Professional Documents

Culture Documents

36 (1) (Vii) and 36 (1) (Viia) Debts Written Off by Banks

36 (1) (Vii) and 36 (1) (Viia) Debts Written Off by Banks

Uploaded by

kavita.m.yadavOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

36 (1) (Vii) and 36 (1) (Viia) Debts Written Off by Banks

36 (1) (Vii) and 36 (1) (Viia) Debts Written Off by Banks

Uploaded by

kavita.m.yadavCopyright:

Available Formats

www.taxguru.

in Assessment

Urban Bad Debts Write-off by Banks: A Ticklish

Issue

Dr. Shakir Hussain Shaik

(IRS: 1992)

CIT (AU), Kurnool, AP

Deputation from 2010 - 2013, as Chief Executive

Dr. Shakir Hussain Shaik is 1992 batch of IRS officer, Central Haj Committee, Bombay and

officer, currently posted as CIT (Appeals), Kurnool, completely stream lined the Haj administration,

Andhra Pradesh. During his service, he has worked introduced transparent selection and training of

in various capacities in Assessment, Investigation, Haj Prilgrims. He has vast experience in the area

Headquarters, Transfer Pricing etc. He was on of Appeals from 2015 to till date.

Executive Summary

A mere provision for bad and doubtful debt(s) is not allowed as a deduction in the computation of taxable

profits. In order to promote rural Banking, the Clause 36(1)(viia) was inserted by the Finance Act 1979 (w.e.f

1-4-1980) to provide for a deduction for Provision for Bad and Doubtful Debts (PBDD), in respect of rural

provisions only. The clause (viia) was distinct and independent of clause (vii) at that stage and banks were

allowed double deduction in respect of rural provisions once at the provision stage under Section (viia) and

again at the write-off stage under Section (vii).

The common practice is that the Banks (having both rural and urban branches) claim deduction for PBDD

under Section 36(1)(viia) and maintain single provision account under Section 36(1)(viia). However, the Banks

debit only the rural bad debts write off and do not debit urban bad debts write off to the provision account.

The Banks create an artificial illusion that they are fully complying with the first proviso to Clause 36(1)(vii) and

Clause 36(2)(v) before the tax authorities and get away with it.

After the insertion of first proviso to Clause 36(1)(vii) and Clause 36(2)(v) in 1985, the Clause 36(1)(viia) is not

distinct and independent of Clause 36(1)(vii) and therefore no separate deduction under each clause.

The deduction allowed for PBDD is only a lump sum figure calculated on the basis of formula specified under

Section 36(1)(viia)(a). It is not advances wise/ debtor wise. It could be in fractions as per the formula and the

method of computation prescribed under Rule 6ABA. To prevent double deduction, it is absolutely necessary

to maintain single provision account in respect of both rural and urban provisions and debit both urban and

rural bad debt write-off to the provision account by the banks (especially with both urban and rural branches).

The claim of the banks that the deduction allowed for the PBDD under Clause 36(1)(viia) is entirely for rural

provisions is based on old law as existed from 1979 to 1985 only. Much water has flown down the Ganges. The

time has come to shake them from the cosy comfort of enjoying such double deductions.

Taxalogue April-June 2021 39

Assessment

www.taxguru.in

GENERAL INTRODUCTION Section 36(1)(viia). However, the banks

The issue of deduction for bad debts write-off is debit only the rural bad debts write-off to

an important issue in the assessments/ appeals the provision account. The banks create an

of all the public sector and private sector banks artificial illusion that they are fully complying

having both urban and rural branches. It is with the first proviso to Section 36(1)(vii) and

common knowledge that urban bad debts write- 36(2)(v). Such Banks do not debit urban bad

off constitute a large chunk, while rural bad debts write-off under Section 36(1)(vii) to

debts write-off constitute a minuscule portion of the provision account. The argument of the

the total bad debts write-off by any bank having banks is that the deduction allowed under

both rural and urban branches. The banks Section 36(1)(viia) is for rural provisions

routinely claimed double deduction of urban only, which is totally misconceived as

bad debts write-off and was also allowed by the explained in the paragraphs below. In effect,

Department as the issue is less understood in the banks are claiming deduction twice in

the Department. Thus, it is observed that many the case of urban bad debts write-off—once

banks take undue advantage of the complex

at the provision stage under Section 36(1)

provisions—the first proviso to Sections 36(1)

(viia) and again at the write-off stage under

(vii), 36(1)(viia) and 36(2)(v).

Section 36(1)(vii) without first debiting the

1.1 Normally, the banks claim deduction for the provision account under Section 36(1)(viia).

provisions for bad and doubtful debts (PBDD)

under Section 36(1)(viia)(a).The banks also ILLUSTRATION

claim deduction for bad debts write-off under

Section 36(1)(vii). To prevent such double To understand the above legal clauses and the

deduction, first proviso to Section 36(1) issue involved, consider the following example:

(vii) and 36(2)(v) was introduced by the

2.1 A bank (having both rural and urban

Finance Act,1985. Accordingly, the assesses

branches),during the AY 2013–14:

claiming deduction under Section 36(1)

(viia) are required to maintain one single a. The bank made rural advances of Rs

provision account under Section36(1)(viia). 1500 Cr. The outstanding rural aggregate

As per the first proviso to Section 36(1)(vii), average advances (AAA) at the end of

the deduction for bad debts write-off under the year (including earlier year advances

Section 36(1)(vii) for the assessees who of Rs. 3500 Cr) was Rs. 5000 Cr.

claim deduction for PBDD under Section

36(1)(viia), shall be limited to the amount b. The income of the bank before claiming

by which such bad debts exceeds the credit deductions under Section 36(1)(viia) and

balance in the provision account under Chapter VI A was Rs. 1000 Crore.

Section 36(1)(viia).

c. The deduction for PBDD under Section

1.2 The common practice is that the banks(having 36(1)(viia)(a) allowed to the bank till

both rural and urban branches) claim AY 2012–13 was Rs. 2000 Cr. Thus, the

deduction for provision for bad and doubtful opening credit balance in the provision

debts (PBDD) under Section 36(1)(viia) and account under Section 36(1)(viia)(a) was

maintain single provision account under Rs. 2000 Crore.

40 April-June 2021 Taxalogue

www.taxguru.in Assessment

d. In its books, bank made provision for bad 10% of AAA (10% x 5000) = 510

and doubtful debts (PBDD)of Rs. 920 Cr

7.5% of total income (7.5%x1000)=75

(830 Cr urban + 90 Cr rural) and debited

to the Profit & Loss Account. Total: 575 Cr

e. The bank claimed deduction for PBDD The provision for bad and doubtful debts

under Section 36(1)(viia)(a) of Rs. 575 debited to the Profit & Loss Account is

Cr in the computation. Rs. 920 Cr (830 Cr for urban debts

+ 90 Cr for rural debts). As per 36(1)(viia),

f. Total bad debts write-off during the year

the provision in the books of accounts can

was Rs. 882 Cr (Rs 880 Cr urban +

be in relation to any debts - not necessarily

Rs. 2 Cr rural)and claimed deduction

in respect of rural advances. Therefore, the

under Section 36(1)(vii) of Rs. 880 Crin

Bank is eligible for deduction of Rs 575 Cr

the computation.

under Section 36(1)(viia)(a).

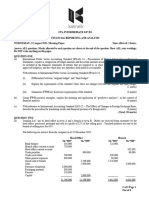

g. The bank’s computation of income is as

B. Deduction under Section 36(1)(vii)

under:

In the computation of income, the Bank

(Rs in Crores)

claimed deduction of Rs 880 Cr for urban

Net profit as per 1000

P&L bad debts write-off under Section 36(1)(vii).

Add: provisions for 920 Since, the Bank is claiming deduction under

bad debts Section 36(1)(viia), it is required to maintain

Less: Deduction 10% of AAA (10% 575 one provision account under Section 36(1)

under Section x 5000)+ 7.5% of (viia) in view of the 36(2)(v). Further, in

36(1)(viia)(a) total income (7.5%

x 1000) view of the first proviso to 36(1)(vii), the

Less: Deduction 880 Cr (Urban 880 deduction for bad debts write-off under

under Section debts) Section 36(1)(vii) for the assessees who

36(1)(vii) claim deduction under Section 36(1)(viia),

Taxable income 465 shall be limited to the amount by which such

2.2 Whether the deduction claimed under bad debts exceeds the credit balance in the

Section 36(1)(viia)(a) and under Section provision account under Section 36(1)(viia).

36(1)(vii) is correct? The Bank’s provision account under Section

36(1)(viia) for AY 2013–14 was as under:

In the computation of income, the provision

of Rs. 920 Cr was added back to the taxable Provision Account under Section 36(1)(viia)

for AY 2013–14

income. The deduction for the PBDD was

(Rs in Crores)

claimed under Section 36(1)(viia) amounting

Rural bad debts 2 Opening

to Rs. 575 Cr being the amount eligible as written-off under balance

per the formula under Section 36(1)(viia) Section 36(1)(vii)

(a). 2000

Provision 575

2.3 Solution: allowed

during the

A. Deduction under Section 36(1)(viia)(a) year

Eligible amount of deduction under Closing balance 2573

Section 36(1)(viia)(a) works out as under: Total 2575 Total 2575

Taxalogue April-June 2021 41

Assessment

www.taxguru.in

In view of the first proviso to Section 36(1)(vii), the debt(s) relating to rural advances made. The

Bank should have debited both rural and urban deduction is limited to a specified percentage

bad debts write-off to the provision account first. of the aggregate average advances made by

Only bad debts in excess of the credit balance in the rural branches computed in the manner

the provision account under Section 36(1)(viia) prescribed by the IT Rules, 1962.

should be allowed as deduction under Section

3.2 The deduction under Section 36(1)(viia)

36(1)(vii). In this case, the bank debited only the

was initially intended solely for provision made

rural bad debts write-off (2 Cr) to the provision

for bad and doubtful debts in respect of rural

account under Section 36(1)(viia). The urban

advances made by rural branches where risk

bad debts write-off (880 Cr) was not debited to

of non-recovery was greater. Initially, when the

the provision account under Section 36(1)(viia).

clause was introduced, it was meant for only

Since, the bad debt write-off doesn’t exceed

Scheduled Banks, which was gradually extended

the credit balance in the provision account, the over a period of time to other entities. As the

deduction of Rs. 880 Cr is not allowable. provisions stand today, under Section36(1)(viia),

3. What is the relationship between there are four clauses which are applicable to:

Clause 36(1)(viia) and Clause 36 (1) • 36(1)(viia)(a): Scheduled & Non-

(vii)? Scheduled and Cooperative banks

In order to understand the critical issue of • 36(1)(viia)(b): Foreign Banks

deduction under Clause 36(1)(viia)(a) and its

relationship with Clause 36(1)(vii), it is necessary • 36(1)(viia)(c): Public Financial institutions

to understand the background of Clause 36(1) etc.

(viia), which is mentioned along with the relevant • 36(1)(viia)(d): NBFC

circulars in the paragraphs below:

3.3 The Gist of the Amendments to Clause

3.1 Background of Clause 36(1)(viia) 36(1)(viia)

Any assessee carrying on business is entitled to The gist of amendments and main features

a deduction under Section 36(1)(vii) of the IT are summarized in the following Table 1:

Act, 1961 of the amount of any debt which is

3.4 Double Deduction Allowed for Rural

written-off as bad debt during the previous year,

Advances Only - Finance Act 1979

in the computation of taxable profits subject to

certain conditions. However, a mere provision The Clause 36(1)(viia) was first Introduced by

for bad and doubtful debt(s) is not allowed as a the Finance Act, 1979 w.e.f. 01 April1980 and

deduction in the computation of taxable profits. at the time of its insertion, this clause reads as

However, in order to promote rural banking under:

and to assist the scheduled commercial banks in ‘(viia) in respect of any provision for bad

making adequate provisions from their current and doubtful debts made by a scheduled

profits to provide for risks in relation to their rural Bank in relation to the advances made

advances, the Finance Act 1979, w.e.f. 01 April by its rural branches, an amount not

1980inserted Clause 36(1)(viia) to provide for a exceeding one and a half per cent of the

deduction, in the computation of taxable profits aggregate average advances made by such

of all scheduled commercial banks, in respect of branches, computed in the prescribed

provisions made by them for bad and doubtful manner.

42 April-June 2021 Taxalogue

www.taxguru.in Assessment

Table 1

Gist of Amendment & Requirement of Limits of Deduction Remarks

Year Provision

Finance Act, 1979 Provision in relation to the not exceeding 1.5% of Applicable to rural

(w.e.f.01 April 1980) rural advances only. AAA* branches of scheduled

Banks only

Any provision for bad and

doubtful debts (PBDD)#

made in relation to the

rural advances

Finance Act, 1982 Same as above Same as above Extended to rural branches

of Non-scheduled Banks

Same as above

also

Finance Act, 1985 Provision can be in relation not exceeding 2% of AAA Proviso to Section

(w.e.f.01 April 1985) to any debt- not necessary 36(1)(vii) and 36(2)(v)

OR

to be in relation to rural simultaneously introduced

The PBDD had to be

advances only not exceeding 10% of total to prevent double

created and debited to the

income** deduction

P&L a/c

Whichever is higher

IT (Amendment) Provision can be in relation not exceeding 2% of AAA*

Act, 1986 w.e.f 01 to any debt- not necessary

+

April1987. to be in relation to rural

advances only. not exceeding 5% of total

Substituted the present

income**

Clause (viia) for the one as

substituted by the Finance

Act, 1985.

Finance Act, 2013 Same as above not exceeding 10% of Explanation 2 was inserted

AAA* - the account referred to in

proviso to Section 36(1)

+

(vii) & 36(2)(v) shall be

not exceeding 7.5 % of only one account

total income**

Finance Act, 2017 Same as above not exceeding 10% of not exceeding 8.5 % of

AAA* total income**

+

not exceeding 8.5 % of

total income**

* AAA stands for aggregate average advances of rural branches

** total income (computed before making any deduction under Section 36(1)(viia)&Ch VIA)

# PBDD stands for Provision for Bad and doubtful debts

The CBDT vide its circular no. 258 of 14th June, conscious decision to allow double deduction to

1979 clarified that this section is independent of promote rural banking as explained in the CBDT

Section 36(1)(vii) and the banks would continue circular, which is incorporated below:

to get full benefit of write-off under Section 36(1) CBDT Circular No. 258 dated 14.06.1979

(vii) in addition to the provision for bad and

‘Deduction in respect of provisions made

doubtful debts under Section 36(1)(viia). At that for bad and doubtful debts relating to rural

stage, the provision was required to be made branches of scheduled commercial banks -

only in relation to the rural advances. It was a Sec. 36(1)(viia)

Taxalogue April-June 2021 43

Assessment

www.taxguru.in

13.1 Under Section 36(1)(vii) of the IT 1959, a nationalised Bank as specified in

Act, a taxpayer carrying on business or Section 3 of the Banking Companies

profession is entitled to a deduction, in the (Acquisition and Transfer of Undertakings)

computation of the taxable profits, of the Act, 1970 or any other Bank included in

amount of any debt which is established to the Second Schedule to the Reserve Bank

have become bad during the previous year, of India Act, 1934. It may be mentioned

subject to certain conditions. However, that all co-operative banks have been

a mere provision for bad and doubtful excluded from the purview of this provision

debts is not allowed as a deduction in the in view of the position that under Section

computation of the taxable profits. 80P(2)(a)(i) of the IT Act, the profits and

gains of a co-operative society engaged in

13.2 In order to promote rural Banking the business of Banking or providing credit

and assist the scheduled commercial facilities to its members are completely

banks in making adequate provisions from exempt from income-tax.

their current profits to provide for risks

13.3 It may be relevant to mention that the

in relation to their rural advances, the

provisions of new cl. (viia) of s. 36(1) relating

Finance Act has inserted a new cl. (viia) in

to the deduction on account of provisions

sub-s. (1) of s. 36 of the IT Act to provide

for bad and doubtful debts is distinct

for a deduction, the computation of the

and independent of the provisions

taxable profits of all scheduled commercial

of Section 36(1)(vii) relating to

banks, in respect of provisions made by

allowance of the bad debts. In other

them for bad and doubtful debts relating

words, the scheduled commercial banks

to advances made by the rural branches. would continue to get the full benefit of the

The deduction will be limited to 1-1/2 per write-off of the irrecoverable debts under

cent of the aggregate average advances s. 36(1)(vii) in addition to the benefit of

made by the rural branches computed in deduction of the provision for bad and

the manner to be prescribed by rules in the doubtful debts under Section 36(1)(viia).

IT Rules, 1962. For this purpose, a “rural

branch” means a branch of a scheduled 13.4 This provision will take effect from

Bank situated in a place with a population 1st April, 1980 and will accordingly apply

not exceeding 10,000 according to the last in relation to the asst. yr. 1980–81 and

subsequent years.’

preceding census of which the relevant

figures have been published before the first In other words, in respect of rural advances,

day of the previous year. The expression the double deduction was allowed—once at

“scheduled Bank” has the same meaning as the stage of provision @1.5% of aggregate

in the Explanation below s. 11(2)(b) of the average advances (AAA) of rural branches and

IT Act but does not include a co-operative again at the stage of write-off of rural advances

Bank. The expression “scheduled Bank” under Section 36(1)(vii). The crucial issue which

would, therefore, cover the State Bank of should be kept in mind is that at the stage of

India constituted under the State Bank of first introduction of the clause, the PBDD had to

India Act, 1955, any subsidiary Bank of the be made only in respect of rural advances and

State Bank of India as defined in the State therefore,deduction under Section 36(1)(viia)

Bank of India (Subsidiary Banks) Act, was also in respect of rural advances.

44 April-June 2021 Taxalogue

www.taxguru.in Assessment

3.5 Drastic change - No double deduction incorporated by or under the laws of a

for any advances country outside India] or a non-scheduled

Bank, an amount not exceeding ten per

(i) The Finance Act, 1985, w.e.f. 01 April

cent of the total income (computed before

1985 made following drastic changes:

making any deduction under this clause

• The provision was not required and Chapter VI-A) or an amount not

to be necessarily in relation to rural exceeding two per cent of the aggregate

advances and it can be in relation to average advances made by the rural

any advances of the bank– rural or branches of such banks, computed in the

urban or both. prescribed manner, whichever is higher.”

• The double deduction in respect (iii)Clause 36(1)(vii) and proviso reads as

of any advances (including rural under:

advances which was allowed as per 36. (1) The deductions provided for in

the Finance Act 1979) was stopped the following clauses shall be allowed in

by introducing proviso to Section respect of the matters dealt with therein,

36(1)(vii) and 36(2)(v). in computing the income referred to in

• Section 36(2)(v) requires section 28—

maintenance of one provision …..

account for the deduction allowed

under Section 36(1)(viia). (vii) subject to the provisions of sub-

section (2), the amount of [any bad

• As per the first proviso to 36(1) debt or part thereof which is written off

(vii), the deduction for bad debts as irrecoverable in the accounts of the

write-off under Section 36(1)(vii) for assessee for the previous year]:

the assessees who claim deduction

for PBDD under Section 36(1) [Provided that in the case of [an

(viia), shall be limited to the amount assessee] to which clause (viia) applies,

by which such bad debts exceeds the amount of the deduction relating to

any such debt or part thereof shall be

the credit balance in the provision

limited to the amount by which such debt

account under Section 36(1)(viia).

or part thereof exceeds the credit balance

• Increased the quantum of in the provision for bad and doubtful

deduction to include 2% of AAA or debts account made under that clause:]

10% of total income, (whichever is

(iv) Simultaneously, Clause 36(2)(v) was

higher).

introduced which reads as under:

(ii) The following Clause (viia) was

“Sec. 36(2) In making any deduction for

substituted w.e.f. 01 April 1985:

a bad debt or part thereof, the following

“in respect of any provision for provisions shall apply —

bad and doubtful debts made by

(i) to (iv) .....

a scheduled Bank [not being a Bank

approved by the Central Government (v) where such debt or part of debt relates

for the purposes of cl. (viiia) or a Bank to advances made by an assessee to

Taxalogue April-June 2021 45

Assessment

www.taxguru.in

which cl. (viia) of sub-s. (1) applies, no s. 36(1)(viia) or a Bank incorporated by or

such deduction shall be allowed unless under the laws of a country outside India]

the assessee has debited the amount of or a non-scheduled Bank, an amount not

such debt or part of debt in that previous exceeding ten per cent of the total income

year to the provision for bad and doubtful (computed before making any deduction

debts account made under that clause.” under the proposed new provision) or

(v) The CBDT in its Circular No. 421 dated two per cent of the aggregate average

12.06.1985 explained the legislative advances made by rural branches of

purpose behind the introduction of proviso such banks, whichever is higher, shall be

to Section 36(1)(vii) and 36(2)(v) which is allowed as a deduction in computing the

reproduced below: taxable profits.

The CBDT Circular No. 421 dated 17.4 Sec. 36(1)(vii) of the Act has also

12.06.1985: been amended to provide that in the case

of a Bank to which s. 36(1)(viia) applies,

“Deduction in respect of provisions made

the amount of bad and doubtful debts

by Banking companies for bad and

shall be debited to the provision for bad

doubtful debts

and doubtful debts account and that the

17.1 Sec. 36(1)(vii) of the IT Act provides deduction admissible under s. 36(1)(vii)

for a deduction in the computation of shall be limited to the amount by which

taxable profits of the amount of any debt such debt or part thereof exceeds the

or part thereof which is established to credit balance in the provision for bad

have become a bad debt in the previous and doubtful debts account.

year. This allowance is subject to the

fulfilment of the conditions specified in 17.5 Sec. 36(2) has been amended by

sub-s. (2) of s. 36. insertion of a new cl. (v) to provide that

where a debt or a part of a debt considered

17.2 Sec. 36(1)(viia) of the IT Act provides bad or doubtful relates to advances made

for a deduction in respect of any provision by a Bank to which s. 36(1)(viia) applies,

for bad and doubtful debts made by a no such deduction shall be allowed unless

scheduled Bank or a non-scheduled Bank the Bank has debited the amount of such

in relation to advances made by its rural debt or part of debt in that previous year

branches, of any amount not exceeding to the provision for bad and doubtful debt

1½ per cent of the aggregate average

account made under cl. (viia) of s. 36(1).”

advances made by such branches.

(vi) Main purpose of proviso to Section

17.3 Having regard to the increasing

36(1)(vii) and 36(2)(v):

social commitments of banks, s. 36(1)

(viia) has been amended to provide that The double deduction in respect of any

in respect of any provision for bad and advances (including rural advances)was

doubtful debts made by a scheduled stopped by the insertion of new provisoand

Bank [not being a Bank approved by the clause. The revenue leakage due to double

Central Government for the purposes of deduction in respect of rural advances was

46 April-June 2021 Taxalogue

www.taxguru.in Assessment

less pre-1985 and therefore, it was allowed (iii) Circular No. 258 dated 14.06.1979- Not

consciously. Post-1985, the provision in the relevant to the present law.

books can be made for urban advances

The amendments made by Finance Act

also and thepossible revenue leakage

1985 stopped double deduction – once at

due to double deduction in respect of

urban advances would have been much the provision stage and again at the write-

more. Therefore, proviso to Clause (vii) off stage. This position continues even

and Clause 36(2)(v) were inserted to stop today. All the banks conveniently fail to

double deduction mainly in respect of take cognizance of this crucial change and

urban advances. However, it was canvassed continue to harp on the CBDT circular no.

by the stakeholders that the new insertion 258 dated 14.06.1979 (which was issued in

was to stop double deduction in respect of connection with the amendments made by

rural advances only (which was allowed pre Finance Act, 1979). When the law itself is

1985).

amended in 1985, there is no reason to rely

3.6 Whether Clause 36(1)(viia) is distinct upon the old circular and old law. At present,

and independent of 36(1)(vii)? the relevant applicable circular is no.421

The banks rely on the CBDT Circular No. 258 dated 12.06.1985 (incorporated above)

dated 14.06.1979 and claim that the Clause wherein it is clarified in clear terms that no

36(1)(viia) is distinct and independent of double deduction is allowed. There is not

Section 36(1)(vii) and therefore they are eligible a single circular or instruction of the CBDT

for deduction under both Clauses 36(1)(viia) after the amendment in 1985, which allows

and 36(1)(vii). The claim of the banks is patently double deduction.

wrong in view of the following:

4 Two Limbs of Eligible Deduction

(i) When the Clause 36(1)(viia) was

introduced by the Finance Act 1979 for the The quantum of eligible deduction underwent

first time, it was distinct and independent of periodic changes and it was increased from

Clause 36(1)(vii) which was also clarified 1.5% to 10% of AAA (present level) and 10%

in the Circular No. 258 dated 14.06.1979. to 8.5% of total income (present level). The

Therefore, in the case of assesses, who claim periodic changes are mentioned below:

deduction for PBDD, the Clause 36(1)(viia)

Finance Act Limits of deduction

is distinct and independent of Section 36(1)

under Section 36(1)

(vii) from 1979to 1985 only. (viia)(a)

Finance Act, 1979 ( w.e.f. Not exceeding 1.5% of

(ii) The first proviso to 36(1)(vii)and 36(2) 1.4.1980) AAA*

(v) were simultaneously introduced by

Finance Act, 1985 (w.e.f Not exceeding 2% of

the Finance Act, 1985. Therefore, w.e.f 1.4.1985) AAA*

01.04.1985, in the case of assesses who OR

claim deduction for PBDD under Section. Not exceeding 10% of

36(1)(viia), the Clause S.36(1)(viia) is not total income**

Whichever is higher

independent of Section .36(1)(vii).

Taxalogue April-June 2021 47

Assessment

www.taxguru.in

IT (Amendment) Act, not exceeding 2% of of a scheduled Bank shall be computed in

1986 w.e.f01 April1987 AAA* the following manner, namely :

+

not exceeding 5% of total (a) the amounts of advances made by

income**

each rural branch as outstanding at

Further changes 4% of AAA + 5% of total

income the end of the last day of each month

Finance Act, 2013 not exceeding 10% of comprised in the previous year shall be

AAA* aggregated separately ;

+

(b) the sum so arrived at in the case of

not exceeding 7.5 % of

each such branch shall be divided by

total income**

Finance Act, 2017 not exceeding 10% of

the number of months for which the

AAA* outstanding advances have been taken

+ into account for the purposes of clause(a);

not exceeding 8.5 % of (c) the aggregate of the sums so arrived

total income**

at in respect of each of the rural branches

* AAA stands for aggregate average advances of rural

shall be the aggregate average advances

branches

** total income (computed before making any deduction made by the rural branches of the

under Section 36(1)(viia)&Ch VIA) scheduled Bank.

# PBDD stands for Provision for Bad and doubtful debts

Explanation : In this rule, “rural branch” and

4.1 First limb - 10% of Aggregate average

“scheduled Bank” shall have the meanings

advances (AAA)

assigned to them in the Explanation to clause

As the Clause 36(1)(viia)(a) stand today, the (viia) of sub-section (1) of section 3650.]

Banks are allowed deduction in respect of the

4.2 Second limb - 8.5% of total income

provision made in the books not exceeding 10%

of the aggregate average advances made by the Most of the Scheduled Banks have both rural and

rural branches of such Bank computed in the urban branches. The second limb to determine

manner prescribed in rule 6ABA. It is noteworthy the eligible deduction is-8.5% of total income

to mention that amidst all the above periodic which includes income of both rural and urban

changes in clause 36(1)(viia) over a period of branches. However, it is common knowledge

time, the rule 6ABA remained unchanged even that rural branches do not make much profit in

today since its introduction w.e.f 01.04.1980. view of the very nature of the business activities

Not a comma or word was added/deleted/ of rural branches as compared to the urban

substituted in this rule which reads as under: branches.

[Computation of aggregate average 5. Is calculation of eligible deduction @

advances for the purposes of clause 10% of AAA is an incentive?

(viia) of sub-section (1) of section 36.

The banks claim that Clause 36(1)(viia) is an

6ABA. For the purposes of clause (viia) of incentive clause and if it is interpreted that the

sub-section (1) of section 36, the aggregate banks have to adjust both the rural and urban

average advances made by the rural branches advances write-off against the provision allowed

under Section 36(1)(viia), then there is no

48 April-June 2021 Taxalogue

www.taxguru.in Assessment

incentive. They further claim that even without advances made during the year are very

claiming any deduction under Section.36(1) less as compared to the total outstanding

(viia), the banks can claim deduction under balances. However, the deduction is allowed

Section 36(1)(vii) in respect of write-off of as per the AAA on the basis of outstanding

debts and allowing a deduction slightly ahead balances at the end of the year which

of write-off stage is not an incentive perse. Let includes earlier years’ advances and not

us examine the claim in the light of the relevant on the basis of rural advances made during

rules and factual position. the year alone. The figures in column D are

worked out on the basis of total outstanding

5.1 As the Clause 36(1)(viia)(a) stand today,

AAA and the figures in column E are worked

the banks are allowed deduction in respect

out on the basis of incremental advances

of the provision made in the books not

made during the year.

exceeding 10% of the aggregate average

advances made by the rural branches of 5.3 Thus, the extra eligible deduction under

such bank computed as per Rule 6ABA. The Section 36(1)(viia)(a) in “column F” in the

outstanding aggregate average advances are above table on the basis of outstanding

calculated including rural advances made balances (including earlier years’ advances)

during the year and the rural advances is nothing but huge incentive for rural

made in the earlier years. This is a huge Banking.

incentive to promote rural Banking given to

the scheduled Banks and other banks which 5.4 It is also quite interesting to note that a

have both rural and urban branches. The Bank with both rural and urban branches is

following data in respect of a bank clearly entitled for deduction on the basis of AAA

illustrates the incentive nature: outstanding at the end of the year, even if it

has not advanced any fresh rural advances

in Rs. (Crores)

during the year. The only requirement is

AY AAA at the Incremental Deduction Deduction Extra

end of year advance as per as per deduction adequate provision has to be made in the

made during outstanding incremental under

the year AAA @ advance @ Section books in relation to any advances—rural or

10% 10% 36(1)(viia)

(a) over and urban or both.

above the

advances

made during 5.5 Apart from that, even if no provision is made

the year as

incentive in the books in respect of rural advances and

A B C D E F= D-E no fresh rural advances are made during the

2011- 2895 - - - -

year, deduction @ 10% of AAA would still

12

2012- 3593 698 359.3 69.8 289.5

be available (on the basis of outstanding

13 AAA of earlier years), if adequate provision

2013- 5109 1516 510.9 151.6 359.3 was made in the books for urban advances.

14

2014- 7373 2264 737.3 226.4 510.9 5.6 Further, even if a bank which has both rural

15 and urban branches will get its deduction for

2015- 8596 1223 859.6 122.3 737.3 provision made in the books under Section

16

36(1)(viia)(a), even if the total income

5.2

The above data shows that the rural is NIL/ loss on the basis of 10% of AAA

Taxalogue April-June 2021 49

Assessment

www.taxguru.in

subject to the provision made in the books income (computed before making

of accounts. However, the banks with only any deduction under this clause and

urban branches will not get deduction for Chapter VIA) and an amount not

the provision made, if there is no income. exceeding 17[ten] per cent of the

aggregate average advances made

5.7 The above discussion makes it crystal clear by the rural branches of such Bank

that the calculation of AAA of rural advances computed in the prescribed manner :

(as per Rule 6ABA) and deduction for PBDD

in respect of any provisions—rural, urban or 6.2 The deduction under Section 36(1)(viia)(a)

both as per the limits of clause 36(1)(viia) is subject to the provision made in the books

(a)-give huge incentive to promote rural of accounts in respect of any advances

Banking. made and subject to the eligible amount as

per the formula prescribed under Section

6. Deduction allowed under Section 36(1) 36(1)(viia)(a).

(viia)(a) is not a standard deduction

• If no provision made in the books, then no

Let us examine, whether deduction under deduction under Section 36(1)(viia)(a) is

Section 36(1)(viia)(a) is a standard deduction allowed whatever may be the eligibility.

(without any conditions attached) allowable

• If the provision made in the books is less

to all select assesses mentioned in the relevant

than its eligibility, then the deduction will

clauses? The answer is -the deduction allowed

be allowed only to the extent of provision

under Section 36(1)(viia)(a) is not a standard

made in the books.

deduction as in the case of House property

income, wherein 30% of annual value is allowed • If the provision made in the books is more

as deduction under Section24 of IT Act without than its eligibility, then the deduction will

any conditions attached. be restricted to the extent of eligibility.

6.1 The deduction is subject to the fulfillment • After 1985, provision in books is not

of certain conditions under the clause 36(1) required to be in relation to only rural

(viia)(a), which is reproduced below: advances and it can be in relation to any

advances - rural, urban or both.

(viia) [in respect of any provision for bad and

doubtful debts made by— • Deduction is applicable to only select

assesses mentioned.

(a) a scheduled Bank [not being 14[* *

*] a Bank incorporated by or under 7. What is the character of the deduction

the laws of a country outside India] allowed under Section 36(1)(viia)(a)—Is it

or a non- scheduled Bank 15[or for rural or urban provisions ?

a co-operative Bank other than a The banks often quote few lines out of context

primary agricultural credit society or from decision of the Hon’ble Supreme Court in

a primary co-operative agricultural the case of Catholic Syrian Bank 343 ITR 270

and rural development Bank], an (SC)and submit that in the case of banks with

amount 16[not exceeding 16a[ eight rural branches, the deduction under Clause

and one-half per cent]] of the total 36(1)(viia)(a) is allowed for rural debts only.

50 April-June 2021 Taxalogue

www.taxguru.in Assessment

7.1 In order to appreciate the issue, it is necessary rural and urban advances, then it can be said

to go through the opening lines of Clause that the deduction is allowed for both rural

36(1)(viia)(a) again which are reproduced and urban provisions subject to the limits

below: laid down under Section 36(1)(viia)(a).

36. (1) The deductions provided for in 7.5 In other words, it can’t be said that the

the following clauses shall be allowed in deduction is allowed only for rural provisions,

respect of the matters dealt with therein, in when the provision is made in the books for

computing the income referred to in section both rural and urban advances. Similarly, it

28— can’t be said that the deduction is allowed

(i) … (vii) ... only for urban provisions, when the provision

is made in the books for both for rural and

(viia) [in respect of any provision for bad and urban advances.

doubtful debts made by—

7.6 The Hon’ble Supreme Court decision in the

7.2 The deduction allowed under Section case of Catholic Syrian Bank was delivered

36(1)(viia)(a) is for the provision for the in the context of the assumption that banks

bad and doubtful debts (PBDD) made in would maintain separate PBDD accounts

the books. Therefore, the character of the in respect of rural branches and non-rural

deduction allowed - whether for rural or branches and therefore it is possible to

urban provision - obviously depends on the

discern PBDD as one in respect of rural

provision made in the books. The simple test

branches and non-rural branches. The

to determine whether deduction allowed is

Hon’ble Supreme Court in that case never

for rural or urban provisions is –to see how

held that the deduction allowed under

much provision is made in the books for

Section.36(1)(viia)(a) for banks(having both

rural and urban advances.

rural and non-rural branches) is in respect

7.3 Deduction (viia)is only a lump sum figure of rural provisions only, irrespective of the

and not advance specific. provision made in the books of accounts.

The deduction allowed for PBDD is only a In fact this issue was not there before the

lump sum figure calculated on the basis of Hon’ble Supreme Court.

formula specified under Section 36(1)(viia) 7.7 The claim that the deduction allowed for

(a). It is not advances wise/ debtor wise/ the PBDD under Section 36(1)(viia) is

party wise. It could be in fractions as per for rural provisions is based on old law as

the formula and the method of computation existed from 1979 to 1985 only as already

prescribed under Rule 6ABA. discussed in earlier paragraphs. After the

7.4 If the provision is made entirely forurban amendments by the Finance act 1985, the

advances, then it can be said that the character of deduction allowed depends on

deduction allowed is only for urban the provision made in the books of accounts.

provisions. If the provision is made entirely In practice, it is observed that only 5 to 10%

for rural advances, then it can be said that of the PBDD in the books is for the rural

the deduction allowed is only for rural advances and 90% to 95% of the PBDD is

provisions. If the provision is made for both for urban advances. It is utterly baseless to

Taxalogue April-June 2021 51

Assessment

www.taxguru.in

claim that the deduction allowed is entirely the following reasons:

for rural advances Section 36(1)(viia)(a),

(i) The deduction under Section36(1)

when the provision made in the books for (viia)(a) is allowed to the extent of

rural advances is only 5%–10%. provision made in the books of accounts

8. If substantial eligible deduction is subject to the limits.

attributable to First limb (10% of AAA), (ii) As explained below, in the case of a

it doesn’t mean deduction allowed is Bank with either only rural branches or

for rural provisions only urban branches, it would be much

easier to link the provision made and

The eligible amount of deduction is as per the

deduction allowed.

formula- 10% of AAA (first limb) and 8.5% of

total income (second limb). It is observed that For example R Bank has only rural

substantial eligible amount of deduction is branches,

attributable to first limb (10% of AAA of rural

advances) and the contribution from the second • All its advances would be from rural branches

limb is negligible. Based on this, the banks also • Provision made in the books also would be

contend that the deduction under Section 36(1) in respect of rural advances.

(viia)(a) allowed to them is for rural provisions

only. This is the biggest fallacy in the minds of • Eligible for deduction under Section 36(1)

the banks. Just because, substantial portion (viia)(a) under both limbs:

of eligible deduction comes from 10% of AAA @ 10% of AAA and

of rural advances, it is wrong to conclude that

the deduction allowed is automatically for rural @ 8.5% of total income of only rural

provisions. As explained above, it depends on branches.

the provision made in the books of accounts.

• Deduction @ 10% of AAA limb will be

9. Why only one provision account available, even if there is no income.

under 36(1)(viia)(a) to prevent double

• Since, provision in the books is made in

deduction?

respect of rural advances only, the deduction

The Finance Act 1985, made amendments allowed under Section 36(viia)(a) is also in

to stop double deduction in respect of rural respect of rural provisions.

advances by introducing proviso to 36(1)(vii)

and 36(2)(v). As per 36(2)(v), the assesses • Since the deduction under Section 36(1)

claiming deduction under Section 36(1)(viia) (viia)(a) will be allowed only to the extent of

are required to maintain only one account for provision made in the books of accounts, it

the provision allowed under Section 36(1)(viia) would be much easier to link the provision

in respect of all advances - rural or urban. The made in the books and deduction allowed.

same thing was clarified by Explanation 2 to For example U Bank has only urban

Section 36(1)(vii),inserted by the Finance Act, branches,

2013.

• All its advances would be from urban

9.1 The mechanism put in place by the Finance

branches

Act 1985 to prevent double deduction is

absolutely necessary and the best in view of • Provision made in the books also would be

52 April-June 2021 Taxalogue

www.taxguru.in Assessment

in respect of urban advances only only and no fresh rural advances are made

during the year, eligible deduction @10%

• Deduction would be allowed under Section

of AAA would be available (on the basis

36(1)(viia)(a) not exceeding @ 8.5% of total

of outstanding AAA of earlier years), if

income which would be in respect of income adequate provision is made in the books for

of urban branches only. urban advances.

• If there is no income, then the deduction • However, the deduction under Section.36(1)

would be NIL. (viia)(a) will be allowed only to the extent

• Since the deduction under Section.36(1) of provision made in the books of accounts.

(viia)(a) will be allowed only to the extent of If no provision made in the books, no

provision made in the books of accounts, it deduction under Section 36(1)(viia)(a) is

would be much easier to link the provision allowed whatever may be the eligibility as

made in the books and deduction allowed. per formula. If the provision made in the

books is less than its eligibility as per the

(iii) Things get much complicated in the case formula under Section.36(1)(viia)(a), then

of a Bank which has both rural and Urban the deduction will be allowed only to the

branches in view of the discussion below: extent of provision made in the books. If

For example RU Bank has both rural and the provision made in the books is more

urban branches than its eligibility, then the deduction will be

restricted to the extent of eligibility as per the

• Provision can be made in respect of both formula.

rural and urban advances in the books.

• The deduction allowed for PBDD is only a

• RU Bank will be entitled for deduction on lump sum figure calculated on the basis of

account of both limbs: formula specified under Section 36(1)(viia)

o @ 10% of AAA and @ 8.5% of total (a). It is not advances wise/ debtor wise /

income. party wise. It could be in fractions as per

the formula,the method of computation u/r

• The eligible deduction under first limb is

6ABA and provision made in the books.

10% of AAA of rural branches.

It will not be possible to link the provision

• The deduction on the basis of second limb made in books in respect of rural/ urban

will include income of both rural and urban advances with the provision allowed under

branches. If there is no income, then the Section. 36(1)(viia)(a) every year.

calculation would be NIL on second limb.

(iv) As explained above, the complexities in

• Even if the total income is a loss, RU Bank the formula based deduction are much more

(which has both rural and urban branches) in the case of banks having both rural and

will continue to get its deduction under urban branches than a Bank with either only

Section.36(1)(viia)(a),as it is entitled for rural or only urban branches. Therefore, the

deduction under the first limb of the eligibility maintenance of one provision account under

@10% AAA.

Section 36(1)(viia) is absolutely necessary

• Apart from that even if provision is made in the case of banks having both rural and

in the books in respect of urban advances urban branches.

Taxalogue April-June 2021 53

Assessment

www.taxguru.in

(v) In view of the inherent complexity possible to discern PBDD as one in respect

involved in the formula based deduction of rural branches and non-rural branches.

under Section36(1)(viia)(a) and the inability The assumption was that when there are two

to link the provision made in books in distinct provision accounts, when the write-

respect of rural/ urban advances with the off takes place, it would be adjusted with the

deduction allowed under Section 36(1)(viia) respective provision accounts. Hence, the

(a) for PBDD every year, the Finance Act

question of double deduction does not arise.

1985 introduced only one provision allowed

account under clause 36(1)(viia) in respect (viii) There is no basis to say that the

of provision for bad and doubtful debts explanation is only with prospective effect.

which shall relate to all types of advances, There is no amendment in the proviso to

including advances made by rural branches. Section 36(1)(vii) and 36(2)(v) since its

(vi) The same thing was clarified by inserting introduction in 1985. In view of the above

Explanation 2 to section 36(1)(vii) by the discussion, the provision account under

Finance Act, 2013. The Explanation reads Section 36(1)(viia) was always only one

as follows: provision account. The Explanation 2 only

“Explanation 2.—For the removal of reiterated the same.

doubts, it is hereby clarified that for the 10. Conclusion

purposes of the proviso to clause (vii) of

this sub-section and clause (v) of sub- It is observed that many banks are maintaining

section (2), the account referred to therein only one provision allowed account for both rural

shall be only one account in respect of and urban advances even prior to the insertion

provision for bad and doubtful debts of Explanation 2. The only hitch is that they

under clause (viia) and such account shall assume that the deduction allowed under clause

relate to all types of advances, including (viia) is entirely for rural provisions irrespective

advances made by rural branches”; of the provision made in the books and do

(vii) Explanation 2 to Section 36(1)(vii) was not debit the urban bad debt write-off to the

inserted in view of the Hon’ble Supreme provision account grossly violating the proviso

Court decision in the case of Catholic Syrian to Sections 36(1)(vii) and 36(2)(v). Their claim

Bank. The Hon’ble Supreme Court decision that the deduction allowed for the PBDD under

in the case of Catholic Syrian Bank was Section 36(1)(viia) is entirely for rural provisions

delivered in the context of the assumption is based on old lawas existed from 1979 to 1985

that banks would maintain separate PBDD only. Much water has flown down the Ganges.

accounts in respect of rural branches and The time has come to shake them from the cosy

non-rural branches and therefore it is comfort of enjoying such double deductions.

* * * * * * * * *

54 April-June 2021 Taxalogue

You might also like

- Property Attack OutlineDocument28 pagesProperty Attack OutlineBrady Williams100% (3)

- Answer Key Inter Acctg 2Document66 pagesAnswer Key Inter Acctg 2URBANO CREATIONS PRINTING & GRAPHICS100% (2)

- ACCA Strategic Business Reporting (SBR) Achievement Ladder Step 8 Questions & AnswersDocument22 pagesACCA Strategic Business Reporting (SBR) Achievement Ladder Step 8 Questions & AnswersAdam MNo ratings yet

- CrvswiDocument588 pagesCrvswiPrasad NayakNo ratings yet

- Marketing Sports EventsDocument19 pagesMarketing Sports EventsGilbert100% (1)

- Options Trading StrategiesDocument6 pagesOptions Trading Strategiessumeetsj87% (23)

- Analysis of Section 36 (1) (Vii) and 36 (1) (Viia) of The Income-Tax Act, 1961 Read With Important Case LawsDocument5 pagesAnalysis of Section 36 (1) (Vii) and 36 (1) (Viia) of The Income-Tax Act, 1961 Read With Important Case LawsPRATIKNo ratings yet

- Taxation-Co-Op-Societies by Ca. Sanjay VanbhatteDocument65 pagesTaxation-Co-Op-Societies by Ca. Sanjay VanbhatteSujayNo ratings yet

- Case Study 1: Case I: Case IIDocument4 pagesCase Study 1: Case I: Case IIajayverma6No ratings yet

- Draft Solutions Diploma in IFRS For SMEs Final Exam JD21Document84 pagesDraft Solutions Diploma in IFRS For SMEs Final Exam JD21Vuthy DaraNo ratings yet

- Paper7 Set1 SolutionDocument17 pagesPaper7 Set1 Solutionwhitedevil69696No ratings yet

- December 2021 - IFRS For SMEs Question (English)Document7 pagesDecember 2021 - IFRS For SMEs Question (English)ramylearning98No ratings yet

- Answer Key Week 4Document10 pagesAnswer Key Week 4Chin FiguraNo ratings yet

- 201908011564640825-Annual Budget Statement 2018-19Document56 pages201908011564640825-Annual Budget Statement 2018-19Tehseen AhmedNo ratings yet

- Abs 2019 20Document66 pagesAbs 2019 20Jawad Khan GNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- BBFH209 BBFH329 Assignment 1Document2 pagesBBFH209 BBFH329 Assignment 1perseverance mutosvoriNo ratings yet

- Class PPT-Prelims Revision Classes Economy Lecture-3 30-Mar-2023Document29 pagesClass PPT-Prelims Revision Classes Economy Lecture-3 30-Mar-2023sdrish26No ratings yet

- BankingDocument26 pagesBankingbhattag283No ratings yet

- Good Formatted Accounting Finance For Bankers AFB 1 1Document32 pagesGood Formatted Accounting Finance For Bankers AFB 1 1Aditya MishraNo ratings yet

- PART-B Analysis Test YtDocument8 pagesPART-B Analysis Test YtRiddhi GuptaNo ratings yet

- Annual Budget Statement 2024-25Document67 pagesAnnual Budget Statement 2024-25Khurshid SheraniNo ratings yet

- 376-Law No. (20) of 2012 - ENDocument30 pages376-Law No. (20) of 2012 - ENmiraNo ratings yet

- Preboard EcoDocument5 pagesPreboard EcoPuja BhardwajNo ratings yet

- Date: To: From: Re: May 17, 2006Document4 pagesDate: To: From: Re: May 17, 2006LancasterFirstNo ratings yet

- Individual AssignmentDocument3 pagesIndividual AssignmentLoveness NyakurimwaNo ratings yet

- MCQs Far-1 (Final)Document64 pagesMCQs Far-1 (Final)farwaakmal7No ratings yet

- ElugabaechariDocument12 pagesElugabaecharihitaNo ratings yet

- Major Economic Indicators: Monthly Update: Volume 11/2020 November 2020Document28 pagesMajor Economic Indicators: Monthly Update: Volume 11/2020 November 2020sagarsbhNo ratings yet

- 588-Law No. (7) of 2013 - ENDocument47 pages588-Law No. (7) of 2013 - ENmiraNo ratings yet

- TAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersDocument9 pagesTAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersMohammad FaridNo ratings yet

- RATIO ANALYSIS MCQsDocument9 pagesRATIO ANALYSIS MCQsAS GamingNo ratings yet

- CH 5Document9 pagesCH 5landmarkconstructionpakistanNo ratings yet

- TXZAF 2019 Dec ADocument8 pagesTXZAF 2019 Dec AKAH MENG KAMNo ratings yet

- 780.0 Per The: Interest WhihDocument2 pages780.0 Per The: Interest WhihDope 90No ratings yet

- CPA 1 - Financial AccountingDocument8 pagesCPA 1 - Financial AccountingPurity muchobella100% (1)

- IFRS For SMEs Exam June 2022 - English VersionDocument8 pagesIFRS For SMEs Exam June 2022 - English Versionramylearning98No ratings yet

- Adobe Scan 19 Feb 2023Document7 pagesAdobe Scan 19 Feb 2023Aman JainNo ratings yet

- St. Thomas College of Engineering & Technology Kozhuvalloor: Time: 2 Hrs Series Exam - II Max. Marks 60Document3 pagesSt. Thomas College of Engineering & Technology Kozhuvalloor: Time: 2 Hrs Series Exam - II Max. Marks 60syulmnmdNo ratings yet

- INCOME TAX Examiner Favorite Question Session 3 Without AnswerDocument11 pagesINCOME TAX Examiner Favorite Question Session 3 Without Answersiddhant.gupta.delhiNo ratings yet

- MS Economics Set-8Document5 pagesMS Economics Set-8Vaidehi BagraNo ratings yet

- 8 Explanatory Memorandum of Federal Receipts 2021 22Document101 pages8 Explanatory Memorandum of Federal Receipts 2021 22Azhar AliNo ratings yet

- Questions & Answers November2022: Page 23 of 73Document8 pagesQuestions & Answers November2022: Page 23 of 73IbrahimNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- MCQ For Bad Debts From ITA RISEDocument36 pagesMCQ For Bad Debts From ITA RISEJahanzaib ButtNo ratings yet

- Tax298 - 2023 - Chapter 7 - SlidesDocument58 pagesTax298 - 2023 - Chapter 7 - SlidesJustyne WebbNo ratings yet

- Wa0003.Document6 pagesWa0003.joanNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- Chapter 18, Modern Advanced Accounting-Review Q & ExrDocument23 pagesChapter 18, Modern Advanced Accounting-Review Q & Exrrlg4814100% (3)

- 23 Account (4) AnswerDocument13 pages23 Account (4) Answertandelautomation6No ratings yet

- Class 12 AMU Model PapersDocument77 pagesClass 12 AMU Model PapersMohammad FarazNo ratings yet

- Major Economic Indicators: Monthly Update: Volume 03/2020 March 2020Document27 pagesMajor Economic Indicators: Monthly Update: Volume 03/2020 March 2020anon_482261011No ratings yet

- Priority Sector Lending PDFDocument11 pagesPriority Sector Lending PDFJitendra Singh Meena100% (1)

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- 20170316FSR3Document141 pages20170316FSR3Blesshy VillanuevaNo ratings yet

- Less: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaDocument11 pagesLess: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaKetan DedhaNo ratings yet

- Bankers Training Institute: Mock TestDocument5 pagesBankers Training Institute: Mock TestHirokjyoti KachariNo ratings yet

- MCQ CH 12 - Set-Off and Carry Forward of Losses - Nov 23Document10 pagesMCQ CH 12 - Set-Off and Carry Forward of Losses - Nov 23NikiNo ratings yet

- Indian Institute of Banking & FinanceDocument90 pagesIndian Institute of Banking & Financegopalmeb67% (3)

- Death of A Partner Sum 2-34Document11 pagesDeath of A Partner Sum 2-34gankNo ratings yet

- Accountancy QPDocument11 pagesAccountancy QPTûshar Thakúr0% (1)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Budget Rigidity in Latin America and the Caribbean: Causes, Consequences, and Policy ImplicationsFrom EverandBudget Rigidity in Latin America and the Caribbean: Causes, Consequences, and Policy ImplicationsNo ratings yet

- ICDS - 7 Government GrantsDocument17 pagesICDS - 7 Government Grantskavita.m.yadavNo ratings yet

- ICDS - 3 Construction ContractsDocument13 pagesICDS - 3 Construction Contractskavita.m.yadavNo ratings yet

- ICDS - 9 Borrowing CostDocument15 pagesICDS - 9 Borrowing Costkavita.m.yadavNo ratings yet

- ICDS - 2 InventoryDocument21 pagesICDS - 2 Inventorykavita.m.yadavNo ratings yet

- Penalty Not Oid If Notice Does Not Tick Mark Concealment - SCDocument16 pagesPenalty Not Oid If Notice Does Not Tick Mark Concealment - SCkavita.m.yadavNo ratings yet

- Allowability of Investment Depreciation Reserve Provision Made by Banks - Taxguru.Document2 pagesAllowability of Investment Depreciation Reserve Provision Made by Banks - Taxguru.kavita.m.yadavNo ratings yet

- Assessment of Banks – Allowance of Deduction To Rural Branches - Taxguru - inDocument1 pageAssessment of Banks – Allowance of Deduction To Rural Branches - Taxguru - inkavita.m.yadavNo ratings yet

- Primer On ValuationDocument6 pagesPrimer On ValuationPawan KasatNo ratings yet

- Cameron - Project ManagerDocument3 pagesCameron - Project ManagerThaw Zin OoNo ratings yet

- Penawaran Harga PT. Sinar Laut InternusaDocument26 pagesPenawaran Harga PT. Sinar Laut InternusaSalwa AnggreaniNo ratings yet

- Indonesia Baroid VPE Structure - 1811 PDFDocument13 pagesIndonesia Baroid VPE Structure - 1811 PDFfebry_rfNo ratings yet

- BMGT 220 Final Exam - Fall 2011Document7 pagesBMGT 220 Final Exam - Fall 2011Geena GaoNo ratings yet

- Lydia Sumipat v. Brigido BangaDocument2 pagesLydia Sumipat v. Brigido BangaRosanne SoliteNo ratings yet

- Business Process Re-Engineering & Government Process Re-EngineeringDocument42 pagesBusiness Process Re-Engineering & Government Process Re-Engineeringrocky bayasNo ratings yet

- Basic Concepts of QualityDocument6 pagesBasic Concepts of QualityAnju Gaurav DrallNo ratings yet

- Sustainability Report Fy 2017 18Document148 pagesSustainability Report Fy 2017 18Prasoon SinhaNo ratings yet

- MonopolyDocument49 pagesMonopolybarkeNo ratings yet

- International Business and Trade Final ExamDocument21 pagesInternational Business and Trade Final ExamMichelle EsperalNo ratings yet

- Introduction To Financial Accounting For Iipm: R.S.Sivaraman Chartered AccountantDocument46 pagesIntroduction To Financial Accounting For Iipm: R.S.Sivaraman Chartered AccountantaashukadelNo ratings yet

- TM Outline - FariisDocument31 pagesTM Outline - FariisLarab MohsinNo ratings yet

- Attachment J - Supplier Concession RequestDocument3 pagesAttachment J - Supplier Concession RequestagusnnnNo ratings yet

- Quality StatementsDocument1 pageQuality StatementsSenthil KumarNo ratings yet

- ProductOverview 2015 en LowDocument171 pagesProductOverview 2015 en LowPutTank-inA-mallNo ratings yet

- IBM Maximo Asset Management Release 7.1: Product Description GuideDocument12 pagesIBM Maximo Asset Management Release 7.1: Product Description GuideKumar AjitNo ratings yet

- DT Ebook BasicTrainingforFutureTradersDocument13 pagesDT Ebook BasicTrainingforFutureTradersZen Trader100% (1)

- Search For An Answer To Any Question... : Have More Answers For FreeDocument10 pagesSearch For An Answer To Any Question... : Have More Answers For FreeMarium Raza100% (1)

- Pacman - ArchDocument8 pagesPacman - ArchJimMNo ratings yet

- Heirs of Sps. Sandejas v. LinaDocument4 pagesHeirs of Sps. Sandejas v. LinaRenz R.0% (1)

- CFA L1 3 Month ScheduleDocument9 pagesCFA L1 3 Month ScheduleSakura2709No ratings yet

- RrorKeeway Super Shadow 250 Manual DespieceDocument16 pagesRrorKeeway Super Shadow 250 Manual Despiecejpsoft100% (1)

- Axiata Iar-Full ReportDocument103 pagesAxiata Iar-Full ReportAnonymous vCRo3mj7MNNo ratings yet

- COSO-ERM Demystifying Sustainability Risk - Full WEBDocument20 pagesCOSO-ERM Demystifying Sustainability Risk - Full WEBEuglena VerdeNo ratings yet

- CV Karntimon - YDocument4 pagesCV Karntimon - Yichigosonix66No ratings yet