Professional Documents

Culture Documents

Lance Alluysius D. Dela Cruz Activity 1 and 2 Bsba HRM 1 - C

Lance Alluysius D. Dela Cruz Activity 1 and 2 Bsba HRM 1 - C

Uploaded by

Lance Dela Cruz0 ratings0% found this document useful (0 votes)

14 views2 pagesThe document discusses the 5 Cs of credit (character, capacity, capital, collateral, and condition) and their implications for evaluating loan applications. It also lists 5 types of credit (installment accounts, revolving credit, charge accounts, lay away plans), along with examples of banks that offer each type and names of specific loans. Each loan is briefly described.

Original Description:

Original Title

LANCE ALLUYSIUS D. DELA CRUZ ACTIVITY 1 AND 2 BSBA HRM 1 - C

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the 5 Cs of credit (character, capacity, capital, collateral, and condition) and their implications for evaluating loan applications. It also lists 5 types of credit (installment accounts, revolving credit, charge accounts, lay away plans), along with examples of banks that offer each type and names of specific loans. Each loan is briefly described.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views2 pagesLance Alluysius D. Dela Cruz Activity 1 and 2 Bsba HRM 1 - C

Lance Alluysius D. Dela Cruz Activity 1 and 2 Bsba HRM 1 - C

Uploaded by

Lance Dela CruzThe document discusses the 5 Cs of credit (character, capacity, capital, collateral, and condition) and their implications for evaluating loan applications. It also lists 5 types of credit (installment accounts, revolving credit, charge accounts, lay away plans), along with examples of banks that offer each type and names of specific loans. Each loan is briefly described.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

LANCE ALLUYSIUS D.

DELA CRUZ BSBA HRM 1 – C

BUSINESS FINANCE ACTIVITY 1 and 2

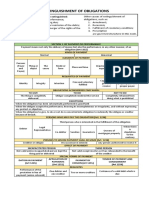

5 CS OF CREDIT FACTORS IMPLICATION

1. CHARACTER Credit History To check if the

borrower was able to

pay his loan obligation

in the past.

2. CAPACITY Credit Capability To check the capacity

by looking at how much

debt you have and

comparing it to how

much income you earn.

3. CAPITAL Credit Income The ability to check

your capital which

includes your savings,

investments and assets

that you are willing to

put toward your loan.

4. COLLATERAL Credit Properties To check if the

borrower has any assets

that can be used as a

payment for his/her

debt.

5. CONDITION Credit Status To check if he/she is

employed at his/her

current job, how his/her

industry is performing,

and future job stability.

TYPES OF CREDIT NAME OF BANK NAME OF LOAN BRIEF DESCRIPTION

1. Installment Security Bank Home Loan A housing loan

Accounts is an

agreement

between a

creditor and a

borrower

where a sum of

money is lent

for the

acquisition of

real estate

property and

related assets.

2. Installment Metrobank Car Loan A Vehicle Loan

Accounts is a loan that

allows you to

purchase two

and four

wheelers for

personal use.

Typically, the

buyer must

repay the loan

in Equated

Monthly

Instalments

over a specific

tenure at a

specific

interest rate.

3. Revolving AUB Student Loan An agreement

Credit by which a

student at a

college or

university

borrows

money from a

bank to pay for

their education

and then pays

the money

back after they

finish studying

and start

working.

4. Charge BPI Emergency Short-term

Accounts Loan loans that are

typically used

for emergency

situations.

5. Lay Away Plan BDO Appliance Loan It allows you to

purchase a

household

appliance with

borrowed

funds that you

can repay over

time, usually in

monthly

increments.

You might also like

- Summary Note - EXTINGUISHMENT OF OBLIGATIONSDocument8 pagesSummary Note - EXTINGUISHMENT OF OBLIGATIONSGiah Mesiona100% (2)

- PFG Credit Card Design Solution-Gaurav ChaturvediDocument6 pagesPFG Credit Card Design Solution-Gaurav ChaturvedikkiiiddNo ratings yet

- Chapter One: The Investment EnvironmentDocument67 pagesChapter One: The Investment EnvironmentZhi Hwang100% (2)

- Chapter 4 Bank Credit InstrumentsDocument17 pagesChapter 4 Bank Credit InstrumentsDeanne Lorraine V. GuintoNo ratings yet

- Notes - Accounting For LawyersDocument8 pagesNotes - Accounting For LawyerssaghiasNo ratings yet

- Discontinued Operation and Non-Current Asset Held-For-saleDocument2 pagesDiscontinued Operation and Non-Current Asset Held-For-saleLui67% (3)

- Credit and CollectionDocument3 pagesCredit and CollectionArnold BelangoyNo ratings yet

- o Credit LineDocument4 pageso Credit LineNichloe Lauren TanNo ratings yet

- 1 Introduction To Credit and CollectionDocument16 pages1 Introduction To Credit and CollectionGigiNo ratings yet

- LLS 7e Global Edition Ch09Document7 pagesLLS 7e Global Edition Ch09thanh subNo ratings yet

- CREDIT and COLLECTIONDocument5 pagesCREDIT and COLLECTIONhannamicaella.cervantes.cvtNo ratings yet

- MB6The Five C S of Credit Analysis PA18072016Document6 pagesMB6The Five C S of Credit Analysis PA18072016ninja980117No ratings yet

- Credit Transactions Midterms ReviewerDocument136 pagesCredit Transactions Midterms ReviewerMatthew Witt100% (4)

- I. Pledge and Mortgage Essential Requisites Promise To DeliverDocument4 pagesI. Pledge and Mortgage Essential Requisites Promise To DeliverZaaavnn VannnnnNo ratings yet

- The Banker-Customer Relationship Is A Fundamental Legal RelaDocument5 pagesThe Banker-Customer Relationship Is A Fundamental Legal RelaMaryam AzizNo ratings yet

- Corporate Finance (Pg. 125-138)Document14 pagesCorporate Finance (Pg. 125-138)Ahana MitraNo ratings yet

- Credit CollectionLECTURES 1 2Document7 pagesCredit CollectionLECTURES 1 2Efren ChanNo ratings yet

- Daily Life - Asking For A Loan: Visit The - C 2009 Praxis Language LTDDocument3 pagesDaily Life - Asking For A Loan: Visit The - C 2009 Praxis Language LTDDiana PalacioNo ratings yet

- Credit and Collection Chapter 2Document45 pagesCredit and Collection Chapter 2BEA CARMONANo ratings yet

- Credit Trans 2Document9 pagesCredit Trans 2Janet AnotdeNo ratings yet

- SPECCOMDocument9 pagesSPECCOMMiller Paulo2 BilagNo ratings yet

- CREDIT Case Reviewer-CAM395ZMV2Document37 pagesCREDIT Case Reviewer-CAM395ZMV2miyumiNo ratings yet

- Terms Ranked From LEAST RISK To MOST RISK For The SellerDocument17 pagesTerms Ranked From LEAST RISK To MOST RISK For The Sellerkamalarora117No ratings yet

- LAW 213 - Reviewer - MidtermDocument3 pagesLAW 213 - Reviewer - MidtermAinah BaratamanNo ratings yet

- Credit and CollectionDocument27 pagesCredit and CollectionBEA CARMONANo ratings yet

- Credit and Collection Activity Commercial CreditDocument2 pagesCredit and Collection Activity Commercial CreditRhenzo ManayanNo ratings yet

- LAAC 208 CREDTRAN ESPEJO 2013 ReviewDocument70 pagesLAAC 208 CREDTRAN ESPEJO 2013 ReviewCL DelabahanNo ratings yet

- Performance Guarantees - Traps and PitfallsDocument3 pagesPerformance Guarantees - Traps and PitfallsWilliam TongNo ratings yet

- Banking Chapter 5Document11 pagesBanking Chapter 5John Kenneth CaminoNo ratings yet

- Banking Laws Dizon Book SummaryDocument2 pagesBanking Laws Dizon Book SummaryJava LasamNo ratings yet

- 50 Business Words, Meaning and SentencesDocument8 pages50 Business Words, Meaning and Sentencesvener magpayoNo ratings yet

- 2.3.3 Financial PlanDocument9 pages2.3.3 Financial PlanKumar DiwakarNo ratings yet

- Lesson 8 - Short Term FinancingDocument16 pagesLesson 8 - Short Term FinancingTomoyo AdachiNo ratings yet

- Angel Credit Transactions PDFDocument10 pagesAngel Credit Transactions PDFJay Kent RoilesNo ratings yet

- PDF 20230915 183638 0000Document28 pagesPDF 20230915 183638 0000niks.kat25No ratings yet

- CPAT Reviewer - Pledge, Mortgaage and AntichresisDocument4 pagesCPAT Reviewer - Pledge, Mortgaage and AntichresisZaaavnn VannnnnNo ratings yet

- Chapter 1. The Nature of CreditDocument14 pagesChapter 1. The Nature of CreditcalliemozartNo ratings yet

- Chapter 2 - General ConceptDocument5 pagesChapter 2 - General ConceptShasharu Fei-fei LimNo ratings yet

- Users of Accounting Information MobDocument2 pagesUsers of Accounting Information MobKhamica ArcherNo ratings yet

- Cac Prelim ReviewerDocument3 pagesCac Prelim ReviewerAnna Lyssa BatasNo ratings yet

- FM 4B Debt Financing Activity CMMDocument12 pagesFM 4B Debt Financing Activity CMMKim EspinaNo ratings yet

- DLF HowtoBuyInfoGraph 2018Document1 pageDLF HowtoBuyInfoGraph 2018Jake LongNo ratings yet

- OUTLINE Cred TransDocument12 pagesOUTLINE Cred TransKara LorejoNo ratings yet

- Retail BankingDocument8 pagesRetail BankingClyncia PereiraNo ratings yet

- Credit Transactions 1st ExamDocument36 pagesCredit Transactions 1st ExamAnonymous Coyote100% (1)

- Company Law 1Document7 pagesCompany Law 1Pushpendra BadgotiNo ratings yet

- Audit Handwritten notesDocument265 pagesAudit Handwritten notesParth SarafNo ratings yet

- Robinhood CreditsDocument98 pagesRobinhood CreditsRoy FloresNo ratings yet

- Credit NotesDocument25 pagesCredit NotesA LNo ratings yet

- Securities and CollateralDocument101 pagesSecurities and CollateralNurfashihahNo ratings yet

- Vocabulary (F&B)Document27 pagesVocabulary (F&B)peachmyzzNo ratings yet

- Letters of Credit Warehouse ReceiptsDocument3 pagesLetters of Credit Warehouse ReceiptsAnne Laraga LuansingNo ratings yet

- Credit and CollectionDocument12 pagesCredit and CollectionTessa AriateNo ratings yet

- Central University of South Bihar: Debenture, Its Kind and Issues of DebentureDocument17 pagesCentral University of South Bihar: Debenture, Its Kind and Issues of DebenturePriyaranjan Singh100% (1)

- GN 2017 Cred TransDocument60 pagesGN 2017 Cred TransAlfonso Dimla100% (1)

- The Nature of Credit Instruments - A Credit InstrumentDocument2 pagesThe Nature of Credit Instruments - A Credit Instrumentjoshua aguirreNo ratings yet

- General Provision: SecurityDocument7 pagesGeneral Provision: SecuritytrextanNo ratings yet

- PRINT CC Week 23Document4 pagesPRINT CC Week 23miyanoharuka25No ratings yet

- BANKINGDocument7 pagesBANKINGSalik AfzalNo ratings yet

- FAR.2920 - Generating Cash From Receivables.Document4 pagesFAR.2920 - Generating Cash From Receivables.Eyes Saw100% (1)

- Credit Trans Reviewer CabreraDocument7 pagesCredit Trans Reviewer CabreraPrincess Dayana PacasumNo ratings yet

- Reverse Mortgage: Leverage Home Equity, the Appraised Value, and Asset-Backed SecuritiesFrom EverandReverse Mortgage: Leverage Home Equity, the Appraised Value, and Asset-Backed SecuritiesNo ratings yet

- BA 25 UNIT I Introduction To Human Resource ManagementDocument10 pagesBA 25 UNIT I Introduction To Human Resource ManagementLance Dela CruzNo ratings yet

- Dela Cruz, Lance Alluysius D. - Performance Task 1Document4 pagesDela Cruz, Lance Alluysius D. - Performance Task 1Lance Dela CruzNo ratings yet

- DATEDocument2 pagesDATELance Dela CruzNo ratings yet

- SocSc 01 Activity 1Document1 pageSocSc 01 Activity 1Lance Dela CruzNo ratings yet

- Lance Alluysius D. Dela Cruz Bsba HRM 1 - CDocument2 pagesLance Alluysius D. Dela Cruz Bsba HRM 1 - CLance Dela CruzNo ratings yet

- Lance Alluysius D. Dela Cruz Bsba HRM 1 - C Activity 2Document1 pageLance Alluysius D. Dela Cruz Bsba HRM 1 - C Activity 2Lance Dela CruzNo ratings yet

- Chapter IIDocument17 pagesChapter IILance Dela CruzNo ratings yet

- It's Time To Confront The Education Crisis Head OnDocument1 pageIt's Time To Confront The Education Crisis Head OnLance Dela CruzNo ratings yet

- 21st LitDocument2 pages21st LitLance Dela CruzNo ratings yet

- Lance Alluysius D. Dela Cruz Module 3 and 4 Contemporary Arts 12 - Diamond Performance Task #1Document2 pagesLance Alluysius D. Dela Cruz Module 3 and 4 Contemporary Arts 12 - Diamond Performance Task #1Lance Dela CruzNo ratings yet

- Lance Alluysius D. Dela Cruz Contemporary Arts 12 - Diamond Written Work #2Document2 pagesLance Alluysius D. Dela Cruz Contemporary Arts 12 - Diamond Written Work #2Lance Dela CruzNo ratings yet

- Case Company Traveloka - RevisedDocument2 pagesCase Company Traveloka - RevisedHendraNo ratings yet

- The Great Financial Scandal of 2003Document21 pagesThe Great Financial Scandal of 2003isaac setabiNo ratings yet

- Chapter 1 Audit of Cash and Cash Equivalents PDFDocument129 pagesChapter 1 Audit of Cash and Cash Equivalents PDFCasey Mae NeriNo ratings yet

- ASSINGMENTDocument2 pagesASSINGMENTBlaise WillieNo ratings yet

- SK Certification Bank 1Document1 pageSK Certification Bank 1Garry GustiloNo ratings yet

- Insurance Policy Receipt TemplateDocument1 pageInsurance Policy Receipt TemplateRahul JiwaneNo ratings yet

- Annual Report of Acs Group PDFDocument458 pagesAnnual Report of Acs Group PDFManyNo ratings yet

- Sample Assignment On Introduction To Malaysian Law of ContractDocument8 pagesSample Assignment On Introduction To Malaysian Law of ContractscholarsassistNo ratings yet

- Raji BF Statement of HoldingDocument23 pagesRaji BF Statement of HoldingBild Andhra PradeshNo ratings yet

- Awareness On e Filing and Tax Returns PDFDocument51 pagesAwareness On e Filing and Tax Returns PDFVijaykumar ChalwadiNo ratings yet

- SureSeats Transaction No 5591075 Has Been APPROVEDDocument2 pagesSureSeats Transaction No 5591075 Has Been APPROVEDMarlon MejiaNo ratings yet

- Foreign Currency Valuation ProcessDocument5 pagesForeign Currency Valuation ProcessVinay SinghNo ratings yet

- Chapter 6 Employee Benefits 2Document16 pagesChapter 6 Employee Benefits 2Thalia Rhine AberteNo ratings yet

- Introduction To Institutional InvestingDocument3 pagesIntroduction To Institutional InvestingOsheen SinghNo ratings yet

- GPA TemplateDocument3 pagesGPA TemplateNitin AgrawalNo ratings yet

- Accounting For Groups of CompaniesDocument9 pagesAccounting For Groups of CompaniesEmmanuel MwapeNo ratings yet

- Prospectus and Allotment of SecuritiesDocument32 pagesProspectus and Allotment of Securitieskryptone 1No ratings yet

- Quiz Business CombinationsDocument26 pagesQuiz Business Combinationsasachdeva17No ratings yet

- United States Court of Appeals, Sixth CircuitDocument8 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsNo ratings yet

- Liddell & Co DigestDocument2 pagesLiddell & Co DigestJoey PastranaNo ratings yet

- EnergDocument45 pagesEnergmelvingodricarceNo ratings yet

- Christopher Collins March Bank StatementDocument2 pagesChristopher Collins March Bank StatementJim BoazNo ratings yet

- Maini - Blueprint - Fi - 100 - Main Document - Ver - 3.0 PDFDocument69 pagesMaini - Blueprint - Fi - 100 - Main Document - Ver - 3.0 PDFBhaskarChakraborty0% (2)

- Cimb April2024Document2 pagesCimb April2024afauzinoNo ratings yet

- What Is Cryptocurrency - Forbes AdvisorDocument12 pagesWhat Is Cryptocurrency - Forbes Advisorhabeeb_matrixNo ratings yet

- Feizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed FirmsDocument10 pagesFeizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed Firmsgiorgos1978No ratings yet