Professional Documents

Culture Documents

Research On Fastags in India and Regulatory Regime

Research On Fastags in India and Regulatory Regime

Uploaded by

Utkarsh TyagiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research On Fastags in India and Regulatory Regime

Research On Fastags in India and Regulatory Regime

Uploaded by

Utkarsh TyagiCopyright:

Available Formats

Research on Fastags in India and Regulatory Regime

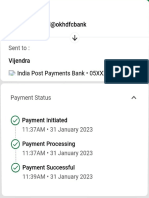

RBI in December 2019 allowed the linking of UPI and Pre-paid Instruments like Smart Cards

for payment of tolls by linking them with Fastags. The transaction process flow of Fastag is

covered here.

Regulatory Requirement, Responsibilities and Procedural Framework for issuance of

Fastags

Banks have to register with National Payments Corporation of India (NPCI). This is because

the NETC Procedural Guidelines prescribe that the ‘Issuer Bank’ will have to be a member of

the NPCI. An ‘Issuer’ is defined as a member of NPCI and one who issues the NETC Tag to

vehicle owner for the payment through NETC System.

There are certain responsibilities to be performed by issuers who are registered with the NPCI.

These can be accessed from Page 46 of the NETC Network Procedural Guidelines.

Relevance of PPIs in Fastag

Operating Payment Systems in India is the sole prerogative of the RBI which it governs under

the Payment and Settlement Systems Act of 2007. Under that enactment, it has authorised a

list of payment system operators to operate in India, which can be accessed here. As per the

RBI Notification in December 2019, all authorised payment systems can be linked with Fastag,

these do not have to be linked with any bank (examples: AmazonPay, PhonePe). Therefore,

while the issuing can only be done by a member of NPCI, the payment can be completed by

any of the PPI-authorized platforms.

Why is Paytm the largest issuer of Fastags in India? Advantages of Paytm Fastag.

News reports which can be accessed here, suggest that Paytm Payments Bank is the largest

issuer because of the fact that it is partnering up with automobile manufacturers to have pre-

fitted Paytm Fastags during the purchase of the vehicle. Further, the Paytm ecosystem doesn’t

require the creation of a separate prepaid account and the money on tolls can be paid from the

wallet which is used for other expenditure. This is in contrast to PhonePe, which requires

adding money to the Fastag account. This is because PhonePe is largely UPI-based, which has

to be linked with the Fastag issuer bank (the procedure for recharging Fastag by PhonePe is

given here.)

In fact the RBI has noted itself in its Booklet on Payment Systems (accessible here), under

Paragraph 26.3, that FinTech firms have leveraged the utility of the existing platforms to offer

a bouquet of innovative payment solutions to widen the reach, enrich user experience and

simultaneously enhance retail payments.

Who holds customer information/KYC data vis-à-vis Fastag?

As per the Procedural Framework, the issuance of KYC and other related-procedures are to be

done and performed at the end of the issuer. Under Section 4.6.1 and 4.7 (Page 50 of the

Procedural Framework), the KYC has to completed at the end of the issuer of the NETC

Fastag. No separate KYC requirement exists at the end of IHMCL or NHAI (Page 111).

You might also like

- ICICI Bank StatementDocument15 pagesICICI Bank StatementManish Menghani0% (1)

- Project SynopsisDocument14 pagesProject SynopsisPushpender Kumar100% (1)

- Marketing Paytm Wallet - Group5DDocument23 pagesMarketing Paytm Wallet - Group5DAdwait Deshpande100% (1)

- A - The Legal 500 and The in House Lawyer Comparative Legal GuideDocument13 pagesA - The Legal 500 and The in House Lawyer Comparative Legal GuideharshNo ratings yet

- Chapter I NtroductionDocument16 pagesChapter I NtroductionE01202114-MUHAMMED ISMAIL K BBA CANo ratings yet

- Content For Axis Bank and FreechargeDocument3 pagesContent For Axis Bank and FreechargeAryanSinghNo ratings yet

- ITLaw 1642Document7 pagesITLaw 1642Liya FathimaNo ratings yet

- Devansh Poddar FEB2024Document7 pagesDevansh Poddar FEB2024dev poddarNo ratings yet

- FINTECHSDocument3 pagesFINTECHSMahima SharmaNo ratings yet

- Paytm Assignment QuestionsDocument7 pagesPaytm Assignment Questionsswati swatiNo ratings yet

- Business StandardDocument2 pagesBusiness StandardAGNIVA RAHUL BHATTACHARYANo ratings yet

- Payment Banks: Digital Revolution in Indian Banking SystemDocument7 pagesPayment Banks: Digital Revolution in Indian Banking SystemResearch SolutionsNo ratings yet

- Group Members::-Plaban Bhattacharjee. Nikhil Aryan. Megha Dhar. AkankshaDocument15 pagesGroup Members::-Plaban Bhattacharjee. Nikhil Aryan. Megha Dhar. AkankshaAkanksha MishraNo ratings yet

- BBPS - FREQUENTLY ASKED QUESTIONS - April 16 2020 - SeenDocument7 pagesBBPS - FREQUENTLY ASKED QUESTIONS - April 16 2020 - Seensachin_sacNo ratings yet

- CHAPTER - 1 - Merged PDFDocument49 pagesCHAPTER - 1 - Merged PDFNiroja NiruNo ratings yet

- The Financial Technology Law Review - The Law ReviewsDocument8 pagesThe Financial Technology Law Review - The Law ReviewsAmira DhawanNo ratings yet

- CHAPTER 4 UpiDocument5 pagesCHAPTER 4 Upimundea251No ratings yet

- Paytm PartnersDocument1 pagePaytm PartnersRachit SrivastavaNo ratings yet

- Ceramic Glazed TilesDocument34 pagesCeramic Glazed TilesAman JaiswalNo ratings yet

- Transaction ProcessingDocument25 pagesTransaction ProcessingAmeerul HasanNo ratings yet

- Factor Affecting Consumer Satisfaction in Cashless Payment Systems in India With Respect To Paytm and BHIMDocument7 pagesFactor Affecting Consumer Satisfaction in Cashless Payment Systems in India With Respect To Paytm and BHIMsiteforprofessionalNo ratings yet

- Fintech Mondaq GuideDocument10 pagesFintech Mondaq GuideAmira DhawanNo ratings yet

- PAYTM - India's 1st Internet Conglomerate: Mobile WalletDocument7 pagesPAYTM - India's 1st Internet Conglomerate: Mobile WalletAchintya GoelNo ratings yet

- Fintech Newsletter 16 Jan 2020 To 30 Apr 2020Document10 pagesFintech Newsletter 16 Jan 2020 To 30 Apr 2020PRIYANSHU KUMARNo ratings yet

- Bhim (Document12 pagesBhim (jatinderNo ratings yet

- Assignment (1) AcademicDocument3 pagesAssignment (1) Academicsamriddhi sinhaNo ratings yet

- Paytm 1Document12 pagesPaytm 1Kanna Shashank100% (2)

- Aabhay Project File On Paytm1Document75 pagesAabhay Project File On Paytm1suresh luviNo ratings yet

- Factor Affecting Consumer Satisfaction in Cashless Payment Systems in India With Respect To Paytm and BHIMDocument6 pagesFactor Affecting Consumer Satisfaction in Cashless Payment Systems in India With Respect To Paytm and BHIMsajeebtheboss352No ratings yet

- Key Asks by The Payments IndustryDocument8 pagesKey Asks by The Payments IndustrySarthakNo ratings yet

- Payment and Settlement SystemDocument16 pagesPayment and Settlement Systemchitra_shresthaNo ratings yet

- Mod 1Document34 pagesMod 1AbhijeetNo ratings yet

- Paytm Case - DR JeyalakshmiDocument5 pagesPaytm Case - DR Jeyalakshmijayalakshmi RNo ratings yet

- National Payments Corporation of IndiaDocument4 pagesNational Payments Corporation of Indiadrako lNo ratings yet

- Mittal School of Business: Course Code: MGN358 Course Title: E BusinessDocument13 pagesMittal School of Business: Course Code: MGN358 Course Title: E BusinessNitin Patidar100% (1)

- Paytm - Software Requirement Specification SRS: Software Engineering (Lovely Professional University)Document14 pagesPaytm - Software Requirement Specification SRS: Software Engineering (Lovely Professional University)wefon43625No ratings yet

- Startup Story of PaytmDocument2 pagesStartup Story of PaytmLove ExpressNo ratings yet

- Introduction PaytmDocument70 pagesIntroduction Paytmmamtamishra.jmstNo ratings yet

- GP 5 Indian Fintech CosDocument16 pagesGP 5 Indian Fintech CosAman AgarwalNo ratings yet

- Mittal School of Business: Course Code: MGN358 Course Title: E BusinessDocument13 pagesMittal School of Business: Course Code: MGN358 Course Title: E BusinessNitin PatidarNo ratings yet

- Group 3 - BCE4th Year - Eco AssignmentDocument5 pagesGroup 3 - BCE4th Year - Eco AssignmentManvi JhaNo ratings yet

- Business StudiesDocument15 pagesBusiness StudiesdiolpNo ratings yet

- Paytm ValuationDocument19 pagesPaytm ValuationAtul AnandNo ratings yet

- E-Comerce - Business EnvironmentDocument6 pagesE-Comerce - Business EnvironmentAbhijeetNo ratings yet

- A_STUDY_ON_PAYTM_PAYMENTS_BANKS[1]Document15 pagesA_STUDY_ON_PAYTM_PAYMENTS_BANKS[1]koushiktp2000No ratings yet

- BharatPe's 12 % Marketing StrategyDocument2 pagesBharatPe's 12 % Marketing Strategyyogesh jangaliNo ratings yet

- Promotion of Payments Through Cards and Digital MeansDocument40 pagesPromotion of Payments Through Cards and Digital MeansPranjal SharmaNo ratings yet

- Reserve Bank of India: Master Directions On Issuance and Operation of Prepaid Payment Instruments in IndiaDocument30 pagesReserve Bank of India: Master Directions On Issuance and Operation of Prepaid Payment Instruments in IndiaLavesh ChauhanNo ratings yet

- Wattal Committee ReportDocument2 pagesWattal Committee ReportKunwarbir Singh lohatNo ratings yet

- Case Study - TrueCaller UPIDocument5 pagesCase Study - TrueCaller UPImon2584No ratings yet

- Presentation For Viva: Sagar Srinivas Mandal HPGD/JL17/2564Document61 pagesPresentation For Viva: Sagar Srinivas Mandal HPGD/JL17/2564Mandal SagarNo ratings yet

- Introduction: PaytmDocument45 pagesIntroduction: Paytmnaina karraNo ratings yet

- Araddhya PDFDocument46 pagesAraddhya PDFanubhavi2022.25No ratings yet

- 1RuRPfkKlFcSoZWkJc1h wCUnRaVXnTKzDocument57 pages1RuRPfkKlFcSoZWkJc1h wCUnRaVXnTKzDipanshu chandrikapureNo ratings yet

- Taniya Pandey FT-B 1121213103Document13 pagesTaniya Pandey FT-B 1121213103taniya pandeyNo ratings yet

- Ezetap Caselet Case Study PDFDocument12 pagesEzetap Caselet Case Study PDFSaurabh KumarNo ratings yet

- Paytm CaseDocument9 pagesPaytm CaseSHREY BAZARINo ratings yet

- EPS Revolutionising TH Indian ATM Industry PDFDocument48 pagesEPS Revolutionising TH Indian ATM Industry PDFBkFromIndiaNo ratings yet

- Paytm: Sharnbasva University, Kalaburagi Page 1 of 43Document43 pagesPaytm: Sharnbasva University, Kalaburagi Page 1 of 43Venkatesh ChavanNo ratings yet

- SC Caseload During PandemicDocument28 pagesSC Caseload During PandemicUtkarsh TyagiNo ratings yet

- Research On BNPL Schemes and Their Benefit To FintechsDocument3 pagesResearch On BNPL Schemes and Their Benefit To FintechsUtkarsh TyagiNo ratings yet

- TRAI RecommendationsDocument80 pagesTRAI RecommendationsUtkarsh TyagiNo ratings yet

- NPCI ResearchDocument4 pagesNPCI ResearchUtkarsh TyagiNo ratings yet

- Impact of Digital Lending On Traditional BanksDocument1 pageImpact of Digital Lending On Traditional BanksUtkarsh TyagiNo ratings yet

- AM-7-Professional Ethics-Profession & EthicsDocument2 pagesAM-7-Professional Ethics-Profession & EthicsUtkarsh TyagiNo ratings yet

- Statement 50358898708 20230601 132252 2Document1 pageStatement 50358898708 20230601 132252 2Jameer HasanNo ratings yet

- Banking Apps Tech Related Current Affairs Final 1 59Document7 pagesBanking Apps Tech Related Current Affairs Final 1 59Raj MitraNo ratings yet

- The Flipkart Story in IndiaDocument18 pagesThe Flipkart Story in IndiaAnirudha ThenganeNo ratings yet

- Descriptive TransactionsDocument11 pagesDescriptive TransactionsVikas SoniNo ratings yet

- Fraud PDF Aisa HaiDocument5 pagesFraud PDF Aisa Haipakyabhai143No ratings yet

- Beepedia Monthly Current Affairs (Beepedia) April 2024Document54 pagesBeepedia Monthly Current Affairs (Beepedia) April 2024manshisinghrajput29No ratings yet

- BS English Delhi 8-2Document22 pagesBS English Delhi 8-2kumar nNo ratings yet

- 694 Idbi StatementDocument26 pages694 Idbi StatementAyn RockyNo ratings yet

- E Proforma - 2022-09-19T104945.433-16Document2 pagesE Proforma - 2022-09-19T104945.433-16vinay.nimmala2000No ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument26 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureRaghav SharmaNo ratings yet

- Transactions Download 02-Mar-2023 213708582Document55 pagesTransactions Download 02-Mar-2023 213708582sagarsharma0929No ratings yet

- 03102019112950pbnr06ed8wsuozgckh Estatement 092019 2202Document9 pages03102019112950pbnr06ed8wsuozgckh Estatement 092019 2202Manoj EmmidesettyNo ratings yet

- AccountStatement01-02-2024 To 02-02-2024Document4 pagesAccountStatement01-02-2024 To 02-02-2024p2777932No ratings yet

- Project Report On UPIDocument52 pagesProject Report On UPI538Mansi Chaurasia67% (3)

- StatementOfAccount - 50328749025 - 10012024 - 142729.pdf 4Document50 pagesStatementOfAccount - 50328749025 - 10012024 - 142729.pdf 4Ravi PrakashNo ratings yet

- Assignment Topic-: Mobile Shop: Group - 7Document9 pagesAssignment Topic-: Mobile Shop: Group - 7Prince NarwariyaNo ratings yet

- AtulDocument15 pagesAtulhemantdahiya712No ratings yet

- Trends in Digital Payments System in India-A Study On Google Pay, Phonepe and PaytmDocument5 pagesTrends in Digital Payments System in India-A Study On Google Pay, Phonepe and PaytmTokyo BtyNo ratings yet

- PhonePe Statement Dec2023 Dec2023Document23 pagesPhonePe Statement Dec2023 Dec2023kesharparwez23No ratings yet

- Job Description-Key Account ExecutiveDocument2 pagesJob Description-Key Account ExecutiveSrei noyaNo ratings yet

- GFF2023 - AgendaDocument64 pagesGFF2023 - AgendaVinay SudershanNo ratings yet

- Top 100 Product Based Companies in IndiaDocument46 pagesTop 100 Product Based Companies in Indiamiles moralesNo ratings yet

- KM123619222 StatementDocument31 pagesKM123619222 StatementrocksebuNo ratings yet

- AccountStatement01-11-2022 To 20-01-2023 PDFDocument31 pagesAccountStatement01-11-2022 To 20-01-2023 PDFAmit KumarNo ratings yet

- Study On UPI PaymentsDocument67 pagesStudy On UPI Paymentseldhoseab370100% (1)

- GSTIN: 29AACCF1132H2ZX CIN: U67190MH2012PTC337657 Pan: Aaccf1132H State Code: 29Document1 pageGSTIN: 29AACCF1132H2ZX CIN: U67190MH2012PTC337657 Pan: Aaccf1132H State Code: 29praneshakshayNo ratings yet

- Jan 2021 To March 2021Document8 pagesJan 2021 To March 2021AKSHAY GHADGENo ratings yet

- Final Report - 19070123125Document25 pagesFinal Report - 19070123125Bright AvenueNo ratings yet

- How To Get Receipt From Phonepe PDFDocument9 pagesHow To Get Receipt From Phonepe PDFSaifullah AhmadNo ratings yet

![A_STUDY_ON_PAYTM_PAYMENTS_BANKS[1]](https://imgv2-2-f.scribdassets.com/img/document/747844303/149x198/83d4597da0/1720087781?v=1)