Professional Documents

Culture Documents

Cop Money Service Business Code of Practice

Cop Money Service Business Code of Practice

Uploaded by

Jack DanielsCopyright:

Available Formats

You might also like

- AMLA Latest Amendments 2023 (Anti-Money Laundering Act Philippines)Document10 pagesAMLA Latest Amendments 2023 (Anti-Money Laundering Act Philippines)Atty. Javier Law Vlog - Law Lectures for Students80% (5)

- Social 9 Unit Plan Interactions and Interdependence of NationsDocument17 pagesSocial 9 Unit Plan Interactions and Interdependence of Nationsapi-349577905No ratings yet

- 08 Rosen Chapter 1 Summary PDFDocument9 pages08 Rosen Chapter 1 Summary PDFSima KhanNo ratings yet

- Fera NewDocument15 pagesFera Newsahar fatmaNo ratings yet

- Anti-Money Laundering Laws in IndiaDocument11 pagesAnti-Money Laundering Laws in IndiaAbhi TripathiNo ratings yet

- Republic Act No. 9160 Anti-Money Laundering Act of 2001Document29 pagesRepublic Act No. 9160 Anti-Money Laundering Act of 2001Jomer FernandezNo ratings yet

- Forex DevelopmentsDocument6 pagesForex DevelopmentsakchatNo ratings yet

- Introduction To Trust AccountsDocument8 pagesIntroduction To Trust AccountsTakudzwa Larry G Chiwanza100% (1)

- FiamlaDocument30 pagesFiamlaKamlesh FulleeNo ratings yet

- Chapter8gston FinancialservicesDocument5 pagesChapter8gston FinancialservicesSakshi DamwaniNo ratings yet

- Foreign Exchange Management Act.: Name Roll No ContributionDocument25 pagesForeign Exchange Management Act.: Name Roll No Contributiondenmax4uNo ratings yet

- The Financial Intelligence and Anti-Money Laundering Act 2002Document48 pagesThe Financial Intelligence and Anti-Money Laundering Act 2002chanfa3851No ratings yet

- Anti-Money Laundering Regulations 3Document18 pagesAnti-Money Laundering Regulations 3Elementry YunNo ratings yet

- Percentage Tax Description 2Document9 pagesPercentage Tax Description 2CPAREVIEWNo ratings yet

- POJK verENGLISH FINAL-sept2017Document38 pagesPOJK verENGLISH FINAL-sept2017pradipto.bhaskoroNo ratings yet

- Fema ActDocument34 pagesFema ActKARISHMAATNo ratings yet

- FEMA ActDocument24 pagesFEMA ActPrince KartikayNo ratings yet

- Amla PDFDocument5 pagesAmla PDFMervidelleNo ratings yet

- Chambers Cheque Bounce U/s 138Document3 pagesChambers Cheque Bounce U/s 138Aditya MaheshwariNo ratings yet

- Amendments To The Anti-Money Laundering ActDocument30 pagesAmendments To The Anti-Money Laundering Actlorkan19No ratings yet

- Note New Currency LawDocument4 pagesNote New Currency LawsanthiNo ratings yet

- Amendments To The Anti-Money Laundering ActDocument25 pagesAmendments To The Anti-Money Laundering ActDon Caballer100% (1)

- Money LaunderingDocument10 pagesMoney LaunderingRitika SharmaNo ratings yet

- Client Alert 01 2023 Guideline On New Anti Money Laundering LawDocument6 pagesClient Alert 01 2023 Guideline On New Anti Money Laundering Lawsocialacc1994No ratings yet

- CIN 14 Closure of Bank Accounts Final February 2018Document7 pagesCIN 14 Closure of Bank Accounts Final February 2018Tahir DestaNo ratings yet

- IBC Section 1 To 16Document13 pagesIBC Section 1 To 16Komal HarlalkaNo ratings yet

- IntroductionDocument40 pagesIntroductionsanariaz6424No ratings yet

- FERA andDocument3 pagesFERA andAjit JenaNo ratings yet

- Manual of Regulation For BanksDocument27 pagesManual of Regulation For BanksCLAINE AVELINONo ratings yet

- Comparison of FERA & FEMADocument9 pagesComparison of FERA & FEMARitesh ShirsatNo ratings yet

- Pbi - 191017 Concening AMLDocument72 pagesPbi - 191017 Concening AMLDee Patria Adithana BangunNo ratings yet

- Analysis of The Prevention of Corruption (Amendment) Bill, 2013 With Special Reference To Investigation and SanctionDocument10 pagesAnalysis of The Prevention of Corruption (Amendment) Bill, 2013 With Special Reference To Investigation and SanctionAnonymous CwJeBCAXpNo ratings yet

- Circular-No-220-14-2024Document6 pagesCircular-No-220-14-2024aldiveoneNo ratings yet

- Notes in Anti-Money Laundering Act Atty. DJ: Tarlac State UniversityDocument15 pagesNotes in Anti-Money Laundering Act Atty. DJ: Tarlac State UniversityCatherine SimeonNo ratings yet

- The Anti-Money Laundering Act (R.A. No. 9160, As Amended by R.A. No. 9194, R.A. No. 10167 and R.A. No. 10365) Policy of The LawDocument5 pagesThe Anti-Money Laundering Act (R.A. No. 9160, As Amended by R.A. No. 9194, R.A. No. 10167 and R.A. No. 10365) Policy of The Lawjosiah9_5100% (2)

- Bangko Sentral NG PilipinasDocument1 pageBangko Sentral NG PilipinaskwyncleNo ratings yet

- FAAFAR Form 27 Revised 28 Jun 2021Document3 pagesFAAFAR Form 27 Revised 28 Jun 2021Pooh HuiNo ratings yet

- Chapter 423 - The Anti - Money Laundering Act Final Chapa PDFDocument29 pagesChapter 423 - The Anti - Money Laundering Act Final Chapa PDFEsther MaugoNo ratings yet

- Money Laundering: Money Laundering Is Generally Regarded As The Practice of Engaging in Financial Transactions ToDocument11 pagesMoney Laundering: Money Laundering Is Generally Regarded As The Practice of Engaging in Financial Transactions TosmatishNo ratings yet

- Money Laundering and Terrorist Financing Prevention PolicyDocument11 pagesMoney Laundering and Terrorist Financing Prevention PolicytoengsayaNo ratings yet

- 2006 - January 18 - Directives On AML StandardsDocument2 pages2006 - January 18 - Directives On AML StandardsLouis NoronhaNo ratings yet

- Fifteenth Congress Third Regular Session 4Document6 pagesFifteenth Congress Third Regular Session 4Shasharu Fei-fei LimNo ratings yet

- The Prevention of Money Laundering Act: (Frequently Asked Questions) OnDocument57 pagesThe Prevention of Money Laundering Act: (Frequently Asked Questions) OnVikram Singh ChauhanNo ratings yet

- FIAMLA Updated August 2020Document61 pagesFIAMLA Updated August 2020Dhanshyam LuckooNo ratings yet

- Levy of GST On Liquidated Damages DisclaimerDocument8 pagesLevy of GST On Liquidated Damages DisclaimerVenkataramana NippaniNo ratings yet

- Financial Intelligence and Anti Money Laundering Act 2002Document79 pagesFinancial Intelligence and Anti Money Laundering Act 2002Bhavna Devi BhoodunNo ratings yet

- AMLC IntegratedDocument19 pagesAMLC Integratedraymund lumantaoNo ratings yet

- Money LaunderingDocument65 pagesMoney LaunderingAlamgir Mohammad TuhinNo ratings yet

- Analytical Study On Myanmar Investment LawDocument12 pagesAnalytical Study On Myanmar Investment LawNaing AungNo ratings yet

- The Future of Tax Treaty - The Discussion of The Applicability of MLIDocument2 pagesThe Future of Tax Treaty - The Discussion of The Applicability of MLIdyahNo ratings yet

- Law On Securities Class Internal Assessment "Disgorgement As A Remedy Under Securities Law"Document5 pagesLaw On Securities Class Internal Assessment "Disgorgement As A Remedy Under Securities Law"Mano FelixNo ratings yet

- Overview of Exchange Control RegulationDocument12 pagesOverview of Exchange Control RegulationYogesh BhandareNo ratings yet

- The Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Document37 pagesThe Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Uday TomarNo ratings yet

- Bmbe CompleteDocument61 pagesBmbe Completedarla1008No ratings yet

- Foreign Exchange Management Act, 1999Document8 pagesForeign Exchange Management Act, 1999amluxavier100% (1)

- UK Bribery Act 2010 - Overview: Bribing Another Person & Being BribedDocument2 pagesUK Bribery Act 2010 - Overview: Bribing Another Person & Being Bribedakashatha shettyNo ratings yet

- Review Materials CompiledDocument338 pagesReview Materials Compilednomercykilling100% (1)

- Legal Research Memo ExampleDocument8 pagesLegal Research Memo Examplegitanjali tehanguriyaNo ratings yet

- Constitutional Law CaseDocument157 pagesConstitutional Law CaseJen MoloNo ratings yet

- Foreign Exchange Management Act - 2Document48 pagesForeign Exchange Management Act - 2Vaibhav VermaNo ratings yet

- 03-Long Term Keyword Rank GoalsDocument1 page03-Long Term Keyword Rank GoalsJack DanielsNo ratings yet

- 01-How To Optimize Your Automatic PPC CampaignsDocument1 page01-How To Optimize Your Automatic PPC CampaignsJack DanielsNo ratings yet

- Guidance To Opening A Business AccountDocument1 pageGuidance To Opening A Business AccountJack DanielsNo ratings yet

- 02-How To Optimize Your Broad Phrase PPC CampaignsDocument1 page02-How To Optimize Your Broad Phrase PPC CampaignsJack DanielsNo ratings yet

- 05-Maximize Your Ad Spend and Keyword Data For CampaignsDocument1 page05-Maximize Your Ad Spend and Keyword Data For CampaignsJack DanielsNo ratings yet

- 04-Choosing The Best Keywords To Convert SalesDocument1 page04-Choosing The Best Keywords To Convert SalesJack DanielsNo ratings yet

- 03-Advertising Reports - Download and OrganizationDocument1 page03-Advertising Reports - Download and OrganizationJack DanielsNo ratings yet

- 01-Why Your Product Listing Can Influence The Buyers' DecisionDocument1 page01-Why Your Product Listing Can Influence The Buyers' DecisionJack DanielsNo ratings yet

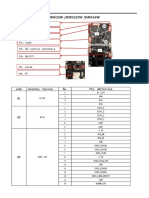

- St25r3911b DiscoDocument5 pagesSt25r3911b DiscoJack DanielsNo ratings yet

- 03-Differences Between Negative Phrase and Exact KeywordsDocument1 page03-Differences Between Negative Phrase and Exact KeywordsJack DanielsNo ratings yet

- Financial Services (Distributed Ledger TechnologyDocument8 pagesFinancial Services (Distributed Ledger TechnologyJack DanielsNo ratings yet

- COI Malta Sample 1542857385Document1 pageCOI Malta Sample 1542857385Jack DanielsNo ratings yet

- Identification Verification Idv CertificationDocument2 pagesIdentification Verification Idv CertificationJack DanielsNo ratings yet

- APDU - EMV, APDU Command - Response Parse at Iso8583.infoDocument1 pageAPDU - EMV, APDU Command - Response Parse at Iso8583.infoJack DanielsNo ratings yet

- CMB General TariffDocument29 pagesCMB General TariffJack DanielsNo ratings yet

- 2MP WIFI TF H.265 Camera Module: FeatureDocument1 page2MP WIFI TF H.265 Camera Module: FeatureJack DanielsNo ratings yet

- EU Settlement Scheme EU Other EEA Swiss Citizens and Family MembersDocument236 pagesEU Settlement Scheme EU Other EEA Swiss Citizens and Family MembersJack DanielsNo ratings yet

- 9F26 Tag Is The ARQCDocument1 page9F26 Tag Is The ARQCJack DanielsNo ratings yet

- (Import) Understanding JCOP - Pre-Personalization - Re-Ws - PLDocument1 page(Import) Understanding JCOP - Pre-Personalization - Re-Ws - PLJack DanielsNo ratings yet

- 2MP 38 38 Single Board H.265 Camera Module: FeatureDocument1 page2MP 38 38 Single Board H.265 Camera Module: FeatureJack DanielsNo ratings yet

- 544 Hillside Rd. Redwood City, CA 94062 USA PH: 1.650.260.2387 Fax: 1.650.260.2389Document2 pages544 Hillside Rd. Redwood City, CA 94062 USA PH: 1.650.260.2387 Fax: 1.650.260.2389Jack DanielsNo ratings yet

- (Import) Understanding JCOP - Memory Dump - Re-Ws - PLDocument1 page(Import) Understanding JCOP - Memory Dump - Re-Ws - PLJack DanielsNo ratings yet

- Web Api For Accessing Secure Element: Version 1.0 - September 2016 Globalplatform Device SpecificationDocument22 pagesWeb Api For Accessing Secure Element: Version 1.0 - September 2016 Globalplatform Device SpecificationJack DanielsNo ratings yet

- 4MP H.265 Hisilicon TH84E Module: FeatureDocument1 page4MP H.265 Hisilicon TH84E Module: FeatureJack DanielsNo ratings yet

- Mc200e 2MP H.265 Xz-36e7-MfDocument1 pageMc200e 2MP H.265 Xz-36e7-MfJack DanielsNo ratings yet

- DM52SW DM54SW DM52S3WDocument2 pagesDM52SW DM54SW DM52S3WJack DanielsNo ratings yet

- Obsolete Product (S) - Obsolete Product (S) : Stpay-Js-S8-C - 2Document3 pagesObsolete Product (S) - Obsolete Product (S) : Stpay-Js-S8-C - 2Jack DanielsNo ratings yet

- Parameters For IPG-83H40PL-BDocument5 pagesParameters For IPG-83H40PL-BJack DanielsNo ratings yet

- Elementos Da Acroyoga - 2020Document3 pagesElementos Da Acroyoga - 2020Thiago Rodrigues NascimentoNo ratings yet

- Apush Chapter 7 VocabDocument1 pageApush Chapter 7 VocabSarahNo ratings yet

- HISTORY Print ReadyDocument27 pagesHISTORY Print ReadyAyush GaurNo ratings yet

- Distilleria Vs CADocument2 pagesDistilleria Vs CAjdg jdgNo ratings yet

- Timeline CLKDocument18 pagesTimeline CLKHamza BouNo ratings yet

- En 55022Document3 pagesEn 55022rosebifNo ratings yet

- DriverDocument41 pagesDriverJoseph JohnstonNo ratings yet

- Ellipses Powerpoint D. GrantDocument15 pagesEllipses Powerpoint D. GrantDeborahNo ratings yet

- Environmental Ethics: Submitted byDocument17 pagesEnvironmental Ethics: Submitted byMeika KuruhashiNo ratings yet

- People Vs GuzonDocument9 pagesPeople Vs GuzonTashi MarieNo ratings yet

- Peer and Technical Review Guideline April 2009Document27 pagesPeer and Technical Review Guideline April 2009afr5364No ratings yet

- Chapter 5 - GasesDocument72 pagesChapter 5 - GasesAmbar WatiNo ratings yet

- NSW Government Gazette, 20 July 2021, Number 331 "Health and Education"Document4 pagesNSW Government Gazette, 20 July 2021, Number 331 "Health and Education"clarencegirlNo ratings yet

- Dayagbil, Escano, Sabdullah, Villablanca EH 406 TAX 1 December 16, 2017Document4 pagesDayagbil, Escano, Sabdullah, Villablanca EH 406 TAX 1 December 16, 2017Vanda Charissa Tibon DayagbilNo ratings yet

- Gambling in IndiaDocument12 pagesGambling in Indialimd4931No ratings yet

- Not PrecedentialDocument12 pagesNot PrecedentialScribd Government DocsNo ratings yet

- King V Hludzenski DecisionDocument9 pagesKing V Hludzenski DecisionpandorasboxofrocksNo ratings yet

- CASE DIGESTS Selected Cases in Pub. Corp. Dela Cruz Vs Paras To Miaa Vs CADocument10 pagesCASE DIGESTS Selected Cases in Pub. Corp. Dela Cruz Vs Paras To Miaa Vs CAErica Dela Cruz100% (1)

- Professional Ethics GABBYDocument193 pagesProfessional Ethics GABBYadeola tayoNo ratings yet

- Comparative Police SystemDocument9 pagesComparative Police SystemBimboy CuenoNo ratings yet

- Arizona v. California, 439 U.S. 419 (1979)Document25 pagesArizona v. California, 439 U.S. 419 (1979)Scribd Government DocsNo ratings yet

- River Valley News Shopper, October 17, 2011Document40 pagesRiver Valley News Shopper, October 17, 2011Pioneer GroupNo ratings yet

- Babcock v. Jackson, 12 N.Y.2d 473 (1963)Document15 pagesBabcock v. Jackson, 12 N.Y.2d 473 (1963)Jovelan V. EscañoNo ratings yet

- People Vs LegaspiDocument7 pagesPeople Vs LegaspistrgrlNo ratings yet

- RodriguezDocument1 pageRodriguezMark Adrian ArellanoNo ratings yet

- Rcpi Vs Verchez 2006Document3 pagesRcpi Vs Verchez 2006Baldr BringasNo ratings yet

- LLM Construction Law Arbitration Adjudication Handbook 2011-12Document36 pagesLLM Construction Law Arbitration Adjudication Handbook 2011-12paulgaynhamNo ratings yet

Cop Money Service Business Code of Practice

Cop Money Service Business Code of Practice

Uploaded by

Jack DanielsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cop Money Service Business Code of Practice

Cop Money Service Business Code of Practice

Uploaded by

Jack DanielsCopyright:

Available Formats

Financial Services (Jersey) Law 1998

Code of Practice

For Money Service Business

First Issued: July 2007

Last Revised: 1 January 2021

Code of Practice for Money Service Business

Contents Page

Glossary 4

Introduction 6

The Principles:

1. A registered person must conduct its money service business with integrity. 9

2. A registered person must have due regard for the interests of its clients. 9

3. A registered person must organise and control its affairs effectively for the

proper performance of its money service business activities and be able to

demonstrate the existence of adequate risk management systems.

› Corporate governance (3.1). 9

› Internal control systems (3.2). 10

› Compliance Officer and Money-laundering Reporting Officer (3.3). 11

› Record keeping (3.4). 13

› Complaints (3.5). 14

› Integrity and competence (3.6). 15

› Payment of financial penalties (3.7) 15

4. A registered person must be transparent in its money service business

15

arrangements.

5. A registered person is expected to deal with the JFSC in an open and

16

co-operative manner.

Effective from: 1 July 2008 Page 3 of 17

Last revised: 1 January 2021

Code of Practice for Money Service Business

Glossary

Unless otherwise defined, the following terms when used in the Code shall have the meanings set

out below. If not defined below or elsewhere in the Code, terms, where relevant, have the same

meanings as are ascribed to them in the FS(J)L.

All terms which appear in this Glossary are reflected in the Code utilising italic text. Guidance to the

Code in the form of “Notes” has been placed in a box to highlight its status.

Anti-money laundering legislation Includes the Proceeds of Crime (Jersey) Law 1999, the

Money Laundering (Jersey) Order 2008 (the Money

Laundering Order) and the Terrorism (Jersey) Law 2002, as

well as any other applicable laws, all as amended from time

to time. It also includes the international sanctions regimes

implemented through the Sanctions and Asset-Freezing

(Implementation of EU Regulations) (Jersey) Order 2020 and

equivalent legislation relating to the implementation of UK

sanctions. The legislation must be observed in conjunction

with the requirements of the relevant Handbook for the

Prevention and Detection of Money Laundering and the

Financing of Terrorism, issued by the JFSC.

Client Has the same meaning as provided by Article 1 of the FS(J)L,

namely:

“client”, in relation to a registered person, means a person,

whether resident on or off Jersey, with or for whom the

registered person transacts or has transacted financial

service business (other than trust company business) or

gives or has given advice about financial service business

(other than trust company business)”.

Code Means the Code of Practice for Money Service Business.

Complaint Means any oral or written expression of dissatisfaction,

whether justified or not, from, or on behalf of, a person

about the provision of, or failure to provide, a service that

relates to money service business carried on by the

registered person, which alleges that the complainant has

suffered (or may suffer) financial loss, material distress or

material inconvenience.

FS(J)L Means the Financial Services (Jersey) Law 1998, as amended.

JFSC Means Jersey Financial Services Commission.

Key person Has the same meaning as provided by Article 1 of the FS(J)L.

Money Laundering Order Means the Money Laundering (Jersey) Order 2008, as

amended.

Page 4 of 17 Effective from: 14 December 2007

Last revised: 1 January 2021

Principal person Has the same meaning as provided by Article 1 of the FS(J)L.

Registered person Means, a person registered under Article 9 of the FS(J)L to

carry on money service business.

Relevant AML/CFT Handbook Means the relevant Handbook for the Prevention and

Detection of Money Laundering and the Financing of

Terrorism, issued by the JFSC.

Effective from: 1 July 2008 Page 5 of 17

Last revised: 1 January 2021

Introduction

Power exercised and scope

The Code of Practice for Money Service Business (the Code) is issued by the Jersey Financial Services

Commission (the JFSC) under powers given to it by Article 19 of the Financial Services (Jersey) Law

1998, as amended (the FS(J)L). The Code has been prepared and issued for the purpose of setting out

the principles and detailed requirements that must be complied with in the conduct of money service

business as defined in Article 2(9) of the FS(J)L.

The Code applies to all persons registered by the JFSC under Article 9 of the FS(J)L to carry on money

service business as defined under Article 2(9) of the FS(J)L (a registered person).

Article 9 of the FS(J)L establishes threshold conditions that apply on an on-going basis – the fit and

proper assessment – to registered persons, principal persons and key personsi. This assessment

process includes consideration of integrity, competence, financial standing, structure and

organisation.

The JFSC has published a Policy Statement: Licensing Policy in respect of those that require

registration under the FS(J)L Part 2 of which provides further information on The JFSC’s “fit and

proper” assessment and paragraph 4.5 of which highlights the continuing nature of the fit and proper

assessment. The Code assists the JFSC with its on-going consideration of the fitness and propriety of

a registered person by setting out actions that the registered person must or must not undertake,

which it can then be assessed against.

Unless otherwise stated, all registered persons must satisfy the five principles and comply with the

detailed standards of conduct.

Where the Code requires a registered person to provide information to the JFSC, such requirement is

established in accordance with the powers provided by Article 8 of the Financial Services Commission

(Jersey) Law 1998.

Registered persons are reminded of the provisions of Article 7 of the FS(J)L in respect of the

prohibition of carrying out unauthorised money service business.

Arrangement of the Codes

The Code provides enforceable requirements in the form of high level principles supported by

detailed rules in the areas of corporate governance and conduct of business and are arranged under

five principles as described below. The Code is arranged under five principles and include detailed

provisions governing minimum standards of conduct expected of registered persons in the areas of

corporate governance and conduct of business matters.

The principles are:

1. A registered person must conduct its money service business with integrity.

2. A registered person must have due regard for the interests of its clients.

3. A registered person must organise and control its affairs effectively for the proper

performance of its money service business activities and be able to demonstrate the

existence of adequate risk management systems.

4. A registered person must be transparent in its money service business arrangements.

5. A registered person is expected to deal with the JFSC in an open and co-operative manner.

Each section of the Code is designed to be understood by reference to its full text including any

notes.

Page 6 of 17 Effective from: 14 December 2007

Last revised: 1 January 2021

Compliance with the Code

The Code should be read by registered persons in conjunction with the FS(J)L and its subordinate

legislation together with any conditions attached to a registration held under the FS(J)L and the

relevant Handbook for the Prevention and Detection of Money Laundering and the Financing of

Terrorism, issued by the JFSC (the relevant AML/CFT Handbook).

It is the responsibility of a registered person, however, not only to comply with the Code, but also to

implement such additional practices as it considers necessary for the proper management and

control of its business. Where a registered person considers that it may not be able to achieve full

compliance with the Code for a temporary period (for example, for a short period after first being

licensed) it should, in advance, agree a plan of action (to include timescales) with the JFSC to bring

itself into full compliance with the Code. In exceptional circumstances, where strict adherence to the

Code would produce an anomalous result, registered persons may apply to the JFSC for variation

from the Code.

Failure by a registered person to comply with the Code represents grounds for the JFSC to take

regulatory action. Where the JFSC has reason to believe that at any time there has been a failure of

the part of a registered person to comply with the Code, it may consider making use of its regulatory

powers which, in serious cases, could include the revocation of a registration to carry on money

service business. In appropriate circumstances, in line with Article 25 of the FS(J)L, the JFSC may issue

a public statement concerning a registered person.

In addition, failure to comply with the Code may support a decision by the JFSC that, for example,

continued non-compliance or other failure to remedy the circumstances giving rise to the breach

may be addressed by the issue of a written direction under Article 23 of the FS(J)L. Such a direction

might impose requirements on the registered person to do or not to do specified things, including

the removal of principal persons or the cessation of business. In appropriate circumstances a

direction can be made public by virtue of Article 25(a) of the FS(J)L. The JFSC also has the power

under Article 21A of the Financial Services Commission (Jersey) Law 1998 to impose financial

penalties for significant and material contraventions of the Code.

Whilst Article 19(3) of the FS(J)L provides that the contravention of the Code shall not of itself render

any person liable to legal proceedings of any kind (excluding regulatory action that may be taken by

the JFSC in response to a contravention) or invalidate any transaction, Article 19(4) provides that,

subject to a condition of registration indicating that any part or parts of the Code are to be wholly or

partly disregarded by a registered person, the Code shall be admissible in evidence if it appears to

the court conducting the proceedings to be relevant to any questions arising in the proceedings and

shall be taken into account in determining any such questions.

When considering a registered person’s failure to comply with the Code the JFSC places emphasis on

whether or not a registered person conducts its business with integrity and deals with the JFSC in an

open and co-operative manner.

Where it appears to the JFSC that a person has failed to comply with the Code, it may issue a public

statement under Article 25(b) of the FS(J)L.

In a number of places the Code requires the JFSC to be advised of a matter “in writing”. For the

avoidance of doubt, a notification given by email, or by means of the JFSC’s online portal, will be

considered by the JFSC to meet that requirement (unless the particular Code requirement specifies

otherwise how a notification “in writing” must be given).

Revision of the Code

Effective from: 1 July 2008 Page 7 of 17

Last revised: 1 January 2021

In accordance with Article 19(1)(b) of the FS(J)L the JFSC may, after consultation with such persons or

bodies as appear to be representative of the interests concerned, revise the Code by revoking,

varying, amending or adding to its provisions.

In November 2018 the JFSC published Consultation Paper No. 10, proposing a number of

amendments to the Code and, in March 2019, published a feedback paper summarising respondents’

comments and the JFSC’s responses.

Rather than detail the amendments here, the JFSC has published a version of the Code that highlights

the amendments applied.

Effective Date

This revised Code is effective from 1 June 2019 for all registered persons.

Any person that has made an application to the JFSC which is currently under consideration, should

review the Code and contact the JFSC to discuss any areas where compliance on grant of registration

may be an issue.

Page 8 of 17 Effective from: 14 December 2007

Last revised: 1 January 2021

The Principles

1 A registered person must conduct its money service

business with integrity.

1.1 Without limiting the scope of the above principle, a registered person must not:

1.1.1 Act or refrain from acting; or

1.1.2 Contract or have any other arrangement,

So as to avoid, or seek to avoid, any regulatory responsibilities it may have under the Code

and the full legal consequences of not following them unless the Code expressly permits any

such avoidance.

2 A registered person must have due regard for the

interests of its clients.

2.1 A registered person must have due regard for the interests of its clients in fulfilling the

responsibilities it has undertaken.

2.2 A registered person must use best endeavours to execute the proper and lawful instructions

of its clients promptly and accurately. This must include appropriate arrangements for

protecting confidentiality.

2.3 A registered person must either avoid any conflict of interest arising or, where conflicts do

occur, must address such conflicts by disclosure, by applying appropriate internal rules of

confidentiality, or by declining to act, as appropriate.

3 A registered person must organise and control its

affairs effectively for the proper performance of its

money service business activities and be able to

demonstrate the existence of adequate risk

management systems.

3.1 Corporate governance

3.1.1 A registered person must operate an effective corporate governance system that

must include the following key elements:

3.1.1.1 An adequate span of control, at all times, appropriate to the nature of its

business.

3.1.1.2 Apportionment of responsibilities in such a way that an individual’s

responsibilities and accountabilities are clear and that there is separation

of critical functions so as to guard against fraud and market abuse.

3.1.1.3 The business and affairs of the registered person must be adequately

monitored and controlled at senior management and board level, as

Effective from: 1 July 2008 Page 9 of 17

Last revised: 1 January 2021

appropriate.

3.1.2 With respect to 3.1.1.1, where a registered person is not a Jersey incorporated

person, the span of control arrangements must be discussed and agreed with the

JFSC in advance of their implementation. If an individual who is not a principal

person but is actively involved in the day-to-day management of the business is to

be included in the determination of span of control then the JFSC will consider the

fitness and propriety of that person using the procedure established for considering

principal persons and key persons.

3.1.3 All aspects of corporate governance arrangements must be subject to appropriately

regular review to ensure their continuing adequacy in light of the registered

person’s business activities and risk profiles, and include a periodic self-assessment,

or external assessment, of the board’s effectiveness.

Notes:

1. Corporate governance is the system by which an organisation is directed and controlled.

A corporate governance framework specifies the distribution of rights and

responsibilities among different participants in the organisation and sets out the rules

and procedures for making decisions. In the context of Principle 3, “risk” refers to all the

risks that a registered person faces, or may face, as a business enterprise.

2. Article 74(1) of the Companies (Jersey) Law 1991 states:

“A director, in exercising the director’s powers and discharging the director’s duties,

shall–

A. Act honestly and in good faith with a view to the best interests of the company;

and

B. Exercise the care, diligence and skill that a reasonably prudent person would

exercise in comparable circumstances.

3. The requirements set out under paragraph 3.1.1 deal with both prudential and conduct

of business issues referring as they do, to the direction of the business of the registered

person itself. As such, this is not a provision that directly governs, for instance,

appropriate signatory arrangements for the execution of a specific transaction or

exercise of a particular discretion.

4. For the purpose of 3.1.1.2, all individuals having up to date job descriptions may best

evidence apportionment of responsibilities. However, the terms of reference relating to

particular offices or committees, or Board resolutions, may also demonstrate

apportionment of responsibilities.

3.2 Internal systems and controls

3.2.1 A registered person must maintain and adequately document policies and

procedures that cover the operations of the business.

3.2.2 A registered person must comply with the JFSC’s policy on outsourcing as may be

updated from time to time.

Notes:

1. With respect to 3.2.2, the JFSC’s policy on outsourcing is available from the JFSC’s

website.

Page 10 of 17 Effective from: 14 December 2007

Last revised: 1 January 2021

2. With respect to the various risk management provisions under principle 3 of the Code,

particularly 3.1, 3.2 and 3.4, it is expected that a registered person will have specifically

considered, amongst other risks, the risk of a cyber security incident, and have in place a

corresponding documented policy to identify assets and risks, to protect them, to

quickly detect potential cyber security incidents, to respond to contain the impact of an

incident and to recover from it.

3.2.3 A registered person must ensure that its internal systems and controls provide

reasonable assurance that:

3.2.3.1 The business is planned and conducted properly and adequately and in an

orderly manner, in accordance with local and any group management

policies;

3.2.3.2 Transactions and commitments are entered into in accordance with

documented general or specific authorities;

3.2.3.3 The accounting and other records of the registered person are complete,

accurate and up to date and can be used to compile financial statements,

management information and returns in line with applicable regulatory

and legal requirements;

3.2.3.4 Management is able to assess and monitor the adequacy of capital in

relation to the dynamics of the business operation, including risk profiles

and the quality of its assets; and

3.2.3.5 Management is able to properly guard against involvement in financial

crime and ensure that the registered person is complying with all relevant

anti-money laundering legislation, and the Code.

Notes:

1. In seeking to ensure that these objectives are met, directors and senior management

need to exercise their judgement in determining the scope and nature of the controls

that are necessary (also having regard to their cost effectiveness). Once such controls

are established, it is the responsibility of directors and senior management to monitor

their effective operation on a regular basis. The JFSC considers that, for this to be

achieved, it is necessary to establish a corporate culture that encapsulates the principles

involved and employee compensation and incentive arrangements that support these.

Supervisory assessment of registered persons will include consideration of these

aspects.

2. The anti-money laundering legislation must be observed in conjunction with the

standards set out in the relevant AML/CFT Handbook. Failure to comply with anti-

money laundering legislation or the relevant AML/CFT Handbook may form the basis for

regulatory action by the JFSC. This is in addition to any legal action that may be taken

by the judicial authorities for failure to comply with anti-money laundering legislation.

3.3 Compliance Officer, Money-laundering Reporting Officer and Money Laundering

Compliance Officer

Effective from: 1 July 2008 Page 11 of 17

Last revised: 1 January 2021

3.3.1 The senior management (most often the board of directors) of the registered

person is responsible for ensuring that it has robust arrangements for compliance

with the regulatory framework.

3.3.2 A registered person must appoint an appropriately skilled and experienced person

as its Compliance Officer.

3.3.3 The registered person must ensure that the Compliance Officer is responsible for:

3.3.3.1 Ensuring appropriate monitoring of operational performances and

managing regulatory and compliance risk within the registered person

which includes, where appropriate, promptly instigating action to remedy

any deficiencies in such arrangements; and

3.3.3.2 Providing the principal point of contact on regulatory matters for

employees and the JFSC.

3.3.4 The Compliance Officer must:

3.3.4.1 Have appropriate independence and direct access to the registered

person’s Jersey board of directors or equivalent;

3.3.4.2 Have unfettered access to all business lines, support departments and

information necessary to properly discharge their responsibilities;

3.3.4.3 Be based in Jersey;

3.3.4.4 Have appropriate status within the registered person to ensure that

directors and senior management react to and determine whether to act

upon his or her recommendations; and

3.3.4.5 Have sufficient resources to properly discharge the responsibilities of the

position.

Notes:

1. Where temporary circumstances arise which result in a registered person having a

limited or inexperienced compliance resource, the JFSC expects the registered person to

support this area of operation as necessary, possibly by importing specialist skills or

through the use of group resources.

2. Where a registered person carries on money service business through a Jersey-based

agent, it may apply to the JFSC for approval to designate an employee of its Jersey-

based agent as its local Compliance Officer. A pre-condition for such approval will be a

requirement for the registered person to undertake to provide the Compliance Officer

with an appropriate level of support and training. Where such approval is granted by

the JFSC, paragraph 3.3.4.1 above shall be read as requiring the Compliance Officer to

have direct access to a senior officer of the registered person who performs equivalent

functions and who has direct access to the registered person’s board of directors or

equivalent.

3. It is a requirement of the Money Laundering Order that a registered person must

appoint a Money Laundering Reporting Officer and a Money Laundering Compliance

Officer. The relevant AML/CFT Handbook sets out additional requirements for the

registered person.

4. The roles of Compliance Officer, Money Laundering Reporting Officer and Money

Laundering Compliance Officer meet the definition of a key person, as defined by Article

1 of the FS(J)L; consequently, Article 14 of the FS(J)L applies.

Page 12 of 17 Effective from: 14 December 2007

Last revised: 1 January 2021

5. Where operating volumes are at a level for it to be appropriate, the Compliance Officer,

the Money Laundering Reporting Officer and the Money Laundering Compliance Officer

may be the same person.

3.4 Record keeping

All Records

3.4.1 A registered person must ensure that it has appropriate record keeping

arrangements for compliance with the applicable laws (including anti-money

laundering legislation and company legislation), Orders and regulatory

requirements, set by the Code or the relevant AML/CFT Handbook.

3.4.2 A registered person is expected to maintain and adequately document policies and

procedures that cover the management of the business.

3.4.3 A registered person is expected to maintain such books and records in a language

understood by the employees of the business. These must be translated into

English at the request of the JFSC. A registered person must be able to readily

retrieve them in Jersey and, if kept otherwise than in legible form, maintain them

so as to be readable at a computer terminal in Jersey so that they may be produced

in legible form without any delay.

3.4.4 A registered person must have a clearly documented policy and procedure

regarding record retention that includes:

3.4.4.1 Periodic review of the accessibility and condition of paper and electronic

records;

3.4.4.2 The adequacy of the safekeeping of records; and

3.4.4.3 Periodic testing of procedures relating to the retrieval of records.

Business Records

3.4.5 A registered person must maintain an audit trail of material changes to the policies

and procedures manual that covers the operation of the business, which is updated

as required. When updates are made, the effective date of such updates must be

recorded and the superseded records maintained.

3.4.6 The period for which business records must be kept is the later of:

3.4.6.1 The period required for any particular record by any law; or

3.4.6.2 Where records relate to significant corporate governance matters, such as

management meeting minutes and risk assessment matters, or are

records relating to requirements established by the Code - ten years from

the date of the record.

3.4.7 A registered person must maintain a list containing the names of any agents it

appoints to carry on money service business on its behalf and the addresses of

premises which such agents operate from, and notify the JFSC, in writing, within

five business days of any changes made to that list.

Effective from: 1 July 2008 Page 13 of 17

Last revised: 1 January 2021

Notes:

1. Where a registered person carries on money service business through a Jersey-based

agent, the requirement in 3.4.7 should be read as requiring the registered person to

maintain a list of the agents it has appointed in Jersey (and not those appointed outside

of Jersey).

2. The Code does not establish any retention requirements for tape recordings of

telephone conversations.

3. With respect to 3.4.5, a material change to the policies and procedures manual is one

that necessitates communication to impacted staff.

4. With respect to 3.4.6.1, the JFSC considers that laws relating to companies, tax,

proceeds of crime, and data protection may be relevant.

Client records

3.4.8 A registered person is expected to keep adequate, orderly and up to date client

records which are in line with the requirements established by Part 4 of the Money

Laundering Order and as set out in the relevant AML/CFT Handbook.

3.4.9 Where the Code requires client related records to be kept, which are in addition to

the records required by the Money Laundering Order, these should be kept for at

least five years from the date of the event to which the record relates.

3.5 Complaints

3.5.1 A registered person must establish and maintain an effective complaint handling

system and procedures.

3.5.2 The complaint handling system and procedures must include provision for:

3.5.2.1 A complainant to be advised in writing when their complaint is considered

closed and, where the complaint is not upheld, for the reason(s) for

rejecting the complaint to be clearly stated; and

3.5.2.2 At the same time, advise the complainant in writing:

3.5.2.2.1 That if they are dissatisfied with its response to the

complaint, the complainant may be able to refer the

complaint to the Channel Islands Financial Ombudsman;

3.5.2.2.2 Of the contact details for the Channel Islands Financial

Ombudsman (namely its website address, postal address,

email address and telephone number).

3.5.3 As soon as it becomes aware, a registered person must notify the JFSC in writing if

the Channel Islands Financial Ombudsman, using the powers it has under Article 16

of the Financial Services Ombudsman (Jersey) Law 2014, requires the registered

person to pay compensation to a complainant or directs the registered person to

take other specified steps in relation to the complainant.

3.5.4 A registered person must deal with the Channel Islands Financial Ombudsman in an

open and co-operative manner.

Note:

1. With respect to 3.5.1, a registered person may wish to consider adopting and following

the “Model complaint-handling procedure for financial services providers” published by

the Channel Islands Financial Ombudsman.

Page 14 of 17 Effective from: 14 December 2007

Last revised: 1 January 2021

2. With respect to 3.5.3, “as soon as it becomes aware” applies from the point at which

the registered person knows, or has reasonable grounds for believing, that any of the

matters stated has occurred or may be about to occur, even where it is outside the

control of the registered person.

3.6 Integrity and competence

Integrity

3.6.1 A registered person must ensure that its directors, senior managers and all other

employees are fit and proper for their roles. The term “employees” includes not

only staff directly employed by the registered person but also indirect employees

such as temporary or contracted employees and other contracted service providers,

and in the case of a sole trader, the proprietor of the business.

Competence

3.6.2 Without limiting paragraph 3.6.1, directors and senior managers will be expected to

be able to demonstrate proper competence.

3.6.3 A registered person must ensure that its employees are appropriately competent on

an on-going basis and trained adequately and appropriately. Competence may

comprise a balance between relevant qualifications held, training received and

experience gained, having regard, amongst other things, to the nature of the work

carried out by the employee and the level of his or her responsibility.

3.7 Payment of financial penalties

3.7.1 A registered person must not pay a financial penalty imposed by the JFSC on any

other person.

3.7.2 A registered person must not enter into, arrange, claim on or make a payment under

a contract of insurance that is intended to have, or has or would have, the effect of

indemnifying any person against all or part of a financial penalty imposed by the JFSC.

Notes:

1. Paragraph 3.7.2 is not intended to prevent a registered person from entering into,

arranging, claiming on or making any payment under a contract of insurance which

indemnifies any person against all or part of the costs of defending JFSC enforcement

action or any costs the person may be ordered to pay to the JFSC.

4 A registered person must be transparent in its money

service business arrangements.

4.1 A registered person must inform its clients that it is regulated by the Jersey Financial Services

JFSC.

4.2 A registered person must communicate information to clients in a way that is adequate, fair

and not misleading. A registered person must also provide confirmation, in legible form, of

any transaction effected for the client.

4.3 A registered person must be open and transparent about its charges - effectively a “no

surprises” policy. Publication of scales of charges, which are available on request, could assist

in this regard.

Effective from: 1 July 2008 Page 15 of 17

Last revised: 1 January 2021

4.4 A registered person must ensure that its advertising and promotional literature is clear, fair,

reasonable and is not deceptive or misleading.

5 A registered person is expected to deal with the JFSC in

an open and co-operative manner.

General Notification

5.1 A registered person must advise the JFSC in writing as soon as it becomes aware of any

matter that might reasonably be expected to affect its registration or be in the interests of its

clients/investors to disclose. Wherever possible, this notification must include details of the

steps the registered person has taken, or intends to take, to mitigate the matter.

5.2 A registered person must comply with the notification requirements of the JFSC’s policy on

outsourcing as may be updated from time to time.

Notes:

1. There is a need for candour and co-operation in a registered person’s relationship with

the JFSC. Article 28(3) of the FS(J)L provides that a registered person, or formerly

registered person, shall be guilty of an offence if he or she fails to provide the JFSC with

any information in his or her possession, knowing or having reasonable cause to believe

that or being reckless as to whether:

A. The information is relevant to the exercise by the JFSC of its functions under the

FS(J)L in relation to the registered person or formerly registered person; and

B. The withholding of the information is likely to result in the JFSC being misled as to

any matter which is relevant to and of material significance for the exercise of

those functions in relation to the registered person or formerly registered person.

2. The scope of Principle 5 is extended to the provision of information and the notification

of events concerning non-regulated activities and other members of the corporate

group, to the extent that such information or events might reasonably be expected to

have a material impact on the registered person in Jersey.

3. The JFSC considers that the obligations of a registered person under this Principle

include the timely provision of data required in connection with a registered person’s

regulatory fees and the timely payment of fees due.

4. With respect to 5.1, “as soon as it becomes aware” applies from the point at which the

registered person knows, or has reasonable grounds for believing, that any of the

matters referred to have occurred or may be about to occur, even where it is outside the

control of the registered person. The JFSC considers the following indicative that

notification is necessary. Any matter which:

A. Is material to the JFSC’s ability to undertake its function of supervision of financial

services provided in or from within Jersey;

B. The registered person considers is material to, or may make it impractical for them

to comply with, one or more of:

i. The provisions of the FS(J)L or any Regulation or Order made under it;

ii. Compliance with a registration condition;

iii. Compliance with a direction issued by the JFSC;

iv. The Code;

Page 16 of 17 Effective from: 14 December 2007

Last revised: 1 January 2021

v. The fitness and propriety of their principal persons or key persons, especially

where the registered person has imposed a formal disciplinary measure or

sanction.

Notifications arising in other parts of the Code

5.3 A registered person is required to comply with notification requirements established in other

parts of the Code:

5.3.1 3.4.7 sets a notification requirement in respect of changes to the details (name and

address) of any agents appointed to carry on money service business on a

registered person’s behalf.

5.3.2 3.5.3 sets a notification requirement where the Channel Islands Financial

Ombudsman requires the registered person to pay compensation to a complainant

or directs the registered person to take other specified steps in relation to the

complainant.

Notifying or providing information via the JFSC’s online portal

5.4 Where the JFSC so specifies (whether in the Code or otherwise) a registered person must

notify or provide information by means of the JFSC’s online portal.

5.5 If, because of a systems failure of any kind, a registered person is unable to access the online

portal to make a relevant notification or provide required information it must notify the JFSC

in writing within one business day of the systems failure being identified.

i Registered person, principal person and key person are defined in Article 1 of the FS(J)L.

Effective from: 1 July 2008 Page 17 of 17

Last revised: 1 January 2021

You might also like

- AMLA Latest Amendments 2023 (Anti-Money Laundering Act Philippines)Document10 pagesAMLA Latest Amendments 2023 (Anti-Money Laundering Act Philippines)Atty. Javier Law Vlog - Law Lectures for Students80% (5)

- Social 9 Unit Plan Interactions and Interdependence of NationsDocument17 pagesSocial 9 Unit Plan Interactions and Interdependence of Nationsapi-349577905No ratings yet

- 08 Rosen Chapter 1 Summary PDFDocument9 pages08 Rosen Chapter 1 Summary PDFSima KhanNo ratings yet

- Fera NewDocument15 pagesFera Newsahar fatmaNo ratings yet

- Anti-Money Laundering Laws in IndiaDocument11 pagesAnti-Money Laundering Laws in IndiaAbhi TripathiNo ratings yet

- Republic Act No. 9160 Anti-Money Laundering Act of 2001Document29 pagesRepublic Act No. 9160 Anti-Money Laundering Act of 2001Jomer FernandezNo ratings yet

- Forex DevelopmentsDocument6 pagesForex DevelopmentsakchatNo ratings yet

- Introduction To Trust AccountsDocument8 pagesIntroduction To Trust AccountsTakudzwa Larry G Chiwanza100% (1)

- FiamlaDocument30 pagesFiamlaKamlesh FulleeNo ratings yet

- Chapter8gston FinancialservicesDocument5 pagesChapter8gston FinancialservicesSakshi DamwaniNo ratings yet

- Foreign Exchange Management Act.: Name Roll No ContributionDocument25 pagesForeign Exchange Management Act.: Name Roll No Contributiondenmax4uNo ratings yet

- The Financial Intelligence and Anti-Money Laundering Act 2002Document48 pagesThe Financial Intelligence and Anti-Money Laundering Act 2002chanfa3851No ratings yet

- Anti-Money Laundering Regulations 3Document18 pagesAnti-Money Laundering Regulations 3Elementry YunNo ratings yet

- Percentage Tax Description 2Document9 pagesPercentage Tax Description 2CPAREVIEWNo ratings yet

- POJK verENGLISH FINAL-sept2017Document38 pagesPOJK verENGLISH FINAL-sept2017pradipto.bhaskoroNo ratings yet

- Fema ActDocument34 pagesFema ActKARISHMAATNo ratings yet

- FEMA ActDocument24 pagesFEMA ActPrince KartikayNo ratings yet

- Amla PDFDocument5 pagesAmla PDFMervidelleNo ratings yet

- Chambers Cheque Bounce U/s 138Document3 pagesChambers Cheque Bounce U/s 138Aditya MaheshwariNo ratings yet

- Amendments To The Anti-Money Laundering ActDocument30 pagesAmendments To The Anti-Money Laundering Actlorkan19No ratings yet

- Note New Currency LawDocument4 pagesNote New Currency LawsanthiNo ratings yet

- Amendments To The Anti-Money Laundering ActDocument25 pagesAmendments To The Anti-Money Laundering ActDon Caballer100% (1)

- Money LaunderingDocument10 pagesMoney LaunderingRitika SharmaNo ratings yet

- Client Alert 01 2023 Guideline On New Anti Money Laundering LawDocument6 pagesClient Alert 01 2023 Guideline On New Anti Money Laundering Lawsocialacc1994No ratings yet

- CIN 14 Closure of Bank Accounts Final February 2018Document7 pagesCIN 14 Closure of Bank Accounts Final February 2018Tahir DestaNo ratings yet

- IBC Section 1 To 16Document13 pagesIBC Section 1 To 16Komal HarlalkaNo ratings yet

- IntroductionDocument40 pagesIntroductionsanariaz6424No ratings yet

- FERA andDocument3 pagesFERA andAjit JenaNo ratings yet

- Manual of Regulation For BanksDocument27 pagesManual of Regulation For BanksCLAINE AVELINONo ratings yet

- Comparison of FERA & FEMADocument9 pagesComparison of FERA & FEMARitesh ShirsatNo ratings yet

- Pbi - 191017 Concening AMLDocument72 pagesPbi - 191017 Concening AMLDee Patria Adithana BangunNo ratings yet

- Analysis of The Prevention of Corruption (Amendment) Bill, 2013 With Special Reference To Investigation and SanctionDocument10 pagesAnalysis of The Prevention of Corruption (Amendment) Bill, 2013 With Special Reference To Investigation and SanctionAnonymous CwJeBCAXpNo ratings yet

- Circular-No-220-14-2024Document6 pagesCircular-No-220-14-2024aldiveoneNo ratings yet

- Notes in Anti-Money Laundering Act Atty. DJ: Tarlac State UniversityDocument15 pagesNotes in Anti-Money Laundering Act Atty. DJ: Tarlac State UniversityCatherine SimeonNo ratings yet

- The Anti-Money Laundering Act (R.A. No. 9160, As Amended by R.A. No. 9194, R.A. No. 10167 and R.A. No. 10365) Policy of The LawDocument5 pagesThe Anti-Money Laundering Act (R.A. No. 9160, As Amended by R.A. No. 9194, R.A. No. 10167 and R.A. No. 10365) Policy of The Lawjosiah9_5100% (2)

- Bangko Sentral NG PilipinasDocument1 pageBangko Sentral NG PilipinaskwyncleNo ratings yet

- FAAFAR Form 27 Revised 28 Jun 2021Document3 pagesFAAFAR Form 27 Revised 28 Jun 2021Pooh HuiNo ratings yet

- Chapter 423 - The Anti - Money Laundering Act Final Chapa PDFDocument29 pagesChapter 423 - The Anti - Money Laundering Act Final Chapa PDFEsther MaugoNo ratings yet

- Money Laundering: Money Laundering Is Generally Regarded As The Practice of Engaging in Financial Transactions ToDocument11 pagesMoney Laundering: Money Laundering Is Generally Regarded As The Practice of Engaging in Financial Transactions TosmatishNo ratings yet

- Money Laundering and Terrorist Financing Prevention PolicyDocument11 pagesMoney Laundering and Terrorist Financing Prevention PolicytoengsayaNo ratings yet

- 2006 - January 18 - Directives On AML StandardsDocument2 pages2006 - January 18 - Directives On AML StandardsLouis NoronhaNo ratings yet

- Fifteenth Congress Third Regular Session 4Document6 pagesFifteenth Congress Third Regular Session 4Shasharu Fei-fei LimNo ratings yet

- The Prevention of Money Laundering Act: (Frequently Asked Questions) OnDocument57 pagesThe Prevention of Money Laundering Act: (Frequently Asked Questions) OnVikram Singh ChauhanNo ratings yet

- FIAMLA Updated August 2020Document61 pagesFIAMLA Updated August 2020Dhanshyam LuckooNo ratings yet

- Levy of GST On Liquidated Damages DisclaimerDocument8 pagesLevy of GST On Liquidated Damages DisclaimerVenkataramana NippaniNo ratings yet

- Financial Intelligence and Anti Money Laundering Act 2002Document79 pagesFinancial Intelligence and Anti Money Laundering Act 2002Bhavna Devi BhoodunNo ratings yet

- AMLC IntegratedDocument19 pagesAMLC Integratedraymund lumantaoNo ratings yet

- Money LaunderingDocument65 pagesMoney LaunderingAlamgir Mohammad TuhinNo ratings yet

- Analytical Study On Myanmar Investment LawDocument12 pagesAnalytical Study On Myanmar Investment LawNaing AungNo ratings yet

- The Future of Tax Treaty - The Discussion of The Applicability of MLIDocument2 pagesThe Future of Tax Treaty - The Discussion of The Applicability of MLIdyahNo ratings yet

- Law On Securities Class Internal Assessment "Disgorgement As A Remedy Under Securities Law"Document5 pagesLaw On Securities Class Internal Assessment "Disgorgement As A Remedy Under Securities Law"Mano FelixNo ratings yet

- Overview of Exchange Control RegulationDocument12 pagesOverview of Exchange Control RegulationYogesh BhandareNo ratings yet

- The Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Document37 pagesThe Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Uday TomarNo ratings yet

- Bmbe CompleteDocument61 pagesBmbe Completedarla1008No ratings yet

- Foreign Exchange Management Act, 1999Document8 pagesForeign Exchange Management Act, 1999amluxavier100% (1)

- UK Bribery Act 2010 - Overview: Bribing Another Person & Being BribedDocument2 pagesUK Bribery Act 2010 - Overview: Bribing Another Person & Being Bribedakashatha shettyNo ratings yet

- Review Materials CompiledDocument338 pagesReview Materials Compilednomercykilling100% (1)

- Legal Research Memo ExampleDocument8 pagesLegal Research Memo Examplegitanjali tehanguriyaNo ratings yet

- Constitutional Law CaseDocument157 pagesConstitutional Law CaseJen MoloNo ratings yet

- Foreign Exchange Management Act - 2Document48 pagesForeign Exchange Management Act - 2Vaibhav VermaNo ratings yet

- 03-Long Term Keyword Rank GoalsDocument1 page03-Long Term Keyword Rank GoalsJack DanielsNo ratings yet

- 01-How To Optimize Your Automatic PPC CampaignsDocument1 page01-How To Optimize Your Automatic PPC CampaignsJack DanielsNo ratings yet

- Guidance To Opening A Business AccountDocument1 pageGuidance To Opening A Business AccountJack DanielsNo ratings yet

- 02-How To Optimize Your Broad Phrase PPC CampaignsDocument1 page02-How To Optimize Your Broad Phrase PPC CampaignsJack DanielsNo ratings yet

- 05-Maximize Your Ad Spend and Keyword Data For CampaignsDocument1 page05-Maximize Your Ad Spend and Keyword Data For CampaignsJack DanielsNo ratings yet

- 04-Choosing The Best Keywords To Convert SalesDocument1 page04-Choosing The Best Keywords To Convert SalesJack DanielsNo ratings yet

- 03-Advertising Reports - Download and OrganizationDocument1 page03-Advertising Reports - Download and OrganizationJack DanielsNo ratings yet

- 01-Why Your Product Listing Can Influence The Buyers' DecisionDocument1 page01-Why Your Product Listing Can Influence The Buyers' DecisionJack DanielsNo ratings yet

- St25r3911b DiscoDocument5 pagesSt25r3911b DiscoJack DanielsNo ratings yet

- 03-Differences Between Negative Phrase and Exact KeywordsDocument1 page03-Differences Between Negative Phrase and Exact KeywordsJack DanielsNo ratings yet

- Financial Services (Distributed Ledger TechnologyDocument8 pagesFinancial Services (Distributed Ledger TechnologyJack DanielsNo ratings yet

- COI Malta Sample 1542857385Document1 pageCOI Malta Sample 1542857385Jack DanielsNo ratings yet

- Identification Verification Idv CertificationDocument2 pagesIdentification Verification Idv CertificationJack DanielsNo ratings yet

- APDU - EMV, APDU Command - Response Parse at Iso8583.infoDocument1 pageAPDU - EMV, APDU Command - Response Parse at Iso8583.infoJack DanielsNo ratings yet

- CMB General TariffDocument29 pagesCMB General TariffJack DanielsNo ratings yet

- 2MP WIFI TF H.265 Camera Module: FeatureDocument1 page2MP WIFI TF H.265 Camera Module: FeatureJack DanielsNo ratings yet

- EU Settlement Scheme EU Other EEA Swiss Citizens and Family MembersDocument236 pagesEU Settlement Scheme EU Other EEA Swiss Citizens and Family MembersJack DanielsNo ratings yet

- 9F26 Tag Is The ARQCDocument1 page9F26 Tag Is The ARQCJack DanielsNo ratings yet

- (Import) Understanding JCOP - Pre-Personalization - Re-Ws - PLDocument1 page(Import) Understanding JCOP - Pre-Personalization - Re-Ws - PLJack DanielsNo ratings yet

- 2MP 38 38 Single Board H.265 Camera Module: FeatureDocument1 page2MP 38 38 Single Board H.265 Camera Module: FeatureJack DanielsNo ratings yet

- 544 Hillside Rd. Redwood City, CA 94062 USA PH: 1.650.260.2387 Fax: 1.650.260.2389Document2 pages544 Hillside Rd. Redwood City, CA 94062 USA PH: 1.650.260.2387 Fax: 1.650.260.2389Jack DanielsNo ratings yet

- (Import) Understanding JCOP - Memory Dump - Re-Ws - PLDocument1 page(Import) Understanding JCOP - Memory Dump - Re-Ws - PLJack DanielsNo ratings yet

- Web Api For Accessing Secure Element: Version 1.0 - September 2016 Globalplatform Device SpecificationDocument22 pagesWeb Api For Accessing Secure Element: Version 1.0 - September 2016 Globalplatform Device SpecificationJack DanielsNo ratings yet

- 4MP H.265 Hisilicon TH84E Module: FeatureDocument1 page4MP H.265 Hisilicon TH84E Module: FeatureJack DanielsNo ratings yet

- Mc200e 2MP H.265 Xz-36e7-MfDocument1 pageMc200e 2MP H.265 Xz-36e7-MfJack DanielsNo ratings yet

- DM52SW DM54SW DM52S3WDocument2 pagesDM52SW DM54SW DM52S3WJack DanielsNo ratings yet

- Obsolete Product (S) - Obsolete Product (S) : Stpay-Js-S8-C - 2Document3 pagesObsolete Product (S) - Obsolete Product (S) : Stpay-Js-S8-C - 2Jack DanielsNo ratings yet

- Parameters For IPG-83H40PL-BDocument5 pagesParameters For IPG-83H40PL-BJack DanielsNo ratings yet

- Elementos Da Acroyoga - 2020Document3 pagesElementos Da Acroyoga - 2020Thiago Rodrigues NascimentoNo ratings yet

- Apush Chapter 7 VocabDocument1 pageApush Chapter 7 VocabSarahNo ratings yet

- HISTORY Print ReadyDocument27 pagesHISTORY Print ReadyAyush GaurNo ratings yet

- Distilleria Vs CADocument2 pagesDistilleria Vs CAjdg jdgNo ratings yet

- Timeline CLKDocument18 pagesTimeline CLKHamza BouNo ratings yet

- En 55022Document3 pagesEn 55022rosebifNo ratings yet

- DriverDocument41 pagesDriverJoseph JohnstonNo ratings yet

- Ellipses Powerpoint D. GrantDocument15 pagesEllipses Powerpoint D. GrantDeborahNo ratings yet

- Environmental Ethics: Submitted byDocument17 pagesEnvironmental Ethics: Submitted byMeika KuruhashiNo ratings yet

- People Vs GuzonDocument9 pagesPeople Vs GuzonTashi MarieNo ratings yet

- Peer and Technical Review Guideline April 2009Document27 pagesPeer and Technical Review Guideline April 2009afr5364No ratings yet

- Chapter 5 - GasesDocument72 pagesChapter 5 - GasesAmbar WatiNo ratings yet

- NSW Government Gazette, 20 July 2021, Number 331 "Health and Education"Document4 pagesNSW Government Gazette, 20 July 2021, Number 331 "Health and Education"clarencegirlNo ratings yet

- Dayagbil, Escano, Sabdullah, Villablanca EH 406 TAX 1 December 16, 2017Document4 pagesDayagbil, Escano, Sabdullah, Villablanca EH 406 TAX 1 December 16, 2017Vanda Charissa Tibon DayagbilNo ratings yet

- Gambling in IndiaDocument12 pagesGambling in Indialimd4931No ratings yet

- Not PrecedentialDocument12 pagesNot PrecedentialScribd Government DocsNo ratings yet

- King V Hludzenski DecisionDocument9 pagesKing V Hludzenski DecisionpandorasboxofrocksNo ratings yet

- CASE DIGESTS Selected Cases in Pub. Corp. Dela Cruz Vs Paras To Miaa Vs CADocument10 pagesCASE DIGESTS Selected Cases in Pub. Corp. Dela Cruz Vs Paras To Miaa Vs CAErica Dela Cruz100% (1)

- Professional Ethics GABBYDocument193 pagesProfessional Ethics GABBYadeola tayoNo ratings yet

- Comparative Police SystemDocument9 pagesComparative Police SystemBimboy CuenoNo ratings yet

- Arizona v. California, 439 U.S. 419 (1979)Document25 pagesArizona v. California, 439 U.S. 419 (1979)Scribd Government DocsNo ratings yet

- River Valley News Shopper, October 17, 2011Document40 pagesRiver Valley News Shopper, October 17, 2011Pioneer GroupNo ratings yet

- Babcock v. Jackson, 12 N.Y.2d 473 (1963)Document15 pagesBabcock v. Jackson, 12 N.Y.2d 473 (1963)Jovelan V. EscañoNo ratings yet

- People Vs LegaspiDocument7 pagesPeople Vs LegaspistrgrlNo ratings yet

- RodriguezDocument1 pageRodriguezMark Adrian ArellanoNo ratings yet

- Rcpi Vs Verchez 2006Document3 pagesRcpi Vs Verchez 2006Baldr BringasNo ratings yet

- LLM Construction Law Arbitration Adjudication Handbook 2011-12Document36 pagesLLM Construction Law Arbitration Adjudication Handbook 2011-12paulgaynhamNo ratings yet