Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsBD Assignment Team C - Fabian and Salma

BD Assignment Team C - Fabian and Salma

Uploaded by

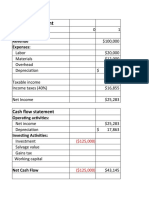

Sarah AnantaThis document presents financial projections for a 4 year project with revenue, direct costs, indirect costs, capital costs, taxes, and discounted cash flows. The internal rate of return (IRR) of 17.32% is greater than the company's weighted average cost of capital (WACC) of 14%, indicating the project should be pursued. Reducing indirect costs by 20% increases the IRR to 18.37%, further improving the project value.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Robert Reid Lady M Confections SubmissionDocument13 pagesRobert Reid Lady M Confections SubmissionSam Nderitu100% (1)

- Spreadsheet Template CourseraDocument4 pagesSpreadsheet Template Courserarutvik55% (11)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Instant Download Triumph Bonneville T100 Repair ManualDocument482 pagesInstant Download Triumph Bonneville T100 Repair Manualdcapito4017100% (1)

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- Coffee Shop Financial PlanDocument28 pagesCoffee Shop Financial PlangerardmacNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- Making Capital Investment DecisionsDocument70 pagesMaking Capital Investment DecisionsBussines LearnNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Excel Solution To 10.1-10.4Document14 pagesExcel Solution To 10.1-10.4mansiNo ratings yet

- Math Assignment Print SheetDocument4 pagesMath Assignment Print Sheetluca.castelvetere04No ratings yet

- 5 Concrete ExampleDocument3 pages5 Concrete ExampleTobias ManunureNo ratings yet

- F - Valuation template-POSTED - For Replicate WITHOUT FORMULASDocument4 pagesF - Valuation template-POSTED - For Replicate WITHOUT FORMULASSunil SharmaNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- Chapter 9 Case Question FinanceDocument3 pagesChapter 9 Case Question FinanceBhargavNo ratings yet

- Value Drivers (Assumptions)Document6 pagesValue Drivers (Assumptions)Phuong ThaoNo ratings yet

- Chapter 16Document25 pagesChapter 16Semh ZavalaNo ratings yet

- Project NPV Sensitivity AnalysisDocument54 pagesProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Multifamily Real EstateDocument17 pagesMultifamily Real EstaterohitranjansindriNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- Designer Lamp Project Blank SpreadsheetDocument4 pagesDesigner Lamp Project Blank SpreadsheetAnna BudaevaNo ratings yet

- She-Ra Newell Assignment 2-Pickins Mining CompanyDocument5 pagesShe-Ra Newell Assignment 2-Pickins Mining CompanyWarda AhsanNo ratings yet

- NPV IRR CalculatorDocument3 pagesNPV IRR CalculatorAli TekinNo ratings yet

- Valuation ProblemDocument4 pagesValuation ProblemPriyankaPoriNo ratings yet

- Assignment Part-2 Solution F18Document3 pagesAssignment Part-2 Solution F18Pablo AlarconNo ratings yet

- Guillermo UpdateddataDocument6 pagesGuillermo UpdateddataGabiNo ratings yet

- 6306903Document4 pages6306903maudiNo ratings yet

- Mayes 8e CH07 SolutionsDocument32 pagesMayes 8e CH07 SolutionsRamez AhmedNo ratings yet

- Based On Accounting Profit: Reak-VEN NalysisDocument5 pagesBased On Accounting Profit: Reak-VEN NalysisgiangphtNo ratings yet

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- Housing Affordability CalculatorDocument2 pagesHousing Affordability CalculatorB singhNo ratings yet

- Pinkey Street-2Document5 pagesPinkey Street-2ki100% (1)

- Coffee Shop Financial PlanDocument27 pagesCoffee Shop Financial PlankkornchomNo ratings yet

- Apple TTMDocument25 pagesApple TTMQuofi SeliNo ratings yet

- Impact of Proposed 2009 Tax IncreaseDocument1 pageImpact of Proposed 2009 Tax IncreaseNathan Benefield100% (1)

- Group2 - Assignment 1Document9 pagesGroup2 - Assignment 1RiturajPaulNo ratings yet

- Home Work 1 Corporate FinanceDocument8 pagesHome Work 1 Corporate FinanceAlia ShabbirNo ratings yet

- Lab 15Document4 pagesLab 15Magandhi SdlNo ratings yet

- XLSXDocument12 pagesXLSXShashwat JhaNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Operating Cash Flows (A) $ 6,895,625.00 $ 8,824,750.00 $ 12,248,375.00 $ 13,087,125.00Document3 pagesOperating Cash Flows (A) $ 6,895,625.00 $ 8,824,750.00 $ 12,248,375.00 $ 13,087,125.00MohitNo ratings yet

- Lease Financing AssignmentDocument8 pagesLease Financing AssignmentAshraful IslamNo ratings yet

- Tata Technologies FinancialsDocument22 pagesTata Technologies FinancialsRitvik DuttaNo ratings yet

- Net Present Value and Other Investment RulesDocument38 pagesNet Present Value and Other Investment RulesBussines LearnNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- 2008-2-00474-TI LampiranDocument3 pages2008-2-00474-TI LampiranMuhamad AzwarNo ratings yet

- Desarrollo de Caso Nº4 MERCURYDocument39 pagesDesarrollo de Caso Nº4 MERCURYclaudia aguillonNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Solutions Chapter 8Document6 pagesSolutions Chapter 8Carmella DismayaNo ratings yet

- Title Names University'S IdsDocument10 pagesTitle Names University'S IdsUzma SiddiquiNo ratings yet

- Financial Planning and Forecasting: AsssumptionsDocument4 pagesFinancial Planning and Forecasting: AsssumptionssubhenduNo ratings yet

- Measuring Economic Value Added (EVA)Document4 pagesMeasuring Economic Value Added (EVA)Paulo NascimentoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A Century of Chromatography and Volume 1000 of The Journal of ChromatographyDocument2 pagesA Century of Chromatography and Volume 1000 of The Journal of ChromatographyWillmann Jimenez MoralesNo ratings yet

- Modular Coordination IbsDocument5 pagesModular Coordination IbsCik Mia100% (1)

- Certified Sirim MIKROTIK PDFDocument3 pagesCertified Sirim MIKROTIK PDFArul Auni AqilNo ratings yet

- Dsa PaperDocument24 pagesDsa Paperhimanshusharma15868No ratings yet

- A Sad Hy Arogan Ivar An A MantraDocument9 pagesA Sad Hy Arogan Ivar An A MantraKrishNo ratings yet

- 4634 Lectures Labs 1 11 1Document212 pages4634 Lectures Labs 1 11 1Tiago Nunes0% (2)

- PRSN94Document18 pagesPRSN94Mula SrikantNo ratings yet

- Live Partition Mobility: Power SystemsDocument196 pagesLive Partition Mobility: Power Systemsmevtorres1977No ratings yet

- Purpose RediscoveredDocument102 pagesPurpose RediscoveredErnest NguboNo ratings yet

- MCNW2820 ThinkBook 16p Gen 4 v041423Document131 pagesMCNW2820 ThinkBook 16p Gen 4 v041423james cabrezosNo ratings yet

- Part 1 固定常考: Work/StudyDocument31 pagesPart 1 固定常考: Work/Study书签No ratings yet

- Sensory FunctionDocument34 pagesSensory FunctionFahra FadhillaNo ratings yet

- Factors Contributing To Burberry'S Failure 1Document16 pagesFactors Contributing To Burberry'S Failure 1benjaminNo ratings yet

- Water Soluble VitaminsDocument89 pagesWater Soluble Vitaminsahmedatef100% (1)

- The Efficiency of Electrocoagulation in Treating Wastewater From A Dairy Industry, Part I: Iron ElectrodesDocument8 pagesThe Efficiency of Electrocoagulation in Treating Wastewater From A Dairy Industry, Part I: Iron ElectrodesazerfazNo ratings yet

- Multiple SclerosisDocument45 pagesMultiple Sclerosispriyanka bhowmikNo ratings yet

- Science Quiz BeeDocument4 pagesScience Quiz BeeLyno ReyNo ratings yet

- ISO Rubber Test Methods - Content.Document6 pagesISO Rubber Test Methods - Content.Jitendra Bhatia0% (1)

- University of Tripoli HS120: - C. - D. Dense Regular Connective TissueDocument4 pagesUniversity of Tripoli HS120: - C. - D. Dense Regular Connective TissueAnn AnooshNo ratings yet

- Is.2042.2006 Insulating BricksDocument8 pagesIs.2042.2006 Insulating BricksGaneshNo ratings yet

- Generalizing The Black-Scholes Formula To Multivariate Contingent ClaimsDocument22 pagesGeneralizing The Black-Scholes Formula To Multivariate Contingent ClaimsDirumilNo ratings yet

- Pipes Angles BM 22 36 en - 2Document1 pagePipes Angles BM 22 36 en - 2elias aouadNo ratings yet

- 102 - SCO8048A-Alert - Fixings-FinalDocument3 pages102 - SCO8048A-Alert - Fixings-FinalO SNo ratings yet

- Coenzymes and Prosthetic GroupsDocument35 pagesCoenzymes and Prosthetic Groupsrishigangwar2No ratings yet

- Analogy - Verbal Reasoning Questions and Answers Page 4Document2 pagesAnalogy - Verbal Reasoning Questions and Answers Page 4Palak JioNo ratings yet

- Valemount Directory Prospect ListDocument45 pagesValemount Directory Prospect Listjordan gallowayNo ratings yet

- 4 - 0 Pex DW GBDocument8 pages4 - 0 Pex DW GBpushinluckNo ratings yet

- Cfi1203 Module 1 Intro To Financial Markets and RegulationDocument20 pagesCfi1203 Module 1 Intro To Financial Markets and RegulationLeonorahNo ratings yet

- Family Genogram in General MedicineDocument6 pagesFamily Genogram in General MedicineEsteban MatusNo ratings yet

BD Assignment Team C - Fabian and Salma

BD Assignment Team C - Fabian and Salma

Uploaded by

Sarah Ananta0 ratings0% found this document useful (0 votes)

7 views2 pagesThis document presents financial projections for a 4 year project with revenue, direct costs, indirect costs, capital costs, taxes, and discounted cash flows. The internal rate of return (IRR) of 17.32% is greater than the company's weighted average cost of capital (WACC) of 14%, indicating the project should be pursued. Reducing indirect costs by 20% increases the IRR to 18.37%, further improving the project value.

Original Description:

Original Title

BD Assignment Team C_Fabian and Salma

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document presents financial projections for a 4 year project with revenue, direct costs, indirect costs, capital costs, taxes, and discounted cash flows. The internal rate of return (IRR) of 17.32% is greater than the company's weighted average cost of capital (WACC) of 14%, indicating the project should be pursued. Reducing indirect costs by 20% increases the IRR to 18.37%, further improving the project value.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesBD Assignment Team C - Fabian and Salma

BD Assignment Team C - Fabian and Salma

Uploaded by

Sarah AnantaThis document presents financial projections for a 4 year project with revenue, direct costs, indirect costs, capital costs, taxes, and discounted cash flows. The internal rate of return (IRR) of 17.32% is greater than the company's weighted average cost of capital (WACC) of 14%, indicating the project should be pursued. Reducing indirect costs by 20% increases the IRR to 18.37%, further improving the project value.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

Discount Rate 18%

Inflation Rate (Direct Cost) 3%

Year 1 2 3 4

Revenue $4,000,000.00 $3,750,000.00 $3,500,000.00 $3,250,000.00

Direct Cost $1,400,000.00 $1,351,875.00 $1,261,750.00 $1,171,625.00

Indirect Cost $700,000.00 $675,937.50 $630,875.00 $585,812.50

Initial Capital Cash Outflow $200,000.00 $0.00 $0.00 $0.00

Capital Mobilization charge $320,000.00 $0.00 $0.00 $0.00

Import Taxes $240,000.00 $0.00 $0.00 $0.00

Revenue (FV) $4,000,000.00 $4,573,170.73 $5,205,234.98 $5,894,429.85

Direct Cost (FV) $1,707,317.07 $2,010,522.01 $2,288,399.04 $2,591,392.64

Indirect Cost (FV) $853,658.54 $1,005,261.01 $1,144,199.52 $1,295,696.32

FBOI 0.285 0.45925 0.45925 0.45925

Average FBOI 0.45925

Present Value (Revenue) $3,389,830.51 $2,693,191.61 $2,130,208.05 $1,676,313.84

Cost $2,860,000.00 $2,027,812.50 $1,892,625.00 $1,757,437.50

Nett Present Value $1,040,746.67

IRR 0.1732741267

Halliburton WACC 14%

Should we continue to pursue this project?

Yes, since IRR>Hal WACC it shows that this project will generate value for the company

What can we do to improve the value of this project?

Decreasing Indirect Cost by 20%, can increase IRR by 1%

Case : Indirect Cost 40% of Direct Cost

Year 1 2 3 4

Revenue $4,000,000.00 $3,750,000.00 $3,500,000.00 $3,250,000.00

Direct Cost $1,400,000.00 $1,351,875.00 $1,261,750.00 $1,171,625.00

Indirect Cost $560,000.00 $540,750.00 $504,700.00 $468,650.00

Initial Capital Cash Outflow $200,000.00 $0.00 $0.00 $0.00

Capital Mobilization charge $320,000.00 $0.00 $0.00 $0.00

Import Taxes $240,000.00 $0.00 $0.00 $0.00

Revenue (FV) $4,000,000.00 $4,573,170.73 $5,205,234.98 $5,894,429.85

Direct Cost (FV) $1,707,317.07 $2,010,522.01 $2,288,399.04 $2,591,392.64

Indirect Cost (FV) $682,926.83 $804,208.80 $915,359.61 $1,036,557.05

FBOI 0.32 0.4953 0.4953 0.4953

Average FBOI 0.4953

Present Value (Revenue) $3,389,830.51 $2,693,191.61 $2,130,208.05 $1,676,313.84

Cost $2,720,000.00 $1,892,625.00 $1,766,450.00 $1,640,275.00

Nett Present Value $1,667,421.67

IRR 0.1837339421

Halliburton WACC 14%

5

$3,000,000.00

$1,081,500.00

$540,750.00

$0.00

$0.00

$0.00

$6,635,380.70

$2,917,139.93

$1,458,569.96

0.45925

$1,311,327.65

$1,622,250.00

5

$3,000,000.00

$1,081,500.00

$432,600.00

$0.00

$0.00

$0.00

$6,635,380.70

$2,917,139.93

$1,166,855.97

0.4953

$1,311,327.65

$1,514,100.00

You might also like

- Robert Reid Lady M Confections SubmissionDocument13 pagesRobert Reid Lady M Confections SubmissionSam Nderitu100% (1)

- Spreadsheet Template CourseraDocument4 pagesSpreadsheet Template Courserarutvik55% (11)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Instant Download Triumph Bonneville T100 Repair ManualDocument482 pagesInstant Download Triumph Bonneville T100 Repair Manualdcapito4017100% (1)

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- Coffee Shop Financial PlanDocument28 pagesCoffee Shop Financial PlangerardmacNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- Making Capital Investment DecisionsDocument70 pagesMaking Capital Investment DecisionsBussines LearnNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Excel Solution To 10.1-10.4Document14 pagesExcel Solution To 10.1-10.4mansiNo ratings yet

- Math Assignment Print SheetDocument4 pagesMath Assignment Print Sheetluca.castelvetere04No ratings yet

- 5 Concrete ExampleDocument3 pages5 Concrete ExampleTobias ManunureNo ratings yet

- F - Valuation template-POSTED - For Replicate WITHOUT FORMULASDocument4 pagesF - Valuation template-POSTED - For Replicate WITHOUT FORMULASSunil SharmaNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- Chapter 9 Case Question FinanceDocument3 pagesChapter 9 Case Question FinanceBhargavNo ratings yet

- Value Drivers (Assumptions)Document6 pagesValue Drivers (Assumptions)Phuong ThaoNo ratings yet

- Chapter 16Document25 pagesChapter 16Semh ZavalaNo ratings yet

- Project NPV Sensitivity AnalysisDocument54 pagesProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Multifamily Real EstateDocument17 pagesMultifamily Real EstaterohitranjansindriNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- Designer Lamp Project Blank SpreadsheetDocument4 pagesDesigner Lamp Project Blank SpreadsheetAnna BudaevaNo ratings yet

- She-Ra Newell Assignment 2-Pickins Mining CompanyDocument5 pagesShe-Ra Newell Assignment 2-Pickins Mining CompanyWarda AhsanNo ratings yet

- NPV IRR CalculatorDocument3 pagesNPV IRR CalculatorAli TekinNo ratings yet

- Valuation ProblemDocument4 pagesValuation ProblemPriyankaPoriNo ratings yet

- Assignment Part-2 Solution F18Document3 pagesAssignment Part-2 Solution F18Pablo AlarconNo ratings yet

- Guillermo UpdateddataDocument6 pagesGuillermo UpdateddataGabiNo ratings yet

- 6306903Document4 pages6306903maudiNo ratings yet

- Mayes 8e CH07 SolutionsDocument32 pagesMayes 8e CH07 SolutionsRamez AhmedNo ratings yet

- Based On Accounting Profit: Reak-VEN NalysisDocument5 pagesBased On Accounting Profit: Reak-VEN NalysisgiangphtNo ratings yet

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- Housing Affordability CalculatorDocument2 pagesHousing Affordability CalculatorB singhNo ratings yet

- Pinkey Street-2Document5 pagesPinkey Street-2ki100% (1)

- Coffee Shop Financial PlanDocument27 pagesCoffee Shop Financial PlankkornchomNo ratings yet

- Apple TTMDocument25 pagesApple TTMQuofi SeliNo ratings yet

- Impact of Proposed 2009 Tax IncreaseDocument1 pageImpact of Proposed 2009 Tax IncreaseNathan Benefield100% (1)

- Group2 - Assignment 1Document9 pagesGroup2 - Assignment 1RiturajPaulNo ratings yet

- Home Work 1 Corporate FinanceDocument8 pagesHome Work 1 Corporate FinanceAlia ShabbirNo ratings yet

- Lab 15Document4 pagesLab 15Magandhi SdlNo ratings yet

- XLSXDocument12 pagesXLSXShashwat JhaNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Operating Cash Flows (A) $ 6,895,625.00 $ 8,824,750.00 $ 12,248,375.00 $ 13,087,125.00Document3 pagesOperating Cash Flows (A) $ 6,895,625.00 $ 8,824,750.00 $ 12,248,375.00 $ 13,087,125.00MohitNo ratings yet

- Lease Financing AssignmentDocument8 pagesLease Financing AssignmentAshraful IslamNo ratings yet

- Tata Technologies FinancialsDocument22 pagesTata Technologies FinancialsRitvik DuttaNo ratings yet

- Net Present Value and Other Investment RulesDocument38 pagesNet Present Value and Other Investment RulesBussines LearnNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- 2008-2-00474-TI LampiranDocument3 pages2008-2-00474-TI LampiranMuhamad AzwarNo ratings yet

- Desarrollo de Caso Nº4 MERCURYDocument39 pagesDesarrollo de Caso Nº4 MERCURYclaudia aguillonNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Solutions Chapter 8Document6 pagesSolutions Chapter 8Carmella DismayaNo ratings yet

- Title Names University'S IdsDocument10 pagesTitle Names University'S IdsUzma SiddiquiNo ratings yet

- Financial Planning and Forecasting: AsssumptionsDocument4 pagesFinancial Planning and Forecasting: AsssumptionssubhenduNo ratings yet

- Measuring Economic Value Added (EVA)Document4 pagesMeasuring Economic Value Added (EVA)Paulo NascimentoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A Century of Chromatography and Volume 1000 of The Journal of ChromatographyDocument2 pagesA Century of Chromatography and Volume 1000 of The Journal of ChromatographyWillmann Jimenez MoralesNo ratings yet

- Modular Coordination IbsDocument5 pagesModular Coordination IbsCik Mia100% (1)

- Certified Sirim MIKROTIK PDFDocument3 pagesCertified Sirim MIKROTIK PDFArul Auni AqilNo ratings yet

- Dsa PaperDocument24 pagesDsa Paperhimanshusharma15868No ratings yet

- A Sad Hy Arogan Ivar An A MantraDocument9 pagesA Sad Hy Arogan Ivar An A MantraKrishNo ratings yet

- 4634 Lectures Labs 1 11 1Document212 pages4634 Lectures Labs 1 11 1Tiago Nunes0% (2)

- PRSN94Document18 pagesPRSN94Mula SrikantNo ratings yet

- Live Partition Mobility: Power SystemsDocument196 pagesLive Partition Mobility: Power Systemsmevtorres1977No ratings yet

- Purpose RediscoveredDocument102 pagesPurpose RediscoveredErnest NguboNo ratings yet

- MCNW2820 ThinkBook 16p Gen 4 v041423Document131 pagesMCNW2820 ThinkBook 16p Gen 4 v041423james cabrezosNo ratings yet

- Part 1 固定常考: Work/StudyDocument31 pagesPart 1 固定常考: Work/Study书签No ratings yet

- Sensory FunctionDocument34 pagesSensory FunctionFahra FadhillaNo ratings yet

- Factors Contributing To Burberry'S Failure 1Document16 pagesFactors Contributing To Burberry'S Failure 1benjaminNo ratings yet

- Water Soluble VitaminsDocument89 pagesWater Soluble Vitaminsahmedatef100% (1)

- The Efficiency of Electrocoagulation in Treating Wastewater From A Dairy Industry, Part I: Iron ElectrodesDocument8 pagesThe Efficiency of Electrocoagulation in Treating Wastewater From A Dairy Industry, Part I: Iron ElectrodesazerfazNo ratings yet

- Multiple SclerosisDocument45 pagesMultiple Sclerosispriyanka bhowmikNo ratings yet

- Science Quiz BeeDocument4 pagesScience Quiz BeeLyno ReyNo ratings yet

- ISO Rubber Test Methods - Content.Document6 pagesISO Rubber Test Methods - Content.Jitendra Bhatia0% (1)

- University of Tripoli HS120: - C. - D. Dense Regular Connective TissueDocument4 pagesUniversity of Tripoli HS120: - C. - D. Dense Regular Connective TissueAnn AnooshNo ratings yet

- Is.2042.2006 Insulating BricksDocument8 pagesIs.2042.2006 Insulating BricksGaneshNo ratings yet

- Generalizing The Black-Scholes Formula To Multivariate Contingent ClaimsDocument22 pagesGeneralizing The Black-Scholes Formula To Multivariate Contingent ClaimsDirumilNo ratings yet

- Pipes Angles BM 22 36 en - 2Document1 pagePipes Angles BM 22 36 en - 2elias aouadNo ratings yet

- 102 - SCO8048A-Alert - Fixings-FinalDocument3 pages102 - SCO8048A-Alert - Fixings-FinalO SNo ratings yet

- Coenzymes and Prosthetic GroupsDocument35 pagesCoenzymes and Prosthetic Groupsrishigangwar2No ratings yet

- Analogy - Verbal Reasoning Questions and Answers Page 4Document2 pagesAnalogy - Verbal Reasoning Questions and Answers Page 4Palak JioNo ratings yet

- Valemount Directory Prospect ListDocument45 pagesValemount Directory Prospect Listjordan gallowayNo ratings yet

- 4 - 0 Pex DW GBDocument8 pages4 - 0 Pex DW GBpushinluckNo ratings yet

- Cfi1203 Module 1 Intro To Financial Markets and RegulationDocument20 pagesCfi1203 Module 1 Intro To Financial Markets and RegulationLeonorahNo ratings yet

- Family Genogram in General MedicineDocument6 pagesFamily Genogram in General MedicineEsteban MatusNo ratings yet