale system, the software automatically records your sales and the

effect on inventory and cost of goods sold when you ring up a sale.

This document is the property of PHINMA EDUCATION

You might also like

- Quickbooks Advanced Certification Part 3Document54 pagesQuickbooks Advanced Certification Part 3Ahmed Rajput75% (8)

- Quickbooks Advanced Certification Part 2Document43 pagesQuickbooks Advanced Certification Part 2Ahmed Rajput50% (6)

- Skrillex Lost Settlement SheetsDocument11 pagesSkrillex Lost Settlement Sheetsapi-302693310100% (2)

- Oracle Test CasesDocument7 pagesOracle Test Casessanjeev19_ynr0% (1)

- Remita PDFDocument1 pageRemita PDFJoyNo ratings yet

- Auditing The Revenue CycleDocument63 pagesAuditing The Revenue CycleJohn Lexter MacalberNo ratings yet

- Buslaw3 VATDocument58 pagesBuslaw3 VATVan TisbeNo ratings yet

- Sas #25 - Accounting Information SystemDocument5 pagesSas #25 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- Daily Chores in QuickbooksDocument8 pagesDaily Chores in QuickbooksPrincess Nicole Posadas OniaNo ratings yet

- Lesson 5: Customers and Sales Part 1Document30 pagesLesson 5: Customers and Sales Part 1Not Going to Argue Jesus is KingNo ratings yet

- A. QB Lesson 6Document28 pagesA. QB Lesson 6Shena Mari Trixia Gepana100% (1)

- SuiteAcademy - Accounting Module 3Document17 pagesSuiteAcademy - Accounting Module 3Chan Yi LinNo ratings yet

- Chapter 3Document18 pagesChapter 3Severus HadesNo ratings yet

- Sas #23 - Accounting Information SystemDocument4 pagesSas #23 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- Learning Sage 50 Accounting 2016 A Modular Approach 1st Edition Freedman Solutions ManualDocument25 pagesLearning Sage 50 Accounting 2016 A Modular Approach 1st Edition Freedman Solutions ManualColtonCunninghamacgn100% (53)

- Chapter 5 - Revenue CycleDocument6 pagesChapter 5 - Revenue Cycleviox reyesNo ratings yet

- FY19 - QBDT Client - Lesson-6 - Enter Sales Information - BDB - v2Document37 pagesFY19 - QBDT Client - Lesson-6 - Enter Sales Information - BDB - v2Nyasha MakoreNo ratings yet

- QuickBooks SyllabusDocument10 pagesQuickBooks SyllabusNot Going to Argue Jesus is KingNo ratings yet

- The Big ListDocument16 pagesThe Big ListHemanth KumarNo ratings yet

- Acc-106 TG 6Document9 pagesAcc-106 TG 6leisky3.07No ratings yet

- Instuctor Lesson 03Document38 pagesInstuctor Lesson 03Ramen NoodlesNo ratings yet

- Accounts - Accounts Receivable Process - Process - STDocument10 pagesAccounts - Accounts Receivable Process - Process - STmatthew mafaraNo ratings yet

- Daily Chores in Quickbook 2Document4 pagesDaily Chores in Quickbook 2Princess Nicole Posadas OniaNo ratings yet

- Fabm2 ActivitiesDocument13 pagesFabm2 ActivitiesNorlaica TAURAKNo ratings yet

- Tanauan Institute, Inc.: PurchasesDocument9 pagesTanauan Institute, Inc.: PurchasesHanna CaraigNo ratings yet

- IT Audit 4ed SM Ch9Document62 pagesIT Audit 4ed SM Ch9randomlungs121223No ratings yet

- IT Audit 4ed SM Ch9Document62 pagesIT Audit 4ed SM Ch9randomlungs121223No ratings yet

- FABM 1 Q2 Weeks 3 4Document11 pagesFABM 1 Q2 Weeks 3 4Maria Hannahlyn Batumbakal DimakulanganNo ratings yet

- M4 Assign No 1 Qtn-1Document2 pagesM4 Assign No 1 Qtn-1Aliah RomeroNo ratings yet

- Quickbooks 2006 Score Student Guide Tracking and Paying Sales TaxDocument16 pagesQuickbooks 2006 Score Student Guide Tracking and Paying Sales TaxRamen NoodlesNo ratings yet

- SuiteAcademy - Accounting Module 4Document18 pagesSuiteAcademy - Accounting Module 4Chan Yi LinNo ratings yet

- F-90 Asset Acquisition With VendorDocument5 pagesF-90 Asset Acquisition With Vendorsunil23456100% (2)

- Exam Preparation QuickbooksDocument29 pagesExam Preparation QuickbooksSyed ShafanNo ratings yet

- 1 Accounting IntroductionDocument16 pages1 Accounting Introductiontmskannan1967No ratings yet

- Accounting 1Document7 pagesAccounting 1Rommel Angelo AgacitaNo ratings yet

- Menu Message: Textbook ProblemDocument10 pagesMenu Message: Textbook ProblemMeilani Irma SalesNo ratings yet

- Introduction To Accounting Transcript 0Document9 pagesIntroduction To Accounting Transcript 0mohsrourNo ratings yet

- in Asset Accounting (FI-AA) in Integration With Accounts Payable (FI-AP), But Without Reference To A Purchase OrderDocument5 pagesin Asset Accounting (FI-AA) in Integration With Accounts Payable (FI-AP), But Without Reference To A Purchase OrdersiddharthNo ratings yet

- Training Program For Store KeepersDocument7 pagesTraining Program For Store KeepersOlalekan PopoolaNo ratings yet

- Class 11 Account Solution For Session (2023-2024) Chapter-4 Recording of Transaction-IIDocument104 pagesClass 11 Account Solution For Session (2023-2024) Chapter-4 Recording of Transaction-IIsyed mohdNo ratings yet

- FABM2 Module 2. Statement of Comprehensive IncomeDocument13 pagesFABM2 Module 2. Statement of Comprehensive IncomeSITTIE RAYMAH ABDULLAHNo ratings yet

- Sales Management SystemDocument13 pagesSales Management Systemtayyaba malikNo ratings yet

- Sas8 Acc100Document12 pagesSas8 Acc100XieNo ratings yet

- Quickbooks 2006 Score Student Guide Entering and Paying BillsDocument11 pagesQuickbooks 2006 Score Student Guide Entering and Paying BillsRamen NoodlesNo ratings yet

- Chap 05 - Merchandising Operations and The Multiple-Step Income Statement (ICA)Document7 pagesChap 05 - Merchandising Operations and The Multiple-Step Income Statement (ICA)Mohamed DiabNo ratings yet

- XK01 - Create Vendor Master: Cost Center Accounting Accounts PayableDocument5 pagesXK01 - Create Vendor Master: Cost Center Accounting Accounts PayableseenusrinivasNo ratings yet

- Q1 LAS Business Finance 12 Week 4 3Document6 pagesQ1 LAS Business Finance 12 Week 4 3Paulo AragonNo ratings yet

- Q1 LAS Business Finance 12 Week 4Document6 pagesQ1 LAS Business Finance 12 Week 4Gerlie BorneaNo ratings yet

- Assignment-1 Aryan Dhir A00157541 GaganSir WaliDocument12 pagesAssignment-1 Aryan Dhir A00157541 GaganSir WaliDeepanshu SHarmaNo ratings yet

- SABTLECTURE07Document26 pagesSABTLECTURE07namudajiyaNo ratings yet

- Expenditure Cycle: For Each Document Listed: 1. Highlight The Important Information 2. Describe Why It Is SignificantDocument13 pagesExpenditure Cycle: For Each Document Listed: 1. Highlight The Important Information 2. Describe Why It Is SignificantRizza L. MacarandanNo ratings yet

- Chapter 4Document17 pagesChapter 4Severus HadesNo ratings yet

- Quickbooks DashboardDocument3 pagesQuickbooks Dashboardvanosoy19No ratings yet

- Lesson 4 Expenditure Cycle PDFDocument19 pagesLesson 4 Expenditure Cycle PDFJoshua JunsayNo ratings yet

- F-90 Asset Acquisition With VendorDocument8 pagesF-90 Asset Acquisition With VendorYTB ResearcherNo ratings yet

- RansaDocument15 pagesRansaNan Ngwe Lar SanNo ratings yet

- (FABM 2) Interactive Module Week 2Document12 pages(FABM 2) Interactive Module Week 2Krisha FernandezNo ratings yet

- Senior High School Department: Quarter 3 - Module 8: Merchandising Concern (Part 1)Document9 pagesSenior High School Department: Quarter 3 - Module 8: Merchandising Concern (Part 1)Jaye RuantoNo ratings yet

- Republic of The Philippines Department of Education Public Technical - Vocational High SchoolsDocument10 pagesRepublic of The Philippines Department of Education Public Technical - Vocational High SchoolsKristel AcordonNo ratings yet

- 005 Caaccst Ch03 Amndd Hs SecDocument20 pages005 Caaccst Ch03 Amndd Hs SecshubratadigitalNo ratings yet

- Transactions NotesDocument6 pagesTransactions NotesHang DauNo ratings yet

- Quickbooks NotesDocument21 pagesQuickbooks NotesWaivorchih Waibochi GiterhihNo ratings yet

- Business and Transfer TaxationDocument16 pagesBusiness and Transfer TaxationEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - ProblemsDocument3 pagesBusiness and Transfer Taxation - ProblemsEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - T or FDocument3 pagesBusiness and Transfer Taxation - T or FEuli Mae SomeraNo ratings yet

- ACC 100 Test BanksDocument15 pagesACC 100 Test BanksEuli Mae SomeraNo ratings yet

- Sas #23 - Accounting Information SystemDocument4 pagesSas #23 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - Multiple ChoiceDocument7 pagesBusiness and Transfer Taxation - Multiple ChoiceEuli Mae SomeraNo ratings yet

- MODULE 12 The Conversion CycleDocument6 pagesMODULE 12 The Conversion CycleEuli Mae SomeraNo ratings yet

- MODEL 13 The Conversion CycleDocument4 pagesMODEL 13 The Conversion CycleEuli Mae SomeraNo ratings yet

- Sas #25 - Accounting Information SystemDocument5 pagesSas #25 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- p2 Exam With AnsDocument8 pagesp2 Exam With AnsEuli Mae SomeraNo ratings yet

- MODULE 14 The Conversion CycleDocument4 pagesMODULE 14 The Conversion CycleEuli Mae SomeraNo ratings yet

- Somera Sas#6Document3 pagesSomera Sas#6Euli Mae SomeraNo ratings yet

- MODULE 16 Financial Reporting and ManagementDocument7 pagesMODULE 16 Financial Reporting and ManagementEuli Mae SomeraNo ratings yet

- MODULE 15 Financial Reporting and ManagementDocument5 pagesMODULE 15 Financial Reporting and ManagementEuli Mae SomeraNo ratings yet

- Somera Sas#7Document3 pagesSomera Sas#7Euli Mae SomeraNo ratings yet

- BAM 031 Part 1 - HandoutDocument25 pagesBAM 031 Part 1 - HandoutEuli Mae SomeraNo ratings yet

- Somera Sas#5Document2 pagesSomera Sas#5Euli Mae SomeraNo ratings yet

- Somera Sas#8Document3 pagesSomera Sas#8Euli Mae SomeraNo ratings yet

- Module 1-4Document3 pagesModule 1-4Euli Mae SomeraNo ratings yet

- IPC PA28-161 REV Mayo 10 2021Document383 pagesIPC PA28-161 REV Mayo 10 2021jarrisonNo ratings yet

- BMBE SeminarDocument60 pagesBMBE SeminarBabyGiant LucasNo ratings yet

- Petty Cash ReplenishmentDocument2 pagesPetty Cash Replenishmentashu tarekegnNo ratings yet

- Sales Order and Purchase OrderDocument1 pageSales Order and Purchase OrderAarti GuptaNo ratings yet

- OSHC - Claims FormDocument3 pagesOSHC - Claims FormMr AkashNo ratings yet

- Materials Management - Step by Step ConfigurationDocument223 pagesMaterials Management - Step by Step Configurationvinay kumar gedelaNo ratings yet

- Roman V ABC Digest - Warehouse ReceiptsDocument1 pageRoman V ABC Digest - Warehouse ReceiptsLook ArtNo ratings yet

- Pizza Online Exercise DFDDocument2 pagesPizza Online Exercise DFD5ladyNo ratings yet

- Primary Registration Index For Application For Taxpayer Identification Number (TIN)Document43 pagesPrimary Registration Index For Application For Taxpayer Identification Number (TIN)Chit ComisoNo ratings yet

- Revised Bharat Kosh Refund FormDocument2 pagesRevised Bharat Kosh Refund Formrd meshramNo ratings yet

- Tiago EVDocument1 pageTiago EVdash155No ratings yet

- Application SummaryDocument14 pagesApplication SummaryIradukunda MarcelNo ratings yet

- PHP Point of SaleDocument52 pagesPHP Point of SalemabnuxNo ratings yet

- ECA Deviation Management CAPADocument4 pagesECA Deviation Management CAPATaniparthy Madhusudhana ReddyNo ratings yet

- Bir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxDocument2 pagesBir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxkehlaniNo ratings yet

- Delhi Excise - BarcodesDocument14 pagesDelhi Excise - BarcodesApoorvAgarwalNo ratings yet

- Karnataka Milk Federation Deepak MB 1 Report 1Document37 pagesKarnataka Milk Federation Deepak MB 1 Report 1nithinnick66No ratings yet

- AE231Document6 pagesAE231Mae-shane SagayoNo ratings yet

- University of The Punjab, Lahore, Pakistan Two Months Training Course On Oracle Financials R12Document6 pagesUniversity of The Punjab, Lahore, Pakistan Two Months Training Course On Oracle Financials R12Zeshan NasirNo ratings yet

- Fabm2 Lesson10 Accounting Practice SetDocument9 pagesFabm2 Lesson10 Accounting Practice SetTrisha TorresNo ratings yet

- Tax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Document1 pageTax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Durga Charan PradhanNo ratings yet

- Fee Receipt - 1000661867 - 21-12-2023 20 - 37 - 01Document1 pageFee Receipt - 1000661867 - 21-12-2023 20 - 37 - 01Keshav Agarwal 11A1No ratings yet

- RA 8424 and Revisions 1997-2011Document280 pagesRA 8424 and Revisions 1997-2011heraroseNo ratings yet

- Sheridan Av Ltd. Sales Process: Sales Order Taken Through Telephone by The Sales Asst. Daisy SinclaireDocument5 pagesSheridan Av Ltd. Sales Process: Sales Order Taken Through Telephone by The Sales Asst. Daisy SinclaireCarmel YparraguirreNo ratings yet

- 23 Cir Vs Mindanao Sanitarium and HospitalDocument5 pages23 Cir Vs Mindanao Sanitarium and HospitalSecret Secret0% (1)

- PT213 Printer User ManualDocument92 pagesPT213 Printer User ManualaravindNo ratings yet