Professional Documents

Culture Documents

Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash Position

Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash Position

Uploaded by

Klabin_RICopyright:

Available Formats

You might also like

- FPSO Lease Rate CalculatorDocument1 pageFPSO Lease Rate Calculatoreduardo_ricaldi100% (4)

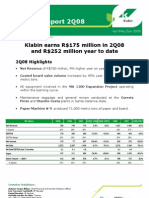

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateDocument15 pagesQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RINo ratings yet

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioDocument18 pagesQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RINo ratings yet

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginDocument18 pagesQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Document19 pagesQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Document19 pages4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RINo ratings yet

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Document16 pagesQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RINo ratings yet

- Quarterly Release: Start Up of Paper Machine # 9Document19 pagesQuarterly Release: Start Up of Paper Machine # 9Klabin_RINo ratings yet

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineDocument19 pages2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RINo ratings yet

- iKRelease2005 2qDocument16 pagesiKRelease2005 2qKlabin_RINo ratings yet

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocument19 pagesQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RINo ratings yet

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Document17 pagesQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RINo ratings yet

- 3q2009release BRGAAP InglesnaDocument24 pages3q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Release 3Q12Document17 pagesRelease 3Q12Klabin_RINo ratings yet

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Document18 pagesSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 366 Million Up To September 2004Document16 pagesKlabin Reports A Net Profit of R$ 366 Million Up To September 2004Klabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Document16 pagesQuarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Klabin_RINo ratings yet

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Document15 pagesCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RINo ratings yet

- 4q2009release BRGAAP InglesnaDocument22 pages4q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Anagement Eport: Initial ConsiderationsDocument8 pagesAnagement Eport: Initial ConsiderationsKlabin_RINo ratings yet

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- Release 2Q15Document17 pagesRelease 2Q15Klabin_RINo ratings yet

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsDocument10 pagesKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RINo ratings yet

- Klabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Document14 pagesKlabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Klabin_RINo ratings yet

- First Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Document10 pagesFirst Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Klabin_RINo ratings yet

- 1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Document18 pages1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Klabin_RINo ratings yet

- Klabin Webcast 20083 Q08Document9 pagesKlabin Webcast 20083 Q08Klabin_RINo ratings yet

- Release 1Q15Document17 pagesRelease 1Q15Klabin_RINo ratings yet

- Klabin Webcast 20092 Q09Document10 pagesKlabin Webcast 20092 Q09Klabin_RINo ratings yet

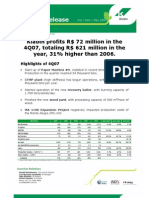

- Quarterly Release: Klabin Profits R$ 72 Million in The 4Q07, Totaling R$ 621 Million in The Year, 31% Higher Than 2006Document19 pagesQuarterly Release: Klabin Profits R$ 72 Million in The 4Q07, Totaling R$ 621 Million in The Year, 31% Higher Than 2006Klabin_RINo ratings yet

- Klabin Reduces Debt: April/June 2003Document16 pagesKlabin Reduces Debt: April/June 2003Klabin_RINo ratings yet

- iKRelease2005 1qDocument16 pagesiKRelease2005 1qKlabin_RINo ratings yet

- Cash Generation Grows by 12% in The Third Quarter: July/September 2001Document13 pagesCash Generation Grows by 12% in The Third Quarter: July/September 2001Klabin_RINo ratings yet

- Klabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Document15 pagesKlabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Klabin_RINo ratings yet

- Release 3Q13Document16 pagesRelease 3Q13Klabin_RINo ratings yet

- Release 3Q15Document17 pagesRelease 3Q15Klabin_RINo ratings yet

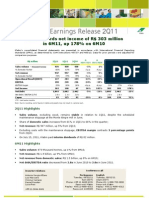

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Document20 pagesKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RINo ratings yet

- Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11Document20 pagesEarnings Release 3Q11: EBITDA of R$277 Million in 3Q11Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument9 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- Schlumberger Announces Third-Quarter 2018 ResultsDocument12 pagesSchlumberger Announces Third-Quarter 2018 ResultsYves-donald MakoumbouNo ratings yet

- Cash Generation Exceeds R$ 181 Million: January/March 2002Document10 pagesCash Generation Exceeds R$ 181 Million: January/March 2002Klabin_RINo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Third Quarter of 2010Document14 pagesBM&FBOVESPA S.A. Announces Earnings For The Third Quarter of 2010BVMF_RINo ratings yet

- EBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Document18 pagesEBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Klabin_RINo ratings yet

- Earnings ReleaseDocument13 pagesEarnings ReleaseBVMF_RINo ratings yet

- Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseDocument17 pagesRelatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseKlabin_RINo ratings yet

- KPresentation2009 1Q IngDocument34 pagesKPresentation2009 1Q IngKlabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Document15 pagesKlabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Klabin_RINo ratings yet

- Mills 3Q12 ResultDocument14 pagesMills 3Q12 ResultMillsRINo ratings yet

- Mills 1Q16 ResultsDocument15 pagesMills 1Q16 ResultsMillsRINo ratings yet

- Ebitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Document17 pagesEbitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument10 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010Document15 pagesBM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010BVMF_RINo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Document15 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Release 4Q12Document18 pagesRelease 4Q12Klabin_RINo ratings yet

- 1Q10 ResultsDocument26 pages1Q10 ResultsFibriaRINo ratings yet

- Press Release 3T09 CAUDIT Eng Rev FinalDocument35 pagesPress Release 3T09 CAUDIT Eng Rev FinalLightRINo ratings yet

- Earnings ReleaseDocument7 pagesEarnings ReleaseBVMF_RINo ratings yet

- NIO Inc. Reports Unaudited Third Quarter 2018 Financial ResultsDocument11 pagesNIO Inc. Reports Unaudited Third Quarter 2018 Financial Resultsdaniel huangNo ratings yet

- Release 2Q16Document19 pagesRelease 2Q16Klabin_RINo ratings yet

- Outboard Motorboats World Summary: Market Sector Values & Financials by CountryFrom EverandOutboard Motorboats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument73 pagesDemonstra??es Financeiras em Padr?es InternacionaisKlabin_RINo ratings yet

- Release 2Q16Document19 pagesRelease 2Q16Klabin_RINo ratings yet

- Rating Klabin - SDocument1 pageRating Klabin - SKlabin_RINo ratings yet

- Shyamal Money & BankingDocument95 pagesShyamal Money & BankingSHYAMAL BANERJEENo ratings yet

- Chapter 1: The Meaning and Objectives of Managerial AccountingDocument12 pagesChapter 1: The Meaning and Objectives of Managerial AccountingNgan Tran Nguyen ThuyNo ratings yet

- Summary of Economic Survey 2022-23Document28 pagesSummary of Economic Survey 2022-23kidijNo ratings yet

- Acc411-Short Notes 2022Document22 pagesAcc411-Short Notes 2022darylNo ratings yet

- Audit and Assurance: Professional Level Examination Monday 5 December 2016 (2 Hours)Document8 pagesAudit and Assurance: Professional Level Examination Monday 5 December 2016 (2 Hours)JusefNo ratings yet

- Chapter 10Document44 pagesChapter 10Rifai RifaiNo ratings yet

- On Social Cost Benefit Analysis by Anup Kumar OjhaDocument15 pagesOn Social Cost Benefit Analysis by Anup Kumar Ojhaanupojha0% (1)

- Rich and Ppor Dad BookDocument1 pageRich and Ppor Dad BookŤŕī ŚhāñNo ratings yet

- Nota Maintenance of Share CapitaDocument8 pagesNota Maintenance of Share CapitaPraveena RaviNo ratings yet

- Md. Forhad Hossain NDocument2 pagesMd. Forhad Hossain Nmfh.manikNo ratings yet

- 3 MYOB Basic Qualificatio Test 3 Evira Jewellery A4Document5 pages3 MYOB Basic Qualificatio Test 3 Evira Jewellery A4Arsi HazzNo ratings yet

- Introduction To InvestmentDocument12 pagesIntroduction To Investmentyusnifarina100% (1)

- Hsslive-XI ACCOUNTING WITH AFS - ANSWERKEY - RAMESH VPDocument6 pagesHsslive-XI ACCOUNTING WITH AFS - ANSWERKEY - RAMESH VPrehankedhenNo ratings yet

- Issue 3 Pet. Banking CIA 3Document3 pagesIssue 3 Pet. Banking CIA 3NancyNo ratings yet

- Annual Report For FY 2018-2019 PDFDocument154 pagesAnnual Report For FY 2018-2019 PDFhukaNo ratings yet

- The Adaptive Markets Hypothesis: Market Efficiency From An Evolutionary PerspectiveDocument33 pagesThe Adaptive Markets Hypothesis: Market Efficiency From An Evolutionary PerspectiveMark JonhstonNo ratings yet

- About Us Investor Relations Media Circulars Holidays Regulations Contact UsDocument4 pagesAbout Us Investor Relations Media Circulars Holidays Regulations Contact UsSushobhan DasNo ratings yet

- Market Myths ExposedDocument33 pagesMarket Myths Exposedkthakker0100% (1)

- Unit 3 Budgetory Control UpgradedDocument18 pagesUnit 3 Budgetory Control UpgradedIrfan KhanNo ratings yet

- Which Type of Benchmarking Is The Company Using?Document20 pagesWhich Type of Benchmarking Is The Company Using?Aslam SiddiqNo ratings yet

- GAM-property Plant and EquipmentDocument83 pagesGAM-property Plant and EquipmentRobert CastilloNo ratings yet

- Sample Final Exam QuestionsDocument28 pagesSample Final Exam QuestionsHuyNo ratings yet

- How To Start Trading: The No-Bs GuideDocument42 pagesHow To Start Trading: The No-Bs GuideAli Naqvi100% (1)

- ACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityDocument4 pagesACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Prospectus Msinvf EnluDocument238 pagesProspectus Msinvf EnluDesaulus swtorNo ratings yet

- VWAP March 31st CleanDocument7 pagesVWAP March 31st CleanZerohedge100% (2)

- Case Study FI enDocument37 pagesCase Study FI enMohini GiriNo ratings yet

- Epa 05Document6 pagesEpa 05nripeshtrivediNo ratings yet

- Keller Ground Engineering India Private Limited Profile ReportDocument14 pagesKeller Ground Engineering India Private Limited Profile ReportVetriselvan ArumugamNo ratings yet

Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash Position

Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash Position

Uploaded by

Klabin_RIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash Position

Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash Position

Uploaded by

Klabin_RICopyright:

Available Formats

Quarterly Report 3Q08

Jul/Aug/Sep 2008

Visit our website: www.klabin.com.br

Klabin concludes MA 1100 Expansion Project with a solid cash position

3Q08 Highlights

Paper and packaging sales volume rose to 388 thousand and 1,186 thousand metric tons in the third quarter (3Q08) and in the year through September (9M08), respectively, up 8% year on year in both periods; Coated board export volume reached 58 thousand metric tons in the quarter and 158 thousand in 9M08, up 97% versus the same period a year ago; Net revenue was R$ 770 million in 3Q08 and R$ 2,291 million in 9M08, representing year-on-year increases of 7% and 8%, respectively; Cash and cash equivalents totaled R$ 2.1 billion in the year to September; Debt profile over next 15 months total R$ 492 million.

R$ million Net Revenue

% Exports

3Q08 770

23%

2Q08 780

24%

3Q07 723

24%

9M08 2.291

25%

9M07 2.128

26%

3Q08/ 2Q08 3Q08/ 3Q07 9M08/9M07 -1,3% 6,6% 7,7%

EBITDA

EBITDA Margin

155

20%

179

23%

200

28%

539

24%

603

28%

-13,7%

-22,7%

-10,7%

Net Income

Net Debt Net Debt/EBTIDA (last 12 months) Capex

-253 2.771 4,1 129 388

36%

175 2.272 3,1 147 412

37%

178 1.755 2,2 417 360

37%

-1 2.771 4,1 486 1.186

38%

550 1.755 2,2 1.449 1.097

38%

-244,7% 22,0%

-242,5% 57,9%

-100,2% 57,9%

-12,3% -5,9%

-69,1% 7,7%

-66,4% 8,2%

Sales Volume - 1,000 t

% Exports

Investor Relations

Antonio Sergio Alfano, CFO and IR Director Luiz Marciano Candalaft, IR Manager Vinicius Campos, IR Analyst Daniel Rosolen, IR Analyst Phone: +55 (11) 3046-8404/8416/8415 invest@klabin.com.br

3Q08 Results October 16th, 2008

Operating and Financial Performance

Production

Paper and coated board production reached 417 thousand metric tons in 3Q08, up 11% on 3Q07 and stable in relation to 2Q08. The annual maintenance stoppage to inspect equipment at the Monte Alegre plant in Paran state was carried out in late July and early August, with associated costs remaining within projections. Production year to date was 1,274 thousand metric tons, an increase of 9% in relation to the same nine-month period in 2007.

Sales Volume

Sales volume excluding wood totaled 388 thousand metric tons in the quarter, 8% higher year on year, and 1,186 thousand metric tons in 9M08, up also 8% against the same period last year. Export sales volume came to 141 thousand metric tons in the quarter, up 5% on 3Q07, and totaled 454 thousand metric tons year to date, up 8% over 9M07. Sales volume in the domestic market was 247 thousand metric tons in 3Q08, up 9% in relation to 3Q07, and totaled 732 thousand metric tons through September, 9% higher than in the same period last year. Coated board sales volume represented 34% of total sales, compared to 25% in 3Q07. Sales Volume by Market

thousand metric tons

1,186 1,097

Sales Volume by Product Year to Date

Others Industrial 2% Bags 8% Kraftliner 29%

38% 38%

Corrugated Boxes 29%

388

412

360

62%

36% 64%

37% 63%

62%

37% 63%

3Q08

2Q08

3Q07

9M08

9M07

does not include wood

Coated Boards 32%

Domestic Market

Foreign Market

Total

Net Revenue

Net revenue including wood came to R$ 770 million in 3Q08, growing by 7% year on year, and was R$ 2,291 million year to date, 8% higher year on year. Net revenue from board sales represented 30% of total net revenue in the quarter, versus 24% in 3Q07 and 30% year to date.

3Q08 Results October 16th, 2008

Net Revenue by Market

R$ million

2.291 2.128

Net Revenue by Product Year to Date

Others 2% Industrial Bags 13%

Wood 7%

Kraftliner 17%

25% 26%

770

780

723

75%

74%

Corrugated Boxes 31% Coated Boards 29%

23% 77%

24% 76%

24% 76%

2Q08

1Q08 Domestic Market

2Q07

1H08 Foreign Market

1H07

includes wood

Export Destinations

Volume Year to Date

North A merica 4%

Net Revenue Year to Date

No rth A merica A frica 5% 4%

A frica 5%

A sia 24%

Latin A merica 41 %

A sia 25%

Latin A merica 43%

Euro pe 26%

Euro pe 23%

Operating Income

Cost of goods sold totaled R$ 588 million in the quarter, up 22% year on year and 1% quarter on quarter, due to the year-on-year increase in sales volume, the change in sales mix, higher input prices (fuel oil, chemical products and natural gas), the depreciation of equipment for the MA 1100 Project and costs with the maintenance stoppage at the Monte Alegre plant. COGS year to date was R$ 1.7 billion, up 23% in relation to 9M07. Selling expenses were R$ 74 million in 3Q08, increasing by 12% year on year and 7% quarter on quarter, due to the variation in sales volume. Selling expenses year to date were R$ 227 million, 13% higher than in 9M07, due to the increase in sales volume. Freight costs were R$ 144 million, represented 63% of total selling expenses.

3Q08 Results October 16th, 2008

General and administrative expenses totaled R$ 54 million in 3Q08, 30% higher year on year and 22% higher quarter on quarter. Part of the increase in expenses is due to the nonrecurring expenses with rescinding contracts with officers, the inauguration of the Monte Alegre plant and legal expenses. General and administrative expenses year to date totaled R$ 139 million, 6% higher than in 9M07. Net other operating revenue (expenses) was negative R$ 6 million in 3Q08, owing to nonrecurring expenses. Operating income before the financial result (EBIT) reached R$ 49 million in 3Q08, 65% and 34% lower than in 3Q07 and 2Q08, respectively, also reflecting the higher depreciation from the MA 1100 Project. Operating cash flow (EBITDA) was R$ 155 million in 3Q08, with EBITDA margin of 20%.

EBITDA and EBITDA Margin 29% 25% 24% 26% 29% 28% 28% 21% 186 184 203 200 200 138 205 179 155 28% 23% 20%

169

170

1Q06

2Q06

3Q06

4Q06

1Q07

2Q07

3Q07

4Q07

1Q08

2Q08

3Q08

EBITDA - R$ Million

EBITDA Margin

Financial result and indebtedness

Klabins gross debt stood at R$ 4,901 million at the close of September 2008, R$ 2,457 million (50%) of which denominated in foreign currency, equivalent to US$1,283 million. The appreciation in the U.S. dollar of 20% in 3Q08 (rate at end of period) generated a net foreign exchange loss with no cash effect of R$ 381 million, impacting net income in the quarter. The Brazilian Development Bank (BNDES) disbursed R$ 279 million for the MA 1100 Expansion Project year to date, bringing the total amount disbursed since the start of the project to R$ 1,681 million. The total amount to be financed under the project is R$ 1,744 million. Gross debt increased by R$ 536 million quarter on quarter, from R$ 4,365 million on June 30, 2008 to R$ 4,901 million on September 30, 2008. The increase is chiefly due to the appreciation in the U.S. dollar and the contracting of a loan for the prepayment of exports in the amount of R$ 30 million. Short-term debt accounted for 6% of total debt. The average debt term is 51 months, or 44 months for local-currency debt and 57 months for foreign-denominated debt. In view of this comfortable debt profile, the impact of foreign exchange variation on the balance sheet will be preceded by an increase in operating cash flow.

3Q08 Results October 16th, 2008

The Company maintains financial strategy focused on the maintenance of a strong cash position and long-term debt. At the close of September, cash and cash equivalents totaled R$ 2.1 billion.

Debt (R$ million) Local Currency Foreign Currency Short Term % Short Term Local Currency Foreign Currency Long Term % Long Term Total Local Currency % Local Currency Total Foreign Currency % Foreign Currency Gross Debt Cash and Cash Equivalents Net Debt 06/30/08 148.4 57.5 205.9 5% 2,216.9 1,942.1 4,159.0 95% 2,365.3 54% 1,999.6 46% 4,364.9 2,093.2 2,271.7 09/30/08 222.5 76.2 298.7 6% 2,220.5 2,381.5 4,602.0 94% 2,443.0 50% 2,457.7 50% 4,900.7 2,129.6 2,771.1

Net debt stood at R$ 2.8 billion on September 30, 2008.

Exports and trade finance operations

The following chart shows the low exposure level of the companys exports to trade finance operations. Over the next 15 months, this exposure will account for only 18% of exports in terms of value. Based on the depreciation of the Brazilian real of R$ 0.32/US$ in the third quarter, additional export revenue projected should total R$ 201 million, compared with an increase in loan maturities of R$ 14 million.

US$ MM 600 510

500 400 300 200

550

550

550

550

550

550

550

550

550

550

550

118

100 0

Oct / 2009 Dec 08 Exports Pre payment Export credit note Exposure 113 5 0 4% 404 18 88 21% 2010 388 67 95 29% 2011 376 153 22 32% 2012 308 216 27 44% 2013 238 273 39 57% 2014 366 146 38 33% 2015 469 43 38 15% 2016 476 0 74 13% 2017 550 0 0 0% 2018 550 0 0 0% 2019 524 0 26 5% 2020 499 0 51 9%

3Q08 Results October 16th, 2008

Net Income

The company posted a net loss of R$ 253 million in 3Q08, mainly due to the appreciation in the U.S. dollar, which generated net financial expenses of R$ 447 million. Year to date, the net loss was R$ 1 million.

Business Performance

BUSINESS UNIT - FORESTRY

Klabin handled 2.1 million metric tons of pine and eucalyptus logs, woodchips and waste for energy generation in 3Q08, an increase of 18% year on year and stable in relation to 2Q08. Of this total, R$ 1.5 million metric tons were transferred to plants in the states of Paran, Santa Catarina and So Paulo. The volume of log sales to sawmills and planer mills totaled 622 thousand metric tons in the quarter, down 7% year on year and stable compared to 2Q08. Net revenue from log sales to third parties in 3Q08 was R$ 53 million, down 14% year on year and 1% quarter on quarter. Klabins customers have managed to reduce their dependence on the U.S. market, increasing sales to Europe and the domestic market. However, the contraction in the U.S. homebuilding market continues to have an adverse affect on wood sales to third parties. In August, new-home starts in the United States fell to a seasonally adjusted annual rate of 865 thousand units, declining by 9% against August 2007 and by 35% against July 2008. At the end of September, the planted area totaled 220 thousand hectares, of which 156 thousand hectares were planted with pine and araucaria and 64 thousand hectares with eucalyptus, in addition to 186 thousand hectares of permanent preservation and legal reserve areas. To support the current expansion in capacity as well as future capacity expansions, the companies continues to invest in increasing its own forest area and through partnerships, leasing agreements and development programs. The forestry unit is preparing for an additional 1.5 million metric tons of fiber per year.

BUSINESS UNIT - PAPER

The volume of paper and coated board sales to third parties was 233 thousand metric tons in 3Q08, growing by 14% year on year and declining by 7% quarter on quarter. Year-todate these sales totaled 718 thousand metric tons, up 15% over the same period last year. Net revenue from paper and coated board was R$ 352 million in 3Q08, up 16% year on year and down 4% quarter on quarter. Paper and board net revenue year to date was R$ 1,061 million, 13% higher than in 9M07. Paper and board export volumes came to 132 thousand metric tons in the quarter, up 8% on 3Q07 and down 6% quarter on quarter, while these exports year to date were 421 thousand metric tons, 9% higher than in 9M07. Exports accounted for 57% of the units total sales volume in 3Q08. Kraftliner Kraftliner sales volume was 99 thousand metric tons in 3Q08, declining by 12% year on year and by 15% quarter on quarter. Kraftliner sales volume year to date was 338 thousand metric tons, down 5% in relation to the same nine-month period a year earlier. Kraftliner

3Q08 Results October 16th, 2008

export sales were 74 thousand metric tons in the quarter, accounting for 74% of total sales of this product. Kraftliner domestic sales rose to 26 thousand metric tons in the quarter, 55% higher than in 3Q07 and 15% lower against 2Q08, and to 75 thousand metric tons year to date, up 56% over 9M07. Net revenue from kraftliner sales was R$ 117 million in 3Q08, representing declines of 8% year on year and quarter on quarter, and R$ 379,000 million year to date, down 7% on 9M07. The Company diversified its sales mix, increased the volume of sales to Latin America and substantially increased the volume of sales to the domestic market.

US$ 900 800 700 600 500 400 300 200

Kraftliner Prices x Currency

6% 720 539 602 763

R$/US$ 4,0 3,5 3,0 2,5

2.43

2.18 1.95

1.69

2,0 1,5

1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08

Average Price (US$) Average FX Rate (R$/US$)

Source: FOEX - Kraftliner brown 175 g/m2 - PIX PACKAGING EUROPE Benchmark Indexes

Coated Board The volume of coated board sales in 3Q08 was 133 thousand metric tons, growing by 48% year on year and declining by 1% quarter on quarter, and 380 thousand metric tons year to date, up 41% on 9M07. Net revenue from coated board came to R$ 235 million in the quarter, 33% higher year on year and down 1% quarter on quarter, and to R$ 682 million year to date, 29% more than in the same nine-month period last year. Coated board exports were 58,000 metric tons in 3Q08, growing by 130% year on year and 9% quarter on quarter, and year to date these exports were 158 thousand metric tons, 97% higher year on year. According to the Brazilian Association of Pulp and Paper Producers (Bracelpa), Brazilian demand for coated board, as measured by domestic shipment volumes, grew by 3% year on year and by 7% quarter on quarter. Year to date, domestic demand for this product was 4% higher year on year. Klabins share of the Brazilian coated board market expanded to 18% in the year to September, compared with 13% in the same nine-month period of 2007. In Europe, the strategy for prices is to follow the market, with principal clients served by our commercial office in Europe. In the U.S. market, the depreciation of Brazilian real has helped to rebuild margins.

3Q08 Results October 16th, 2008

In the domestic market, the company is sustaining growth and expanding its market share, boosting domestic sales with products targeting markets new to the company.

BUSINESS UNIT CORRUGATED BOARD

Preliminary data from the Brazilian Corrugated Board Association (ABPO) indicate that shipments of corrugated boxes and sheets increased by 5% in 3Q08 (26 thousand metric tons) compared to the same period last year and remained stable quarter on quarter. Year to date, shipments grew 1% (24 thousand metric tons) and remained unchanged in relation to the same period last year. Klabins shipments in the quarter totaled 112 thousand metric tons, falling 3% year on year and 8% quarter on quarter. In 9M08, this figure totaled 340 thousand metric tons, down 3% on 9M07. Klabin holds 20% market share in this segment.

Brazilian shipments of corrugated boxes - thousand tons 553 470 555 559 551 565 591

3Q02

Source: ABPO

3Q03

3Q04

3Q05

3Q06

3Q07

3Q08

Corrugated boxes net revenue came to R$ 244 million in the quarter, 1% lower year on year and 2% lower quarter on quarter. This net revenue year to date was R$ 717 million, 6% more than in 9M07. Prices increased 5.6% in the quarter and 9.0% year to date. The lower availability of credit and the recent increase in the exchange rate may boost the demand for local non-durable goods, strengthening the demand for corrugated boxes in subsequent months. The company is rebuilding margins by implementing price increases.

BUSINESS UNIT - INDUSTRIAL BAGS

The volume of industrial bags at the plants in Brazil and Argentina totaled 32 thousand metric tons in 3Q08, down 2% year on year and stable quarter on quarter. Year to date, industrial bags sales volume totaled 98 thousand metric tons, 3% higher year on year. Industrial bags net revenue was R$ 106 million in 3Q08 and R$ 309 million year to date, growing by 6% in relation to both 3Q07 and 9M07. In 3Q08, industrial bags sales moved up by 8% and 7% compared to 3Q07 and 2Q08, respectively.

3Q08 Results October 16th, 2008

According to the National Cement Manufacturers Trade Union, cement consumption in the first eight months of 2008 was 15% higher year over year.

National Consumption of Cement

Million tonnes

5,0

4,0

3,0

2,0 jan feb mar apr may jun jul aug sep oct nov dec

2006

Source: National Cement Industy Association (SNIC)

2007

2008

Capital Markets

At September 30th, 2008 Preferred Shares Share Price (KLBN4) Book Value Average Daily Trading Volume 3Q08 Market Capitalization 600.9 million R$ 3.96 R$ 2.86 R$ 9.3 million R$ 3.6 billion

The following chart shows the performance of Klabins preferred stock and the benchmark Ibovespa index:

KLBN4 x IBOVESPA

Inception 28/12/07 = 100 120 110 100 90 80 70 60 50

28/12/07 28/01/08 28/02/08 28/03/08 28/04/08 28/05/08 28/06/08 28/07/08 28/08/08 28/09/08

-22,5%

-40,1%

KLBN4

IBOVESPA

3Q08 Results October 16th, 2008

In 3Q08, Klabin preferred stock (KLBN4) registered a nominal decline of 33.9%, while the Ibovespa fell 23.8%. The company's shares were traded in all trading sessions on the BOVESPA in the quarter, registering 71,825 transactions involving 123.7 million shares, for average daily trading volume of R$ 9.3 million, down 16.7% from the R$ 11.7 million registered in 3Q07 Klabin preferred stock was traded on the Bovespa at the average price of R$ 4.92 per share in the quarter, down from the average price of R$ 6.49 per share in 2Q08 Klabin stock also trades on the U.S. market as Level I ADRs, listed on the over-the-counter under the ticker KLBAY. Klabins share capital is represented by 917.7 million shares, of which 316.8 million are common shares and 600.9 million are preferred shares. On September 30, the Company held 15.0 million preferred shares in treasury.

Stock buyback program

The extraordinary meeting of the Board of Directors held on October 10, 2008 authorized a Stock Buyback Program involving up to 46.2 million shares issued by the company. The program is valid for 365 days, i.e. until October 13, 2008.

Dividends

As of October 1, 2008, Klabins shareholders received interim dividends based on the results of the balance sheet at the close of June 2008 in the amount of R$ 117 million, equivalent to R$ 121.71 per thousand common shares and R$ 133.88 per thousand preferred shares.

Capex

The main capex made in the quarter are listed below:

R$ Million Forestry Paper mills Conversion Total

3Q08 66 50 13 129

2Q08 61 76 9 147

9M08 193 263 31 486

On September 15, the inauguration of the MA 1100 Project was attended by Mr. Miguel Jorge, the Minister of Development, Industry and Trade, Mr. Roberto Requio, Governor of Paran, as well as other authorities, members of the board, the executive officers and the employees of the unit. All equipment involved in the MA 1100 Expansion Project was delivered and is already operational.

10

3Q08 Results October 16th, 2008

Outlook

Klabin plans to continue its long-term strategy for the board, paper and packaging businesses. However, in view of the current scenario of limited credit and high interest rates caused by the turbulence in world financial markets, the company will work to preserve its working capital, debt profile and cash position. Envisaging future investments, we continue to expand our forest areas by drawing on own and third-party funds.

Conference Call

Friday, October 17th, 2008 at 10:00 a.m. (Brazil). Password: Klabin Telephone: +55 (11) 4688-6301 Replay: +55 (11) 46886312 Password: 993

Conference Call

Friday, October 17 th, 2008 at 10:00 a.m. (U.S. ET) / 11:00 a.m. (Braslia) Password: Klabin Telephone: U.S. participants: +1 (888) 700-0802 International participants: +1 (786) 924-6977 Brazilian participants: +55 (11) 4688-6301 Replay: +55 (11) 46886312 Password: 191

Webcast

An audio webcast of the conference call is also available over the internet. Access: www.ccall.com.br/klabin

With gross revenue of R$ 3.4 billion in 2007, Klabin is the largest integrated manufacturer of packaging paper in Brazil, with annual production capacity of 2.0 million metric tons. The Company has adopted a strategic focus in the following businesses: paper and coated board for packaging, corrugated box, industrial sacks and wood. Klabin is the leader in all markets in which it operates.

The statements made in this earnings release concerning the Company's business prospects, projected operating and financial results and potential growth are merely projections and were based on Managements expectations of the Companys future. These expectations are highly susceptible to changes in the market, in the state of the Brazilian economy, in the industry and in international markets, and therefore are subject to change.

11

3Q08 Results October 16th, 2008

Attachment 1 Consolidated Income Statement Brazilian Corporate Law (Thousands of R$)

3Q08 Gross Revenue Net Revenue Cost of Products Sold Gross Profit Selling Expenses General & Administrative Expenses Other Revenues (Expenses) Total Operating Expenses Operating Income (before Fin. Results) Equity in net income (loss) of subsidiaries Financial Expenses Financial Revenues Net Foreign Exchange Losses Net Financial Revenues Operating Income Non Operating Revenues (Expenses) Net Income before Taxes Income Tax and Soc. Contrib. Minority Interest Net Income Depreciation/Amortization/Exhaustion EBITDA 926.747 770.201 (587.910) 182.291 (73.584) (53.790) (5.809) (133.183) 49.108 (178) (126.613) 60.585 (381.061) (447.089) (398.159) 724 (397.435) 146.702 (2.409) (253.142) 105.520 154.628 2Q08 941.643 780.296 (582.324) 197.972 (79.462) (44.142) 569 (123.035) 74.937 (3) (77.411) 84.371 167.028 173.988 248.922 591 249.513 (72.167) (2.374) 174.972 104.206 179.143 3Q07 869.035 722.756 (481.913) 240.843 (65.731) (41.251) 4.711 (102.271) 138.572 (120) (47.445) 80.676 67.963 101.194 239.646 1.015 240.661 (59.511) (3.632) 177.518 61.557 200.129 9M08 2.754.796 2.290.851 (1.682.003) 608.848 (227.031) (138.741) (6.646) (372.418) 236.430 (238) (292.469) 203.442 (194.754) (283.781) (47.589) 1.496 (46.093) 53.259 (8.185) (1.019) 302.190 538.620 9M07 2.552.951 2.127.792 (1.372.736) 755.056 (200.036) (131.224) (2.983) (334.243) 420.813 (161) (151.714) 227.164 234.202 309.652 730.304 6.607 736.911 (176.780) (10.578) 549.553 182.495 603.308 100,0% 76,3% 23,7% 9,6% 7,0% 0,8% 17,3% 6,4% 0,0% 16,4% 7,9% 49,5% 58,0% 51,7% 0,1% 51,6% 19,0% 0,3% 32,9% 13,7% 20,1% 100,0% 74,6% 25,4% 10,2% 5,7% 0,1% 15,8% 9,6% 0,0% 9,9% 10,8% 21,4% 22,3% 31,9% 0,1% 32,0% 9,2% 0,3% 22,4% 13,4% 23,0% 100,0% 66,7% 33,3% 9,1% 5,7% 0,7% 14,2% 19,2% 0,0% 6,6% 11,2% 9,4% 14,0% 33,2% 0,1% 33,3% 8,2% 0,5% 24,6% 8,5% 27,7% 100,0% 73,4% 26,6% 9,9% 6,1% 0,3% 16,3% 10,3% 0,0% 12,8% 8,9% 8,5% 12,4% 2,1% 0,1% 2,0% 2,3% 0,4% 0,0% 13,2% 23,5% % of Net Revenue 3Q08 2Q08 3Q07 9M08

12

12

3Q08 Results October 16th, 2008

Attachment 2 Consolidated Balance Sheet Brazilian Corporate Law (Thousands of R$)

Assets Current Assets Cash and banks Short-term investments Receivables Inventories Recoverble taxes and contributions Other receivables 30/9/2008 3,416,776 60,630 2,068,922 504,715 398,429 335,998 48,082 31/12/2007 3,062,117 224,221 1,874,420 434,357 336,146 110,821 82,152 Liabilities and StockholdersEquity Current Liabilities Loans and financing Suppliers Income tax and social contribution Taxes payable Salaries and payroll charges Dividends to pay Other accounts payable Long-Term Liabilities Loans and financing Other accounts payable Minority Interests StockholdersEquity Capital Capital reserves Revaluation reserve Profit reserve Treasury stock Accumulated profits Total 30/9/2008 788,402 298,698 208,841 2,018 40,810 77,089 116,995 43,951 4,752,028 4,601,962 150,066 138,517 2,622,665 1,500,000 84,491 81,541 1,030,334 (73,701) 0 8,301,612 31/12/2007 926,984 243,309 373,463 31,125 42,483 69,350 120,002 47,252 4,009,442 3,862,226 147,216 128,365 2,741,299 1,500,000 84,574 83,117 1,147,309 (73,701) 0 7,806,090

Long-Term Receivables Deferred income tax and soc. Contrib. Taxes to compensate Judicial Deposits Other receivables

490,851 111,830 187,164 92,058 99,799

524,136 56,512 323,177 84,574 59,873

Permanent Assets Other investments Property, plant & equipment, net Deferred charges Total

4,393,985 48,547 4,085,086 260,352 8,301,612

4,219,837 66,870 3,991,690 161,277 7,806,090

13

13

3Q08 Results October 16th, 2008 3Q08 Results October 16th, 2008

Attachment 3 Loan Maturity Schedule September 30th, 2008

R$ Million Bndes Finame Others Local Currency Trade Finance Others Fixed Assets Foreign Currency Gross Debt

Local Currency Foreign Currency Gross Debt

4Q08 21.4 7.5 28.9 22.5 0.4 6.0 29.0 57.9

Average Cost 10.9 % p.y. 5.1 % p.y.

2009 175.7 202.0 377.8 37.6 1.8 16.8 56.1 433.9

2010 302.2 159.9 462.2 171.4 1.8 33.8 207.1 669.3

2011 302.2 16.7 318.9 272.0 1.8 53.2 327.0 645.9

2012 287.0 16.7 303.6 449.9 1.8 51.0 502.7 806.3

2013 261.5 17.9 279.4 490.4 1.5 75.3 567.3 846.7

2014 254.7 20.9 275.6 253.6 72.9 326.5 602.1

After 2015 331.2 65.5 396.7 80.8 361.2 442.0 838.7

Total 1,935.9 507.1 2,443.0 1,778.3 9.2 670.2 2,457.7 4,900.7

Average Tenor 44 months 57 months 51 months

R$ Million

847 806

839

669

646 602 442 503 327 327 567

207 434 56

462 378 58 29 29 4Q08 2009 2010 2011 2012 2013

Local Currency

397 319 304 279 276

2014

After 2015

Foreign Currency

14 14

3Q08 Results October 16th, 2008

Attachment 4 Consolidated Cash Flow Statement Brazilian Corporate Law (Thousands of R$)

Third Quarter 2008 2007 Cash Flow from operating activities Net Income Items not affecting cash and cash equivalents Depreciation, amortization and depletion Provision for loss on permanent assets Deferred income and social contribution Interest and exchange variation on loans and financing Payament of interest Equity and subsidiaries Exchange variation on foreign investments Minority interest Reserve for contingencies Others Decrease (increase) in assets Accounts receivable Inventories Recoverable taxes Prepaid expenses Other receivables Increase (decrease) in liabilities Suppliers Taxes and payable Deferred income and social contribution Salaries, vacation and payroll charges Other payables Net cash provided by operating activities (carry forward) Cash flow from investing activities Acquisition of fixed assets, net of recoverable taxes Increase in deferred assets Goodwill on acquisition of investments Sale of property, plant and equipment Judicial deposits Others Net cash provided by (used in) investing activities Cash from financing activities New loans and financing Amortization of financing Capital contribution to subsidiaries by minority shareholders Dividends paid Stock repurchase Others Net cash used in financing activities Increase (Decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (253,142) 0 105,520 4,156 (61,501) 528,848 (69,048) 178 (3,452) 2,409 (5,597) 0 0 (2,795) (30,379) (29,704) 10,626 (5,141) 0 (25,470) 1,350 (86,778) 9,587 (1,152) 88,515 (126,276) (2,582) 116 4,865 (3,977) 0 (127,854) 94,412 (18,477) 0 0 0 (273) 75,662 36,323 2,093,229 2,129,552 36,323 177,518 61,557 886 15,947 (60,459) (56,904) 120 2,231 3,632 448 0 0 (26,731) (19,212) (93,352) 4,557 (447) 0 (674) (3,702) 39,383 6,815 33,926 85,539 (396,369) (20,154) 3,357 741 0 (412,425) 475,635 (42,408) 2,078 (173,001) 36 262,340 (64,546) 2,196,711 2,132,165 (64,546) january to september 2008 2007 (1,019) 302,190 4,760 (55,161) 460,227 (214,400) 238 (1,437) 8,185 2,137 (6,229) (70,358) (62,115) (89,164) 11,248 (16,781) (164,236) (1,673) (30,247) 7,739 (8,226) 75,678 (406,424) (80,044) 6,264 (1,869) 6,043 (476,030) 727,959 (178,661) 2,292 (120,002) (325) 431,263 30,911 2,098,641 2,129,552 30,911 549,553 182,495 2,558 49,709 (155,412) (192,406) 161 2,540 10,578 3,246 (7,437) (61,663) (28,811) (266,655) 2,538 (32,685) 194,866 20,750 113,355 1,854 64,051 453,185 (1,338,924) (56,203) (54,139) 5,194 4,465 (1,439,607) 1,394,830 (233,141) 4,148 (283,007) (47,822) (6,602) 828,406 (158,016) 2,290,181 2,132,165 (158,016)

15

You might also like

- FPSO Lease Rate CalculatorDocument1 pageFPSO Lease Rate Calculatoreduardo_ricaldi100% (4)

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateDocument15 pagesQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RINo ratings yet

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioDocument18 pagesQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RINo ratings yet

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginDocument18 pagesQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Document19 pagesQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Document19 pages4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RINo ratings yet

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Document16 pagesQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RINo ratings yet

- Quarterly Release: Start Up of Paper Machine # 9Document19 pagesQuarterly Release: Start Up of Paper Machine # 9Klabin_RINo ratings yet

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineDocument19 pages2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RINo ratings yet

- iKRelease2005 2qDocument16 pagesiKRelease2005 2qKlabin_RINo ratings yet

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocument19 pagesQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RINo ratings yet

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Document17 pagesQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RINo ratings yet

- 3q2009release BRGAAP InglesnaDocument24 pages3q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Release 3Q12Document17 pagesRelease 3Q12Klabin_RINo ratings yet

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Document18 pagesSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 366 Million Up To September 2004Document16 pagesKlabin Reports A Net Profit of R$ 366 Million Up To September 2004Klabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Document16 pagesQuarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Klabin_RINo ratings yet

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Document15 pagesCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RINo ratings yet

- 4q2009release BRGAAP InglesnaDocument22 pages4q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Anagement Eport: Initial ConsiderationsDocument8 pagesAnagement Eport: Initial ConsiderationsKlabin_RINo ratings yet

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- Release 2Q15Document17 pagesRelease 2Q15Klabin_RINo ratings yet

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsDocument10 pagesKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RINo ratings yet

- Klabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Document14 pagesKlabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Klabin_RINo ratings yet

- First Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Document10 pagesFirst Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Klabin_RINo ratings yet

- 1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Document18 pages1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Klabin_RINo ratings yet

- Klabin Webcast 20083 Q08Document9 pagesKlabin Webcast 20083 Q08Klabin_RINo ratings yet

- Release 1Q15Document17 pagesRelease 1Q15Klabin_RINo ratings yet

- Klabin Webcast 20092 Q09Document10 pagesKlabin Webcast 20092 Q09Klabin_RINo ratings yet

- Quarterly Release: Klabin Profits R$ 72 Million in The 4Q07, Totaling R$ 621 Million in The Year, 31% Higher Than 2006Document19 pagesQuarterly Release: Klabin Profits R$ 72 Million in The 4Q07, Totaling R$ 621 Million in The Year, 31% Higher Than 2006Klabin_RINo ratings yet

- Klabin Reduces Debt: April/June 2003Document16 pagesKlabin Reduces Debt: April/June 2003Klabin_RINo ratings yet

- iKRelease2005 1qDocument16 pagesiKRelease2005 1qKlabin_RINo ratings yet

- Cash Generation Grows by 12% in The Third Quarter: July/September 2001Document13 pagesCash Generation Grows by 12% in The Third Quarter: July/September 2001Klabin_RINo ratings yet

- Klabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Document15 pagesKlabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Klabin_RINo ratings yet

- Release 3Q13Document16 pagesRelease 3Q13Klabin_RINo ratings yet

- Release 3Q15Document17 pagesRelease 3Q15Klabin_RINo ratings yet

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Document20 pagesKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RINo ratings yet

- Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11Document20 pagesEarnings Release 3Q11: EBITDA of R$277 Million in 3Q11Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument9 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- Schlumberger Announces Third-Quarter 2018 ResultsDocument12 pagesSchlumberger Announces Third-Quarter 2018 ResultsYves-donald MakoumbouNo ratings yet

- Cash Generation Exceeds R$ 181 Million: January/March 2002Document10 pagesCash Generation Exceeds R$ 181 Million: January/March 2002Klabin_RINo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Third Quarter of 2010Document14 pagesBM&FBOVESPA S.A. Announces Earnings For The Third Quarter of 2010BVMF_RINo ratings yet

- EBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Document18 pagesEBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Klabin_RINo ratings yet

- Earnings ReleaseDocument13 pagesEarnings ReleaseBVMF_RINo ratings yet

- Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseDocument17 pagesRelatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseKlabin_RINo ratings yet

- KPresentation2009 1Q IngDocument34 pagesKPresentation2009 1Q IngKlabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Document15 pagesKlabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Klabin_RINo ratings yet

- Mills 3Q12 ResultDocument14 pagesMills 3Q12 ResultMillsRINo ratings yet

- Mills 1Q16 ResultsDocument15 pagesMills 1Q16 ResultsMillsRINo ratings yet

- Ebitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Document17 pagesEbitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument10 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010Document15 pagesBM&FBOVESPA S.A. Announces Earnings For The Second Quarter of 2010BVMF_RINo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Document15 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Release 4Q12Document18 pagesRelease 4Q12Klabin_RINo ratings yet

- 1Q10 ResultsDocument26 pages1Q10 ResultsFibriaRINo ratings yet

- Press Release 3T09 CAUDIT Eng Rev FinalDocument35 pagesPress Release 3T09 CAUDIT Eng Rev FinalLightRINo ratings yet

- Earnings ReleaseDocument7 pagesEarnings ReleaseBVMF_RINo ratings yet

- NIO Inc. Reports Unaudited Third Quarter 2018 Financial ResultsDocument11 pagesNIO Inc. Reports Unaudited Third Quarter 2018 Financial Resultsdaniel huangNo ratings yet

- Release 2Q16Document19 pagesRelease 2Q16Klabin_RINo ratings yet

- Outboard Motorboats World Summary: Market Sector Values & Financials by CountryFrom EverandOutboard Motorboats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument73 pagesDemonstra??es Financeiras em Padr?es InternacionaisKlabin_RINo ratings yet

- Release 2Q16Document19 pagesRelease 2Q16Klabin_RINo ratings yet

- Rating Klabin - SDocument1 pageRating Klabin - SKlabin_RINo ratings yet

- Shyamal Money & BankingDocument95 pagesShyamal Money & BankingSHYAMAL BANERJEENo ratings yet

- Chapter 1: The Meaning and Objectives of Managerial AccountingDocument12 pagesChapter 1: The Meaning and Objectives of Managerial AccountingNgan Tran Nguyen ThuyNo ratings yet

- Summary of Economic Survey 2022-23Document28 pagesSummary of Economic Survey 2022-23kidijNo ratings yet

- Acc411-Short Notes 2022Document22 pagesAcc411-Short Notes 2022darylNo ratings yet

- Audit and Assurance: Professional Level Examination Monday 5 December 2016 (2 Hours)Document8 pagesAudit and Assurance: Professional Level Examination Monday 5 December 2016 (2 Hours)JusefNo ratings yet

- Chapter 10Document44 pagesChapter 10Rifai RifaiNo ratings yet

- On Social Cost Benefit Analysis by Anup Kumar OjhaDocument15 pagesOn Social Cost Benefit Analysis by Anup Kumar Ojhaanupojha0% (1)

- Rich and Ppor Dad BookDocument1 pageRich and Ppor Dad BookŤŕī ŚhāñNo ratings yet

- Nota Maintenance of Share CapitaDocument8 pagesNota Maintenance of Share CapitaPraveena RaviNo ratings yet

- Md. Forhad Hossain NDocument2 pagesMd. Forhad Hossain Nmfh.manikNo ratings yet

- 3 MYOB Basic Qualificatio Test 3 Evira Jewellery A4Document5 pages3 MYOB Basic Qualificatio Test 3 Evira Jewellery A4Arsi HazzNo ratings yet

- Introduction To InvestmentDocument12 pagesIntroduction To Investmentyusnifarina100% (1)

- Hsslive-XI ACCOUNTING WITH AFS - ANSWERKEY - RAMESH VPDocument6 pagesHsslive-XI ACCOUNTING WITH AFS - ANSWERKEY - RAMESH VPrehankedhenNo ratings yet

- Issue 3 Pet. Banking CIA 3Document3 pagesIssue 3 Pet. Banking CIA 3NancyNo ratings yet

- Annual Report For FY 2018-2019 PDFDocument154 pagesAnnual Report For FY 2018-2019 PDFhukaNo ratings yet

- The Adaptive Markets Hypothesis: Market Efficiency From An Evolutionary PerspectiveDocument33 pagesThe Adaptive Markets Hypothesis: Market Efficiency From An Evolutionary PerspectiveMark JonhstonNo ratings yet

- About Us Investor Relations Media Circulars Holidays Regulations Contact UsDocument4 pagesAbout Us Investor Relations Media Circulars Holidays Regulations Contact UsSushobhan DasNo ratings yet

- Market Myths ExposedDocument33 pagesMarket Myths Exposedkthakker0100% (1)

- Unit 3 Budgetory Control UpgradedDocument18 pagesUnit 3 Budgetory Control UpgradedIrfan KhanNo ratings yet

- Which Type of Benchmarking Is The Company Using?Document20 pagesWhich Type of Benchmarking Is The Company Using?Aslam SiddiqNo ratings yet

- GAM-property Plant and EquipmentDocument83 pagesGAM-property Plant and EquipmentRobert CastilloNo ratings yet

- Sample Final Exam QuestionsDocument28 pagesSample Final Exam QuestionsHuyNo ratings yet

- How To Start Trading: The No-Bs GuideDocument42 pagesHow To Start Trading: The No-Bs GuideAli Naqvi100% (1)

- ACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityDocument4 pagesACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Prospectus Msinvf EnluDocument238 pagesProspectus Msinvf EnluDesaulus swtorNo ratings yet

- VWAP March 31st CleanDocument7 pagesVWAP March 31st CleanZerohedge100% (2)

- Case Study FI enDocument37 pagesCase Study FI enMohini GiriNo ratings yet

- Epa 05Document6 pagesEpa 05nripeshtrivediNo ratings yet

- Keller Ground Engineering India Private Limited Profile ReportDocument14 pagesKeller Ground Engineering India Private Limited Profile ReportVetriselvan ArumugamNo ratings yet