Professional Documents

Culture Documents

A Program For Boomers To Liberate Pre Tax Assets 1

A Program For Boomers To Liberate Pre Tax Assets 1

Uploaded by

YTCopyright:

Available Formats

You might also like

- Matthew Lesko Let Uncle Sam Pay Your Bills PDFDocument33 pagesMatthew Lesko Let Uncle Sam Pay Your Bills PDFCarol100% (4)

- Bank Branch Internal Audit Work ProgramDocument31 pagesBank Branch Internal Audit Work Programozlem100% (1)

- New Titusville Utility BillDocument2 pagesNew Titusville Utility BillBrevard Times100% (2)

- Tax Tips 2022Document26 pagesTax Tips 2022Mary Juvy Ramao100% (1)

- Spring 2013 Tax, Retirement & Estate PlanningDocument4 pagesSpring 2013 Tax, Retirement & Estate PlanningBusiness Bank of Texas, N.A.No ratings yet

- $26,000 Retirement OpportunityDocument2 pages$26,000 Retirement OpportunityRobert GrantNo ratings yet

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthFrom EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNo ratings yet

- A Look at Some Financial Changes & The Opportunities They May PresentDocument3 pagesA Look at Some Financial Changes & The Opportunities They May Presentapi-118535366No ratings yet

- Ten Income and Estate Tax Planning Strategies For 2014: Ideas From PutnamDocument4 pagesTen Income and Estate Tax Planning Strategies For 2014: Ideas From PutnamPrince McGershonNo ratings yet

- Forbes 2018 Tax GuideDocument16 pagesForbes 2018 Tax GuideJerry WhittonNo ratings yet

- 2018 Year End Tax TipsDocument4 pages2018 Year End Tax TipsMichael CallahanNo ratings yet

- A Guide To 2013 Tax Changes (And More)Document15 pagesA Guide To 2013 Tax Changes (And More)Doug PotashNo ratings yet

- Retirement Topics - IRA Contribution LimitsDocument3 pagesRetirement Topics - IRA Contribution LimitsSriniNo ratings yet

- Centorbi - AE Taxes White Paper - DL - GGDocument8 pagesCentorbi - AE Taxes White Paper - DL - GGchad centorbiNo ratings yet

- Year-End Tax Guide 2015/16Document10 pagesYear-End Tax Guide 2015/16api-311814387No ratings yet

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDocument4 pagesEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Taxes & Health Care ReformDocument1 pageTaxes & Health Care Reformmck_ndiayeNo ratings yet

- 16 Don'T-Miss Tax DeductionsDocument4 pages16 Don'T-Miss Tax DeductionsGon FloNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- Can I Really Have A Tax Free Retirement?Document5 pagesCan I Really Have A Tax Free Retirement?Mark HoustonNo ratings yet

- 5 Tax InstrumentsDocument3 pages5 Tax InstrumentsktsnlNo ratings yet

- Tower Club Legal Lunch Forum January 10, 2014 Tax Update On Selected TopicsDocument32 pagesTower Club Legal Lunch Forum January 10, 2014 Tax Update On Selected TopicsPeter Rudolph, CPANo ratings yet

- Strategies To Pay Less TaxDocument4 pagesStrategies To Pay Less TaxblkdwgNo ratings yet

- Iul IraDocument3 pagesIul IraWadnerson BoileauNo ratings yet

- Re 2020 Year-End Tax Planning For IndividualsDocument3 pagesRe 2020 Year-End Tax Planning For Individualselnara safronovaNo ratings yet

- DWM Olt Trad LaDocument26 pagesDWM Olt Trad LaBullet GunnerNo ratings yet

- First Home Super Saver SchemeDocument5 pagesFirst Home Super Saver Schemeishtee894No ratings yet

- Income Tax and Its DeductionsDocument7 pagesIncome Tax and Its DeductionsCanadaupdatesNo ratings yet

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehNo ratings yet

- Tax EfficientDocument22 pagesTax EfficientBrijesh NagarNo ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- F1040es 2018Document18 pagesF1040es 2018diversified1No ratings yet

- Chapter 7 - SeniorsDocument48 pagesChapter 7 - SeniorsRyan YangNo ratings yet

- FP Group WorkDocument12 pagesFP Group WorkStellina JoeshibaNo ratings yet

- ACC 330 Final Project Formal Letter To Client TemplateDocument4 pagesACC 330 Final Project Formal Letter To Client TemplateBREANNA JOHNSONNo ratings yet

- It's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCDocument4 pagesIt's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- Chapter 6 - DeductionsDocument86 pagesChapter 6 - DeductionsRyan YangNo ratings yet

- Ceesay Exp19 Word Ch04 CapAssessment RetirementDocument10 pagesCeesay Exp19 Word Ch04 CapAssessment RetirementcsaysalifuNo ratings yet

- Case Study TaxDocument5 pagesCase Study TaxAnonymous wfLsDXifNo ratings yet

- Income Splitting Strategies enDocument6 pagesIncome Splitting Strategies eneriklicanadaNo ratings yet

- Chapter 08 FINDocument32 pagesChapter 08 FINUnoNo ratings yet

- Synergy Financial Group: Your Personal CFODocument4 pagesSynergy Financial Group: Your Personal CFOgvandykeNo ratings yet

- R04 Trial Study Notes v5.0Document15 pagesR04 Trial Study Notes v5.0michaeleslamiNo ratings yet

- E.Types of Retirement Plans-1Document13 pagesE.Types of Retirement Plans-1Madhu dollyNo ratings yet

- Sipp Guide UkDocument20 pagesSipp Guide UkRobertNo ratings yet

- Collaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterDocument4 pagesCollaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterJanet BarrNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- p969 PDFDocument22 pagesp969 PDFstalker1841No ratings yet

- Cliff Notes - PM RetirementDocument5 pagesCliff Notes - PM RetirementJohnathan JohnsonNo ratings yet

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions ManualDocument56 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manualhymarbecurllzkit100% (24)

- US Individual RegulationDocument3 pagesUS Individual RegulationDarab AkhtarNo ratings yet

- What Is An IRA? - RKB Accounting & Tax ServicesDocument6 pagesWhat Is An IRA? - RKB Accounting & Tax ServicesRKB AccountingNo ratings yet

- 1 TaxPlanningStrategies2014Document9 pages1 TaxPlanningStrategies2014ExactCPANo ratings yet

- Year-Round Tax Saving Tips: Vow To Be More EfficientDocument4 pagesYear-Round Tax Saving Tips: Vow To Be More EfficientSrinivas ThoutaNo ratings yet

- Digital Assignment - 3: Submitted To: Submitted byDocument11 pagesDigital Assignment - 3: Submitted To: Submitted byMonashreeNo ratings yet

- Q No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentsDocument3 pagesQ No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentswaqasNo ratings yet

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- MA State Tax InstructionDocument41 pagesMA State Tax InstructionYang JeanNo ratings yet

- Total IncomeDocument3 pagesTotal IncomeFaisal AhmedNo ratings yet

- SmartestSalesBook EbookDocument280 pagesSmartestSalesBook EbookYT100% (1)

- Carbon NanotubeDocument5 pagesCarbon NanotubeYTNo ratings yet

- CNAS Report Rewire Semiconductor Tech FinalDocument28 pagesCNAS Report Rewire Semiconductor Tech FinalYTNo ratings yet

- CSET The ChipmakersDocument54 pagesCSET The ChipmakersYTNo ratings yet

- CSET Maintaining The AI Chip Competitive Advantage of The United States and Its Allies 20191206Document8 pagesCSET Maintaining The AI Chip Competitive Advantage of The United States and Its Allies 20191206YTNo ratings yet

- Artificial Intelligence The Time To Act Is Now - McKinseyDocument12 pagesArtificial Intelligence The Time To Act Is Now - McKinseyYTNo ratings yet

- How Quantum Computing Can Help Tackle Global Warming - McKinseyDocument6 pagesHow Quantum Computing Can Help Tackle Global Warming - McKinseyYTNo ratings yet

- An Elementary Introduction To Quantum Entanglementand - 19-02-22 - CancesDocument37 pagesAn Elementary Introduction To Quantum Entanglementand - 19-02-22 - CancesYTNo ratings yet

- Stellar One: GH-09, Sector-1, Greater Noida WestDocument7 pagesStellar One: GH-09, Sector-1, Greater Noida WestRavi BhattacharyaNo ratings yet

- E-Banking Act.1Document2 pagesE-Banking Act.1Christian Lorenz EdulanNo ratings yet

- Audit Financier by Falloul Moulay El MehdiDocument1 pageAudit Financier by Falloul Moulay El MehdiDriss AitbourigueNo ratings yet

- Precious M. Resaba: ProfileDocument2 pagesPrecious M. Resaba: ProfileaishwaryaNo ratings yet

- AGREEMENT AntipoloDocument3 pagesAGREEMENT AntipoloLen Lacson MarianoNo ratings yet

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- Rick S Is A Popular Restaurant For Fine Dining The OwnerDocument1 pageRick S Is A Popular Restaurant For Fine Dining The OwnerAmit PandeyNo ratings yet

- Step-By-Step Guide To Managing Your Partner AccountDocument18 pagesStep-By-Step Guide To Managing Your Partner AccountUsama AhmadNo ratings yet

- 2022 Escobar-Ring Contract (PCT)Document4 pages2022 Escobar-Ring Contract (PCT)InvestmentsNo ratings yet

- BuxlyDocument13 pagesBuxlyAimen KhatanaNo ratings yet

- NC LT NoticeDocument219 pagesNC LT NoticeEsha ChaudharyNo ratings yet

- (Nov 2020) Latest Safecustody ListingDocument923 pages(Nov 2020) Latest Safecustody Listingcinta amaniNo ratings yet

- Pitch Deck Telkom YooBeeDocument18 pagesPitch Deck Telkom YooBeeDini Estri MulianingsihNo ratings yet

- One Warehouse Multiretailer System With Centralized Stock InformationDocument13 pagesOne Warehouse Multiretailer System With Centralized Stock InformationdeevaNo ratings yet

- COMP 1787 Coursework 23-24 T2 NewDocument8 pagesCOMP 1787 Coursework 23-24 T2 Newphamanhhy27No ratings yet

- Group3 PizzanadaDocument36 pagesGroup3 Pizzanadatwiceitzyskz100% (1)

- America The Story of US Great Depression New DealDocument2 pagesAmerica The Story of US Great Depression New DealTori JemesNo ratings yet

- 1.2 Terms and Conditions For Subcontractor Rev. 01.2022Document11 pages1.2 Terms and Conditions For Subcontractor Rev. 01.2022melisbbNo ratings yet

- BCG MatrixDocument28 pagesBCG MatrixsatishNo ratings yet

- Summer Internship Project Report (SIP) On A Study On Customer SatisfactionDocument60 pagesSummer Internship Project Report (SIP) On A Study On Customer SatisfactionriyaNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- Agricultural Extension in Asia Constraints and Options For ImprovementDocument15 pagesAgricultural Extension in Asia Constraints and Options For ImprovementMarejen Almedilla VillaremoNo ratings yet

- B315F962 - ไกด์สัม BBA TUDocument55 pagesB315F962 - ไกด์สัม BBA TUJaruwat somsriNo ratings yet

- Legaltech SurveyDocument5 pagesLegaltech SurveyJohnNo ratings yet

- Chapter 5 Discussion QuestionsDocument3 pagesChapter 5 Discussion QuestionsAngelica RodriguezNo ratings yet

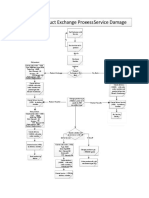

- Product Exchange Process - Service Damage: Old Product Old ProductDocument2 pagesProduct Exchange Process - Service Damage: Old Product Old ProductsameerjaleesNo ratings yet

- Stages of Digital Transformation in Competency Management - TejaDocument6 pagesStages of Digital Transformation in Competency Management - TejaImmanuel Teja HarjayaNo ratings yet

A Program For Boomers To Liberate Pre Tax Assets 1

A Program For Boomers To Liberate Pre Tax Assets 1

Uploaded by

YTOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Program For Boomers To Liberate Pre Tax Assets 1

A Program For Boomers To Liberate Pre Tax Assets 1

Uploaded by

YTCopyright:

Available Formats

A Program for Boomers to Liberate Pre-Tax

Assets

November 26, 2019

by Anson J. Glacy, Jr.

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily

represent those of Advisor Perspectives

Baby Boomers are arriving at retirement with large accumulations that have not yet been exposed to

federal income tax (FIT) and are grappling with ways to access those assets without incurring

inordinate tax bills. The 2017 Tax Cuts and Jobs Act contains provisions that enable Boomers to

liberate their pre-tax assets at highly favorable tax rates. I describe a program that synchronizes the

distribution of pre-tax assets with availability of generationally-low tax rates, while keeping the dictates

of Medicare, Social Security and the governing IRS tax code firmly in view.

The program is suitable for Baby Boomers confronting retirement with large pre-tax accumulations.

Importantly, the program is designed to avoid the Income-Related Monthly Adjustment Amounts

(IRMAA) that can raise Medicare Part B and Part D premiums in retirement by over 140%. I show how

to open up headroom for the planned distributions by deferring income and capital gains on the

Boomer’s taxable investments. I also discuss the chronology related to the moving parts of the

program.

Introduction

Since the 1970s, Congress has passed numerous bills meant to encourage retirement savings by

deferring taxation on contributions and subsequent earnings. In addition to the “alphabet soup” of tax-

qualified 401(a), 401(k) and 403(b) plans enabled in eponymous sections of the tax code, various other

deferred-compensation arrangements and employee stock option plans can contribute to Boomer pre-

tax balances. According to the Investment Company Institute, a trade group, $17.6 trillion was held in

defined-contribution and IRA plans alone as of March of 2019, about half owned by Baby Boomers

(i.e., those born between 1946 and 1964). Fidelity reports that the number of its own customers with a

401(k) balance of $1 million or more jumped to a record 196,000 in the second quarter of 2019.

The 2017 Tax Cuts and Jobs Act

The 2017 Tax Cuts and Jobs Act reduced tax rates across the board and made other changes to the

tax code. For a married couple taking the standard deduction of $24,400, the following are the

Page 1, ©2019 Advisor Perspectives, Inc. All rights reserved.

applicable 2019 tax rates at key income breakpoints:

During the remaining years of the 2017 Tax Cuts and Jobs Act, taxpayers with an adjusted gross

income at the $170,000 level can expect to pay an average tax rate of about 14%.

Medicare considerations

Since 2011, couples on Medicare with a modified adjusted gross income (MAGI) over $170,000 have

been paying an additional monthly premium or IRMAA for their Medicare Part B and D coverages.

(MAGI is calculated as adjusted gross income (AGI) plus tax-exempt interest income.) (According to

the Centers for Medicare and Medicaid Services, IRMAA affects fewer than 5% of current Medicare

beneficiaries.) In order to avoid IRMAA, MAGI must not exceed $170,000. (IRMAA is invoked if MAGI

exceeds $170,000 by even a dollar.) In order to maximize the amount of MAGI available for the

liberation of pre-tax assets, competing sources of taxable income must be removed or deferred to the

extent possible.

Taxable investments

In order to open up MAGI headroom, Boomers could reposition their taxable investment accounts to

defer income and capital gains indefinitely by only holding zero-dividend stocks (like Berkshire

Hathaway Inc. Class B (BRK.B) and Alphabet Inc. Class A (GOOGL)). Were they to keep holdings in

the form of mutual funds or ETFs, they would lose control to the fund manager of the realization of

capital gains and losses. More importantly, they would not get to deduct internal fund losses instigated

by the fund manager that exceed internal fund gains. Boomers may also want to reconsider their use of

tax-exempt bonds since tax-exempt interest is part of MAGI.

Social Security considerations

To free up additional MAGI, Boomers should consider delaying receipt of Social Security until age 70,

whereupon benefits increase by up to 32% over the amount available at full retirement age (between

66 and 67 for Boomers; see table below). The obvious disadvantage to delaying Social Security

benefits, of course, is that the recipient collects benefits for a shorter period of time. Anyone

considering such a delay should first perform the appropriate break-even analysis using a realistic

estimate of remaining life expectancy that reflects the person’s particular health situation and lifestyle.

Page 2, ©2019 Advisor Perspectives, Inc. All rights reserved.

Required minimum distributions

Required minimum distributions (RMD) are distributions a taxpayer must make from tax-deferred

retirement plans like 401(k) and IRA plans annually starting in the calendar year he or she reaches

70.5 years of age. For someone turning 70 in the calendar year they turn 70.5, the initial required

distribution is 3.65% of assets, increasing to 5.35% after ten years. RMDs can be burdensome or

inconvenient to taxpayers. Enacting a program to liberate pre-tax assets prior to age 70.5 can reduce or

eliminate a taxpayer’s ultimate exposure to required minimum distributions.

Tax payments

A married couple taking distributions from their pre-tax assets equal to the 2019 IRMAA limit of

$170,000 would incur a tax bill of $23,749, as shown above. The couple could simply direct their

broker/administrator to tax-withhold the $23,749 from proceeds, leaving the remainder for household

needs. To the extent such post-tax amounts are in excess of household needs, the couple could direct

moneys to a Roth IRA. Actually, the couple could direct the entire $170,000 to a Roth IRA. In this

case, money to pay taxes and for household needs would have to come from outside sources. A year-

by-year program of partial Roth conversions up to the annual IRMAA limit in conjunction with a taxable

investment account positioned to maximally defer taxable income and capital gains can be a powerful

way to build wealth for heirs in a highly tax-efficient manner.

Investor suitability

The objective of this strategy is to synchronize the distribution of pre-tax assets with availability of

generationally-low tax rates, while keeping the dictates of Medicare, Social Security and the governing

IRS tax code firmly in view. The strategy is suitable for taxpayers with substantial headroom in their

yearly MAGI that would be necessary to make the strategy viable. Retirees in their early 60s with the

ability to control their MAGI are especially suitable for the strategy.

Method

Joe Boomer was born on January 1, 1956 and retired on December 31, 2018 with $1,190,000 in his

Page 3, ©2019 Advisor Perspectives, Inc. All rights reserved.

company 401(k) account. Joe is in good health and plans to delay receipt of Social Security until

January 1, 2026, when he turns 70. He qualifies for the maximum Social Security benefit which is

expected to be about $48,000 per year in 2026. He turns 70.5 in 2026 and therefore would be required

to begin RMDs in that year. Outside of a non-interest-bearing checking account and his primary

residence, Joe has no other assets or taxable income.

Joe decides to begin an orderly program to convert his 401(k) account to a Roth IRA in order to enjoy

the favorable tax rates under the 2017 Tax Cuts and Jobs Act, which expires in 2025. Joe wants to

keep taxable distributions at $170,000 each year to avoid IRMAA. He calculates that his Social Security

benefit will be sufficient income for him and his wife once he reaches age 70.

Joe realizes that he will need liquid assets to pay Roth conversion taxes, his Medicare premiums and

for household needs. For 2019, the first year of the program, these outlays are:

Ignoring interest and inflation, Joe would need a balance in his non-interest-bearing checking account

of about $450,000 to fund seven years of outlays. He and his wife plan to sell their primary residence

for $450,000, its assessed value, and relocate to a rental property in a low-cost state in the American

southwest.

After seven years, at the January 1, 2026 completion of the program, Joe will have successfully

redirected the entirety of his 401(k) assets into a Roth IRA, fully satisfied his FIT obligations at a highly

favorable tax rate, and positioned his Roth IRA for years of tax-free growth and ultimate delivery to his

heirs as a tax-free inheritance. Since Joe is in good health, he might live for twenty years or more after

he reaches age 70. Assuming a real return of 6.5% per year for stocks, he very well might pass along

a tax-free estate in excess of $4 million (2019 dollars) to his heirs.

Furthermore, he will have commenced Social Security at the maximum possible benefit and avoided

any exposure to RMDs or to IRMAA exactions. His sole taxable income will be his $48,000 Social

Security benefit, thereby incurring a total FIT rate of about 5%.

Joe and his wife will rely on Medicare during retirement. Generally, Medicare pays 80% of doctor

and/or hospital bills, leaving the rest up to Joe. He feels comfortable that his Roth IRA balance can

safely be tapped for Medicare co-pays if need be. (Joe also takes comfort in the knowledge that

medical expenses are tax-deductible to the extent that they exceed 7.5% of his adjusted gross income.)

Potential pitfalls

Changes to the tax code could undercut this kind of liberation program. For example, Congress could

raise tax rates prior to 2026 or limit the attractiveness of a Roth IRA. Congress could also reduce

Page 4, ©2019 Advisor Perspectives, Inc. All rights reserved.

Social Security benefits or make the IRMAA more burdensome.

Conclusion

The 2017 Tax Cuts and Jobs Act presents a generational opportunity to liberate pre-tax assets at highly

favorable tax rates. It is possible to devise a program to methodically tap pre-tax assets in a manner

that observes the dictates of Medicare, Social Security and the governing IRS tax code. Baby Boomers

approaching retirement with large pent-up pre-tax accumulations can benefit from this type of liberation

program.

Anson J. Glacy, Jr., ASA, CERA, CFA, is a financial professional with extensive risk management

and value optimization experience in the consulting, asset management and corporate settings. He

presently serves as managing director at Prescriptive Analytics GmbH

Page 5, ©2019 Advisor Perspectives, Inc. All rights reserved.

You might also like

- Matthew Lesko Let Uncle Sam Pay Your Bills PDFDocument33 pagesMatthew Lesko Let Uncle Sam Pay Your Bills PDFCarol100% (4)

- Bank Branch Internal Audit Work ProgramDocument31 pagesBank Branch Internal Audit Work Programozlem100% (1)

- New Titusville Utility BillDocument2 pagesNew Titusville Utility BillBrevard Times100% (2)

- Tax Tips 2022Document26 pagesTax Tips 2022Mary Juvy Ramao100% (1)

- Spring 2013 Tax, Retirement & Estate PlanningDocument4 pagesSpring 2013 Tax, Retirement & Estate PlanningBusiness Bank of Texas, N.A.No ratings yet

- $26,000 Retirement OpportunityDocument2 pages$26,000 Retirement OpportunityRobert GrantNo ratings yet

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthFrom EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNo ratings yet

- A Look at Some Financial Changes & The Opportunities They May PresentDocument3 pagesA Look at Some Financial Changes & The Opportunities They May Presentapi-118535366No ratings yet

- Ten Income and Estate Tax Planning Strategies For 2014: Ideas From PutnamDocument4 pagesTen Income and Estate Tax Planning Strategies For 2014: Ideas From PutnamPrince McGershonNo ratings yet

- Forbes 2018 Tax GuideDocument16 pagesForbes 2018 Tax GuideJerry WhittonNo ratings yet

- 2018 Year End Tax TipsDocument4 pages2018 Year End Tax TipsMichael CallahanNo ratings yet

- A Guide To 2013 Tax Changes (And More)Document15 pagesA Guide To 2013 Tax Changes (And More)Doug PotashNo ratings yet

- Retirement Topics - IRA Contribution LimitsDocument3 pagesRetirement Topics - IRA Contribution LimitsSriniNo ratings yet

- Centorbi - AE Taxes White Paper - DL - GGDocument8 pagesCentorbi - AE Taxes White Paper - DL - GGchad centorbiNo ratings yet

- Year-End Tax Guide 2015/16Document10 pagesYear-End Tax Guide 2015/16api-311814387No ratings yet

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDocument4 pagesEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Taxes & Health Care ReformDocument1 pageTaxes & Health Care Reformmck_ndiayeNo ratings yet

- 16 Don'T-Miss Tax DeductionsDocument4 pages16 Don'T-Miss Tax DeductionsGon FloNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- Can I Really Have A Tax Free Retirement?Document5 pagesCan I Really Have A Tax Free Retirement?Mark HoustonNo ratings yet

- 5 Tax InstrumentsDocument3 pages5 Tax InstrumentsktsnlNo ratings yet

- Tower Club Legal Lunch Forum January 10, 2014 Tax Update On Selected TopicsDocument32 pagesTower Club Legal Lunch Forum January 10, 2014 Tax Update On Selected TopicsPeter Rudolph, CPANo ratings yet

- Strategies To Pay Less TaxDocument4 pagesStrategies To Pay Less TaxblkdwgNo ratings yet

- Iul IraDocument3 pagesIul IraWadnerson BoileauNo ratings yet

- Re 2020 Year-End Tax Planning For IndividualsDocument3 pagesRe 2020 Year-End Tax Planning For Individualselnara safronovaNo ratings yet

- DWM Olt Trad LaDocument26 pagesDWM Olt Trad LaBullet GunnerNo ratings yet

- First Home Super Saver SchemeDocument5 pagesFirst Home Super Saver Schemeishtee894No ratings yet

- Income Tax and Its DeductionsDocument7 pagesIncome Tax and Its DeductionsCanadaupdatesNo ratings yet

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehNo ratings yet

- Tax EfficientDocument22 pagesTax EfficientBrijesh NagarNo ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- F1040es 2018Document18 pagesF1040es 2018diversified1No ratings yet

- Chapter 7 - SeniorsDocument48 pagesChapter 7 - SeniorsRyan YangNo ratings yet

- FP Group WorkDocument12 pagesFP Group WorkStellina JoeshibaNo ratings yet

- ACC 330 Final Project Formal Letter To Client TemplateDocument4 pagesACC 330 Final Project Formal Letter To Client TemplateBREANNA JOHNSONNo ratings yet

- It's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCDocument4 pagesIt's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- Chapter 6 - DeductionsDocument86 pagesChapter 6 - DeductionsRyan YangNo ratings yet

- Ceesay Exp19 Word Ch04 CapAssessment RetirementDocument10 pagesCeesay Exp19 Word Ch04 CapAssessment RetirementcsaysalifuNo ratings yet

- Case Study TaxDocument5 pagesCase Study TaxAnonymous wfLsDXifNo ratings yet

- Income Splitting Strategies enDocument6 pagesIncome Splitting Strategies eneriklicanadaNo ratings yet

- Chapter 08 FINDocument32 pagesChapter 08 FINUnoNo ratings yet

- Synergy Financial Group: Your Personal CFODocument4 pagesSynergy Financial Group: Your Personal CFOgvandykeNo ratings yet

- R04 Trial Study Notes v5.0Document15 pagesR04 Trial Study Notes v5.0michaeleslamiNo ratings yet

- E.Types of Retirement Plans-1Document13 pagesE.Types of Retirement Plans-1Madhu dollyNo ratings yet

- Sipp Guide UkDocument20 pagesSipp Guide UkRobertNo ratings yet

- Collaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterDocument4 pagesCollaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterJanet BarrNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- p969 PDFDocument22 pagesp969 PDFstalker1841No ratings yet

- Cliff Notes - PM RetirementDocument5 pagesCliff Notes - PM RetirementJohnathan JohnsonNo ratings yet

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions ManualDocument56 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manualhymarbecurllzkit100% (24)

- US Individual RegulationDocument3 pagesUS Individual RegulationDarab AkhtarNo ratings yet

- What Is An IRA? - RKB Accounting & Tax ServicesDocument6 pagesWhat Is An IRA? - RKB Accounting & Tax ServicesRKB AccountingNo ratings yet

- 1 TaxPlanningStrategies2014Document9 pages1 TaxPlanningStrategies2014ExactCPANo ratings yet

- Year-Round Tax Saving Tips: Vow To Be More EfficientDocument4 pagesYear-Round Tax Saving Tips: Vow To Be More EfficientSrinivas ThoutaNo ratings yet

- Digital Assignment - 3: Submitted To: Submitted byDocument11 pagesDigital Assignment - 3: Submitted To: Submitted byMonashreeNo ratings yet

- Q No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentsDocument3 pagesQ No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentswaqasNo ratings yet

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- MA State Tax InstructionDocument41 pagesMA State Tax InstructionYang JeanNo ratings yet

- Total IncomeDocument3 pagesTotal IncomeFaisal AhmedNo ratings yet

- SmartestSalesBook EbookDocument280 pagesSmartestSalesBook EbookYT100% (1)

- Carbon NanotubeDocument5 pagesCarbon NanotubeYTNo ratings yet

- CNAS Report Rewire Semiconductor Tech FinalDocument28 pagesCNAS Report Rewire Semiconductor Tech FinalYTNo ratings yet

- CSET The ChipmakersDocument54 pagesCSET The ChipmakersYTNo ratings yet

- CSET Maintaining The AI Chip Competitive Advantage of The United States and Its Allies 20191206Document8 pagesCSET Maintaining The AI Chip Competitive Advantage of The United States and Its Allies 20191206YTNo ratings yet

- Artificial Intelligence The Time To Act Is Now - McKinseyDocument12 pagesArtificial Intelligence The Time To Act Is Now - McKinseyYTNo ratings yet

- How Quantum Computing Can Help Tackle Global Warming - McKinseyDocument6 pagesHow Quantum Computing Can Help Tackle Global Warming - McKinseyYTNo ratings yet

- An Elementary Introduction To Quantum Entanglementand - 19-02-22 - CancesDocument37 pagesAn Elementary Introduction To Quantum Entanglementand - 19-02-22 - CancesYTNo ratings yet

- Stellar One: GH-09, Sector-1, Greater Noida WestDocument7 pagesStellar One: GH-09, Sector-1, Greater Noida WestRavi BhattacharyaNo ratings yet

- E-Banking Act.1Document2 pagesE-Banking Act.1Christian Lorenz EdulanNo ratings yet

- Audit Financier by Falloul Moulay El MehdiDocument1 pageAudit Financier by Falloul Moulay El MehdiDriss AitbourigueNo ratings yet

- Precious M. Resaba: ProfileDocument2 pagesPrecious M. Resaba: ProfileaishwaryaNo ratings yet

- AGREEMENT AntipoloDocument3 pagesAGREEMENT AntipoloLen Lacson MarianoNo ratings yet

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- Rick S Is A Popular Restaurant For Fine Dining The OwnerDocument1 pageRick S Is A Popular Restaurant For Fine Dining The OwnerAmit PandeyNo ratings yet

- Step-By-Step Guide To Managing Your Partner AccountDocument18 pagesStep-By-Step Guide To Managing Your Partner AccountUsama AhmadNo ratings yet

- 2022 Escobar-Ring Contract (PCT)Document4 pages2022 Escobar-Ring Contract (PCT)InvestmentsNo ratings yet

- BuxlyDocument13 pagesBuxlyAimen KhatanaNo ratings yet

- NC LT NoticeDocument219 pagesNC LT NoticeEsha ChaudharyNo ratings yet

- (Nov 2020) Latest Safecustody ListingDocument923 pages(Nov 2020) Latest Safecustody Listingcinta amaniNo ratings yet

- Pitch Deck Telkom YooBeeDocument18 pagesPitch Deck Telkom YooBeeDini Estri MulianingsihNo ratings yet

- One Warehouse Multiretailer System With Centralized Stock InformationDocument13 pagesOne Warehouse Multiretailer System With Centralized Stock InformationdeevaNo ratings yet

- COMP 1787 Coursework 23-24 T2 NewDocument8 pagesCOMP 1787 Coursework 23-24 T2 Newphamanhhy27No ratings yet

- Group3 PizzanadaDocument36 pagesGroup3 Pizzanadatwiceitzyskz100% (1)

- America The Story of US Great Depression New DealDocument2 pagesAmerica The Story of US Great Depression New DealTori JemesNo ratings yet

- 1.2 Terms and Conditions For Subcontractor Rev. 01.2022Document11 pages1.2 Terms and Conditions For Subcontractor Rev. 01.2022melisbbNo ratings yet

- BCG MatrixDocument28 pagesBCG MatrixsatishNo ratings yet

- Summer Internship Project Report (SIP) On A Study On Customer SatisfactionDocument60 pagesSummer Internship Project Report (SIP) On A Study On Customer SatisfactionriyaNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- Agricultural Extension in Asia Constraints and Options For ImprovementDocument15 pagesAgricultural Extension in Asia Constraints and Options For ImprovementMarejen Almedilla VillaremoNo ratings yet

- B315F962 - ไกด์สัม BBA TUDocument55 pagesB315F962 - ไกด์สัม BBA TUJaruwat somsriNo ratings yet

- Legaltech SurveyDocument5 pagesLegaltech SurveyJohnNo ratings yet

- Chapter 5 Discussion QuestionsDocument3 pagesChapter 5 Discussion QuestionsAngelica RodriguezNo ratings yet

- Product Exchange Process - Service Damage: Old Product Old ProductDocument2 pagesProduct Exchange Process - Service Damage: Old Product Old ProductsameerjaleesNo ratings yet

- Stages of Digital Transformation in Competency Management - TejaDocument6 pagesStages of Digital Transformation in Competency Management - TejaImmanuel Teja HarjayaNo ratings yet