Professional Documents

Culture Documents

Tax and Accounting 3

Tax and Accounting 3

Uploaded by

Jerrom DuqueCopyright:

Available Formats

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Sample Questions Mathematics Category 2Document8 pagesSample Questions Mathematics Category 2Rufat Asgarov100% (1)

- 3 Group Accounts and Business Combinations Lecture NotesDocument47 pages3 Group Accounts and Business Combinations Lecture NotesAKINYEMI ADISA KAMORU100% (4)

- William Blakes Illustrations For Dantes Divine ComedyDocument298 pagesWilliam Blakes Illustrations For Dantes Divine Comedyraul100% (3)

- Life 2e BrE Inter SB U01AB Day-1Document29 pagesLife 2e BrE Inter SB U01AB Day-1Quỳnh NhưNo ratings yet

- The University of The South Pacific: Lab 1 (Worth 4%)Document3 pagesThe University of The South Pacific: Lab 1 (Worth 4%)Donald BennettNo ratings yet

- Losses: Nominal Value of Outstanding ISSUED SHARES - Stated Value of The SharesDocument4 pagesLosses: Nominal Value of Outstanding ISSUED SHARES - Stated Value of The SharesEdge JulianNo ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsGhillian Mae GuiangNo ratings yet

- Tax and Accounting 4Document1 pageTax and Accounting 4Jerrom DuqueNo ratings yet

- De La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesDocument4 pagesDe La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesJere Mae MarananNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- 01 IntaxDocument5 pages01 IntaxAbigail VergaraNo ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross IncomeNoroNo ratings yet

- Lesson 12Document6 pagesLesson 12Jamaica bunielNo ratings yet

- Last Minute Notes DeductionDocument2 pagesLast Minute Notes DeductionPrincess Helen Grace BeberoNo ratings yet

- Deductions On Gross IncomeDocument6 pagesDeductions On Gross IncomeJamaica DavidNo ratings yet

- Ifrs at A Glance: IAS 12 Income TaxesDocument4 pagesIfrs at A Glance: IAS 12 Income Taxeslina_siscanu6356No ratings yet

- TAXXXDocument10 pagesTAXXXFirstYear OneBNo ratings yet

- ACTAX-3153-N002-Intro To Income Taxation PDFDocument5 pagesACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanNo ratings yet

- Notes To Accounts CompanyDocument9 pagesNotes To Accounts CompanyMy NameNo ratings yet

- Allowable Deductions From Gross IncomeDocument5 pagesAllowable Deductions From Gross IncomeTet VergaraNo ratings yet

- Unit TrustDocument3 pagesUnit TrustGayathri PathmanathanNo ratings yet

- Special Accounting ConsiderationsDocument9 pagesSpecial Accounting ConsiderationsIvy Claire SemenianoNo ratings yet

- Financial InstrumentsDocument21 pagesFinancial InstrumentsTommaso SpositoNo ratings yet

- Definition .: The Philippine Securities and Exchange Commission deDocument15 pagesDefinition .: The Philippine Securities and Exchange Commission demiya girlNo ratings yet

- Earnings Per ShareDocument5 pagesEarnings Per SharePushTheStart GamingNo ratings yet

- Earnings Per ShareDocument5 pagesEarnings Per SharePushTheStart GamingNo ratings yet

- 4 Franchise Ifrs 15 2020Document15 pages4 Franchise Ifrs 15 2020natalie clyde matesNo ratings yet

- Exempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawDocument5 pagesExempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawPaula Mae DacanayNo ratings yet

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeShena Gladdys BaylonNo ratings yet

- TAX 1 - Gross ProfitDocument3 pagesTAX 1 - Gross ProfitPacaña, Vincent Michael M.No ratings yet

- Ind-AS: Overview: by CA Jatin FuriaDocument18 pagesInd-AS: Overview: by CA Jatin FuriamansiNo ratings yet

- Presentation - PFRF For CoopsDocument55 pagesPresentation - PFRF For CoopsKellen HernandezNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Investment in Debt SecuritiesDocument7 pagesInvestment in Debt SecuritiesRoma Suliguin0% (1)

- Accounting For Business Combination L3 Lesson 3: IFRS 10 Consolidated Financial StatementDocument3 pagesAccounting For Business Combination L3 Lesson 3: IFRS 10 Consolidated Financial StatementBeatrice Ella DomingoNo ratings yet

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroNo ratings yet

- Income Tax: Full PFRS, Prfs For Smes & Pfrs For SesDocument15 pagesIncome Tax: Full PFRS, Prfs For Smes & Pfrs For SesChara etangNo ratings yet

- FAR 04 Investment in Debt Instruments LectureDocument4 pagesFAR 04 Investment in Debt Instruments Lecturebyunb3617No ratings yet

- Equity Program FAQDocument14 pagesEquity Program FAQNikhil SinghalNo ratings yet

- NotesDocument3 pagesNotesMichaela Marie MierNo ratings yet

- Chapter 9 SummaryDocument4 pagesChapter 9 SummaryFubuki JigokuNo ratings yet

- Lesson 12Document10 pagesLesson 12shadowlord468No ratings yet

- Business Combinations - ASPEDocument3 pagesBusiness Combinations - ASPEShariful HoqueNo ratings yet

- Capital Gains (CA)Document87 pagesCapital Gains (CA)Aiswarya ManojNo ratings yet

- XH-H 3e PPT Chap05Document69 pagesXH-H 3e PPT Chap05An NhiênNo ratings yet

- TAX LAW BALA SA BAR SERIES ExportDocument10 pagesTAX LAW BALA SA BAR SERIES Exportmetrexz17.03No ratings yet

- IFRS Vs GAAP DifferencesDocument5 pagesIFRS Vs GAAP DifferencesMahmoud SalahNo ratings yet

- FAR IFRS StandardsDocument11 pagesFAR IFRS Standardsyfarhana2002No ratings yet

- Factsheet IAS12 Income TaxesDocument14 pagesFactsheet IAS12 Income TaxesMira EbreoNo ratings yet

- Funac Midterm ReviewerDocument17 pagesFunac Midterm Reviewermanuelsophia.cpaNo ratings yet

- Business TaxDocument3 pagesBusiness Taxsharlica1990No ratings yet

- Chap 13 - Income From BusinessDocument14 pagesChap 13 - Income From BusinessMuhammad Saad UmarNo ratings yet

- Tax Midterm ReviewerDocument8 pagesTax Midterm ReviewerkarenongsucoNo ratings yet

- Investment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Document11 pagesInvestment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Richie BoomaNo ratings yet

- CHAP23Document2 pagesCHAP23LeonilaEnriquezNo ratings yet

- Investments DiscussionDocument5 pagesInvestments DiscussionKathrine CruzNo ratings yet

- Chapter 5: Final Income Taxation Final Withholding SystemDocument4 pagesChapter 5: Final Income Taxation Final Withholding SystemHanz RecitasNo ratings yet

- Intercorporate Investments 2019Document14 pagesIntercorporate Investments 2019Jähäñ ShërNo ratings yet

- Statement of Financial Position (Balance Sheet)Document2 pagesStatement of Financial Position (Balance Sheet)KattNo ratings yet

- UntitledDocument1 pageUntitledJevanie CastroverdeNo ratings yet

- Pfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsDocument6 pagesPfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsSHARON SAMSONNo ratings yet

- Principle of Organic Medicine ChemistryDocument331 pagesPrinciple of Organic Medicine ChemistryVictoria TinajeroNo ratings yet

- Shore Protection Manual - Vol-II - US Army - 1984Document300 pagesShore Protection Manual - Vol-II - US Army - 1984hihappy2cuNo ratings yet

- On The Roll With The Environment: June 7, 20213 Min ReadDocument3 pagesOn The Roll With The Environment: June 7, 20213 Min Readkyzel colNo ratings yet

- World Religions Exam Review 2024Document3 pagesWorld Religions Exam Review 2024Marina SolakaNo ratings yet

- Junior Agronomist - On Contract: Gujarat State Fertilizers and Chemicals LTDDocument2 pagesJunior Agronomist - On Contract: Gujarat State Fertilizers and Chemicals LTDZayn AliNo ratings yet

- MIP Model For Split Delivery VRP With Fleet & Driver SchedulingDocument5 pagesMIP Model For Split Delivery VRP With Fleet & Driver SchedulingMinh Châu Nguyễn TrầnNo ratings yet

- CAESAR II® How To Solve Friction ForceDocument2 pagesCAESAR II® How To Solve Friction Forcefurqan100% (1)

- Poetry Analysis - Song LyricsDocument4 pagesPoetry Analysis - Song LyricsSohrab AliNo ratings yet

- Pompes Doseuses Motorisées Fra PDFDocument16 pagesPompes Doseuses Motorisées Fra PDFichrakNo ratings yet

- What Is Intranet?: Document & Content ManagementDocument4 pagesWhat Is Intranet?: Document & Content Managementali muhdorNo ratings yet

- Midterm PathfitDocument5 pagesMidterm PathfitEDETH SUBONGNo ratings yet

- I. Objectives: PE10PF-Ia-h-39Document3 pagesI. Objectives: PE10PF-Ia-h-39Ken Genece LlanesNo ratings yet

- Maltus Population TheoryDocument6 pagesMaltus Population TheoryAlga BijuNo ratings yet

- WF D02A Energy MeterDocument10 pagesWF D02A Energy MeterfioNo ratings yet

- A Robust Framework For Malicious PDF Detection LeveragingDocument20 pagesA Robust Framework For Malicious PDF Detection LeveragingIdontspeakeNo ratings yet

- Ex. No: 6.a Linear Search AimDocument6 pagesEx. No: 6.a Linear Search AimSARANYA.R MIT-AP/CSENo ratings yet

- Physical Education and Physical FitnessDocument33 pagesPhysical Education and Physical FitnessKaitlinn Jamila AltatisNo ratings yet

- 1 - Mql4-BookDocument464 pages1 - Mql4-BookPradito BhimoNo ratings yet

- Method Statement For Marble Flooring and Marble Wall CladdingDocument10 pagesMethod Statement For Marble Flooring and Marble Wall Claddingumit100% (1)

- Love of Radhe-KrishnaDocument3 pagesLove of Radhe-KrishnaavncntnNo ratings yet

- (1996) JOSA 13 Space-Bandwidth Product of Optical Signals and SyDocument4 pages(1996) JOSA 13 Space-Bandwidth Product of Optical Signals and Sythanhevt92No ratings yet

- Hotmails 10Document57 pagesHotmails 10joinhands62No ratings yet

- Unit 1 - Theories of Origin of Human LanguageDocument7 pagesUnit 1 - Theories of Origin of Human LanguageHerford Guibang-Guibang100% (1)

- Nitish-ResumeDocument1 pageNitish-Resumeshariq khanNo ratings yet

- I VTECDocument20 pagesI VTECraju100% (2)

- HVT DS HAEFELY 9231-Capacitor V2206Document4 pagesHVT DS HAEFELY 9231-Capacitor V2206sunilNo ratings yet

Tax and Accounting 3

Tax and Accounting 3

Uploaded by

Jerrom DuqueOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax and Accounting 3

Tax and Accounting 3

Uploaded by

Jerrom DuqueCopyright:

Available Formats

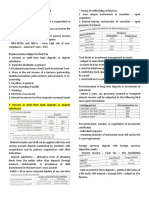

TAX & ACCOUNTING RECONCILIATION

CHARITABLE CONTRIBUTIONs

Deductible in full

- Government

- Certain Foreign inst. Or international Org

- Accredited NGO bu the Philippine Council

on NGO certification (PCNC)

Subject to limitations

- 5% of the taxable income before

considering the consideration.

FOREX

Income Statement whether realized or Only realized gains and losses, not including

unrealized. unrealized

- Transaction is transalted into functional - For conversion of foreign currency to

currency at the spot rate at the date of Php, the prevailing interbank reference

the transactions. rate shall apply.

- Monetary asset and liabilities are - Forex gains losses are recognized when

translated using the closing rate as of the they are actually recognized.

FS date with gains and losses recognized

in P&L.

Employee Benefits

The amount of deductible expense depends on

Includes: whether the plan is registered with the BIR or not

Service Cost - Not registered- Actual retirement

Net Interest Cost benefits paid

- Registered -Actual contribution normal

cost while contribution for past service

liability is amortized over 10 Years.

Leases-Lessee

- Lease expense is deductible as when

All leases are accounted for as a finance lease incurred provided the appropriate taxes

wherein the lessee recognizes. are withheld on lease payments.

- Depreciation expense

- Interest Expense

Losses Generally:

- Realized loss-deductible

- Generally losses are recognized in profit - Unrealized loss – non deductible

or loss in the year incurred. Casualty Losses

- Should be reported within 45 days from

the date of occurrence

- NOLCO can be carried forward over the 3

years.

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Sample Questions Mathematics Category 2Document8 pagesSample Questions Mathematics Category 2Rufat Asgarov100% (1)

- 3 Group Accounts and Business Combinations Lecture NotesDocument47 pages3 Group Accounts and Business Combinations Lecture NotesAKINYEMI ADISA KAMORU100% (4)

- William Blakes Illustrations For Dantes Divine ComedyDocument298 pagesWilliam Blakes Illustrations For Dantes Divine Comedyraul100% (3)

- Life 2e BrE Inter SB U01AB Day-1Document29 pagesLife 2e BrE Inter SB U01AB Day-1Quỳnh NhưNo ratings yet

- The University of The South Pacific: Lab 1 (Worth 4%)Document3 pagesThe University of The South Pacific: Lab 1 (Worth 4%)Donald BennettNo ratings yet

- Losses: Nominal Value of Outstanding ISSUED SHARES - Stated Value of The SharesDocument4 pagesLosses: Nominal Value of Outstanding ISSUED SHARES - Stated Value of The SharesEdge JulianNo ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsGhillian Mae GuiangNo ratings yet

- Tax and Accounting 4Document1 pageTax and Accounting 4Jerrom DuqueNo ratings yet

- De La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesDocument4 pagesDe La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesJere Mae MarananNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- 01 IntaxDocument5 pages01 IntaxAbigail VergaraNo ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross IncomeNoroNo ratings yet

- Lesson 12Document6 pagesLesson 12Jamaica bunielNo ratings yet

- Last Minute Notes DeductionDocument2 pagesLast Minute Notes DeductionPrincess Helen Grace BeberoNo ratings yet

- Deductions On Gross IncomeDocument6 pagesDeductions On Gross IncomeJamaica DavidNo ratings yet

- Ifrs at A Glance: IAS 12 Income TaxesDocument4 pagesIfrs at A Glance: IAS 12 Income Taxeslina_siscanu6356No ratings yet

- TAXXXDocument10 pagesTAXXXFirstYear OneBNo ratings yet

- ACTAX-3153-N002-Intro To Income Taxation PDFDocument5 pagesACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanNo ratings yet

- Notes To Accounts CompanyDocument9 pagesNotes To Accounts CompanyMy NameNo ratings yet

- Allowable Deductions From Gross IncomeDocument5 pagesAllowable Deductions From Gross IncomeTet VergaraNo ratings yet

- Unit TrustDocument3 pagesUnit TrustGayathri PathmanathanNo ratings yet

- Special Accounting ConsiderationsDocument9 pagesSpecial Accounting ConsiderationsIvy Claire SemenianoNo ratings yet

- Financial InstrumentsDocument21 pagesFinancial InstrumentsTommaso SpositoNo ratings yet

- Definition .: The Philippine Securities and Exchange Commission deDocument15 pagesDefinition .: The Philippine Securities and Exchange Commission demiya girlNo ratings yet

- Earnings Per ShareDocument5 pagesEarnings Per SharePushTheStart GamingNo ratings yet

- Earnings Per ShareDocument5 pagesEarnings Per SharePushTheStart GamingNo ratings yet

- 4 Franchise Ifrs 15 2020Document15 pages4 Franchise Ifrs 15 2020natalie clyde matesNo ratings yet

- Exempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawDocument5 pagesExempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawPaula Mae DacanayNo ratings yet

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeShena Gladdys BaylonNo ratings yet

- TAX 1 - Gross ProfitDocument3 pagesTAX 1 - Gross ProfitPacaña, Vincent Michael M.No ratings yet

- Ind-AS: Overview: by CA Jatin FuriaDocument18 pagesInd-AS: Overview: by CA Jatin FuriamansiNo ratings yet

- Presentation - PFRF For CoopsDocument55 pagesPresentation - PFRF For CoopsKellen HernandezNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Investment in Debt SecuritiesDocument7 pagesInvestment in Debt SecuritiesRoma Suliguin0% (1)

- Accounting For Business Combination L3 Lesson 3: IFRS 10 Consolidated Financial StatementDocument3 pagesAccounting For Business Combination L3 Lesson 3: IFRS 10 Consolidated Financial StatementBeatrice Ella DomingoNo ratings yet

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroNo ratings yet

- Income Tax: Full PFRS, Prfs For Smes & Pfrs For SesDocument15 pagesIncome Tax: Full PFRS, Prfs For Smes & Pfrs For SesChara etangNo ratings yet

- FAR 04 Investment in Debt Instruments LectureDocument4 pagesFAR 04 Investment in Debt Instruments Lecturebyunb3617No ratings yet

- Equity Program FAQDocument14 pagesEquity Program FAQNikhil SinghalNo ratings yet

- NotesDocument3 pagesNotesMichaela Marie MierNo ratings yet

- Chapter 9 SummaryDocument4 pagesChapter 9 SummaryFubuki JigokuNo ratings yet

- Lesson 12Document10 pagesLesson 12shadowlord468No ratings yet

- Business Combinations - ASPEDocument3 pagesBusiness Combinations - ASPEShariful HoqueNo ratings yet

- Capital Gains (CA)Document87 pagesCapital Gains (CA)Aiswarya ManojNo ratings yet

- XH-H 3e PPT Chap05Document69 pagesXH-H 3e PPT Chap05An NhiênNo ratings yet

- TAX LAW BALA SA BAR SERIES ExportDocument10 pagesTAX LAW BALA SA BAR SERIES Exportmetrexz17.03No ratings yet

- IFRS Vs GAAP DifferencesDocument5 pagesIFRS Vs GAAP DifferencesMahmoud SalahNo ratings yet

- FAR IFRS StandardsDocument11 pagesFAR IFRS Standardsyfarhana2002No ratings yet

- Factsheet IAS12 Income TaxesDocument14 pagesFactsheet IAS12 Income TaxesMira EbreoNo ratings yet

- Funac Midterm ReviewerDocument17 pagesFunac Midterm Reviewermanuelsophia.cpaNo ratings yet

- Business TaxDocument3 pagesBusiness Taxsharlica1990No ratings yet

- Chap 13 - Income From BusinessDocument14 pagesChap 13 - Income From BusinessMuhammad Saad UmarNo ratings yet

- Tax Midterm ReviewerDocument8 pagesTax Midterm ReviewerkarenongsucoNo ratings yet

- Investment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Document11 pagesInvestment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Richie BoomaNo ratings yet

- CHAP23Document2 pagesCHAP23LeonilaEnriquezNo ratings yet

- Investments DiscussionDocument5 pagesInvestments DiscussionKathrine CruzNo ratings yet

- Chapter 5: Final Income Taxation Final Withholding SystemDocument4 pagesChapter 5: Final Income Taxation Final Withholding SystemHanz RecitasNo ratings yet

- Intercorporate Investments 2019Document14 pagesIntercorporate Investments 2019Jähäñ ShërNo ratings yet

- Statement of Financial Position (Balance Sheet)Document2 pagesStatement of Financial Position (Balance Sheet)KattNo ratings yet

- UntitledDocument1 pageUntitledJevanie CastroverdeNo ratings yet

- Pfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsDocument6 pagesPfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsSHARON SAMSONNo ratings yet

- Principle of Organic Medicine ChemistryDocument331 pagesPrinciple of Organic Medicine ChemistryVictoria TinajeroNo ratings yet

- Shore Protection Manual - Vol-II - US Army - 1984Document300 pagesShore Protection Manual - Vol-II - US Army - 1984hihappy2cuNo ratings yet

- On The Roll With The Environment: June 7, 20213 Min ReadDocument3 pagesOn The Roll With The Environment: June 7, 20213 Min Readkyzel colNo ratings yet

- World Religions Exam Review 2024Document3 pagesWorld Religions Exam Review 2024Marina SolakaNo ratings yet

- Junior Agronomist - On Contract: Gujarat State Fertilizers and Chemicals LTDDocument2 pagesJunior Agronomist - On Contract: Gujarat State Fertilizers and Chemicals LTDZayn AliNo ratings yet

- MIP Model For Split Delivery VRP With Fleet & Driver SchedulingDocument5 pagesMIP Model For Split Delivery VRP With Fleet & Driver SchedulingMinh Châu Nguyễn TrầnNo ratings yet

- CAESAR II® How To Solve Friction ForceDocument2 pagesCAESAR II® How To Solve Friction Forcefurqan100% (1)

- Poetry Analysis - Song LyricsDocument4 pagesPoetry Analysis - Song LyricsSohrab AliNo ratings yet

- Pompes Doseuses Motorisées Fra PDFDocument16 pagesPompes Doseuses Motorisées Fra PDFichrakNo ratings yet

- What Is Intranet?: Document & Content ManagementDocument4 pagesWhat Is Intranet?: Document & Content Managementali muhdorNo ratings yet

- Midterm PathfitDocument5 pagesMidterm PathfitEDETH SUBONGNo ratings yet

- I. Objectives: PE10PF-Ia-h-39Document3 pagesI. Objectives: PE10PF-Ia-h-39Ken Genece LlanesNo ratings yet

- Maltus Population TheoryDocument6 pagesMaltus Population TheoryAlga BijuNo ratings yet

- WF D02A Energy MeterDocument10 pagesWF D02A Energy MeterfioNo ratings yet

- A Robust Framework For Malicious PDF Detection LeveragingDocument20 pagesA Robust Framework For Malicious PDF Detection LeveragingIdontspeakeNo ratings yet

- Ex. No: 6.a Linear Search AimDocument6 pagesEx. No: 6.a Linear Search AimSARANYA.R MIT-AP/CSENo ratings yet

- Physical Education and Physical FitnessDocument33 pagesPhysical Education and Physical FitnessKaitlinn Jamila AltatisNo ratings yet

- 1 - Mql4-BookDocument464 pages1 - Mql4-BookPradito BhimoNo ratings yet

- Method Statement For Marble Flooring and Marble Wall CladdingDocument10 pagesMethod Statement For Marble Flooring and Marble Wall Claddingumit100% (1)

- Love of Radhe-KrishnaDocument3 pagesLove of Radhe-KrishnaavncntnNo ratings yet

- (1996) JOSA 13 Space-Bandwidth Product of Optical Signals and SyDocument4 pages(1996) JOSA 13 Space-Bandwidth Product of Optical Signals and Sythanhevt92No ratings yet

- Hotmails 10Document57 pagesHotmails 10joinhands62No ratings yet

- Unit 1 - Theories of Origin of Human LanguageDocument7 pagesUnit 1 - Theories of Origin of Human LanguageHerford Guibang-Guibang100% (1)

- Nitish-ResumeDocument1 pageNitish-Resumeshariq khanNo ratings yet

- I VTECDocument20 pagesI VTECraju100% (2)

- HVT DS HAEFELY 9231-Capacitor V2206Document4 pagesHVT DS HAEFELY 9231-Capacitor V2206sunilNo ratings yet