Professional Documents

Culture Documents

Family Medicare Policy CIS

Family Medicare Policy CIS

Uploaded by

GIJO0 ratings0% found this document useful (0 votes)

16 views6 pagesThis document provides a summary of coverage, exclusions, and payment details for the Family Medicare Policy offered by United India Insurance Company Limited.

The policy provides basic coverage for inpatient hospitalization expenses, day care procedures, pre- and post-hospitalization expenses, Ayurvedic/homeopathic/Unani treatment, donor expenses, organ donor benefit, road ambulance cover, and health checkups. Optional covers include restoration of sum insured and maternity expenses.

Major exclusions are war/nuclear risks, stem cell/infertility treatments, congenital defects, investigation/evaluation, unproven treatments, cosmetic surgery, obesity treatments, alcohol/substance abuse treatments, and non-allopathic

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a summary of coverage, exclusions, and payment details for the Family Medicare Policy offered by United India Insurance Company Limited.

The policy provides basic coverage for inpatient hospitalization expenses, day care procedures, pre- and post-hospitalization expenses, Ayurvedic/homeopathic/Unani treatment, donor expenses, organ donor benefit, road ambulance cover, and health checkups. Optional covers include restoration of sum insured and maternity expenses.

Major exclusions are war/nuclear risks, stem cell/infertility treatments, congenital defects, investigation/evaluation, unproven treatments, cosmetic surgery, obesity treatments, alcohol/substance abuse treatments, and non-allopathic

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views6 pagesFamily Medicare Policy CIS

Family Medicare Policy CIS

Uploaded by

GIJOThis document provides a summary of coverage, exclusions, and payment details for the Family Medicare Policy offered by United India Insurance Company Limited.

The policy provides basic coverage for inpatient hospitalization expenses, day care procedures, pre- and post-hospitalization expenses, Ayurvedic/homeopathic/Unani treatment, donor expenses, organ donor benefit, road ambulance cover, and health checkups. Optional covers include restoration of sum insured and maternity expenses.

Major exclusions are war/nuclear risks, stem cell/infertility treatments, congenital defects, investigation/evaluation, unproven treatments, cosmetic surgery, obesity treatments, alcohol/substance abuse treatments, and non-allopathic

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

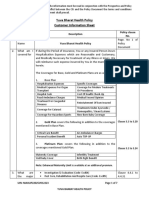

FAMILY MEDICARE POLICY – CUSTOMER INFORMATION SHEET

United India Insurance Company Limited

CIN: U93090TN1938GOI000108

UIN NO. UIIHLIP20013V032021

Customer Information Sheet

Description is illustrative and not exhaustive

Sr. No Title Description Refer to Policy

Clause No.

Page 1 of Policy

1 Product Name Family Medicare Policy

Document

Basic Cover:

1. In-patient Hospitalisation Expenses V.1

2. Day Care Procedures V.2

3. Pre and Post–Hospitalisation Expenses V.3

4. Ayurvedic/Homeopathic/Unani treatment V.4

5. Donor Expenses Cover V.5

6. Organ Donor Benefit- When Insured Person is the V.6

Donor

What am I covered 7. Road Ambulance Cover

2 V.7

for

8. Cost of Health Check-up V.8

9. Modern Treatment Methods & Advancement in V.9

Technology

Optional Covers:

10. Restoration of Sum Insured (For SI Rs.3 Lac & Above) V.10

11. Maternity Expenses and New Born Baby Cover (For SI V.11

> 3 Lacs)

12. Daily Cash Allowance on Hospitalisation V.12

1. War & War like operations VI.B.1

2. Injury or Disease due to nuclear weapon / materials VI.B.2

3. Stem cell implantation/surgery/therapy, harvesting,

storage except for Hematopoietic stem cells for bone VI.B.3 a

marrow transplant for haematological conditions

4. Congenital external disease or defects or anomalies VI.B.4

What are the major 5. Expenses related to Sterility and infertility (Code-Excl17) VI.B.5

3 exclusions in the 6. a. Treatment traceable to childbirth except ectopic VI.B.6

policy? pregnancy

b. Expenses towards miscarriage and lawful medical

termination of pregnancy (Code-Excl18)

7. Investigation & Evaluation (Code-Excl04) VI.B.9

8. Expenses related to any unproven treatment/ services VI.B.10

(Code-Excl16)

9. Cosmetic or plastic surgery or any treatment unless as a VI.B.12

part of medically necessary treatment. (Code-Excl08)

UIN NO. UIIHLIP20013V032021 Page 1

FAMILY MEDICARE POLICY – CUSTOMER INFORMATION SHEET

10. Expenses related to the surgical treatment of obesity that VI.B.19

does not fulfil all the specified conditions in the policy

(Code-Excl06)

11. Treatment for, Alcoholism, drug or substance abuse or any VI.B.21

addictive condition (Code-Excl12)

12. Treatments other than Allopathy and Ayurvedic, VI.B.25

Homeopathic & Unani branches of medicine.

13. Any expenses incurred on Domiciliary Treatment VI.B.26

14. Any expenses incurred on Outpatient Treatment VI.B.27

15. Unless used intra-operatively, expenses on prosthesis, VI.B.30

corrective devices; External and or durable Medical / Non-

medical equipment used for diagnosis/treatment/

monitoring/maintenance/support.

16. Treatments including Rotational Field Quantum Magnetic VI.B.32

Resonance (RFQMR), External Counter Pulsation (ECP),

Enhanced External Counter Pulsation (EECP), Hyperbaric

Oxygen Therapy, chondrocyte or osteocyte implantation,

procedures using platelet rich plasma, Trans Cutaneous

Electric Nerve Stimulation; Use of oral immunomodulatory/

supplemental drugs

17. Any item(s) or treatment specified in list of expenses (non- Annexure 1,

medical) VI.B.34

Basic Cover:

Organ Donor Benefit (Where insured person is donor)- 12 V.6

months

Pre-existing disease(s) covered after 48 months of

VI.A.1

continuous coverage. (Code-Excl01)

Any disease contracted by the Insured person during the

first 30 days from the commencement date of the policy. VI.A.3

(Not applicable in case of renewal policies; in case of

4 Waiting Period accidental injuries.) (Code-Excl03)

Two year for named diseases. VI.A.2.Table A

Four Years for Joint Replacement due to Degenerative VI.A.2.Table B

condition; Age-related Osteoarthritis & Osteoporosis; Age-

related Macular Degeneration; Named Mental Illnesses; All

Neurodegenerative disorders

Optional Cover:

Maternity Expenses & New Born Baby Cover: 24 months of V.11.a.i

continuous coverage.

Cashless facility for treatment in network hospitals if VII.7.b

insured has opted for claim processing by TPA.

Reimbursement for treatment in non-network hospitals or VII.7.c.i

5 Pay out Basis on policies opted without TPA

Reimbursement for pre–hospitalisation and post–

VII.7.c.ii

hospitalisation claims.

Reimbursement for Cost of Health Check-up. VII.7.c.iii

Applicable only for Policies with Sum Insured < Rs. 5 Lacs:

Expenses exceeding the following Sub-limits:

6 Cost Sharing V.1.A

a) Room charges beyond 1% of Sum Insured per day

b) ICU/ICCU charges beyond 2% of Sum Insured per day. V.1.B

UIN NO. UIIHLIP20013V032021 Page 2

FAMILY MEDICARE POLICY – CUSTOMER INFORMATION SHEET

c) In case of admission to a room at rates exceeding the V.1.1, Note a

aforesaid limits in Clause V.1.A, the

reimbursement/payment of all associated medical

expenses incurred at the Hospital shall be effected in

the same proportion as the admissible rate per day

bears to the actual rate per day of Room Rent.

Proportionate Deductions shall not be applied in

respect of those hospitals where differential billing is

not followed or for those expenses where differential

billing is not adopted based on the room category.

Applicable for Policies with Sum Insured Rs. 5 Lacs and

above:

a) Expenses exceeding the following Sub-limits:

b) 1% of Sum Insured or Single Occupancy Standard Air- V.1.A

Conditioned Room Charges whichever is higher

c) In case of admission to a room at rates exceeding the

aforesaid limits in Clause V.1.A, the V.1.1 Note a

reimbursement/payment of all associated medical

expenses incurred at the Hospital shall be effected in

the same proportion as the admissible rate per day

bears to the actual rate per day of Room Rent.

Proportionate Deductions shall not be applied in

respect of those hospitals where differential billing is

not followed or for those expenses where differential

billing is not adopted based on the room category.

For persons with age of entry above 60 years in Family Note on Co-

Medicare Policy, every admissible claim under V.1 to V.5, V.7, Payment after

V.9 and V.10 shall be subject to a Co-payment of 10% on the Section V.9 &

admissible claim amount. Section V.10.2

Other sub-limits:

a) Cataract– Actual expenses or 10% of Sum Insured V.1.2.a

whichever is less, subject to a maximum of Rs. 50000 only

per hospitalisation/surgery

b) Ayurvedic/Homeopathic/Unani Treatment: Limits vary as V.4

per SI as follows

a. Upto 3 Lacs: 10,000

b. > 3 Lacs and upto 15 Lacs: 15,000

c. > 15 Lacs and upto 25 Lacs: 25,000

c) Mental Illness Cover Limit: In case of following mental V.1.2.b

6 Cost Sharing illnesses the actual Inpatient Hospitalization expenses will

be covered upto 25% of Sum Insured subject to a maximum

of Rs. 3,00,000 per policy year;

a. Schizophrenia (ICD - F20; F21; F25)

b. Bipolar Affective Disorders (ICD - F31; F34)

c. Depression (ICD - F32; F33)

d. Obsessive Compulsive Disorders (ICD - F42; F60.5)

e. Psychosis (ICD - F 22; F23; F28; F29)

d) Pre & Post Hospitalisation is limited to actual expenses V.3

incurred subject to maximum of 10% of Sum Insured per

hospitalisation/surgery

UIN NO. UIIHLIP20013V032021 Page 3

FAMILY MEDICARE POLICY – CUSTOMER INFORMATION SHEET

e) Modern Treatment Methods & Advancement in V.9

Technology: In case of an admissible claims under Section

V.1/ V.2 as applicable, Expenses incurred on the following

procedures are covered subject to limits:

a. Uterine Artery Embolization & High Intensity Focussed Ultrasound

(HIFU): Upto 20% of Sum Insured subject to a maximum of Rs. 2

Lacs per policy period

b. Balloon Sinuplasty: Upto 10% of Sum Insured subject to a

maximum of Rs. 1 Lac per policy period

c. Deep Brain Stimulation: Upto 70% of Sum Insured per policy

period

d. Oral Chemotherapy: Upto 20% of Sum Insured subject to a

maximum of Rs. 2 Lacs per policy period

e. Immunotherapy- Monoclonal Antibody to be given as injection:

Upto 20% of Sum Insured subject to a maximum of Rs. 2 Lacs per

policy period

f. Intra vitreal Injections: Upto 10% of Sum Insured subject to a

maximum of Rs. 1 Lac per policy period

g. Robotic Surgeries (including Robotic Assisted Surgeries):

i. Upto 75% of Sum Insured per policy period for claims

involving Robotic Surgeries for (i) the treatment of any

disease involving Central Nervous System irrespective of

aetiology; (ii) Malignancies

ii. Upto 50% of Sum Insured per policy period for claims

involving Robotic Surgeries for other diseases

h. Stereotactic Radio Surgeries: Upto 50% of Sum Insured per policy

period

i. Bronchial Thermoplasty: Upto 30% of Sum Insured subject to a

maximum of Rs. 3 Lacs per policy period

j. Vaporisation of the Prostate (Green laser treatment or holmium

laser treatment): Upto 30% of Sum Insured subject to a maximum

of Rs. 2 Lacs per policy period

k. Intra Operative Neuro Monitoring (IONM): Upto 15% of Sum

Insured per policy period

l. Stem Cell Therapy: Hematopoietic stem cells for bone marrow

transplant for haematological conditions to be covered only: No

additional sub-limit

Deductible: Daily Cash Allowance on Hospitalisation: Daily

6 Cost Sharing V.12

Cash Allowance for the first 24 hours Hospitalization

The policy may be cancelled at any time on grounds of VII.10.a.i

fraud, misrepresentation, non-disclosure of material fact,

by sending 15 days’ notice to the Insured.

In case of non-cooperation by the Insured person/s, the VII.10.a.ii

policy shall be cancelled and the rateable proportion of the

premium paid shall be refunded if no claim has been

reported/ paid under the policy, subject to a minimum

retention of Rs.100.

7 Cancellation The insured may cancel the policy at any time and if no VII.10.b

claim has been made up to the date of cancellation, then

the company shall allow refund of premium at our short

period rate table given below, subject to a minimum

retention of Rs.100:

Cancellation after period on risk Rate of premium to be

refunded

Upto one month 3/4th of the annual rate

>1 month and upto 3 months 1/2 of the annual rate

>3 months and upto 6 months 1/4th of the annual rate

UIN NO. UIIHLIP20013V032021 Page 4

FAMILY MEDICARE POLICY – CUSTOMER INFORMATION SHEET

Exceeding 6 months No refund

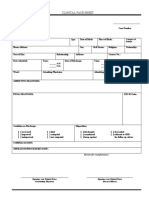

Notification of Claim within 24 hours from the date of VII.7.a

emergency hospitalization required or before discharge

from Hospital, whichever is earlier; At least 48 hours prior

to admission in Hospital in case of planned Hospitalization.

Procedure for Cashless claims VII.7.b

Procedure for reimbursement of claims VII.7.c

List of documents required VII.7.d

Time limit for submission of documents VII.7.e

Type of claim Time limit for submission of

documents to company/TPA

8 Claims Reimbursement of hospitalisation Within 15 days of date of

and pre- hospitalisation expenses discharge from hospital

(limited to 30 days)

Reimbursement of post Within 15 days from

hospitalisation expenses (limited completion of post

to 60 days) hospitalisation treatment

Reimbursement of Cost of Health Within 15 (fifteen) days from

Check-up Health Check-up

Claim settlement VII.7.f

Services Offered by TPA VII.7.g

1. Company: IX

a) Policy issuing Office,

b) Registered &: 24, Whites Road, Chennai – 600014

c) Company website: www.uiic.co.in

Policy Servicing/

d) customercare@uiic.co.in

9 Grievance/

2. IRDAI (IGMS/Call Centre):

Complaints

a) www.irdai.gov.in IX

b) complaints@irda.gov.in

3. Ombudsman: http://www.ecoi.co.in/ombudsman.html IX

1. Renewal of Policy: The policy can be renewed annually VII.11

throughout the lifetime of the insured. In the event of

break in the policy a grace period of 30 days is allowed.

2. Migration: The insured can opt for migration of policy to VII.17

our other similar products at the time of renewal.

3. Portability: This policy is subject to the Guidelines of IRDAI VII.16

on Portability of Health Insurance Policies, as amended

from time to time.

4. Change of Sum Insured: On applying at the time of VII.12

10 Insured’s Rights

renewal. The acceptance of the enhancement would be at

the discretion of the company.

All waiting periods as defined in the Policy shall apply for

the incremental portion of the Sum Insured from the

effective date of enhancement of such Sum Insured

5. Turnaround Time (TAT): In case of reimbursement, VII.7.f.i

company shall offer a settlement of the claim within 30

days from the date of receipt of final document.

UIN NO. UIIHLIP20013V032021 Page 5

FAMILY MEDICARE POLICY – CUSTOMER INFORMATION SHEET

1. Truth and accuracy of statements in the Proposal VII.1.a

2. The terms and conditions of the policy must be fulfilled by

the Insured Person for the Company to make any payment VII.2

11 Insured’s Obligations

for claim(s) arising under the policy.

3. Insured will disclose all material information during the VII.6.c

policy period in writing to the policy issuing office.

LEGAL DISCLAIMER: The information must be read in conjunction with the product brochure and policy document.

In case of any conflict between the Customer Information sheet and policy document the terms and conditions

mentioned in the policy document shall prevail.

UIN NO. UIIHLIP20013V032021 Page 6

You might also like

- Daniel Castro IndictmentDocument27 pagesDaniel Castro IndictmentWWMTNo ratings yet

- National Asthma - Bronchiolitis - COPD GuidelinesDocument84 pagesNational Asthma - Bronchiolitis - COPD GuidelinesFaisol Kabir86% (7)

- Annexure III (A) Parivar CIS PDFDocument3 pagesAnnexure III (A) Parivar CIS PDFJayalakshmi RajendranNo ratings yet

- Customer Information Sheet: Ican EssentialDocument22 pagesCustomer Information Sheet: Ican EssentialDkkkkNo ratings yet

- Cis StumpDocument8 pagesCis Stumpdhinesh subramaniamNo ratings yet

- Cis FMPDocument7 pagesCis FMPdhinesh subramaniamNo ratings yet

- Star Health Gain Insurance Policy: Unique Identification No.: SHAHLIP18088V021718Document6 pagesStar Health Gain Insurance Policy: Unique Identification No.: SHAHLIP18088V021718RAMSHANKAR.S cse2014No ratings yet

- SBI General Insurance Company Limited: (Description Is Illustrative and Not Exhaustive)Document45 pagesSBI General Insurance Company Limited: (Description Is Illustrative and Not Exhaustive)adnaanrashid7No ratings yet

- Super Top-Up Medicare Policy: United India Insurance Company LimitedDocument5 pagesSuper Top-Up Medicare Policy: United India Insurance Company LimitedGIJONo ratings yet

- Cis IhipDocument5 pagesCis Ihipdhinesh subramaniamNo ratings yet

- PolicyDocument9 pagesPolicytridarsinomNo ratings yet

- CIS Yuva Bharat Health PolicyDocument7 pagesCIS Yuva Bharat Health PolicyS PNo ratings yet

- Cis IhipDocument7 pagesCis Ihipdhinesh subramaniamNo ratings yet

- Individual Health Insurance Policy CISDocument3 pagesIndividual Health Insurance Policy CISGIJONo ratings yet

- Cis DocumentDocument21 pagesCis Documentyoga.crossfit.kickboxingNo ratings yet

- Group Health Insurance Customer Information Sheet: ICICI Lombard General Insurance Company LimitedDocument29 pagesGroup Health Insurance Customer Information Sheet: ICICI Lombard General Insurance Company LimitedPankaj GuptaNo ratings yet

- Health Wallet Combined PW Cis HegiDocument32 pagesHealth Wallet Combined PW Cis Hegihiteshmohakar15No ratings yet

- Equicover Health Cis PWDocument27 pagesEquicover Health Cis PWLogeshParthasarathyNo ratings yet

- Key Information Sheet: IhealthDocument18 pagesKey Information Sheet: Ihealthmksnake77No ratings yet

- Navi Cure - Customer Information Sheet: Product Name What Am I Covered ForDocument12 pagesNavi Cure - Customer Information Sheet: Product Name What Am I Covered ForsandeepfoxNo ratings yet

- Title Description: UIN: RHLHLIP19097V011819Document45 pagesTitle Description: UIN: RHLHLIP19097V011819Touch MidasNo ratings yet

- Star Special Care BrochureDocument2 pagesStar Special Care BrochureAkhileshNo ratings yet

- 4016 - X - 220414582 - 01 - 000 MobiproDocument7 pages4016 - X - 220414582 - 01 - 000 MobiproGulshan KanojiaNo ratings yet

- Medical Insurance BenifitsDocument13 pagesMedical Insurance BenifitsdhineshNo ratings yet

- Arogya Sanjeevani A5 Size PW HehiDocument26 pagesArogya Sanjeevani A5 Size PW Hehihiteshmohakar15No ratings yet

- Category 2 TOBDocument5 pagesCategory 2 TOBxavier francisNo ratings yet

- The Health Insurance SpecialistDocument8 pagesThe Health Insurance SpecialistYogesh KhemaniNo ratings yet

- IC 38 Short Notes (2) 82Document1 pageIC 38 Short Notes (2) 82Anil KumarNo ratings yet

- United - Group - Ask QueDocument10 pagesUnited - Group - Ask Querickyarya2000No ratings yet

- Health Edge Insurance: Customer Information SheetDocument6 pagesHealth Edge Insurance: Customer Information Sheetkhandepravin589No ratings yet

- Customer Information Sheet: HDFC ERGO General Insurance Company LimitedDocument29 pagesCustomer Information Sheet: HDFC ERGO General Insurance Company LimitedvigneshNo ratings yet

- جدول منافع الاغاثة الدولية 2023 PresentationDocument8 pagesجدول منافع الاغاثة الدولية 2023 PresentationMohammed ShoupiNo ratings yet

- Arogya Sanjeevani Policy CIS - 2Document3 pagesArogya Sanjeevani Policy CIS - 2PrasanthNo ratings yet

- The Health Insurance SpecialistDocument8 pagesThe Health Insurance SpecialistsaranyaNo ratings yet

- Max Care Brochure ENDocument4 pagesMax Care Brochure ENMinnie FarangNo ratings yet

- Senior Citizens Red Carpet Health InsurancePolicyDocument12 pagesSenior Citizens Red Carpet Health InsurancePolicyTatwam Siddha NandaNo ratings yet

- National Insurance Company Limited National Mediclaim PolicyDocument19 pagesNational Insurance Company Limited National Mediclaim PolicySIMON DSOUZANo ratings yet

- S. NO. Title Description: Group Health (Floater) InsuranceDocument4 pagesS. NO. Title Description: Group Health (Floater) Insurancejay rawatNo ratings yet

- ReAssure Policy WordingsDocument27 pagesReAssure Policy Wordingsmindhunter786No ratings yet

- FAQ For COVID-19 Coverage For Individual CustomersDocument7 pagesFAQ For COVID-19 Coverage For Individual CustomersYAP KER QI MoeNo ratings yet

- ReAssure Policy Wordings PDFDocument26 pagesReAssure Policy Wordings PDFvicharNo ratings yet

- CIS YuvaanDocument7 pagesCIS Yuvaandhinesh subramaniamNo ratings yet

- Policy Star Women Care Insurance Policy V 8 Web 2 824e6a4919Document18 pagesPolicy Star Women Care Insurance Policy V 8 Web 2 824e6a4919Pravin PatilNo ratings yet

- New Eready - HmoaDocument13 pagesNew Eready - HmoaEngilbert MaqueraNo ratings yet

- National Mediclaim Policy (NMP)Document20 pagesNational Mediclaim Policy (NMP)Binode SarkarNo ratings yet

- Benefit Manual M&V 23-24 - Jan 1Document22 pagesBenefit Manual M&V 23-24 - Jan 1mdmoosasohail8No ratings yet

- Cis YhipDocument7 pagesCis Yhipdhinesh subramaniamNo ratings yet

- DigitHealthCarePlusPolicy PolicyWordingsDocument67 pagesDigitHealthCarePlusPolicy PolicyWordingsKhushiNo ratings yet

- Health - Individual Mediclaim Policy PDFDocument25 pagesHealth - Individual Mediclaim Policy PDFAlakh BhattNo ratings yet

- RELHLIP21521V032021Document29 pagesRELHLIP21521V032021Shubrojyoti ChowdhuryNo ratings yet

- Star Health and Allied Insurance Company LimitedDocument12 pagesStar Health and Allied Insurance Company LimitedChandrasen JaggerNo ratings yet

- Arogya Supreme: Protect Your Loved Ones With A Comprehensive PolicyDocument14 pagesArogya Supreme: Protect Your Loved Ones With A Comprehensive Policytaxsachin16No ratings yet

- Women Care Insurance Policy PolicyclacuseDocument16 pagesWomen Care Insurance Policy PolicyclacuseAnirudh SagaNo ratings yet

- Health Wallet ProspectusDocument14 pagesHealth Wallet ProspectusKanchan ChoudhuryNo ratings yet

- Policy - NMPDocument21 pagesPolicy - NMPSakshi G AwasthiNo ratings yet

- Cis DocumentDocument23 pagesCis Documentatadu1No ratings yet

- Customer Information Sheet: Optima PlusDocument20 pagesCustomer Information Sheet: Optima PlusvigneshNo ratings yet

- Arogya SHJDocument13 pagesArogya SHJshubhamNo ratings yet

- Gold PolicyDocument14 pagesGold Policycrazyhardik094No ratings yet

- Health Financing Reform in Ukraine: Progress and Future DirectionsFrom EverandHealth Financing Reform in Ukraine: Progress and Future DirectionsNo ratings yet

- Important DetailsDocument3 pagesImportant DetailsGIJONo ratings yet

- MacroDocument1 pageMacroGIJONo ratings yet

- Super Top-Up Medicare Policy: United India Insurance Company LimitedDocument5 pagesSuper Top-Up Medicare Policy: United India Insurance Company LimitedGIJONo ratings yet

- Individual Health Insurance Policy CISDocument3 pagesIndividual Health Insurance Policy CISGIJONo ratings yet

- Endt Yes BiDocument1 pageEndt Yes BiGIJONo ratings yet

- DM Guidelines CCPDocument87 pagesDM Guidelines CCPfuad20No ratings yet

- Mcce QDocument139 pagesMcce QBahaa LotfyNo ratings yet

- Histology of The Respiratory System 20152016Document44 pagesHistology of The Respiratory System 20152016mugilanNo ratings yet

- Screening Diagnosa Keperawatan Dan Diagnosa Potensial Komplikasi ISDA PDFDocument4 pagesScreening Diagnosa Keperawatan Dan Diagnosa Potensial Komplikasi ISDA PDFRina AnnisaNo ratings yet

- Fulltext - Jda v3 Id1087Document5 pagesFulltext - Jda v3 Id1087Caterina PatrauceanNo ratings yet

- Light Therapy: Intensity 14 Distances (Inches) 22Document19 pagesLight Therapy: Intensity 14 Distances (Inches) 22sheebagracelin86No ratings yet

- Biotechnology Old Question PaperDocument10 pagesBiotechnology Old Question PaperHarshitNo ratings yet

- IV Cheatsheet Bgnocolor PDFDocument2 pagesIV Cheatsheet Bgnocolor PDFHermiie Joii Galang MaglaquiiNo ratings yet

- Chapter 4 Javier Et Al. Final ..Document19 pagesChapter 4 Javier Et Al. Final ..Jose BernelNo ratings yet

- Questionnaire (HM)Document15 pagesQuestionnaire (HM)Angelo Mercede100% (2)

- GIE Colonscopy Prep and Diet GuideDocument4 pagesGIE Colonscopy Prep and Diet GuideNiar MarhaliNo ratings yet

- E-Patients White PaperDocument126 pagesE-Patients White PaperPatients Know BestNo ratings yet

- Clinical Face Sheet: Category of PatientDocument14 pagesClinical Face Sheet: Category of PatientMarjorie UmipigNo ratings yet

- Questions About The Ideas of The Passage Skill 1. Answer Main Idea Questions CorrectlyDocument12 pagesQuestions About The Ideas of The Passage Skill 1. Answer Main Idea Questions CorrectlyRama AgustianingsihNo ratings yet

- Science Alzheimer PDFDocument7 pagesScience Alzheimer PDFSinn VolleNo ratings yet

- Pre-And Postnatal Risk Factors in The Pathogenesis of BPD: The Role of InfectionsDocument35 pagesPre-And Postnatal Risk Factors in The Pathogenesis of BPD: The Role of InfectionslordofthewebNo ratings yet

- Interventions To Increase Pediatric Vaccine Uptake An Overview of Recent FindingsDocument10 pagesInterventions To Increase Pediatric Vaccine Uptake An Overview of Recent FindingsMariaNo ratings yet

- Web 1 - Dr. Wahyuni Indawati, Sp. A (K) - Diagnosis and Management of Allergic Rhinitis in ChildrenDocument27 pagesWeb 1 - Dr. Wahyuni Indawati, Sp. A (K) - Diagnosis and Management of Allergic Rhinitis in Childrenbungkang elsaNo ratings yet

- (F 1.0) DensetsuKemononoAnaDocument57 pages(F 1.0) DensetsuKemononoAnaJumper AnonNo ratings yet

- International Ayurvedic Medical Journal: CharacterizedDocument4 pagesInternational Ayurvedic Medical Journal: CharacterizedDrHassan Ahmed ShaikhNo ratings yet

- Gadtc PHCDocument246 pagesGadtc PHCshawnNo ratings yet

- DermatophyteDocument8 pagesDermatophyteBhuvana RajNo ratings yet

- Standard Operating Procedure (SOP)Document2 pagesStandard Operating Procedure (SOP)Rudrajit KarguptaNo ratings yet

- Preoperative Assessment of The Patient With Heart Disease Case FileDocument2 pagesPreoperative Assessment of The Patient With Heart Disease Case Filehttps://medical-phd.blogspot.comNo ratings yet

- HES-005-Session-9-SASDocument9 pagesHES-005-Session-9-SASDave Ortiz Robert MaglasangNo ratings yet

- SYNOPSISDocument18 pagesSYNOPSISsameer jadhavNo ratings yet

- Uti in PregnancyDocument12 pagesUti in PregnancyDiya laljyNo ratings yet

- Hiatal HerniaDocument6 pagesHiatal HerniaElaine Jean UayanNo ratings yet

- Provisional: Borderline Personality Disorder Differential DXDocument6 pagesProvisional: Borderline Personality Disorder Differential DXhernandez2812No ratings yet