Professional Documents

Culture Documents

Tax 2 Sample Problem Solving

Tax 2 Sample Problem Solving

Uploaded by

Alberto NicholsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax 2 Sample Problem Solving

Tax 2 Sample Problem Solving

Uploaded by

Alberto NicholsCopyright:

Available Formats

PROBLEM SOLVING ON BUSINESS TRANSACTIONS

1 Amount of tax liability Tax liability

Regular transactions subject to and exclusive of

VAT 168,000.00 1400000x0.12

(1344000/1.12)x0.1

Purchases inclusive of VAT (on regular sale) 144,000.00 2

Purchases inclusive of VAT (on zero-rated sales) 80,640.00 672000x0.12

Total amount of tax liability 392,640.00

2 VAT for Stormy Company is zero since it is a foreign denominated sale like an export

sale when the TV and refrigerator is sold to an OFW, a nonresident.

3 The VAT is P72,0000 from the sale of 1-unit of 4-door sedan car (P600,00x12%). The 1

unit of 15-seater van is not VATable since it is a foreign currency denominated sale.

4 Data Tax liability

Since it is VAT-exempt

Export Sale 0.00 transaction

Local Sales 60,000.00 It is taxable P60,000x12%

Purchases related to sales, inclusive of VAT

Cannot claim since it is VAT-

On export sale 0.00 exempt

On local sale 42,000.00 (392,000/1.12)x0.12

Total Tax Liability 102,000.00

5

Sale to private entities subject to 12%

VAT 1,000,000.00

Sale to government 500,000.00

Purchases during the quarter applied to

all sales 300,000.00

Purchases from VAT-registered persons applicable

to sale to government/quarter 200,000.00

Purchase during the quarter applied to sales to

private entities 400,000.00

a. Standard input VAT 120,000.00 1000000x12%

b. Actual Input tax on sale on government 25,000.00 500000x5%

c. Input tax chargeable to cost or expense 35,000.00 300,000x12%+200,000/1112%x12%

d. VAT payable for the quarter 48,000.00 400000x12%

6

1. Input tax attributable to sales subject to

12% 25,000.00 5000+20000

2. Input tax attributable to zero-rated sales 3,000.00

3. Input tax attributable to VAT-exempt sales 2,000.00

4. Input tax attributable to government sales 4,000.00

You might also like

- Introduction To Market Integration ModuleDocument5 pagesIntroduction To Market Integration ModuleYram Gambz100% (6)

- Tax2 - Seatworks-04 06 2020-AnswersDocument7 pagesTax2 - Seatworks-04 06 2020-AnswersAllen Fey De JesusNo ratings yet

- Chapter 7-The Regular Output VatDocument7 pagesChapter 7-The Regular Output VatJamaica DavidNo ratings yet

- Quiz - Business TaxesDocument4 pagesQuiz - Business TaxesFery Ann C. BravoNo ratings yet

- Value Added TaxDocument6 pagesValue Added Taxarjohnyabut80% (10)

- VAT On Merchandise Purchased and SoldDocument5 pagesVAT On Merchandise Purchased and SoldBernadette Solis100% (1)

- First Semester, Academic Year 2020-2021 First Semester, Academic Year 2020-2021Document3 pagesFirst Semester, Academic Year 2020-2021 First Semester, Academic Year 2020-2021Alberto NicholsNo ratings yet

- 1991 India Economic CrisisDocument3 pages1991 India Economic CrisisDev DeepNo ratings yet

- Business Tax - Output VAT ActivityDocument4 pagesBusiness Tax - Output VAT ActivityDrew BanlutaNo ratings yet

- Output and Input VAT1Document21 pagesOutput and Input VAT1Eza MayandiaNo ratings yet

- May 15 Input VATDocument15 pagesMay 15 Input VATA cNo ratings yet

- VAT-problems-key by Andrew Gil AmbrayDocument10 pagesVAT-problems-key by Andrew Gil AmbrayMark Gelo WinchesterNo ratings yet

- Exercise 2Document15 pagesExercise 2Riezel PepitoNo ratings yet

- Review Problems and Notes in VAT - With Answers and SolutionsDocument27 pagesReview Problems and Notes in VAT - With Answers and SolutionsCPAREVIEWNo ratings yet

- Output VatDocument16 pagesOutput VatLica Dapitilla Perin100% (1)

- Input VATDocument16 pagesInput VATLove RosalunaNo ratings yet

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Document4 pagesQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionNo ratings yet

- CH11 - Value Added TaxDocument33 pagesCH11 - Value Added TaxDimple AtienzaNo ratings yet

- Nput Vat On Mixed TransactionsDocument15 pagesNput Vat On Mixed TransactionsBSACCBLK1COLEEN CALUGAYNo ratings yet

- Business Tax Chapter 9 (9-23 To 25)Document1 pageBusiness Tax Chapter 9 (9-23 To 25)Elai grace FernandezNo ratings yet

- Revenue Memorandum Circular 36-2021 v2Document32 pagesRevenue Memorandum Circular 36-2021 v2lizzyNo ratings yet

- TBLTAX Chapter 4 Input and Output TaxDocument16 pagesTBLTAX Chapter 4 Input and Output TaxBeny MiraflorNo ratings yet

- Value Added TaxesDocument75 pagesValue Added TaxesLEILALYN NICOLAS100% (1)

- BUSLAW3 C1 (Notes On Business Taxes)Document7 pagesBUSLAW3 C1 (Notes On Business Taxes)Brad Stevens1911No ratings yet

- Chapter 3 Value Added Tax Sale of Good PropertiesDocument8 pagesChapter 3 Value Added Tax Sale of Good PropertiesMary Grace BaquiranNo ratings yet

- FA - Recording Transactions and Events: Sales TaxDocument2 pagesFA - Recording Transactions and Events: Sales TaxBhupendra SinghNo ratings yet

- Tax Endterm Business Taxes: ExampleDocument4 pagesTax Endterm Business Taxes: ExampleCharmaine ChuaNo ratings yet

- Written ReportDocument10 pagesWritten ReportSamantha TayoneNo ratings yet

- Chapter 13 1Document16 pagesChapter 13 1Nile NguyenNo ratings yet

- VAT ON SALE OF GOODS OR PROPERTIESv2Document27 pagesVAT ON SALE OF GOODS OR PROPERTIESv2Trisha Mae BoholNo ratings yet

- Income Taxation 2023 DiscussionsDocument16 pagesIncome Taxation 2023 DiscussionsKenjay SarcoNo ratings yet

- VAT QuizzerDocument28 pagesVAT Quizzerlc100% (1)

- TAX2 ReyesDocument9 pagesTAX2 ReyesClaire BarrettoNo ratings yet

- Lesson 6 Business TaxesDocument9 pagesLesson 6 Business TaxesReino CabitacNo ratings yet

- Chapter 8 Output VAT ZERO-Rated Sales Chapter 8 Output VAT ZERO - Rated SalesDocument9 pagesChapter 8 Output VAT ZERO-Rated Sales Chapter 8 Output VAT ZERO - Rated SalesSunny DaeNo ratings yet

- VAT Handouts TaxDocument9 pagesVAT Handouts TaxRenmar CruzNo ratings yet

- Output Vat Zero RatedDocument13 pagesOutput Vat Zero RatedVanessa CruzNo ratings yet

- Excise Tax - 4.16.22Document91 pagesExcise Tax - 4.16.22Jacy Marie LedesmaNo ratings yet

- Computaion Pre FinalDocument4 pagesComputaion Pre FinalPaupauNo ratings yet

- Value Added Tax (VAT)Document8 pagesValue Added Tax (VAT)Allen KateNo ratings yet

- Bus Tax Notes 2Document44 pagesBus Tax Notes 2Zhaneah Rhej SaradNo ratings yet

- Chapter 1&2 Introduction To Business Taxes & Vat On Sale of Goods or PropertiesDocument6 pagesChapter 1&2 Introduction To Business Taxes & Vat On Sale of Goods or PropertiesBSA3Tagum Marilet100% (1)

- Output Vat (Ch7&8)Document118 pagesOutput Vat (Ch7&8)Renz Francis LimNo ratings yet

- 01 Seatwork VAT Subject TransactionDocument2 pages01 Seatwork VAT Subject TransactionJaneLayugCabacunganNo ratings yet

- Input TaxDocument10 pagesInput TaxJan ernie MorillaNo ratings yet

- Module 6 Chapter 8 Output VAT Zero Rated SalesDocument5 pagesModule 6 Chapter 8 Output VAT Zero Rated SalesChris SumandeNo ratings yet

- Output TaxDocument15 pagesOutput TaxAmie Jane MirandaNo ratings yet

- Input TaxDocument18 pagesInput TaxAmie Jane MirandaNo ratings yet

- Week 3 Learning ObjectivesDocument2 pagesWeek 3 Learning Objectiveshazel sergioNo ratings yet

- VAT Powerpoint PDFDocument202 pagesVAT Powerpoint PDFRuchie EtolleNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- Value Added Tax - Part 1: - The Regular Output VATDocument25 pagesValue Added Tax - Part 1: - The Regular Output VATAjey MendiolaNo ratings yet

- RCITDocument8 pagesRCITjanellemoralestNo ratings yet

- Chapter 8 Output Vat Zero-Rated SalesDocument8 pagesChapter 8 Output Vat Zero-Rated SalesJamaica DavidNo ratings yet

- Lecture 6 - Value-Added TaxDocument6 pagesLecture 6 - Value-Added TaxVic FabeNo ratings yet

- Lecture 6 - Value-Added TaxDocument7 pagesLecture 6 - Value-Added TaxPiyey LlarenaNo ratings yet

- Chapter 15 PDFDocument11 pagesChapter 15 PDFG & E ApparelNo ratings yet

- Tax Chapter 8Document25 pagesTax Chapter 8Farhani Sam RacmanNo ratings yet

- VAT IntroductionDocument22 pagesVAT IntroductionMa.annNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Business PolicyDocument31 pagesBusiness PolicyAlberto NicholsNo ratings yet

- Business Policy On Industry AnalysisDocument2 pagesBusiness Policy On Industry AnalysisAlberto NicholsNo ratings yet

- Legal Terminologies in Business LawDocument13 pagesLegal Terminologies in Business LawAlberto NicholsNo ratings yet

- Management Information SystemDocument23 pagesManagement Information SystemAlberto Nichols0% (1)

- Humanities Concepts and PrinciplesDocument58 pagesHumanities Concepts and PrinciplesAlberto NicholsNo ratings yet

- Sample Abstract of The StudyDocument1 pageSample Abstract of The StudyAlberto NicholsNo ratings yet

- Accounting Basic ConceptsDocument2 pagesAccounting Basic ConceptsAlberto NicholsNo ratings yet

- Advantages vs. Disadvantages of Debt FinancingDocument3 pagesAdvantages vs. Disadvantages of Debt FinancingAlberto NicholsNo ratings yet

- Business Policy On Industry AnalysisDocument2 pagesBusiness Policy On Industry AnalysisAlberto NicholsNo ratings yet

- Brief History of DebtDocument3 pagesBrief History of DebtAlberto NicholsNo ratings yet

- Organizational Development ConceptsDocument3 pagesOrganizational Development ConceptsAlberto NicholsNo ratings yet

- Business Policy On LicenseeDocument1 pageBusiness Policy On LicenseeAlberto NicholsNo ratings yet

- Understanding One SelfDocument4 pagesUnderstanding One SelfAlberto NicholsNo ratings yet

- Taxation 2 Sample Business ExercisesDocument3 pagesTaxation 2 Sample Business ExercisesAlberto NicholsNo ratings yet

- Financial Statements ConceptsDocument6 pagesFinancial Statements ConceptsAlberto NicholsNo ratings yet

- Philosophy Study of ManDocument1 pagePhilosophy Study of ManAlberto NicholsNo ratings yet

- Business Policy 101Document10 pagesBusiness Policy 101Alberto NicholsNo ratings yet

- Extinguishment of ObligationsDocument16 pagesExtinguishment of ObligationsAlberto NicholsNo ratings yet

- Tax 2 On Tax LiabilitiesDocument2 pagesTax 2 On Tax LiabilitiesAlberto NicholsNo ratings yet

- Social Science DefinitionDocument1 pageSocial Science DefinitionAlberto NicholsNo ratings yet

- Book Review On The Approaches of The Study of ManDocument7 pagesBook Review On The Approaches of The Study of ManAlberto NicholsNo ratings yet

- Rythmic Dances in Physical EducationDocument35 pagesRythmic Dances in Physical EducationAlberto NicholsNo ratings yet

- Social Science IntroductionDocument1 pageSocial Science IntroductionAlberto NicholsNo ratings yet

- Introduction To Philippine HistoryDocument1 pageIntroduction To Philippine HistoryAlberto NicholsNo ratings yet

- Making Negative News LetterDocument1 pageMaking Negative News LetterAlberto NicholsNo ratings yet

- Housing ShortageDocument16 pagesHousing ShortageRhuzz Villanueva ZgirNo ratings yet

- 1.2 Budget Process BDocument4 pages1.2 Budget Process BHarsh RajNo ratings yet

- Barcoma Prelim Week 1 AssingmentDocument2 pagesBarcoma Prelim Week 1 AssingmentMark VlogsNo ratings yet

- Thiruvalluvar ThirukkuralDocument1 pageThiruvalluvar Thirukkuralskgopal2No ratings yet

- Zimbabwe HistoryDocument3 pagesZimbabwe HistoryJohn Ox100% (1)

- Statistics Bulletin: Each Page Shows A Stamp Indicating The Time and Date of The Latest UpdateDocument127 pagesStatistics Bulletin: Each Page Shows A Stamp Indicating The Time and Date of The Latest UpdatesugengNo ratings yet

- Chapter 10 Comparative Development Experiences of India and Its NeighboursDocument3 pagesChapter 10 Comparative Development Experiences of India and Its NeighboursHeyaNo ratings yet

- CBP 7851Document18 pagesCBP 7851xesNo ratings yet

- E@banking Price List Private Individuals: Payment Services Used by e Banking International Outgoing Money TransfersDocument2 pagesE@banking Price List Private Individuals: Payment Services Used by e Banking International Outgoing Money TransfersToniTuliNo ratings yet

- AIDS, Condoms and Carnival Durex in BrazilDocument39 pagesAIDS, Condoms and Carnival Durex in BrazilJordana Le GallNo ratings yet

- LC Presentasion 2-Deri Firmansyah-Eks39 ADocument7 pagesLC Presentasion 2-Deri Firmansyah-Eks39 ADeri FirmansyahNo ratings yet

- RBICFCDocument16 pagesRBICFCPrasun SamantaNo ratings yet

- Romania European Innovation Scoreboard 2021Document1 pageRomania European Innovation Scoreboard 2021start-up.roNo ratings yet

- Topic GPDocument10 pagesTopic GPaidanNo ratings yet

- 2023 Asia Partners Internet ReportDocument332 pages2023 Asia Partners Internet ReportBen SetoNo ratings yet

- Bloomberg Economic Outlook 2020 PDFDocument25 pagesBloomberg Economic Outlook 2020 PDFkhansarizki100% (1)

- BRICS - Wikipedia, The Free EncyclopediaDocument5 pagesBRICS - Wikipedia, The Free Encyclopedianavin shuklaNo ratings yet

- Belarusian Grocery Retail Market BCG - July2018 - English - tcm26 196435 PDFDocument158 pagesBelarusian Grocery Retail Market BCG - July2018 - English - tcm26 196435 PDFmaxNo ratings yet

- Cotton Textile IndustryDocument24 pagesCotton Textile IndustryZonish BakshNo ratings yet

- Data Coffee Consumption in IndiaDocument1 pageData Coffee Consumption in IndiaAshok NagarajanNo ratings yet

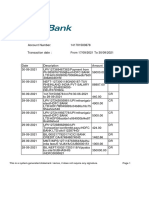

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument2 pagesStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceNAGENDRA SINGH ShekhawatNo ratings yet

- Pages 601-650 of 839Document50 pagesPages 601-650 of 839Juno AlabanzaNo ratings yet

- Notification 11 2021Document2 pagesNotification 11 2021sudhagar palaniNo ratings yet

- SAC49246675-Company Credit ReportDocument8 pagesSAC49246675-Company Credit ReportDabbech RihabNo ratings yet

- Preliminary Exam 2014 JC2 Economics H2 (9732) : Paper 2 - EssayDocument3 pagesPreliminary Exam 2014 JC2 Economics H2 (9732) : Paper 2 - EssayJoann KwekNo ratings yet

- Statement 1632994799036Document4 pagesStatement 1632994799036vijay_akasNo ratings yet

- Salary SlipDocument4 pagesSalary Slipbindu mathaiNo ratings yet

- Privatization of Public Transport in IndiaDocument13 pagesPrivatization of Public Transport in IndiaProf. R V SinghNo ratings yet