Professional Documents

Culture Documents

Investment Final Report

Investment Final Report

Uploaded by

Noman SyedOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Final Report

Investment Final Report

Uploaded by

Noman SyedCopyright:

Available Formats

INVESTMENT

ANALYSIS &

PORTFOLIO MGT

DR. ISMA ZAIGHAM

FINAL TERM REPORT 2022

2

GROUP LEADS

REESHA KHAN

MUHAMMAD FARHAN UDDIN

MUHAMMAD WAJAHAT ANSARI

MUHAMMAD ADEEL FAROOQ

SYED NOMAN ZIA

SIDDIQUE WAHID

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

3

Firstly, we would like to thanks to Almighty Allah, for giving us the stand, will-

power, patience and making us capable to complete this report.

The project proves to be a very good learning experience. We deal with intense

pressure to process the knowledge and information as to our need and requirement.

We own great deal of gratitude to the people who helped us in every possible manner

in the compiling of this report.

Secondly, we would like to thanks Ms. Isma Zaigham our course instructor who

provided us wonderful opportunity to study a new and valuable course, who

coordinated and collaborated with us and gave us a skill-full guidance and valuable

time.

Lastly, we hope and pray that the prepare reports meets the standard conditions we

had obeyed to and the readers have worthy time going through it.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

4

TABLE OF CONTENT

Contents

FINAL TERM REPORT 2022 ................................................................................................... 1

INTRODUCTION ..................................................................................................................... 5

ECONOMIC FACTORS AND CORPORATE EVENTS............................................................ 6

ENGRO FERTILIZER LTD................................................................................................... 6

FATIMA FERTILIZERS ....................................................................................................... 8

BETA ...................................................................................................................................... 10

RISK BASED ON BETA ..................................................................................................... 10

ENGRO FERTILIZER LTD................................................................................................. 10

FATIMA FERTILIZER ....................................................................................................... 11

RATIO ANALYSIS AND RISK AND RETURN ..................................................................... 13

GRAPHICAL REPRESENTATION RATIO ANALYSIS ........................................................ 14

LIQUIDITY RATIOS .......................................................................................................... 14

DEBT MANAGEMENT RATIO ......................................................................................... 15

PROFITABILITY RATIOS ................................................................................................. 16

MARKET VALUE RATIOS ................................................................................................ 17

COVID 19 IMPACT OVER RATIOS AND COMPANY OPERATIONS ................................ 18

ENGRO FERTILIZER LTD................................................................................................. 18

FATIMA FERTILIZER ....................................................................................................... 18

CONCLUSION........................................................................................................................ 19

REFRENCES........................................................................................................................... 20

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

5

INTRODUCTION

Engro Fertilizers Limited – a 56.3% owned subsidiary of Engro Corporation – is a

premier fertilizer manufacturing and marketing company having a portfolio of

fertilizer products with significant focus on balanced crop nutrition and increased

yield.

“WE ARE PASSIONATE ABOUT TRANSFORMING

THE AGRICULTURAL LANDSCAPE, BRINGING

CHANGE AND HELPING THE FARMER GROW.”

The Fatima Fertilizer Company Limited was incorporated on December 24, 2003, as a

joint venture between two major business groups in Pakistan namely, Fatima Group

and Arif Habib Group. The foundation stone of the company was laid on April 26,

2006 by the then Prime Minister of Pakistan. The construction of the Complex

commenced in March 2007 and is housed on 950 acres of land.

“TO BE A WORLD CLASS MANUFACTURER OF

FERTILIZER AND ANCILLARY PRODUCTS, WITH A

FOCUS ON SAFETY, QUALITY AND POSITIVE

CONTRIBUTION TO NATIONAL ECONOMIC GROWTH

AND DEVELOPMENT. WE WILL CARE FOR THE

ENVIRONMENT AND THE COMMUNITIES WE WORK IN

WHILE CONTINUING TO CREATE SHAREHOLDERS'

VALUE.”

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

6

ECONOMIC FACTORS AND CORPORATE EVENTS

YEARS AVERAGE EFERT – FATF – INFLATION GDP INTEREST

MKT – RATE RETURNS RETURNS RATE GROWTH RATE

% % % % % %

2016 0.78 -0.38 -0.21 2.86 5.5 5.75

2017 -0.19 -0.20 -0.22 4.8 5.2 5.75

2018 -0.21 0.10 0.24 4.7 5.5 6.5

2019 0.28 0.10 -0.37 6.8 1.9 13.25

2020 0.17 -0.21 0.23 11.2 -0.47 7

14 13.25

11.2

12

10

8 6.5 6.8 7

5.75

5.5 5.75 5.5 INFLATION RATE

5

4.2

8 4.7

6 GDP GROWTH

4 2.86

1.9 INTEREST RATE

2

-0.47

0

2016 2017 2018 2019 2020

-2

ENGRO FERTILIZER LTD.

2016

Stock market shows the average return of 0.78% however Engro fertilizers and

Fatima fertilizers shows average return of -0.38% and -0.21% respectively. As per the

statement Engro fertilizers is not in line with stock market as its return is lower than market

return, it is so low that it’s going in negative. The economic condition in 2016 was overall

good but due to a corporate event which was, urea offtake was low for the start of 2016

mainly due to poor crop economics as well as low international prices and subsidy rumors on

urea. This event reflected returns and stock prices of Engro in a way that returns reduce from

-0.26 to -0.38 and stock prices also reduce from 84.13 to 67.98 as compare to 2015.

2017

Stock market shows the average return of -0.19% however Engro fertilizers and

Fatima fertilizers shows average return of -0.20% and -0.22% respectively. As per the

statement Engro fertilizers is not in line with stock market as its return is lower than market

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

7

return, The economic condition in 2017 was badly in terms of inflation had a big change from

2016 to 2017 as it almost increase by 8.35 times that could be a reason for lower returns. On

the other side stock prices hard increases and 2017 although inflation rate is higher that

means stock price had decreases in current years but Engro fertilizer stock prices increases

although Economic conditions are worst as compared to 2016 so that stock price shows

increase in 2017. Due to inflation rate is almost 8.35 times more so actually in monetary

terms it's gave null effect. Stock prices increase just because Engro Fertilizer performed

outstanding in this year.

2018

Stock market shows the average return of -0.21% however, Engro fertilizers and

Fatima fertilizers shows average return of 0.10% and 0.24% respectively. As per the

statement, Engro fertilizers show positive return in relation with stock market as its return is

higher than market return. The rising interest rates from 2017 to 2018 of 5.75% to 6.5%

respectively also increases borrowing cost, even the borrowing cost was higher Engro

fertilizers borrowed more, which could be for introducing new products. They introduced 4

new products leading towards the highest ever profits. In 2018, Engro won the Pakistan

Advertisers Society (PAS) award for its “Aam Aadmi Nahi” campaign in the category of

“Agriculture & Related Industries” in PAS AWARDS 2018. Moreover, highest ever full year

sales of Urea were also achieved resulting in high returns and increasing the stock price from

67.22 to 72.02.

2019

Stock market shows the average return of 0.28% however, Engro fertilizers and

Fatima fertilizers shows average return of 0.10% and -0.37% respectively. As per the

statement, Engro fertilizers show decreasing return in relation with stock market as its return

is less than market. The economic condition is worst in all three cases as inflation, GDP

growth rate and interest rate, that lead to worsen the Engro fertilizers performance in terms of

return and stock price but it’s surprising that Engro fertilizers shows depicted growth in 2019

as its CEO stated that We continued to build upon our legacy of 50+ years and set records

across our spectrum of business endeavors. Furthermore, company maintains the highest

standards of safety and environment at its plant sites for which the Company was awarded for

Excellence in Safety, Environmental Compliance, and Energy Efficiency at the International

Fertilizers Association Awards in Paris after this winning moment The Zarkhez Plant

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

8

achieved the highest ever score of 86%, beating the previous score of 83%, putting Engro in

first place across the entire green office network in Pakistan. Under the above news the stock

prices effects positively, beating the previous price of 72.02 to 73.57.

2020

Stock market shows the average return of 0.22% however, Engro fertilizers and

Fatima fertilizers shows average return of -0.21% and 0.23% respectively. As per the

statement, Engro fertilizers show decreasing return in relation with stock market as its return

is less than market it is so low that it’s going in negative. In 2020, Covid was the major factor

affecting every economy globally, the economic condition was worst in all three cases as

compare to all 5 years 2016-2020 as inflation increased to 11.2%, GDP growth rate faced a

tremendous decline trend it went till -0.47%, increasing public debt and using reserves.

Interest rate was reduced to 7% that supported companies to increase borrowings on low cost

to fulfill their major needs. Hence, the stock price was reduced from 73.57 to 63.86 which led

to decline in returns due the pandemic all over the world.

FATIMA FERTILIZERS

2016

Stocks return of Fatima fertilizer is 0.21% in 2016 due to the positive growth of GDP

5.5%wich creates bullish trend in stock market so more investor will come for investment so

increase stocks price and returns too. Interest rate were also not very high investor preferred

for investment in stocks rather than savings in banks and inflation rate was also low which is

2.86% which is good for growing stocks like Fatima where return lies on annually. On the

other hand, stock prices also decrease in 2016 as compare to 2015 from 44 to 36.89.

2017

Stocks return was negative which is -0.22% in 2017 due to the increases in inflation to

4.15% which is not favorable for Fatima fertilizer stocks so results in negative returns and

interest rate is also high comparatively previous year which is 2.86% to 5.75% so investor

will move to bank who offers more returns on savings rather than investing in stocks so

results in less returns of stocks due to less demand. As its mentioned in report that Discount

Rate Increase Finance Cost of the Company would increase, impacting the shareholder value

negatively. Thus, lower EPS would negatively affect share price hence, the stock price was

reduced from 36.89 to 31.3.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

9

2018

Due to the decreases in inflation rate from 4.15% to 3.93% which is good for annually

return stocks and increase in growth of GDP to 5.8% bullish trends in stocks market so that’s

why it helps out to recover from negative to positive trend at 0.24% and Fatima fertilizer also

announced for expansion in business by merging its subsidiaries which attracts long term

investors. Market Share improved from 20 to 23%. Under the above news the stock prices

effects positively, beating the previous price of 31.3 to 34.1.

2019

Due to pandemic raised in the starts of this year all economic activities were shut

down so GDP was declined to 1% and inflation rate rose to 6.74% which creates bearish

trend in stock market and annually return stocks not performed well in high inflation due to

rise in finance cost so its stocks return declined to in negative which was -0.37%. Moreover,

one of the factors which shows drastic change in a stock price in 2019 as compare to 2018

which is on decreasing mode as Fatima fertilizers faced technical issue: Sadiqabad Plant

faced some technical issues due to which planned production target for the year could not be

achieved. The issues have been addressed and the Company has taken all the necessary

measures for disruptions-free optimum level operations of Sadiqabad Plant in the future.

2020

As restrictions of covid-19 become ease for corporate sector and due to merger of its

subsidiaries which they were announced in Oct 2018 so they enjoyed their business

expansion policy as more investors invested in Fatima fertilizer stocks which results in

increases its stocks returns to 0.23% and interest rate was also too down which was 1.32% so

investors also invested in stocks rather than saving in a bank. Moreover, its share prices also

show positive effect as compare to 2019 hence, FATF previously had issue in Sadiqabad

plant of technical problem arises which was resolved and performed outclass Sadiqabad Plant

reliability yielding ever highest on stream-factor (97.8%). Market Share improved from 23%

to 24% earnings per share increased to Rs. 6.32 per share compared to Rs. 5.75 per share in

2019. Under the above news the stock prices effects positively, beating the previous price of

27.14 to 28.96.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

10

BETA

RISK BASED ON BETA

Beta is a measure of a stock's volatility in relation to the overall market. By

definition, the market, such as the KSE 100 Index, has a beta value nearly 1.0 on average,

and individual stocks are ranked according to how much they deviate from the market. Beta

is a concept that measures the expected move in a stock relative to movements in the overall

market. Beta greater than 1.0 suggests that the stock is riskier than the broader market, and a

beta less than 1.0 indicates a stock with lower riskiness of stock.

BETA VALUES

0.90

0.85

0.80 0.79

0.70 0.70 0.69 0.67

0.60 0.63

0.56 0.54

0.50 0.53 0.51

0.40

0.30

0.20

0.10

-

2016 2017 2018 2019 2020

ENGRO FATIMA

ENGRO FERTILIZER LTD.

The Beta value of Engro Fertilizer ltd. remains below 1.0 from FY-2016 to FY-2020

which shows that the value of stock is less volatile throughout this tenure for Engro. In

depth, if we analyze the movement of beta value of Engro, we can see that it shows a

decreasing trend from FY-2016 to FY-2018 which an impact of 0.26, but in FY-2019 it

shows increasing trend and positive impact by increase of 0.16. Throughout in agricultural

industry, Engro ltd has less risker stock with less return. Engro ltd stock is less risky. In the

year 2019 beta again came over on its decreasing trend and dropped by the value of 0.18

which indicates that the value of return also got decreased compare to 2018 which made an

increase in the average return for the year from FY-2018 – FY2019. In the year 2020 beta is

at 0.51 which is less risky. Overall return of Engro ltd was lesser then in ideal market with

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

11

value of beta greater than 1.0 but here in the case of Engro ltd risk & return is not extreme

that means investors that earn lower return with lower risk are more willing to pick Engro ltd

as their investment option. And for better picture, we can see that the decrease in Beta value

also on the other hand affecting the realized rate of return of FY-2019 to FY-2020 that is

also decreased by approximately 3 times of ROR of previous year FY-2019.

FATIMA FERTILIZER

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

2016 2017 2018 2019 2020

EFERT FATF

The Beta value of Fatima Fertilizer remains below 1.0 from FY-2016 to FY-2020

which shows that the value of stock is less volatile throughout this tenure. In depth, if we

analyze the movement of beta value of FATF, we can see that it shows increasing trend from

FY-2016 to FY-2017 with a change of 0.15, but in FY-2018 it shows decreasing trend and

major impact of fall from 0.85 to 0.56 that is negative impact of 0.29 in the horizon of FAFT

throughout in agricultural industry, FATF has less risker stock with less returns. FATF stock

is less risky. In FY-2019 beta again came over on its increasing trend growth occurred by

the value of 0.13 which indicates that the value of return also got increased compared to

previous events, which made an increase in the average return for the year from FY-2018 to

FY2019. In the year 2020 beta is at 0.67 which is less risky. And overall return of FATF was

lesser then in ideal market with value of beta greater than 1.0 but here in the case of FATF,

risk & return is not considered as ideal that means investors that earn lower return with

lower risk are more willing to choose FATF as their investment option. And for better

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

12

picture, we can see that the increase in Beta value also on the other hand affecting the

realized rate of return of FY-2019 to FY-2020 to be increased as shown above. (See graph of

RoR).

FATF have more upward trend beta i.e., greater beta values ranging (0.54-0.85)

which is considerably better than EFERT. The Beta value is greater of FATF from EFERT

except FY 2016 and FY 2018. On the other hand, Both the companies hold their investment

to maturity which represent investments with fixed or determinable payments and fixed

maturity where the Company has positive intent and ability to hold such investments to

maturity.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

13

RATIO ANALYSIS AND RISK AND RETURN

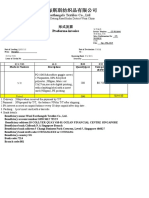

ENGRO FERTILIZER LTD. 2020 2019 2018 2017 2016

Working Capital

Amount 10,067,503 6,307,572 2,669,938 (669,467) 3,080,747

Management

LIQUIDITY RATIO

Current Ratio Times 1.21 1.12 1.07 0.98 1.13

DEBT Debt Ratios % 64.9% 66.8% 62.3% 61.4% 59.7%

MANAGEMENT

RATIO Debt Equity Ratio Times 1.85 2.01 1.65 1.59 1.48

Return on Total

% 13.1% 14.4% 14.6% 9.5% 9.1%

Assets

PROFITIBILITY Basic Earning Power

% 14.7% 24.1% 20.5% 16.5% 16.1%

RATIOS (BEP) Ratio

Return on Common

Times 1.26 1.39 1.25 0.76 0.70

Equity

Price/Earnings Ratio Times 5.02 5.28 5.54 8.91 5.04

MARKET VALUE

RATIOS

Market/Book Ratio Times 8.24 5.30 1.77 5.96 2.86

FATIMA FERTILIZER LTD. 2020 2019 2018 2017 2016

Working Capital

Amount 1,406,452 (6,033,006) 2,171,108 1,951,352 1,082,784

Management

LIQUIDITY RATIO

Current Ratio Times 1.03 0.88 1.09 1.10 1.03

DEBT Debt Ratios % 44.7% 49.7% 43.4% 45.9% 57.2%

MANAGEMENT

RATIO Debt Equity Ratio Times 0.81 0.99 0.77 0.85 1.33

Return on Total

% 8.4% 7.8% 12.1% 10.6% 8.8%

Assets

PROFITIBILITY Basic Earning

% 14.1% 13.5% 18.2% 15.0% 13.0%

RATIOS Power (BEP) Ratio

Return on Common

Times 0.28 0.25 0.29 0.23 0.21

Equity

Price/Earnings

Times 4.60 4.62 5.77 6.13 7.92

MARKET VALUE Ratio

RATIOS

Market/Book Ratio Times 0.70 0.72 1.10 1.21 1.64

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

14

GRAPHICAL REPRESENTATION RATIO ANALYSIS

LIQUIDITY RATIOS

1.40

1.20 1.21

1.13 1.10 1.12

1.09

7

1.00 1.03 1.03

0.98

0.88

0.80

0.60

0.40

0.20

-

2016 2017 2018 2019 2020

EFERT FATF

For Engro Fertilizer ltd., Current ratio shows the upward trend of liquidity ratio from

FY-2017 to 2020. In FY 2016 to 2017 the current ratio of EFERT decline from 0.15 units. So

overall position of EFERT indicates an upward trend which means that EFERT has enough

liquid assets to repay its short debt obligations. However, in FY 2017, the EFERT current

ratio is below 1. Which indicates that however, it slipped to 0.98 due to lower margins,

increased utilization of short-term borrowing and current maturities of long-term finance.

Risk that also might affect the stock price and company might be baring operations from max

debt management that we can see in SOFP of Engro in FY 2017.

On the other hand, for Fatima Fertilizer, current ratio indicates a mixed trend due to

economic factors discussed primarily above. Which create challenges for FATF for managing

their operations. Liquidity position of Fatima has shown tremendous improvement till 2018

resulting from profits arising out of increased sales volume and better margins. But in FY

2019, it slipped below 1.0 that to 0.88, due to lower margins, increased utilization of short-

term borrowing and current maturities of long-term finance. But the worst scenario continues

to its growth and in FY 2020, however the liquidity position of FATF again comes to its

stability position.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

15

DEBT MANAGEMENT RATIO

2.50

2.00 2.01

1.85

1.59 1.65

1.50 1.48

1.33

1.00 0.99

0.85 0.67 0.65 0.81

0.60 0.57 0.61 0.62 0.77

0.46 0.43 0.50 0.45

0.50

0.00

2016 2017 2018 2019 2020

ENGRO-D/A FATIMA-D/A ENGRO-D/E FATIMA-D/E

Engro Fertilizer ltd., Debt equity ratio indicates an upward trend until there was a

major impact of WACC in FY 2020, however before this condition D/E ratio increased to

1.59 when compared to 1.48 of FY 2016 and it will continue to grow till FY 2019 to 2.01. It

might be because of Engro applied for further borrowing during the span of 2016 to 2019,

increase in long term debts for permanent working capital needs. Debt Assets ratio also

picturizing the same impact due to higher policy rates, increased level of borrowings and

Covid-19 impact as compared to previous years. Weighted average cost of debt increased to

13.34% in FY 20 as compared to 9.8% in FY 19 that might be the reason that Engro shifted it

major operations and plants that was financing through debt shifted to equity.

On the other hand, Debt equity ratio in FATF shows mixed trend, and a similar effect

of increase of WACC might be seen over FATF. The D/E ratio decreased to 0.81 (FY 2020)

when compared to 1.33 of FY 19. Debt service ratio fell in FY 20 due to higher policy rates;

increased level of borrowings and Covid-19 impact as compared to previous years. Weighted

average cost of debt increased to 13.34% in FY 20 as compared to 9.8% in FY 19 due to

increase in interest rates. However, the overall debt management of FAFT is far more ideal

because their debt is less in proportion as compared with EFERT throughout the period.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

16

PROFITABILITY RATIOS

160.0%

140.0% 139.0%

120.0% 124.8% 125.9%

100.0%

80.0% 75.9%

69.7%

60.0%

40.0%

20.0% 9.1%8.82%

1.3% 9.5%10.263%.0% 12.218

14.6% %.9% 14.4%7.82%

5.1% 27.7%

13.1%8.4%

0.0%

2016 2017 2018 2019 2020

ENGRO - ROA FATIMA - ROA ENGRO - ROE FATIMA - ROE

Engro has recorded annual sales growth in till FY 2018. With the increase in sales

revenue, the Company’s gross profit steadily increased from FY 2015 to FY 8.94%. The

growth in ROE is aligned and moves in the same manner that both EFERT and FATF except

in FY 2019 and FY 2020, that the ROE of EFERT decrease while the FATF ROE increased

slightly. The decrease in roe on EFERT might be cause of the rumor that was spread against

UREA – the main product of EFERT, that affects the sales volume of EFERT and users

shifted to FATF that provide the growth in Sales Volume and lower gross profit.

0.18 0.24

0.25 0.15 0.21 0.14 0.14

0.13

0.16 0.17

0.20 0.15

0.15

0.10 FATIMA-BEP

0.05

ENGRO-BEP

0.00

2016 2017 2018 2019 2020

ENGRO-BEP FATIMA-BEP

While FATF improved profitability and margins until 2018 faced down turn in FY

2019. The decline in profitability ratios in primarily on account of lower sales volumes and

shrunk gross margins. Political uncertainty, significant PKR devaluation and hike in

borrowing cost hampered the profit margins in FY 2019. Gross profit margin started to fall

from FY 2017 due to increase in cost of production. In FY 2019, the Company gross profit

margin dropped due to abnormal rupee devaluation, decrease in national consumption and

other macro-economic factors including declined GDP. The trend continued in FY 2020 as

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

17

well, the economy of the country shrank massively, and eruption of COVID-19 pandemic

further worsened the situation.

MARKET VALUE RATIOS

10.00

8.91

9.00

7.92 8.24

8.00

7.00

6.13

6.00 5.96 5.54 5.77 5.28

5.04 5.02

5.00 5.230

4.6 4.60

4.00

3.00 2.86

2.00 1.77

1.64

1.00 1.21 1.10

0.72 0.70

0.00

2016 2017 2018 2019 2020

ENGRO-P/E FATIMA-P/E FATIMA-M/B ENGRO-M/B

The P/E ratio shows what the market is willing to pay today for a stock based on its

past or future earnings. A high P/E could mean that a stock's price is high relative to earnings

and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is

low relative to earnings.

In the case of EFERT, the P/E ratio indicates the declining trend and except in FY

2017 whereas in FATF FY 2016, it was the point where maximum P/E ratio was achieved

and then its ratios continue to decline. Certain industries have high PE ratios because

investors have higher earnings growth expectations. Companies that establish new trends or

develop innovative productivity solutions may have high PE ratios because investors are

willing to pay a premium for potentially high earnings growth. And comparatively, EFERT

has lower P/E ratio as compared to FATF.

On the other hand, Market Book value ratio of Engro is showing the declining trend

whereas FATF shows the mixed trend that is primarily affecting due to unstable stock price

of till FY 2018 but during pandemic and other economic factors, FATF performed

marvelously and shows a tremendous growth and reach to the top MB ratio throughout the

period that is 8.24 time. And its comparatively better than EFERT. It also indicates that the

market value of FATF is better.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

18

COVID 19 IMPACT OVER RATIOS AND COMPANY

OPERATIONS

ENGRO FERTILIZER LTD.

The global COVID-19 pandemic poses a significant challenge to not only global, but

also national economic prosperity. As one of Pakistan’s most responsible companies, Engro

Fertilizers remains committed to the alleviation of adverse impact of this global pandemic on

our nation, in particular the agriculture sector which remains the largest driver of employment

in our country. The Company hereby announces a further reduction in urea prices by Rs

240/bag. This additional price cut would result in an overall price reduction of Rs 400 per bag

since the beginning of the year. With the outbreak of Covid-19, Pakistan’s farmers are facing

unprecedented challenges. In this difficult time, Engro Fertilizers stands firm with the people

of Pakistan and the Government to prioritize the sustainability of agriculture sector to ensure

our nation’s food security. In this pursuit, the Company has made an additional price

reduction to support our valued farmers in these trying times.

Since we can see in the above ratio calculation, that how the profitability ratios of EFERT

have decline during the FY 2020; both profitability ratios ROE & ROA has decline during

the pandemic and decline in the GP causing the impact over the EPS of EFERT through

retained earnings of FY 2020.

FATIMA FERTILIZER

Despite multiple challenges faced by the FATF during the year due to COVID-19 and

along with the locust attack which emerged as a key risk factor for the agriculture sector,

FATF achieved the highest ever sales volume of 1.87 million MT in 2020. On a year-on-year

basis, sales volume increased by 1.8% as compared to last year. As a result of steadiness in

overall sales volumes, despite some price uncertainties in the first half of the year, the

Company managed to deliver sales revenue of Rs 71.27 billion showing a decline of

approximately 5%, compared to sales revenue of Rs 74.96 billion in the year 2019. Since we

can see that the overall profitability ratios, debt management ratios and market value ratio of

FATF is slightly greater and more consistent th EFERT. We also see that the realized rate of

return 0.23% and beta coefficient of FATF is 0.68, greater in FY 2020 by EFERT. And FATF

has performed overall better in outbreak of pandemic.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

19

CONCLUSION

Both the companies; EFERT and FATF has performed assuredly throughout the time

period of FY 2016 to FY 2020. This conclusion is based upon the calculations and reference,

that might be differ from actual ingredients. As we can see in calculation of Stock beta, A

beta value that is less than 1.0 means that the security is theoretically less volatile than the

market. Including this stock in a portfolio makes it less risky than the same portfolio without

the stock. we can see it clearly that on average the Stock beta of FATF is relatively greater,

that is (β=0.664) whereas the stock beta of EFERT is lower on average, that is (β=0.63). since

the value β of FATF is almost nearly to the ideal volatility rate (β=1), since the stock price

and rate are also be affected due to maximum β of FATF and the average stock return of FY

2016 to FY 2020 is -0.6%, whereas EFERT is -0.12%. so preferable, it may happen that

investors eyes will be attracted to FATF stock more than EFERT.

Now if we put eyes over the ratio analysis, its clearly picturized and interpreted that

the FATF’s ratios are relatively better than EFERT i.e., Debt Management, Market Value and

Liquidity ratios of FATF is on better side. Except Profitability ratio, because its might be the

reason for FATF that excessive operating costs, inadequate revenue, or, in most cases, a

combination of both. Inefficient operating practices, which result in poor utilization,

excessive fleet strength, and overstaffing, are common causes of excessive cost in countries

like Pakistan and specially when the market is competitive.

During the pandemic (COVID 19), it was world outbreak and slowed down the

economy of the whole world but on the same side it was creating challenges for every sector

industrial production. Both the agricultural sector has faced several challengers mentioned in

economic factors and impacts of COVID 19.

Since the we came here over the conclusion that FATF and EFERT, both performed

well and achieved their benchmarks over the years and will do further. But FATF, has

performed slightly more efficiently than EFERT, in several aspect and moreover the gold

points that FATF has higher stock market, greater rate of returns, and efficient ratios. So, we

suggest investor to invest their capital more in FATF, as it might provide them more return

in future.

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

20

REFRENCES

https://www.engrofertilizers.com/themes/engro/documents/EFert_-_Company_info.pdf

https://www.engro.com/engro-fertilizers/

http://fatima-group.com/ffcl/page.php/vision-and-mission-ffcl

https://www.investing.com/equities/engro-fertilizers-ltd-historical-data

https://www.investing.com/equities/fatima-fertilz-historical-data

https://www.engro.com/investor-relations/financial-reports/

https://www.marketscreener.com/quote/stock/ENGRO-FERTILIZERS-LIMITED-

16337606/financials/

http://fatima-group.com/updata/files/files/211_20210405123756.pdf

https://www.investopedia.com/investing/beta-know-risk/

https://www.nasdaq.com/glossary/p/portfolio-beta

https://www.engrofertilizers.com/trust/press-release-detail/2020/engro-fertilizers-reduces-

urea-prices-by-a-further-rs-240-to-ensure-national-food-security-and-support-the-farmers-of-

pakistan

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

You might also like

- Pinata Unit Plan and Lessons PortfolioDocument7 pagesPinata Unit Plan and Lessons Portfolioapi-281759709No ratings yet

- OceanLink Partners Q1 2019 LetterDocument14 pagesOceanLink Partners Q1 2019 LetterKan ZhouNo ratings yet

- Adaptive School - StrategiesDocument301 pagesAdaptive School - StrategiesAngel GiranoNo ratings yet

- GISA 7.0 Aug20 StudentWorkbookDocument205 pagesGISA 7.0 Aug20 StudentWorkbookHostDavid100% (1)

- CAS Investment Partners April 2022 Letter To InvestorsDocument25 pagesCAS Investment Partners April 2022 Letter To InvestorsZerohedgeNo ratings yet

- Seven Secrets Boxing FootworkDocument25 pagesSeven Secrets Boxing Footworkehassan4288% (16)

- Analyst Presentation 2018Document90 pagesAnalyst Presentation 2018Sanket SharmaNo ratings yet

- Financial Management Project: Presented byDocument16 pagesFinancial Management Project: Presented byAsif KhanNo ratings yet

- Introduction To Finance: Group Name: The Financial FittersDocument20 pagesIntroduction To Finance: Group Name: The Financial FittersMonera Bhuiyan MimNo ratings yet

- Extraordinary When One Looks at The Performance of The Broader Universe" As Well As WhenDocument9 pagesExtraordinary When One Looks at The Performance of The Broader Universe" As Well As Whenravi_405No ratings yet

- Sample ReportDocument52 pagesSample ReportAli AzgarNo ratings yet

- Group 3 Tyre Report - Question 4Document21 pagesGroup 3 Tyre Report - Question 4k60.2111213014No ratings yet

- 2022.07 Pavise Monthly Letter FlagshipDocument4 pages2022.07 Pavise Monthly Letter FlagshipKan ZhouNo ratings yet

- 2017 Prabhat Investor Presentation For q1 Fy 17Document31 pages2017 Prabhat Investor Presentation For q1 Fy 17goyal.rohit8089No ratings yet

- As We Outlined in Last Quarter'S Letter: Exhibit 1: Greenwood'S Composite Performance vs. Msci Acwi All Cap (Net)Document3 pagesAs We Outlined in Last Quarter'S Letter: Exhibit 1: Greenwood'S Composite Performance vs. Msci Acwi All Cap (Net)Sunil ParikhNo ratings yet

- Risk & Return AnalysisDocument13 pagesRisk & Return AnalysisTaleya FatimaNo ratings yet

- Group F FIN201 Section 3Document27 pagesGroup F FIN201 Section 3Nayeem MahmudNo ratings yet

- Investors / Analyst's Presentation For December 31, 2016 (Company Update)Document16 pagesInvestors / Analyst's Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Perfect Fitness - Modified 4.2.3Document27 pagesPerfect Fitness - Modified 4.2.3Ben NoamanNo ratings yet

- Fin358 - Group Assignment (Nestle)Document25 pagesFin358 - Group Assignment (Nestle)KyubodanNo ratings yet

- Vietnam Insight 2020 PDFDocument156 pagesVietnam Insight 2020 PDFCông MinhNo ratings yet

- WING Wingstop Investor Presentation June 2018Document37 pagesWING Wingstop Investor Presentation June 2018Ala BasterNo ratings yet

- Fca B SiddharthDocument12 pagesFca B SiddharthSiddharth SangtaniNo ratings yet

- Exhibit 1: Greenwood'S Composite Performance vs. Msci Acwi All Cap (Net)Document4 pagesExhibit 1: Greenwood'S Composite Performance vs. Msci Acwi All Cap (Net)Kan ZhouNo ratings yet

- Nisha PPT 1Document13 pagesNisha PPT 1Anonymous Fr37v90cqNo ratings yet

- Hayden Capital Quarterly Letter 2021 Q1Document16 pagesHayden Capital Quarterly Letter 2021 Q1fatih jumongNo ratings yet

- Vietnam Insight Handbook - Share by WorldLine Technology PDFDocument156 pagesVietnam Insight Handbook - Share by WorldLine Technology PDFBaty Ne100% (1)

- Project Feasibility ProjectDocument100 pagesProject Feasibility ProjectPakkamas_Jitma_5732No ratings yet

- IR Savouries Sweets Papad IndiaDocument31 pagesIR Savouries Sweets Papad IndiaDeependra Pratap SinghNo ratings yet

- Reliance Retail: (Rs in Crores) FY19 FY20 FY21Document2 pagesReliance Retail: (Rs in Crores) FY19 FY20 FY21PASURA LENIN CARENo ratings yet

- Q12021 ArquitosCapitalManagement LetterDocument3 pagesQ12021 ArquitosCapitalManagement LetterCamille ManuelNo ratings yet

- Final Report BFDocument22 pagesFinal Report BFAdil IqbalNo ratings yet

- Term-Paper-Group-D NiloyDocument21 pagesTerm-Paper-Group-D Niloyomarsakib19984No ratings yet

- IBF Term ProjectDocument21 pagesIBF Term Projectzayans84No ratings yet

- Nykaa Investor PresentationDocument54 pagesNykaa Investor PresentationNaishadhNo ratings yet

- Accounts TaskDocument10 pagesAccounts TaskParesh BhimaniNo ratings yet

- Time Period Hayden (Net) S&P 500 MSCI World (ACWI)Document13 pagesTime Period Hayden (Net) S&P 500 MSCI World (ACWI)Andy HuffNo ratings yet

- HondaDocument9 pagesHondazahid atiqNo ratings yet

- Microfinance PulseDocument24 pagesMicrofinance PulseNitin GuptaNo ratings yet

- Report Fin 201Document26 pagesReport Fin 201F.T. BhuiyanNo ratings yet

- CRISIL - Indian Pharmaceutical and CDMO MarketDocument69 pagesCRISIL - Indian Pharmaceutical and CDMO Marketnandhiniravi90100% (1)

- AFM - Latest - LatestDocument23 pagesAFM - Latest - LatestXyz YxzNo ratings yet

- ALLIDocument16 pagesALLIAbdullah KhanNo ratings yet

- Autotech Automotive After Market Report 2022Document10 pagesAutotech Automotive After Market Report 2022ayman saberNo ratings yet

- Stock Price & Pattern of ShareholdingDocument15 pagesStock Price & Pattern of ShareholdingdanyalNo ratings yet

- BCG Global Asset Management 2020 May 2020 R - tcm9 247209 PDFDocument27 pagesBCG Global Asset Management 2020 May 2020 R - tcm9 247209 PDFLawrence HNo ratings yet

- Deliverable 5 - Trend Analysis & PresentationDocument6 pagesDeliverable 5 - Trend Analysis & PresentationRamizNo ratings yet

- RV Capital Letter 2018-06Document10 pagesRV Capital Letter 2018-06Rocco HuangNo ratings yet

- Fin201-Termpaper-1 (1) 2 PDFDocument35 pagesFin201-Termpaper-1 (1) 2 PDFTanvir ImranNo ratings yet

- Olam International Limited: Q1 2016 Results BriefingDocument25 pagesOlam International Limited: Q1 2016 Results Briefingashokdb2kNo ratings yet

- WING Investor Presentation IR Website 2018 WingstopDocument37 pagesWING Investor Presentation IR Website 2018 WingstopAla BasterNo ratings yet

- Credit Analysis of Premier Foods PLC - Sample 1Document14 pagesCredit Analysis of Premier Foods PLC - Sample 1BethelNo ratings yet

- Marketing Plan of Candi MilkDocument48 pagesMarketing Plan of Candi MilkDipock Mondal83% (12)

- BankingSurvey2012 KPMGDocument59 pagesBankingSurvey2012 KPMGmc100207566No ratings yet

- Q1 2017 Letter Conscious CapitalistsDocument5 pagesQ1 2017 Letter Conscious CapitalistsAnonymous Ht0MIJNo ratings yet

- The Financial Analysis of Aci Limited: Sabrina AkhterDocument18 pagesThe Financial Analysis of Aci Limited: Sabrina AkhterReaz RahmanNo ratings yet

- SiemensDocument9 pagesSiemensCam SNo ratings yet

- Group 4 Assignment 2 Seminar in BankingDocument22 pagesGroup 4 Assignment 2 Seminar in BankingMuhammad Khairul AnuarNo ratings yet

- Rallis India Limited, Q1 2022 Earnings Call, Jul 22, 2021Document28 pagesRallis India Limited, Q1 2022 Earnings Call, Jul 22, 2021Anurag JainNo ratings yet

- Business Plan - For Food PackagingDocument72 pagesBusiness Plan - For Food PackagingFad JNo ratings yet

- DeepakDocument27 pagesDeepakKeerthi Raje UrasNo ratings yet

- EFIN 519 ( (Bank Fund Management) : On "Key Performance Indicator (KPI) "Document22 pagesEFIN 519 ( (Bank Fund Management) : On "Key Performance Indicator (KPI) "anika moniNo ratings yet

- Financial Accounting Assignment On Midcap: South Indian BankDocument28 pagesFinancial Accounting Assignment On Midcap: South Indian BankANKIT YADAVNo ratings yet

- Azerbaijan: Moving Toward More Diversified, Resilient, and Inclusive DevelopmentFrom EverandAzerbaijan: Moving Toward More Diversified, Resilient, and Inclusive DevelopmentNo ratings yet

- Different Engagements Different EngagementsDocument14 pagesDifferent Engagements Different EngagementsNoman SyedNo ratings yet

- IC ComponentsDocument3 pagesIC ComponentsNoman SyedNo ratings yet

- Audit Evidence (Isa 500) Audit Evidence (Isa 500)Document11 pagesAudit Evidence (Isa 500) Audit Evidence (Isa 500)Noman SyedNo ratings yet

- Social Research: Prepared byDocument28 pagesSocial Research: Prepared byNoman SyedNo ratings yet

- Ayesha Siddiqua - Sharjeel Hanif - Wajahat Ansari - Farhan Uddin - Syed Noman ZiaDocument15 pagesAyesha Siddiqua - Sharjeel Hanif - Wajahat Ansari - Farhan Uddin - Syed Noman ZiaNoman SyedNo ratings yet

- Social Groups and Organizations: Prepared by Fatima Zehra NaqviDocument25 pagesSocial Groups and Organizations: Prepared by Fatima Zehra NaqviNoman SyedNo ratings yet

- Syed Noman Zia: 02-112182-056 Introduction To Sociology Assignment No. 1Document3 pagesSyed Noman Zia: 02-112182-056 Introduction To Sociology Assignment No. 1Noman SyedNo ratings yet

- Sociology Social Research StepsDocument3 pagesSociology Social Research StepsNoman SyedNo ratings yet

- Syed Noman Zia: 02-112182-056 Introduction To Sociology Assignment No. 1Document3 pagesSyed Noman Zia: 02-112182-056 Introduction To Sociology Assignment No. 1Noman SyedNo ratings yet

- HRM Chapter 5Document3 pagesHRM Chapter 5Noman SyedNo ratings yet

- Quiz - 1: State The Below Are True or FalseDocument4 pagesQuiz - 1: State The Below Are True or FalseNoman SyedNo ratings yet

- HRM Chapter 4 SummaryDocument5 pagesHRM Chapter 4 SummaryNoman Syed0% (1)

- (Download PDF) Digital Media Steganography Principles Algorithms and Advances 1St Edition Mahmoud Hassaballah Editor Online Ebook All Chapter PDFDocument43 pages(Download PDF) Digital Media Steganography Principles Algorithms and Advances 1St Edition Mahmoud Hassaballah Editor Online Ebook All Chapter PDFdorothy.parkhurst152100% (15)

- BTBP Repertory DR Dhwanika DhagatDocument39 pagesBTBP Repertory DR Dhwanika DhagatDrx Rustom AliNo ratings yet

- Verified Component List Aama Certification Program: Part One Components of Certified Windows and DoorsDocument14 pagesVerified Component List Aama Certification Program: Part One Components of Certified Windows and Doorsjuan rodriguezNo ratings yet

- The Development of The Horror Genre FinalDocument6 pagesThe Development of The Horror Genre Finalapi-289624692No ratings yet

- Agreement Copy From Parties - Azzurra Pharmaconutrition PVT - Ltd...............Document4 pagesAgreement Copy From Parties - Azzurra Pharmaconutrition PVT - Ltd...............PUSHKAR PHARMANo ratings yet

- Richard-2019-9-29 - (PO 1048) PDFDocument1 pageRichard-2019-9-29 - (PO 1048) PDFLeslie Ali TapodocNo ratings yet

- Travel in MichiganDocument3 pagesTravel in Michiganricetech100% (4)

- Bhs IndonesiaDocument3 pagesBhs IndonesiaBerlian Aniek HerlinaNo ratings yet

- Bus 201Document28 pagesBus 201offjaNo ratings yet

- Bagaimana Pendalaman Keuangan Dan Cadangan Devisa Mempengaruhi Stabilitas Nilai Tukar Di NEGARA EMERGING MARKET? (Pendekatan Panel ARDL)Document9 pagesBagaimana Pendalaman Keuangan Dan Cadangan Devisa Mempengaruhi Stabilitas Nilai Tukar Di NEGARA EMERGING MARKET? (Pendekatan Panel ARDL)Yanri DayaNo ratings yet

- Curriculum Vitae - SUDHIR GUDURIDocument8 pagesCurriculum Vitae - SUDHIR GUDURIsudhirguduruNo ratings yet

- 14 - Stakeholder AnalysisDocument9 pages14 - Stakeholder Analysiseritros1717No ratings yet

- w3 Written AssignmentDocument5 pagesw3 Written AssignmentЯрослав КоршуновNo ratings yet

- Milestone Academy: Class IX - Progress Report - 2020-21Document1 pageMilestone Academy: Class IX - Progress Report - 2020-21Priyansh AnandNo ratings yet

- Hyper Discord I ADocument86 pagesHyper Discord I ATimothy BowenNo ratings yet

- Metroparks Magazine, Spring-Summer '11Document32 pagesMetroparks Magazine, Spring-Summer '11MyMetroparksNo ratings yet

- English To Telugu Vegetables NamesDocument6 pagesEnglish To Telugu Vegetables NamesUbed Ahmed73% (15)

- Resisting Colonialism Through A Ghanaian LensDocument6 pagesResisting Colonialism Through A Ghanaian LensAyeni KhemiNo ratings yet

- Orion Vs KaflamDocument4 pagesOrion Vs KaflamAdrian HilarioNo ratings yet

- 0500 FigurativeLanguage TPDocument30 pages0500 FigurativeLanguage TPsabinNo ratings yet

- A Comparative Experimental Investigation of ConcreteDocument7 pagesA Comparative Experimental Investigation of ConcreteSafwat El RoubyNo ratings yet

- Ahsan's CVDocument2 pagesAhsan's CVAhsan DilshadNo ratings yet

- 5 Books Recommended by Paul Tudor JonesDocument4 pages5 Books Recommended by Paul Tudor Jonesjackhack220No ratings yet

- (Blackwell Handbooks in Linguistics) Melissa A. Redford - The Handbook of Speech Production (2015, Wiley-Blackwell)Document6 pages(Blackwell Handbooks in Linguistics) Melissa A. Redford - The Handbook of Speech Production (2015, Wiley-Blackwell)Akbar Pandu SetiawanNo ratings yet

- Thank-You For Downloading The SW Tool IQ-OQ-PQ Template!Document14 pagesThank-You For Downloading The SW Tool IQ-OQ-PQ Template!MichelleNo ratings yet

- Nooyen - Nursery TRIBARDocument1 pageNooyen - Nursery TRIBARRicardo Diaz NiñoNo ratings yet