Professional Documents

Culture Documents

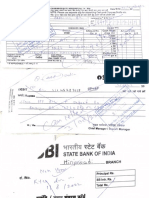

Annexure I Non-Home

Annexure I Non-Home

Uploaded by

rishabh0 ratings0% found this document useful (0 votes)

7 views2 pagesThe document outlines the transactions available to customers at non-home bank branches. It defines a home branch as where the customer's account is maintained, and a non-home branch as any other branch. At non-home branches, customers can deposit up to ₹200,000 per day for savings accounts and withdraw up to ₹50,000 per day for 'P' segment accounts. Transfer limits are ₹10 lakhs for most savings accounts and ₹50 lakhs for some accounts. Passbook updates are allowed at non-home branches without charge. Overall debit limits are ₹10 lakhs for most branches and ₹5 lakhs for single-

Original Description:

SBI rules

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the transactions available to customers at non-home bank branches. It defines a home branch as where the customer's account is maintained, and a non-home branch as any other branch. At non-home branches, customers can deposit up to ₹200,000 per day for savings accounts and withdraw up to ₹50,000 per day for 'P' segment accounts. Transfer limits are ₹10 lakhs for most savings accounts and ₹50 lakhs for some accounts. Passbook updates are allowed at non-home branches without charge. Overall debit limits are ₹10 lakhs for most branches and ₹5 lakhs for single-

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesAnnexure I Non-Home

Annexure I Non-Home

Uploaded by

rishabhThe document outlines the transactions available to customers at non-home bank branches. It defines a home branch as where the customer's account is maintained, and a non-home branch as any other branch. At non-home branches, customers can deposit up to ₹200,000 per day for savings accounts and withdraw up to ₹50,000 per day for 'P' segment accounts. Transfer limits are ₹10 lakhs for most savings accounts and ₹50 lakhs for some accounts. Passbook updates are allowed at non-home branches without charge. Overall debit limits are ₹10 lakhs for most branches and ₹5 lakhs for single-

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Annexure – I

Transactions available at Non-home branches

1. Definition of Branch:

a. Home Branch: Home Branch is a branch where the Customer’s Account is

maintained.

b. Non-Home Branch: The Banking facilities available to Customers at branches

other than home branch are called non-home branches.

2. Admissible transactions:

2.1 Cash Deposit:

a) P-Segment Savings Bank: No restriction.

b) In AGR/ SME Segment’ Non -Home deposit is ₹ 2,00,000/- per day.

2.2 Cash Withdrawal: Cash Payment at Non-Home Branch: Maximum

limit per Day

a) ‘P’ segment:

i. Self-Payment: ₹50,000/-, No cash payment to third parties.

ii. ‘P’ Segment – ₹5,000/- for self (using withdrawal form) accompanied with

Savings Bank Passbook.

iii. Super Senior Citizens (more than 80 years of age): Cash Payment to third

party up to ₹10,000/-.

b) SME segment: ₹1,00, 000/- for self. No cash payment to third parties.

c) AGR segment: ₹1,00, 000/- for self (KCC Cheques only)

d) No cash payment to third parties.

e) No cash payment of CAG/MCG/CMP Cheques at non-home branch.

2.3 Transfer transactions: The maximum limits are as under:

a) Savings Bank Accounts (instrument type 31):

i) Savings Bank other than HNI/NRI : ₹10 lakh.

ii) HNI/ NRI Savings Bank : ₹50 lakh.

b) Current Accounts (Instrument type 29):

i) Personal, Corporate & Institutional, Govt. Department: ₹50 Lakh.

ii) In case of Govt. Department accounts: No cap.

(if a separate arrangement exists with the Department)

iii) Corporate Client Cheques Payable At Par (CCPAP):

With facsimile signature : ₹ 10Lakh.

Otherwise : Unlimited.

iv) Under Corporate Client Cheques Payable At Par (CCPAP) the instrument

number, account number, instrument type, amount and date of expiry are

validated at the time of payment to ensure against fraudulent payment of the

CCPAP.

c) Cash Credit (Instrument type 30): Max. ₹50 lacs.

3. Passbook Updation: Facility of Savings bank pass -book updation at all

nonhome branches except Personal Banking Branches (PBBs), Specialised

Personal Banking Branches (SPBBs), Corporate Account Group (CAG),

Commercial Clients Group (CCG) and NRI branches throughout the country,

without any charge.

4. Others:

a) There will be a general cap of ₹ 10 lacs in originating debits for nonhome

transactions for all branches and ₹ 5 lacs for branches manned by Single

Officer and Single Clerk.

b) All RTGS transactions will be restricted to home branches only.

c) Depositors may submit the Form 15G/H at the any branch (Home/ Non-home).

d) Transactions at Non-Home branches are NOT allowed for SBI CAPGAINS PLUS

under Capital Gain Accounts Scheme-1988.

You might also like

- Unit 03 - Testing Conjectures KODocument1 pageUnit 03 - Testing Conjectures KOpanida SukkasemNo ratings yet

- The Sadhana of Buddha AkshobhyaDocument22 pagesThe Sadhana of Buddha AkshobhyaNilo Gelais Costa Junior100% (5)

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Final Project Reports SBI POSDocument83 pagesFinal Project Reports SBI POSTarun Kathiriya80% (5)

- The First Computers Were PeopleDocument39 pagesThe First Computers Were Peopleskywriter36No ratings yet

- Acknowledgement and Mitc Ca EnglishDocument3 pagesAcknowledgement and Mitc Ca Englishhar vNo ratings yet

- Mitc For Bob Lite Savings AccountDocument4 pagesMitc For Bob Lite Savings AccountramsanjayyNo ratings yet

- Non Home Cash Transaction 20180904130706 20180908142340Document1 pageNon Home Cash Transaction 20180904130706 20180908142340Durga Prasad RellaNo ratings yet

- KYC QuestionDocument7 pagesKYC Questiontalrejajyoti73% (11)

- Retail Products and Services of State Bank of IndiaDocument81 pagesRetail Products and Services of State Bank of IndiaNishant Singh50% (2)

- Assignment 1 - Banking OperationDocument72 pagesAssignment 1 - Banking OperationRAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- Savings Account DetailsDocument2 pagesSavings Account Detailsmysto9No ratings yet

- Savings AccountDocument27 pagesSavings AccountkjlgururajNo ratings yet

- Angel High School & Junior Colllege, Loni Kalbhor Subject: Book Keeping & Accountancy Question BankDocument21 pagesAngel High School & Junior Colllege, Loni Kalbhor Subject: Book Keeping & Accountancy Question BankShruti sukumarNo ratings yet

- Hand Out On GSTDocument45 pagesHand Out On GSTSiddhartha100% (1)

- Non Home BR Revised CirDocument17 pagesNon Home BR Revised CirNitesh VazekarNo ratings yet

- Handbook On DIGITAL Products 20210815125103Document29 pagesHandbook On DIGITAL Products 20210815125103Neos EonsNo ratings yet

- Handbook On DIGITAL Products 20210818110220Document29 pagesHandbook On DIGITAL Products 20210818110220omvir singhNo ratings yet

- Commerce Topic 2Document16 pagesCommerce Topic 2Anonymous lVpFnX3No ratings yet

- Crown Salary Account 01042014Document2 pagesCrown Salary Account 01042014Vikram IsgodNo ratings yet

- Pubali BankDocument13 pagesPubali BankAminul Islam100% (1)

- FAQs On Cash Withdrawal11july2022Document2 pagesFAQs On Cash Withdrawal11july2022Ravi KumarNo ratings yet

- Untitled 1Document26 pagesUntitled 1ER SAABNo ratings yet

- What Is This Product About?Document6 pagesWhat Is This Product About?Franco BegnadenNo ratings yet

- Interview 1Document7 pagesInterview 1rituNo ratings yet

- Branch Licensing PolicyDocument10 pagesBranch Licensing Policyma_sadamNo ratings yet

- HRA Manual Feb 2019Document6 pagesHRA Manual Feb 2019kuchnaiNo ratings yet

- Banking Terms & Abbreviations: Test Series CourseDocument5 pagesBanking Terms & Abbreviations: Test Series CourseGuruGanesh Kudlur100% (1)

- Punjab National Bank Vision & Mission StatementDocument34 pagesPunjab National Bank Vision & Mission StatementdhruvinNo ratings yet

- Fast Plus Account Product Disclosure Sheet - 12072022Document6 pagesFast Plus Account Product Disclosure Sheet - 12072022Dan SantosNo ratings yet

- SB 160 Baroda Bank Mitra Bachat Khata HO - BR - 114 - 137Document4 pagesSB 160 Baroda Bank Mitra Bachat Khata HO - BR - 114 - 137Suraj KumarNo ratings yet

- Special Deposits of Fysal BankDocument6 pagesSpecial Deposits of Fysal BankGhulam Abbas100% (2)

- 41 New Products of SBI (As On 30.09.2010)Document10 pages41 New Products of SBI (As On 30.09.2010)Abhinav SaraswatNo ratings yet

- Bankciwamb Bank PH Pds Fast Plus AccountDocument6 pagesBankciwamb Bank PH Pds Fast Plus AccountChuckie TajorNo ratings yet

- Master Circular On Non Home Transactions Updated Till 31.10.2023Document19 pagesMaster Circular On Non Home Transactions Updated Till 31.10.2023kanoimalNo ratings yet

- Question Bank On Customer Service: Prepared by SBILD AurangabadDocument22 pagesQuestion Bank On Customer Service: Prepared by SBILD AurangabadsayanNo ratings yet

- AFB Short NotesDocument5 pagesAFB Short Notesstudy studyNo ratings yet

- Citizens Charter Cbi19Document20 pagesCitizens Charter Cbi19Movies BlogNo ratings yet

- CIMB Product Disclosure Sheet - UpSave Account - 03252019 PDFDocument5 pagesCIMB Product Disclosure Sheet - UpSave Account - 03252019 PDFClaudette LopezNo ratings yet

- Bank of Baroda PO Banking Awareness Free PDF Capsule PDFDocument21 pagesBank of Baroda PO Banking Awareness Free PDF Capsule PDFManikandan VpNo ratings yet

- Mcqs Based On Bank'S Circulars During July, 2021Document8 pagesMcqs Based On Bank'S Circulars During July, 2021Shilpa JhaNo ratings yet

- RECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Document11 pagesRECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Arun PrakashNo ratings yet

- Citigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeDocument1 pageCitigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeNikhil RaviNo ratings yet

- ChallanDocument1 pageChallanapi-279452985No ratings yet

- Benefits of Post Office Savings AccountsDocument7 pagesBenefits of Post Office Savings Accounts2K22/BAE/79 KESHAV GARGNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- BanksDocument24 pagesBanksViral Mandalia0% (1)

- Cheque Collection PolicyDocument10 pagesCheque Collection PolicyXfyxdNo ratings yet

- Conversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountDocument2 pagesConversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountIlyas SafiNo ratings yet

- First Preboard FAR ReviewDocument26 pagesFirst Preboard FAR Reviewlois martinNo ratings yet

- RBI Revised Notification 6 July 2017 PDFDocument9 pagesRBI Revised Notification 6 July 2017 PDFMoneylife FoundationNo ratings yet

- ARDAN - Financial PlanDocument31 pagesARDAN - Financial PlanIna Therese ArdanNo ratings yet

- 02 Cases On Banker Customer RelationshipDocument4 pages02 Cases On Banker Customer RelationshipVikashKumar100% (1)

- Chapter16 - Basic Savings Bank Deposit AccountDocument3 pagesChapter16 - Basic Savings Bank Deposit Accountshubhram2014No ratings yet

- Pds Lifestyle-0223en PDFDocument5 pagesPds Lifestyle-0223en PDFWilfred ImangNo ratings yet

- Banking Operations - Bank of IndiaDocument21 pagesBanking Operations - Bank of IndiaEkta singhNo ratings yet

- Core Recommendations of Goipuria CommitteeDocument2 pagesCore Recommendations of Goipuria Committeepun33tNo ratings yet

- BFSI Training Manual - PDF - 20230810 - 164502 - 0000Document136 pagesBFSI Training Manual - PDF - 20230810 - 164502 - 0000deepak643aNo ratings yet

- 150722-Revision in Service Charges Updated As On 30062022Document21 pages150722-Revision in Service Charges Updated As On 30062022Vinoth KumarNo ratings yet

- Prepaid Payment Instruments (PPIs)Document11 pagesPrepaid Payment Instruments (PPIs)nilesh bhagatNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- PPF Account Closing FormsDocument3 pagesPPF Account Closing FormsrishabhNo ratings yet

- Annexure III Non - HomeDocument1 pageAnnexure III Non - HomerishabhNo ratings yet

- Annexure II Non-HomeDocument4 pagesAnnexure II Non-HomerishabhNo ratings yet

- Main Keyword: Private Tutor For IGCSE Private Tuition For IGCSE Home Tutor For IGCSE Home Tuition For IGCSEDocument3 pagesMain Keyword: Private Tutor For IGCSE Private Tuition For IGCSE Home Tutor For IGCSE Home Tuition For IGCSErishabhNo ratings yet

- 253-Falcon 20F-5BR SN 273 N17DQDocument6 pages253-Falcon 20F-5BR SN 273 N17DQteuiragNo ratings yet

- ISKCON Desire Tree - Krishna Showing Universal FormDocument29 pagesISKCON Desire Tree - Krishna Showing Universal FormISKCON desire treeNo ratings yet

- SQL ExceriseDocument10 pagesSQL ExceriseSri VatsaNo ratings yet

- Cigre PDFDocument18 pagesCigre PDFJay Rameshbhai Parikh100% (1)

- Per 3 Science7Document2 pagesPer 3 Science7Maria Cristina PolNo ratings yet

- Google Glass PresentationDocument25 pagesGoogle Glass PresentationVenu Kinng100% (1)

- New DLL Physical ScienceDocument14 pagesNew DLL Physical ScienceFritzie MacalamNo ratings yet

- Filipino American RelationshipDocument3 pagesFilipino American RelationshipSamuel Grant ZabalaNo ratings yet

- CPRG - V4 - Advanced Issues in Contract PricingDocument304 pagesCPRG - V4 - Advanced Issues in Contract Pricingjarod437No ratings yet

- WEST BENGAL UNIVERSITY OF TECHNOLOGY Summer Proj AyanDocument38 pagesWEST BENGAL UNIVERSITY OF TECHNOLOGY Summer Proj AyanMukesh Kumar SinghNo ratings yet

- Priinciples of Statistics PDFDocument62 pagesPriinciples of Statistics PDFkaroNo ratings yet

- 10 1 1 590 9326 PDFDocument13 pages10 1 1 590 9326 PDFsbarwal9No ratings yet

- Wem Pu 6089 A PDFDocument74 pagesWem Pu 6089 A PDFolalekanNo ratings yet

- Classrooms Decide The Future of The Nation by Awais Raza 2K19 ENG 40Document6 pagesClassrooms Decide The Future of The Nation by Awais Raza 2K19 ENG 40Maryam HamdanNo ratings yet

- Diagnosis of Hirschsprung Disease: Lusine Ambartsumyan, Caitlin Smith, and Raj P KapurDocument15 pagesDiagnosis of Hirschsprung Disease: Lusine Ambartsumyan, Caitlin Smith, and Raj P KapurGhina Mauizha WulandariNo ratings yet

- Brochure UNIPVDocument20 pagesBrochure UNIPVPurushoth KumarNo ratings yet

- Practical and Assignment 6Document3 pagesPractical and Assignment 6ioleNo ratings yet

- Ce511 Tabinas HW01Document18 pagesCe511 Tabinas HW01Kathlyn Kit TabinasNo ratings yet

- Nisbet Idea of Progress PDFDocument31 pagesNisbet Idea of Progress PDFHernan Cuevas ValenzuelaNo ratings yet

- Social Dimensions in Education Part 1Document4 pagesSocial Dimensions in Education Part 1Laurice Marie GabianaNo ratings yet

- PSY313-C Case SampleDocument16 pagesPSY313-C Case Samplefajrr loneNo ratings yet

- GSCFF APF TechniquesDocument18 pagesGSCFF APF TechniquesMaharaniNo ratings yet

- Staffing: The Management and Nonmanagerial Human Resources InventoryDocument22 pagesStaffing: The Management and Nonmanagerial Human Resources InventorySophia Pintor0% (1)

- NAA ItemNumber391518Document203 pagesNAA ItemNumber391518Jonathan ArmstrongNo ratings yet

- Customer Service AssignmentDocument2 pagesCustomer Service AssignmentJoe Kau Zi YaoNo ratings yet

- Particle Size Distribution of Granular Activated Carbon: Standard Test Method ForDocument6 pagesParticle Size Distribution of Granular Activated Carbon: Standard Test Method Forlayth100% (1)

- Intellectual CharismaDocument16 pagesIntellectual CharismaAlejandraNo ratings yet