Professional Documents

Culture Documents

Quiz 2 Part 1

Quiz 2 Part 1

Uploaded by

Renz CastroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 2 Part 1

Quiz 2 Part 1

Uploaded by

Renz CastroCopyright:

Available Formats

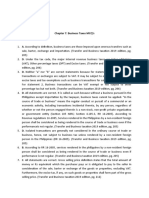

QUIZ 2 – PART 1 POLA <3

Note: Di sure yung sagot kinopya ko palang HAHAHAHAHA pero yan mga tanong. (ata)

1. The output VAT on P15,000 VAT sales invoice amount is P1,650. FALSE

2. Zero – rated transactions are allowed with tax credit for Input VAT attributable to such sales or

receipts, while VAT – exempt transactions are not. FALSE

3. Input taxes are valued added taxes paid on local purchases of goods from VAT registered

taxpayer. TRUE

4. VAT taxable sales of VAT Person sold to non-VAT person is exempt from 12% Output VAT.

FALSE

5. Both Zero – rated and VAT – exempt transactions are not subject to 12% Output VAT. TRUE

6. Consignment of goods if actual sale is made within 60 days following the date such goods were

consigned is a transaction deemed sale. TRUE

7. All sales of VAT – registered person, domestic sales and export sales are subject to 12% Output

VAT. FALSE

8. Taxable base on services does not include advance payments. FALSE

9. Export sales by VAT – person is subject to 12% Output VAT. FALSE

10. Importations are subject to 12% VAT. TRUE

11. Gross receipts of domestic corporation carrier within the Philippines from transport of cargoes by

land are VAT taxable transactions. TRUE

12. Export sales of VAT registered person is exempt from VAT. TRUE

13. Distribution to shareholders of goods or properties as share in profits of a Vat registered company

is a transaction deemed sale. TRUE

14. The allowable transitional input tax is the higher between 2% of the value of the beginning

inventory or actual Vat paid on such inventory. TRUE

15. The value added tax due on the sale of taxable goods, property and services by any person

whether or not he has taken the necessary steps to be registered is called input tax. FALSE

16. Gross receipts of Domestic Corporation from transport of passengers and cargoes by air or sea

from Philippines to foreign country are Zero – rated transactions. TRUE

17. If the business is registered as non-VAT and its gross sales or receipts is P 3,000,000 and below

per year, it is exempted from business tax. FALSE

18. Manufacturer of canned goods is allowed a presumptive input value added tax. TRUE

19. The taxable base for supply of services is the gross receipts. TRUE

20. If the cost of goods acquired subject to depreciation / amortization exceeds P 1,000,000,

excluding VAT, the related Input VAT should be spread over 60 days or its useful life, whichever

is determinable. TRUE

21. If the business is registered as VAT business, its VAT taxable transaction is taxed at 12%

business tax. TRUE

22. The Output VAT is 12% of sales or gross receipts. TRUE

23. A non VAT registered person whose total sales for the year exceed P3,000,000 is subject to 12%.

TRUE

24. Sale of residential house and lot with a value of P 3,000,000 is subject to VAT. TRUE

25. Transfer of inventory in payment of debts may, subject to VAT. TRUE

You might also like

- Selling Today 12th Edition Manning Test BankDocument16 pagesSelling Today 12th Edition Manning Test BankMrPatrickWeissibpmc100% (15)

- TAX 2 ExercisesDocument22 pagesTAX 2 ExercisesWinter Summer50% (4)

- Marketing Plan For Red BullDocument12 pagesMarketing Plan For Red Bullnirav100% (1)

- Barnes & Noble AnalysisDocument28 pagesBarnes & Noble Analysislethuy_tram391088% (8)

- CombinepdfDocument129 pagesCombinepdfMary Jane G. FACERONDANo ratings yet

- Pre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimDocument11 pagesPre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimMark MagnoNo ratings yet

- Mystic of Salesmanship RazaDocument3 pagesMystic of Salesmanship Razayatin rajputNo ratings yet

- Jill Table - AnswersDocument3 pagesJill Table - AnswersKaraNo ratings yet

- Quiz 2 Part1Document1 pageQuiz 2 Part1Renz CastroNo ratings yet

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroNo ratings yet

- Chapter 13 Mixed Business TransactionsDocument10 pagesChapter 13 Mixed Business TransactionsGeraldNo ratings yet

- VAT ReportDocument32 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- Chapter 10Document17 pagesChapter 10kochanay oya-oyNo ratings yet

- (G5 P1) VatDocument41 pages(G5 P1) VatFiliusdeiNo ratings yet

- VatDocument50 pagesVatnikolaevnavalentinaNo ratings yet

- Vat System and OptDocument15 pagesVat System and Optlyra21No ratings yet

- Chapter 10 Practice Problems ValenciaDocument1 pageChapter 10 Practice Problems ValenciaElai grace FernandezNo ratings yet

- Vat AssDocument6 pagesVat AssRhanda BernardoNo ratings yet

- Accounting Ed.04 (Business & Transfer Taxes) Ma. Daria N. Labalan, Cpa, Mba TF-7:20-8:55Document3 pagesAccounting Ed.04 (Business & Transfer Taxes) Ma. Daria N. Labalan, Cpa, Mba TF-7:20-8:55Jerbert JesalvaNo ratings yet

- Value Added TaxDocument87 pagesValue Added TaxShaira Grace RodriguezNo ratings yet

- Lecture VAT With ExercisesDocument82 pagesLecture VAT With ExercisesAko C JamzNo ratings yet

- VatDocument70 pagesVatPETERWILLE CHUANo ratings yet

- VATPT For PicpaDocument73 pagesVATPT For PicpaJoy Superales SalaoNo ratings yet

- Section 4.110-4 of RR 16-05Document4 pagesSection 4.110-4 of RR 16-05fatmaaleahNo ratings yet

- Value Added Tax: Output Tax Less Input Tax VAT PayableDocument26 pagesValue Added Tax: Output Tax Less Input Tax VAT PayableRon RamosNo ratings yet

- Antonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenDocument22 pagesAntonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenJayvee FelipeNo ratings yet

- Value Added Tax (VAT) : Transfer and Business TaxDocument58 pagesValue Added Tax (VAT) : Transfer and Business TaxRizzle RabadillaNo ratings yet

- VAT ReviewerDocument3 pagesVAT ReviewerCJ LopezNo ratings yet

- Melanie S. Samsona Business Tax Chapter 7 ExercisesDocument3 pagesMelanie S. Samsona Business Tax Chapter 7 ExercisesMelanie SamsonaNo ratings yet

- Chapter 9 TaxDocument27 pagesChapter 9 TaxJason MalikNo ratings yet

- Vat Quizzer ReviewerDocument3 pagesVat Quizzer ReviewerLouiseNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- Taxn03b Vat IntroDocument20 pagesTaxn03b Vat IntroTrishamae legaspiNo ratings yet

- VAT On Sale of Goods and PropertiesDocument55 pagesVAT On Sale of Goods and PropertiesNEstanda100% (1)

- Business TaxesDocument100 pagesBusiness Taxeslynne tahilNo ratings yet

- IntroBusTax QuestsDocument9 pagesIntroBusTax QuestsTwish BarriosNo ratings yet

- VAT On Sale of Goods and PropertiesDocument55 pagesVAT On Sale of Goods and PropertiesKarlo PalerNo ratings yet

- Gimenez Jose Mari CDocument14 pagesGimenez Jose Mari CMari Calica GimenezNo ratings yet

- Value Added Tax Ust PDFDocument23 pagesValue Added Tax Ust PDFcalliemozartNo ratings yet

- Value-Added Tax Nature of VatDocument22 pagesValue-Added Tax Nature of VatDiossaNo ratings yet

- Comprehensive VAT TAXATION (3!31!14)Document166 pagesComprehensive VAT TAXATION (3!31!14)dereckriveraNo ratings yet

- A NonDocument2 pagesA NonAlthea PalmaNo ratings yet

- Chapter 9 Part 1 Input VatDocument25 pagesChapter 9 Part 1 Input VatChristian PelimcoNo ratings yet

- A. C. D. With:: If of Is If If of If IsDocument3 pagesA. C. D. With:: If of Is If If of If IsFerl Diane SiñoNo ratings yet

- Chapter 8Document9 pagesChapter 8nena cabañesNo ratings yet

- St. Anthony'S College San Jose, AntiqueDocument9 pagesSt. Anthony'S College San Jose, AntiqueClaire Araneta AlcozeroNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- VAT ReportDocument21 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- A. VatDocument5 pagesA. VatKaye L. Dela CruzNo ratings yet

- Chapter 1 Introduction To Business TaxDocument16 pagesChapter 1 Introduction To Business TaxJerome EspinaNo ratings yet

- Frequently Asked QuestionsDocument40 pagesFrequently Asked Questionsroy rebosuraNo ratings yet

- VatDocument5 pagesVatninaryzaNo ratings yet

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezNo ratings yet

- EA10 Value Added Tax MC 1 1Document10 pagesEA10 Value Added Tax MC 1 1Nicole BatoyNo ratings yet

- Notes On VATDocument15 pagesNotes On VATErnest Benz Sabella DavilaNo ratings yet

- 2 Value Added TaxDocument216 pages2 Value Added TaxnichNo ratings yet

- Taxation Value Added TaxDocument21 pagesTaxation Value Added TaxJhambhey GuzmanNo ratings yet

- VAT Casasola NotesDocument7 pagesVAT Casasola NotesCharm AgripaNo ratings yet

- Written ReportDocument10 pagesWritten ReportSamantha TayoneNo ratings yet

- VALUE ADDED TAX and EXCISE TAXDocument18 pagesVALUE ADDED TAX and EXCISE TAXTrisha Nicole Flores0% (1)

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument28 pagesInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNo ratings yet

- Tax 2 Notes Finals 4Document36 pagesTax 2 Notes Finals 4Boom ManuelNo ratings yet

- Chapter 7 MCQ'S AssignmentDocument3 pagesChapter 7 MCQ'S AssignmentMary Joy CabilNo ratings yet

- Bustax Chapter 9Document10 pagesBustax Chapter 9Pineda, Paula MarieNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- To Be Discussed Midterm ExaminationDocument7 pagesTo Be Discussed Midterm ExaminationRenz CastroNo ratings yet

- Vat BRRT BRRT Ver 2Document3 pagesVat BRRT BRRT Ver 2Renz CastroNo ratings yet

- Quiz 2 Part 2Document4 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- Quiz Estate TaxDocument1 pageQuiz Estate TaxRenz CastroNo ratings yet

- Quiz 2 Part 2Document5 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- Quiz 2 Part1Document1 pageQuiz 2 Part1Renz CastroNo ratings yet

- To Be Discussed Final ExaminationDocument11 pagesTo Be Discussed Final ExaminationRenz CastroNo ratings yet

- Quiz On Estate TaxDocument4 pagesQuiz On Estate TaxRenz CastroNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sandeep patilNo ratings yet

- GST Notes GST Notes: LLB 3 Years (Karnataka State Law University) LLB 3 Years (Karnataka State Law University)Document15 pagesGST Notes GST Notes: LLB 3 Years (Karnataka State Law University) LLB 3 Years (Karnataka State Law University)swetha shree chavan mNo ratings yet

- UNIT 5 - Pricing DecisionsDocument47 pagesUNIT 5 - Pricing Decisionsp nishithaNo ratings yet

- Sales & Receivables JournalDocument627 pagesSales & Receivables JournalRACHEL DAMALERIONo ratings yet

- Motivated Seller Script - The Wholesalers ToolboxDocument6 pagesMotivated Seller Script - The Wholesalers ToolboxGreg Mayhem TaylorNo ratings yet

- Long Quiz - SF (BSA 1)Document2 pagesLong Quiz - SF (BSA 1)Amie Jane MirandaNo ratings yet

- IKEA SWOT AnalysisDocument8 pagesIKEA SWOT AnalysisRayan KaziNo ratings yet

- B5 Nabm4Document4 pagesB5 Nabm4Flonie DensingNo ratings yet

- 5 Industry AnalysisDocument18 pages5 Industry AnalysisAxel CabornayNo ratings yet

- Acrysil Q2FY21 Concall - LTDocument1 pageAcrysil Q2FY21 Concall - LTanantNo ratings yet

- Chapter 1 Company ProfileDocument7 pagesChapter 1 Company ProfileRitika RawatNo ratings yet

- Cost Accounting: Schaum's Outline of Theory and Problems of Cost AccountingDocument56 pagesCost Accounting: Schaum's Outline of Theory and Problems of Cost AccountingAbdillahi Ibrahim Sh NorNo ratings yet

- Bba Notes Marekting in ManagementDocument4 pagesBba Notes Marekting in ManagementCaptainVipro YTNo ratings yet

- Session 2Document17 pagesSession 2SylvesterNo ratings yet

- Third Schedule Invoice FormatDocument2 pagesThird Schedule Invoice FormatShahid AzizNo ratings yet

- Accist ReviewerDocument8 pagesAccist ReviewerAngel MesiasNo ratings yet

- Doku - Pub - Workbook bsbmgt616 Develop and Implement Strategic PlansDocument26 pagesDoku - Pub - Workbook bsbmgt616 Develop and Implement Strategic PlansMohd Faizal Bin AyobNo ratings yet

- Gas Station Business Plan ExampleDocument32 pagesGas Station Business Plan ExampleANWARNo ratings yet

- DELL Supply Chain ManagementDocument12 pagesDELL Supply Chain ManagementElena ElenaNo ratings yet

- Communication Strategy WalDocument9 pagesCommunication Strategy WalgayaNo ratings yet

- Michaeel Porter Five Forces Case StudyDocument17 pagesMichaeel Porter Five Forces Case Studymanasa_s_raman100% (1)

- Overhead ControlDocument24 pagesOverhead ControlBishnuNo ratings yet

- Nature's BasketDocument16 pagesNature's BasketHKNo ratings yet

- Acc720 - Individual Assignment - Nur Amnani Mohamed Idrus - 2022418564Document5 pagesAcc720 - Individual Assignment - Nur Amnani Mohamed Idrus - 2022418564amnaniuitmNo ratings yet

- P&G Vs CIR - Vat RulingDocument7 pagesP&G Vs CIR - Vat Rulingcaren kay b. adolfoNo ratings yet