Professional Documents

Culture Documents

Q3 Midterm Review Exercise - XLSX - Development

Q3 Midterm Review Exercise - XLSX - Development

Uploaded by

Maria Jose Guevara Miranda0 ratings0% found this document useful (0 votes)

10 views1 pageMary is a trader who provided cash book transactions for her business in July 2019. The cash book shows cash receipts of $1,500 in cash sales on July 11th and $1,050 received from a customer on July 21st. Cash payments included $500 for a computer on July 7th, $150 for electricity on July 28th, and ending cash on hand of $200. The bank account began with an overdraft of $1,550, and saw deposits of $1,000 on July 14th and $550 on July 30th, and payments of $100 for insurance on July 3rd, $2,500 for purchases on July 19th, and $800 in withdrawals on July 25th

Original Description:

Original Title

Q3 Midterm review exercise.xlsx - Development (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMary is a trader who provided cash book transactions for her business in July 2019. The cash book shows cash receipts of $1,500 in cash sales on July 11th and $1,050 received from a customer on July 21st. Cash payments included $500 for a computer on July 7th, $150 for electricity on July 28th, and ending cash on hand of $200. The bank account began with an overdraft of $1,550, and saw deposits of $1,000 on July 14th and $550 on July 30th, and payments of $100 for insurance on July 3rd, $2,500 for purchases on July 19th, and $800 in withdrawals on July 25th

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageQ3 Midterm Review Exercise - XLSX - Development

Q3 Midterm Review Exercise - XLSX - Development

Uploaded by

Maria Jose Guevara MirandaMary is a trader who provided cash book transactions for her business in July 2019. The cash book shows cash receipts of $1,500 in cash sales on July 11th and $1,050 received from a customer on July 21st. Cash payments included $500 for a computer on July 7th, $150 for electricity on July 28th, and ending cash on hand of $200. The bank account began with an overdraft of $1,550, and saw deposits of $1,000 on July 14th and $550 on July 30th, and payments of $100 for insurance on July 3rd, $2,500 for purchases on July 19th, and $800 in withdrawals on July 25th

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

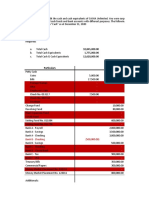

Mary is a trader.

She provided the following information for July 2019:

1-Jul Bank overdraft $1,550

3-Jul Cash balance $900

3-Jul Paid insurance by bank transfer for $100

7-Jul Purchased a computer paying cash, $500

11-Jul Cash sales of $1,500

14-Jul Deposited $1,000 cash into the business bank account

19-Jul Purchased goods for resale for $2,500 and paid by cheque

21-Jul Lizzie, a credit customer, paid $1,050 directly into Mary's business bank account

25-Jul Mary withdrew $800 from the business bank account for personal use

28-Jul Paid electricity bill for $150, in cash

30-Jul Deposited all cash into the business bank account except $200

a. Write up Mary's cash book for the month of July 2019.

b. Balance the cash book and bring down the balances on 1 August 2019.

Enter the transactions in order of date.

Cash Bank Cash Bank

Date Details Date Details

$ $ $ $

July 1 Balance b/d ( 900) July 1 Balance b/d ( 1,550)

11 Sales ( 1,500) 3 Insurance expense ( 100)

14 Cash C ( 1,000) 7 Office equipment ( 500)

21 Lizzie ( 1,050) 14 Bank C ( 1,000)

30 Cash C ( 550) 19 Purchases ( 2,500)

31 Balance c/d ( 2,350) 25 Drawings ( 800)

28 Electricity expense ( 150)

30 Bank C ( 550)

31 Balance c/d ( 200)

( 2,400) ( 4,950) ( 2,400) ( 4,950)

1-Aug Balance b/d ( 200) 1-Aug Balance b/d ( 2,350)

You might also like

- Confirmed Divergence Manual PDFDocument57 pagesConfirmed Divergence Manual PDFDigitsmarterNo ratings yet

- Heidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were CompletedDocument6 pagesHeidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were Completedlaale dijaan100% (1)

- No. Debits NoDocument11 pagesNo. Debits Nomohitgaba19100% (1)

- Explain The Essential Distinctions Among The StagesDocument1 pageExplain The Essential Distinctions Among The StagesMaureen LeonidaNo ratings yet

- Assignment 2 GuidanceDocument5 pagesAssignment 2 GuidanceFun Toosh345100% (1)

- Mock Test (Final Exam) KeyDocument4 pagesMock Test (Final Exam) KeyKhoa TrầnNo ratings yet

- On December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingDocument12 pagesOn December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingKim Cristian MaañoNo ratings yet

- Pembahasan CH 3 4 5Document30 pagesPembahasan CH 3 4 5bella0% (1)

- Bank AccountDocument19 pagesBank AccountAbayome AsukileNo ratings yet

- Accounts HWDocument5 pagesAccounts HWDaniella AngellaNo ratings yet

- Manual A2 FinalDocument43 pagesManual A2 FinalkazamNo ratings yet

- Year 11 Accounting Assessment 3 - Homework Assignment ANSWER KEYDocument4 pagesYear 11 Accounting Assessment 3 - Homework Assignment ANSWER KEYJanice BaltorNo ratings yet

- Issued StockDocument17 pagesIssued Stockapi-16021729No ratings yet

- Benjamin Mini-Mart CASH BOOK (Bank Columns) Date Particulars Fol Amounts$ Date Particulars Fol Amounts $Document8 pagesBenjamin Mini-Mart CASH BOOK (Bank Columns) Date Particulars Fol Amounts$ Date Particulars Fol Amounts $Christine Ramkissoon100% (1)

- Finac Nov 2017Document5 pagesFinac Nov 2017Amanda Hove HoveNo ratings yet

- Non Profit OrganisationsDocument6 pagesNon Profit OrganisationsRealGenius (Carl)No ratings yet

- 7110 Principles of Accounts: MARK SCHEME For The October/November 2012 SeriesDocument7 pages7110 Principles of Accounts: MARK SCHEME For The October/November 2012 SeriesJě Sűis KëShNo ratings yet

- Latihan Bank ReconDocument4 pagesLatihan Bank ReconAndrew MikiNo ratings yet

- Brandy Corbin SolutionsDocument5 pagesBrandy Corbin Solutionsadeel499No ratings yet

- Acc136 Module GuideDocument36 pagesAcc136 Module Guidemcskelta8No ratings yet

- Problem 2-2A: InstructionsDocument6 pagesProblem 2-2A: Instructionspratik2000No ratings yet

- CH 7 - Assignment 1 SolutionDocument4 pagesCH 7 - Assignment 1 SolutionBoitumelo MatjeleNo ratings yet

- Pretest - Cash and ReceivablesDocument5 pagesPretest - Cash and ReceivablesMycah AliahNo ratings yet

- Name: Nguyen Thi Tien Tien: InstructionsDocument20 pagesName: Nguyen Thi Tien Tien: InstructionsChery Tiên TiênNo ratings yet

- Answers To Extra QuestionsDocument8 pagesAnswers To Extra QuestionsHashani KumarasingheNo ratings yet

- Tugas Pertemuan 4Document6 pagesTugas Pertemuan 4Muhammad Musaid Rafii MaradityaNo ratings yet

- E 16.3 Date Account Ref DR CRDocument13 pagesE 16.3 Date Account Ref DR CRNicolas ErnestoNo ratings yet

- Assignment 1 G10 - ACCT9700Document8 pagesAssignment 1 G10 - ACCT9700Senior BrosNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- 4 Preparing A Bank ReconciliationDocument9 pages4 Preparing A Bank ReconciliationSamuel DebebeNo ratings yet

- Home Control Work - Variant 10 - Le Duc Tuan Minh - IFF18-3kDocument15 pagesHome Control Work - Variant 10 - Le Duc Tuan Minh - IFF18-3kMinh LêNo ratings yet

- Suggested Answers PSPM AA015 2021Document9 pagesSuggested Answers PSPM AA015 2021Shiela shiniNo ratings yet

- IT Application15. Ann Marie C. GeligDocument15 pagesIT Application15. Ann Marie C. GeligGlaizel LarragaNo ratings yet

- 04 Branch AccountsDocument23 pages04 Branch Accountslasix47725No ratings yet

- 04 Branch Accounts PQ SolDocument24 pages04 Branch Accounts PQ Soltyagivansh1200No ratings yet

- ACC10 - Journal Entry, T-AccountDocument1 pageACC10 - Journal Entry, T-AccountVimal KvNo ratings yet

- Class Practice Qs 2 - Janet - Journalizing and Posting - With SolutionDocument7 pagesClass Practice Qs 2 - Janet - Journalizing and Posting - With SolutionAhmed P. FatehNo ratings yet

- Double Entry Book-Keeping Part IDocument7 pagesDouble Entry Book-Keeping Part IHsu Lae NandarNo ratings yet

- Worksheet Chapter 1 Accruals and prepayments (應計與預付項目)Document5 pagesWorksheet Chapter 1 Accruals and prepayments (應計與預付項目)Aejaz MohamedNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- ACCT 6010 Assignment #1Document15 pagesACCT 6010 Assignment #1patel avaniNo ratings yet

- Module 9 - Accounts and Financial ServicesDocument4 pagesModule 9 - Accounts and Financial ServicesAshleigh JarrettNo ratings yet

- ComprehensiveaccountinghwDocument11 pagesComprehensiveaccountinghwapi-348361031No ratings yet

- Topic 1 - Control AccountsDocument17 pagesTopic 1 - Control AccountsVarsha GhanashNo ratings yet

- Assignment-4 and 8Document15 pagesAssignment-4 and 8Carla Sader0% (1)

- Funko - Versiã N Avanzada - SOLUCIÃ NDocument11 pagesFunko - Versiã N Avanzada - SOLUCIÃ Nlucia guoNo ratings yet

- 100 Answers - Past PapersDocument4 pages100 Answers - Past PaperspmainaNo ratings yet

- Cash, BNK Recon and AR Answer KeyDocument6 pagesCash, BNK Recon and AR Answer KeyNanya BisnestNo ratings yet

- Jurnal 1Document8 pagesJurnal 1William MangumbanNo ratings yet

- ch2 2-5 Mastery ProblemDocument4 pagesch2 2-5 Mastery Problemapi-510166083No ratings yet

- Practice SetDocument100 pagesPractice SetZamantha Oliveros100% (1)

- Usa Ma 21Document9 pagesUsa Ma 21Usama17No ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Suspense AccountsDocument5 pagesSuspense Accountsr233684qNo ratings yet

- ACC 201 Assesment #1 FALL 2020Document2 pagesACC 201 Assesment #1 FALL 2020Bj RootsNo ratings yet

- Ink Books SuppliesDocument81 pagesInk Books SuppliesZamantha Oliveros100% (1)

- Ink Books SuppliesDocument63 pagesInk Books SuppliesZamantha Oliveros100% (1)

- Assignment - 1 (Revised)Document8 pagesAssignment - 1 (Revised)RaffyNo ratings yet

- Ink Books Supplies 2Document94 pagesInk Books Supplies 2Zamantha Oliveros100% (1)

- Audit Cash - Aud ProblemsDocument36 pagesAudit Cash - Aud ProblemsIvy BautistaNo ratings yet

- Trail Balance 0 Ledger AccountsDocument8 pagesTrail Balance 0 Ledger AccountsMohamed AliNo ratings yet

- Dry Coffee Processing Plant-Business PlanDocument19 pagesDry Coffee Processing Plant-Business PlanAdam Calixte Mayo Mayo100% (1)

- Let's Check Activity 1: Practice Set 7 Mathematics in Our WorldDocument6 pagesLet's Check Activity 1: Practice Set 7 Mathematics in Our WorldMarybelle Torres VotacionNo ratings yet

- Chapter 2 - Standardisation and Food Food LegislationDocument49 pagesChapter 2 - Standardisation and Food Food LegislationLam Thoại NguyễnNo ratings yet

- PW84PRP4819931 SoaDocument5 pagesPW84PRP4819931 Soasadhamba3No ratings yet

- Muhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofDocument3 pagesMuhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofsyahrinNo ratings yet

- 3396roll On Roll Off Ship Dock SafetyDocument20 pages3396roll On Roll Off Ship Dock SafetyJosé Juan Hernández IzquierdoNo ratings yet

- Ultratech Cement Limited Unit: Maihar Cement Works SarlanagarDocument1 pageUltratech Cement Limited Unit: Maihar Cement Works Sarlanagarjogender kumarNo ratings yet

- MKTM028 FathimathDocument23 pagesMKTM028 FathimathShyamly DeepuNo ratings yet

- "A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDDocument2 pages"A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDPrashant Bansod100% (1)

- Company Profile - BravoFabsDocument14 pagesCompany Profile - BravoFabssong.anarNo ratings yet

- LESSON 2 - Basic Economic ProblemsDocument19 pagesLESSON 2 - Basic Economic Problemsalleah tapilNo ratings yet

- Banglalink Nabeela PPT Final (Iv-Vi)Document6 pagesBanglalink Nabeela PPT Final (Iv-Vi)Shahrear AkibNo ratings yet

- Shifting Paradigms On Strategic Customer Relationship ManagementDocument8 pagesShifting Paradigms On Strategic Customer Relationship ManagementRajeev ChinnappaNo ratings yet

- How To Be A Canteen ConcessionaireDocument2 pagesHow To Be A Canteen ConcessionairePersonal MailNo ratings yet

- Revenue Regulations No. 02-40Document46 pagesRevenue Regulations No. 02-40zelayneNo ratings yet

- Using Receivables Credit To CashDocument630 pagesUsing Receivables Credit To CashWilliam VelascoNo ratings yet

- Big 4Document13 pagesBig 4Samyak JainNo ratings yet

- UBS Client (CIS)Document3 pagesUBS Client (CIS)Osting Sebio0% (1)

- Design Thinkers' Starter PackDocument22 pagesDesign Thinkers' Starter PackrafeheNo ratings yet

- Intermediate Microeconomic Theory. W3 W4Document12 pagesIntermediate Microeconomic Theory. W3 W4Wynnie RondonNo ratings yet

- Lecture No5 - Equal-Payment - Series-ModifiedDocument13 pagesLecture No5 - Equal-Payment - Series-Modifiedpoqwuradfo apdsoaafNo ratings yet

- Lecture 2 AcceptanceDocument12 pagesLecture 2 AcceptanceMason TangNo ratings yet

- CFAF Std. T&C (EL) - Standard Terms and Conditions Governing Education LoanDocument5 pagesCFAF Std. T&C (EL) - Standard Terms and Conditions Governing Education LoanAvinab PandeyNo ratings yet

- Literature Review of Working Capital Management PDFDocument6 pagesLiterature Review of Working Capital Management PDFbzknsgvkgNo ratings yet

- Project ReportDocument48 pagesProject ReportMalharNo ratings yet

- United Food Pakistan Balance Sheet For The Year 2011 To 2020Document34 pagesUnited Food Pakistan Balance Sheet For The Year 2011 To 2020tech& GamingNo ratings yet

- Executors Guide Digital Will Guide PackDocument6 pagesExecutors Guide Digital Will Guide PackOneNationNo ratings yet