Professional Documents

Culture Documents

Finding Semiconductor Leadership. The Wyckoff Way - Power Charting - 2.03.2023

Finding Semiconductor Leadership. The Wyckoff Way - Power Charting - 2.03.2023

Uploaded by

jim kang0 ratings0% found this document useful (0 votes)

52 views7 pagesThe document discusses using a simple scan to identify emerging industry leadership in the stock market. The scan looks for industry groups where the stocks are above their 39-week moving average, the moving average is trending up, and ranks the groups by relative strength (RS) score. As an example, the speaker ran the scan on industry groups and identified semiconductors as showing leadership characteristics. This scan is the first step in the speaker's process to identify emerging trends moving from broad market indexes down to specific industry groups and stocks.

Original Description:

Finding Semiconductor Leadership. the Wyckoff Way

Original Title

Finding Semiconductor Leadership. the Wyckoff Way - Power Charting - 2.03.2023

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses using a simple scan to identify emerging industry leadership in the stock market. The scan looks for industry groups where the stocks are above their 39-week moving average, the moving average is trending up, and ranks the groups by relative strength (RS) score. As an example, the speaker ran the scan on industry groups and identified semiconductors as showing leadership characteristics. This scan is the first step in the speaker's process to identify emerging trends moving from broad market indexes down to specific industry groups and stocks.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

0 ratings0% found this document useful (0 votes)

52 views7 pagesFinding Semiconductor Leadership. The Wyckoff Way - Power Charting - 2.03.2023

Finding Semiconductor Leadership. The Wyckoff Way - Power Charting - 2.03.2023

Uploaded by

jim kangThe document discusses using a simple scan to identify emerging industry leadership in the stock market. The scan looks for industry groups where the stocks are above their 39-week moving average, the moving average is trending up, and ranks the groups by relative strength (RS) score. As an example, the speaker ran the scan on industry groups and identified semiconductors as showing leadership characteristics. This scan is the first step in the speaker's process to identify emerging trends moving from broad market indexes down to specific industry groups and stocks.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

You are on page 1of 7

[0:14] Welcome to power charting I am your host, Bruce Frazier and very exciting

times in the market.

[0:20] The FED may interest rate decision announcements.

[0:25] Yesterday Market is responding bull asleep from that.

[0:28] We'll talk a little bit about that and then we will get right into finding

leadership, we're going to use semiconductor Industry Group, as our case study

analysis, and we really liked some of the things that are happening in that.

[0:44] Group and many others at this time.

[0:46] So the but to start, let's go to Read that right for bed, it'll help you go

to sleep.

[0:56] And then here a great question from one of our community about analogs and

was very intrigued with the fact that this 2002 three analog using the DOW

Industrials was compared to the S&P 500.

[1:12] It was curious to know if you can compare different instruments to each

other such as two different indexes.

[1:19] Absolutely, we are in charting King at the unfolding behavior of mass

psychology among investors in chart patterns.

[1:30] So anytime you're looking at a chart pattern you're effectively looking at

an analog so head and shoulders top you're looking at some idealized example of a

head and shoulders top and comparing it to an instrument that you're currently

studying so that is a form of an analog and here in this case, we work Comparing

the accumulation structure of 2002 3 in the Dow Jones to the way that the S&P 500

has been setting up in 22 and 23.

[2:05] And we numbered these, you can see here.

[2:10] There are deviations or variances in the way.

[2:13] This is unfolding, but you can see climactic low at one rally in a up.

[2:20] Thrusting action into two.

[2:22] Four is a lower high point.

[2:24] Three actually is a secondary test with a slight undercutting of the climax

at one, which proves to be good support.

[2:32] And so now .5, and then we made the case that point six would be important

next leg or next event up.

[2:42] Now, look at the distinctions because part of looking at Analog studies is

to look for what is a like but what are the deviations and so know.

[2:53] Note, the rally from five to six back in 2020.

[2:57] 2003 was a diminishing thrust.

[3:03] Slowing Advanced weakening.

[3:06] As it was going up, making a lower high and this proved to be a final high.

[3:11] But in fact, the different situation occurred, there was a sharp break

initially in 2002 in December, then a low into the end of Year.

[3:23] And then around good rally phase to start the rally, as was the case at from

five to six prior, but then continuation with just an ability to be able to just

keep pushing up, much better rally in the second.

[3:40] Half up to six, and it took out point for so inherently a stronger rally

occurred.

[3:47] This is a distinction, A variation between then, and now, that's what we do.

[3:52] With analogues is something that Wyckoff is really, really good at and he

didn't have relative strength analysis.

[3:59] So he was always looking at waves ways that waves of advanced a waves of

decline, comparing and contrasting looking for relative strength characteristics in

those times many years ago, and so something different is occurring now and we will

talk a little bit more about that, the FED met.

[4:19] So, anyway, good question on analogs.

[4:22] Said discussing and then here CPI I pointed out kind of mid-year second half

of the year.

[4:32] I pointed out that inflation was slowing CPI index started to really flatten

out in the second half of the Year.

[4:41] Well, we were looking at and we just study price.

[4:44] We I'm not a fed Watcher.

[4:46] I don't try to figure out what's in their head.

[4:48] I'm just looking at what prices are doing.

[4:50] You see the US Treasury Treasury to year topping out at 4.7, it starts to go

down.

[4:58] Well, at the same time or in a similar period, you can see that the CPI was

flattening out.

[5:04] So the two-year really is making a vote about what it sees happening with

inflation and interest rates started to fall, we took a point, figure count of that

structure.

[5:16] Got to count that went down to like 410 2390.

[5:20] Showed you those charts in the past.

[5:22] And so, Now we're just hovering right around for.

[5:25] So the two year was really voting and saying that there was a Slowdown in

inflation coming, maybe a Slowdown in the economy and it was causing interest rates

to fall.

[5:40] So note in November and December on this data that were actually getting

down tips in the CPI index.

[5:49] Whether that can happen in the Futures, anybody He's guess but the trend is

now slightly falling and if this can continue the FED which made more Khalid

dovish, I guess but they raised a quarter yesterday but also they seem to indicate

that the trajectory of rate Rises would continue but at a lesser rate, slightly

lesser pace and they're really watching this data in my view.

[6:23] And so I think this is what the bond markets been reacting to why the bond

market has been rallying nicely in the last number of months.

[6:32] And also, I think it's why the FED is going to soften their position and

their interest rate.

[6:40] And this is, I think, what's helping the stock market to have a more

important rally as we go forward.

[6:47] Okay?

[6:48] So enough on that, I had next week, I'll show you some point figure.

[6:54] Charts, probably the most important thing I could show you right now, would

be this chart here, which shows the we were looking at this.

[7:05] A lot of things have happened very quickly in January into February, but we

were looking for a break in the NASDAQ 100 Above This downtrending supply line.

[7:15] It broke that went up to the 200s broken through that only spent a couple

days on the 200.

[7:21] It's working.

[7:23] Overhead Supply.

[7:24] This is what this green shading is about is there's a lot of over said,

overhead Supply in here.

[7:31] And what we really want to see, is a good acceleration of this rally before

a pause, and then a pause, not any kind of a return return back into the structure.

[7:43] This didn't, now starts to look more like accumulation and it doesn't even

look complete yet.

[7:51] But this is very Constructive and we're accelerating which means there could

be an element of climactic Behavior.

[7:59] Now, as we go into point and figure count areas and we'll look more at those

next week.

[8:06] But anyway, you can see here that this climactic Behavior could go on for a

period of time.

[8:12] It'd be great to see it.

[8:13] Get above the peak here.

[8:15] Set in August before it has any kind of arrest but we will just have to

watch and see what happens.

[8:23] And also, I just point out here I put this point figure count don't have the

chart to show you, but 1:49, 11 for, and look at how it really picked up the

climactic low.

[8:35] And also tended, to be the place where the lows are more or less holding is

right in this 11 to area, couple of pushes below, but it can't stay below.

[8:45] So classic Behavior.

[8:47] Okay, let's move on to our topic for the day.

[8:51] We've talked about this This form of scanning in the past because it's a

really a technique that I've been using for.

[8:59] Gosh, I don't know decades.

[9:01] And it's the way that I process the market for leadership, how I organize

the market going from sectors, really indexes to sectors industry, groups to stocks

and I'm looking for emerging leadership.

[9:17] I want to show you this very simple tool.

[9:19] We've talked about it before I talked about it at chart Khan.

[9:22] And looked at the industrial sector.

[9:25] Today we're going to look at semiconductors but initially I want to show you

here.

[9:30] The scan that I use.

[9:33] Now you see a lot of stuff here but it's really quite simple.

[9:36] These two lines of line 15 16 and 18 are the scan itself up here.

[9:44] We have the different categories of sectors that I will be scanning on and

the Lashes up, here are comment out that particular sector so that it doesn't scan.

[10:01] So it just makes it a comment.

[10:03] And if I want to activate it and scan on it, all I have to do, put my

cursor in and go in here and backspace this out, make it groups of cyclical and

now, this is an active group, and then I would comment out The industry groups.

[10:25] But now what I did is, I actually did a scan on the industry groups because

I want to show you that this is the first cut that I do really is, look at the

industry groups, which is for all sectors, and look for them.

[10:39] In order of leadership, let's talk a minute about this scan What we are in

line, 15, what we are asking for?

[10:49] Is that the stock in this group is above its 39 week moving average, price

is above the 39 that it's that simple.

[11:01] So all you're doing is you're asking for the weekly close to be above the

weekly close of the 39 week.

[11:09] Moving average period, the next line is asking, Thing that the 39 week

moving average be ticking upward, it's an upward Trend.

[11:19] Now this is important because this is our definition of an uptrend, Rising

price above a rising moving average.

[11:28] 39 weeks is a long term moving average takes a lot to turn a 39 week moving

average up.

[11:34] But once you have that up now you have the conditions for Trend.

[11:38] So we are asking that three that in this particular Airline that current,

the current 39 week moving average, is above three weeks ago, so that would define

their being an uptrend in the 39-week.

[11:57] Now, we also want the same condition for relative strength, but to simplify

things what we do is were actually just going to rank on scooter.

[12:07] And so the next line line 18 is ranked by scooter, scooter is a great tool.

[12:11] It's a great index every Instrument in.

[12:15] Well most, every instrument in the stock charts universe is ranked by

scooter has a scooter rank.

[12:23] So we Rank by scooter, strongest to weakest.

[12:27] And the only stocks that we want to or industry groups Etc that we want to

focus on are the ones that are above a rising 39.

[12:38] Of their price, and above a rising 39 of the relative strength.

[12:43] Now, scooter gives us an approximation for that.

[12:47] So the, the logic here is quite simple and that is that we have to have the

condition of being price, being above a rising 39 as a precondition for anything.

[13:00] So, now if we ranked by scooter were generally only going to see the

scooters that are also showing us that the relative strength is Thing to.

[13:08] So let's have a look and I've run the scan for you so that you can see the

this is the industry groups.

[13:17] And here they are.

[13:18] And you can see that there's about a hundred little over 100 industry

groups only 51 of them.

[13:24] Right now, meet our criteria and this is the lowest currently biotech is

only a 16 on the scooter Rank and which is quite low.

[13:35] And the These other industry groups are in order of their relative momentum

which is a great indicator Auto Parts here has a scooter of 83 and Marine Transport

publishing.

[13:54] So you can see them the very top, the winner right now is renewable, energy

equipment, and that is right at the top.

[14:01] I think n phases the really important stock in that group but there are

others.

[14:06] Also, number two, Steel.

[14:08] Very interesting.

[14:09] So steel is, has a 98.9 scooter Rank and is in a strong upward, momentum

Trent.

[14:19] All right, so let's now turn to, I just picked one out.

[14:24] This has a scooter of 69.

[14:27] This is Home Improvement retailers.

[14:30] So this would be Lowe's Home Depot etcetera and look at our conditions

being met Here we can see over here that the moving average is definitely up

ticking prices above and up ticking moving average 39, and the price has formed

what appears to be an accumulation type structure.

[14:56] The the reaction after getting above the moving average has been quiet dull

and sideways.

[15:04] This is a very constructive, it's not pulling back.

[15:07] Is consolidating which shows that the stocks might be near the completion

of accumulation.

[15:13] And then also, you can see that the relative strength, which tends to be

more volatile is above its Rising 39, and has had a good pull back on relative

strength, starting to turn up again.

[15:27] We look for the conditions of confirmation that price is above a rising 39.

[15:33] You can see this back in 2017, actually, back to 2016, But also, the

relative strength is confirming.

[15:39] This because relative strength is our confirmation of leadership.

[15:44] If relative strength is rising and price is rising.

[15:48] We have the conditions of leadership.

[15:50] This is a stock that is outperforming the market.

[15:54] This is an industry group.

[15:55] That's outperforming the market very important.

[15:59] Now let's turn our attention.

[16:02] Let's keep going here.

[16:03] Let's look at, in this case, here's semiconductors.

[16:07] So here's our scan workbench, note and I'll show you a little trick here.

[16:13] I also have the S&P 500 up here, I like to look at those, here's the

Industry Group list, they're all commented out, they won't be acted on in the scan,

the only group in here and this is an industry group.

[16:25] Everything else is a sector or an index.

[16:27] This is the only Industry Group in here and it's blue, which means that

it's It's not commented out the way that we put this group in here.

[16:37] As we went down to the scan workbench and we went to sectors and industries

and here's all the sectors and caps but we go down to technology.

[16:49] Technology is in here and we go to semiconductors, click on this and then

add it with this button.

[16:57] And now this will be and it will be written in the form.

[17:01] It needs to be in to be scannable.

[17:04] And now we have groups in here, we can just remove this after we're done,

leave all the other sectors in and just run this one.

[17:11] So we don't have to write new scans, we can if we want, but we can just

literally plug this in and run it.

[17:18] And so that's exactly what we've done for today.

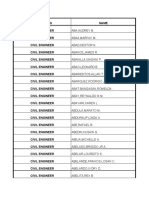

[17:21] And so, here is semiconductors, here's our list, and you can see there in

order rank of scooter, which is this column here?

[17:31] All semiconductor industry stocks.

[17:34] There's about 91 92, stocks in this industry group only 51 meet our

criteria.

[17:41] So we're seeing the most important uptrends.

[17:46] Everything else is in some sort of some form of a, not of an uptrend of our

preference.

[17:52] Okay, so now we can see, here are some names.

[17:56] These are the strongest, and let's just go in.

[18:01] And so here is the group.

[18:05] Lets go to the top.

[18:06] Here are the groups in order of scooter, 10 per page and we can just go

through and we can scan right through.

[18:16] Now, look at this eh eh our test systems and note how far away the stock is

from its Rising 39.

[18:26] Notice how long it's been going up.

[18:29] It's been going up since about September.

[18:31] Timber October of, I mean, it's been going up before that, but has been

above the moving average, relative strength is up prices up.

[18:39] This is leadership and Leadership tends to persist.

[18:42] This stock is absolutely reflecting that because it's the strongest stock

in the semiconductor sector.

[18:50] Okay, Industry Group.

[18:53] Here's another one.

[18:54] Again, they're ranked by strength of scooter.

[18:56] And this one excellus Technologies.

[19:02] Yes, formed a re accumulation structure here and pause.

[19:08] Look at this, pause at resistance up here.

[19:11] You can go into a daily chart and really study this.

[19:14] But note that the relative strength has been rising really since the end of

2020.

[19:22] So incre up on relative strength in gear up on price and it's just

persistent persistent.

[19:30] Persisted at a Really good, react accumulation in 2022 and is now marking

up again.

[19:36] This is exactly what we're looking for.

[19:38] Even if you're a traitor, a short-term Trader.

[19:42] You want to trade, you want to focus on stocks that have got persistent

leadership.

[19:47] This scan can get that information for you so that you can see best

candidates or you're campaigning purposes.

[19:57] Now, some of these are in this case, In this case, you can see that the

market cap, 1.14 billion smaller company, A dia and big jump and now it's

consolidating its jump, can it continue?

[20:17] I tend to believe I like the way it's pausing here.

[20:20] After a very important jump, I do not know the reason for that.

[20:24] And so here is allegro and Allegro Microsystems note, the jump up Here.

[20:32] And then the persistency of the momentum as this stock is going higher, one

of the really strong stocks and look this whole area back to going public.

[20:41] Pretty much is a re cumulation preparation for another advance.

[20:46] So again, how you choose to interact with these really strong momentum,

stocks is really a personal decision.

[20:57] I leave that up to you, but what I want to do now I've shown you some of

the really Wrong ones.

[21:02] But let's get down here into the scooter ranks that are a little lower.

[21:09] Here's click kulick and sofa.

[21:12] And you can see the accumulation type structure after declining in 21.

[21:18] Look at this mid-year 21.

[21:20] It starts a top out in a downtrend will just.

[21:23] Now if we look over here, we see that there's up, ticking 39 up, ticking 39

on relative strength above of and both cases acceleration is starting to occur and

it's coming out of an accumulation type.

[21:37] Structure may need a backup or a pause here.

[21:40] Darlin quiet would be best.

[21:42] But this has definitely the look of potential accumulation and here so that

we would call this emerging potential leadership.

[21:53] And so these are stocks that once they get going, they can go for a couple

of years.

[22:00] And so this case, this is co Hugh and here note the accumulation style

structure It has a rally up to resistance, pulls back.

[22:13] Backs up to a rising 39.

[22:16] Relative strength is confirmed up.

[22:18] We would expect that.

[22:19] This is a condition that can continue and that this might be very early in

an ongoing uptrend.

[22:26] So this is what we are trading for.

[22:28] And we just said stops at the appropriate places to protect Capital, Lam

Research, Greek accumulation, cyclic, accumulation type structure.

[22:38] Relative strength is now confirming.

[22:41] We don't want to be in these stocks.

[22:42] When relative strength is down because the institutions are avoiding

relative strength, weakness and they are pursuing relative strength.

[22:55] As you can see, look, here's about the area where you got above the 39.

[23:00] On price.

[23:02] You got above the 39 on relative strength and this condition continued from

early.

[23:10] 19 all the way up to the point at which price turned down above, a rising

39, and relative strength was already down was mid 20, 21.

[23:21] So, this is over two years.

[23:23] So these are the conditions that we seek for leadership.

[23:27] Now, sometimes they don't last as long, this may be aborted, that's why

we're Risk Managers.

[23:33] So we're really careful about this and you might just be trading these

stocks completely up to you.

[23:40] So here, another accumulation structure?

[23:43] This is nxp.

[23:44] I relative strength is now getting in gear been out of gear for more than a

year out of here.

[23:52] So anyway, and you can do this with all industry groups.

[23:56] I'm just showing you semiconductors actually the semiconductor group

itself.

[24:01] The actual index of the semiconductor group is not yet on a confirmed by.

[24:05] But let me give you this logic because we only have a couple minutes left

and that Is, when you see an industry group, that is really close to turning up,

you want to go into the individual components.

[24:17] Look for leadership, look for the big cap, stocks look for the

institutional favorites, but go into that group.

[24:24] Just the way I showed you here and identify the leadership names and look

to see whether or not leadership is already starting to confirm up Trends because

you know that there are certain stocks that are going to Two need to confirm up,

Trends to pull up the index itself for that Industry Group.

[24:46] So there's always going to be leadership, focus on the leadership.

[24:50] And so that's one thing I like to do is I like to look for industry groups

that are on the verge on the cusp of changing from down to up, or up to down,

depending on your, you know, how you like to trade my case, I like to trade the

uptrends but For that, that inflection point in you'll see It'll be weeks ahead of

time.

[25:15] It will start to show up and then from that go in and identify what's

already leading the way up liked by K.

[25:25] Ahar here systems was leading for a long time.

[25:30] Prior to the semiconductors and there's no reason you can't trade.

[25:35] Good leadership.

[25:36] That was a fantastic stock to be trading even though the Group itself was

not yet up but again, personal preference item in the future.

[25:47] I will talk about these rates of change.

[25:49] I've talked a little bit about this previously, but rated change on price

rate of change on relative strength, will do more on this.

[25:57] I hope you found this interesting.

[25:58] Helpful useful, plug that scan in and use it and become familiar with it

and it will serve you well and with that thank you so much for being here.

[26:11] We'll see you next time.

[26:12] Take care.

You might also like

- Cambridge IGCSE Mathematics Core and Extended Workbook by Ric Pimentel, Terry Wall PDFDocument97 pagesCambridge IGCSE Mathematics Core and Extended Workbook by Ric Pimentel, Terry Wall PDFPrince Yug86% (22)

- Transcription Hub TestDocument3 pagesTranscription Hub TestMonaliza SequigNo ratings yet

- Inner Circle Trader (ICT) Mentorship SeriesDocument50 pagesInner Circle Trader (ICT) Mentorship Seriesjim kang100% (2)

- Third Party Laboratory Assignment 07 02 18Document4 pagesThird Party Laboratory Assignment 07 02 18jim kangNo ratings yet

- CELTA Handbook IH Updated New LRT FormatDocument112 pagesCELTA Handbook IH Updated New LRT FormatPenélope Reyero Hernández ͛⃝⃤88% (8)

- Unit 1 Test-Part 1 Reading: As A Young GirlDocument19 pagesUnit 1 Test-Part 1 Reading: As A Young GirlVictoria PhamNo ratings yet

- The Powerx Strategy: Companion GuideDocument34 pagesThe Powerx Strategy: Companion GuideRePro100% (1)

- DEMAT QuestionnaireDocument3 pagesDEMAT QuestionnaireKIRAN88% (8)

- Trading The VXXDocument9 pagesTrading The VXX43stang100% (1)

- ICT22 EPISODE 3Document20 pagesICT22 EPISODE 3Stans WoleNo ratings yet

- Bookmap Education Part 1Document45 pagesBookmap Education Part 1Dey CHdezNo ratings yet

- Cash Flow StatementDocument8 pagesCash Flow StatementClaptrapjackNo ratings yet

- M02 - 01 - DIG3521: Scope and The Scope TriangleDocument18 pagesM02 - 01 - DIG3521: Scope and The Scope TriangleBamNo ratings yet

- Describing Graphs 2Document3 pagesDescribing Graphs 2KatieSalsburyNo ratings yet

- Lec 15Document16 pagesLec 15sushil.tripathiNo ratings yet

- Lec6 PDFDocument52 pagesLec6 PDFAshima shafiqNo ratings yet

- Lec6 PDFDocument52 pagesLec6 PDFAshima shafiqNo ratings yet

- Lec 37Document31 pagesLec 37Roshan SinghNo ratings yet

- MKT-475-report SAMPLEDocument23 pagesMKT-475-report SAMPLEHridoy SahaNo ratings yet

- Lec 16Document19 pagesLec 16sushil.tripathiNo ratings yet

- Managed Futures Drawdown, Recovery, and Run Up Cycles: October 4, 2010Document5 pagesManaged Futures Drawdown, Recovery, and Run Up Cycles: October 4, 2010intercontiNo ratings yet

- Lec3 PDFDocument47 pagesLec3 PDFBharathiraja MoorthyNo ratings yet

- OpenSAP Ibcs1-Tl Week 2 TranscriptDocument16 pagesOpenSAP Ibcs1-Tl Week 2 TranscriptHafiz Muhammad AzamNo ratings yet

- Transcript: Post Results Call Q4 Analyst MeetingDocument11 pagesTranscript: Post Results Call Q4 Analyst MeetingDon PadillaNo ratings yet

- Lec17 PDFDocument26 pagesLec17 PDFMumtazAhmadNo ratings yet

- The Right Investment Product For MillenialsDocument4 pagesThe Right Investment Product For MillenialsemailkeandriNo ratings yet

- PleaseDocument16 pagesPleaseErza ScarletNo ratings yet

- 小作文 各图表句式Document7 pages小作文 各图表句式Victor LeoNo ratings yet

- 2c. Ewy-Qqq-Iwm (Transcribed On 10-Sep-2023 20-54-47)Document3 pages2c. Ewy-Qqq-Iwm (Transcribed On 10-Sep-2023 20-54-47)邱维No ratings yet

- How Com Graph STDDocument5 pagesHow Com Graph STDEhsan Mohades Rad100% (1)

- Financial Accounting Prof. Varadraj Bapat School of Management Indian Institute of Technology, Bombay Lecture - 02 Financial StatementsDocument9 pagesFinancial Accounting Prof. Varadraj Bapat School of Management Indian Institute of Technology, Bombay Lecture - 02 Financial StatementsMohankumarNo ratings yet

- Unit 1,2 điềnDocument9 pagesUnit 1,2 điềnMoah MoahNo ratings yet

- Lec 40Document32 pagesLec 40Roshan SinghNo ratings yet

- M01 - 03 - DIG3521: Programs and PortfoliosDocument5 pagesM01 - 03 - DIG3521: Programs and PortfoliosBamNo ratings yet

- Zoom Reunión 2023-11-30 10-41-32-en-USDocument8 pagesZoom Reunión 2023-11-30 10-41-32-en-USjbecerraNo ratings yet

- Lec 19Document18 pagesLec 19MumtazAhmadNo ratings yet

- Module 4Document29 pagesModule 4bangrhomaNo ratings yet

- Finance Interview QuestionsDocument14 pagesFinance Interview QuestionsVivek SequeiraNo ratings yet

- 2015 q1 Fpa Crescent FundDocument41 pages2015 q1 Fpa Crescent FundCanadianValueNo ratings yet

- 17 5-TranscriptDocument5 pages17 5-TranscriptSoporte BarbatNo ratings yet

- Charlie McElligott Transcript Nov 14th - 2019Document16 pagesCharlie McElligott Transcript Nov 14th - 2019ZerohedgeNo ratings yet

- Nifty 50 Analysis Research PaperDocument5 pagesNifty 50 Analysis Research Paperbibaswanm7No ratings yet

- ATW216 Test 1: Total: 60 MarksDocument7 pagesATW216 Test 1: Total: 60 Marksmaele2No ratings yet

- Reading GraphsDocument10 pagesReading Graphschristopher fernandoNo ratings yet

- October 14, 2010 PostsDocument734 pagesOctober 14, 2010 PostsAlbert L. PeiaNo ratings yet

- Gann Square of 9 FORMULADocument13 pagesGann Square of 9 FORMULApatelpratik1972100% (2)

- Lec 3Document52 pagesLec 3Leeladhar ChourasiyaNo ratings yet

- 2a. Ftse-Spy (Transcribed On 10-Sep-2023 20-17-58)Document4 pages2a. Ftse-Spy (Transcribed On 10-Sep-2023 20-17-58)邱维No ratings yet

- Q2FY11 Conference Call Transcript: ModeratorDocument42 pagesQ2FY11 Conference Call Transcript: ModeratoriaminsoupNo ratings yet

- Project Planning & Control Prof. Koshy Varghese Department of Civil Engineering Indian Institute of Technology, MadrasDocument10 pagesProject Planning & Control Prof. Koshy Varghese Department of Civil Engineering Indian Institute of Technology, MadrasAmitNo ratings yet

- Lec 13Document15 pagesLec 13ROADYNo ratings yet

- 4-1 Technical - Analysis Intro@Infinity - CourseDocument6 pages4-1 Technical - Analysis Intro@Infinity - CoursepierodicarloNo ratings yet

- Open Interest Liquidation FundingDocument10 pagesOpen Interest Liquidation FundinggiooocaNo ratings yet

- BANK NIFTY WEEKLY OPTIONS - 11 PRACTICAL TRADING SETIFFERENT MARKET CONDITIONS - Prathyush P GopinathanDocument93 pagesBANK NIFTY WEEKLY OPTIONS - 11 PRACTICAL TRADING SETIFFERENT MARKET CONDITIONS - Prathyush P Gopinathanwadatkar.amit104No ratings yet

- Formulas: Index, Match, and IndirectDocument15 pagesFormulas: Index, Match, and IndirectSvinoPukasNo ratings yet

- How To Conduct Top Down Analysis From Algorithm PerspectiveDocument20 pagesHow To Conduct Top Down Analysis From Algorithm PerspectivePrashantPatilNo ratings yet

- How To Make Money Trading BitcoinDocument24 pagesHow To Make Money Trading Bitcoinanthonniofbc100% (2)

- Topic 3 8 Investment AppraisalDocument20 pagesTopic 3 8 Investment AppraisalEren BarlasNo ratings yet

- Let's Talk Bitcoin - Ep 83Document16 pagesLet's Talk Bitcoin - Ep 83skyeredNo ratings yet

- Lec2 PDFDocument22 pagesLec2 PDFAshima shafiqNo ratings yet

- A Gut Punch PDFDocument9 pagesA Gut Punch PDFDeep BorsadiyaNo ratings yet

- Module 3 - TextDocument33 pagesModule 3 - TextbangrhomaNo ratings yet

- 25 CompoundpatternDocument3 pages25 CompoundpatternOmar EhabNo ratings yet

- Project Management For Managers Dr. M.K. Barua Department of Management Indian Institute of Technology, Roorkee Lecture - 46 Slacks & Floats-IIDocument7 pagesProject Management For Managers Dr. M.K. Barua Department of Management Indian Institute of Technology, Roorkee Lecture - 46 Slacks & Floats-IIMoseenNo ratings yet

- Renko Forex strategy - Let's make money: A stable, winnig Forex strategyFrom EverandRenko Forex strategy - Let's make money: A stable, winnig Forex strategyNo ratings yet

- Total Return and Defective Summary - Monthly 2020-2021 0706Document24 pagesTotal Return and Defective Summary - Monthly 2020-2021 0706jim kangNo ratings yet

- Solar Deck Lights Vendor FeedbackDocument10 pagesSolar Deck Lights Vendor Feedbackjim kangNo ratings yet

- My Trade Mistakes#2Document2 pagesMy Trade Mistakes#2jim kangNo ratings yet

- Defective Summary Monthly 2017-2018Document37 pagesDefective Summary Monthly 2017-2018jim kangNo ratings yet

- Monthly Return and Defective Summary FY21-FY22Document108 pagesMonthly Return and Defective Summary FY21-FY22jim kangNo ratings yet

- THD-P-002-2A2B For Specialty Channel Product-UL-V7Document19 pagesTHD-P-002-2A2B For Specialty Channel Product-UL-V7jim kangNo ratings yet

- THD-27L-26-001-US Lighting Fixture With Motion Sensor-UL-V9Document47 pagesTHD-27L-26-001-US Lighting Fixture With Motion Sensor-UL-V9jim kangNo ratings yet

- (SS75C LF120X BK T6) 190306135GZU 001 - Security2019 3 18Document29 pages(SS75C LF120X BK T6) 190306135GZU 001 - Security2019 3 18jim kangNo ratings yet

- QCM6aRS322Mb K10CX BK T6 181225044GZU 001 - PPT 2019.01.30Document28 pagesQCM6aRS322Mb K10CX BK T6 181225044GZU 001 - PPT 2019.01.30jim kangNo ratings yet

- Solar Light Specification-Protocol - Update - Final 05232019Document6 pagesSolar Light Specification-Protocol - Update - Final 05232019jim kangNo ratings yet

- SL18P-R5X-DB-2 Ir-001086-002-1000956882Document35 pagesSL18P-R5X-DB-2 Ir-001086-002-1000956882jim kangNo ratings yet

- Battery Operated Product Sep 24 2018Document5 pagesBattery Operated Product Sep 24 2018jim kangNo ratings yet

- THD-P-008 Transit Packaging Method and Shipping Appearance review-UL-V3 - 2015-11-30Document11 pagesTHD-P-008 Transit Packaging Method and Shipping Appearance review-UL-V3 - 2015-11-30jim kangNo ratings yet

- RS233MB-M53-ORB-6 145208 11743857-1aR02-FDocument61 pagesRS233MB-M53-ORB-6 145208 11743857-1aR02-Fjim kangNo ratings yet

- US Product Quality and Compliance Manual Sep 26 2018Document25 pagesUS Product Quality and Compliance Manual Sep 26 2018jim kangNo ratings yet

- Solar Light Specification Protocol - Update - With Deck Fence Step String Light Requirement - DraftDocument7 pagesSolar Light Specification Protocol - Update - With Deck Fence Step String Light Requirement - Draftjim kangNo ratings yet

- RS224M-M52-CB-4 27L-0383.102466.PPT - 74798 11245625-1aR02-F GDocument58 pagesRS224M-M52-CB-4 27L-0383.102466.PPT - 74798 11245625-1aR02-F Gjim kangNo ratings yet

- Bulletin Template and Distribution Form Solar Protocol D16 05232019Document1 pageBulletin Template and Distribution Form Solar Protocol D16 05232019jim kangNo ratings yet

- THD-P-001-1A1B V3 For General ProductDocument12 pagesTHD-P-001-1A1B V3 For General Productjim kangNo ratings yet

- Swing Trading Part1Document17 pagesSwing Trading Part1jim kangNo ratings yet

- THD - 27L-7-003UCM V1 Solar LightDocument11 pagesTHD - 27L-7-003UCM V1 Solar Lightjim kangNo ratings yet

- THD Hampton Bay CTQ Report - #11245625-1d - #102466 - Passed - 052316 - JiaweiDocument2 pagesTHD Hampton Bay CTQ Report - #11245625-1d - #102466 - Passed - 052316 - Jiaweijim kangNo ratings yet

- THD-27L-7-003-UCM Solar Light-UL-V4 2015-11-23Document24 pagesTHD-27L-7-003-UCM Solar Light-UL-V4 2015-11-23jim kangNo ratings yet

- Solar Evaluation Plan中英文 (更新版)Document5 pagesSolar Evaluation Plan中英文 (更新版)jim kangNo ratings yet

- Session 04 WTC PPT Jan 28 2019Document32 pagesSession 04 WTC PPT Jan 28 2019jim kangNo ratings yet

- Session 03 WTC PPT January 21 2019Document23 pagesSession 03 WTC PPT January 21 2019jim kangNo ratings yet

- Eastern Grey Kangaroo AnatomyDocument3 pagesEastern Grey Kangaroo AnatomyKayla FreilichNo ratings yet

- Trimble R8s GNSS Receiver: User GuideDocument71 pagesTrimble R8s GNSS Receiver: User GuideSilvio Vuolo NetoNo ratings yet

- Title: Investigation of Agriculture Related Problems of Rural Women in District LayyahDocument10 pagesTitle: Investigation of Agriculture Related Problems of Rural Women in District LayyahMuhammad Asim Hafeez ThindNo ratings yet

- The Plant Journal - 2023 - Selma Garc A - Engineering The Plant Metabolic System by Exploiting Metabolic RegulationDocument28 pagesThe Plant Journal - 2023 - Selma Garc A - Engineering The Plant Metabolic System by Exploiting Metabolic RegulationRodrigo ParolaNo ratings yet

- Kono Subarashii Sekai Ni Shukufuku Wo! Volume 2 PDFDocument198 pagesKono Subarashii Sekai Ni Shukufuku Wo! Volume 2 PDFRokhi NNo ratings yet

- Aba, AudrDocument162 pagesAba, AudrRenuka TekumudiNo ratings yet

- Daikin AC University Training Course Guide PDFDocument37 pagesDaikin AC University Training Course Guide PDFLeonard FransiscoNo ratings yet

- Unit-4 Disaster Management NotesDocument33 pagesUnit-4 Disaster Management Notesholalo6378No ratings yet

- Track DHL Express Shipments: Result SummaryDocument2 pagesTrack DHL Express Shipments: Result SummaryJorge Adolfo Barajas VegaNo ratings yet

- Ly Tieu Long - 1 Thoi Vang BongDocument4 pagesLy Tieu Long - 1 Thoi Vang Bonghoaitrung796969No ratings yet

- Agricultural Cooperative Society ReportDocument44 pagesAgricultural Cooperative Society Reportckeerthana56No ratings yet

- VASTU-SHASHTRA - 1 - Architecture Seminar TopicsDocument3 pagesVASTU-SHASHTRA - 1 - Architecture Seminar TopicsNupur BhadraNo ratings yet

- CIMAP Charges For AnalysisDocument11 pagesCIMAP Charges For AnalysisSaloman RaviNo ratings yet

- Do's & Don'Ts For TurbochargersDocument7 pagesDo's & Don'Ts For Turbochargersvikrant GarudNo ratings yet

- Mil Week 2Document3 pagesMil Week 2Mhagz MaggieNo ratings yet

- A TETRA and DMR Comparison PDFDocument5 pagesA TETRA and DMR Comparison PDFSam Ba DialloNo ratings yet

- Goodle Drive Tutorial # 2Document4 pagesGoodle Drive Tutorial # 2JOEL P. RODRIGUEZNo ratings yet

- What Is Time Complexity?: Produce There Required OutputDocument4 pagesWhat Is Time Complexity?: Produce There Required OutputrohitNo ratings yet

- Contemporary Philippine Arts From The Regions MODULE 5Document5 pagesContemporary Philippine Arts From The Regions MODULE 5JOHN RULF OMAYAN100% (1)

- Spirit f1 ManualDocument38 pagesSpirit f1 ManualPedro Ponce SàezNo ratings yet

- TechRef StationControllerDocument28 pagesTechRef StationControllerАлишер ГалиевNo ratings yet

- Chapter 11 - Our SexualityDocument5 pagesChapter 11 - Our SexualityDarnellNo ratings yet

- See Also:: Eighteenth Dynasty of Egypt Family TreeDocument1 pageSee Also:: Eighteenth Dynasty of Egypt Family TreeBilly FrankovickNo ratings yet

- EPC Saur Energy InternationalDocument3 pagesEPC Saur Energy InternationalNarendra PatelNo ratings yet

- Gestetner MP C3001/4501 Gestetner MP C3002/ 3502: High PerformanceDocument2 pagesGestetner MP C3001/4501 Gestetner MP C3002/ 3502: High PerformanceDipa Nusantara ArthaNo ratings yet

- FovizamDocument18 pagesFovizamMickey PierceNo ratings yet

- Math 7-Q4-Module-3Document16 pagesMath 7-Q4-Module-3Peterson Dela Cruz Enriquez33% (3)