Professional Documents

Culture Documents

Chap11 Long Term Decision Making

Chap11 Long Term Decision Making

Uploaded by

Saiful AliCopyright:

Available Formats

You might also like

- Accounting Tools For Business Decision Making 5th Edition Kimmel Solutions ManualDocument7 pagesAccounting Tools For Business Decision Making 5th Edition Kimmel Solutions ManualPatrickMillerkoqd100% (51)

- Hard Bargaining Tactics in Football TransfersDocument2 pagesHard Bargaining Tactics in Football TransfersOmpriya Acharya100% (1)

- Capital Budgeting - Part 1Document6 pagesCapital Budgeting - Part 1Aurelia RijiNo ratings yet

- Corporate Finance (Lecture-3)Document72 pagesCorporate Finance (Lecture-3)meahearun nesa mouNo ratings yet

- Unit 12Document13 pagesUnit 12Mîñåk ŞhïïNo ratings yet

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- BU7753 Finance For Managers: Capital Investment AppraisalDocument27 pagesBU7753 Finance For Managers: Capital Investment AppraisalMuhammad Sajid SaeedNo ratings yet

- Global MBA Business Accounting & FinanceDocument48 pagesGlobal MBA Business Accounting & FinanceFebri AndikaNo ratings yet

- Investment Appraisal Techniques 2Document24 pagesInvestment Appraisal Techniques 2Jul 480wesh100% (1)

- Management of Cost and RiskDocument39 pagesManagement of Cost and RisktechnicalvijayNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingRashika JainNo ratings yet

- Capital Investment Decisions: 1: Question IM 13.1 AdvancedDocument7 pagesCapital Investment Decisions: 1: Question IM 13.1 AdvancedrahimNo ratings yet

- Exercise Chapter 3Document3 pagesExercise Chapter 3Phương ThảoNo ratings yet

- TEST PROJECT FINANCE AND COST MANAGEMENT Section BDocument6 pagesTEST PROJECT FINANCE AND COST MANAGEMENT Section BNyasha MakovaNo ratings yet

- Investment Decision: Unit IiiDocument50 pagesInvestment Decision: Unit IiiFara HameedNo ratings yet

- Investment Appraisal 1Document13 pagesInvestment Appraisal 1Arslan ArifNo ratings yet

- CH 10Document76 pagesCH 10Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- P4 Advanced Investment AppraisalDocument37 pagesP4 Advanced Investment AppraisalfarzycimaNo ratings yet

- Capital Budgeting - FINAL (A)Document59 pagesCapital Budgeting - FINAL (A)nikhilnegi1704No ratings yet

- Project - PPT 5 Additional ReadingDocument89 pagesProject - PPT 5 Additional Readingeyerusalem tesfayeNo ratings yet

- QuestionsforDiscussion NPVIRRDocument3 pagesQuestionsforDiscussion NPVIRRTauseef Ahmed100% (1)

- Non-Discounting Criteria Discounting CriteriaDocument89 pagesNon-Discounting Criteria Discounting CriteriaAytenew AbebeNo ratings yet

- Unit 5Document46 pagesUnit 519-R-0503 ManogjnaNo ratings yet

- Development 1Document20 pagesDevelopment 1AgreyNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- Chapter 9Document44 pagesChapter 9Phạm Thùy DươngNo ratings yet

- Chap11 Quiz5 MI2Document15 pagesChap11 Quiz5 MI2lynvuong101299No ratings yet

- 6 - Chapter Six - Project AppraisalDocument31 pages6 - Chapter Six - Project AppraisalmeseretNo ratings yet

- Tutorial 4 - SolutionDocument16 pagesTutorial 4 - SolutionNg Chun SenfNo ratings yet

- 4 Capital Investment Nov 2020Document76 pages4 Capital Investment Nov 2020Gabriel Alva AnkrahNo ratings yet

- Investment Appraisal BBADocument25 pagesInvestment Appraisal BBAreubensimone4No ratings yet

- Investment Appraisal 1: Process and MethodsDocument22 pagesInvestment Appraisal 1: Process and MethodsAshura ShaibNo ratings yet

- Lecture 28-31capital BudgetingDocument68 pagesLecture 28-31capital BudgetingNakul GoyalNo ratings yet

- Chapter Four Part Two: Importance of Capital BudgetingDocument12 pagesChapter Four Part Two: Importance of Capital Budgetingnahu a dinNo ratings yet

- Homework 2 2018 Auditing 12522Document3 pagesHomework 2 2018 Auditing 12522Muhammad MudassarNo ratings yet

- Presentation 8-Project AppraisalDocument22 pagesPresentation 8-Project AppraisalafzalNo ratings yet

- 5, 6 & 7 Capital BudgetingDocument42 pages5, 6 & 7 Capital BudgetingNaman AgarwalNo ratings yet

- CapitalexpredecnsDocument25 pagesCapitalexpredecnsIamTinuNo ratings yet

- ACCT 2200 - Chapter 11 P2 - With SolutionsDocument26 pagesACCT 2200 - Chapter 11 P2 - With Solutionsafsdasdf3qf4341f4asDNo ratings yet

- Capital Budgeting Questions - UE - FMDocument3 pagesCapital Budgeting Questions - UE - FMVimoli MehtaNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- CH (10) - Book AnswersDocument17 pagesCH (10) - Book AnswersabdulraufdghaybeejNo ratings yet

- Capital Budgeting Techniques (1st Week)Document18 pagesCapital Budgeting Techniques (1st Week)Jebeth RiveraNo ratings yet

- Cost of Capital and Investment CriteriaDocument9 pagesCost of Capital and Investment Criteriamuhyideen6abdulganiyNo ratings yet

- Capital Budgeting (NPV PI)Document22 pagesCapital Budgeting (NPV PI)Udit DhawanNo ratings yet

- Lecture 10 - Capital Investment Decisions - JJDocument28 pagesLecture 10 - Capital Investment Decisions - JJTariq KhanNo ratings yet

- PM Chapter 5Document31 pagesPM Chapter 5tedrostesfay74No ratings yet

- MBA7001 Week 5 Investment Appraisal Methods 1Document39 pagesMBA7001 Week 5 Investment Appraisal Methods 1Pranjal JaiswalNo ratings yet

- L 5 Capital Investment DecisionsDocument23 pagesL 5 Capital Investment DecisionsMist FactorNo ratings yet

- Screening Capital Investment ProposalsDocument13 pagesScreening Capital Investment ProposalsSandia EspejoNo ratings yet

- Capital Budgeting DetailDocument64 pagesCapital Budgeting DetailDEV BHADANANo ratings yet

- Financial Analysis of Final)Document28 pagesFinancial Analysis of Final)Mangesh GulhaneNo ratings yet

- Capital Budgeting - EvaluationDocument47 pagesCapital Budgeting - Evaluationpranav1931129No ratings yet

- UNIT 4 - Capital BudgetingDocument38 pagesUNIT 4 - Capital BudgetingKrishnan SrinivasanNo ratings yet

- Financial Management Unit 3 DR Ashok KumarDocument65 pagesFinancial Management Unit 3 DR Ashok Kumarsk tanNo ratings yet

- CapbudgetDocument31 pagesCapbudgetnaveen penugondaNo ratings yet

- CH 10Document74 pagesCH 10Chi NguyễnNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- CH2 - TP3Document1 pageCH2 - TP3Saiful AliNo ratings yet

- CH2 - TP2Document1 pageCH2 - TP2Saiful AliNo ratings yet

- CH2 - TP1Document1 pageCH2 - TP1Saiful AliNo ratings yet

- CH1 - TP1Document1 pageCH1 - TP1Saiful AliNo ratings yet

- CH1 - TP2Document1 pageCH1 - TP2Saiful AliNo ratings yet

- Chap13 Non-Profit Making OrganisationsDocument7 pagesChap13 Non-Profit Making OrganisationsSaiful AliNo ratings yet

- Chap14 The Calculation & Interpretation of Accounting RatiosDocument6 pagesChap14 The Calculation & Interpretation of Accounting RatiosSaiful AliNo ratings yet

- 4.3. Obligations of Borrowers: Questions To PonderDocument6 pages4.3. Obligations of Borrowers: Questions To PonderTin CabosNo ratings yet

- Solved Suppose Congress and The President Decide To Increase Government PurchasesDocument1 pageSolved Suppose Congress and The President Decide To Increase Government PurchasesM Bilal SaleemNo ratings yet

- Financial Math TestDocument172 pagesFinancial Math TestCP Mario Pérez López100% (2)

- Salary INCOME - ITDocument64 pagesSalary INCOME - ITHrishikesh AshtaputreNo ratings yet

- Statements Jan-23. 12Document3 pagesStatements Jan-23. 12Basmma EidNo ratings yet

- Abc-Consolidation With Intercompany TransactionsDocument3 pagesAbc-Consolidation With Intercompany TransactionsLeonardo MercaderNo ratings yet

- Amazing Intraday Strategy - GUNTU RAMARAODocument25 pagesAmazing Intraday Strategy - GUNTU RAMARAOwadatkar.amit104No ratings yet

- Financial Management Sri Individidual Cia 1.2Document7 pagesFinancial Management Sri Individidual Cia 1.2ALLIED AGENCIESNo ratings yet

- Basic Accounting PrinciplesDocument5 pagesBasic Accounting PrinciplesGracie BulaquinaNo ratings yet

- 1Document3 pages1Stook01701No ratings yet

- Capital Market Review and Outlook: AnnualDocument20 pagesCapital Market Review and Outlook: AnnualbigaNo ratings yet

- Pay Slip Components: Covance Pty LimitedDocument1 pagePay Slip Components: Covance Pty LimitedAndrés PatiñoNo ratings yet

- Annual Report 2020Document352 pagesAnnual Report 2020ismat arteeNo ratings yet

- B014393 HN in Business L4 SpecificationDocument480 pagesB014393 HN in Business L4 SpecificationRajivVyasNo ratings yet

- Factsheet GB en Gb00byvxbg82Document9 pagesFactsheet GB en Gb00byvxbg82RocketNo ratings yet

- Shakeeb Resume1Document3 pagesShakeeb Resume1Shakeeb AshaiNo ratings yet

- Sunlife Proposal Bianca OseraDocument2 pagesSunlife Proposal Bianca OseraBianca Joy OseraNo ratings yet

- Municipality of Guipos: Republic of The Philippines Province of Zamboanga de SurDocument21 pagesMunicipality of Guipos: Republic of The Philippines Province of Zamboanga de SurMelvinson Loui Polenzo SarcaugaNo ratings yet

- Egov Urban Portal-Water Tax PDFDocument2 pagesEgov Urban Portal-Water Tax PDFPadmavathi Putra LokeshNo ratings yet

- List of Payment Purpose Code KRDocument10 pagesList of Payment Purpose Code KRあいうえおかきくけこNo ratings yet

- Bank Reconciliation Statement - Process - Format - ExampleDocument5 pagesBank Reconciliation Statement - Process - Format - ExampleCykee100% (1)

- American International Group Inc and SubsidiariesDocument14 pagesAmerican International Group Inc and SubsidiariesFOXBusiness.com50% (2)

- Ramcharan Tharu Laxmi BankDocument3 pagesRamcharan Tharu Laxmi BankNikhil Visa ServicesNo ratings yet

- Real Estate Finance and Investment - Lecture NotesDocument2 pagesReal Estate Finance and Investment - Lecture NotesCoursePin100% (1)

- Republic Act No.10881 - Amendments On Investment RestrictionsDocument3 pagesRepublic Act No.10881 - Amendments On Investment Restrictionsdefaens8053No ratings yet

- Ra 6552 Maceda LawDocument9 pagesRa 6552 Maceda Lawjmr constructionNo ratings yet

- Short Term LoansDocument2 pagesShort Term LoansGopi NathNo ratings yet

- 15-IFRS 15 - SummaryDocument6 pages15-IFRS 15 - SummaryhusseinNo ratings yet

Chap11 Long Term Decision Making

Chap11 Long Term Decision Making

Uploaded by

Saiful AliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap11 Long Term Decision Making

Chap11 Long Term Decision Making

Uploaded by

Saiful AliCopyright:

Available Formats

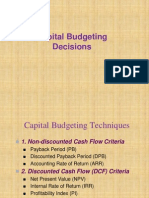

LONG TERM DECISION MAKING CHAPTER 11

11.1 Payback Period

• The payback period is the number of years required for a project to accumulated enough cash to pay for

the cost of the initial investment

• This method of evaluating projects focuses on liquidity and how quickly cash investment in a project is

recouped.

• The shorter the payback period, the more desirable the investment

11.1.1 Advantages of payback period

✓ Risky projects with long payback periods are not favoured by this method

✓ It focuses on liquidity, and is a useful technique if a firm is facing cash constraints.

11.1.2 Disadvantages of payback period

Cash flows which occur after the payback period are ignored

The time value of money (inflation) is ignored

It takes no account of the overall profitability of a project

Example 11.1

The management of Low Risk Ltd is currently evaluating the following project.

Year 0 Year 1 Year 2 Year 3 Year 4

Initial Investment £120,000

Cash inflows £40,000 £40,000 £40,000 £60,000

Required: Determine the project’s payback period.

Example 11.2

Pink Ltd is considering investing in plant machine. The cost of purchasing the machine is £18,000, and it is

expected to produce annual savings of £3,000. The machine is expected to have a useful life of ten years. Pink

Ltd considers an investment to be acceptable if it pays back within five years.

Required:

a) What is the machine’s payback period?

b) Should Pink Ltd invest in the machine?

Example 11.3

The management of Brislington Ltd is currently evaluating the following investment proposal:

Year 0 Year 1 Year 2 Year 3 Year 4

Initial Investment £120,000

Cash inflows £30,000 £80,000 £60,000 £40,000

Required: Determine the project’s payback period

Pearson LCCI LEVEL 3 ACCOUNTING (ASE20104)

LONG TERM DECISION MAKING CHAPTER 11

11.2 Net present value method

▪ Net present value (NPV) is the difference between the present value of the cash inflows from a project

and the initial amount invested in the project.

▪ The method required discounting of all cash flows to their present value. Discounting means multiplying

the cash flow by the discount factor.

▪ Present value is the cash received in future years restated to its current value, effectively adjusting for

inflation and risk

▪ If the present value of the cash inflows is less than the initial cash investment, the project is said to have a

negative net present value.

11.2.1 Advantages of payback period

✓ Gives a clear decision rule: accept positive NPV projects and reject negative NPV project.

✓ Takes the time value of money

11.2.2 Disadvantages of payback period

Selecting an appropriate discount rate for the project can be problematic

The method requires estimating the useful life of the project and timing of cash flows associated

with the project.

Example 11.4

Alan Ltd is considering purchasing a vehicle for £28,000. The running costs of the vehicle are estimated at

£3,000 per year but Alan Ltd will save £7,000 on distribution costs per year. The vehicle will be sold for £5,000

at the end of Year 5.

Required: Calculate the net present value

Discounting factors:

Year 1 0.893

Year 2 0.797

Year 3 0.712

Year 4 0.636

Year 5 0.567

Example 11.5

Ronnie Ltd is considering the purchase of new machinery. The purchase price of the machinery is £200,000;

the estimated useful life will be six years.

Installation costs will be an additional £20,000. The existing machinery can be sold for £50,000. Annual cost

savings will be £36,000. The scrap value of the new machinery will be £5,200.

Required: a) What is the NPV of this capital project?

b) Should the project be undertaken?

Discounting factors:

Year 1 0.870

Year 2 0.756

Year 3 0.658

Year 4 0.582

Year 5 0.497

Year 6 0.432

Pearson LCCI LEVEL 3 ACCOUNTING (ASE20104)

LONG TERM DECISION MAKING CHAPTER 11

11.3 Accounting rate of return

The accounting rate of return (ARR) related the net income generated by a project to the initial capital

investment.

It is measured as follows:

11.3.1 Advantages of payback period

✓ The method is easy to understand

✓ The calculation are simple

11.3.2 Disadvantages of payback period

It does not take the timing of cash flows into account

It focuses on profits and not cash flows

Example 11.6

Alex Ltd is considering purchasing a vehicle for £28,000. The running costs of the vehicle are estimated at

£4,000 per year but Alex Ltd will save £9,000 distribution costs per year. The vehicle will be sold for £5,000 at

the end of Year 5.

Required: Calculate the accounting rate of return.

TARGET PRACTICE

11.1 Jinn Ltd has to choose between three investments, details of which are as follows:

Investment A Investment B Investment C

Year Cash Flows Year Cash Flows Year Cash Flows

0 (65,000) 0 (45,000) 0 (155,000)

1–4 25,000 1–5 11,000 1 30,000

5 10,000 2 40,000

3 20,000

4 140,000

5 (60,000)

Required:

a) Calculate the net present value of each investment and state which would be preferred using the NPV

criteria.

b) Calculate the payback period for each investment and state which would be preferred using the payback

criteria

c) Calculate the accounting rate of return on each investment and state which would be preferred using ARR

d) Which is the three investments would the company undertake?

Discounting factors:

Year 1 0.909

Year 2 0.826

Year 3 0.751

Year 4 0.683

Year 5 0.621

Pearson LCCI LEVEL 3 ACCOUNTING (ASE20104)

You might also like

- Accounting Tools For Business Decision Making 5th Edition Kimmel Solutions ManualDocument7 pagesAccounting Tools For Business Decision Making 5th Edition Kimmel Solutions ManualPatrickMillerkoqd100% (51)

- Hard Bargaining Tactics in Football TransfersDocument2 pagesHard Bargaining Tactics in Football TransfersOmpriya Acharya100% (1)

- Capital Budgeting - Part 1Document6 pagesCapital Budgeting - Part 1Aurelia RijiNo ratings yet

- Corporate Finance (Lecture-3)Document72 pagesCorporate Finance (Lecture-3)meahearun nesa mouNo ratings yet

- Unit 12Document13 pagesUnit 12Mîñåk ŞhïïNo ratings yet

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- BU7753 Finance For Managers: Capital Investment AppraisalDocument27 pagesBU7753 Finance For Managers: Capital Investment AppraisalMuhammad Sajid SaeedNo ratings yet

- Global MBA Business Accounting & FinanceDocument48 pagesGlobal MBA Business Accounting & FinanceFebri AndikaNo ratings yet

- Investment Appraisal Techniques 2Document24 pagesInvestment Appraisal Techniques 2Jul 480wesh100% (1)

- Management of Cost and RiskDocument39 pagesManagement of Cost and RisktechnicalvijayNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingRashika JainNo ratings yet

- Capital Investment Decisions: 1: Question IM 13.1 AdvancedDocument7 pagesCapital Investment Decisions: 1: Question IM 13.1 AdvancedrahimNo ratings yet

- Exercise Chapter 3Document3 pagesExercise Chapter 3Phương ThảoNo ratings yet

- TEST PROJECT FINANCE AND COST MANAGEMENT Section BDocument6 pagesTEST PROJECT FINANCE AND COST MANAGEMENT Section BNyasha MakovaNo ratings yet

- Investment Decision: Unit IiiDocument50 pagesInvestment Decision: Unit IiiFara HameedNo ratings yet

- Investment Appraisal 1Document13 pagesInvestment Appraisal 1Arslan ArifNo ratings yet

- CH 10Document76 pagesCH 10Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- P4 Advanced Investment AppraisalDocument37 pagesP4 Advanced Investment AppraisalfarzycimaNo ratings yet

- Capital Budgeting - FINAL (A)Document59 pagesCapital Budgeting - FINAL (A)nikhilnegi1704No ratings yet

- Project - PPT 5 Additional ReadingDocument89 pagesProject - PPT 5 Additional Readingeyerusalem tesfayeNo ratings yet

- QuestionsforDiscussion NPVIRRDocument3 pagesQuestionsforDiscussion NPVIRRTauseef Ahmed100% (1)

- Non-Discounting Criteria Discounting CriteriaDocument89 pagesNon-Discounting Criteria Discounting CriteriaAytenew AbebeNo ratings yet

- Unit 5Document46 pagesUnit 519-R-0503 ManogjnaNo ratings yet

- Development 1Document20 pagesDevelopment 1AgreyNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- Chapter 9Document44 pagesChapter 9Phạm Thùy DươngNo ratings yet

- Chap11 Quiz5 MI2Document15 pagesChap11 Quiz5 MI2lynvuong101299No ratings yet

- 6 - Chapter Six - Project AppraisalDocument31 pages6 - Chapter Six - Project AppraisalmeseretNo ratings yet

- Tutorial 4 - SolutionDocument16 pagesTutorial 4 - SolutionNg Chun SenfNo ratings yet

- 4 Capital Investment Nov 2020Document76 pages4 Capital Investment Nov 2020Gabriel Alva AnkrahNo ratings yet

- Investment Appraisal BBADocument25 pagesInvestment Appraisal BBAreubensimone4No ratings yet

- Investment Appraisal 1: Process and MethodsDocument22 pagesInvestment Appraisal 1: Process and MethodsAshura ShaibNo ratings yet

- Lecture 28-31capital BudgetingDocument68 pagesLecture 28-31capital BudgetingNakul GoyalNo ratings yet

- Chapter Four Part Two: Importance of Capital BudgetingDocument12 pagesChapter Four Part Two: Importance of Capital Budgetingnahu a dinNo ratings yet

- Homework 2 2018 Auditing 12522Document3 pagesHomework 2 2018 Auditing 12522Muhammad MudassarNo ratings yet

- Presentation 8-Project AppraisalDocument22 pagesPresentation 8-Project AppraisalafzalNo ratings yet

- 5, 6 & 7 Capital BudgetingDocument42 pages5, 6 & 7 Capital BudgetingNaman AgarwalNo ratings yet

- CapitalexpredecnsDocument25 pagesCapitalexpredecnsIamTinuNo ratings yet

- ACCT 2200 - Chapter 11 P2 - With SolutionsDocument26 pagesACCT 2200 - Chapter 11 P2 - With Solutionsafsdasdf3qf4341f4asDNo ratings yet

- Capital Budgeting Questions - UE - FMDocument3 pagesCapital Budgeting Questions - UE - FMVimoli MehtaNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- CH (10) - Book AnswersDocument17 pagesCH (10) - Book AnswersabdulraufdghaybeejNo ratings yet

- Capital Budgeting Techniques (1st Week)Document18 pagesCapital Budgeting Techniques (1st Week)Jebeth RiveraNo ratings yet

- Cost of Capital and Investment CriteriaDocument9 pagesCost of Capital and Investment Criteriamuhyideen6abdulganiyNo ratings yet

- Capital Budgeting (NPV PI)Document22 pagesCapital Budgeting (NPV PI)Udit DhawanNo ratings yet

- Lecture 10 - Capital Investment Decisions - JJDocument28 pagesLecture 10 - Capital Investment Decisions - JJTariq KhanNo ratings yet

- PM Chapter 5Document31 pagesPM Chapter 5tedrostesfay74No ratings yet

- MBA7001 Week 5 Investment Appraisal Methods 1Document39 pagesMBA7001 Week 5 Investment Appraisal Methods 1Pranjal JaiswalNo ratings yet

- L 5 Capital Investment DecisionsDocument23 pagesL 5 Capital Investment DecisionsMist FactorNo ratings yet

- Screening Capital Investment ProposalsDocument13 pagesScreening Capital Investment ProposalsSandia EspejoNo ratings yet

- Capital Budgeting DetailDocument64 pagesCapital Budgeting DetailDEV BHADANANo ratings yet

- Financial Analysis of Final)Document28 pagesFinancial Analysis of Final)Mangesh GulhaneNo ratings yet

- Capital Budgeting - EvaluationDocument47 pagesCapital Budgeting - Evaluationpranav1931129No ratings yet

- UNIT 4 - Capital BudgetingDocument38 pagesUNIT 4 - Capital BudgetingKrishnan SrinivasanNo ratings yet

- Financial Management Unit 3 DR Ashok KumarDocument65 pagesFinancial Management Unit 3 DR Ashok Kumarsk tanNo ratings yet

- CapbudgetDocument31 pagesCapbudgetnaveen penugondaNo ratings yet

- CH 10Document74 pagesCH 10Chi NguyễnNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- CH2 - TP3Document1 pageCH2 - TP3Saiful AliNo ratings yet

- CH2 - TP2Document1 pageCH2 - TP2Saiful AliNo ratings yet

- CH2 - TP1Document1 pageCH2 - TP1Saiful AliNo ratings yet

- CH1 - TP1Document1 pageCH1 - TP1Saiful AliNo ratings yet

- CH1 - TP2Document1 pageCH1 - TP2Saiful AliNo ratings yet

- Chap13 Non-Profit Making OrganisationsDocument7 pagesChap13 Non-Profit Making OrganisationsSaiful AliNo ratings yet

- Chap14 The Calculation & Interpretation of Accounting RatiosDocument6 pagesChap14 The Calculation & Interpretation of Accounting RatiosSaiful AliNo ratings yet

- 4.3. Obligations of Borrowers: Questions To PonderDocument6 pages4.3. Obligations of Borrowers: Questions To PonderTin CabosNo ratings yet

- Solved Suppose Congress and The President Decide To Increase Government PurchasesDocument1 pageSolved Suppose Congress and The President Decide To Increase Government PurchasesM Bilal SaleemNo ratings yet

- Financial Math TestDocument172 pagesFinancial Math TestCP Mario Pérez López100% (2)

- Salary INCOME - ITDocument64 pagesSalary INCOME - ITHrishikesh AshtaputreNo ratings yet

- Statements Jan-23. 12Document3 pagesStatements Jan-23. 12Basmma EidNo ratings yet

- Abc-Consolidation With Intercompany TransactionsDocument3 pagesAbc-Consolidation With Intercompany TransactionsLeonardo MercaderNo ratings yet

- Amazing Intraday Strategy - GUNTU RAMARAODocument25 pagesAmazing Intraday Strategy - GUNTU RAMARAOwadatkar.amit104No ratings yet

- Financial Management Sri Individidual Cia 1.2Document7 pagesFinancial Management Sri Individidual Cia 1.2ALLIED AGENCIESNo ratings yet

- Basic Accounting PrinciplesDocument5 pagesBasic Accounting PrinciplesGracie BulaquinaNo ratings yet

- 1Document3 pages1Stook01701No ratings yet

- Capital Market Review and Outlook: AnnualDocument20 pagesCapital Market Review and Outlook: AnnualbigaNo ratings yet

- Pay Slip Components: Covance Pty LimitedDocument1 pagePay Slip Components: Covance Pty LimitedAndrés PatiñoNo ratings yet

- Annual Report 2020Document352 pagesAnnual Report 2020ismat arteeNo ratings yet

- B014393 HN in Business L4 SpecificationDocument480 pagesB014393 HN in Business L4 SpecificationRajivVyasNo ratings yet

- Factsheet GB en Gb00byvxbg82Document9 pagesFactsheet GB en Gb00byvxbg82RocketNo ratings yet

- Shakeeb Resume1Document3 pagesShakeeb Resume1Shakeeb AshaiNo ratings yet

- Sunlife Proposal Bianca OseraDocument2 pagesSunlife Proposal Bianca OseraBianca Joy OseraNo ratings yet

- Municipality of Guipos: Republic of The Philippines Province of Zamboanga de SurDocument21 pagesMunicipality of Guipos: Republic of The Philippines Province of Zamboanga de SurMelvinson Loui Polenzo SarcaugaNo ratings yet

- Egov Urban Portal-Water Tax PDFDocument2 pagesEgov Urban Portal-Water Tax PDFPadmavathi Putra LokeshNo ratings yet

- List of Payment Purpose Code KRDocument10 pagesList of Payment Purpose Code KRあいうえおかきくけこNo ratings yet

- Bank Reconciliation Statement - Process - Format - ExampleDocument5 pagesBank Reconciliation Statement - Process - Format - ExampleCykee100% (1)

- American International Group Inc and SubsidiariesDocument14 pagesAmerican International Group Inc and SubsidiariesFOXBusiness.com50% (2)

- Ramcharan Tharu Laxmi BankDocument3 pagesRamcharan Tharu Laxmi BankNikhil Visa ServicesNo ratings yet

- Real Estate Finance and Investment - Lecture NotesDocument2 pagesReal Estate Finance and Investment - Lecture NotesCoursePin100% (1)

- Republic Act No.10881 - Amendments On Investment RestrictionsDocument3 pagesRepublic Act No.10881 - Amendments On Investment Restrictionsdefaens8053No ratings yet

- Ra 6552 Maceda LawDocument9 pagesRa 6552 Maceda Lawjmr constructionNo ratings yet

- Short Term LoansDocument2 pagesShort Term LoansGopi NathNo ratings yet

- 15-IFRS 15 - SummaryDocument6 pages15-IFRS 15 - SummaryhusseinNo ratings yet