Professional Documents

Culture Documents

Mba 3 Sem Investment Analysis and Portfolio Management Kmbnfm01 2022

Mba 3 Sem Investment Analysis and Portfolio Management Kmbnfm01 2022

Uploaded by

Nomaan TanveerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mba 3 Sem Investment Analysis and Portfolio Management Kmbnfm01 2022

Mba 3 Sem Investment Analysis and Portfolio Management Kmbnfm01 2022

Uploaded by

Nomaan TanveerCopyright:

Available Formats

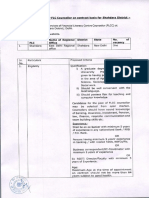

Printed Page: 1 of 2

Subject Code: KMBNFM01

0Roll No: 0 0 0 0 0 0 0 0 0 0 0 0 0

MBA

(SEM III) THEORY EXAMINATION 2021-22

Investment Analysis and Portfolio Management

Time: 3 Hours Total Marks: 100

Note: 1. Attempt all Sections. If require any missing data; then choose suitably.

SECTION A

1. Attempt all questions in brief. 2 x 10 = 20

Qno. Question Marks CO

a. Define the term Investment. 2 1

b. What are the objectives of Investment? 2 1

c. Explain interest rate risk. 2 2

d. What do you mean by Financial Risk? 2 2

e. Name Bullish Reversal chart Patterns. 2 3

f. What is the use of Relative strength index? 2 3

g. What is time value of money? 2 4

h. Explain discount rate. 2 4

i. What is Nifty 50? 2 5

1

j. What do you mean by NAV 2 5

32

22

_1

6.

SECTION B

1P

19

2. Attempt any three of the following:

2O

0.

23

Qno. Question Marks CO

P2

a. State and explain the characteristics of an investment. 10 1

3.

Q

b. What is meant by systematic risk? What are the sources of systematic 10 2

|4

risk?

05

c. Briefly discuss Capital Asset Pricing Model. 10 3

d. Explain holding period model of share valuation. 10 4

6:

e. What is a mutual fund? What are the various classifications of mutual 10 5

:3

fund.

13

2

SECTION C

02

3. Attempt any one part of the following:

n -2

Qno. Question Marks CO

Ja

a. What is a financial market? What is the difference between primary 10 1

5-

market and secondary market?

|0

b. What was the need to setup SEBI? Explain its organization. 10 1

4. Attempt any one part of the following:

Qno. Question Marks CO

a. What is the significance of economic forecasting in fundamental 10 2

analysis?

b. Explain the various factors than an industry must take into consideration 10 2

while doing industry analysis.

1 | P a g e

QP22O1P_132 | 05-Jan-2022 13:36:05 | 43.230.196.221

Printed Page: 2 of 2

Subject Code: KMBNFM01

0Roll No: 0 0 0 0 0 0 0 0 0 0 0 0 0

5. Attempt any one part of the following:

Qno. Question Marks CO

a. What is meant by technical analysis and discuss basic principles and 10 3

hypothesis of Daw Theory.

b. What is meant by arbitrage? Describe the APT model. 10 3

6. Attempt any one part of the following:

Qno. Question Marks CO

a. What is the value of the bond? Explain the concept. 10 4

b. Explain the use of P/E ratio in share valuation. 10 4

7. Attempt any one part of the following:

Qno. Question Marks CO

a. What is meant by portfolio evolution & discuss stages in portfolio 10 5

evaluation?

b. Why do portfolios need periodical revisions? What are the two portfolio 10 5

reversion strategies?

1

32

22

_1

6.

1P

19

2O

0.

23

P2

3.

Q

|4

05

6:

:3

13

2

02

n -2

Ja

5-

|0

2 | P a g e

QP22O1P_132 | 05-Jan-2022 13:36:05 | 43.230.196.221

You might also like

- Ferrari IPO CaseDocument13 pagesFerrari IPO CaseKelsey100% (4)

- Major Development Programs and Personalities in Science And-1Document27 pagesMajor Development Programs and Personalities in Science And-1Prince Sanji66% (128)

- 102 - Managerial-EconomicsDocument2 pages102 - Managerial-EconomicsAkash KashyapNo ratings yet

- Financial Accounting For Managers KMB103Document3 pagesFinancial Accounting For Managers KMB103ujjawalr9027No ratings yet

- Entrepreneurship Development KOE083Document2 pagesEntrepreneurship Development KOE083Ashish ChauhanNo ratings yet

- University Q Paper ARTIFICIAL-INTELLIGENCE-KME062Document2 pagesUniversity Q Paper ARTIFICIAL-INTELLIGENCE-KME062Prashant KashyapNo ratings yet

- Mba 3 Sem Supply Chain and Logistics Management Kmbnom01 2022Document1 pageMba 3 Sem Supply Chain and Logistics Management Kmbnom01 2022kapa123No ratings yet

- Mba 3 Sem International Business Management Kmb302 2020Document2 pagesMba 3 Sem International Business Management Kmb302 2020ShUbhAm sMaRtYNo ratings yet

- Project-Management-Entrepreneurship-Khu802 2021Document1 pageProject-Management-Entrepreneurship-Khu802 2021Shivam ThakurNo ratings yet

- Btech Me 5 Sem Industrial Engineering Kme503 2021Document2 pagesBtech Me 5 Sem Industrial Engineering Kme503 2021Wizard ToxicNo ratings yet

- KMBN 102 (PUT)Document3 pagesKMBN 102 (PUT)ashraf hussainNo ratings yet

- Time: 3 Hours Total Marks: 100: Q No. Marks CODocument2 pagesTime: 3 Hours Total Marks: 100: Q No. Marks COShan ShrNo ratings yet

- Mba 1 Sem Computer Application in Management Kmb108 2022Document2 pagesMba 1 Sem Computer Application in Management Kmb108 2022Mohd FaizanNo ratings yet

- Artificial Intelligence For Engineers KMC 101 PDFDocument1 pageArtificial Intelligence For Engineers KMC 101 PDFavinas_3marNo ratings yet

- Mba 3 Sem Supply Chain and Logistics Management Kmbom01 2020Document2 pagesMba 3 Sem Supply Chain and Logistics Management Kmbom01 2020Neha Sharma100% (1)

- Mba 3 Sem International Logistics Kmbib02 2020Document2 pagesMba 3 Sem International Logistics Kmbib02 2020tushaar B'ramaniNo ratings yet

- KVE401Document2 pagesKVE401Dilip RawatNo ratings yet

- 1st Assignment KMBN204Document1 page1st Assignment KMBN204Groot GamingNo ratings yet

- Btech Ec 7 Sem Vlsi Design Kec072 2022Document2 pagesBtech Ec 7 Sem Vlsi Design Kec072 2022Vishal KushwahaNo ratings yet

- Industrial Engineering Kme 503 1Document3 pagesIndustrial Engineering Kme 503 1ANKIT JHANo ratings yet

- Ma (KMBNMK02) 2021-22Document1 pageMa (KMBNMK02) 2021-22Kanika singhNo ratings yet

- Bioeconomics Koe072Document2 pagesBioeconomics Koe072xefedoy533No ratings yet

- Constitution of India Law and Engineering KNC 501Document1 pageConstitution of India Law and Engineering KNC 501ANKIT JHA100% (1)

- Eco Bba 1Document1 pageEco Bba 1Ashish DiwakarNo ratings yet

- Database Management System KCS 501Document2 pagesDatabase Management System KCS 501Sparsh SaxenaNo ratings yet

- R17-Eee-Cse-Mefa QP 2Document2 pagesR17-Eee-Cse-Mefa QP 2kisnamohanNo ratings yet

- Mba 4 Sem Project and Sourcing Management Kmbnom04 2022Document2 pagesMba 4 Sem Project and Sourcing Management Kmbnom04 2022Wasim QuraishiNo ratings yet

- Vlsi Technology Kec 053Document1 pageVlsi Technology Kec 053Anonymous eWMnRr70qNo ratings yet

- Bcom 3 Sem Financial Markets and Operations 22100580 Apr 2022Document2 pagesBcom 3 Sem Financial Markets and Operations 22100580 Apr 2022lightpekka2003No ratings yet

- BBA 1 Investment Analysis and Portfolio Managment Set 3Document2 pagesBBA 1 Investment Analysis and Portfolio Managment Set 3ayush singhNo ratings yet

- Mba 3 Sem Cloud Computing For Business Kmbit03 2020Document1 pageMba 3 Sem Cloud Computing For Business Kmbit03 2020tushaar B'ramaniNo ratings yet

- Mba 1 Sem Business Communication Kmls107 2021Document1 pageMba 1 Sem Business Communication Kmls107 2021Aman RoxxNo ratings yet

- Mba 3 Sem Data Analytics and Business Decisions Kmbnit01 2022Document1 pageMba 3 Sem Data Analytics and Business Decisions Kmbnit01 2022kapa123No ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoDocument3 pagesTime: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoHimanshuNo ratings yet

- Idea To Business Model Koe060Document1 pageIdea To Business Model Koe060viku9267No ratings yet

- Time: 3 Hours Total Marks: 100Document3 pagesTime: 3 Hours Total Marks: 100Huba ZehraNo ratings yet

- Bifs 1Document2 pagesBifs 1connectjawapkNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages: 02 Sub Code: KMB207 Paper Id: 270247 Roll NoDocument2 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 02 Sub Code: KMB207 Paper Id: 270247 Roll NoHimanshuNo ratings yet

- Software Project Management Koe068Document2 pagesSoftware Project Management Koe068ayush kushwahaNo ratings yet

- Strategic Management - KMB301Document2 pagesStrategic Management - KMB301Shubhendu shekhar pandeyNo ratings yet

- QP22O1P - 290: Time: 3 Hours Total Marks: 100Document4 pagesQP22O1P - 290: Time: 3 Hours Total Marks: 100Rahul Kumar SInhaNo ratings yet

- Model Paper With Solution Kmbn201Document25 pagesModel Paper With Solution Kmbn201DivyaNo ratings yet

- Mba 4 Sem Emerging Technology in Global Business Environment Kmba401 2022Document2 pagesMba 4 Sem Emerging Technology in Global Business Environment Kmba401 2022Shivani PalNo ratings yet

- Machine Learning Techniques Kcs 055Document2 pagesMachine Learning Techniques Kcs 055Ritesh TiwariNo ratings yet

- Time: 3 Hours Total Marks: 100 Note: 1. Attempt All Sections. If Require Any Missing DataDocument4 pagesTime: 3 Hours Total Marks: 100 Note: 1. Attempt All Sections. If Require Any Missing DataUjjwal SharmaNo ratings yet

- Investment Management VTU Question PapersDocument4 pagesInvestment Management VTU Question PapersVishnu PrasannaNo ratings yet

- Fundamentals of Mechanical Engineering Mechatronics-Kme-101tDocument1 pageFundamentals of Mechanical Engineering Mechatronics-Kme-101tTangent ChauhanNo ratings yet

- BC 22Document2 pagesBC 22Mayank Kumar JhaNo ratings yet

- Btech 8 Sem Cloud Computing Koe081 2022Document2 pagesBtech 8 Sem Cloud Computing Koe081 2022ali shanNo ratings yet

- Environmental Engineering Kce603Document2 pagesEnvironmental Engineering Kce603Abhinav MauryaNo ratings yet

- Computer Applications in Management - KMB108Document2 pagesComputer Applications in Management - KMB108dhruv.chaudhary0722No ratings yet

- Btech As 3 Sem Technical Communication Kas301 2021Document1 pageBtech As 3 Sem Technical Communication Kas301 2021Priyanshu SuryavanshiNo ratings yet

- Coi MergedDocument3 pagesCoi Mergedsakshamprem2003No ratings yet

- Coi Old Paper 20 21 1Document1 pageCoi Old Paper 20 21 1sahanikaran2205No ratings yet

- Computer Graphics Qut PaperDocument2 pagesComputer Graphics Qut PaperjyotirmaypatelNo ratings yet

- Exam 2022 AccountingDocument2 pagesExam 2022 AccountingEditz meniaNo ratings yet

- Pom 22Document1 pagePom 22userdumb709No ratings yet

- Mca 1 Sem Principles of Management and Communication Kca103 2022Document1 pageMca 1 Sem Principles of Management and Communication Kca103 2022kimog66911No ratings yet

- Mca 3 Sem Web Technology Kca021 2022Document2 pagesMca 3 Sem Web Technology Kca021 2022shivanibitmeerutNo ratings yet

- Bifs 2Document1 pageBifs 2connectjawapkNo ratings yet

- Bpharm 1 Sem Pharmaceutical Analysis 1 Theory bp102t 2022Document1 pageBpharm 1 Sem Pharmaceutical Analysis 1 Theory bp102t 2022ShivamNo ratings yet

- Currency Strategy: The Practitioner's Guide to Currency Investing, Hedging and ForecastingFrom EverandCurrency Strategy: The Practitioner's Guide to Currency Investing, Hedging and ForecastingNo ratings yet

- Bpharm 3 Sem Pharmaceutical Engineering Bp304t 2022Document1 pageBpharm 3 Sem Pharmaceutical Engineering Bp304t 2022Nomaan TanveerNo ratings yet

- Bpharm 3 Sem Pharmacognosy 2 rph305 2022Document1 pageBpharm 3 Sem Pharmacognosy 2 rph305 2022Nomaan TanveerNo ratings yet

- Mba 3 Sem International Business Management rmb302 2022Document1 pageMba 3 Sem International Business Management rmb302 2022Nomaan TanveerNo ratings yet

- Mba 3 Sem Consumer Behaviour and Marketing Communication kmbnmk01 2022Document2 pagesMba 3 Sem Consumer Behaviour and Marketing Communication kmbnmk01 2022Nomaan TanveerNo ratings yet

- Detailed AdvertisementDocument10 pagesDetailed AdvertisementNomaan TanveerNo ratings yet

- The Main Focus of The Lecture WasDocument1 pageThe Main Focus of The Lecture WasNomaan TanveerNo ratings yet

- NewDocument1 pageNewNomaan TanveerNo ratings yet

- It Skills LabDocument14 pagesIt Skills LabNomaan TanveerNo ratings yet

- Mba 3 Sem Strategic Management Kmba301 2022Document1 pageMba 3 Sem Strategic Management Kmba301 2022Nomaan TanveerNo ratings yet

- Abhishek Kumar Summer Training Project Report On Tata Motors - TOAZ - InfoDocument85 pagesAbhishek Kumar Summer Training Project Report On Tata Motors - TOAZ - InfoNomaan TanveerNo ratings yet

- Innovation of Neem Refresh Juice With Honey: Name: Anjali Mourya. Class: MBA 1Document10 pagesInnovation of Neem Refresh Juice With Honey: Name: Anjali Mourya. Class: MBA 1Nomaan TanveerNo ratings yet

- SBM ITB BrochureDocument28 pagesSBM ITB Brochuresubhan missuariNo ratings yet

- Employer Branding in Digital EraDocument2 pagesEmployer Branding in Digital Erarina hafiaNo ratings yet

- Adani Agri Logistics LTDDocument4 pagesAdani Agri Logistics LTDRajveersinh GohilNo ratings yet

- Simple Melitz Model PDFDocument14 pagesSimple Melitz Model PDFnazrulNo ratings yet

- Chapter 18 - Budgeting The Education PlanDocument2 pagesChapter 18 - Budgeting The Education PlanSheila May DomingoNo ratings yet

- KPMG - Indonesian TaxDocument13 pagesKPMG - Indonesian Taxbang bebetNo ratings yet

- Rezultate Financiare Preliminare: La 31 Decembrie 2022Document21 pagesRezultate Financiare Preliminare: La 31 Decembrie 2022teoxysNo ratings yet

- M&A - CH 29Document10 pagesM&A - CH 29Frizky PutraNo ratings yet

- 19b Shradhanjali Case Analysis2Document1 page19b Shradhanjali Case Analysis2Sudeep RujNo ratings yet

- Final Caiib MatDocument227 pagesFinal Caiib MatPrince VenkatNo ratings yet

- Sri Lankan Economy Contracted by 1.5 Percent - Census & Statistics Dept.Document4 pagesSri Lankan Economy Contracted by 1.5 Percent - Census & Statistics Dept.Ada DeranaNo ratings yet

- Tax Bulletin 54 PDFDocument68 pagesTax Bulletin 54 PDFABC 123No ratings yet

- Simplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDocument4 pagesSimplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDarwin Dionisio ClementeNo ratings yet

- End-Term Assessment Subject: Economics (GE-O) Marks: 30 Submission: 02/03/2022 Type of Submission: Short Film/Video InstructionsDocument2 pagesEnd-Term Assessment Subject: Economics (GE-O) Marks: 30 Submission: 02/03/2022 Type of Submission: Short Film/Video InstructionsTANISHA GOYALNo ratings yet

- Debate On The Developmental State: by Ethiopian ScholarsDocument70 pagesDebate On The Developmental State: by Ethiopian ScholarsYemane HayetNo ratings yet

- Dandot 2008 AnnualDocument39 pagesDandot 2008 AnnualMuhammad haseebNo ratings yet

- Presentation On State Bank of PakistanDocument61 pagesPresentation On State Bank of PakistanMuhammad WasifNo ratings yet

- Closing Stock - GSTDocument8 pagesClosing Stock - GSTpuran1234567890No ratings yet

- Group A FinalDocument2 pagesGroup A Finalapi-380281979No ratings yet

- Cicm Customer Experience ManagementDocument95 pagesCicm Customer Experience ManagementHillary MtandwaNo ratings yet

- Customer Behaviour in Ecommerce: Case Studies From The Online Grocery MarketDocument120 pagesCustomer Behaviour in Ecommerce: Case Studies From The Online Grocery Marketali sriNo ratings yet

- Lesson 1Document39 pagesLesson 1ncncNo ratings yet

- Answers To Textbook Problems: and Price PDocument3 pagesAnswers To Textbook Problems: and Price PThaliaNo ratings yet

- Analysis On Customer Service Department Activities Of: HBL, Itahari BranchDocument50 pagesAnalysis On Customer Service Department Activities Of: HBL, Itahari BranchSujan BajracharyaNo ratings yet

- Application of Industry 4.0 in The Procurement Processes of Supply Chains: A Systematic Literature ReviewDocument25 pagesApplication of Industry 4.0 in The Procurement Processes of Supply Chains: A Systematic Literature ReviewVitor PontesNo ratings yet

- Swot Analysis of Tata MotorsDocument2 pagesSwot Analysis of Tata MotorsVaibhav KediaNo ratings yet

- Important Notes of Company Law For CS Executive - Dec, 2012 ExamDocument16 pagesImportant Notes of Company Law For CS Executive - Dec, 2012 ExamPuja Mohan75% (4)

- Cost Analysis For 1,000 To 3000 Poultry (Layers) Capacity & Feed Mill in Nigeria - Agriculture - NigeriaDocument15 pagesCost Analysis For 1,000 To 3000 Poultry (Layers) Capacity & Feed Mill in Nigeria - Agriculture - NigeriamayorladNo ratings yet