Professional Documents

Culture Documents

Capital Structure

Capital Structure

Uploaded by

ManjushaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Structure

Capital Structure

Uploaded by

ManjushaCopyright:

Available Formats

5.

CAPITAL STRUCTURE

5.1. INTRODUCTION

Capital structure is the particular combination of debt and equity used by a company to finance its

overall operations and growth. Equity capital arises from ownership shares in a company and claims

Net Income

to its future cash flows and profits.

It is calculated by dividing total liabilities by total equity. Capital structures can be divided into 4

structures like-

Equity only Equity and Equity and Equity, debenture

Equity only

debentures preferences and preferences

OPTIMAL CAPITAL STRUCTURE

An optimal capital structure is the best mix of debt and equity financing that maximizes a company's

market value while minimizing its cost of capital. Minimizing the weighted average cost of capital

(WACC) is one way to optimize for the lowest cost mix of financing. We do maximum earning of

share – EBIT-EPS analysis Objective of optimum capital structure is –

Max value of firm

Max equity shareholder wealth

Max earning per share (EPS) Then choosing capital structure which ever is max and also mini cost

of capital.

FACTORS AFFECTING THE CAPITAL STRUCTURE:

Cost of debt

Cost of equity

Interest coverage ratio

COST OF DEBT: The cost of debt is the effective interest rate that a company pays on its debts,

such as bonds and loans.

COST OF EQUITY: Cost of equity is the return that a company requires for an investment or

project, or the return that an individual requires for an equity investment.

INTEREST COVERAGE RATIO: The interest coverage ratio is a debt and profitability ratio used to

determine how easily a company can pay interest on its outstanding debt.

Capital Structure

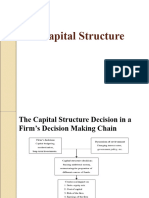

CAPITAL STRUCTURE THEORIES:

Theories

Net Operating Traditional Miller And Modigliani

Income Approaches

NET INCOME APPROACH :The Net Income Approach was presented by Durand. The theory suggests

increasing the value of the firm by decreasing the overall cost of capital which is measured in terms

of the Weighted Average Cost of Capital. This can be done by having a higher proportion of debt,

which is a cheaper source of finance compared to equity finance. Weighted Average Cost of Capital

(WACC) is the weighted average costs of equity and debts where the weights are the amount of

capital raised from each source. WACC = Required Rate of Return x Amount of Equity + Cost of debt

x Amount of Debt Total Amount of Capital (Debt + Equity) .

NET OPERATING INCOME APPROACH: Net Operating Income Approach to capital structure believes

that the value of a firm is not affected by the change of debt component in the capital structure. It

assumes that the benefit that a firm derives by infusion of debt is negated by the simultaneous

increase in the required rate of return by the equity shareholders. With an increase in debt, the risk

associated with the firm, mainly bankruptcy risk, also increases and such a risk perception increases

the expectations of the equity shareholders. This theory is just opposite to NI approach. NI approach

is relevant to capital structure decision. It means decision of debt equity mix does affect the WACC

and value of the firm. As per NOI approach the capital structure decision is irrelevant and the degree

of financial leverage does not affect the WACC and market value of the firm. NOI approach evaluates

the cost of capital and therefore the optimal Capital Structure on the basis of operating leverage by

means of NOI approach.

TRADITIONAL APPROACH :This approach does not define hard and fast facts, and it says that the

cost of capital is a function of the capital structure. The unique thing about this approach is that it

believes in an optimal capital structure. Optimal capital structure implies that the cost of capital is

minimum at a particular ratio of debt and equity, and the firm’s value is maximum for a more –

Traditional Approach.

MODIGLIANI AND MILLER APPROACH (MM APPROACH) It is a capital structure theory named after

Franco Modigliani and Merton Miller. MM theory proposed two propositions. Proposition I: It says

that the capital structure is irrelevant to the value of a firm. The value of two identical firms would

remain the same, and value would not affect the choice of finance adopted to finance the assets.

The value of a firm is dependent on the expected future earnings. It is when there are no taxes.

Proposition II: It says that the financial leverage boosts the value of a firm and reduces WACC. It is

when tax information is available.

DEBT EQUITY RATIO OF DEEPAK SPINNERS LIMITED:

Debt percentage=debt/debt+equity

Equity percentage=equity/debt+equity

year 2021 2020 2019 2018

debt percentage 22% 34% 41% 48%

year 2021 2020 2019 2018

equity

percentage 78% 66% 59% 52%

debt percentage

60%

50%

40%

30%

20%

10%

0%

2021 2020 2019 2018

equity percentage

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

2021 2020 2019 2018

You might also like

- Capital Structure and LeverageDocument31 pagesCapital Structure and Leveragealokshri25No ratings yet

- Capital Structure TheoryDocument10 pagesCapital Structure TheoryMd. Nazmul Kabir100% (1)

- Capital StructureDocument55 pagesCapital Structurekartik avhadNo ratings yet

- Leverage: Capital StructureDocument74 pagesLeverage: Capital Structurekomalgupta89No ratings yet

- FM AssignmentDocument16 pagesFM AssignmentSarvagya GuptaNo ratings yet

- RelianceDocument9 pagesRelianceIshpreet SinghNo ratings yet

- Capital StructureDocument41 pagesCapital StructureOloye ElayelaNo ratings yet

- FM S5 Capitalstructure TheoriesDocument36 pagesFM S5 Capitalstructure TheoriesSunny RajoraNo ratings yet

- Study MaterialDocument17 pagesStudy MaterialRohit KumarNo ratings yet

- Chapter 2 - CompleteDocument29 pagesChapter 2 - Completemohsin razaNo ratings yet

- Cfpresen 150305061517 Conversion Gate01Document18 pagesCfpresen 150305061517 Conversion Gate01Kiran BabuNo ratings yet

- Capital Structure Theory1Document9 pagesCapital Structure Theory1Kamba RumbidzaiNo ratings yet

- Numericals On Capital Structure Theories - KDocument12 pagesNumericals On Capital Structure Theories - Knidhi100% (1)

- QLesson 3 Capital StructureDocument63 pagesQLesson 3 Capital StructureSay SayNo ratings yet

- Unit 3rd Financial Management BBA 4thDocument18 pagesUnit 3rd Financial Management BBA 4thYashfeen FalakNo ratings yet

- Optimal Capital StructureDocument13 pagesOptimal Capital StructureScarlet SalongaNo ratings yet

- Capital Structure Financial StrategyDocument9 pagesCapital Structure Financial StrategyAyesha HamidNo ratings yet

- Chapter Four: Capital StructureDocument28 pagesChapter Four: Capital StructureFantayNo ratings yet

- Capital Structure Unit 3Document9 pagesCapital Structure Unit 3Hardita DhameliaNo ratings yet

- Capital Structure TheoriesDocument23 pagesCapital Structure Theorieskaran katariaNo ratings yet

- University of Central Punjab: F 2020 Course Title: Financial Strategy Course Code: IVA5833Document8 pagesUniversity of Central Punjab: F 2020 Course Title: Financial Strategy Course Code: IVA5833Ayesha HamidNo ratings yet

- Capital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmDocument11 pagesCapital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmArun NairNo ratings yet

- Vision Institute of Accountancy: Financial ManagementDocument13 pagesVision Institute of Accountancy: Financial ManagementtitrasableNo ratings yet

- Capital Structure TheoriesDocument13 pagesCapital Structure TheoriesShruti AshokNo ratings yet

- Captial StructureDocument51 pagesCaptial Structurepragyaan classesNo ratings yet

- Welcome To The Presentation: Presenter: Dibakar Chandra DasDocument25 pagesWelcome To The Presentation: Presenter: Dibakar Chandra Dasdibakardas10017No ratings yet

- Mba NotesDocument12 pagesMba NotesSrishtiNo ratings yet

- Capital Structure: Meaning of Capital Structure Theories of Capital StructureDocument21 pagesCapital Structure: Meaning of Capital Structure Theories of Capital Structureashanil07No ratings yet

- Capital Structure and Firm ValueDocument39 pagesCapital Structure and Firm ValueIndrajeet KoleNo ratings yet

- 11a-Capital Structure TG1Document17 pages11a-Capital Structure TG1Discovery School libraryNo ratings yet

- Lesson 22 Capital Structure TheoriesDocument6 pagesLesson 22 Capital Structure TheoriesSana Ur Rehman100% (1)

- Capital Structure TheoriesDocument9 pagesCapital Structure TheoriesMahesh HadapadNo ratings yet

- FM L20 (Part 1)Document16 pagesFM L20 (Part 1)Sahil DagarNo ratings yet

- F D C S: Inancing Ecisions Apital TructureDocument54 pagesF D C S: Inancing Ecisions Apital TructurePrabhatiNo ratings yet

- Capital StructureDocument36 pagesCapital StructureAishvarya PujarNo ratings yet

- Capital Structure TheoriesDocument2 pagesCapital Structure TheoriesTHEOPHILUS ATO FLETCHERNo ratings yet

- Week 12 Risk ManagementDocument29 pagesWeek 12 Risk ManagementRay Mund100% (1)

- FM Sheet 4 (JUHI RAJWANI)Document8 pagesFM Sheet 4 (JUHI RAJWANI)Mukesh SinghNo ratings yet

- Capital Structure DecisionDocument10 pagesCapital Structure DecisionDrusti M SNo ratings yet

- Capital Structure TheoriesDocument14 pagesCapital Structure TheoriesbuddingbachelorNo ratings yet

- Leverage: Let's DiscussDocument9 pagesLeverage: Let's DiscussClaudette ManaloNo ratings yet

- Theories of Capital Stracture: Presented byDocument18 pagesTheories of Capital Stracture: Presented bySaleem Ul QamarNo ratings yet

- Capital Structure CH 16 CFA SlidesDocument20 pagesCapital Structure CH 16 CFA SlidesMrinal BajajNo ratings yet

- Capital Structure TheoriesDocument26 pagesCapital Structure Theoriesprajii100% (1)

- FM Unit 2Document24 pagesFM Unit 2KarishmaNo ratings yet

- Capital StructureDocument28 pagesCapital Structureluvnica6348No ratings yet

- FM Capital Structure TheoryDocument6 pagesFM Capital Structure Theoryjabeenbegum916No ratings yet

- Net Income ApproachDocument6 pagesNet Income ApproachDisha Ganatra80% (5)

- Capital StructureDocument28 pagesCapital Structureyaatin dawarNo ratings yet

- Financial Management Chapter 5Document60 pagesFinancial Management Chapter 5CA Uma KrishnaNo ratings yet

- Unit IVDocument48 pagesUnit IVGhar AjaNo ratings yet

- Advanced Financial ManagementDocument23 pagesAdvanced Financial ManagementDhaval Lagwankar75% (4)

- CF Assignment - Capital Structure - FreshDocument3 pagesCF Assignment - Capital Structure - Freshganesh gowthamNo ratings yet

- Capital StructureDocument41 pagesCapital StructureRAJASHRI SNo ratings yet

- Advance Financial ManagementDocument62 pagesAdvance Financial ManagementKaneNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- HRM Work BookDocument13 pagesHRM Work BookManjushaNo ratings yet

- OM Batch-29 PPTDocument194 pagesOM Batch-29 PPTManjushaNo ratings yet

- BM AssignmentDocument3 pagesBM AssignmentManjushaNo ratings yet

- Impact of Covid On Global LogisticsDocument7 pagesImpact of Covid On Global LogisticsManjushaNo ratings yet

- VijethaDocument7 pagesVijethaManjushaNo ratings yet

- UntitledDocument479 pagesUntitledshantanuNo ratings yet

- Advanced Accounting-2 Company: HoldingDocument20 pagesAdvanced Accounting-2 Company: HoldingTB AhmedNo ratings yet

- Tutorial 1 - Financial Statement (Basic)Document6 pagesTutorial 1 - Financial Statement (Basic)danial kalNo ratings yet

- Kepada Yth. /: Ahmad Afdul GufronDocument7 pagesKepada Yth. /: Ahmad Afdul GufronSujinta AnnasNo ratings yet

- 14 Zutter Smart MFBrief 15e ch14Document69 pages14 Zutter Smart MFBrief 15e ch14My videos My videoNo ratings yet

- Fabm Perf TaskDocument2 pagesFabm Perf TaskJohn Wayne LaynesaNo ratings yet

- Intermediate Accounting I - Chapter 1Document35 pagesIntermediate Accounting I - Chapter 1Wijdan Saleem EdwanNo ratings yet

- Bank Regulatory CapitalDocument9 pagesBank Regulatory CapitalDristi PoddarNo ratings yet

- Theories Cash and Cash EquivalentsDocument9 pagesTheories Cash and Cash EquivalentsJavadd KilamNo ratings yet

- Fins5514 L04 2023 PDFDocument78 pagesFins5514 L04 2023 PDFwilliam YuNo ratings yet

- Ppe RevaluationDocument6 pagesPpe RevaluationjonapdfsNo ratings yet

- Short Term BudgetingDocument37 pagesShort Term BudgetingVeronica JaraNo ratings yet

- 8 Business Purchase and MergerDocument39 pages8 Business Purchase and Mergerprincessaay99No ratings yet

- Fabm-P eDocument12 pagesFabm-P eEmiel CepeNo ratings yet

- Financial Statement Analysis and Valuation 4th Edition Easton Test BankDocument30 pagesFinancial Statement Analysis and Valuation 4th Edition Easton Test BankTroyKnappdpci100% (15)

- Assessment Accounting - Exercise-U1Document5 pagesAssessment Accounting - Exercise-U1Anam KhanNo ratings yet

- ICARE First Preboard AFARDocument17 pagesICARE First Preboard AFARaceNo ratings yet

- Quiz 1 - Intacc 2Document9 pagesQuiz 1 - Intacc 2Usagi TsukkiNo ratings yet

- Afar Answerkey SynthesisDocument688 pagesAfar Answerkey SynthesisPearl Mae De VeasNo ratings yet

- Variables CompustatDocument22 pagesVariables Compustatmatthiaskoerner19No ratings yet

- Abfl-Tcns MergerDocument1 pageAbfl-Tcns MergermunniNo ratings yet

- FAR 2 Final Mock SolutionDocument11 pagesFAR 2 Final Mock SolutionsheldonjabrazaNo ratings yet

- Acc 201 CH 9Document7 pagesAcc 201 CH 9Trickster TwelveNo ratings yet

- Assignment 2023 For BPOI - 105 (005) (DBPOFA Prog)Document1 pageAssignment 2023 For BPOI - 105 (005) (DBPOFA Prog)Pawar ComputerNo ratings yet

- (FR - F7 - Tài liệu ôn thi) Part D - Preparation of financial statementsDocument17 pages(FR - F7 - Tài liệu ôn thi) Part D - Preparation of financial statementsTrúc Diệp KiềuNo ratings yet

- Petra Answer 21221Document5 pagesPetra Answer 21221wedu nchiniNo ratings yet

- Chingu WorksheetDocument74 pagesChingu Worksheetanis khanNo ratings yet

- Financial Statements Part BDocument29 pagesFinancial Statements Part Bhaleemafaizann2008No ratings yet

- Rectification of Error WorksheetDocument10 pagesRectification of Error WorksheetMayank VermaNo ratings yet

- Corporate Finance Cheat SheetDocument3 pagesCorporate Finance Cheat Sheet050610220479No ratings yet