Professional Documents

Culture Documents

Tax and Accounting 1

Tax and Accounting 1

Uploaded by

Jerrom Duque0 ratings0% found this document useful (0 votes)

3 views2 pagesThis document compares and contrasts revenue recognition standards between PFRS (Philippine Financial Reporting Standards) and Philippine income tax rules. Key differences include:

- Under PFRS, revenue from real estate sales is recognized when control over the asset is transferred to the customer. For tax purposes, different methods apply depending on the initial payment percentage.

- For real estate developers, PFRS requires percentage of completion method where revenue is recognized over time. Tax recognizes revenue upon delivery or title transfer.

- In a principal/agent relationship, PFRS looks at control factors to determine if revenue is reported gross or net. Tax guidance specifies treatment for different agency types.

Original Description:

Tax and accounting reconciliation notes summary part 1

Original Title

TAX AND ACCOUNTING 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document compares and contrasts revenue recognition standards between PFRS (Philippine Financial Reporting Standards) and Philippine income tax rules. Key differences include:

- Under PFRS, revenue from real estate sales is recognized when control over the asset is transferred to the customer. For tax purposes, different methods apply depending on the initial payment percentage.

- For real estate developers, PFRS requires percentage of completion method where revenue is recognized over time. Tax recognizes revenue upon delivery or title transfer.

- In a principal/agent relationship, PFRS looks at control factors to determine if revenue is reported gross or net. Tax guidance specifies treatment for different agency types.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesTax and Accounting 1

Tax and Accounting 1

Uploaded by

Jerrom DuqueThis document compares and contrasts revenue recognition standards between PFRS (Philippine Financial Reporting Standards) and Philippine income tax rules. Key differences include:

- Under PFRS, revenue from real estate sales is recognized when control over the asset is transferred to the customer. For tax purposes, different methods apply depending on the initial payment percentage.

- For real estate developers, PFRS requires percentage of completion method where revenue is recognized over time. Tax recognizes revenue upon delivery or title transfer.

- In a principal/agent relationship, PFRS looks at control factors to determine if revenue is reported gross or net. Tax guidance specifies treatment for different agency types.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

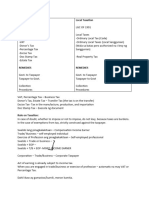

TAX & ACCOUNTING RECONCILIATION

PIE – Public Interest Entity

Treatment: Full PFRS

Non-PIE –

Large: Total assets 350M Total Liab 250M

Medium: Assets and Liab more than 100M but not more than 250M

Small: Total Assets and Liab not more than 100M

PFRS 15 Revenue Recognition (Real Estates)

For tax Revenue recognition (accrual, unless a specific method is prescribed by the BIR)

Tax Revenue (When earliest)

PFRS INCOME TAX

Revenue Lessor > over the term of lease (pantay Revenue is recognized when earned or when

pantay) received whichever comes first

Revenue – Real Estate Sale of Real Property

Recognized when control over the asset is Cash Basis

transferred to the customer. Deferred Cash Basis – More than 25%

----- Gains are taxable in the year of sale

Ordinary Asset. Di alam ni BIR lahat ng assets! Installment Basis – Initial Payment is not more

Cash and Deferred Cash Basis – Full Recognition than 25%

Installment – Based on Collection (if not > 25%) ------ Only portion of the percentage of Total

consideration received during the year

- Upon delivery or transfer of Title.

Real Estate Developer

- Revenue is recognized using the

percentage of completion

- PFRS 15.

Over the period of Time.

- (Mostly sale of service) When the

customers simultaneously satisfy benefits

and consummation.

- (Esp. Real Estate) When the performance

does not create an asset with alternative

use.

-

Principal / Agent Relationship

Principal (Functions/Accountability) Travel, Security, & Janitorial Agency

- Price Setting - Portion for remittance should not be

- Inventory Risk reported as revenue.

- Credit Risk - Agency Fee (with Ruling) is only reported

- Primary Responsibility - Janitorial Agency (without ruling)

reported as billed amount.

TAX & ACCOUNTING RECONCILIATION

Whether selling of Goods or Services,

follow Accrual basis!

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Nucor at CrossroadsDocument10 pagesNucor at CrossroadsNicolas AlfredNo ratings yet

- IM - Updates in Financial Reporting Standards (ACCO 40023) - Cash To AccrualDocument13 pagesIM - Updates in Financial Reporting Standards (ACCO 40023) - Cash To AccrualJasmine100% (2)

- Chapter 4 Revenues and Other Receipts PDFDocument5 pagesChapter 4 Revenues and Other Receipts PDFSteffany Roque100% (1)

- Chapter 4 - Reveneus and Other ReceiptsDocument18 pagesChapter 4 - Reveneus and Other Receiptsweddiemae villariza100% (8)

- Taxation PDFDocument55 pagesTaxation PDFHumphrey OdchigueNo ratings yet

- Presentation3.1 - Audit of Receivables, Revenue and Other Related AccountsDocument36 pagesPresentation3.1 - Audit of Receivables, Revenue and Other Related AccountsRoseanne Dela CruzNo ratings yet

- Tax and Accounting 2Document2 pagesTax and Accounting 2Jerrom DuqueNo ratings yet

- Tax and Accounting 4Document1 pageTax and Accounting 4Jerrom DuqueNo ratings yet

- As 9Document3 pagesAs 9krishlohana93No ratings yet

- Tax Case LawDocument8 pagesTax Case LawseshnaidooNo ratings yet

- FARreviewerDocument5 pagesFARreviewerKimNo ratings yet

- DTTL Tax Serbiahighlights 2018Document4 pagesDTTL Tax Serbiahighlights 2018BbaPbaNo ratings yet

- National Taxation Local TaxationDocument13 pagesNational Taxation Local TaxationjoanamaetaclasNo ratings yet

- TAXXXDocument10 pagesTAXXXFirstYear OneBNo ratings yet

- Recenue Recognition PDFDocument33 pagesRecenue Recognition PDFVinay GoyalNo ratings yet

- Chapter - 1 & 2 (Presentations On Introduction To Accounting & The Accounting Equation)Document52 pagesChapter - 1 & 2 (Presentations On Introduction To Accounting & The Accounting Equation)ravinbd96No ratings yet

- The Government Accounting ProcessDocument21 pagesThe Government Accounting ProcesskripsNo ratings yet

- Notes - Output VatDocument4 pagesNotes - Output VatSunny DaeNo ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsGhillian Mae GuiangNo ratings yet

- Real Estate Taxation - Transfer of PropertyDocument9 pagesReal Estate Taxation - Transfer of PropertyJuan FrivaldoNo ratings yet

- Basics of AccountingDocument42 pagesBasics of AccountingGgaurav KumarNo ratings yet

- Module 4. Revenues and Other ReceiptsDocument10 pagesModule 4. Revenues and Other ReceiptsAbegail CadacioNo ratings yet

- Ias 12 TaxationDocument15 pagesIas 12 TaxationHải AnhNo ratings yet

- 2.0 Business As An Element and Accounting For Business CombinationDocument29 pages2.0 Business As An Element and Accounting For Business CombinationGlensh Reigne CarlitNo ratings yet

- Losses: Nominal Value of Outstanding ISSUED SHARES - Stated Value of The SharesDocument4 pagesLosses: Nominal Value of Outstanding ISSUED SHARES - Stated Value of The SharesEdge JulianNo ratings yet

- Inctax1stquizsemis4 12Document4 pagesInctax1stquizsemis4 12Jerica CaballesNo ratings yet

- Revenues and Other ReceiptsDocument28 pagesRevenues and Other ReceiptsJV100% (1)

- Ias 12 TaxationDocument14 pagesIas 12 TaxationĐức DuyNo ratings yet

- The Accounting Equation and The Double-Entry SystemDocument24 pagesThe Accounting Equation and The Double-Entry SystemJohn Mark MaligaligNo ratings yet

- T 32fd6f43 3cd3 4d19 b62d 111e849211bfincome StatementDocument45 pagesT 32fd6f43 3cd3 4d19 b62d 111e849211bfincome StatementthukrishivNo ratings yet

- Unit TrustDocument3 pagesUnit TrustGayathri PathmanathanNo ratings yet

- ACCA FR Concept CapsuleDocument8 pagesACCA FR Concept CapsulehasharawanNo ratings yet

- Chapter - 1 & 2 (Presentations On Introduction To Accounting & The Accounting Equation)Document52 pagesChapter - 1 & 2 (Presentations On Introduction To Accounting & The Accounting Equation)Sattaki RoyNo ratings yet

- Accounting Cheat SheetDocument2 pagesAccounting Cheat SheetvgirotraNo ratings yet

- Chapter 2 - The Accounting Equation and The Double Entry SystemDocument3 pagesChapter 2 - The Accounting Equation and The Double Entry SystemalonNo ratings yet

- CPA Regulation (Reg) Notes 2013Document7 pagesCPA Regulation (Reg) Notes 2013amichalek0820100% (3)

- Chapter 1 - Introduction To Accounting: Concepts and PrinciplesDocument25 pagesChapter 1 - Introduction To Accounting: Concepts and Principlesd_hambrettNo ratings yet

- Income Tax Schemes, Accounting Periods, Methods, and ReportingDocument30 pagesIncome Tax Schemes, Accounting Periods, Methods, and ReportingamiNo ratings yet

- IA 1 - 4 ReceivablesDocument9 pagesIA 1 - 4 ReceivablesVJ MacaspacNo ratings yet

- Cambodian 2018 Tax Booklet: A Summary of Cambodian TaxationDocument26 pagesCambodian 2018 Tax Booklet: A Summary of Cambodian TaxationLee XingNo ratings yet

- General Finance &accounting Interview Question BankDocument19 pagesGeneral Finance &accounting Interview Question Bankarts.amita09No ratings yet

- To Study This: Balance Sheet To Study This: Income Statement To Study This: Cash FlowDocument8 pagesTo Study This: Balance Sheet To Study This: Income Statement To Study This: Cash FlowChama SekkatNo ratings yet

- Business and Transfer Taxation by BanggawanDocument1 pageBusiness and Transfer Taxation by BanggawanwktxlsrkfNo ratings yet

- FAR Chapt. 7Document8 pagesFAR Chapt. 7Ryan GaniaNo ratings yet

- PAS 12 Income TaxesDocument12 pagesPAS 12 Income Taxeshjihjbj,iljNo ratings yet

- Txtrbus NotesDocument14 pagesTxtrbus NotesMARIA VERNADETTE SHARISSE LEGASPINo ratings yet

- Notes On VATDocument15 pagesNotes On VATRica BlancaNo ratings yet

- Real Estate Terms DefinitionsDocument9 pagesReal Estate Terms DefinitionsPrasanjeet BhattacharjeeNo ratings yet

- Slump SaleDocument13 pagesSlump SaleAnjali kashyapNo ratings yet

- Financial Statements, Cash Flows, and TaxesDocument27 pagesFinancial Statements, Cash Flows, and TaxeszhengcunzhangNo ratings yet

- Wealth Management PPT FinalDocument42 pagesWealth Management PPT FinalCyvita VeigasNo ratings yet

- 3.4final AccountsDocument103 pages3.4final Accountsedclausen1No ratings yet

- Ifrs at A Glance: IAS 12 Income TaxesDocument4 pagesIfrs at A Glance: IAS 12 Income Taxeslina_siscanu6356No ratings yet

- 2024 01 10 Taxation TX 5Document13 pages2024 01 10 Taxation TX 5Banner Of PraiseNo ratings yet

- Temporary Differences (Result in Deferred Taxes) :: Royalties Received in AdvanceDocument41 pagesTemporary Differences (Result in Deferred Taxes) :: Royalties Received in AdvanceIrfanali Jusab100% (1)

- DTTL Tax Boliviahighlights 2018Document3 pagesDTTL Tax Boliviahighlights 2018MikailOpintoNo ratings yet

- Chapter 7 SummaryDocument3 pagesChapter 7 SummaryAce Hulsey TevesNo ratings yet

- (ACCCOB2) Chapters 3-5 Receivables, Investments, InventoryDocument11 pages(ACCCOB2) Chapters 3-5 Receivables, Investments, InventoryMichaella PurgananNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Ôn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Document48 pagesÔn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Thương TrầnNo ratings yet

- Apple and Its Marketing StrategyDocument6 pagesApple and Its Marketing StrategyArjun KhanalNo ratings yet

- 1207 4295 1 PBDocument10 pages1207 4295 1 PBZahra AmeliaNo ratings yet

- ROYAL SCANS AND DIAGNOSTICS - CompressedDocument23 pagesROYAL SCANS AND DIAGNOSTICS - CompressedAegan VetrinarayananNo ratings yet

- Adv AccountssumsDocument419 pagesAdv Accountssumsmasdram_91849140750% (2)

- Trends in Credit Risk MGMTDocument24 pagesTrends in Credit Risk MGMTr.jeyashankar9550No ratings yet

- Curriculum 20170817Document2 pagesCurriculum 20170817DamTokyoNo ratings yet

- Chapter 2: Accounting Equation and The Double-Entry SystemDocument15 pagesChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae SasutilNo ratings yet

- Product MixDocument1 pageProduct Mixyashpandya01No ratings yet

- Manish KumarDocument121 pagesManish KumarHirdesh JainNo ratings yet

- Flow of Production PlanningDocument2 pagesFlow of Production Planningbalu4indiansNo ratings yet

- Paper10 Set2 AnsDocument19 pagesPaper10 Set2 Anssamuel NjeckNo ratings yet

- AIS Chapter 13 Expenditure CycleDocument39 pagesAIS Chapter 13 Expenditure CycleShakuli YesrNo ratings yet

- Map PDFDocument48 pagesMap PDFuwuniverse dailyNo ratings yet

- Chapter 11 Bme 4004Document5 pagesChapter 11 Bme 4004lowi shooNo ratings yet

- Jurnal InternasionalDocument7 pagesJurnal InternasionaldaimisNo ratings yet

- Ch#5 Strategy in M ChannelsDocument7 pagesCh#5 Strategy in M ChannelsbakedcakedNo ratings yet

- Managing in Turbulent Times - Srikant GokhaleDocument17 pagesManaging in Turbulent Times - Srikant GokhaleAshick AliNo ratings yet

- Berhanu G. Final ThesisDocument63 pagesBerhanu G. Final Thesistamrat lisanworkNo ratings yet

- Mindanao State University-Naawan: College of Business Administration and AccountancyDocument6 pagesMindanao State University-Naawan: College of Business Administration and AccountancyMiralona RelevoNo ratings yet

- Rosewood Case AnalysisDocument4 pagesRosewood Case AnalysisAbhijeet SinghNo ratings yet

- Lecture 7 Implementation of StrategiesDocument18 pagesLecture 7 Implementation of Strategiesnatasha carmichaelNo ratings yet

- The Brita Products Company Case ReportDocument3 pagesThe Brita Products Company Case ReportSojung Yoon100% (1)

- Broker and ResponsibilitiesDocument19 pagesBroker and ResponsibilitiesmahadevavrNo ratings yet

- Bab 6-Transfer PricingDocument16 pagesBab 6-Transfer PricinghanifahNo ratings yet

- Anisah BBIM4103 Jan2019Document25 pagesAnisah BBIM4103 Jan2019Supian Jannatul FirdausNo ratings yet

- Entrepreneurial MarketingDocument15 pagesEntrepreneurial MarketingammuajayNo ratings yet

- Consumer Evaluation and Competitive Advantage in Retail Financial Services - A Research AgendaDocument22 pagesConsumer Evaluation and Competitive Advantage in Retail Financial Services - A Research Agendajjle100% (2)

- Lilac Flour Mills - FinalDocument9 pagesLilac Flour Mills - Finalrahulchohan2108100% (1)