Professional Documents

Culture Documents

Chapter 4 Graded Problems-1

Chapter 4 Graded Problems-1

Uploaded by

almacen chrisCopyright:

Available Formats

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Solutions Manual: Financial Accounting: Reporting, Analysis and Decision MakingDocument61 pagesSolutions Manual: Financial Accounting: Reporting, Analysis and Decision MakingJeffrey Sanchez Rojas100% (2)

- 4052 Xls Eng Prof BLAINE KITCHENWAREDocument11 pages4052 Xls Eng Prof BLAINE KITCHENWAREMafernanda GR57% (7)

- AFAR - PreWeek - May 2022Document31 pagesAFAR - PreWeek - May 2022Miguel ManagoNo ratings yet

- ADMS 2500 Practice Final Exam SolutionsDocument20 pagesADMS 2500 Practice Final Exam SolutionsAyat TaNo ratings yet

- Assignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachDocument5 pagesAssignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachCacjungoyNo ratings yet

- Partnership Dissolution - Practice ExercisesDocument5 pagesPartnership Dissolution - Practice ExercisesVon Andrei Medina0% (2)

- PB DifficultDocument20 pagesPB DifficultPaulo MiguelNo ratings yet

- Partnership Dissolution & LiquidationDocument15 pagesPartnership Dissolution & LiquidationJean Ysrael Marquez50% (4)

- ACCTSPTRANS All About PartnershipDocument7 pagesACCTSPTRANS All About PartnershipShailene David0% (1)

- Advnce - fin.Acc.&Repprac 2Document17 pagesAdvnce - fin.Acc.&Repprac 2Jerry Licayan0% (1)

- BAC 522 Mid Term ExamDocument9 pagesBAC 522 Mid Term ExamJohn Carlo Cruz0% (1)

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- Business Combi and Conso HandoutDocument16 pagesBusiness Combi and Conso HandoutKarlo Jude Acidera100% (2)

- FM CasesDocument13 pagesFM CasesHira Ejaz Ahmed ShaikhNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- Wala LangDocument8 pagesWala LangMax Dela TorreNo ratings yet

- Quiz On Partnership DissolutionDocument4 pagesQuiz On Partnership Dissolution이삐야No ratings yet

- 03 - Handout - Partnership DissolutionDocument4 pages03 - Handout - Partnership DissolutionJanysse CalderonNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- Week 15 Q1Document11 pagesWeek 15 Q1Carlo AgravanteNo ratings yet

- Accounting Special Transaction - PartnershipDocument12 pagesAccounting Special Transaction - PartnershipMikee LajatoNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- BAFINAR - Quiz 2 ColarDocument3 pagesBAFINAR - Quiz 2 ColarRonalyn ColarNo ratings yet

- Template - Acctg. Major 3 Module 2Document7 pagesTemplate - Acctg. Major 3 Module 2Ryan PatitoNo ratings yet

- Print SW PartnershipDocument5 pagesPrint SW PartnershipMike MikeNo ratings yet

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFDocument16 pages1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAANo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- LSPU - Pre - Battery ExamDocument10 pagesLSPU - Pre - Battery ExamRosejane EMNo ratings yet

- [MOCK QE] ParCor WITH SOLUTIONDocument20 pages[MOCK QE] ParCor WITH SOLUTION2023102461No ratings yet

- Partnership Dissolution QuestionsDocument3 pagesPartnership Dissolution QuestionsArkkkNo ratings yet

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocument6 pagesAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNo ratings yet

- Exercises - Partnership CombinepdfDocument8 pagesExercises - Partnership CombinepdfRiana CellsNo ratings yet

- Quiz - Dissolution and Liquidation (Answers)Document8 pagesQuiz - Dissolution and Liquidation (Answers)peter pakerNo ratings yet

- Question 3 and 4 Are Based On The FollowingDocument5 pagesQuestion 3 and 4 Are Based On The Following03LJNo ratings yet

- Prequalifying ExaminationDocument7 pagesPrequalifying Examinationablay logeneNo ratings yet

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- Introduction of Partnership FormationDocument16 pagesIntroduction of Partnership FormationRamon AlpitcheNo ratings yet

- 2 2nd TutorialDocument4 pages2 2nd TutorialJon Dumagil Inocentes, CPANo ratings yet

- ACCT601 - Prelim Examination PDFDocument10 pagesACCT601 - Prelim Examination PDFSweet EmmeNo ratings yet

- Midterm Exercises 1 ProblemsDocument2 pagesMidterm Exercises 1 Problemslinkin soyNo ratings yet

- Partnership Formation and Operation.Document4 pagesPartnership Formation and Operation.May RamosNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Notre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong CityDocument15 pagesNotre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong Cityirishjade100% (1)

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Financial Accounting and ReportingDocument8 pagesFinancial Accounting and ReportingPauline Idra100% (1)

- Basic Concepts of PartnershipDocument5 pagesBasic Concepts of PartnershipKyla DizonNo ratings yet

- QUIZ 02: Partnership Operations Name: - ID No.Document6 pagesQUIZ 02: Partnership Operations Name: - ID No.yoj cepilloNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationMary Elisha PinedaNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- 2 Partnership DissolutionDocument9 pages2 Partnership DissolutionLach Mae . FloresNo ratings yet

- Partnership CompleteDocument6 pagesPartnership CompleteJoshua TorillaNo ratings yet

- Review of PartnershipDocument13 pagesReview of PartnershipKristine BlancaNo ratings yet

- 7 PARCOR Testbank Answer KeyDocument12 pages7 PARCOR Testbank Answer Keygiodarine0814No ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- Partnership Dissolution 1of 2 PDFDocument2 pagesPartnership Dissolution 1of 2 PDFAngelo VilladoresNo ratings yet

- ACCO20033 FAR1 Final Deptal Date 2-28-2021 For GMail Users Time 8 00 Am ToDocument22 pagesACCO20033 FAR1 Final Deptal Date 2-28-2021 For GMail Users Time 8 00 Am ToElijah SundaeNo ratings yet

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoNo ratings yet

- Acctg 2 - 2nd MimeoDocument4 pagesAcctg 2 - 2nd MimeoJon Dumagil Inocentes, CPANo ratings yet

- Partnership Formation & OperationDocument4 pagesPartnership Formation & Operationdiane pandoyosNo ratings yet

- Partnership DrillDocument4 pagesPartnership DrillCelestiaNo ratings yet

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- Chapter 2 Case 2 Sole Proprietors-1Document1 pageChapter 2 Case 2 Sole Proprietors-1almacen chrisNo ratings yet

- WM Concepts WM Hierarchy - R.B.Document2 pagesWM Concepts WM Hierarchy - R.B.almacen chrisNo ratings yet

- Group Presentation Rubric and Scoring-1Document1 pageGroup Presentation Rubric and Scoring-1almacen chrisNo ratings yet

- P-Activity 5 10 PtsDocument1 pageP-Activity 5 10 Ptsalmacen chrisNo ratings yet

- P-Activity 3 20 PtsDocument1 pageP-Activity 3 20 Ptsalmacen chrisNo ratings yet

- P-Activity 2 10 PtsDocument1 pageP-Activity 2 10 Ptsalmacen chrisNo ratings yet

- PRELIMS VOC1.A AAC - BSSLAW1.BAUTISTA-khristina-CassandraDocument15 pagesPRELIMS VOC1.A AAC - BSSLAW1.BAUTISTA-khristina-Cassandraalmacen chrisNo ratings yet

- P-Activity 1 10 PtsDocument1 pageP-Activity 1 10 Ptsalmacen chrisNo ratings yet

- P-Activity 6 25 PtsDocument1 pageP-Activity 6 25 Ptsalmacen chrisNo ratings yet

- P-Activity 4 10 PtsDocument1 pageP-Activity 4 10 Ptsalmacen chrisNo ratings yet

- PRELIMS VOC1.A AAC - BSSLAW1.NALLIW-Julie-AnnDocument13 pagesPRELIMS VOC1.A AAC - BSSLAW1.NALLIW-Julie-Annalmacen chrisNo ratings yet

- Project Report ON Chanduka Restaurant: Nikita Chanduka Finance A 19MBAJ0209Document8 pagesProject Report ON Chanduka Restaurant: Nikita Chanduka Finance A 19MBAJ0209Nikita ChandukaNo ratings yet

- Financial Modelling FundamentalsDocument44 pagesFinancial Modelling FundamentalsNguyen Binh MinhNo ratings yet

- Hydrochem AnalysisDocument7 pagesHydrochem AnalysisSaransh Kejriwal100% (2)

- Consolidated Financial StatementsDocument29 pagesConsolidated Financial StatementsPramad BhattacharjeeNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument78 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeSiyedong Ardi100% (1)

- Partnership PracticeDocument1 pagePartnership PracticeIce Voltaire Buban GuiangNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFAINDRILA BERA100% (1)

- Wilmar Cahaya Indonesia Tbk. (S)Document3 pagesWilmar Cahaya Indonesia Tbk. (S)Solihul HadiNo ratings yet

- Accounting For Partnership and CorporatDocument1 pageAccounting For Partnership and Corporatretuyasheena16No ratings yet

- F2019 Final Exam Review With AnswersDocument16 pagesF2019 Final Exam Review With AnswersRob WangNo ratings yet

- Finance and Accounting Alex TilkinDocument87 pagesFinance and Accounting Alex Tilkinalex tilkinNo ratings yet

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- DSCR Case Study FinalDocument7 pagesDSCR Case Study FinalVISHAL PATILNo ratings yet

- ACCT5001 2024 - Module 4 Week 4 - Tutorial Template For StudentsDocument4 pagesACCT5001 2024 - Module 4 Week 4 - Tutorial Template For Studentsaish.gasllllNo ratings yet

- ACC 1101 Tutorial - Trade Receivables 2Document2 pagesACC 1101 Tutorial - Trade Receivables 2Qila IlaNo ratings yet

- Baps March 2021Document34 pagesBaps March 2021Adjin LomoteyNo ratings yet

- Accounting GuessDocument5 pagesAccounting GuessjhouvanNo ratings yet

- REVISI P2.1 SD P2.12Document24 pagesREVISI P2.1 SD P2.12yusufahriza25No ratings yet

- Name: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CDocument5 pagesName: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CKirti RawatNo ratings yet

- Gaap Graded2016Document385 pagesGaap Graded2016Venniah Musunda100% (1)

- E4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Document7 pagesE4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Quynh Cao PhuongNo ratings yet

- The Basic Financial StatementsDocument2 pagesThe Basic Financial StatementsPark ChimmyNo ratings yet

- Consolidated Accounts QuestionsDocument10 pagesConsolidated Accounts QuestionsGiedrius SatkauskasNo ratings yet

- Pearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Test Bank Full Chapter PDFDocument66 pagesPearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Test Bank Full Chapter PDFWilliamDanielsezgj100% (12)

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

Chapter 4 Graded Problems-1

Chapter 4 Graded Problems-1

Uploaded by

almacen chrisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 Graded Problems-1

Chapter 4 Graded Problems-1

Uploaded by

almacen chrisCopyright:

Available Formats

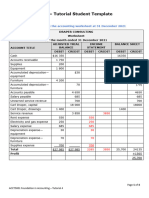

Problem #1

Admission by Purchase of Interest or Investment of Assets

Mallari and Chua are partners who share profits and losses in a ratio of 3:2, respectively. They have the

following capital balances on Sept. 30, 2019:

Mallari, Capital Chua, Capital

P250,000 Cr. P500,000 Cr.

The partners agreed to admit Palatino to the partnership.

Required: Calculate the capital balances of each partner after the admission of Palatino, assuming that

bonuses are recorded when appropriate for each of the following assumptions:

1. Palatino paid Mallari P250,000 for 50% of his interest.

2. Palatino invested P250,000 for a one-fourth interest in the partnership.

3. Palatino invested P250,000 for a 30% interest in the partnership.

4. Palatino invested P250,000 for a 20% interest in the partnership.

Problem #2

Admission by Purchase of Interest or Investment of Assets

Castro and Falceso are partners who share profits and losses in a ratio of 2:3, respectively, and have the

following capital balances on Sept. 30, 2020: Castro, Capital, P100,000 Cr. and Falceso, Capital, P150,000

Cr. The partners agreed to admit Garachico to the partnership.

Required: Calculate the capital balances of each partner after the admission of Garachico, assuming that

bonuses are recorded when appropriate for each of the following assumptions:

1. Garachicho paid Castro P50,000 for 40% of his interest.

2. Garachico invested P50,000 for a one-sixth interest in the partnership.

3. Garachico invested P50,000 for a 25% interest in the partnership.

4. Garachico invested P50,000 for a 15% interest in the partnership.

Problem #3

Admission by Purchase of Interest or Investment of Assets

Dolores Aguilar, Isolde Sustrina, and Beth Bigalbal are partners in Cavite Realty Company. Their capital

balances as at July 31, 2019, are as follows:

Aguilar, Capital Sustrina, Capital Bigalbal, Capital

450,000 150,000 300,000

Each partner has agreed to admit Nelia Pascual to the partnership.

Required:

Prepare the entries to record Pascual’s admission to or Aguilar’s withdrawal from the partnership under

each of the following conditions:

a. Pascual paid Aguilar P125,000 for 20% of Aguilar’s interest in the partnership.

b. Pascual invested P200,000 cash in the partnership and received an interest equal to her investment.

c. Pascual invested P300,000 cash in the partnership for a 20% interest in the business. A bonus is to be

recorded for the original partners on the basis of their capital balances.

d. Pascual invested P300,000 cash in the partnership for a 40% interest in the business. The original

partners gave Pascual a bonus according to the ratio of their capital balances on July 31, 2019.

e. Aguilar withdrew from the partnership, taking P525,000. The excess of withdrawn assets over

Aguilar’s partnership interest is distributed according to the balances of the Capital accounts.

f. Aguilar withdrew by selling her interest directly to Pascual for P600,000.

Problem #4

Withdrawal of a Partner

Gregorio is retiring from the partnership of Guerra, Guillermo, and Gregorio. The profit and loss ratio is

2:2:1, respectively. After the accountant has posted the revaluation and closing entries, the credit

balances in the Capital accounts are: Guerra, P530,000; Guillermo, P430,000; and Gregorio, P210,000.

Required: Journalize the journal entries to record the retirement of Gregorio under each of the following

unrelated assumptions:

1. Gregorio retires, taking P210,000 of partnership cash for her equity.

2. Gregorio retires, taking P270,000 of partnership cash for her equity.

Problem #5

Withdrawal of a Partner

On July 10, 2019, Partner Ibrahim decided to withdraw from Cebedo, Basa and Ibrahim Partnership.

Their profit and loss ratio is 3:2:1, respectively. Partnership assets are to be used to acquire Ibrahim’s

partnership interest. The statement of financial position for the partnership on that date follows:

Cebedo, Basa and Ibrahim

Statement of Financial Position

July 10, 2019

Assets Liabilities and Partner’s Capital

Cash P 74,000 Liabilities P 45,000

Trade Accounts Receivable (net) 36,000 Cebedo, Capital 120,000

Plants Assets (net) 135,000 Basa, Capital 60,000

Goodwill (net) 30,000 Ibrahim, Capital 50,000

Total P275,000 Total P275,000

Required:

Prepare the journal entries to record Ibrahim’s withdrawal under each of the following assumptions:

1. Ibrahim is paid P54,000, and the excess amount paid over Ibrahim’s capital account balance is

recorded as a bonus to Ibrahim from Cebedo and Basa.

2. Ibrahim is paid P45,000, and the difference is recorded as a bonus to Cebedo and Basa from Ibrahim.

3. Ibrahim accepted cash of P40,500 and plant assets (equipment) with a current fair value of P9,000.

The equipement had cost P30,000 and was 60% depreciated, with no residual value (Record any gain or

loss on the disposal of the equipment in the partner’s capital accounts).

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Solutions Manual: Financial Accounting: Reporting, Analysis and Decision MakingDocument61 pagesSolutions Manual: Financial Accounting: Reporting, Analysis and Decision MakingJeffrey Sanchez Rojas100% (2)

- 4052 Xls Eng Prof BLAINE KITCHENWAREDocument11 pages4052 Xls Eng Prof BLAINE KITCHENWAREMafernanda GR57% (7)

- AFAR - PreWeek - May 2022Document31 pagesAFAR - PreWeek - May 2022Miguel ManagoNo ratings yet

- ADMS 2500 Practice Final Exam SolutionsDocument20 pagesADMS 2500 Practice Final Exam SolutionsAyat TaNo ratings yet

- Assignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachDocument5 pagesAssignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachCacjungoyNo ratings yet

- Partnership Dissolution - Practice ExercisesDocument5 pagesPartnership Dissolution - Practice ExercisesVon Andrei Medina0% (2)

- PB DifficultDocument20 pagesPB DifficultPaulo MiguelNo ratings yet

- Partnership Dissolution & LiquidationDocument15 pagesPartnership Dissolution & LiquidationJean Ysrael Marquez50% (4)

- ACCTSPTRANS All About PartnershipDocument7 pagesACCTSPTRANS All About PartnershipShailene David0% (1)

- Advnce - fin.Acc.&Repprac 2Document17 pagesAdvnce - fin.Acc.&Repprac 2Jerry Licayan0% (1)

- BAC 522 Mid Term ExamDocument9 pagesBAC 522 Mid Term ExamJohn Carlo Cruz0% (1)

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- Business Combi and Conso HandoutDocument16 pagesBusiness Combi and Conso HandoutKarlo Jude Acidera100% (2)

- FM CasesDocument13 pagesFM CasesHira Ejaz Ahmed ShaikhNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- Wala LangDocument8 pagesWala LangMax Dela TorreNo ratings yet

- Quiz On Partnership DissolutionDocument4 pagesQuiz On Partnership Dissolution이삐야No ratings yet

- 03 - Handout - Partnership DissolutionDocument4 pages03 - Handout - Partnership DissolutionJanysse CalderonNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- Week 15 Q1Document11 pagesWeek 15 Q1Carlo AgravanteNo ratings yet

- Accounting Special Transaction - PartnershipDocument12 pagesAccounting Special Transaction - PartnershipMikee LajatoNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- BAFINAR - Quiz 2 ColarDocument3 pagesBAFINAR - Quiz 2 ColarRonalyn ColarNo ratings yet

- Template - Acctg. Major 3 Module 2Document7 pagesTemplate - Acctg. Major 3 Module 2Ryan PatitoNo ratings yet

- Print SW PartnershipDocument5 pagesPrint SW PartnershipMike MikeNo ratings yet

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFDocument16 pages1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAANo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- LSPU - Pre - Battery ExamDocument10 pagesLSPU - Pre - Battery ExamRosejane EMNo ratings yet

- [MOCK QE] ParCor WITH SOLUTIONDocument20 pages[MOCK QE] ParCor WITH SOLUTION2023102461No ratings yet

- Partnership Dissolution QuestionsDocument3 pagesPartnership Dissolution QuestionsArkkkNo ratings yet

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocument6 pagesAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNo ratings yet

- Exercises - Partnership CombinepdfDocument8 pagesExercises - Partnership CombinepdfRiana CellsNo ratings yet

- Quiz - Dissolution and Liquidation (Answers)Document8 pagesQuiz - Dissolution and Liquidation (Answers)peter pakerNo ratings yet

- Question 3 and 4 Are Based On The FollowingDocument5 pagesQuestion 3 and 4 Are Based On The Following03LJNo ratings yet

- Prequalifying ExaminationDocument7 pagesPrequalifying Examinationablay logeneNo ratings yet

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- Introduction of Partnership FormationDocument16 pagesIntroduction of Partnership FormationRamon AlpitcheNo ratings yet

- 2 2nd TutorialDocument4 pages2 2nd TutorialJon Dumagil Inocentes, CPANo ratings yet

- ACCT601 - Prelim Examination PDFDocument10 pagesACCT601 - Prelim Examination PDFSweet EmmeNo ratings yet

- Midterm Exercises 1 ProblemsDocument2 pagesMidterm Exercises 1 Problemslinkin soyNo ratings yet

- Partnership Formation and Operation.Document4 pagesPartnership Formation and Operation.May RamosNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Notre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong CityDocument15 pagesNotre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong Cityirishjade100% (1)

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Financial Accounting and ReportingDocument8 pagesFinancial Accounting and ReportingPauline Idra100% (1)

- Basic Concepts of PartnershipDocument5 pagesBasic Concepts of PartnershipKyla DizonNo ratings yet

- QUIZ 02: Partnership Operations Name: - ID No.Document6 pagesQUIZ 02: Partnership Operations Name: - ID No.yoj cepilloNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationMary Elisha PinedaNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- 2 Partnership DissolutionDocument9 pages2 Partnership DissolutionLach Mae . FloresNo ratings yet

- Partnership CompleteDocument6 pagesPartnership CompleteJoshua TorillaNo ratings yet

- Review of PartnershipDocument13 pagesReview of PartnershipKristine BlancaNo ratings yet

- 7 PARCOR Testbank Answer KeyDocument12 pages7 PARCOR Testbank Answer Keygiodarine0814No ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- Partnership Dissolution 1of 2 PDFDocument2 pagesPartnership Dissolution 1of 2 PDFAngelo VilladoresNo ratings yet

- ACCO20033 FAR1 Final Deptal Date 2-28-2021 For GMail Users Time 8 00 Am ToDocument22 pagesACCO20033 FAR1 Final Deptal Date 2-28-2021 For GMail Users Time 8 00 Am ToElijah SundaeNo ratings yet

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoNo ratings yet

- Acctg 2 - 2nd MimeoDocument4 pagesAcctg 2 - 2nd MimeoJon Dumagil Inocentes, CPANo ratings yet

- Partnership Formation & OperationDocument4 pagesPartnership Formation & Operationdiane pandoyosNo ratings yet

- Partnership DrillDocument4 pagesPartnership DrillCelestiaNo ratings yet

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- Chapter 2 Case 2 Sole Proprietors-1Document1 pageChapter 2 Case 2 Sole Proprietors-1almacen chrisNo ratings yet

- WM Concepts WM Hierarchy - R.B.Document2 pagesWM Concepts WM Hierarchy - R.B.almacen chrisNo ratings yet

- Group Presentation Rubric and Scoring-1Document1 pageGroup Presentation Rubric and Scoring-1almacen chrisNo ratings yet

- P-Activity 5 10 PtsDocument1 pageP-Activity 5 10 Ptsalmacen chrisNo ratings yet

- P-Activity 3 20 PtsDocument1 pageP-Activity 3 20 Ptsalmacen chrisNo ratings yet

- P-Activity 2 10 PtsDocument1 pageP-Activity 2 10 Ptsalmacen chrisNo ratings yet

- PRELIMS VOC1.A AAC - BSSLAW1.BAUTISTA-khristina-CassandraDocument15 pagesPRELIMS VOC1.A AAC - BSSLAW1.BAUTISTA-khristina-Cassandraalmacen chrisNo ratings yet

- P-Activity 1 10 PtsDocument1 pageP-Activity 1 10 Ptsalmacen chrisNo ratings yet

- P-Activity 6 25 PtsDocument1 pageP-Activity 6 25 Ptsalmacen chrisNo ratings yet

- P-Activity 4 10 PtsDocument1 pageP-Activity 4 10 Ptsalmacen chrisNo ratings yet

- PRELIMS VOC1.A AAC - BSSLAW1.NALLIW-Julie-AnnDocument13 pagesPRELIMS VOC1.A AAC - BSSLAW1.NALLIW-Julie-Annalmacen chrisNo ratings yet

- Project Report ON Chanduka Restaurant: Nikita Chanduka Finance A 19MBAJ0209Document8 pagesProject Report ON Chanduka Restaurant: Nikita Chanduka Finance A 19MBAJ0209Nikita ChandukaNo ratings yet

- Financial Modelling FundamentalsDocument44 pagesFinancial Modelling FundamentalsNguyen Binh MinhNo ratings yet

- Hydrochem AnalysisDocument7 pagesHydrochem AnalysisSaransh Kejriwal100% (2)

- Consolidated Financial StatementsDocument29 pagesConsolidated Financial StatementsPramad BhattacharjeeNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument78 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeSiyedong Ardi100% (1)

- Partnership PracticeDocument1 pagePartnership PracticeIce Voltaire Buban GuiangNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFAINDRILA BERA100% (1)

- Wilmar Cahaya Indonesia Tbk. (S)Document3 pagesWilmar Cahaya Indonesia Tbk. (S)Solihul HadiNo ratings yet

- Accounting For Partnership and CorporatDocument1 pageAccounting For Partnership and Corporatretuyasheena16No ratings yet

- F2019 Final Exam Review With AnswersDocument16 pagesF2019 Final Exam Review With AnswersRob WangNo ratings yet

- Finance and Accounting Alex TilkinDocument87 pagesFinance and Accounting Alex Tilkinalex tilkinNo ratings yet

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- DSCR Case Study FinalDocument7 pagesDSCR Case Study FinalVISHAL PATILNo ratings yet

- ACCT5001 2024 - Module 4 Week 4 - Tutorial Template For StudentsDocument4 pagesACCT5001 2024 - Module 4 Week 4 - Tutorial Template For Studentsaish.gasllllNo ratings yet

- ACC 1101 Tutorial - Trade Receivables 2Document2 pagesACC 1101 Tutorial - Trade Receivables 2Qila IlaNo ratings yet

- Baps March 2021Document34 pagesBaps March 2021Adjin LomoteyNo ratings yet

- Accounting GuessDocument5 pagesAccounting GuessjhouvanNo ratings yet

- REVISI P2.1 SD P2.12Document24 pagesREVISI P2.1 SD P2.12yusufahriza25No ratings yet

- Name: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CDocument5 pagesName: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CKirti RawatNo ratings yet

- Gaap Graded2016Document385 pagesGaap Graded2016Venniah Musunda100% (1)

- E4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Document7 pagesE4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Quynh Cao PhuongNo ratings yet

- The Basic Financial StatementsDocument2 pagesThe Basic Financial StatementsPark ChimmyNo ratings yet

- Consolidated Accounts QuestionsDocument10 pagesConsolidated Accounts QuestionsGiedrius SatkauskasNo ratings yet

- Pearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Test Bank Full Chapter PDFDocument66 pagesPearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Test Bank Full Chapter PDFWilliamDanielsezgj100% (12)

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

![[MOCK QE] ParCor WITH SOLUTION](https://imgv2-1-f.scribdassets.com/img/document/747626715/149x198/0a08f4a564/1720022318?v=1)