Professional Documents

Culture Documents

Holgate Principal

Holgate Principal

Uploaded by

Vishwa Shah0 ratings0% found this document useful (0 votes)

217 views12 pagesThe document discusses premiums, discounts, and forward rates. It defines that a premium exists when the forward rate is greater than the spot rate, while a discount exists when the forward rate is less than the spot rate. It also defines the annualized forward margin as the percentage difference between the spot and forward rates. The Holgate Principle states that a premium on the base currency is added to the spot rate to get the forward rate, while a discount on the base currency is subtracted from the spot rate. There are examples calculating forward rates using spot rates and swap points.

Original Description:

tybms

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses premiums, discounts, and forward rates. It defines that a premium exists when the forward rate is greater than the spot rate, while a discount exists when the forward rate is less than the spot rate. It also defines the annualized forward margin as the percentage difference between the spot and forward rates. The Holgate Principle states that a premium on the base currency is added to the spot rate to get the forward rate, while a discount on the base currency is subtracted from the spot rate. There are examples calculating forward rates using spot rates and swap points.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

217 views12 pagesHolgate Principal

Holgate Principal

Uploaded by

Vishwa ShahThe document discusses premiums, discounts, and forward rates. It defines that a premium exists when the forward rate is greater than the spot rate, while a discount exists when the forward rate is less than the spot rate. It also defines the annualized forward margin as the percentage difference between the spot and forward rates. The Holgate Principle states that a premium on the base currency is added to the spot rate to get the forward rate, while a discount on the base currency is subtracted from the spot rate. There are examples calculating forward rates using spot rates and swap points.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

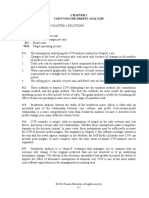

PREMIUM AND DISCOUNT

If the forward exchange rate for a currency is more than the spot rate, a

premium exists for that currency

Premium = Forward > Spot

A discount happens when the forward exchange rate is less than the spot

rate. A negative premium is equivalent to a discount

Discount = Forward < Spot

The annualized percentage between spot rate and forward

rate is called forward premium or discount

Annualized forward margin(AFM) =

[(Forward rate - Spot rate) / Spot rate] x (12/m) x 100

OR

[(Forward rate - Spot rate) / Spot rate] x (365/d) x 100

Prof Virani Charmi International Finance

Holgate Principle

This principles states that :

Premium on base currency is always added to the spot

rate to arrive at the corresponding forward rate

Discount on base currency is always subtracted from the

spot rate to arrive at the corresponding forward rate

Premium on base currency implies discount on variable

currency

And

Discount on base currency implies premium on variable

currency

Prof Virani Charmi International Finance

Holgate Principle

If Bid > Ask

Points are subtracted from the spot

If Bid < Ask

Points are Added to the spot

This is also known as “High-Low” or “Low-High” Rule

“High-Low” Rule:

If the bid points are higher ,the spot rate has to be made lower (by

subtracting bid ask points from spot bid ask rates) to find forward

bid ask rate

“Low-High” Rule:

If the bid points are lower ,the spot rate has to be made high(by

adding bid ask points to spot bid ask rates) to find forward bid ask

rate

Prof Virani Charmi International Finance

Example 1:

Calculate the forward buying and selling rates from the

following information

Spot USD 1= Rs 70.6000/70.9000

a One month 1000/1100

b Two months 1200/1300

c Three months 1400/1500

d Four months 1550/1600

Prof Virani Charmi International Finance

Solution:

BID ASK

Spot USD INR 70.6000 70.9000

a Swap points One month 1000 1100

b Swap points Two months 1200 1300

c Swap points Three months 1400 1500

d Swap points Four months 1550 1600

As per Holgate principle,

To find forward rate:

1. Premium on base currency is added to spot rate

2. Discount on base currency is subtracted from spot rate

Prof Virani Charmi International Finance

Solution:

(USD INR) BID (USD INR) ASK

Spot USD INR 70.6000 70.9000

a Swap points One month

BID 1000 < ASK 1100

Premium added to spot 70.7000 71.0100

b Swap points Two months

BID 1200 < ASK 1300

Premium added to spot 70.7200 71.0300

c Swap points Three months

BID 1400 < ASK 1500

Premium added to spot 70.7400 71.0500

Prof Virani Charmi International Finance

Solution:

(USD INR) BID (USD INR) ASK

d Swap points Four months

BID 1550 < ASK 1600

Premium added to spot 70.7550 71.0600

Spot USD INR 70.7000 / 70.0100

Forward 1 month USD INR 70.7000/71.0100

Forward 2 month USD INR 70.7200/71.0300

Forward 3 month USD INR 70.7400/71.0500

Forward 4 month USD INR 70.7550/71.0600

Prof Virani Charmi International Finance

Example 2:

Calculate the forward rates of Euro to Rupee for following

information:

Spot 1 USD = INR 60.6010 / 50

Spot 1 EURO = USD 1.3787/97

Dollar to Rupee Swap Points Euro to Dollar Swap Points

1 month 20/30 1 month 30/25

2 months 40/50 2 months 60/50

3 months 60/70 3 months 80/70

4 months 80/90 4 months 95/90

Prof Virani Charmi International Finance

Solution:

Given BID ASK Given BID ASK

Spot USD INR 60.6010 60.6050 Spot EUR USD 1.3787 1.3797

Swap points 1 20 30 Swap points 1 30 25

month month

Swap points 2 40 50 Swap points 2 60 50

months months

Swap points 3 60 70 Swap points 3 80 70

months months

Swap points 4 80 90 Swap points 4 95 90

months months

To find forward rates of EUR INR:

(EUR USD )bid x (USD INR)bid

(EUR USD )ask x (USD INR)ask

Prof Virani Charmi International Finance

To find forward rates of EUR INR:

( EUR INR ) bid = ( EUR USD ) bid x ( USD INR ) bid

( EUR INR ) Ask = ( EUR USD ) Ask x ( USD INR ) ask

USD INR EUR USD EUR INR

BID ASK BID ASK BID ASK

a b c d axc bxd

Spot 60.6010 60.6050 1.3787 1.3797 83.5506 83.6167

1 month 60.6030 60.6080 1.3757 1.3772 83.3715 83.4693

Bid 20 < Ask 30 Bid 30 > Ask 25

Premium added to Discount

spot rate subtracted from

spot rate

60.6010 60.6050 1.3787 1.3797

+ + - -

0.0020 0.0030 0.0030 0.0025

Prof Virani Charmi International Finance

To find forward rates of EUR INR:

( EUR INR ) bid = ( EUR USD ) bid x ( USD INR ) bid

( EUR INR ) Ask = ( EUR USD ) Ask x ( USD INR ) ask

USD INR EUR USD EUR INR

BID ASK BID ASK BID ASK

a b c d axc bxd

Spot 60.6010 60.6050 1.3787 1.3797 83.5506 83.6167

2 month 60.6050 60.6100 1.3727 1.3747

Bid 40 < Ask 50 Bid 60 > Ask 50

Premium added to Discount

spot rate subtracted from

spot rate

60.6010 60.6050 1.3787 1.3797

+ + - -

0.0040 0.0050 0.0060 0.0050

Prof Virani Charmi International Finance

Spot EUR INR 83.5506 / 83.6167

Forward 1 month EUR INR 83.3715 / 83.4693

Forward 2 month EUR INR 83.1925 / 83.3206

Forward 3 month EUR INR 83.0740 / 83.2021

Forward 4 month EUR INR 82.9858 / 83.0836

Prof Virani Charmi International Finance

You might also like

- Unit 6 Written Assignment BUS 5110Document5 pagesUnit 6 Written Assignment BUS 5110luiza100% (6)

- Odoo User Guide (OK) PDFDocument21 pagesOdoo User Guide (OK) PDFyekukexemi100% (1)

- Other Consolidation Reporting Issues: Solutions Manual, Chapter 9 1Document81 pagesOther Consolidation Reporting Issues: Solutions Manual, Chapter 9 1Gillian Snelling100% (4)

- Case - ch11Document4 pagesCase - ch11riki3100% (14)

- Financial Planning and Forecasting Brigham SolutionDocument29 pagesFinancial Planning and Forecasting Brigham SolutionShahid Mehmood100% (6)

- Management of Accounts Receivable Sample ProblemsDocument3 pagesManagement of Accounts Receivable Sample ProblemsJulienne Aristoza100% (8)

- Leo BurnettDocument30 pagesLeo BurnettBindi DharodNo ratings yet

- Assigning Output Type WMTA To Inbound Deliveries - SAP DocumentationDocument2 pagesAssigning Output Type WMTA To Inbound Deliveries - SAP DocumentationlavleenlesyaNo ratings yet

- Blade Case Study - Assignment-2Document5 pagesBlade Case Study - Assignment-2shonnashiNo ratings yet

- FX Derivatives ForwardDocument28 pagesFX Derivatives ForwardtreiptreuNo ratings yet

- Sums NPVDocument5 pagesSums NPVDarpan KapadiaNo ratings yet

- Candy Live Policy-2.05Document5 pagesCandy Live Policy-2.05Gesang FirmansyahNo ratings yet

- Principles of FinanceDocument7 pagesPrinciples of FinanceAslam Abdullah MarufNo ratings yet

- Unit-4 Exchange Rate QuotationsDocument10 pagesUnit-4 Exchange Rate QuotationsSOLANKI DHRUVRAJ RAJU 20215048No ratings yet

- Paper 1Document16 pagesPaper 1anjudeshNo ratings yet

- BBA VI Sem. - International Finance - Practical ProblemsDocument16 pagesBBA VI Sem. - International Finance - Practical ProblemsdeepeshmahajanNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingEswara kumar JNo ratings yet

- Combined IB TestDocument47 pagesCombined IB Test77Rohan AgroyaNo ratings yet

- BFF2341 Tri A 2020 Mini Test 2 SolutionDocument3 pagesBFF2341 Tri A 2020 Mini Test 2 SolutionDuankai LinNo ratings yet

- Problem Solving questions-IFTDocument18 pagesProblem Solving questions-IFTPiyush KothariNo ratings yet

- Corporate FinanceDocument8 pagesCorporate Financedivyakashyapbharat1No ratings yet

- Corporate Finance - V - STDocument13 pagesCorporate Finance - V - STSubhana NasimNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Measures of Leverage: Abhishek SinhaDocument30 pagesMeasures of Leverage: Abhishek Sinhadev guptaNo ratings yet

- Sahyog - Winner - System VersionDocument31 pagesSahyog - Winner - System VersionUtkarshNo ratings yet

- Managerial Accounting Solutions Chapter 3 PDFDocument42 pagesManagerial Accounting Solutions Chapter 3 PDFadam_garcia_81No ratings yet

- Financial Derivatives and Risk ManagementDocument5 pagesFinancial Derivatives and Risk Management60JHEERAK AGRAWALNo ratings yet

- Payroll AccountingDocument26 pagesPayroll AccountingBeboy LacreNo ratings yet

- Christ CIA FM MidtermDocument6 pagesChrist CIA FM MidtermKSHITIZ CHOUDHARYNo ratings yet

- NPV and Irr (English)Document13 pagesNPV and Irr (English)RobertKimtaiNo ratings yet

- Capital Budgeting MathDocument3 pagesCapital Budgeting MathMD.TARIQUL ISLAM CHOWDHURYNo ratings yet

- Chapter 3 Time Value of MoneyDocument23 pagesChapter 3 Time Value of MoneyAkshat SinghNo ratings yet

- Foreign Exchange Markets and Dealings: Solution RQ.33.3Document3 pagesForeign Exchange Markets and Dealings: Solution RQ.33.3NeelNo ratings yet

- Solution of Tutorial 6Document4 pagesSolution of Tutorial 6Richard MidgleyNo ratings yet

- Chapter7 The Time Value of MoneyDocument27 pagesChapter7 The Time Value of MoneyShikhar KumarNo ratings yet

- FM Eco Important 1620388826Document126 pagesFM Eco Important 1620388826Naresh SomvanshiNo ratings yet

- Domain - 2 - Financial Metrics - Question - EVM - KPIsDocument11 pagesDomain - 2 - Financial Metrics - Question - EVM - KPIsducthanghnaNo ratings yet

- Forex Solutions RevisionDocument20 pagesForex Solutions RevisionGAURAV MALLA 2122053No ratings yet

- Ch7 SFM Illustrations Futures Derivatives 20-07-2021 B503f5fe0a4d486587926d148cDocument41 pagesCh7 SFM Illustrations Futures Derivatives 20-07-2021 B503f5fe0a4d486587926d148cPraveen ReddyNo ratings yet

- IpDocument11 pagesIpMd TariqueNo ratings yet

- Goodwill Valuation With ExamplesDocument6 pagesGoodwill Valuation With ExamplesVipin Mandyam KadubiNo ratings yet

- Revison CF 13.07.2023 (All)Document116 pagesRevison CF 13.07.2023 (All)seyon sithamparanathanNo ratings yet

- Bus 5110 Managerial Acccounting Written Assignment Unit 6Document6 pagesBus 5110 Managerial Acccounting Written Assignment Unit 6rumbidzai chemhereNo ratings yet

- Chapter 7 Practice ProblemsDocument12 pagesChapter 7 Practice ProblemsFarjana Hossain DharaNo ratings yet

- BSLI Group SuperannuationDocument12 pagesBSLI Group Superannuationrahul aggarwalNo ratings yet

- Ulang Kaji MTES 3043Document5 pagesUlang Kaji MTES 3043江芷羚No ratings yet

- The Time Value of MoneyDocument28 pagesThe Time Value of MoneyRajat ShrinetNo ratings yet

- Part 2 - Chapter 5 - Present Worth AnalysisDocument20 pagesPart 2 - Chapter 5 - Present Worth AnalysisCharbel YounesNo ratings yet

- 06 Task Performance 1 MRDocument5 pages06 Task Performance 1 MRclaudia smithNo ratings yet

- WACC & PaybackDocument9 pagesWACC & PaybackBelle Dela CruzNo ratings yet

- Presentation Cost BenefitDocument15 pagesPresentation Cost BenefitNo HopeNo ratings yet

- Bhagyodya Stampings Note utxD0RUNkpDocument3 pagesBhagyodya Stampings Note utxD0RUNkpAshutosh BiswalNo ratings yet

- Economic Analysis: Summary TableDocument79 pagesEconomic Analysis: Summary TableGeorgios PalaiologosNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- Universiti Teknologi Mara Common Test Answer SchemeDocument5 pagesUniversiti Teknologi Mara Common Test Answer SchemesyqhNo ratings yet

- CT Far340 SS Nov 2019 PDFDocument5 pagesCT Far340 SS Nov 2019 PDFsyqhNo ratings yet

- FRM 5Document4 pagesFRM 5irfanhaidersewagNo ratings yet

- Minimum Expected Rate of Return 12% Minimum Pay Back Period 4.5 YearsDocument4 pagesMinimum Expected Rate of Return 12% Minimum Pay Back Period 4.5 Yearsjagan pawanismNo ratings yet

- Capital Budgeting Discounted Cash FlowDocument15 pagesCapital Budgeting Discounted Cash FlowRanu AgrawalNo ratings yet

- Additional Problems On Credit PolicyDocument2 pagesAdditional Problems On Credit PolicyJayant RaneNo ratings yet

- IB Bm2tr 3 Resources Answers8Document6 pagesIB Bm2tr 3 Resources Answers8Gabriel FungNo ratings yet

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- The Ultimate Sports Betting Secrets: 5 Winning Strategies to Make $1500 Per Month Tax FreeFrom EverandThe Ultimate Sports Betting Secrets: 5 Winning Strategies to Make $1500 Per Month Tax FreeNo ratings yet

- Durga PrasadDocument3 pagesDurga PrasadKavitha100% (1)

- Optimal Solution For The Transportation ProblemDocument7 pagesOptimal Solution For The Transportation ProblemkrbiotechNo ratings yet

- Study Guide For Students in Cost AccountingDocument41 pagesStudy Guide For Students in Cost Accountingjanine moldinNo ratings yet

- Cia IDocument2 pagesCia IdeviNo ratings yet

- Babok Guide MindmapDocument1 pageBabok Guide MindmapVitalii Liakh0% (1)

- Laundrywashing Machine Service in The Debre Markos Town PDFDocument49 pagesLaundrywashing Machine Service in The Debre Markos Town PDFnegash tigabuNo ratings yet

- Japanese Management StyleDocument10 pagesJapanese Management Styleshweta_lalwani6011No ratings yet

- Mof Company Shin YangDocument4 pagesMof Company Shin YangNicki Vine CapuchinoNo ratings yet

- ACI Company AnalysisDocument7 pagesACI Company Analysisalfaz shaikhNo ratings yet

- BrochureDocument47 pagesBrochureB ShaikNo ratings yet

- Pran Frooto Scandal CaseDocument7 pagesPran Frooto Scandal CaseRawfun Elahe Rose0% (1)

- 2017 Qbus6310 6 LPDocument32 pages2017 Qbus6310 6 LPJagan Somasundaram SathappanNo ratings yet

- An Empirical Study of The Factors Influencing Consumer Behaviour in The Electric Appliances MarketDocument12 pagesAn Empirical Study of The Factors Influencing Consumer Behaviour in The Electric Appliances MarketNikmatur RahmahNo ratings yet

- AlvaForm Catalog (v3.0) 12X27 (SOFT) 24APR2013Document6 pagesAlvaForm Catalog (v3.0) 12X27 (SOFT) 24APR2013inama33No ratings yet

- Documented - Information para Iso9001-2015Document5 pagesDocumented - Information para Iso9001-2015jrodangarNo ratings yet

- Barney SMCA4 10Document24 pagesBarney SMCA4 10Shibashish SahuNo ratings yet

- Leveraging Human Resource Development Expertise To Improve Supply Chain Manager's Skills and CompetenciesDocument3 pagesLeveraging Human Resource Development Expertise To Improve Supply Chain Manager's Skills and CompetenciesMasz AshuraNo ratings yet

- Divya DixitDocument1 pageDivya DixitJeetendra KumarNo ratings yet

- FLUOR Presentation On Managing Mega ProjectsDocument21 pagesFLUOR Presentation On Managing Mega ProjectsZubair100% (4)

- FRK 100 Year Test 2 Questions FINAL2Document7 pagesFRK 100 Year Test 2 Questions FINAL2Frederick LekalakalaNo ratings yet

- Circular-2019 E7 0Document36 pagesCircular-2019 E7 0Cag ExamsNo ratings yet

- Supply-Chain Management - Wikipedia PDFDocument128 pagesSupply-Chain Management - Wikipedia PDFKambiz sutoodaNo ratings yet

- Taqdeer Center EstimateDocument2 pagesTaqdeer Center EstimateSourav Raha100% (1)

- Chancellor ERPDocument37 pagesChancellor ERPempires4No ratings yet

- KPI Help in Predicting The Growth of BusinessDocument1 pageKPI Help in Predicting The Growth of Businessvishal kashyapNo ratings yet

- Business Law 2Document6 pagesBusiness Law 2JavidNo ratings yet