Professional Documents

Culture Documents

CFAS Notes

CFAS Notes

Uploaded by

Mikasa AckermanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFAS Notes

CFAS Notes

Uploaded by

Mikasa AckermanCopyright:

Available Formats

CFAS Midterm Notes because employee service does not

increase the amount of the benefit.

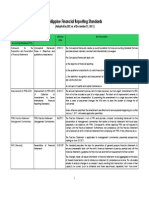

PAS 19 EMPLOYEE BENEFITS

(When the absences occur)

- Are “all forms of consideration given by 2. Post-employee benefits

an entity in exchange for service - Are employee benefits (other than

rendered by employees” (pas 19.8) termination benefits) that are payable

after the completion of employment.

Post-employment benefit plans are

Four Categories of employee benefits under classified as either:

PAS 19 1. Defined contribution plans

1. Short-term employee benefits - the employer commits to

- Are employee benefits (other than contribute to a fund which will be

termination benefits) that are due to be used to pay for the retirement

settled within 12 months after the end benefits of the employees.

of the period in which the employees - risk that retirement benefit may

render the related service. be insufficient rests with the

employee.

Recognition and measurement 2. Defined benefit plans

When an employee has rendered service to - The employer commits to pay

an entity during an accounting period, the retiring employees a definite

entity shall recognize the undiscounted amount.

amount of short-term employee benefits - risk that retirement benefit may

expected to be paid in exchange for that be insufficient rests with the

service: employer,

- as a liability (accrued expense), after Other relevant terms

deducting any amount already paid. - Contributory – both the employee and

- as an asset (prepaid expense) if the employer contributes for the

amount paid is in excess of the retirement benefits of the employee

undiscounted amount of the benefits

incurred; - Non-contributory – only the employer

- as an expense, unless the employee contributes for the retirement benefits

benefit forms part of the cost of an of the employee.

asset, e.x as part of the cost of - Funded – a fund is transferred to a

inventories or property, plant and trustee who will manage the fund. The

equipment. trustee assumes obligation of paying

Short-term compensated absences retirement benefits out from the fun

and directly to retiring employees.

• Accumulating compensated absences

are those that are carried forward and - Unfunded – no fund is transferred to a

can be used in future periods if the trustee. The employer retains the

current period’s entitlement is not used obligation of paying retirement benefits

in full. Accumulating compensated to employees.

absences may either be Accounting for defined contribution plan

1. Vesting – wherein employees are

entitled to a cash payment for unused - The accounting for defined contribution

entitlement on leaving the entity; or plans is straightforward because the

2. non-vesting – wherein employees are reporting entity’s obligation for each

not entitled to a cash payment for period is determined by the amounts to

unused entitlement on leaving the be contributed for that period.

entity. Consequently, no actuarial assumptions

(When the employees render service are required to measure the obligation

that increases their entitlement to or the expense and there is no

future compensated absences) possibility of any actuarial gain or loss.

• Non-accumulating compensated Accounting for defined benefit plan

absences are those that are not carried

forward. No liability or expense is - The accounting for defined benefit

recognized until the absences occur, plans is complex because actuarial

assumptions are required to measure

the obligation and the expense and - Actuarial assumptions are an entity’s

there is a possibility of actuarial gains best estimates of the variables that will

and losses. Obligations are measured on determine the ultimate cost of

a discounted basis. providing post-employment benefits.

1. Demographic assumptions about the

Accounting procedures for defined benefit plans

future characteristics of employees who

Step 1: determine the deficit or surplus are eligible for benefits. Demographic

(deficit)surplus=FVPA-PV of DBO assumptions deal with matters such as:

a. Morality, both during and after

Step 2: determine the net defined benefit employment

liability (asset) b. Rates of employee turnover,

- If there is a deficit, the deficit is the net disability and early retirement

defined benefit liability c. The proportion of plan members

- If there is a surplus, the net defined with dependents who will be

benefit asset is the lower of the surplus eligible for benefits

and the asset ceiling d. Claim rates under medical plans

2. Financial assumptions, dealing with

(The asset ceiling is the present value of any items such as:

economic benefits available in the form of e. The discount rates

refunds from the plan or reductions in f. Future salary and benefit levels

future contributions to the plan) g. Future medical costs, if any,

including cost of administering

claims and payments

h. The expected rate of return on plan

assets

Actuarial assumption – discount rate

- The rate used to discount post-

employment benefit obligations shall be

determined by reference to market

yields at the end of the reporting period

on high quality corporate bonds.

Definition of terms - In countries where there is no deep

1. Current service cost – is the increase in market in such bonds, the market yields

the present value of a defined benefit at the end of the reporting period on

obligation resulting from employee government bonds shall be used.

service in the current period.

2. Past service cost – is the change in the 3. Other long-term employee benefits

present value of the defined benefit - Are employee benefits (other than post-

obligation resulting from a plan employment benefits and termination

amendment or curtailment. benefits) that are due to be settled

3. Gain or loss on settlement – the beyond 12 months after the end of the

difference between the present value of period in which the employees render

the defined benefit obligation and the the related service.

settlement price. - Other long term employee benefits are

4. Interest cost on the defined benefit accounted for using the procedures

obligation – is the increase during a applicable for a defined benefit plan.

period in the present value of a defined However, all of the components of the

benefit obligation which arises because net benefit cost are recognized in profit

the benefits are one period closer to or loss.

settlement.

5. Actuarial gains and losses – see changes 4. Termination benefits

in the present value of the defined - Are employee benefits provided in

benefit obligation resulting from exchange for the termination of an

experience adjustments and the effects employee’s employment as a result of

of changes in actuarial assumptions. either:

1. An entity’s decision to terminate an

employee’s employment before the

Actuarial Assumptions normal retirement date; or

2. An employee’s decision to accept d. Government procurement policy

an entity’s offer of benefits in that is responsible for a portion of

exchange for the termination of the entity’s sales, and

employment. e. Public improvements that benefit

the entire community.

Measurement

Recognition

Termination benefits are initially and

subsequently recognized in accordance with the Government grants are recognized if

nature of the employee benefit. there is reasonable assurance that:

a. The attached conditions will be

a. If the termination benefits are payable

complied with; and

within 12months, the entity shall

b. The grants will be received.

account for the termination benefits

similarly with short-term employee Classifications of government grants according

benefits. to attached condition

b. If the termination benefits are payable

a. Grants related to assets – grants whose

beyond 12 months, the entity shall

primary condition is that an entity

account for the termination benefits

qualifying for them should purchase,

similarly with other long-term benefits.

construct or otherwise acquire long-

c. If the termination benefits are, in

term assets.

substance, enhancement to post-

b. Grants related to income – grants other

employment benefits, the entity shall

than those related to assets.

account for the benefits as post-

employment benefits. Initial measurement

• Monetary grants are measured at the

a. Amount of cash received; or

PAS 20 ACCOUNTING FOR GOVERNMENT

b. The fair value of amount receivable;

GRANTS AND DISCLOSURE OF GOVERNMENT

or

ASSISTANCE

c. Carrying amount of loan payable to

- Government grants are assistance government which repayment is

received from the government in the forgiven; or

form of transfers of resources in d. Discount on loan payable to

exchange for compliance with certain government at a below-market rate

conditions. of interest.

- Government grants excluded • Non-monetary grants (e.x land and

government assistance whose vale other resources) are measured at the

cannot be reasonably measured or a. Fair value of non-monetary asset

cannot be distinguished from the received.

entity’s normal trading transactions. b. Alternatively, at nominal amount or

zero, plus direct costs incurred in

Examples of government grants preparing the asset for its intended

a. Receipt of cash, land, or other non- use.

cash assets from the government

subject to compliance with certain Accounting for government grants

conditions • The main concept in accounting for

b. Receipt of financial aid in case of gov’t grants is the Matching Concept.

loss from a calamity • This means that the gov’t grant is

c. Forgiveness of an existing loan from recognizes as expense the related cost

the government for which the grant is intended to

d. Benefit of a government loan with compensate.

below-market rate of interest

Presentation of Government grants related to

The following are not government assets

grant:

• Government grants related to assets

a. Tax benefits, are presented in the statement of

b. Free technical or marketing advice, financial position either by:

c. Provision of guarantees,

a. Gross presentation – the grant is Factors in determining functional currency

presented as deferred income

Primary factors

(liability); or

b. Net presentation – the grant is An entity’s functional currency is:

deducted when computing for the

carrying amount of the asset. 1. The currency that mainly influences:

- Sales prices

Presentation of Government grants related to - Cost of goods sold/Cost of services

income provided

• Grants related to income are Secondary factors

sometimes presented in the income

2. The currency in which funds from

statement either by:

financing activities are generated.

a. Gross presentation – the grant is

presented separately or under a 3. The currency in which receipts from

general heading such as “other operating activities are usually retained.

income”, or Foreign currency transactions

b. Net presentation – the grant is

deducted in reporting the related • Initial recognition: The foreign currency

expense. amount is translated at the spot

exchange rate at the date of the

Repayment of Gov’t. Grants transaction.

• A government grant that becomes • Subsequent recognition: At the end of

repayable is accounted for as a change each reporting period:

in accounting estimate that is treated 1. Foreign currency monetary items

prospectively under PAS 8 are retranslated using the closing

rate;

2. Non-monetary items that are

measured at historical cost in a

PAS 21 THE EFFECTS OF CHANGES IN FOREIGN

foreign currency shall be translated

EXCHANGE RATES

using the exchange rate at the date

Two ways of conducting foreign activities of the transaction; and

3. Non-monetary items that are

1. Foreign currency transactions –

measured at fair value in a foreign

individual entities often enter into

currency shall be translated using

transactions in a foreign currency.

the exchange rates at the date

2. Foreign operations – groups often

when the fair value was

include overseas entities.

determined.

Two main accounting issues

Monetary Items

• Exchange rates are constantly changing.

- Are units of currency held and assets

Therefore, the principal issues in

and liabilities to be received or paid in a

accounting for foreign activities are

fixed or determinable number of units

determining:

of currency.

1. Which exchange rate(s) to use; and

2. How to report the effects of Recognition of exchange differences

changes in exchange rates in the

• When a foreign currency transaction

financial statements.

occurred in one period and settled in

Functional currency another period:

a. The exchange difference between

• When preparing financial statements, a

the transaction date and the end of

reporting entity must identify its

reporting period is recognized in

functional currency.

the period of transaction, while

• Functional currency is the currency of b. The exchange difference between

the primary economic environment in the end of the previous reporting

which the entity operates. period and the date of settlement is

• The primary economic environment in recognized in the period of

which an entity operates is normally the settlement.

one in which it primarily generates and • When a foreign currency transaction

expends cash. occurred and settled in the same

period, all the exchange difference is Qualifying asset

recognized in that period.

• Qualifying asset is an asset that

Foreign operations necessarily takes a substantial period of

time to get ready for its intended use or

• A foreign operation is an entity that is a

sale. Depending on the circumstances,

subsidiary, associate, joint venture or

any of the following may be qualifying

branch of a reporting entity, the

assets:

activities of which are based or

A. Inventories

conducted in a country or currency

B. Manufacturing plants

other than those of the reporting entity.

C. Power generation facilities

Translation to the presentation currency D. Intangible assets

E. Investment properties measured

1. Assets and liabilities are translated at under cost model

the closing rate at the date of the • The following are not qualifying assets

statement of financial position. a. Financial assets, and inventories

2. Income and expenses, including other

that are manufactured, or

comprehensive income, are translated

otherwise produced, over a short

at spot exchange rates at the dates of period of time.

the transactions. For practical reason, b. Assets that are ready for their

average rates for a period may be used,

intended use or sale when acquired

if they provide a reasonable

are not qualifying assets.

approximation of the spot rates when c. Assets that are routinely

the transactions took place. However, if

manufactured or otherwise

exchange rates fluctuate significantly,

produced in large quantities on a

the use of the average rate is

repetitive basis.

inappropriate. d. assets measured at fair value.

3. The resulting exchange difference is

recognized in other comprehensive Commencement of capitalization

income.

• The capitalization of borrowing costs as

PAS 23 BORROWING COSTS part of the cost of a qualifying asset

commences on the date when all of the

Core principle

following conditions are met:

- “Borrowing costs that are directly a. The entity incurs expenditures for

attributable to the acquisition, the asset;

construction or production of a b. The entity incurs borrowing costs;

qualifying asset form part of the cost of and

that asset. Other borrowing costs are c. It undertakes activities that are

recognized as an expense.” (PAS 23.1) necessary to prepare the asset for

its intended use or sale.

Borrowing costs

- Borrowing costs are interest and other Suspension of capitalization

costs incurred by an entity in

connection with the borrowing of • Capitalization of borrowing costs shall

funds. be suspended during extended periods

of suspension of active development of

Borrowing costs may include: a qualifying asset.

1. interest expense on financial liabilities

or lease liabilities computed using the Cessation of capitalization

effective interest method

2. Exchange differences arising from • An entity shall cease capitalizing

foreign currency borrowings to the borrowing costs when substantially all

extent that they are regarded as an the activities necessary to prepare the

adjustment to interest costs. qualifying asset for its intended use or

sale are complete.

Determining borrowing costs eligible for b. sale in the ordinary course of

capitalization business” (pas40)

1. Qualifying assets financed through Investment property PPE (owner-occupied

Specific property)

Held to earn rentals or Held for use in the

borrowing for capital production or supply of

Interest expense on specific borrowing Less: appreciation or both. goods or services or for

administrative purposes

Investment income earned on specific

borrowing Generates cash flows Generates cash flows in

largely independently conjunction with the

= Borrowing cost eligible for capitalization of the other assets other assets held by an

held by an entity. entity.

Includes only land and May include assets other

Determining borrowing costs eligible for

building than land and building

capitalization

Accounted for under Accounted for

2. Qualifying assets financed through PAS40 under PAS16

General borrowing

Total interest expense on general borrowings Examples of investment property

Divide by: Total general borrowings a. Land held for long-term capital

appreciation rather than for short-term

= Capitalization rate sale in the ordinary course of business.

b. Land held for a currently undetermined

future use.

Average expenditure on the asset c. A building owned by the entity (or held

by the entity under a finance lease) and

Multiply by: Capitalization rate

leased out under one or more operating

= Borrowing cost that may be eligible for leases.

capitalization d. A building that is vacant but is held to

be leased out under one or more

operating leases

The amount computed in the formula above e. Property that is being constructed or

shall be compared with the actual borrowing developed for future use as investment

costs incurred during the period. The amount to property.

be capitalized is the lower amount.

Examples of items that are not investment

property

Financial statement presentation a. Property intended for sale in the

ordinary course of business or property

• Qualifying assets are not segregated acquired exclusively with a view to

from other assets in the financial subsequently disposal in the near future

statements. They are presented as or for development and resale.

regular assets under their normal b. Property being constructed or develop

classification as provided under other on behalf of third parties (PFRS15

standards. Revenue from contracts with customer)

c. Owner-occupied property (PAS16) and

PAS 40 INVESTMENT PROPERTY owner-occupied property awaiting

disposal.

Investment property d. Property that is lease to another entity

- Is “property (land or a build – or a part under a finance lease.

of a building – or both) held (by the Property that is partly investment property and

owner or by the lessee under finance partly owner-occupied

lease) to earn rentals or for capital

appreciation or both, rather than for: • If the portions could be sold separately

a. use in the production or supply of (or leased out separately under a

goods or services or for finance lease), an entity accounts for

administrative purposes; or the portions separately. The portion

being rented out under operating lease

is classified as investment property and Fair value model

the portion used as owner-occupied is

• After initial recognition, an entity that

classified as property, plant, and

chooses the fair value model shall

equipment.

measure all of its investment property

• If the portion could not be sold

at fair value, except in cases where the

separately, the property is investment

exemptions under PAS40 applies

property only if an insignificant portion

• Changes in fair values are recognized in

is held for use in the production or

profit or loss.

supply of goods or services or for

administrative purposes. If the owner- • Depreciable assets classified as

occupied portion is significant, the investment property measured under

entire property is classified as property, fair value model are not depreciated.

plant, and equipment. • If the fair value of an item of investment

property cannot be determined reliably

Ancillary services to occupants on initial recognition, such item is

subsequently measure under the cost

• When ancillary services are provided to

model.

the occupants of a property held, the

property is classified as investment

property if the services are insignificant

to the arrangement as a whole.

Cost model

Measurement

Initial: cost • After initial recognition, an entity that

Subsequent: either the cost model or chooses the cost model shall measure

fair value model all of its investment property at cost

less any accumulated depreciation and

impairment losses in accordance with

• The following are excluded from the PAS 16 Property, plant, and equipment.

cost of investment property and are Transfers

expensed immediately:

a. Start-up costs (unless they are • Transfers to, or from, investment

necessary to bring the property to property shall be made when, and only

the condition necessary for it to be when, there is a change in use,

capable of operating in the manner evidenced by:

intended by management) a. Commencement of owner-occupation,

b. Operating losses incurred before for a transfer from investment property

the investment property achieves to owner-occupied property;

the planned level of occupancy b. Commencement of development with a

c. Abnormal amounts of wasted view to sale, for a transfer from

material, labor or other resources investment property to inventories;

incurred in constructing or c. End of owner-occupation, for a transfer

developing the property from owner-occupied property to

investment property; or

d. Commencement of an operating lease

Change in accounting policy to another party, for a transfer from

• A change from the cost model to the inventories to investment property.

fair value is accounted prospectively

• A change from the fair value model to

the cost model is not permitted. PAS41 AGRICULTURE

Determining fair value - Is applied to account for the following

when they relate to agriculture activity:

• PAS40 requires all entities to determine a. Biological assets, except for bearer

the fair value of investment property plants

whether it uses the cost model or fair b. Agricultural produce at the point of

value model. Fair values determined are harvest; and

used for measurement and disclosure c. Unconditional government grants

purposes if the entity uses the fair value related to a biological asset

model and for disclosure purposes only

if the entity uses the cost model.

measured at its fair value less cost Agricultural activity

to sell

• PAS 41 applies to biological assets,

- Does not applied to the following:

agricultural produce and gov’t grants

a. Land (PAS16 PPE and PAS40

only when they relate to agricultural

INVESTMENT PROPERTY)

activity.

b. Bearer plants related to agricultural

activity (PAS16). However, PAS41 • Agricultural activity is the management

applies to the produce on those by an entity of the biological

bearer plants. transformation of biological assets for

c. Government grants related to sale, into agricultural produce, or into

bearer plants (PAS20 acctg. for additional biological assets.

gov’t grants and disclosure of gov’t Common features of agricultural activity

assistance).

d. Intangible assets (PAS38 Intangible a. Capability to change – living animals

assets) and plants are capable of biological

• PAS41 is applied to agricultural produce transformation

at the point of harvest. After the point b. Management of change – management

of harvest, PAS2 inventories or other facilitates biological transformation by

applicable standard is applied. enhancing, or at least stabilizing,

conditions necessary for the process to

Nature of asset take place. - Harvesting from

• Living animal or Biological asset unmanaged sources is not agricultural

plant (PAS41) however, activity.

bearer plants are c. Measurement of change – the change

classified as in quality or quantity brought about by

Property, plant and

biological transformation is measured

equipment

and monitored as a routine

• Unprocessed Agricultural produce

(PAS41) management function.

harvested

product Recognition

• Processed Inventory (PAS2)

harvested A biological asset or agricultural produce is

product recognized when:

a. The entity controls the asset as a result

of past events;

b. It is probable that future economic

benefits associated with the asset will

flow to the entity; and

c. The fair value or cost of the asset can be

measured reliably.

Measurement

• A biological asset shall be measured on

initial recognition and at the end of

each reporting period at its fair value

less costs to sell.

• Agricultural produce harvested from an

Consumable vs. Bearer biological assets entity’s biological assets shall be

measured at its fair value less costs to

Biological assets are either consumable or

sell at the point of harvest. Such

bearer.

measurement is the cost at that date

a. Consumable – those that are to be when applying PAS2 Inventories or

harvested as agricultural produce or another applicable standard.

sold as biological assets. E.x timber • A biological asset is measured at cost

b. Bearer – those other than consumable less accumulated depreciation and

biological assets. E.x fruit tree accumulated impairment loss if the fair

• PAS41 applies to both consumable and value of the biological asset cannot be

bearer animals. However, PAS41 only to measured reliable on initial recognition.

consumable plants but not to bearer

Definitions

plants

• Fair value is the price that would be specifications or are able to sustain

received to sell an asset or paid to regular harvests.

transfer a liability in an orderly b. Immature biological assets are

transaction between market those that have not yet attained

participants at the measurement date. harvestable specifications or are

• Costs to sell are the incremental costs not yet able to sustain regular

directly attributable to the disposal of harvests.

an asset, excluding finance costs and 3. Disclosure of breakdown of total “Gain

income taxes (e.x commissions to (loss) from changes in FVLCS) during the

brokers, levies by regulatory agencies period attributable to price change and

and commodity exchange, and transfer physical change

taxes and duties)

• Costs to sell do not include transport

costs, advertising costs, income taxes, PFRS 1 FIRST-TIME ADOPTION OF PHILIPPINE

and interest expense. FINANCIAL REPORTING STANDARDS

• If location is a characteristic of the

First PFRS financial statements

biological asset, the price in the

principal (or most advantageous) • Are the “the first annual financial

market shall be adjusted for the statements in which an entity adopts

transport costs. PFRSs, by an explicit and unreserved

statement of compliance with PFRSs”.

Gains and losses

(PFRSs1.3)

• A gain or loss arising on initial • Financial statements are considered

recognition of a biological asset at fair “First PFRSs financial statements” if the

value less costs to sell and from a previous financial statements:

change in fair value less costs to sell of a a. Were prepared in accordance with

biological asset shall be included in other reporting standards not

profit or loss for the period in which it consistent with the PFRS; or

arises b. Did not contain an explicit and

unreserved statement of

Nature of Accounting

compliance with PRFSs; or

government grant procedure

c. Contained an explicit and

Government grant Recognize income equal

unreserved statement of

(a) is unconditional to fair value of the

and (b) relates to grant when the grant compliance with some, but not all,

biological asset becomes receivable PFRSs; or

measured at FVLCS d. Were prepared using some, but not

Government grant Recognize income only all, applicable PFRSs; or

is conditional when condition is met e. Prepared in accordance with PFRSs

Relates to Account for the grant but were used for internal reporting

biological asset under PAS20 purposes only; or

measured at cost f. Did not contain a complete set of

Is conditional but a Recognize income using financial statements as required

portion of the straight – line method under PAS1 Presentation of

grant is retained Financial Statements.

according to the g. The entity did not present financial

time that has

statements in previous periods.

elapsed

• PFRS 1 is applied only once

• An entity presenting its first PFRS

Encourage disclosures financial statements is called a “first-

time adopter”

Disclosure of the following information is

encouraged but not required: Recognition and measurement

1. Disclosure of consumable and bearer • PFRS 1 requires an entity to prepare

biological assets. and present an opening PFRS statement

2. Disclosure of mature and immature of financial position at the date of

biological assets. transition to PFRSs.

a. Mature biological assets are those • The date to transition to PFRSs is the

that have attained harvestable beginning of the earliest period for

which an entity presents full

comparative information under PFRSs in instead of paying in cash the entity

its first PFRS financial statements. The issues its own shares of stocks or share

application of the PFRSs stars on this options; or

date. 2. Cash-settled share-based payment

transaction – is a transaction whereby

Accounting policies

an entity acquires goods or services and

• The entity selects its accounting policies incurs an obligation to pay cash at an

based on the latest versions of PFRSs as amount that is based on the fair value

at the current reporting date. The of equity instruments; or

selected policies are then applied to all 3. Choice between equity-settled and

financial statements presented together cash-settled

with the first PFRS financial statements. • Equity instrument is a contract that

evidences a residual interest in the

Retrospective application assets of an entity after deducting all of

• In general (but subject to some its liabilities.

exceptions which will be discussed Core principle

momentarily), PFRS 1 requires

retrospective application of the • An entity shall recognize in profit or loss

accounting policies selected by the first- and financial position the effects of

time adopter. share-based payment transactions,

• PFRS 1 requires an entity to do the including expenses associated with

following in its opening PFRS statement transactions in which share options are

of financial position: granted to employees.

a. Recognize all assets and liabilities

Recognition

whose recognition is required by

PFRSs; • Goods and services received in share-

b. Not recognize items as assets or based payment transactions are

liabilities if PFRSs do not permit recognized when the goods are

such recognition; received or as the services are received.

c. Reclassify items recognized under Goods or services received that do not

previous GAAP that have different qualify as assets are recognized as

classifications under PFRSs; and expenses.

d. Apply PFRSs in measuring all

recognized assets and liabilities • The entity shall recognize:

(PFRS1.10) a. A corresponding increase in equity if

the goods or services were received in

Exceptions to the requirements of PFRS 1

an equity-settled share-based payment

• A first-time adopter is exempted from transaction, or

complying with the “retrospective b. A liability if the goods or services were

application” requirement of PFRS 1 if: acquired in a cash-settled share-based

a. The cost of compliance exceeds the payment transaction.

expected benefit.

Equity-settled share-based payment

b. Retrospective application requires

transactions

management judgements about

past conditions after the outcome Summary of initial measurement

of a particular transaction is already Transactions with non- Transactions with

known. employees employees and others

providing similar

Presentation and disclosure services

Goods or services Goods or services

• The first PFRS financial statements shall

acquired from non- acquired from

include at least one-year comparative

employees are employees and others

information. measured using the providing similar

PFRS 2 Share-based payments following order of services are measured

priority: using the following

Scope of PFRS 2 1. Fair value of order of priority:

goods or 1. Fair value of

1. Equity-settled share-based payment services equity

transaction – is a transaction whereby received at instruments

an entity acquires goods or services and measurement granted at

date. grant date Employee share option plans – equity settled

2. Fair value of 2. Intrinsic value

equity • Share option is a contract that gives the

instrument holder the right, but not the obligation,

granted at to subscribe to the entity’s shares at a

measurement fixed or determinable price for a

date. specified period of time. Some share

options given to employees may not

require any subscription price, meaning

• Equity instrument granted is the right

shares will be issued to the employees

(conditional or unconditional) to an

in consideration merely for services

equity instrument of the entity

rendered.

conferred by the entity on another

party under a share-based payment Measurement of compensation

arrangement.

• Since employee share option plan is a

• Measurement date is the date at which

transaction with an employee, the

the fair value of the equity instruments

following order of priority shall be used

granted is measured for the purposes of

to measure the services received

PFRS 2.

(salaries expense):

a. For transactions with non-

1. Fair value of equity instruments

employees, the measurement date

granted at grant date

is the date when the entity receives

2. Intrinsic value

the good or service.

b. For transactions with employees Recognition of equity-settled share-based

and others providing similar compensation plans

services, the measurement date is

grant date. 1. If the share options granted vest

immediately, salaries expense shall be

• Grant date is the date at which the

recognized in full with a corresponding

entity and the counterparty agree to a

increase in equity at grant date.

share-based payment arrangement,

2. If the share options granted do not vest

being when the entity and the

counterparty have a shared until the employee completes a

specified period of service, the entity

understanding of the terms and

shall recognize the related

conditions of the arrangement.

compensation expense as the services

• Intrinsic value is the difference between

are rendered by the employee over the

the fair value of the shares to which the

vesting period.

counterparty has the conditional or

unconditional right to subscribe or the In the absence of evidence to the contrary, it

right to receive and the subscription shall be presumed that the share options vest

price (if any) that the counterparty is immediately.

required to pay for those shares.

Cash-settled share-based payment transactions

Share-based compensation plans

• A cash-settled share-based payment

• Share-based compensation plan is an transaction is one whereby an entity

arrangement whereby an employee is acquires goods or services and incurs an

given compensation in return for obligation to pay cash at an amount

services rendered in the form of the that is based on the fair value of equity

entity’s equity instruments or cash instruments.

based on the fair value of the entity’s • The goods or services acquired and the

equity instruments or a choice of liability incurred on cash-settled share-

settlement between equity instrument based payment transactions are

and cash. Examples: measured at the fair value of the

a. Employee share options (equity- liability.

settled)

b. Employee share appreciation rights

(cash settled) • At the end of each reporting period and

c. Compensation plans with a choice even on settlement date, the liability

of settlement between (1) and (2) shall be remeasured to fair value.

above

Changes in fair value are recognized in the compound instrument and its

profit or loss. components as follows:

A. If the fair value of one settlement

alternative is the same as the other, the

Employee share appreciation rights (SARs) –

fair value of the equity component is

cash-settled

zero, and hence the fair value of the

• A share appreciation right is a form of compound financial instrument is the

compensation given to an employee same as the fair value of the debt

whereby the employee is entitled to component.

future cash payment (rather than an B. If the fair values of the settlement

equity instrument), based on the alternatives differ, the fair value of the

increase in the entity’s share price from equity component will be greater than

a specified level over a specified period zero, in which case, the fair value of the

of time. compound financial instrument will be

greater than the fair value of the debt

Measurement of compensation component.

• The liability for the future cash payment • If the entity has the right to choose

on share appreciation rights shall be settlement between cash (or other

measured, initially and at the end of assets) or equity instruments, the entity

each reporting period until settled, at has not granted a compound

the fair value of the share appreciation instrument.

rights. Changes in fair value are • In such case, the entity shall determine

recognized in profit or loss. whether it has a present obligation to

settle in cash and shall account for the

Recognition of cash-settled share-based share-based payment transaction

compensation plans accordingly.

a. If the share appreciation rights granted • If the entity has a present obligation to

vest immediately, the entity shall settle in cash, it shall account for the

recognize the related compensation transaction as a cash-settled share-

expense on the services received in full based payment transaction.

with a corresponding increase in liability • If the entity has no present obligation to

at grant date. settle in cash, it shall account for the

b. If the share options granted do not vest transaction as an equity-settled share-

until the employee completes a based payment transaction.

specified period of service, the entity

shall recognize the services received,

and a liability to pay for them, as the PRFS 3 BUSINESS COMBINATIONS

employee renders service during that

Definition of a Business Combination

period.

- A business combination is “a

Share-based payment transactions with cash

transaction or other event in which an

alternatives

acquirer obtains control of one or more

• If the counterparty has the right to businesses.” (PFRS 3)

choose settlement between cash (or

Control

other assets) or equity instruments, the

entity has granted a compound • An investor controls an investee when

instrument. the investor is exposed, or has rights, to

• For transactions with non-employees, variable returns from its involvement

the equity component is computed as with the investee and has the ability to

the difference between the fair value of affect those returns through its power

goods or services received and the fair over the investee.

value of the debt component at the • Control is normally presumed to exist

date the goods or services are received. when the ownership interest acquired

in the voting rights of the acquiree is

more than 50% (or 51% or more).

• For transactions with employees and • Control may exist even if the acquirer

others providing similar services, the holds less than 50% interest in the

entity shall measure the fair value of voting rights of acquiree, such as in the

following cases:

1. The acquirer has the power to • The acquisition date is the date on

appoint or remove the majority of which the acquirer obtains control of

the board of directors of the the acquiree.

acquiree; or

2. The acquirer has the power to cast

the majority of votes at board

meetings or equivalent bodies

within the acquiree; or

3. The acquirer has power over more

than half of the voting rights of the

acquiree because of an agreement

with other investors; or

4. The acquirer has power to control

the financial and operating policies

of the acquiree because of a law or Consideration transferred

an agreement.

• The consideration transferred in a

Accounting for business combinations business combination is measured at

fair value.

• Business combinations are accounted

• Examples of potential forms of

for using the acquisition method. This

consideration include:

method requires the following:

1. Cash,

1. Identifying the acquirer;

2. Other assets,

2. Determining the acquisition date; and

3. A business or a subsidiary of the

3. Recognizing and measuring goodwill.

acquirer,

This requires recognizing and measuring

4. Contingent consideration,

the following:

5. Ordinary or preference equity

a. Consideration transferred

instruments, options, warrants and

b. Non-controlling interest in the

member interests of mutual

acquiree

entities.

c. Previously held equity interest in

the acquiree Acquisition-related costs

d. Identifiable assets acquired and

liabilities assumed on the business • Acquisition-related costs are costs the

combination. acquirer incurs to effect a business

combination.

• Acquisition-related costs are recognized

Identifying the acquirer as expenses in the periods in which they

• The acquirer is the entity that obtains are incurred, except for the following:

control of the acquiree. The acquiree is a. Costs to issue debt securities

the business that the acquirer obtains measured at amortized cost –

control of in a business combination. included in the initial measurement

of the resulting financial liability.

• The acquirer is normally the entity that:

b. Costs to issue equity securities – are

a. Transfers cash or other assets and

accounted for as deduction from

incurs liabilities;

share premium. If share premium is

b. Issues its equity interests (except in

insufficient, the issue costs are

reverse acquisitions);

deducted from retained earnings.

c. Receives the largest portion of the

voting rights;

d. Has the ability to elect or appoint or

to remove a majority; Non-controlling interest (NCI)

e. Dominates the management of the • Non-controlling interest (NCI) is the

combined entity; equity in a subsidiary not attributable,

f. Significantly larger of the combining directly or indirectly, to parent.

entities;

• NCI is measured either at:

a. Fair value, or

g. Initiated the combination b. The NCI’s proportionate share of

Determining the acquisition date the acquiree’s identifiable net

assets.

• A non-current asset (or disposal group)

is classified as “held for sale” if all of the

Previously held equity interest in the acquiree

following conditions are met:

• Previously held equity interest in the 1. The asset or disposal group is

acquiree pertains to any interest held available for immediate sale in its

by the acquirer before the business present condition subject only to

combination. terms that are usual and customary;

and

2. The sale is highly probable (i.e.,

Net identifiable assets acquired significantly more likely than not).

• On acquisition date, the acquirer shall i. Management is committed to a

recognize, separately from goodwill, the plan to sell the asset;

identifiable assets acquired, the ii. An active program to locate a

liabilities assumed and any non- buyer has been initiated;

controlling interest in the acquiree. iii. The sale price is reasonable in

• Any unidentifiable asset of the acquiree relation to its current fair value;

(e.g., any recorded goodwill by the iv. The sale is expected to be

acquiree) shall not be recognized. completed within one year; and

• The identifiable assets acquired and the v. It is unlikely that the plan of sale

liabilities assumed are measured at will be withdrawn.

their acquisition-date fair values. Exception to the one-year requirement

• An extension of the period required to

PFRS 5 NON-CURRENT ASSETS HELF FOR SALE complete a sale does not preclude an

AND DISCONTINUED OPERATIONS asset (or disposal group) from being

classified as held for sale if:

Core Principle 1. the delay is attributable to events

or circumstances beyond the

• A noncurrent asset is presented in the

entity’s control; and

classified statement of financial position

2. there is sufficient evidence that the

as current asset only when it qualifies to

entity remains committed to its

be classified as “held for sale” in

plan to sell the asset (or disposal

accordance with PFRS 5.

group)

Scope Event after reporting period

• PFRS 5 applies to the following non- • If the criteria for classification as held

current assets: for sale are met after the reporting

a. Property, plant and equipment period, an entity shall not classify a non-

b. Investment property measured current asset (or disposal group) as held

under the Cost model for sale in those financial statements

c. Investments in associate or when issued.

subsidiary or joint venture

d. Intangible assets

Non-current assets that are to be abandoned

• An entity shall not classify as held for

Classification of non-current assets (or disposal

sale a non-current asset (or disposal

groups) as Held for Sale

group) that is to be abandoned since

• A non-current asset (or disposal group) the asset’s carrying amount will be

is classified as held for sale or held for recovered through continuing use

distribution to owners if it carrying rather than principally through a sale.

amount will be recovered principally

through a sale transaction rather than

through continuing use. • An entity shall not account for a non-

current asset that has been temporarily

taken out of use as if it had been

Conditions for classification as held for sale abandoned.

Initial and subsequent measurement Non-current A single non- Statement of

asset held current asser financial

• Lower of carrying amount and fair value for sale (e.x position

less cost to sell. equipment)

• A write-down to fair value less cost to Disposal A group of Statement of

sell, and related reversal thereof, is group held assets (e.x financial

recognized in profit or loss. for sale equipment position

• Reversal of impairment is recognized as and

gain to the extent of cumulative inventories

impairment loss that has been and payables

recognized. directly

related to the

• Depreciation (amortization) ceases

equipment

during the period an asset is classified

and

as held for sale. inventories)

Discontinued A component Statement of

operation of an entity financial

Changes to a plan of sale (e.x a branch) position and

statement of

• A non-current asset that ceases to be profit or loss

classified as held for sale shall be and other

measured at the lower of the asset’s: comprehensive

1. Carrying amount before it was income.

classified as held for sale, adjusted

for any depreciation, amortization

Presentation of discontinued operations

or revaluation that would have

been recognized had the asset not • The results of operations of the

been classified as held for sale, and discontinued operations, including

2. Recoverable amount at the date of impairment losses and actual gain on

subsequent decision not to sell. disposal, is presented as a single

amount, net of tax, after profit or loss

Discontinued operations from continuing operations.

• If a component of an entity qualified as

• A discontinued operation is a discontinued operation during the year,

component of an entity that either has all of its results of operations, before

been disposed of or is classified as held and after classification date, shall be

for sale, and classified as discontinued operations.

1. Represents a major line of business

or geographical area of operations;

2. Is part of a single coordinated plan Direct costs associated to decision to dispose a

to dispose of a separate major line component

of business or geographical area of • Costs or adjustments directly associated

operations; or with the decision to dispose a

3. Is a subsidiary acquired exclusively component should be recognized and

with a view to resale shown as part of discontinued

operations. Examples of such costs

Component of an entity include:

1. such items as severance pay or

• A component of an entity comprises employee termination costs,

operations and cash flows that can be 2. additional pension costs,

clearly distinguished, operationally and 3. employee relocation expenses, and

for financial reporting purposes, from 4. future rentals on long-term leases

the rest of the entity. It can be cash

generating unit or group of cash Comparative information

generating units. • If, in the current year, a component of

an entity is classified as discontinued

operation, an entity shall re-present the

Classification Asset(s) being Presentation disclosures for prior periods presented

sold in the financial statements so that the

disclosures relate to all operations that

have been discontinued by the - 0

reporting period for the latest period

presented. 2. Under a profit-sharing plan, Entity A

agrees to pay its employees 5% of its

Events after the reporting period

annual profit. The bonus shall be

• If the criteria for classification as divided among the employees currently

discontinued operation are met after employed as at year-end. Relevant

the reporting period but before the information follows: Profit for the year

financial statements are authorized for ₱8,000,000; Employees at the beginning

issue, the entity shall disclose the of the year 8; Average employees

information in the notes as non- during the year 7; Employees at the

adjusting event after the reporting end of the year 6. If the employee

period. benefits remain unpaid, how much

liability shall Entity A accrue at the end

Cessation of classification as held for sale: Effect of the year?

on comparative statement of financial position - 400,000

• The cessation of classification as 3. Which of the following instances does

discontinued operation is accounted for not preclude an entity from recognizing

retrospectively; while depreciation during a certain period?

• The cessation of classification as held - The asset becomes idle or is taken out

for sale (non-current assets and of active use.

disposal groups that are not 4. Which of the following is not

components of an entity) is accounted considered a government grant under

for prospectively. PAS 20?

- Tax breaks

FS presentation 5. Which of the following is not one of the

essential characteristics of a PPE?

• Non-current assets held for sale and

- primarily held for sale

assets and liabilities of disposal groups

6. You are the business owner of Entity A.

are presented as current assets (current

You have 10 employees, each earning

liabilities) but separately from the other

₱20,000 per month. You pay salaries on

assets and liabilities in the statement of

a bi-monthly basis. During the month of

financial position.

April 20x1, none of your employees

• An entity shall not offset the assets and

were absent, late or have rendered

liabilities of a disposal group.

overtime service. When will you

recognize the salaries expense (and at

QUIZ what amount) for the first payday in the

month of April 20x1? Timing of

recognition Amount recognized

PAS 16,19,20 - April 15 ; 100,000

1. Entity A has 20 employees who are each 7. Which of the following is considered a

entitled to one day paid vacation leave government grant under PAS 20?

for each month of service rendered. - Cancellation of an existing loan from

Unused vacation leaves cannot be the government

carried forward and are forfeited when 8. You are employed as an accountant.

employees leave the entity. All the Your company’s retirement plan states

employees have rendered service that, upon retirement, an employee

throughout the current year and have (not less than 60 years but not more

taken a total of 150 days of vacation than 65 years of age) is entitled to a

leaves. The average daily rate of the lump sum payment equal to the

employees in the current period is employee’s final monthly salary level

₱1,000. However, a 5% increase in the multiplied by the number of years in

rate is expected to take into effect in service (not less than 10 years). At the

the following year. Based on Entity A’s end of month following the month of

past experience, the average annual retirement and every month thereafter,

employee turnover rate is 20%. How the retired employee is entitled to a

much will Entity A accrue at the end of monthly pension equal to one-eighth

the current year for unused (1/8) of the final monthly salary level.

entitlements? The monthly pensions cease upon

death of the retired employee. revalues the equipment at a fair value

However, if the employee has of ₱820,000. There is no change in the

immediate dependent(s) with age of residual value and the remaining useful

less than 18 years, the dependent(s) will life of the asset. How much is the

be entitled to the monthly pensions, revaluation surplus on December 31,

which will cease when the dependent(s) 20x3?

reaches 18 years of age. What type of - 31,154

post-employment benefit plan does 13. In 20x1, Entity A proposes an

your company have? environmental clean-up project for a

- Defined benefits plan river. The government supports this

9. Entity A acquires equipment on January project and gives Entity A a ₱1M

1, 20x1. Information on costs is as monetary grant conditioned that the

follows: Purchase price, gross of trade money will only be spent on the

discount 1,000,000; Trade discount proposed project. The proposed project

available 10,000; Freight costs 20,000; is expected to take about 2 years to

Testing costs 30,000; Net disposal complete. Entity A starts the clean-up

proceeds of samples generated during project in 20x2. How should Entity A

testing 5,000; Present value of recognize income from the government

estimated costs of dismantling the grant?

equipment at the end of its useful life - over the period of the project as

6,209. The equipment has an estimated expenses are incurred

useful life of 10 years and a residual 14. According to PAS 16, the selection of an

value of ₱200,000. Entity A uses the appropriate depreciation method rests

straight-line method of depreciation. upon the entity’s

How much is the carrying amount of the - management.

equipment on December 31, 20x3? 15. The main concept used in recognizing

- 788,846 income from government grants is

10. If plotted on a graph (X-axis: time; Y- - matching

axis: ₱), the depreciation charges under 16. PAS 16 requires an entity to review the

the straight-line method would show. depreciation method and the estimates

- a straight-line. of useful life and residual value at the

11. Entity A acquires equipment on January end of each year-end. A change in any

1, 20x1. Information on costs is as of these is accounted for using

follows:Purchase price, gross of trade - prospective application.

discount 1,000,000; Trade discount 17. Imagine you are an employer (an

available 10,000; Freight costs 20,000; awesome one). When should you

Testing costs 30,000; Net disposal recognize short-term employee

proceeds of samples generated during benefits?

testing 5,000; Present value of - When the employees have rendered

estimated costs of dismantling the service in exchange for the employee

equipment at the end of its useful life benefits.

6,209. How much is the initial cost of 18. According to PAS 20, a government

the equipment? grant that becomes repayable is

- 1,041,209 accounted for

12. Entity A acquires equipment on January - prospectively.

1, 20x1. Information on costs is as

follows:Purchase price, gross of trade PAS 21-23

discount 1,000,000; Trade discount

available 10,000; Freight costs 20,000; 1. These are those which do not give rise

Testing costs 30,000; Net disposal to a right to receive (or an obligation to

proceeds of samples generated during deliver) a fixed or determinable amount

testing 5,000; Present value of of money.

estimated costs of dismantling the - Non-monetary items

equipment at the end of its useful life 2. You are an auditor. ABC Philippines Co.,

6,209. The equipment has an estimated your client, is not sure on what to

useful life of 10 years and a residual disclose in its financial statements as its

value of ₱200,000. Entity A uses the functional currency. Relevant

straight-line method of depreciation. information follows: ABC Philippines

On December 31, 20x3, Entity A Co. is a branch of ABC U.S. Co. ABC

Philippines operates in a Philippine - (200,000)

Economic Zone Authority (PEZA) Special

Economic Zone. ABC Philippines is

engaged in the apparel business. All of 5. On January 1, 20x1, Entity A obtained a

its raw materials are imported from the 10%, ₱5,000,000 loan, specifically to

main office in the U.S. and all of its finance the construction of a building.

finished products are exported directly The proceeds of the loan were

to U.S. customers. The U.S. customers temporarily invested and earned

remit payments to the U.S. main office. interest income of ₱180,000. The

The U.S. main office will then provide construction was completed on

the Philippine branch its working capital December 31, 20x1 for total

needs. None of ABC Philippines Co.s’ construction costs of ₱7,000,000. How

finished products are sold in the much is the cost of the building on

Philippines. The raw materials imported initial recognition?

and finished goods exported are - 7,320,000

denominated in U.S. dollars. 2. ABC 6. An asset is being constructed for an

Philippines Co. is required to file enterprise's own use. The asset has

audited financial statements with the been financed with a specific new

Philippine Securities and Exchange borrowing. The interest cost incurred

Commission (SEC) and the Bureau of during the construction period as a

Internal Revenue (BIR). What is the result of expenditures for the asset is

presentation currency for the financial - a part of the historical cost of acquiring

statements to be filed with the said the asset to be written off over the

government agencies? term of the borrowing used to finance

- Philippine peso the construction of the asset.

3. You are an auditor. ABC Philippines Co., 7. Which of the following may not be

your client, is not sure on what to considered a “qualifying asset” under

disclose in its financial statements as its PAS 23?

functional currency. Relevant - An expensive private jet that can be

information follows: ABC Philippines purchased from a local vendor.

Co. is a branch of ABC U.S. Co. ABC 8. On December 1, 20x1, you imported a

Philippines operates in a Philippine machine from a foreign supplier for

Economic Zone Authority (PEZA) Special $100,000, due for settlement on

Economic Zone. ABC Philippines is January 6, 20x2. Your functional

engaged in the apparel business. All of currency is the Philippine peso. When

its raw materials are imported from the preparing the December 31, 20x1

main office in the U.S. and all of its statement of financial position, which of

finished products are exported directly the following will you translate to the

to U.S. customers. The U.S. customers closing rate?

remit payments to the U.S. main office. - accounts payable

The U.S. main office will then provide 9. Capitalization of borrowing costs

the Philippine branch its working capital - Shall be suspended only during

needs. None of ABC Philippines Co.s’ extended periods of delays in which

finished products are sold in the active development is delayed.

Philippines. The raw materials imported 10. Which of the following costs may not be

and finished goods exported are eligible for capitalization as borrowing

denominated in U.S. dollars. What is costs under PAS 23?

ABC Philippines Co.’s functional - Imputed cost of equity.

currency?

- U.S. dollar PAS 40-41

4. On December 1, 20x1, you imported a

machine from a foreign supplier for 1. Which of the following qualifies for

$100,000, due for settlement on classification as an investment

January 6, 20x2. Your functional property?

currency is the Philippine peso. The - Property that is currently being

relevant exchange rates are as follows: developed for future use as investment

Dec. 1, 20x1: ₱50:$1; Dec. 31, 20x1: property

₱52:$1; Jan. 6, 20x2: ₱47:$1. -

How much foreign exchange gain (loss)

2. Which of the following is considered an property under the fair value model

inventory rather than an agricultural after one year?

produce at the point of harvest? - 980,000

- Tea 9. Biological assets and agricultural

3. Which of the following statements is produce are recognized when all of the

incorrect regarding the accounting for following are present except

biological assets? - probable future event

- PAS 41 is used to account for both 10. The distinguishing characteristic that

consumable and bearer plants. identifies an investment property from

4. Which of the following is considered an the other assets of an entity is

agricultural produce? - it generates separately identifiable cash

- felled trees flows from the other assets of the

5. Which of the following is most likely an entity.

acceptable measurement for

agricultural produce: Initial PFRS 1-2

measurement ; Subsequent

measurement 1. The statement of financial position of

- fair value less costs to sell ; lower of ABC Co. as of January 1, 20x4 included

cost and NRV an allowance for bad debts computed

6. Entity A acquires an investment using the “aging of accounts receivable”

property for ₱1,000,000 cash. method. The “over 120 days” category

Additional costs incurred are as in the aging schedule included a

follows:• Repairs and ₱200,000 receivable which was actually

remodelling before occupancy, written off on January 5, 20x4 (the 20x3

₱50,000.• Legal costs of financial statements were authorized

transferring title to the property, for issue on March 1, 20x4). ABC Co.

₱20,000.• Repairs after could not have foreseen this event on

occupancy, ₱15,000.The investment December 31, 20x3. Does ABC Co. need

property is estimated to have a to revise its previous estimate of bad

remaining useful life of 10 years and a debts as of January 1, 20x4 (date of

residual value equal to 5% of initial cost. transition) on December 31, 20x5 (end

Entity A uses the straight line method of of first PFRS reporting period)?

depreciation. How much is the carrying - No. The receipt of the information on

amount of the investment property January 5, 20x4 is accounted for

under the cost model after one year? prospectively as a non-adjusting event

- 968,350 after the reporting period.

7. Under this model, an investment 2. Many shares and most share options

property is measured at cost less are not traded in an active market.

accumulated depreciation and Therefore, it is often difficult to arrive at

accumulated impairment losses. a fair value of the equity instruments

- Cost model being issued. Which of the following

8. Entity A acquires an investment option valuation techniques should not

property for ₱1,000,000 cash. be used as a measure of fair value in the

Additional costs incurred are as first instance?

follows:• Repairs and - Intrinsic value.

remodelling before occupancy, 3. PFRS 1 requires a first time adopter to

₱50,000.• Legal costs of do which of the following in the

transferring title to the property, opening PFRS statement of financial

₱20,000.• Repairs after position?

occupancy, ₱15,000.The investment - All of these

property is estimated to have a 4. Retrospective application of accounting

remaining useful life of 10 years and a policies means

residual value equal to 5% of initial cost. - as if PFRSs have been used all along.

Entity A uses the straight-line method 5. PFRS 1 requires an entity to prepare

of depreciation. The investment and present an

property has a fair value of ₱980,000 at - opening PFRS statement of financial

the end of Year 1. How much is the position.

carrying amount of the investment

6. Under PFRS 1, the early application of 6. The acquisition date is

PFRSs that have not yet become - the date on which the acquirer obtains

effective as of the current reporting control of the acquiree.

period 7. On January 1, 20x1, ABC Co. acquired

- is permitted, but not required. 60% interest in XYZ, Inc. for ₱2,000,000

7. Elizabeth, a public limited company, has cash. ABC Co. incurred transaction

granted 100 share appreciation rights to costs of ₱100,000 in the business

each of its 1,000 employees in January combination. ABC Co. elected to

20X4. The management feels that as of measure NCI at the NCI’s proportionate

December 31, 20X4, 90% of the awards share in XYZ, Inc.’s identifiable net

will vest on December 31, 20X6. The fair assets. The fair values of XYZ’s

value of each share appreciation right identifiable assets and liabilities at the

on December 31, 20X4, is P10. What is acquisition date were ₱6,000,000 and

the fair value of the liability to be ₱3,500,000, respectively. How much is

recorded in the financial statements for the goodwill (gain on a bargain

the year ended December 31, 20X4? purchase)?

- P300,000 - 500,000

8. The date to transition to PFRSs is

8. According to PFRS 5, gains and losses on

- the beginning of the earliest period for

remeasurement of assets held for sale are

which an entity presents full

comparative information under PFRSs in - recognized in profit or loss.

its first PFRS financial statements.

9. An entity that presents its first PFRS

financial statements is referred to

under PFRS 1 as a PRELIM QUIZZES

- first-time adopter.

1. At the end of the period, Entity A has

deductible temporary difference of

100,000. Entity A’s income tax rate is

PFRS 3-5 30%. Entity A’s statement of financial

position would report which of the

1. The “excess of the acquirer’s interest in following? (gimultiply ang 30% sa 100k)

the net fair value of acquiree’s - 30,000 deferred tax asset.

identifiable assets, liabilities, and 2. Biological assets and agricultural

contingent liabilities over cost” produce are recognized when all of the

(formerly known as negative goodwill) following are present except

should be - probable future event

- Reassessed as to the accuracy of its 3. Which of the following assets can be

measurement and then recognized measured using the revaluation model?

immediately in profit or loss. - PPE and Investment

2. Assets that are classified as held for 4. According to PAS 23, borrowing costs

sale under PFRS 5 are are capitalized when

- not depreciated. - They relate directly to the acquisition,

3. According to PFRS 5, the assets and construction or production of a

liabilities of a disposal group are qualifying asset.

presented 5. Which of the following is not one of the

- separately on the face of the statement principal issues in the accounting for

of financial position. PPE?

4. Which of the following statements is - Recognition of carrying amount as

true regarding the accounting expense when the related revenue is

treatment of costs to sell under PFRS recognized.

5? 6. ABC Co. During the period your

- Costs to sell are discounted if it is company purchased staplers worth

expected that the sale will be made 1,500. Although the staplers have an

beyond one year. estimated useful life of 10 years.

5. The statement of profit or loss includes

which of the following?

- Discontinued operations.

You might also like

- IAS 19 SummaryDocument6 pagesIAS 19 SummaryMuchaa VlogNo ratings yet

- Finals Conceptual Framework and Accounting Standards AnswerkeyDocument7 pagesFinals Conceptual Framework and Accounting Standards AnswerkeyMay Anne MenesesNo ratings yet

- Module 12 PAS 36Document6 pagesModule 12 PAS 36Jan JanNo ratings yet

- Toa Conceptual FrameworkDocument6 pagesToa Conceptual FrameworkDarwin Lopez100% (1)

- Pas 16 Property, Plant and EquipmentDocument7 pagesPas 16 Property, Plant and EquipmentElaiza Jane CruzNo ratings yet

- Reviewer Intangible AssetsDocument10 pagesReviewer Intangible AssetsMay100% (1)

- Conceptual Framework For Financial ReportingDocument8 pagesConceptual Framework For Financial ReportingsmlingwaNo ratings yet

- Overview of Philippine Financial Reporting Standards 9 (PFRS 9)Document4 pagesOverview of Philippine Financial Reporting Standards 9 (PFRS 9)Earl John ROSALESNo ratings yet

- Reviewer in Cfas - PFRS 11 - 15Document4 pagesReviewer in Cfas - PFRS 11 - 15geyb awayNo ratings yet

- Pas 10 Events After The Reporting PeriodDocument1 pagePas 10 Events After The Reporting PeriodAcissej100% (1)

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Document27 pagesPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaNo ratings yet

- Accounting For Labor 3Document13 pagesAccounting For Labor 3Charles Reginald K. HwangNo ratings yet

- Conceptual Framework: (Underlying Assumptions and Qualitative CharacteristicsDocument25 pagesConceptual Framework: (Underlying Assumptions and Qualitative Characteristicsjeams vidalNo ratings yet

- Midterms Conceptual Framework and Accounting StandardsDocument9 pagesMidterms Conceptual Framework and Accounting StandardsMay Anne MenesesNo ratings yet

- APC 403 PFRS For SEs (Section 1-2)Document3 pagesAPC 403 PFRS For SEs (Section 1-2)AnnSareineMamadesNo ratings yet

- Mid Inter 1 2017 2016Document4 pagesMid Inter 1 2017 2016SuhaeniNo ratings yet

- Fundamentals of PartnershipsDocument6 pagesFundamentals of PartnershipsJobelle Candace Flores AbreraNo ratings yet

- PAS 1 Presentation of Financial StatementsDocument63 pagesPAS 1 Presentation of Financial StatementsNita Costillas De MattaNo ratings yet

- Chapter 15 Ppe Part 1 2020 EditionDocument24 pagesChapter 15 Ppe Part 1 2020 EditionMark Rafael MacapagalNo ratings yet

- CFAS ReviewerDocument6 pagesCFAS ReviewerAziNo ratings yet

- Mock Examination QuestionnaireDocument9 pagesMock Examination QuestionnaireRenabelle CagaNo ratings yet

- Accounting For Government GrantsDocument4 pagesAccounting For Government GrantsSandia EspejoNo ratings yet

- Exam 1 - Key AnswersDocument23 pagesExam 1 - Key Answersarlynajero.ckcNo ratings yet

- Chapter 14 - Pas 16 Property, Plant and Equipment: Measurement After RecognitionDocument5 pagesChapter 14 - Pas 16 Property, Plant and Equipment: Measurement After RecognitionVince PeredaNo ratings yet

- CASH FLOW STATEMENTS - Quiz 2Document2 pagesCASH FLOW STATEMENTS - Quiz 2JyNo ratings yet

- Lecture 3 Provisions - Contingent Liabilities and Contingent AssetsDocument23 pagesLecture 3 Provisions - Contingent Liabilities and Contingent AssetsBrenden KapoNo ratings yet

- University of Perpetual Help System Dalta: I. PAS 20: Government Grant A. DefinitionDocument3 pagesUniversity of Perpetual Help System Dalta: I. PAS 20: Government Grant A. DefinitionJeanette LampitocNo ratings yet

- A Summary of IFRS 5Document2 pagesA Summary of IFRS 5Asma AliNo ratings yet

- Pas 23 - Borrowing CostsDocument8 pagesPas 23 - Borrowing CostsZehra LeeNo ratings yet

- Multiple ChoiceDocument6 pagesMultiple Choicetough mamaNo ratings yet

- CFASDocument8 pagesCFASAmie Jane MirandaNo ratings yet