Professional Documents

Culture Documents

Klabin Reports 2nd Quarter Earnings of R$ 15 Million: Highlights

Klabin Reports 2nd Quarter Earnings of R$ 15 Million: Highlights

Uploaded by

Klabin_RICopyright:

Available Formats

You might also like

- Transferwise Document 10 PDFDocument2 pagesTransferwise Document 10 PDFMai-linh Polero Dean0% (1)

- Yahoo! Finance SpreadsheetDocument9 pagesYahoo! Finance Spreadsheetsandip_exlNo ratings yet

- Marketing Plan of Beauty SpotDocument39 pagesMarketing Plan of Beauty SpotZiwho Na100% (2)

- First Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Document10 pagesFirst Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Klabin_RINo ratings yet

- Cash Generation Exceeds R$ 181 Million: January/March 2002Document10 pagesCash Generation Exceeds R$ 181 Million: January/March 2002Klabin_RINo ratings yet

- Klabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Document14 pagesKlabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Klabin_RINo ratings yet

- Cash Generation Grows by 12% in The Third Quarter: July/September 2001Document13 pagesCash Generation Grows by 12% in The Third Quarter: July/September 2001Klabin_RINo ratings yet

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateDocument15 pagesQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Document19 pagesQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RINo ratings yet

- Ebitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Document17 pagesEbitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Klabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Document16 pagesQuarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Klabin_RINo ratings yet

- Klabin Reduces Debt: April/June 2003Document16 pagesKlabin Reduces Debt: April/June 2003Klabin_RINo ratings yet

- Release 3Q12Document17 pagesRelease 3Q12Klabin_RINo ratings yet

- iKRelease2005 2qDocument16 pagesiKRelease2005 2qKlabin_RINo ratings yet

- Release 1Q15Document17 pagesRelease 1Q15Klabin_RINo ratings yet

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocument19 pagesQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RINo ratings yet

- Release 2Q15Document17 pagesRelease 2Q15Klabin_RINo ratings yet

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Document16 pagesQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RINo ratings yet

- iKRelease2005 1qDocument16 pagesiKRelease2005 1qKlabin_RINo ratings yet

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Document15 pagesCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Document15 pagesKlabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Klabin_RINo ratings yet

- Klabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Document15 pagesKlabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Klabin_RINo ratings yet

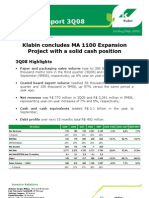

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDocument15 pagesQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RINo ratings yet

- EBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Document18 pagesEBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Klabin_RINo ratings yet

- Indústrias Klabin Announces Fourth Quarter and Consolidated Results For 2000Document10 pagesIndústrias Klabin Announces Fourth Quarter and Consolidated Results For 2000Klabin_RINo ratings yet

- Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseDocument17 pagesRelatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseKlabin_RINo ratings yet

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Document18 pagesSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RINo ratings yet

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Document20 pagesKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RINo ratings yet

- iKRelease2000 1qDocument6 pagesiKRelease2000 1qKlabin_RINo ratings yet

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioDocument18 pagesQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Document18 pagesQuarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Klabin_RINo ratings yet

- Mills 3Q12 ResultDocument14 pagesMills 3Q12 ResultMillsRINo ratings yet

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- Klabin Webcast 20092 Q09Document10 pagesKlabin Webcast 20092 Q09Klabin_RINo ratings yet

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Document17 pagesQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RINo ratings yet

- Cash Generation Reaches R$ 979 Million in 2002: October/December 2002Document19 pagesCash Generation Reaches R$ 979 Million in 2002: October/December 2002Klabin_RINo ratings yet

- Release 4Q12Document18 pagesRelease 4Q12Klabin_RINo ratings yet

- Quarterly Release: Start Up of Paper Machine # 9Document19 pagesQuarterly Release: Start Up of Paper Machine # 9Klabin_RINo ratings yet

- Mills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsDocument14 pagesMills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsMillsRINo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- Accenture Reports Strong Second-Quarter Fiscal 2011 ResultsDocument12 pagesAccenture Reports Strong Second-Quarter Fiscal 2011 ResultsPriya NairNo ratings yet

- Klabin S.A.: Anagement EportDocument9 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 366 Million Up To September 2004Document16 pagesKlabin Reports A Net Profit of R$ 366 Million Up To September 2004Klabin_RINo ratings yet

- Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11Document20 pagesEarnings Release 3Q11: EBITDA of R$277 Million in 3Q11Klabin_RINo ratings yet

- PHP WKPF BKDocument5 pagesPHP WKPF BKfred607No ratings yet

- Mills 1Q16 ResultsDocument15 pagesMills 1Q16 ResultsMillsRINo ratings yet

- Release 3Q15Document17 pagesRelease 3Q15Klabin_RINo ratings yet

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Document19 pages4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RINo ratings yet

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineDocument19 pages2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RINo ratings yet

- 2Q16 Financial StatementsDocument82 pages2Q16 Financial StatementsJBS RINo ratings yet

- Market Notes May 13 FridayDocument3 pagesMarket Notes May 13 FridayJC CalaycayNo ratings yet

- Kimberly-Clark Announces First Quarter 2021 ResultsDocument7 pagesKimberly-Clark Announces First Quarter 2021 ResultsSachin DhorajiyaNo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010Document15 pagesBM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010BVMF_RINo ratings yet

- Financial Report EmpeDocument9 pagesFinancial Report EmpeCY ParkNo ratings yet

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginDocument18 pagesQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RINo ratings yet

- Earnings 1Q12Document8 pagesEarnings 1Q12Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 940 Million Up To September 2003Document16 pagesKlabin Reports A Net Profit of R$ 940 Million Up To September 2003Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 1.0 Billion in 2003: October/December 2003Document17 pagesKlabin Reports A Net Profit of R$ 1.0 Billion in 2003: October/December 2003Klabin_RINo ratings yet

- Dados Econ?mico-Financeiros - Demonstra??es Financeiras em Padr?es InternacionaisDocument68 pagesDados Econ?mico-Financeiros - Demonstra??es Financeiras em Padr?es InternacionaisBVMF_RINo ratings yet

- NE 06-09 - em InglDocument101 pagesNE 06-09 - em InglLightRINo ratings yet

- PHP 1 RQi UgDocument5 pagesPHP 1 RQi Ugfred607No ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument73 pagesDemonstra??es Financeiras em Padr?es InternacionaisKlabin_RINo ratings yet

- Release 2Q16Document19 pagesRelease 2Q16Klabin_RINo ratings yet

- Rating Klabin - SDocument1 pageRating Klabin - SKlabin_RINo ratings yet

- Ekosistem Galangan KapalDocument1 pageEkosistem Galangan KapalFITRI ADINo ratings yet

- Summative Test Q1 Week 5-6Document2 pagesSummative Test Q1 Week 5-6erlita credoNo ratings yet

- Contemporary Arts Daily Lesson LogDocument4 pagesContemporary Arts Daily Lesson LogGian Carlos BolañosNo ratings yet

- End Term Project: "Fundamental Analysis of Selected Securities of Indian Stock Market"Document73 pagesEnd Term Project: "Fundamental Analysis of Selected Securities of Indian Stock Market"bijegaonkarNo ratings yet

- Auburn Trader - January 21, 2009Document12 pagesAuburn Trader - January 21, 2009GCMediaNo ratings yet

- Competition Law OutlineDocument2 pagesCompetition Law OutlinegauravbhuwaniaNo ratings yet

- Cimb MacDocument3 pagesCimb MacanisNo ratings yet

- Floriculture Industry: Bhagya Vijayan JR - Msc. Agricultural ExtensionDocument22 pagesFloriculture Industry: Bhagya Vijayan JR - Msc. Agricultural ExtensionArunKhemaniNo ratings yet

- Nexus and Continuous DeliveryDocument77 pagesNexus and Continuous DeliveryPradyumna BNo ratings yet

- Public Sector Marketing Tony ProctorDocument8 pagesPublic Sector Marketing Tony ProctorPère elie AssaadNo ratings yet

- Chapter 12 Pay-For-Performance and Financial IncentivesDocument4 pagesChapter 12 Pay-For-Performance and Financial IncentivesLindsey Hoffman100% (2)

- Factor-Factor RelationshipDocument28 pagesFactor-Factor RelationshipMohammad RizwanNo ratings yet

- Ref 08Document99 pagesRef 08carito marinNo ratings yet

- About EthicsDocument21 pagesAbout EthicsJade MarkNo ratings yet

- Chairman Speech 2007 HerohondaDocument4 pagesChairman Speech 2007 HerohondaMitesh ChhabraNo ratings yet

- (Toppers Interview) Neha Nautiyal (AIR 185 - CSE 2011) Working Professional Cracks UPSC and Shares History Booklist and Study Tips MrunalDocument7 pages(Toppers Interview) Neha Nautiyal (AIR 185 - CSE 2011) Working Professional Cracks UPSC and Shares History Booklist and Study Tips Mrunalarjun.lnmiit100% (1)

- 4485562466Document1 page4485562466Anonymous Nl2Z1GNo ratings yet

- Economics PDFDocument61 pagesEconomics PDFArbind SapkotaNo ratings yet

- MAC Tutorial Exercises K22 Student VersionDocument5 pagesMAC Tutorial Exercises K22 Student VersionNguyễn Ngọc HuyềnNo ratings yet

- Adelaide Council Development PlanDocument466 pagesAdelaide Council Development PlanWoo JungNo ratings yet

- ColliersDocument9 pagesColliersAB AgostoNo ratings yet

- Unit 2 - The Demand For MoneyDocument31 pagesUnit 2 - The Demand For Moneyrichard kapimpaNo ratings yet

- QUIZ 1 Partnership Formation: Mona Lisa Statement of Financial Position October 1, 2019Document2 pagesQUIZ 1 Partnership Formation: Mona Lisa Statement of Financial Position October 1, 2019simontambisNo ratings yet

- Make in IndiaDocument10 pagesMake in Indiamunna tiwariNo ratings yet

- Car Rent ContractDocument16 pagesCar Rent ContractrainNo ratings yet

- "The Use of Solar Energy Has Not Been Opened Up Because The Oil Industry Does Not Own The Sun." - Ralph NaderDocument42 pages"The Use of Solar Energy Has Not Been Opened Up Because The Oil Industry Does Not Own The Sun." - Ralph NaderAzman AzmanNo ratings yet

- Marketing Contacts PDFDocument4 pagesMarketing Contacts PDFOmprakaash0% (1)

Klabin Reports 2nd Quarter Earnings of R$ 15 Million: Highlights

Klabin Reports 2nd Quarter Earnings of R$ 15 Million: Highlights

Uploaded by

Klabin_RIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Klabin Reports 2nd Quarter Earnings of R$ 15 Million: Highlights

Klabin Reports 2nd Quarter Earnings of R$ 15 Million: Highlights

Uploaded by

Klabin_RICopyright:

Available Formats

August 1, 2001

www.klabin.com.br

Klabin reports 2nd quarter earnings of R$ 15 million

Sales Volume totaled 453 thousand tons, 7% higher than the previous quarter; Net Revenue reaches R$ 567 million, 6% higher than the previous quarter; EBITDA was R$183 million, an improvement of 3% over the previous quarter; Net Profit registered R$ 15 million; Sale of Klabin Riocell forestry assets for R$ 67 million; Hedge operations of US$ 264 million, significantly reducing foreign currency exposure.

Highlights

R$ Million Average Price (R$/ton) Sales Volume (1,000 ton) Net Revenue Gross Profit Gross Margin EBIT Net Profit (Loss) EBITDA EBITDA margin (%) Equity Net Debt Total Capitalization Net Debt / EBITDA (annualized) Net Debt / Total Capitalization Depreciation / Amortization Capital Expenditures 2Q/01 1,301 453 *567 *235 *41% *124 15 *183 *32% 1,425 2,408 3,894 *3,3 x 62% 58 92 1Q/01 1,327 425 536 217 40% 122 (80) 178 33% 1,428 2,369 3,856 3,3 x 61% 55 64 2Q/00 1,400 334 433 185 43% 106 2 145 33% 968 1,394 2,623 2,4 x 53% 39 47 QoQ -2% 7% 6% 8% 2% 3%

2%

* Excluding the net result on the sale of forestry assets of Klabin Riocell.

**The results of Igaras, acquired on October 3, 2000, are consolidated as from the 4th Q00

Release Trimestral 1 de agosto de 2001

Economic and Financial Performance

Initial Considerations

The results of Igaras, acquired in October 2000, have been consolidated into Klabins statements since 4th Q00. Due to the significant contribution of this acquisition and for the purposes of a better understanding of the Companys performance, all comparisons in this report are based on figures for 2Q01 in relation to those of 1Q01. The sale of Klabin Riocells forestry assets, concluded in May 2001, generated net revenue of R$ 67 million and net operating revenue of R$ 42 million. Due to the nonrecurring nature of this transaction and to provide a better analysis of Klabins 2Q01 results as well as a comparison with the previous quarter, a proforma income statement excluding the result of the forestry assets sale is shown in attachments I and II. Similarly, the comments that follow also do not take into account this effect.

Net Revenue and Sales Volume

Sales volume for 2Q01 was 453 thousand tons (878 thousand tons for the first half of 2001), 7% higher than the previous quarter. The recovery in pulp exports from Klabin Riocell, contributed to the improvement in sales volume, reporting a growth of 35% during the period. The pulp segment accounted for 21% of volume in 2Q01 and 19% for the first half of the year. The packaging segment was mainly flat, reporting a slight growth of 2% in the quarter due to an increase of 3% in the sales volume of corrugated boxes and 5% in multiwall sacks and envelopes. This segment continues to account for the majority of sales volume, representing 66% in 2Q01 and 68% for the first half of 2001. In other segments, tissue recorded an increase of 14% in sales volume. The only exception to this positive trend was the decline of 19% in publication paper sales volume, which reflected falling demand in the domestic market. In terms of markets, the recovery in Klabin Riocells exports led to an increase in export volume increasing from 35% in 1Q01 to 40% in 2Q01.

Volume 1st Q01

Pulp 19% Tissue 7% Publication Paper 6%

Sales Volume by Market

Sacks/ Envelopes 7%

40%

35%

60%

Corrugated Boxes 30%

65% 1st Q'01

Exports

Packaging Paper 31%

2nd Q'01

Domestic Market

Release Trimestral 1 de agosto de 2001

The average price in 2Q01 of R$ 1,301 per ton reflects a decline of 2% in relation to 1Q01 (R$ 1,327 per ton). This decline is due to changes in the mix of products sold during the period, with a higher portion of pulp (which prices fell in the period) offsetting the increase in prices in other segments, especially packaging paper. As a result of the trends in volumes and prices, net revenue in 2Q01 was R$ 567 million, an increase of 6% compared with the previous quarter. Net revenue for the first half of 2001 totaled R$ 1,103 million. Revenue breakdown in the first half of 2001 is shown below with the packaging paper segment accounting for 59% of revenue, pulp 16%, and the other segments 25%.

Net Revenue 1st Q01

Pulp 16% Publication Paper 7% Sacks/ Envelopes 9%

Net Revenue by Market

34%

30%

Others 2% Tissue 16%

66%

70% 1st Q'01

Exports

2nd Q'01

Domestic Market

Packaging Paper 24%

Corrugated Boxes 26%

Operating Result and EBITDA

The operating profit before the financial result was R$ 124 million in 2Q01 representing a margin of 22% - a slight decline of 1% compared to the previous quarter. This small reduction reflected increased selling expenses during the period, a result of higher exports and increased freight costs. This effect offset the lower general and administrative expenses, which were down by R$ 1.8 million despite a non-recurring expense of R$ 1.3 million in severance EBITDA payments. R$ Million Margin EBITDA totaled R$ 183 million, an increase of 3% compared to the previous quarter, evidence of the Companys steady cash generation. Meanwhile, EBITDA margin was 32% in the quarter and 33% in the first half of the year.

200 150 100 50 0

35%

33%

35%

31%

33%

32%

40% 30%

144

145

164

178

178

183

20% 10% 0%

1Q 00

2Q 00

3Q 00

4Q 00

1Q 01

2Q 01

EBITDA

EBITDA Margin

Excluding the effect on the sale of forestry assets in 2Q01

Release Trimestral 1 de agosto de 2001

Financial Results and Debt

Net financial expenses totaled R$ 150 million in 2Q01 of which R$ 70 million, or 47% relates to the 6.6% depreciation of the Real against the US Dollar during the quarter. In the first half of the year, Klabin accumulated net financial expenses of R$ 384 million, of which R$ 224 million, or 58% of the total, related to the net effects of the foreign exchange rate variation on liabilities indexed to foreign currency. The accumulated devaluation of the local currency in 1H01 was 17.9%, compared to 0.6% in 1H00, thus distorting any comparison between the two periods. Net debt was R$ 2,408 million at the end 2Q01, or 62% of total capitalization (61% in 1Q01), an increase of 2% compared to the previous quarter. Compared to December 2000, gross debt fell by R$ 25 million and net debt by R$ 67 million. The larger portion of the companys debt is concentrated in the long term (72%), with maturities extending out to 2008. Foreign currency denominated financing remained almost unchanged, growing slightly from US$ 800 million in 1Q01 to US$ 803 million in 2Q01. Foreign currency debt can be broken down as follows: US$ 473 million in trade finance, US$ 147 million in Eurobonds and the remaining US$ 183 million in other financing lines (IFC, DEG and others). As part of its policy of minimizing foreign currency exposure, at the end of 2Q01, the Company had outstanding hedge operations amounting to US$ 264 million, thus leaving only 8% of the total foreign currency financing exposed. The chart below shows the Companys foreign currency debt: Foreign Currency Debt June 30, 2001 US$ Million TOTAL Trade Finance - Natural Hedge Hedge Exposure 803 (473) (264) 66

Net Profit

In the 2Q01, Klabin recorded a net profit of R$ 15 million as a result of extraordinary gains from the sale of forestry assets amounting to R$ 40 million after income tax. Without these non recurring gains, the net result would have been a loss of R$ 25 million, an improvement in relation to 1Q01, where the Company posted a loss of R$ 80 million. The loss for the first half of the year totaled R$ 65 million, and as a direct result of the effect of the 17.9% depreciation of the Real against the US Dollar, causing net financial expenses in the amount of R$ 224 million.

Release Trimestral 1 de agosto de 2001

Capital Expenditures

Capital expenditures totaled R$ 92 million in 2Q01 and R$ 156 million in the first half of the year. Expenditures were mainly directed towards the Klabin Riocell expansion project, as well as preventive maintenance of Klabins plants. Investments of R$ 52 million were made in the Klabin Riocell project in 2Q01, totaling R$ 88 million for the first half of the year, with approximately 55% of the project being completed.

National Plan for Energy Rationing

Klabin is reducing its energy consumption by 10MWh/h, or 4% of its total needs, to comply with the Brazilian governments rationing program for the Southeast and Northeast regions of the country. In order to adhere to government requirements in these areas, Klabin has shifted its paper production to lower specific power consumption products, also adopting other power saving measures at its plants and invested R$ 2 million in the acquisition of power generators. As a result, Klabin is maintaining its production at paper mills, corrugated boxes and tissue plants at pre-rationing levels. The plants located in the south of Brazil are not subject to energy rationing.

Capital Markets

Klabins preferred shares were traded on all the business days of the So Paulo Stock Exchange (Bovespa) in 1H01. Share prices reported a depreciation of 41% against a decline of 5% in the Ibovespa. During 1Q01, the Bovespa recorded 7,609 transactions involving 70 million Klabin preferred shares with an average daily volume of R$ 589,000. Investor confidence in the sector remains low due to the 17.9% devaluation of the Real in the first half of the year, the crisis in Argentina and its consequent effects on the Brazilian economy, and the domestic energy crisis. However, in June, Klabins shares reported a 15% appreciation, the best performance among its peers at the Bovespa.

Share Performance at Ibovespa Base: 12/28/00 = 100

130 120 110 100 90 80 70 60 50 40 30

ec 8Ja 15 n -J a 22 n -J a 30 n -J an 6Fe 13 b -F e 20 b -F eb 1M a 8- r M 15 ar -M 22 ar -M 29 ar -M a 5- r Ap 12 r -A p 20 r -A p 27 r -A p 7- r M 14 ay -M 21 ay -M 28 ay -M ay 4Ju 11 n -J u 19 n -J u 26 n -J un 28 -D

Ibovespa

Klabin

Release Trimestral 1 de agosto de 2001

Dividends

Dividends totaling R$ 22.5 million were distributed to shareholders in May on the basis of R$ 23.01 per thousand common shares and R$ 25.31 per thousand preferred shares.

For further information, please contact:

Ronald Seckelmann, CFO and Investor Relations Director Luiz Marciano Candalaft, Investor Relations Manager Phone: +55 (11) 3225-4045 E-mail: marciano@klabin.com.br Doris Pompeu Brasil Phone: +55 (11) 3848-0887 ext: 208 E-mail: doris.pompeu@thomsonir.com.br

Klabin is the leading forest products company in Latin America. With gross revenue of R$ 2.1 billion in 2000, it is the largest integrated producer of pulp and paper in Brazil with an annual sales production capacity of 2.1 million tons. The Companys strategic focus includes activities in the following areas: cartons, corrugated boxes, paper sacks, tissue, wood and pulp.

Statements included in this report regarding the Companys business outlook and anticipated financial and operating results, regarding the Companys growth potential, constitute forward-looking statements and are based on management expectations regarding the future of the Company. These expectations are highly dependent on changes in the market, general economic performance of Brazil, industry and international markets, therefore they are subject to change.

Attachment 1 Consolidated Income Statement Brazilian Corporate Law (Thousand of R$)

1st Q/01

535,926 (319,197) 216,729 (52,550) (40,334) (1,786) (94,670) 122,059 (92,127) (153,648) 12,540 (111,176) 2,118 (109,058) 29,593 (283) (79,748) 55,456 177,515 (951) 15,163 58,171 224,282 (2,012) 18,126 2,402 15,724 15,724 2,402 18,126 (2,012) (951) 15,163 58,171 182,651 15,438 15,438 (70,695) (70,695) (95,130) (95,130) 41,631 166,111 124,480 2,421 41,631 3,003 (82,953) 2,898 126,900 284 127,184 31,605 668 94,911 2,715 5,136 (110,107) (110,107) 15,437 (1,905) (1,905) 119 (38,518) (38,518) (1,816) (69,684) (69,684) 17,134 9.8 7.5 0.3 17.7 22.8 17.2 28.7 2.3 20.7 0.4 20.3 5.5 0.1 14.9 10.3 33.1 276,218 234,587 17,858 40.4 (357,539) (332,714) 13,517 59.6 633,757 567,301 31,375 100.0

(Thousands of R$) 2nd Q/01 (*)

Results 2nd Q/01 Change

% of Net Revenue 1st Q/01 2nd Q/01 (*)

100.0 58.6 41.4 12.3 6.8 0.3 19.4 21.9 7.3 16.8 12.5 2.7 2.8 0.4 3.2 0.4 0.2 2.7 10.3 32.2

Net Revenue

Cost of Products Sold

Gross Profit

Selling Expenses

General & Administrative Expenses

Others Revenue (Expenses)

Total Operating Expenses

Operating Result (before Fin. Results)

Net Result on the Sale of Forestry Assets

Financial Expenses

Net Foreign Exchange Losses

Financial Revenues

Operating Result

Non Operating Revenues (Expenses)

Net Income (Loss) before Taxes

Income Tax and Soc. Contrib.

Minority Interest

Net Income (Loss)

Amortization / Depreciation

EBITDA

* Excluding the Net Result on the Sale of Forestry Assets of Klabin Riocell (Net Revenue and Cost of Produtcs Sold)

Attachment 2 Consolidated Income Statement Brazilian Corporate Law (Thousand of R$)

1st Half'00

840,905 (474,121) 366,784 (88,382) (67,137) 722 (154,797) 211,987 (119,745) (3,003) 21,750 110,989 2,101 113,090 (50,338) (23,167) 39,585 77,211 289,198 (1,234) (64,585) 113,627 401,797 27,581 (90,932) 4,520 (95,452) 27,978 27,978 (95,452) 4,520 (90,932) 27,581 (1,234) (64,585) 113,627 360,166 (224,343) (224,343) (187,257) (187,257) 41,631 288,170 246,539 (204,777) (204,777) 49,980 34,552 41,631 67,512 221,340 6,228 (206,441) 2,419 (204,022) 77,919 (21,933) (104,170) 36,416 70,968 (3,691) (3,691) 4,413 (78,852) (78,852) 11,715 (122,234) (122,234) 33,852 492,947 451,316 84,532 (676,736) (651,911) 177,790 56.4 43.6 10.5 8.0 0.1 18.4 25.2 14.2 0.4 2.6 13.2 0.2 13.4 6.0 2.8 4.7 9.2 34.4 1,169,683 1,103,227 262,322 100.0

(Thousands of R$) 1st Half'01 (*)

Results 1st Half'01 Change

% of Net Revenue 1st Half'00 1st Half'01 (*)

100.0 59.1 40.9 11.1 7.1 0.3 18.6 22.3 3.8 17.0 20.3 2.5 8.7 0.4 8.2 2.5 0.1 5.9 10.3 32.6

Net Revenue

Cost of Products Sold

Gross Profit

Selling Expenses

General & Administrative Expenses

Others Revenue (Expenses)

Total Operating Expenses

Operating Result (before Fin. Results)

Net Result on the Sale of Forestry Assets

Financial Expenses

Net Foreign Exchange Losses

Financial Revenues

Operating Result

Non Operating Revenues (Expenses)

Net Income (Loss) before Taxes

Income Tax and Soc. Contrib.

Minority Interest

Net Income (Loss)

Amortization / Depreciation

EBITDA

* Excluding the Net Result on the Sale of Forestry Assets of Klabin Riocell (Net Revenue and Cost of Produtcs Sold) *The results of Igaras, acquired on October 3, 2000, are consolidated as from the 4th Q00 8

Attachment 3 Consolidated Balance Sheet Brazilian Corporate Law (Thousand of R$)

Dec. 31-00 Jun. 30-01 832,036 24,382 127,470 301,305 236,230 82,345 60,304 902,422 11,033 183,404 317,819 245,529 71,969 72,668 Current Loans and financing Debentures Suppliers Income tax and social contribution Taxes payable Payroll provisions Other accounts payable

Assets

Liabilities and Shareholder's Equity

Dec. 31-00 Jun. 30-01 1,247,717 952,094 2,822 157,956 33,425 25,711 37,792 37,917 989,463 723,665 3,052 151,675 10,727 21,623 37,130 41,591

Current Cash and banks Short-term investiments Receivables Inventories Recoverable taxes and contributions Other receivables

Long-Term Deferred income tax and soc. contrib. Taxes to compensate Recoverable taxes Other receivables 3,312,913 609,193 2,578,416 125,304 3,349,771 641,592 2,581,202 126,977

211,570 83,946 25,221 52,568 49,835

268,609 48,216 107,881 63,826 48,686

Permanent Other investiments Property, plant & equipment, net Deferred charges

Total

4,356,519

4,520,802

Long-Term Loans and financing Debentures Other accounts payable Results for Future Fiscal Years Minority Interests Shareholders' Equity Capital Capital reserves Revaluation reserve Profit reserve Retained Earnings Total

1,798,051 1,556,553 115,300 126,198 23,507 58,892 1,228,352 928,444 111,604 102,988 85,316 0 4,356,519

2,026,215 1,760,677 115,300 150,238 19,574 60,261 1,425,289 1,206,589 117,495 101,392 62,802 (62,989) 4,520,802

Attachment 4 Sales Volume and Net Average Price Consolidated 100%

1,000 t 1st Q (*) 2nd Q (*) 38 36 74 62 34 37 72 92 56 64 16 28 72 76 26 27 3 4 319 1,333 1,400 334 364 1,447 457 1,344 1,474 1,380 4th Q 38 136 35 83 49 34 135 27 3 YEAR 150 353 144 334 236 98 372 108 13

Publication Paper Packaging Tissue Pulp Klabin Riocell Klabin Bacell Corrugated Boxes Sacks/ Envelopes Others

2000 3rd Q (*) 38 81 38 87 67 20 89 28 3

2001 1st Q 2nd Q 30 25 135 135 30 34 70 94 49 69 21 25 128 132 30 31 2 2 425 1,327 453 1,301

Total

Average Price (R$/ton)

*Does not include Igaras sales volume and prices.

10

You might also like

- Transferwise Document 10 PDFDocument2 pagesTransferwise Document 10 PDFMai-linh Polero Dean0% (1)

- Yahoo! Finance SpreadsheetDocument9 pagesYahoo! Finance Spreadsheetsandip_exlNo ratings yet

- Marketing Plan of Beauty SpotDocument39 pagesMarketing Plan of Beauty SpotZiwho Na100% (2)

- First Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Document10 pagesFirst Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Klabin_RINo ratings yet

- Cash Generation Exceeds R$ 181 Million: January/March 2002Document10 pagesCash Generation Exceeds R$ 181 Million: January/March 2002Klabin_RINo ratings yet

- Klabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Document14 pagesKlabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Klabin_RINo ratings yet

- Cash Generation Grows by 12% in The Third Quarter: July/September 2001Document13 pagesCash Generation Grows by 12% in The Third Quarter: July/September 2001Klabin_RINo ratings yet

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateDocument15 pagesQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Document19 pagesQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RINo ratings yet

- Ebitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Document17 pagesEbitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Klabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Document16 pagesQuarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Klabin_RINo ratings yet

- Klabin Reduces Debt: April/June 2003Document16 pagesKlabin Reduces Debt: April/June 2003Klabin_RINo ratings yet

- Release 3Q12Document17 pagesRelease 3Q12Klabin_RINo ratings yet

- iKRelease2005 2qDocument16 pagesiKRelease2005 2qKlabin_RINo ratings yet

- Release 1Q15Document17 pagesRelease 1Q15Klabin_RINo ratings yet

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocument19 pagesQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RINo ratings yet

- Release 2Q15Document17 pagesRelease 2Q15Klabin_RINo ratings yet

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Document16 pagesQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RINo ratings yet

- iKRelease2005 1qDocument16 pagesiKRelease2005 1qKlabin_RINo ratings yet

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Document15 pagesCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Document15 pagesKlabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Klabin_RINo ratings yet

- Klabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Document15 pagesKlabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Klabin_RINo ratings yet

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDocument15 pagesQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RINo ratings yet

- EBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Document18 pagesEBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Klabin_RINo ratings yet

- Indústrias Klabin Announces Fourth Quarter and Consolidated Results For 2000Document10 pagesIndústrias Klabin Announces Fourth Quarter and Consolidated Results For 2000Klabin_RINo ratings yet

- Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseDocument17 pagesRelatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseKlabin_RINo ratings yet

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Document18 pagesSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RINo ratings yet

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Document20 pagesKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RINo ratings yet

- iKRelease2000 1qDocument6 pagesiKRelease2000 1qKlabin_RINo ratings yet

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioDocument18 pagesQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Document18 pagesQuarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Klabin_RINo ratings yet

- Mills 3Q12 ResultDocument14 pagesMills 3Q12 ResultMillsRINo ratings yet

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- Klabin Webcast 20092 Q09Document10 pagesKlabin Webcast 20092 Q09Klabin_RINo ratings yet

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Document17 pagesQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RINo ratings yet

- Cash Generation Reaches R$ 979 Million in 2002: October/December 2002Document19 pagesCash Generation Reaches R$ 979 Million in 2002: October/December 2002Klabin_RINo ratings yet

- Release 4Q12Document18 pagesRelease 4Q12Klabin_RINo ratings yet

- Quarterly Release: Start Up of Paper Machine # 9Document19 pagesQuarterly Release: Start Up of Paper Machine # 9Klabin_RINo ratings yet

- Mills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsDocument14 pagesMills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsMillsRINo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- Accenture Reports Strong Second-Quarter Fiscal 2011 ResultsDocument12 pagesAccenture Reports Strong Second-Quarter Fiscal 2011 ResultsPriya NairNo ratings yet

- Klabin S.A.: Anagement EportDocument9 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 366 Million Up To September 2004Document16 pagesKlabin Reports A Net Profit of R$ 366 Million Up To September 2004Klabin_RINo ratings yet

- Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11Document20 pagesEarnings Release 3Q11: EBITDA of R$277 Million in 3Q11Klabin_RINo ratings yet

- PHP WKPF BKDocument5 pagesPHP WKPF BKfred607No ratings yet

- Mills 1Q16 ResultsDocument15 pagesMills 1Q16 ResultsMillsRINo ratings yet

- Release 3Q15Document17 pagesRelease 3Q15Klabin_RINo ratings yet

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Document19 pages4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RINo ratings yet

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineDocument19 pages2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RINo ratings yet

- 2Q16 Financial StatementsDocument82 pages2Q16 Financial StatementsJBS RINo ratings yet

- Market Notes May 13 FridayDocument3 pagesMarket Notes May 13 FridayJC CalaycayNo ratings yet

- Kimberly-Clark Announces First Quarter 2021 ResultsDocument7 pagesKimberly-Clark Announces First Quarter 2021 ResultsSachin DhorajiyaNo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010Document15 pagesBM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010BVMF_RINo ratings yet

- Financial Report EmpeDocument9 pagesFinancial Report EmpeCY ParkNo ratings yet

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginDocument18 pagesQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RINo ratings yet

- Earnings 1Q12Document8 pagesEarnings 1Q12Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 940 Million Up To September 2003Document16 pagesKlabin Reports A Net Profit of R$ 940 Million Up To September 2003Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 1.0 Billion in 2003: October/December 2003Document17 pagesKlabin Reports A Net Profit of R$ 1.0 Billion in 2003: October/December 2003Klabin_RINo ratings yet

- Dados Econ?mico-Financeiros - Demonstra??es Financeiras em Padr?es InternacionaisDocument68 pagesDados Econ?mico-Financeiros - Demonstra??es Financeiras em Padr?es InternacionaisBVMF_RINo ratings yet

- NE 06-09 - em InglDocument101 pagesNE 06-09 - em InglLightRINo ratings yet

- PHP 1 RQi UgDocument5 pagesPHP 1 RQi Ugfred607No ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument73 pagesDemonstra??es Financeiras em Padr?es InternacionaisKlabin_RINo ratings yet

- Release 2Q16Document19 pagesRelease 2Q16Klabin_RINo ratings yet

- Rating Klabin - SDocument1 pageRating Klabin - SKlabin_RINo ratings yet

- Ekosistem Galangan KapalDocument1 pageEkosistem Galangan KapalFITRI ADINo ratings yet

- Summative Test Q1 Week 5-6Document2 pagesSummative Test Q1 Week 5-6erlita credoNo ratings yet

- Contemporary Arts Daily Lesson LogDocument4 pagesContemporary Arts Daily Lesson LogGian Carlos BolañosNo ratings yet

- End Term Project: "Fundamental Analysis of Selected Securities of Indian Stock Market"Document73 pagesEnd Term Project: "Fundamental Analysis of Selected Securities of Indian Stock Market"bijegaonkarNo ratings yet

- Auburn Trader - January 21, 2009Document12 pagesAuburn Trader - January 21, 2009GCMediaNo ratings yet

- Competition Law OutlineDocument2 pagesCompetition Law OutlinegauravbhuwaniaNo ratings yet

- Cimb MacDocument3 pagesCimb MacanisNo ratings yet

- Floriculture Industry: Bhagya Vijayan JR - Msc. Agricultural ExtensionDocument22 pagesFloriculture Industry: Bhagya Vijayan JR - Msc. Agricultural ExtensionArunKhemaniNo ratings yet

- Nexus and Continuous DeliveryDocument77 pagesNexus and Continuous DeliveryPradyumna BNo ratings yet

- Public Sector Marketing Tony ProctorDocument8 pagesPublic Sector Marketing Tony ProctorPère elie AssaadNo ratings yet

- Chapter 12 Pay-For-Performance and Financial IncentivesDocument4 pagesChapter 12 Pay-For-Performance and Financial IncentivesLindsey Hoffman100% (2)

- Factor-Factor RelationshipDocument28 pagesFactor-Factor RelationshipMohammad RizwanNo ratings yet

- Ref 08Document99 pagesRef 08carito marinNo ratings yet

- About EthicsDocument21 pagesAbout EthicsJade MarkNo ratings yet

- Chairman Speech 2007 HerohondaDocument4 pagesChairman Speech 2007 HerohondaMitesh ChhabraNo ratings yet

- (Toppers Interview) Neha Nautiyal (AIR 185 - CSE 2011) Working Professional Cracks UPSC and Shares History Booklist and Study Tips MrunalDocument7 pages(Toppers Interview) Neha Nautiyal (AIR 185 - CSE 2011) Working Professional Cracks UPSC and Shares History Booklist and Study Tips Mrunalarjun.lnmiit100% (1)

- 4485562466Document1 page4485562466Anonymous Nl2Z1GNo ratings yet

- Economics PDFDocument61 pagesEconomics PDFArbind SapkotaNo ratings yet

- MAC Tutorial Exercises K22 Student VersionDocument5 pagesMAC Tutorial Exercises K22 Student VersionNguyễn Ngọc HuyềnNo ratings yet

- Adelaide Council Development PlanDocument466 pagesAdelaide Council Development PlanWoo JungNo ratings yet

- ColliersDocument9 pagesColliersAB AgostoNo ratings yet

- Unit 2 - The Demand For MoneyDocument31 pagesUnit 2 - The Demand For Moneyrichard kapimpaNo ratings yet

- QUIZ 1 Partnership Formation: Mona Lisa Statement of Financial Position October 1, 2019Document2 pagesQUIZ 1 Partnership Formation: Mona Lisa Statement of Financial Position October 1, 2019simontambisNo ratings yet

- Make in IndiaDocument10 pagesMake in Indiamunna tiwariNo ratings yet

- Car Rent ContractDocument16 pagesCar Rent ContractrainNo ratings yet

- "The Use of Solar Energy Has Not Been Opened Up Because The Oil Industry Does Not Own The Sun." - Ralph NaderDocument42 pages"The Use of Solar Energy Has Not Been Opened Up Because The Oil Industry Does Not Own The Sun." - Ralph NaderAzman AzmanNo ratings yet

- Marketing Contacts PDFDocument4 pagesMarketing Contacts PDFOmprakaash0% (1)