Professional Documents

Culture Documents

Atlas Honda Cash Flow

Atlas Honda Cash Flow

Uploaded by

omair0 ratings0% found this document useful (0 votes)

24 views4 pagesThis document is the cash flow statement for Atlas Honda Limited for the year ended June 30, 2003. It shows cash inflows and outflows from operating, investing, and financing activities. Key line items include net cash generated from operations of Rs. 724.2 million, net cash used in investing activities of Rs. 67.5 million, and net cash used in financing activities of Rs. 42.3 million. The overall increase in cash and cash equivalents for the year was Rs. 614.3 million.

Original Description:

Original Title

atlas honda cash flow

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is the cash flow statement for Atlas Honda Limited for the year ended June 30, 2003. It shows cash inflows and outflows from operating, investing, and financing activities. Key line items include net cash generated from operations of Rs. 724.2 million, net cash used in investing activities of Rs. 67.5 million, and net cash used in financing activities of Rs. 42.3 million. The overall increase in cash and cash equivalents for the year was Rs. 614.3 million.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

24 views4 pagesAtlas Honda Cash Flow

Atlas Honda Cash Flow

Uploaded by

omairThis document is the cash flow statement for Atlas Honda Limited for the year ended June 30, 2003. It shows cash inflows and outflows from operating, investing, and financing activities. Key line items include net cash generated from operations of Rs. 724.2 million, net cash used in investing activities of Rs. 67.5 million, and net cash used in financing activities of Rs. 42.3 million. The overall increase in cash and cash equivalents for the year was Rs. 614.3 million.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 4

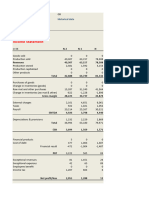

ATLAS HONDA LIMITED

CASH FLOW STATEMENT

FOR THE YEAR ENDED JUNE 30, 2003 NOTE 2003

CASH FLOWS FROM OPERATING ACTIVITIES (Rupees)

Net Profit before taxation P/L 650,927

Adjustment for:

Depreciation 5 89,645

Foreign exchange (gain) /loss 33 (128)

Gain on sale of investment 32 (11,053)

Interest income =18011+20293 32 (38,304)

Interest expense =468+18011+1931 33 20,410

Dividend income 32 (166)

Amortization 6 2,067

Gratuity provision 20 14,192

Finance charges on leased assets 33 77

Diminution in value of investment

Loss on sale of fixed assets 30 5,829

Oprating profit before working capital changes 733,496

Working capital changes:

(Increase) / decrease in current assets

Stores, spares & tools B/S (54,802)

Stock-in-trade B/S (95,026)

Trade debtors B/S 116,716

Advances, deposits & prepayments 13 (22,707)

=(199702-110433-8219-7460)-(354378-249584-2134-6363)

(55,819)

Increase in current liabilities

Creditors, provisions, accrued charges & other liabilities 24 400,848

=(591002-3935)-(989977-2062)

Cash generated form operations 1,078,525

Interest paid (22,140)

Gratuity paid 20 (48,864)

Income taxes paid W-2 (286,675)

Long term loans and deposits

=(16130+7460)-(13874+6363) 9 3,353

Net cash generated from operations 724,199

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of fixed assets =132059-552+2770 5&7 (134,277)

Investment in mutual fund units (100,000)

Sale proceeds of fixed assets 8,674

Sale proceeds of investment 13,880

Sale proceed of investment in mutual fund units 100,732

Interest received W-3 44,389

Dividend received 32 166

Software development / acquisition cost 6 (1,089)

(67,525)

Net cash flow before financing activities 656,674

FINANCING ACTIVITIES

Repayment of long term loans =20,090+20,000+5,000

18.01 , 18.02 & 18.03 (45,090)

Acquisition of long term loans =100,000+50,000 18.02 & 18.03 150,000

Repayments of redeemable capital =19,788+5,000 17.01 & 17.02 (24,788)

Repayment of supplier's credit -

Repayment of obligation under finance lease 19 (1,233)

Dividend paid w-4 (121,218)

Net cash (used in) financing activities (42,329)

Increase in cash & cash equivalents 614,345

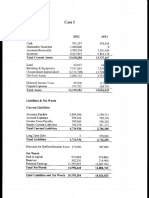

W-1

NTEREST PAYABLE

Cash (bal) 22,283 Opening n24 3,935

Accrued 20,410

Closing n24 2,062 20410 143

24,345 24,345

W-2

INCOME TAX

Advance opning n13 110,433 Deferred Tax Op P/L 15,000

Deferred Tax Cl P/L 33,000 Provision P/L 223,524

Advance Cl n13 249,584

Provision for Tax Cl P/L 220000 Prov for Tax Op P/L 162,000

Cash (bal) 286,675

650,108 650,108

W-3

NTEREST RECEIVABLE

Opening N13 8,219 Closing N13 2,134

Cash (bal) 44,389

Accrued N32 18,011

N32 20,293

46,523 46,523

W-4

DIVIDEND PAYABLE

Cash (bal) 121,218 Opening Unclaimed n26 3,639

Proposed P/L 122,621

Closing unclaimed P/L 5,042

126,260 126,260

115092 40182

45090

120000

You might also like

- Practical Exercises SpredsheetsDocument13 pagesPractical Exercises SpredsheetsGhanshyam Sharma75% (4)

- IM On ACCO 20043 Financial Accounting and Reporting Part 2 - FINALDocument106 pagesIM On ACCO 20043 Financial Accounting and Reporting Part 2 - FINALlorah jane SilangNo ratings yet

- Lecture 10 CmaDocument8 pagesLecture 10 CmaUmair HayatNo ratings yet

- How To Win The Lotter With The Law of AttractionDocument32 pagesHow To Win The Lotter With The Law of AttractionGnostic the Ancient One100% (30)

- Packages Cash FlowDocument3 pagesPackages Cash FlowomairNo ratings yet

- Nishat Cash FlowDocument2 pagesNishat Cash FlowomairNo ratings yet

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- Tuto 6Document6 pagesTuto 6WEI QUAN LEENo ratings yet

- Consolidated Cash Flow StatementDocument4 pagesConsolidated Cash Flow StatementPrinceNo ratings yet

- Receipts and Payments AccountDocument2 pagesReceipts and Payments AccountUmapathi MNo ratings yet

- Assignment 1 (Part 2)Document10 pagesAssignment 1 (Part 2)Sanghya MahendranNo ratings yet

- Revenue: Non-Current AssetsDocument5 pagesRevenue: Non-Current Assetsfahim tusarNo ratings yet

- Financial Accounting 3a Assignment 2 2022Document9 pagesFinancial Accounting 3a Assignment 2 2022sartynaftalNo ratings yet

- AasffffDocument7 pagesAasffffDaddyNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- Prime Finance First MF2012Document1 pagePrime Finance First MF2012Abrar FaisalNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- Lotus 2017Document14 pagesLotus 2017teingnidetioNo ratings yet

- Stanley Gibbons Group PLCDocument2 pagesStanley Gibbons Group PLCImran WarsiNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- Vitrox'S Balance Sheet For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000 Cash Flows From Operating ActivitiesDocument2 pagesVitrox'S Balance Sheet For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000 Cash Flows From Operating ActivitiesHong JunNo ratings yet

- b2 AnsDocument13 pagesb2 AnsRashid AbeidNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Tempest FA Template FH 2023Document6 pagesTempest FA Template FH 2023Gts PierreNo ratings yet

- HR Welfare Society 13-10-13Document11 pagesHR Welfare Society 13-10-13WazedZayedNo ratings yet

- Cash Flow Statement 2016-2020Document8 pagesCash Flow Statement 2016-2020yip manNo ratings yet

- Masteel 4Q 2023Document12 pagesMasteel 4Q 2023GZHNo ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- FS Gogold 2023 Q3Document17 pagesFS Gogold 2023 Q3Jasdeep ToorNo ratings yet

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Document8 pages4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiNo ratings yet

- Cash Flow Statement Lourdesllanes2022 FINALDocument5 pagesCash Flow Statement Lourdesllanes2022 FINALDv AccountingNo ratings yet

- Account AssignmentDocument2 pagesAccount AssignmentYIH PEI CHUNGNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Unconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010Document1 pageUnconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010maqsoom471No ratings yet

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Document201 pagesAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- Section A (Group 11)Document14 pagesSection A (Group 11)V PrasantNo ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- Unaudited Summary Consolidated and Separate Financial StatementsDocument2 pagesUnaudited Summary Consolidated and Separate Financial Statementsbentilwilliams65No ratings yet

- 133399-A 2018 2018 Annual CFDocument1 page133399-A 2018 2018 Annual CFVijay KumarNo ratings yet

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkNo ratings yet

- 133399-AA 2018 2018 Annual CFDocument1 page133399-AA 2018 2018 Annual CFVijay KumarNo ratings yet

- Page 17 - Cash FlowDocument1 pagePage 17 - Cash Flowapi-3701112No ratings yet

- CR - MA-2023 - Suggested - AnswersDocument15 pagesCR - MA-2023 - Suggested - AnswersfahadsarkerNo ratings yet

- Andy's Cannabis Financial StatementsDocument3 pagesAndy's Cannabis Financial Statementsnickstevens24No ratings yet

- Handout Environmend Green Financial Statements ADocument5 pagesHandout Environmend Green Financial Statements AshamielpeNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- Interim Report 2010Document38 pagesInterim Report 2010YennyNo ratings yet

- MicrosoftDocument11 pagesMicrosoftJannah Victoria AmoraNo ratings yet

- Increase in Long Term Loans and AdvancesDocument2 pagesIncrease in Long Term Loans and Advancesusama siddiquiNo ratings yet

- Cash Flows - SolvedDocument4 pagesCash Flows - SolvedChetan DhuriNo ratings yet

- Amerbran Company ADocument6 pagesAmerbran Company ATale FernandezNo ratings yet

- Boa Financials For q3 30 Sept. 2021Document1 pageBoa Financials For q3 30 Sept. 2021Fuaad DodooNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- Cash Flow CasesDocument13 pagesCash Flow Casesziad ElhamzawyNo ratings yet

- RFL Bond Report q1 Fy 2015Document6 pagesRFL Bond Report q1 Fy 2015husnuozyegiinNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Consolidated Cash Flow StatementDocument1 pageConsolidated Cash Flow Statementsurya553No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Ratios For SugarDocument4 pagesRatios For SugaromairNo ratings yet

- Fertilizer RatiosDocument12 pagesFertilizer RatiosomairNo ratings yet

- Packages Annualreport2002Document66 pagesPackages Annualreport2002omairNo ratings yet

- Nishat Cash FlowDocument2 pagesNishat Cash FlowomairNo ratings yet

- Packages Cash FlowDocument3 pagesPackages Cash FlowomairNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow QuestionomairNo ratings yet

- Cash Flow and Profit ExamplesDocument3 pagesCash Flow and Profit ExamplesomairNo ratings yet

- Corporate FinanceDocument3 pagesCorporate Financezairulp1No ratings yet

- Investment Strategy For Indian Markets Post-CovidDocument21 pagesInvestment Strategy For Indian Markets Post-CovidJcoveNo ratings yet

- Intermediate Accounting 9th Edition Spiceland Solutions ManualDocument37 pagesIntermediate Accounting 9th Edition Spiceland Solutions Manualensampleruskw3ob100% (17)

- Financial Economics Study MaterialDocument13 pagesFinancial Economics Study MaterialFrancis MtamboNo ratings yet

- Microeconomics by John BurkettDocument355 pagesMicroeconomics by John BurkettAbir GhoshNo ratings yet

- PNB Vs IACDocument2 pagesPNB Vs IACIsha Soriano100% (1)

- Swot Analysis of Equity SharesDocument6 pagesSwot Analysis of Equity SharesChristin MathewNo ratings yet

- Oded Stark MigrationofLabor PDFDocument20 pagesOded Stark MigrationofLabor PDFThales SperoniNo ratings yet

- Saja .K.a Apollo TyresDocument52 pagesSaja .K.a Apollo TyresSaja Nizam Sana100% (1)

- URC 2013 Annual ReportDocument154 pagesURC 2013 Annual ReportKhunkhun CilukbaaNo ratings yet

- Gopro - Gopro For Rent PH ContractDocument2 pagesGopro - Gopro For Rent PH Contractpatricia.gavarraNo ratings yet

- Agreement of StoreDocument4 pagesAgreement of Store111122223No ratings yet

- Political Reform Act 2017Document139 pagesPolitical Reform Act 2017L. A. PatersonNo ratings yet

- T Cop Y T Cop Y: Bharti Airtel (B)Document12 pagesT Cop Y T Cop Y: Bharti Airtel (B)Mayank GuptaNo ratings yet

- PayslipDocument1 pagePayslipVenu GudlaNo ratings yet

- City 2011 BudgetbookDocument283 pagesCity 2011 BudgetbookArjun SinghNo ratings yet

- 单项工程 东南亚大区36327 Indonesia One 膨胀螺栓采购合同书 印尼喜利得 2018.12.18Document4 pages单项工程 东南亚大区36327 Indonesia One 膨胀螺栓采购合同书 印尼喜利得 2018.12.18Anonymous L7ChJdNo ratings yet

- Atty Ligon Tx2Document92 pagesAtty Ligon Tx2karlNo ratings yet

- DPR Tsiic ModelDocument3 pagesDPR Tsiic ModelMohan P100% (2)

- 321202333809PM - 0 - List of Custodian, Alternate Custodian, PAR Manager As On 20.03.2023Document48 pages321202333809PM - 0 - List of Custodian, Alternate Custodian, PAR Manager As On 20.03.2023Lovelpreet KaurNo ratings yet

- Case, Fare & Otter Economics Chapter 24 SummaryDocument41 pagesCase, Fare & Otter Economics Chapter 24 SummaryDward James FortalezaNo ratings yet

- Foriegn Investment in Real Estate - IndiaDocument6 pagesForiegn Investment in Real Estate - IndiasirishdsNo ratings yet

- CFA Level II Mock Exam 5 - Solutions (AM)Document60 pagesCFA Level II Mock Exam 5 - Solutions (AM)Sardonna FongNo ratings yet

- MQ13 13 b-1Document13 pagesMQ13 13 b-1Jona ResuelloNo ratings yet

- ACST101 Final Exam S1 2015 QuestionsDocument20 pagesACST101 Final Exam S1 2015 Questionssamathuva12No ratings yet

- Premium Ready Reckoner - All Conventional PlansDocument11 pagesPremium Ready Reckoner - All Conventional PlansAmit MaheshwariNo ratings yet