Professional Documents

Culture Documents

Class Example 2

Class Example 2

Uploaded by

TsekeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class Example 2

Class Example 2

Uploaded by

TsekeCopyright:

Available Formats

Class Example 2 - Solution

This is a contract in which performance obligation is satisfied over time. The entity is carrying out the

work for the benefit of the customer rather creating an asset for its own use and in this case has an

enforceable right to receive consideration for work completed to date. We can see this from the fact

that certificate of work completed have been issued.

IFRS 15 states that the amount of payment that the entity is entitled correspond to the amount of

work completed to date (ie goods/ services transferred) which approximate to cost incurred in

satisfying performance obligation plus a reasonable profit margin.

In this case the contract is certified as 50% complete, measuring progress under the output method.

At 31 December 2022, the entity would have recognised a cumulative revenue of R7 500 000 and

cost of sales of R6 000 000, leaving profit of R1 500 000. The contract asset will be R7 500 000 on a

condition that the remaining work is completed, the other R7 500 000 will be classified as accounts

receivable as there no more conditions attached since work has been completed.

You might also like

- African Holistic Health - Llaila o Afrika PDFDocument305 pagesAfrican Holistic Health - Llaila o Afrika PDFGnostic the Ancient One93% (181)

- 11Document137 pages11Alex liao100% (1)

- Payment Procedures Under The RIAI Form of Contract and The PublicDocument12 pagesPayment Procedures Under The RIAI Form of Contract and The PublicAbd Aziz MohamedNo ratings yet

- ch18 PDFDocument44 pagesch18 PDFerylpaez67% (9)

- IFRS 15 - RevenueDocument44 pagesIFRS 15 - RevenueEXAM RASWANNo ratings yet

- Accounting Seminar - Assignment CH 10 (Doni Rahmad & Fachriza Mizafin)Document5 pagesAccounting Seminar - Assignment CH 10 (Doni Rahmad & Fachriza Mizafin)Kazuyano DoniNo ratings yet

- Question On IFRS 15Document2 pagesQuestion On IFRS 15Adeleke TemitayoNo ratings yet

- SAP RAR Use Case Scenarios04 08Document8 pagesSAP RAR Use Case Scenarios04 08Jignesh Vasa100% (1)

- @2015 IFA II CH 5 - Revenue RecognitionDocument98 pages@2015 IFA II CH 5 - Revenue Recognitiongenenegetachew64No ratings yet

- 11 10 PDF FreeDocument137 pages11 10 PDF FreeKristenNo ratings yet

- Engage - Revenue Recognition-1Document129 pagesEngage - Revenue Recognition-1Johhahawie jajwiNo ratings yet

- Module 1 Accounting ReportDocument12 pagesModule 1 Accounting ReportLovely Joy SantiagoNo ratings yet

- Ac08605 - Revenue From Contracts With CustomersDocument30 pagesAc08605 - Revenue From Contracts With CustomersWilie MichaelNo ratings yet

- Cfas Revenue Recognition - StudentsDocument41 pagesCfas Revenue Recognition - StudentsMiel Viason CañeteNo ratings yet

- 13) IFRS-15 RevenueDocument34 pages13) IFRS-15 Revenuemanvi jainNo ratings yet

- CFAS Unit 1 - Module 5.1Document11 pagesCFAS Unit 1 - Module 5.1Ralph Lefrancis DomingoNo ratings yet

- Corporate Reporting Homework (Day 1)Document9 pagesCorporate Reporting Homework (Day 1)Sara MirchevskaNo ratings yet

- Revenues From Contracts With CustomersDocument8 pagesRevenues From Contracts With CustomersSandia EspejoNo ratings yet

- 7 - Long-Term Construction ContractsDocument6 pages7 - Long-Term Construction ContractsDarlene Faye Cabral RosalesNo ratings yet

- Unit VIII Accounting For Long Term Construction ContractsDocument8 pagesUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveNo ratings yet

- As 9 - Revenue Recognition: Presented by Pooja Duggal Saloni Chellani Prerna Choudhary Punnet Hemdev Apurva AkhilDocument15 pagesAs 9 - Revenue Recognition: Presented by Pooja Duggal Saloni Chellani Prerna Choudhary Punnet Hemdev Apurva AkhilPuneet HemdevNo ratings yet

- Acca Ifrs 15Document19 pagesAcca Ifrs 15Ittihadul islamNo ratings yet

- SBR 2020-21 MCQ Progress Test 2 AnswersDocument11 pagesSBR 2020-21 MCQ Progress Test 2 AnswersA JamelNo ratings yet

- 02 - LTCCDocument20 pages02 - LTCCfaye margNo ratings yet

- CR Mock 03.11.2022Document7 pagesCR Mock 03.11.2022George NicholsonNo ratings yet

- 1 Modul - Accounting IntermediateDocument30 pages1 Modul - Accounting IntermediatepastadishéNo ratings yet

- KsadsadsDocument3 pagesKsadsadsKenneth Bryan Tegerero Tegio0% (1)

- Ias 15Document23 pagesIas 15Harsh KhandelwalNo ratings yet

- ACC2001 Lecture 1Document49 pagesACC2001 Lecture 1michael krueseiNo ratings yet

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaNo ratings yet

- Revenue From Contracts With Customers: (IFRS 15)Document34 pagesRevenue From Contracts With Customers: (IFRS 15)yonas alemuNo ratings yet

- IAS 11 Construction Contracts Summary With Example p4gDocument4 pagesIAS 11 Construction Contracts Summary With Example p4gvaradu1963No ratings yet

- IFRS 15-1 Five Steps ModelDocument59 pagesIFRS 15-1 Five Steps ModelJIAYING LIUNo ratings yet

- IFRS 15 - Revenue From Contracts With CustomersDocument12 pagesIFRS 15 - Revenue From Contracts With CustomersJoice BobosNo ratings yet

- Reviewer in Revenue and Expense RecognitionDocument7 pagesReviewer in Revenue and Expense RecognitionPaupauNo ratings yet

- Topic 3 Long-Term Construction Contracts ModuleDocument20 pagesTopic 3 Long-Term Construction Contracts ModuleMaricel Ann BaccayNo ratings yet

- Accounting Theory - Revenue RecognitionDocument5 pagesAccounting Theory - Revenue RecognitionHeather Hudson100% (1)

- AffDocument69 pagesAffdishanialahakoonNo ratings yet

- 04 Revenue s20 FinalDocument90 pages04 Revenue s20 FinalKatlego BafanaNo ratings yet

- A Study On Contract Costing: Project ReportDocument7 pagesA Study On Contract Costing: Project ReportAŋoop KrīşħŋặNo ratings yet

- Assurance Unit 3Document11 pagesAssurance Unit 3hyojin YUNNo ratings yet

- Revenue From Contracts With Customers (Ind As-115) : Applicable From May 2019 Exam OnwardsDocument5 pagesRevenue From Contracts With Customers (Ind As-115) : Applicable From May 2019 Exam OnwardsVM educationzNo ratings yet

- Chapter 11. RevenueDocument62 pagesChapter 11. RevenueАйбар КарабековNo ratings yet

- PFRS 15Document3 pagesPFRS 15Micaella DanoNo ratings yet

- IFRS 15 Examples and ExercisesDocument10 pagesIFRS 15 Examples and ExercisesYami Heather0% (1)

- Midterm 138 - BDocument6 pagesMidterm 138 - BJoyce Anne IgotNo ratings yet

- Revenue Ifrs 15Document24 pagesRevenue Ifrs 15kimuli FreddieNo ratings yet

- HKAS 37 ProvisionsDocument46 pagesHKAS 37 Provisionssalinik328No ratings yet

- Chapter 38 Revenue From Contracts With CustomersDocument10 pagesChapter 38 Revenue From Contracts With CustomersEllen MaskariñoNo ratings yet

- Financial Reporting: IAS 11 - Construction ContractsDocument6 pagesFinancial Reporting: IAS 11 - Construction ContractsazmattullahNo ratings yet

- Module 1-LIABILITIES and PREMIUM LIABILITYDocument10 pagesModule 1-LIABILITIES and PREMIUM LIABILITYKathleen SalesNo ratings yet

- Materi PPL Psak 72Document67 pagesMateri PPL Psak 72Anthony FeryantoNo ratings yet

- Lesson 9 Long Term ConstructionDocument13 pagesLesson 9 Long Term ConstructionheyheyNo ratings yet

- Accounting Quick Update - IFRS 16 - Leases and IFRS 15 - RevenueDocument50 pagesAccounting Quick Update - IFRS 16 - Leases and IFRS 15 - RevenueTAWANDA CHIZARIRANo ratings yet

- BSA 3101 Topic 3A - Revenue From ContractsDocument14 pagesBSA 3101 Topic 3A - Revenue From ContractsDerek ShepherdNo ratings yet

- Aks 2023 - 2024 - Far 4 - Day 1Document8 pagesAks 2023 - 2024 - Far 4 - Day 1John Carl TuazonNo ratings yet

- MODULE 8 (Part 2)Document6 pagesMODULE 8 (Part 2)trixie maeNo ratings yet

- Revenue From Contracts With Customers - IFRS 15Document5 pagesRevenue From Contracts With Customers - IFRS 15Joice BobosNo ratings yet

- Facr-Test Ifrs-15Document4 pagesFacr-Test Ifrs-15James MartinNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- King Code Presentation - Principles 2Document28 pagesKing Code Presentation - Principles 2TsekeNo ratings yet

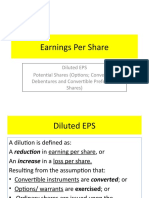

- 3.earnings Per ShareDocument13 pages3.earnings Per ShareTsekeNo ratings yet

- IAS 8 - Homework QuestionsDocument2 pagesIAS 8 - Homework QuestionsTsekeNo ratings yet

- Contract ModificationsDocument16 pagesContract ModificationsTsekeNo ratings yet

- 2020 DT Notes RevisionDocument7 pages2020 DT Notes RevisionTsekeNo ratings yet

- Class Examples 3Document6 pagesClass Examples 3TsekeNo ratings yet

- CAATSDocument2 pagesCAATSTseke0% (1)

- Audit of Inventory and Warehousing CycleDocument6 pagesAudit of Inventory and Warehousing CycleTsekeNo ratings yet

- 05 Current Taxation s19 FinalDocument29 pages05 Current Taxation s19 FinalTsekeNo ratings yet

- Auditing 4 NotesDocument2 pagesAuditing 4 NotesTsekeNo ratings yet

- Minorities in IraqDocument272 pagesMinorities in IraqTsekeNo ratings yet