Professional Documents

Culture Documents

Introduction and Basic Concepts of Customs Law

Introduction and Basic Concepts of Customs Law

Uploaded by

Import Export ConsultancyCopyright:

Available Formats

You might also like

- Exemption From Custom DutyDocument13 pagesExemption From Custom DutyAbhinav PrasadNo ratings yet

- Taxation Unit 5Document35 pagesTaxation Unit 5GITANJALI MISHRANo ratings yet

- 76072bos61477 m4 cp1Document69 pages76072bos61477 m4 cp1GAUTAM JHANo ratings yet

- Customs DutyDocument8 pagesCustoms DutyRanvids100% (1)

- HHDocument13 pagesHHLaxminarayanNo ratings yet

- Customs ActDocument7 pagesCustoms ActVarun VarierNo ratings yet

- Draft Preventive Manual Vol IDocument654 pagesDraft Preventive Manual Vol Ipooram001No ratings yet

- EIDT Unit 4Document12 pagesEIDT Unit 4Samarth SahuNo ratings yet

- Shail Sir ProjectDocument16 pagesShail Sir ProjectPreeti singhNo ratings yet

- SSK Business Taxation Unit 5Document19 pagesSSK Business Taxation Unit 5yogitamil680No ratings yet

- Introduction To Customs Duty: Brief Background of Customs LawDocument8 pagesIntroduction To Customs Duty: Brief Background of Customs LawABC 123No ratings yet

- Assignment PDFDocument16 pagesAssignment PDFअभिशील राजेश जायसवालNo ratings yet

- Customs IntroductionDocument62 pagesCustoms IntroductionJitendra VernekarNo ratings yet

- 2018 Tariff NotesDocument23 pages2018 Tariff NotesYash SawantNo ratings yet

- Objectives of Customs ActDocument1 pageObjectives of Customs ActWelcome 1995No ratings yet

- Customs Act, 1962Document40 pagesCustoms Act, 1962Mainak ChandraNo ratings yet

- 34 Taxation in IndiaDocument8 pages34 Taxation in IndiaSharma AiplNo ratings yet

- Tax in IndiaDocument7 pagesTax in IndiaAbhas JaiswalNo ratings yet

- Foreign Trade Development and Regulation FTDRAct 1992Document14 pagesForeign Trade Development and Regulation FTDRAct 1992Ayushman DubeyNo ratings yet

- Faculty of Law: Jamia Millia IslamiaDocument25 pagesFaculty of Law: Jamia Millia IslamiaShimran ZamanNo ratings yet

- Unit I - Customs DutyDocument64 pagesUnit I - Customs Duty21ubha116 21ubha116No ratings yet

- Central ExciseDocument2 pagesCentral ExciseNawab SahabNo ratings yet

- Constitutional Validity (Excise Duties, Custom Duties & Service Taxes)Document19 pagesConstitutional Validity (Excise Duties, Custom Duties & Service Taxes)07anshuman100% (2)

- Taxation in India - Wikipedia, The Free EncyclopediaDocument5 pagesTaxation in India - Wikipedia, The Free EncyclopediaranokshivaNo ratings yet

- Assignment 1 (New)Document8 pagesAssignment 1 (New)adil_lodhiNo ratings yet

- 13 - Tax Law - Customs Law - 271219Document25 pages13 - Tax Law - Customs Law - 271219Sushil BansalNo ratings yet

- GSTDocument195 pagesGSTNitesh VyasNo ratings yet

- The Foreign Trade (Development and Regulation) Act, 1992Document3 pagesThe Foreign Trade (Development and Regulation) Act, 1992Laxmi WankhedeNo ratings yet

- Origin of Customs DutyDocument45 pagesOrigin of Customs DutyJayagokul SaravananNo ratings yet

- Constitutional Provision Governing Taxation in IndiaDocument3 pagesConstitutional Provision Governing Taxation in IndiaAnonymous H1TW3YY51KNo ratings yet

- Customs Law in IndiaDocument5 pagesCustoms Law in Indialtbtran010903No ratings yet

- Basics of Income TaxDocument15 pagesBasics of Income Taxdevi sreeNo ratings yet

- Constitutional Provisions Relating To TaxesDocument7 pagesConstitutional Provisions Relating To Taxessanjana sethNo ratings yet

- Customs IntroductionDocument19 pagesCustoms IntroductionanshuNo ratings yet

- Types of Custom DutiesDocument29 pagesTypes of Custom DutiesShikhar AgarwalNo ratings yet

- State Control Over Import and Export of GoodsDocument5 pagesState Control Over Import and Export of GoodsSumit DashNo ratings yet

- GST in IndiaDocument13 pagesGST in IndiaDeepesh SinghNo ratings yet

- Companies Act 1956: Ministry of Corporate Affairs. ObjectivesDocument7 pagesCompanies Act 1956: Ministry of Corporate Affairs. ObjectivesmanjushreeNo ratings yet

- Customs Law: Carraige of Goods by Sea and Multi-Modal TransportDocument27 pagesCustoms Law: Carraige of Goods by Sea and Multi-Modal TransportaviingoleNo ratings yet

- Constitutional Power of Taxation-1Document55 pagesConstitutional Power of Taxation-1Drafts StorageNo ratings yet

- GST Notes For ExamDocument2 pagesGST Notes For ExamShivajee SNo ratings yet

- Assessment: (Sec 2 (2) )Document18 pagesAssessment: (Sec 2 (2) )poojabhagatNo ratings yet

- Customs DutyDocument8 pagesCustoms DutyBhavana GadagNo ratings yet

- Constitution TaxationDocument6 pagesConstitution TaxationdharshibutbetterNo ratings yet

- Service Tax: Inheritance Tax Interest Tax Gift Tax Wealth Tax Wealth Tax Act, 1957Document3 pagesService Tax: Inheritance Tax Interest Tax Gift Tax Wealth Tax Wealth Tax Act, 1957PraWin KharateNo ratings yet

- CustomsDocument50 pagesCustomsThe Lingo LadsNo ratings yet

- History of Tax Law in India: The Glocal Law SchoolDocument12 pagesHistory of Tax Law in India: The Glocal Law SchoolSajid KhanNo ratings yet

- Basic Concepts: 1.1 Constitution of IndiaDocument34 pagesBasic Concepts: 1.1 Constitution of IndiaJitendra VernekarNo ratings yet

- Income Tax Notes Till Salary 2022 by Sachin Arora SEH PDFDocument69 pagesIncome Tax Notes Till Salary 2022 by Sachin Arora SEH PDF1234t dvhhNo ratings yet

- Introduction To Customs DutyDocument34 pagesIntroduction To Customs DutyKunal Thakor67% (3)

- Custom ReadingsDocument43 pagesCustom ReadingsAnirudhaRudhraNo ratings yet

- Chapter - IiDocument13 pagesChapter - IiAnkit YadavNo ratings yet

- Direct Indirect TaxDocument6 pagesDirect Indirect TaxcrappitycarapNo ratings yet

- Custom ReadingsDocument43 pagesCustom ReadingsShantanu RaiNo ratings yet

- Tax Constitutional ProvisionDocument10 pagesTax Constitutional ProvisionRuhul AminNo ratings yet

- Customs, Excise and GST Full MaterialDocument55 pagesCustoms, Excise and GST Full MaterialramNo ratings yet

- Business Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsFrom EverandBusiness Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsNo ratings yet

- Prohibition On Export and ImportDocument2 pagesProhibition On Export and ImportImport Export ConsultancyNo ratings yet

- Overview of Cier-2010Document2 pagesOverview of Cier-2010Import Export ConsultancyNo ratings yet

- Index of The Customs Act, 1962Document8 pagesIndex of The Customs Act, 1962Import Export ConsultancyNo ratings yet

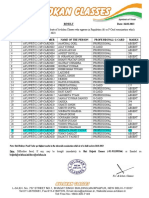

- Result F CardDocument1 pageResult F CardImport Export ConsultancyNo ratings yet

- CIERDocument9 pagesCIERImport Export ConsultancyNo ratings yet

- ANSWER SHEET F CARD 19 FebDocument21 pagesANSWER SHEET F CARD 19 FebImport Export ConsultancyNo ratings yet

- Answer Sheet F Card 12.02.2023Document15 pagesAnswer Sheet F Card 12.02.2023Import Export ConsultancyNo ratings yet

- ANSWER SHEET 5 Mar 23Document15 pagesANSWER SHEET 5 Mar 23Import Export ConsultancyNo ratings yet

Introduction and Basic Concepts of Customs Law

Introduction and Basic Concepts of Customs Law

Uploaded by

Import Export ConsultancyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction and Basic Concepts of Customs Law

Introduction and Basic Concepts of Customs Law

Uploaded by

Import Export ConsultancyCopyright:

Available Formats

INTRODUCTION AND BASIC CONCEPTS OF CUSTOMS LAW

Customs Act, 1962:

The Customs Act, enacted by the parliament of India in year 1962. Extended whole of India also any

offences are contravention committed there under outside India by any person.

There are XVII Chapters and 161 Sections under Customs Act, 1962.

Customs Tariff Act, 1975:

The Customs Tariff Act means statutory provisions for levy of Customs Duty. CTA 1975 enacted by

parliament in the 26th year of the republic of India.

There are 13 sections and 98 chapters. However, 98 Chapters are divided into 21 Sections.

The Import Duty levied Under Customs Act, 1962 of First Schedule of Customs Tariff Act 1975 and

Export Duty levied Under Customs Tariff Act, 1975 of Second Schedule.

After going through this part, you will be able to understand:

Meaning and objects of Customs duty

Definitions and Concepts

Scope and coverage of Custom Law

Types of custom Duties

Rate of Custom Duties applicable

INTRODUCTION

Custom Duty is an indirect tax, imposed under the Customs Act formulated in 1962. The power to enact

the law is provided under the Constitution of India under the Article 265, which states that ―no tax shall

be levied or collected except by authority of law‖. Entry No. 83 of List I to Schedule VII of the

Constitution empowers the Union Government to legislate and collect duties on import and exports. The

Customs Act, 1962 is the basic statute which governs entry or exit of different categories of vessels,

aircrafts, goods, passengers etc., into or outside the country. The Act extends to the whole of the India.

Customs Act, 1962 just like any other tax law is primarily for the levy and collection of duties but at the

same time it has the other and equally important purposes such as:

Purpose of Customs Act

(i) Regulation of imports and exports

(ii) Protection of domestic industry;

(iii) Prevention of smuggling;

(iv) Conservation and augmentation of foreign exchange and so on.

For More Information please visit: www.avlokan.in

Toll Free No.: 1800-309-7149

You might also like

- Exemption From Custom DutyDocument13 pagesExemption From Custom DutyAbhinav PrasadNo ratings yet

- Taxation Unit 5Document35 pagesTaxation Unit 5GITANJALI MISHRANo ratings yet

- 76072bos61477 m4 cp1Document69 pages76072bos61477 m4 cp1GAUTAM JHANo ratings yet

- Customs DutyDocument8 pagesCustoms DutyRanvids100% (1)

- HHDocument13 pagesHHLaxminarayanNo ratings yet

- Customs ActDocument7 pagesCustoms ActVarun VarierNo ratings yet

- Draft Preventive Manual Vol IDocument654 pagesDraft Preventive Manual Vol Ipooram001No ratings yet

- EIDT Unit 4Document12 pagesEIDT Unit 4Samarth SahuNo ratings yet

- Shail Sir ProjectDocument16 pagesShail Sir ProjectPreeti singhNo ratings yet

- SSK Business Taxation Unit 5Document19 pagesSSK Business Taxation Unit 5yogitamil680No ratings yet

- Introduction To Customs Duty: Brief Background of Customs LawDocument8 pagesIntroduction To Customs Duty: Brief Background of Customs LawABC 123No ratings yet

- Assignment PDFDocument16 pagesAssignment PDFअभिशील राजेश जायसवालNo ratings yet

- Customs IntroductionDocument62 pagesCustoms IntroductionJitendra VernekarNo ratings yet

- 2018 Tariff NotesDocument23 pages2018 Tariff NotesYash SawantNo ratings yet

- Objectives of Customs ActDocument1 pageObjectives of Customs ActWelcome 1995No ratings yet

- Customs Act, 1962Document40 pagesCustoms Act, 1962Mainak ChandraNo ratings yet

- 34 Taxation in IndiaDocument8 pages34 Taxation in IndiaSharma AiplNo ratings yet

- Tax in IndiaDocument7 pagesTax in IndiaAbhas JaiswalNo ratings yet

- Foreign Trade Development and Regulation FTDRAct 1992Document14 pagesForeign Trade Development and Regulation FTDRAct 1992Ayushman DubeyNo ratings yet

- Faculty of Law: Jamia Millia IslamiaDocument25 pagesFaculty of Law: Jamia Millia IslamiaShimran ZamanNo ratings yet

- Unit I - Customs DutyDocument64 pagesUnit I - Customs Duty21ubha116 21ubha116No ratings yet

- Central ExciseDocument2 pagesCentral ExciseNawab SahabNo ratings yet

- Constitutional Validity (Excise Duties, Custom Duties & Service Taxes)Document19 pagesConstitutional Validity (Excise Duties, Custom Duties & Service Taxes)07anshuman100% (2)

- Taxation in India - Wikipedia, The Free EncyclopediaDocument5 pagesTaxation in India - Wikipedia, The Free EncyclopediaranokshivaNo ratings yet

- Assignment 1 (New)Document8 pagesAssignment 1 (New)adil_lodhiNo ratings yet

- 13 - Tax Law - Customs Law - 271219Document25 pages13 - Tax Law - Customs Law - 271219Sushil BansalNo ratings yet

- GSTDocument195 pagesGSTNitesh VyasNo ratings yet

- The Foreign Trade (Development and Regulation) Act, 1992Document3 pagesThe Foreign Trade (Development and Regulation) Act, 1992Laxmi WankhedeNo ratings yet

- Origin of Customs DutyDocument45 pagesOrigin of Customs DutyJayagokul SaravananNo ratings yet

- Constitutional Provision Governing Taxation in IndiaDocument3 pagesConstitutional Provision Governing Taxation in IndiaAnonymous H1TW3YY51KNo ratings yet

- Customs Law in IndiaDocument5 pagesCustoms Law in Indialtbtran010903No ratings yet

- Basics of Income TaxDocument15 pagesBasics of Income Taxdevi sreeNo ratings yet

- Constitutional Provisions Relating To TaxesDocument7 pagesConstitutional Provisions Relating To Taxessanjana sethNo ratings yet

- Customs IntroductionDocument19 pagesCustoms IntroductionanshuNo ratings yet

- Types of Custom DutiesDocument29 pagesTypes of Custom DutiesShikhar AgarwalNo ratings yet

- State Control Over Import and Export of GoodsDocument5 pagesState Control Over Import and Export of GoodsSumit DashNo ratings yet

- GST in IndiaDocument13 pagesGST in IndiaDeepesh SinghNo ratings yet

- Companies Act 1956: Ministry of Corporate Affairs. ObjectivesDocument7 pagesCompanies Act 1956: Ministry of Corporate Affairs. ObjectivesmanjushreeNo ratings yet

- Customs Law: Carraige of Goods by Sea and Multi-Modal TransportDocument27 pagesCustoms Law: Carraige of Goods by Sea and Multi-Modal TransportaviingoleNo ratings yet

- Constitutional Power of Taxation-1Document55 pagesConstitutional Power of Taxation-1Drafts StorageNo ratings yet

- GST Notes For ExamDocument2 pagesGST Notes For ExamShivajee SNo ratings yet

- Assessment: (Sec 2 (2) )Document18 pagesAssessment: (Sec 2 (2) )poojabhagatNo ratings yet

- Customs DutyDocument8 pagesCustoms DutyBhavana GadagNo ratings yet

- Constitution TaxationDocument6 pagesConstitution TaxationdharshibutbetterNo ratings yet

- Service Tax: Inheritance Tax Interest Tax Gift Tax Wealth Tax Wealth Tax Act, 1957Document3 pagesService Tax: Inheritance Tax Interest Tax Gift Tax Wealth Tax Wealth Tax Act, 1957PraWin KharateNo ratings yet

- CustomsDocument50 pagesCustomsThe Lingo LadsNo ratings yet

- History of Tax Law in India: The Glocal Law SchoolDocument12 pagesHistory of Tax Law in India: The Glocal Law SchoolSajid KhanNo ratings yet

- Basic Concepts: 1.1 Constitution of IndiaDocument34 pagesBasic Concepts: 1.1 Constitution of IndiaJitendra VernekarNo ratings yet

- Income Tax Notes Till Salary 2022 by Sachin Arora SEH PDFDocument69 pagesIncome Tax Notes Till Salary 2022 by Sachin Arora SEH PDF1234t dvhhNo ratings yet

- Introduction To Customs DutyDocument34 pagesIntroduction To Customs DutyKunal Thakor67% (3)

- Custom ReadingsDocument43 pagesCustom ReadingsAnirudhaRudhraNo ratings yet

- Chapter - IiDocument13 pagesChapter - IiAnkit YadavNo ratings yet

- Direct Indirect TaxDocument6 pagesDirect Indirect TaxcrappitycarapNo ratings yet

- Custom ReadingsDocument43 pagesCustom ReadingsShantanu RaiNo ratings yet

- Tax Constitutional ProvisionDocument10 pagesTax Constitutional ProvisionRuhul AminNo ratings yet

- Customs, Excise and GST Full MaterialDocument55 pagesCustoms, Excise and GST Full MaterialramNo ratings yet

- Business Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsFrom EverandBusiness Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsNo ratings yet

- Prohibition On Export and ImportDocument2 pagesProhibition On Export and ImportImport Export ConsultancyNo ratings yet

- Overview of Cier-2010Document2 pagesOverview of Cier-2010Import Export ConsultancyNo ratings yet

- Index of The Customs Act, 1962Document8 pagesIndex of The Customs Act, 1962Import Export ConsultancyNo ratings yet

- Result F CardDocument1 pageResult F CardImport Export ConsultancyNo ratings yet

- CIERDocument9 pagesCIERImport Export ConsultancyNo ratings yet

- ANSWER SHEET F CARD 19 FebDocument21 pagesANSWER SHEET F CARD 19 FebImport Export ConsultancyNo ratings yet

- Answer Sheet F Card 12.02.2023Document15 pagesAnswer Sheet F Card 12.02.2023Import Export ConsultancyNo ratings yet

- ANSWER SHEET 5 Mar 23Document15 pagesANSWER SHEET 5 Mar 23Import Export ConsultancyNo ratings yet