Professional Documents

Culture Documents

BIR Ruling No. 307-82

BIR Ruling No. 307-82

Uploaded by

Alfred Hernandez Campañano0 ratings0% found this document useful (0 votes)

28 views2 pagesBIR Ruling

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBIR Ruling

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

28 views2 pagesBIR Ruling No. 307-82

BIR Ruling No. 307-82

Uploaded by

Alfred Hernandez CampañanoBIR Ruling

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

December 13, 1982

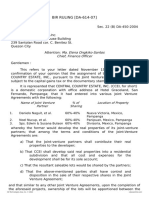

BIR RULING NO. 307-82

321-00 000-00 307-82

Engineering Equipment, Inc. and

F.F. Mañacop Construction Co., Inc.

Joint Venture

86 West Avenue, Quezon City

Attention: Atty. Antonio C . Ravelo

Vice-President for Administration

and Finance Project Principal, FFMCCI

Gentlemen :

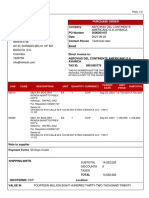

This refers to your letters dated December 21, 1981 and January 12,

1982 requesting that your joint venture partnership which is undertaking a

certain government construction project be exempted from the payment of

income tax; that you be allowed to order from your printers the printing of

official receipts, invoices and other business forms; and to register separate

books of accounts for the joint venture. cdta

Documentary evidence submitted show that Engineering Equipment,

Inc. (EEI) and F.F. Mañacop Construction Company, Inc. (FFMCCI), which are

corporations duly registered in accordance with the laws of the Republic of

the Philippines, entered into a contractual relationship whereby they will

undertake the construction of the Iloilo Fishing Port of the Ministry of Public

Works for and in consideration of an estimated price of P118,449,992.13;

that under this relationship, FFMCCI shall manage the implementation and

prosecution of the project as Project Principal; that EEI and FFMCCI shall

contribute equally to a common fund to prosecute the project; that the

parties shall participate equally in the profits, after deducting project

management fees; and that there is joint and several commitment,

responsibility and undertaking of the parties, as well as their right to collect

payment from the Government.

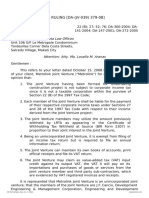

In reply thereto, I have the honor to inform you that under the

foregoing facts, a joint venture or consortium was formed for the purpose of

undertaking a construction project. Accordingly, the joint venture is exempt

from the corporate income tax pursuant to Section 20(b) of the Tax Code, as

amended by P.D. No. 1774. Such being the case, it is not required to file

quarterly and final or adjustment returns with respect to income earned from

the said project. However, the joint venture is subject to the payment of

business taxes, such as the fixed tax of P100.00 and 3% contractor's tax

prescribed by Sections 192(l) and 205 of the Tax Code, as amended.

Moreover, since all corporations, companies, partnerships or persons

required by law to pay internal revenue taxes, are required to keep books of

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

accounts pursuant to Section 321 of the Tax Code, as implemented by

Revenue Regulations No. V-1, otherwise known as the "Bookkeeping

Regulations", the joint venture is, therefore, required to register with this

office the joint venture's books of accounts, invoices and receipts serially

numbered in duplicate, showing among other things, its name or style and

business address, before starting its operation as a joint venture. This

registration and printing requirement, however, is within the jurisdiction of

the Regional Director of the region where the principal office of the joint

venture is located.

The above ruling is based on your representation and the same will be

revoked if, after investigation, it is ascertained that the facts are different

from those represented. cdasia

Very truly yours,

RUBEN B. ANCHETA

Acting Commissioner

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- In The Kitchen - BB Major - MN0259662Document8 pagesIn The Kitchen - BB Major - MN0259662lieke100% (2)

- Method Statement Installation of Duct BankDocument63 pagesMethod Statement Installation of Duct BankGerry Dwi Putra100% (2)

- BIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncDocument3 pagesBIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncKathleen Leynes100% (1)

- Bir Ruling No. 1243-18 - JvsDocument3 pagesBir Ruling No. 1243-18 - Jvsjohn allen MarillaNo ratings yet

- Complaint Daniel L Gelb Plaza I Inc Tom Petters BankruptcyDocument24 pagesComplaint Daniel L Gelb Plaza I Inc Tom Petters BankruptcyCamdenCanary100% (1)

- Negligence NotesDocument6 pagesNegligence Noteshouselanta75% (4)

- 2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdDocument3 pages2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdRen Mar CruzNo ratings yet

- Bir Ruling No. JV-187-21Document4 pagesBir Ruling No. JV-187-21Ren Mar CruzNo ratings yet

- 2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Document3 pages2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Boss NikNo ratings yet

- 2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubDocument3 pages2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubRen Mar CruzNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- 5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8wDocument2 pages5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8wCarlo AlfonsoNo ratings yet

- COCOSDE Legal Basis of Condominiums and Condominium Plan by LEE, Elixabeth S. (Leeleebeth)Document5 pagesCOCOSDE Legal Basis of Condominiums and Condominium Plan by LEE, Elixabeth S. (Leeleebeth)ELIXABETH LEENo ratings yet

- 1999 BIR - Ruling - DA 087 99 - 20210505 13 16oil1yDocument2 pages1999 BIR - Ruling - DA 087 99 - 20210505 13 16oil1yJM CBNo ratings yet

- 2008-BIR Ruling (DA - C-182 559-08)Document8 pages2008-BIR Ruling (DA - C-182 559-08)Jay MirandaNo ratings yet

- LB DST Deposit For Future Stock SubscriptionDocument3 pagesLB DST Deposit For Future Stock SubscriptionVence EugalcaNo ratings yet

- Mantto Prev. CavDocument9 pagesMantto Prev. CavKaren Daniela AnayaNo ratings yet

- BIR RulingDocument3 pagesBIR RulingyakyakxxNo ratings yet

- ITAD RULING NO. 009-03 Dated January 16, 2003Document4 pagesITAD RULING NO. 009-03 Dated January 16, 2003Kriszan ManiponNo ratings yet

- Bir Ruling Da JV 039 379 078Document5 pagesBir Ruling Da JV 039 379 078Alfred Hernandez CampañanoNo ratings yet

- Sample PMS Terms and ConditionsDocument12 pagesSample PMS Terms and ConditionsJosh Qc OngNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- LVM Const. v. F.T. SanchezDocument6 pagesLVM Const. v. F.T. SanchezJm BrjNo ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- Post Qua Report ARFF San JoseDocument5 pagesPost Qua Report ARFF San JoseKim Patrick VictoriaNo ratings yet

- Itad Bir Ruling No. 328-12: September 3, 2012 September 3, 2012Document3 pagesItad Bir Ruling No. 328-12: September 3, 2012 September 3, 2012nathalie velasquezNo ratings yet

- Civil Service Commission v. BerayDocument14 pagesCivil Service Commission v. Beraysharief abantasNo ratings yet

- G & W Architects, Engineers and Project Consultants Co. v. Commissioner of Internal Revenue, C.T.A. Case No. 8604, (August 16, 2016) PDFDocument20 pagesG & W Architects, Engineers and Project Consultants Co. v. Commissioner of Internal Revenue, C.T.A. Case No. 8604, (August 16, 2016) PDFKriszan ManiponNo ratings yet

- DOJ Opinion No. 135 S. 1987Document2 pagesDOJ Opinion No. 135 S. 1987Dione Klarisse GuevaraNo ratings yet

- Philex Mining Corporation v. CIR, 551 SCRA 428, 16 April 2008Document11 pagesPhilex Mining Corporation v. CIR, 551 SCRA 428, 16 April 2008RPSA CPANo ratings yet

- DMCIHI - 021 Declaration of Cash Dividends - Final - April 4Document13 pagesDMCIHI - 021 Declaration of Cash Dividends - Final - April 4counsellorsNo ratings yet

- 037-16 Bir Ruling 191086-2016-BIR - RULING - NO. - 037-16Document3 pages037-16 Bir Ruling 191086-2016-BIR - RULING - NO. - 037-16KC AtinonNo ratings yet

- Da 404 05Document4 pagesDa 404 05fatmaaleahNo ratings yet

- For The Year 2021 Non-Stock Corporation: Alternate Mobile NumberDocument6 pagesFor The Year 2021 Non-Stock Corporation: Alternate Mobile NumberJon Carlo CastronuevoNo ratings yet

- 8 Medina Vs City of Baguio 1952Document3 pages8 Medina Vs City of Baguio 1952SDN HelplineNo ratings yet

- BIR Ruling ECCP 068-08Document4 pagesBIR Ruling ECCP 068-08Kendra Miranda LorinNo ratings yet

- Post Qua Report Tower San JoseDocument5 pagesPost Qua Report Tower San JoseKim Patrick VictoriaNo ratings yet

- Authorizing Resolution of IDA September 11, 2019 (PILOT Amendment) (Nut Brown Realty, LLC) (4841-0629-3667 3)Document5 pagesAuthorizing Resolution of IDA September 11, 2019 (PILOT Amendment) (Nut Brown Realty, LLC) (4841-0629-3667 3)Kelsey O'ConnorNo ratings yet

- BIR Ruling No 455-07Document7 pagesBIR Ruling No 455-07Peggy SalazarNo ratings yet

- 3-2021-51109 - Certificate of Registration (New Law New Rules) - B-2022-43740Document5 pages3-2021-51109 - Certificate of Registration (New Law New Rules) - B-2022-43740JimBeeNo ratings yet

- Bir Ruling Da 108 07Document9 pagesBir Ruling Da 108 07Ylmir_1989No ratings yet

- BIR - Ruling DA-263-00 (20 June 2000)Document2 pagesBIR - Ruling DA-263-00 (20 June 2000)josephine.t.ycongNo ratings yet

- First Balfour, Inc.-MRAIL, Inc. Joint VentureDocument4 pagesFirst Balfour, Inc.-MRAIL, Inc. Joint VentureVince Lupango (imistervince)No ratings yet

- Bir Ruling No. 812-18Document1 pageBir Ruling No. 812-18Godfrey TejadaNo ratings yet

- 2022 Taisei DMCI - Joint - Venture20220922 12 13fnp5dDocument4 pages2022 Taisei DMCI - Joint - Venture20220922 12 13fnp5dVince Lupango (imistervince)No ratings yet

- For The Year Ended December 31, 2021 With Comparative Figures For December 31, 2020Document8 pagesFor The Year Ended December 31, 2021 With Comparative Figures For December 31, 2020WenjunNo ratings yet

- BIR Ruling DA-143-06Document4 pagesBIR Ruling DA-143-06joefieNo ratings yet

- Lowe Ruling (BIR Ruling (DA - (C-283) 705-09)Document3 pagesLowe Ruling (BIR Ruling (DA - (C-283) 705-09)Kriszan ManiponNo ratings yet

- Dalisay v. SSSDocument23 pagesDalisay v. SSSCaryl EstradaNo ratings yet

- BIR Ruling No. 123-2018Document3 pagesBIR Ruling No. 123-2018AizaNo ratings yet

- Philex Mining Corp Vs CirDocument8 pagesPhilex Mining Corp Vs CirIrish Joi TapalesNo ratings yet

- Post Qua Report ARFF PlaridelDocument5 pagesPost Qua Report ARFF PlaridelKim Patrick VictoriaNo ratings yet

- BIR RULING (DA-203-06) : April 3, 2006Document2 pagesBIR RULING (DA-203-06) : April 3, 2006Richard100% (1)

- CHW Contract 2020Document12 pagesCHW Contract 2020Zkarea BashtaweNo ratings yet

- 038-16 Bir Ruling 191087-2016-Kyeryong - Construction - Industrial - Co. - Ltd.20190502-5466-1lm5il9Document4 pages038-16 Bir Ruling 191087-2016-Kyeryong - Construction - Industrial - Co. - Ltd.20190502-5466-1lm5il9KC AtinonNo ratings yet

- SEC Opinion (November 16, 1982) Atty. Leonen R. GutierrezDocument3 pagesSEC Opinion (November 16, 1982) Atty. Leonen R. GutierrezAlyssa Marie MartinezNo ratings yet

- Revenue Memorandum Circular No. 13-85: SubjectDocument4 pagesRevenue Memorandum Circular No. 13-85: SubjectAemie JordanNo ratings yet

- BIR Ruling (DA-455-07) August 17, 2007Document11 pagesBIR Ruling (DA-455-07) August 17, 2007Raiya AngelaNo ratings yet

- RMC 55-2010Document0 pagesRMC 55-2010Peggy SalazarNo ratings yet

- Third Division: DecisionDocument15 pagesThird Division: DecisionApril IsidroNo ratings yet

- 01 Jul 2023 - 03 Jul 2026 (AAAA)Document2 pages01 Jul 2023 - 03 Jul 2026 (AAAA)kriforbizNo ratings yet

- Guaranty CasesDocument148 pagesGuaranty CasesJoanne LontokNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- SPA Sample Pre-TrialDocument2 pagesSPA Sample Pre-TrialAlfred Hernandez CampañanoNo ratings yet

- Authorization Letter IBP MakatiDocument1 pageAuthorization Letter IBP MakatiAlfred Hernandez CampañanoNo ratings yet

- Certification NotaryDocument1 pageCertification NotaryAlfred Hernandez CampañanoNo ratings yet

- Affidavit of Loss - AhcDocument1 pageAffidavit of Loss - AhcAlfred Hernandez CampañanoNo ratings yet

- AR Moi2Document1 pageAR Moi2Alfred Hernandez CampañanoNo ratings yet

- QuitclaimDocument2 pagesQuitclaimAlfred Hernandez CampañanoNo ratings yet

- Bir Ruling Da JV 039 379 078Document5 pagesBir Ruling Da JV 039 379 078Alfred Hernandez CampañanoNo ratings yet

- JCC Decision - Complaints Against Parker J - 11 June 2020 - FinalDocument17 pagesJCC Decision - Complaints Against Parker J - 11 June 2020 - Finaljillian100% (1)

- Module 4 - Part1Document10 pagesModule 4 - Part1Bea Mae AQUINONo ratings yet

- Bar Exam Tips and Secrets - Atty. MortelDocument4 pagesBar Exam Tips and Secrets - Atty. MortelKaren HaleyNo ratings yet

- Omnibus - TintinDocument1 pageOmnibus - TintinJules Arc CastronuevoNo ratings yet

- Futures Rep Motion by Takata Re Roger FrankelDocument13 pagesFutures Rep Motion by Takata Re Roger FrankelKirk HartleyNo ratings yet

- Fatca and Real Estate Infrastructure FundsDocument4 pagesFatca and Real Estate Infrastructure FundsJustine991No ratings yet

- Equitable Insurance vs. Transmodal InternationalDocument2 pagesEquitable Insurance vs. Transmodal InternationalJohn Mark RevillaNo ratings yet

- Bacsin v. WahimanDocument5 pagesBacsin v. WahimanChriscelle Ann PimentelNo ratings yet

- The Contradictions of LibertarianismDocument18 pagesThe Contradictions of LibertarianismLeandro Domiciano100% (1)

- 7.20.22 Jordan Grassley Letter To DOJDocument5 pages7.20.22 Jordan Grassley Letter To DOJFox News0% (1)

- OCRPfizer 1 RedactedDocument46 pagesOCRPfizer 1 RedactedJamie WhiteNo ratings yet

- Pinellas Deputy George Moffet Jr. Plea DUI To Reckless DrivingDocument2 pagesPinellas Deputy George Moffet Jr. Plea DUI To Reckless DrivingJames McLynasNo ratings yet

- Bates V Post Office Claimants' Appendix of AuthoritiesDocument93 pagesBates V Post Office Claimants' Appendix of AuthoritiesNick WallisNo ratings yet

- The Memoirs Elpidio QuirinoDocument137 pagesThe Memoirs Elpidio QuirinoAdrian Asi0% (1)

- Introduction To LawDocument13 pagesIntroduction To LawWISDOM-INGOODFAITHNo ratings yet

- Pesigan v. Angeles, 129 SCRA 174 (1984)Document4 pagesPesigan v. Angeles, 129 SCRA 174 (1984)Hann Faye BabaelNo ratings yet

- Republic of The Philippines, Petitioner, vs. Jennifer B. CAGANDAHAN, RespondentDocument78 pagesRepublic of The Philippines, Petitioner, vs. Jennifer B. CAGANDAHAN, RespondentCedrick Contado Susi BocoNo ratings yet

- Patnode Unlimited Stalking OrderDocument81 pagesPatnode Unlimited Stalking OrderWilliam N. GriggNo ratings yet

- UST Faculty Union v. BitonioDocument5 pagesUST Faculty Union v. BitonioEmir Mendoza100% (1)

- Cknowledgement: SOURAV AGARWAL, Research Assistant in Law, Indian Institute of Legal Studies, For HisDocument19 pagesCknowledgement: SOURAV AGARWAL, Research Assistant in Law, Indian Institute of Legal Studies, For HisArkaprava BhowmikNo ratings yet

- CTA EB Case No. 250 and 255Document25 pagesCTA EB Case No. 250 and 255trina tsai100% (1)

- Rongitsch V Diversified Adjustment Service Inc Civil Cover SheetDocument1 pageRongitsch V Diversified Adjustment Service Inc Civil Cover SheetghostgripNo ratings yet

- Heirs of Jose Lim Vs Juliet Villa Lim Case DigestDocument1 pageHeirs of Jose Lim Vs Juliet Villa Lim Case DigestNovi Mari NobleNo ratings yet

- Facts of The Case:: (G.R. No. 32329. March 23, 1929.) in Re Luis B. Tagorda Duran & Lim For RespondentDocument2 pagesFacts of The Case:: (G.R. No. 32329. March 23, 1929.) in Re Luis B. Tagorda Duran & Lim For RespondentCherry BepitelNo ratings yet

- PSA 53 - Information Note On Private InvestigatorsDocument2 pagesPSA 53 - Information Note On Private Investigatorssimon martin ryderNo ratings yet

- Position Paper Final DraftDocument13 pagesPosition Paper Final DraftAshley Kate Patalinjug100% (1)

- 13263-Article Text-56700-1-10-20150221Document12 pages13263-Article Text-56700-1-10-20150221Lazarus Kadett NdivayeleNo ratings yet