Professional Documents

Culture Documents

045 China Banking Corporation v. CA

045 China Banking Corporation v. CA

Uploaded by

Dexter GasconOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

045 China Banking Corporation v. CA

045 China Banking Corporation v. CA

Uploaded by

Dexter GasconCopyright:

Available Formats

TAXATION LAW 1 CASE DIGEST AY 13-14 | G01

045 China Banking Corporation v. CA

G.R. No. 125508 Date: July 19, 2000

TOPIC: Capital Gains and Losses: Limitation on Capital Loss

PONENTE: Vitug, J.

FACTS:

1. Sometime in 1980, petitioner China Banking Corporation made a 53% equity investment in the First CBC Capital

(Asia) Ltd., a Hongkong subsidiary engaged in financing and investment with "deposit-taking" function. The

investment amounted to P16, 227,851.80, consisting of 106,000 shares with a par Value of P100 per share.

2. The books had shown that First CBC Capital (Asia), Ltd., has become insolvent. With the approval of Bangko

Sentral, petitioner wrote-off as being worthless its investment in First CBC Capital (Asia), Ltd., in its 1987 Income

Tax Return and treated it as a bad debt or as an ordinary loss deductible from its gross income.

3. Respondent Commissioner of internal Revenue disallowed the deduction and assessed petitioner for income tax

deficiency in the amount of P8, 533,328.04, inclusive of surcharge, interest and compromise penalty. The

disallowance of the deduction was made on the ground that the investment should not be classified as being

"worthless" and that, although the Hongkong Banking Commissioner had revoked the license of First CBC Capital

as a "deposit-taping" company, the latter could still exercise, however, its financing and investment

activities. Assuming that the securities had indeed become worthless, respondent Commissioner of Internal

Revenue held the view that they should then be classified as "capital loss," and not as a bad debt expense there

being no indebtedness to speak of between petitioner and its subsidiary.

4. Petitioner contested the ruling of respondent Commissioner before the CTA holding that the securities had not

indeed become worthless. The tax court sustained the Commissioner as well as the Court of Appeals.

ISSUE: WON “securities becoming worthless” be allowed as deduction from gross income of CBC.

HELD: No. In the case at bar, First CBC Capital (Asia), Ltd., the investee corporation, is a subsidiary corporation of

petitioner bank whose shares in said investee corporation are not intended for purchase or sale but as an

investment. Unquestionably then, any loss therefrom would be a capital loss, not an ordinary loss, to the investor.

RATIO:

1. An equity investment is a capital, not ordinary asset of the investor, the sale or exchange in which

results in either a capital gain or capital loss. The gain or loss is ordinary when the property sold or

exchanged is not a capital asset. Sec 29 of NIRC on securities becoming worthless during the tax

year are capital assets, the loss resulted therefrom shall be considered as a loss from the sale or

exchange, on the last day of such taxable year, of capital assets.

2. A capital gain or a capital loss normally requires the concurrence of two conditions for it to result:

1) there is a sale or exchange; 2) the thing sold or exchanged is a capital asset. Capital losses are

allowed to be deducted only to the extent of capital gains, e.i. gains derived from the sale or

exchange of capital assets, and not from any other income of the taxpayer… any capital loss can be

deducted only from capital gains.

CASE LAW/ DOCTRINE:

Capital losses are deductible only to the extent of capital gains.

Capital losses are allowed to be deducted only to the extent of capital gains, i.e., gains derived from the sale or exchange

of capital assets, and not from any other income of the taxpayer.

You might also like

- GCRO Top230 PG April2019Document223 pagesGCRO Top230 PG April2019Edmerl AbadNo ratings yet

- Legal Memorandum Initial Public OfferingDocument6 pagesLegal Memorandum Initial Public OfferingMarisa U. TambunanNo ratings yet

- Receipt TravelokaDocument1 pageReceipt TravelokaEmilia Rosanti100% (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Safari - 19 Jun 2019 at 5:37 PM PDFDocument1 pageSafari - 19 Jun 2019 at 5:37 PM PDFshinghuiNo ratings yet

- China Banking Corporation Vs CADocument5 pagesChina Banking Corporation Vs CAFrancis CastilloNo ratings yet

- Petitioner Vs Vs Respondents: en BancDocument8 pagesPetitioner Vs Vs Respondents: en BancVMNo ratings yet

- China Banking Corporation, - Court of Appeals, Commissioner of Internal Revenue and Court of Tax AppealsDocument9 pagesChina Banking Corporation, - Court of Appeals, Commissioner of Internal Revenue and Court of Tax AppealsJose Antonio BarrosoNo ratings yet

- China Banking Corporation Vs CADocument2 pagesChina Banking Corporation Vs CARahl SulitNo ratings yet

- China Banking Corporation v. Court of AppealsDocument2 pagesChina Banking Corporation v. Court of Appealsrafael.louise.roca2244No ratings yet

- 5 Gamboa Vs TevesDocument11 pages5 Gamboa Vs TevesLuigi JaroNo ratings yet

- 8 - Chinabank Vs CA - G.R. No. 125508 PDFDocument5 pages8 - Chinabank Vs CA - G.R. No. 125508 PDFJason BUENANo ratings yet

- China Banking Corp V CADocument7 pagesChina Banking Corp V CANikko SterlingNo ratings yet

- China Banking Corporation, vs. Court of Appeals, G.R. No. 125508Document11 pagesChina Banking Corporation, vs. Court of Appeals, G.R. No. 125508Mae TrabajoNo ratings yet

- 44-China Banking Corp. v. CA G.R. No. 125508 July 19, 2000Document5 pages44-China Banking Corp. v. CA G.R. No. 125508 July 19, 2000Jopan SJNo ratings yet

- 1 Chinabank Co Vs CADocument10 pages1 Chinabank Co Vs CAIan Kenneth MangkitNo ratings yet

- Chinabank V CA - Full TextDocument5 pagesChinabank V CA - Full TextNewbie KyoNo ratings yet

- CHINA BANKING CORPORATION v. COURT OF APPEALS, COMMISSIONER OF INTERNAL REVENUE and COURT OF TAX APPEALS - G.R. No. 125508 - (2000)Document8 pagesCHINA BANKING CORPORATION v. COURT OF APPEALS, COMMISSIONER OF INTERNAL REVENUE and COURT OF TAX APPEALS - G.R. No. 125508 - (2000)Jo BatsNo ratings yet

- 93-A China Banking Corporation v. Court of AppealsDocument2 pages93-A China Banking Corporation v. Court of AppealsAdi CruzNo ratings yet

- China Bank Vs CA 336 SCRA 179 (Sec 39 Cap Gain/loss) - InganDocument27 pagesChina Bank Vs CA 336 SCRA 179 (Sec 39 Cap Gain/loss) - InganShanielle Qim CañedaNo ratings yet

- Tax2-Case Digests Atty. AcasDocument107 pagesTax2-Case Digests Atty. AcasHi Law School0% (1)

- China Banking and CIR V CTA DigestsDocument3 pagesChina Banking and CIR V CTA Digestsniza_zunigaNo ratings yet

- 178 Supreme Court Reports Annotated: China Banking Corporation vs. Court of AppealsDocument16 pages178 Supreme Court Reports Annotated: China Banking Corporation vs. Court of AppealsJazzmene Febe GulpanNo ratings yet

- TaxationDocument27 pagesTaxationdorothy92105No ratings yet

- 4 - China Banking Corporation v. CA - CIR - CTADocument2 pages4 - China Banking Corporation v. CA - CIR - CTACheska VergaraNo ratings yet

- Tax CasesDocument24 pagesTax CasesMarj RoxasNo ratings yet

- CalasanzDocument8 pagesCalasanzGenesis LealNo ratings yet

- IT Module No. 6 Capital Gains Taxation Module Specific Learning OutcomesDocument18 pagesIT Module No. 6 Capital Gains Taxation Module Specific Learning Outcomesdesiree bautistaNo ratings yet

- Tax 2 Digest (0406) GR 108576 012099 Cir Vs CaDocument3 pagesTax 2 Digest (0406) GR 108576 012099 Cir Vs CaAudrey Deguzman100% (1)

- Departmental Interpretation and Practice Notes No. 13 (Revised)Document7 pagesDepartmental Interpretation and Practice Notes No. 13 (Revised)Difanny KooNo ratings yet

- BIR Ruling DA - (C-267) 672-09Document3 pagesBIR Ruling DA - (C-267) 672-09Marlene TongsonNo ratings yet

- Final Case Law Pack - Updated - FY 2023 v1Document14 pagesFinal Case Law Pack - Updated - FY 2023 v12389551No ratings yet

- Morales Taxation Topic 7 Capital Gains and LossesDocument10 pagesMorales Taxation Topic 7 Capital Gains and LossesMary Joice Delos santosNo ratings yet

- Profits and Gains of Business or ProfessionDocument14 pagesProfits and Gains of Business or Professionsadathnoori100% (1)

- CHAPTER 7 Capital Gains Taxation (Module)Document15 pagesCHAPTER 7 Capital Gains Taxation (Module)Shane Mark CabiasaNo ratings yet

- Capital Reduction Article 1597312616Document5 pagesCapital Reduction Article 1597312616JUNA SURESHNo ratings yet

- TAXATION-LAW-REVIEW answer-FINAL-EXAM-PART-2Document5 pagesTAXATION-LAW-REVIEW answer-FINAL-EXAM-PART-2Roxanne Datuin UsonNo ratings yet

- Chapter 4-Final Income TaxationDocument17 pagesChapter 4-Final Income TaxationPrincesa RoqueNo ratings yet

- Paper Industries Corporation of The PhilippinesDocument3 pagesPaper Industries Corporation of The PhilippinesCalagui Tejano Glenda JaygeeNo ratings yet

- Digests in TaxDocument7 pagesDigests in TaxBernadette RacadioNo ratings yet

- Cfas Quizzes FinalsDocument10 pagesCfas Quizzes FinalsSaeym SegoviaNo ratings yet

- 22 Andys Furniture IncDocument22 pages22 Andys Furniture IncSalar AliNo ratings yet

- Capital Gains Tax PDFDocument6 pagesCapital Gains Tax PDFjanus lopezNo ratings yet

- Cpa Review - CGTDocument10 pagesCpa Review - CGTKenneth Bryan Tegerero TegioNo ratings yet

- Tax Law Cases Sem-1Document43 pagesTax Law Cases Sem-1rashmi narayanNo ratings yet

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- Paper Industries Corporation of The PhilippinesDocument2 pagesPaper Industries Corporation of The PhilippinesCalagui Tejano Glenda JaygeeNo ratings yet

- Week 3 QuizDocument4 pagesWeek 3 QuizLyra EscosioNo ratings yet

- Accounting For Shareholders Equity KINGDocument11 pagesAccounting For Shareholders Equity KINGAlexis KingNo ratings yet

- Coinmen For Startups Tax Implications For Startups and Its InvestorsDocument33 pagesCoinmen For Startups Tax Implications For Startups and Its Investorshustlerstupid737No ratings yet

- The Company Audit - II: © The Institute of Chartered Accountants of IndiaDocument35 pagesThe Company Audit - II: © The Institute of Chartered Accountants of IndiaHarikrishnaNo ratings yet

- Module 9 PDFDocument7 pagesModule 9 PDFtrixie maeNo ratings yet

- Module 9Document7 pagesModule 9trixie maeNo ratings yet

- Module 9 PDFDocument7 pagesModule 9 PDFtrixie maeNo ratings yet

- Module 9 PDFDocument7 pagesModule 9 PDFtrixie maeNo ratings yet

- Deduction - Losses - CharitableDocument12 pagesDeduction - Losses - CharitableVictor LimNo ratings yet

- Kuenzle & Streiff, Inc., Petitioner, V. The Commissioner of Internal Revenue, Respondent. (G.R. No. L-18840. May 29, 1969.)Document7 pagesKuenzle & Streiff, Inc., Petitioner, V. The Commissioner of Internal Revenue, Respondent. (G.R. No. L-18840. May 29, 1969.)Samantha BaricauaNo ratings yet

- Week 6Document8 pagesWeek 6Richelle GraceNo ratings yet

- All Subjects - CCDocument11 pagesAll Subjects - CCMJ YaconNo ratings yet

- KẾ TOÁN QUỐC TẾ NÂNG CAO - ÔNDocument7 pagesKẾ TOÁN QUỐC TẾ NÂNG CAO - ÔNcamnhu622003No ratings yet

- CA IPCC Company Audit IIDocument50 pagesCA IPCC Company Audit IIanon_672065362No ratings yet

- 25-28 TaxDocument8 pages25-28 TaxCath VillarinNo ratings yet

- Chamber of Real Estate and Builders' Association, Inc. vs. Executive SecretaryDocument10 pagesChamber of Real Estate and Builders' Association, Inc. vs. Executive SecretaryLemUyNo ratings yet

- Case 71 - 97Document40 pagesCase 71 - 97Dexter GasconNo ratings yet

- Bachrach v. SeifertDocument1 pageBachrach v. SeifertDexter GasconNo ratings yet

- 016 Alhambra Cigar and Cigarette Manufacturing, Co. v. CollectorDocument1 page016 Alhambra Cigar and Cigarette Manufacturing, Co. v. CollectorDexter GasconNo ratings yet

- 055-077 Labor RevDocument61 pages055-077 Labor RevDexter GasconNo ratings yet

- 001-026 Labor RevDocument64 pages001-026 Labor RevDexter GasconNo ratings yet

- 044-054 Labor RevDocument20 pages044-054 Labor RevDexter GasconNo ratings yet

- Up V de Los AngelesDocument10 pagesUp V de Los AngelesDexter GasconNo ratings yet

- LITONJUA vs. L & R CORPORATION (Dex)Document2 pagesLITONJUA vs. L & R CORPORATION (Dex)Dexter GasconNo ratings yet

- 027-032 Labor RevDocument11 pages027-032 Labor RevDexter GasconNo ratings yet

- Formaran Vs OngDocument1 pageFormaran Vs OngDexter GasconNo ratings yet

- Parks V Province of TarlacDocument5 pagesParks V Province of TarlacDexter GasconNo ratings yet

- 033-043 Labor RevDocument30 pages033-043 Labor RevDexter GasconNo ratings yet

- Sarming V DyDocument2 pagesSarming V DyDexter GasconNo ratings yet

- PCIB V FrancoDocument9 pagesPCIB V FrancoDexter GasconNo ratings yet

- Gatuslao v. YansonDocument6 pagesGatuslao v. YansonDexter GasconNo ratings yet

- TAGAYTAY REALTY CO., INC. v. ARTURO G. GACUTAN (Dex)Document6 pagesTAGAYTAY REALTY CO., INC. v. ARTURO G. GACUTAN (Dex)Dexter GasconNo ratings yet

- 008 Union Bank of The Philippines vs. SECDocument2 pages008 Union Bank of The Philippines vs. SECDexter GasconNo ratings yet

- Cagayan Coop v. RapananDocument8 pagesCagayan Coop v. RapananDexter GasconNo ratings yet

- 017 NG Gan Zee vs. Asian Crusader Life Ass. CorpDocument2 pages017 NG Gan Zee vs. Asian Crusader Life Ass. CorpDexter GasconNo ratings yet

- 049 Timoteo Sarona v. NLRC, Royale Security Agency, Et Al.Document2 pages049 Timoteo Sarona v. NLRC, Royale Security Agency, Et Al.Dexter GasconNo ratings yet

- 047 Uy Hu & Co. v. The Prudential Assurance Co., Ltd.Document2 pages047 Uy Hu & Co. v. The Prudential Assurance Co., Ltd.Dexter GasconNo ratings yet

- 020 Association of Int'l Shipping Lines, Inc., Et Al v. Phil. Ports Authority Et AlDocument2 pages020 Association of Int'l Shipping Lines, Inc., Et Al v. Phil. Ports Authority Et AlDexter GasconNo ratings yet

- Martelino V NHMF CorpDocument2 pagesMartelino V NHMF CorpDexter GasconNo ratings yet

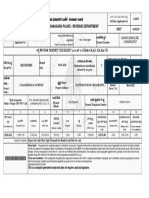

- Bruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LDocument1 pageBruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LManjunathNo ratings yet

- Chemalite AnswersDocument2 pagesChemalite AnswersMine SayracNo ratings yet

- Finacle Menus FlowDocument155 pagesFinacle Menus FlowDeepak Prasad50% (2)

- Obillos, Jr. vs. Commissioner of Internal Revenue (139 SCRA 436 (1985) )Document2 pagesObillos, Jr. vs. Commissioner of Internal Revenue (139 SCRA 436 (1985) )BryanNo ratings yet

- AAR - ITC On Capital Goods in Case of Taxable + Exepmt SupplyDocument3 pagesAAR - ITC On Capital Goods in Case of Taxable + Exepmt SupplyJigar MakwanaNo ratings yet

- PRISM+ Order 576529109583562577Document1 pagePRISM+ Order 576529109583562577Soc BasilloteNo ratings yet

- Account Statement 25-05-2023T02 58 36Document1 pageAccount Statement 25-05-2023T02 58 36SHEHERYAR QAZI 26488No ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceIRSNo ratings yet

- Book InvoiceDocument1 pageBook InvoiceKaushik DasNo ratings yet

- REFUNDDocument52 pagesREFUNDarpit85No ratings yet

- OpTransactionHistory11 23Document7 pagesOpTransactionHistory11 23PRABHAT SRIVASTAVNo ratings yet

- Chapter 4 Answer KeyDocument1 pageChapter 4 Answer KeyStefanie SaphiraNo ratings yet

- Subham Sharma Sep 21Document1 pageSubham Sharma Sep 21Goldy SahuNo ratings yet

- 72814cajournal Feb2023 11Document1 page72814cajournal Feb2023 11S M SHEKARNo ratings yet

- STD Fee ChallanDocument1 pageSTD Fee ChallanSonia SigarNo ratings yet

- Calculation of Total Tax IncidenceDocument1 pageCalculation of Total Tax IncidenceRipul Nabi50% (4)

- Introduction To Accounting - Kartiks Case StudyDocument3 pagesIntroduction To Accounting - Kartiks Case Studynudetarzan1985No ratings yet

- Jainism in Odisha Chapter 1Document13 pagesJainism in Odisha Chapter 1Bikash DandasenaNo ratings yet

- Flow Chart PembayaranDocument6 pagesFlow Chart PembayaranRona VeriansyahNo ratings yet

- Gpay Network (S) Pte. LTDDocument2 pagesGpay Network (S) Pte. LTDdanylodesignNo ratings yet

- Free Payslip Open Office TemplateDocument1 pageFree Payslip Open Office TemplateSurializa RamliNo ratings yet

- Withholding Return SampleDocument15 pagesWithholding Return Sampleoyesigye DennisNo ratings yet

- Christopher Driskell - MATH 12 (10.1) The US Tax SystemDocument3 pagesChristopher Driskell - MATH 12 (10.1) The US Tax SystemdriskelltopherNo ratings yet

- 166716594Document2 pages166716594Jose El JaguarNo ratings yet

- MarchDocument1 pageMarchSushmita BaraikNo ratings yet

- TM 314C Topic 1 BF and BCDocument25 pagesTM 314C Topic 1 BF and BCLicardo, Marc PauloNo ratings yet

- Cost Sheet - 2 BHKDocument2 pagesCost Sheet - 2 BHKgouriNo ratings yet