Professional Documents

Culture Documents

Introduction To Tax (Summary)

Introduction To Tax (Summary)

Uploaded by

Loise MorenoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Tax (Summary)

Introduction To Tax (Summary)

Uploaded by

Loise MorenoCopyright:

Available Formats

INTRODUCTION TO TAXATION 4.

They are all ways in which the State interferes with private

rights and properties.

Taxation- defined as a State power, a legislative process, and a 5. They all exist independently of the Constitution and are

mode of government cost distribution. exercisable even without a Constitutional grant.

6. They all presuppose an equivalent from of compensation

1. State power- inherent power; to enforce proportional received by the persons affected by the exercise of the

contribution from its subjects for public purpose. power.

2. Legislative process- need to have a legislature to levy taxes 7. The exercise of these powers by the local government

3. Mode of cost distribution- allocate its cost or burden to its units may be limited by the national legislature.

subjects

Basis of Taxation--- mutuality of support between people and the

government.

Public Services

Government People

Taxes

*Receipt of benefits is conclusively presumed

Theories of Cost Allocation

1. Benefit received Theory-more benefits you receive, more

taxes you pay

2. Ability to Pay Theory – those who earn more; pay more

taxes

Lifeblood Doctrine- taxes are the lifeblood of the government.

Implications of the lifeblood doctrine in taxation:

1. Tax is imposed even in the absence of a Constitutional

grant.

2. Claims for tax exemption are construed against the

taxpayers.

3. The government reserves the right to choose the objects

of taxation.

Scope of the Taxation Power

4. The courts are not allowed to interfere with the collection

Taxation power is the most absolute of all powers of the

of taxes.

government

5. In taxation:

a. Income received in advance is taxable upon It is regarded as comprehensive, unlimited, plenary, and

receipt supreme (CUPS).

b. Deduction for capital expenditures and

prepayments is not allowed as it effectively Limitations of the Taxation Power

defers the collection of income tax 1. Inherent limitations

c. A lower amount of deduction is preferred when a. Territoriality of taxation

a claimable expense is subject to limit b. International comity

d. A higher tax base is preferred when the tax c. Public Purpose

object has multiple bases. d. Exemption of the government

e. Non-delegation of the taxing power

Inherent Powers of the State

1. Taxation power- the power to enforce proportional 2. Constitutional Limitations

contribution from its subjects to sustain itself a. Due process of law

2. Police power- the general power to enact laws to protect b. Equal protection of the law

the well-being of the people c. Uniformity rule in taxation

3. Eminent Domain- the power of the State to take private d. Progressive system of taxation

property for public use after paying just compensation. e. Non imprisonment for non-payment of debt or poll

tax

Similarities of the 3 Inherent Powers of the State f. Non-impairment of obligation and contract

1. They are all necessary attributes of the sovereignty g. Free worship rule

2. They are all inherent to the State h. Exemption of religious or charitable entities, non-

3. They are all legislative in nature profit cemeteries, churches and mosque from

property taxes

i. Non-appropriation of public funds or property for the Categories of Escapes from Taxation

benefit of any church, sect or system of religion I.Those that result to loss of government revenue

j. Exemption from taxes of the revenues and assets of 1. Tax Evasion- tax dodging; illegal

non-profit, non stock educational institutions. 2. Tax avoidance- legal, tax minimization; side stepping the law

k. Concurrence of a majority of all members of Congress 3. Tax exemption

for the passage of a law granting tax exemption

l. Non diversification of tax collections II.Those that do not result to loss of government revenue

m. Non delegation of the power of taxation 1. Shifting- transferring tax burden

n. Non impairment of the jurisdiction of the Supreme a. Forward shifting

Court to review tax cases b. Backward shifting

o. The requirement that appropriations, revenue, or c. Onward shifting

tariff bills shall originate exclusively in the House of 2. Capitalization

Representatives 3. Transformation

p. The delegation of taxing power to local government

units. Tax Amnesty- giving taxpayers to reform; covers both civil and

criminal liability; forgives retrospectively; requires payment

Stages of the Exercise of the Taxation Power

1. Levy or imposition- called impact of taxation; legislative Tax Condonation-tax remission. Forgiveness of a tax obligation;

act in taxation covers civil obligation; requires no payment; forgives prospectively

Matters of legislative discretion in the exercise of taxation

a. Determining the object of taxation

b. Setting the tax rate or amount to be collected

c. Determining the purpose of the levy which must be

public use

d. Kind of tax to be imposed

e. Apportionment of the tax between the national and

local government

f. Situs of taxation

g. Method of collection

2. Assessment and Collection – incidence of taxation;

administrative act of taxation

Situs of Taxation- place of taxation

Other Fundamental Doctrines in Taxation

1. Marshall Doctrine

2. Holme’s Doctrine

3. Prospectivity of Tax Laws

4. Non compensation or set off

5. Non assignment of taxes

6. Imprescriptibility in taxation

7. Doctrine of Estoppel

8. Judicial Non interference

9. Strict Construction of Tax Laws

Double Taxation – occurs when the same taxpayer is taxed twice by

the same tax jurisdiction for the same thing

Elements of double Taxation

1. Same Object

2. Same type of tax

3. Same purpose of tax

4. Same taxing jurisdiction

5. Same tax period

Type of Double Taxation

1. Direct Double Taxation

2. Indirect Double Taxation

Escapes from Taxation- means available to taxpayer to limit or avoid

impact of taxation.

You might also like

- Limitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationDocument5 pagesLimitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationEunice JusiNo ratings yet

- Public International LawDocument4 pagesPublic International LawMasoom Reza100% (2)

- 37 People v. Ringor PDFDocument1 page37 People v. Ringor PDFKEDNo ratings yet

- Aguirre V SOJDocument2 pagesAguirre V SOJJaz Sumalinog0% (1)

- Income TaxationDocument18 pagesIncome TaxationKwen Zel100% (1)

- Income Taxation NotesDocument3 pagesIncome Taxation NotesMa. Valerie LabareñoNo ratings yet

- TAX Major Quiz 1 Answer KeyDocument9 pagesTAX Major Quiz 1 Answer KeyTeresaNo ratings yet

- Lopez V CA Case DigestDocument3 pagesLopez V CA Case DigestMakjaz VelosoNo ratings yet

- Prelim TaxDocument5 pagesPrelim TaxDonna Zandueta-TumalaNo ratings yet

- Fundamental Principles of TaxationDocument34 pagesFundamental Principles of TaxationKaren DammogNo ratings yet

- Lecture 6 - Value-Added TaxDocument6 pagesLecture 6 - Value-Added TaxVic FabeNo ratings yet

- Crimpro Assignment 4Document78 pagesCrimpro Assignment 4yeahyetNo ratings yet

- Chapter 1 NotesDocument12 pagesChapter 1 NotesGerald Nitz PonceNo ratings yet

- Income Tax-100 QuestionsDocument5 pagesIncome Tax-100 QuestionsChez Nicole LimpinNo ratings yet

- Principles of A Sound Tax SystemDocument3 pagesPrinciples of A Sound Tax SystemhppddlNo ratings yet

- City of Manila v. Coca-Cola BottlersDocument17 pagesCity of Manila v. Coca-Cola BottlersRo CheNo ratings yet

- Chapter 2Document18 pagesChapter 2geexellNo ratings yet

- Tax Notes On Passive IncomeDocument4 pagesTax Notes On Passive IncomeMaria Anna M LegaspiNo ratings yet

- 2008 Bar Exam QuestionsDocument11 pages2008 Bar Exam QuestionsBlake Clinton Y. Dy100% (1)

- Bac 102 Income TaxationDocument24 pagesBac 102 Income TaxationErica BrionesNo ratings yet

- Past CPA Board On MASDocument11 pagesPast CPA Board On MASjoshNo ratings yet

- INCOME TAXATION REVIEWER-Fundamentals of TaxationDocument7 pagesINCOME TAXATION REVIEWER-Fundamentals of TaxationEli PinesNo ratings yet

- Philippine Christian University: Midterm Examination inDocument5 pagesPhilippine Christian University: Midterm Examination inleo pigafetaNo ratings yet

- The Usual Modes of Avoiding Occurrence of Double Taxation AreDocument8 pagesThe Usual Modes of Avoiding Occurrence of Double Taxation AreGIRLNo ratings yet

- Basic Principles of TaxationDocument15 pagesBasic Principles of TaxationmmhNo ratings yet

- Limitations On The Power of TaxationDocument3 pagesLimitations On The Power of TaxationanaNo ratings yet

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananNo ratings yet

- Taxation I Atty. Francisco Gonzalez General Principles of TaxationDocument45 pagesTaxation I Atty. Francisco Gonzalez General Principles of TaxationBea Czarina NavarroNo ratings yet

- 1 Fundamental Principles of TaxationDocument13 pages1 Fundamental Principles of TaxationAlted AluraNo ratings yet

- Estate TaxationDocument4 pagesEstate TaxationThe Brain Dump PHNo ratings yet

- CHAPTER 4 Obligations and ContractsDocument5 pagesCHAPTER 4 Obligations and ContractsDen0% (1)

- Gen. Principles of TaxationDocument22 pagesGen. Principles of TaxationPageduesca RouelNo ratings yet

- Module 7 Chapter 9 Input VATDocument7 pagesModule 7 Chapter 9 Input VATChris SumandeNo ratings yet

- Reaction Paper - Polsci ElanoDocument1 pageReaction Paper - Polsci ElanoLeri IsidroNo ratings yet

- Community Tax HandoutsDocument3 pagesCommunity Tax HandoutsKana Lou Cassandra BesanaNo ratings yet

- Local TaxationDocument16 pagesLocal TaxationJoAnne Yaptinchay ClaudioNo ratings yet

- Notes in SEC Circulars and IssuancesDocument13 pagesNotes in SEC Circulars and IssuancesJeremae Ann CeriacoNo ratings yet

- TRAIN Law (PWC Philippines)Document16 pagesTRAIN Law (PWC Philippines)Rose Ann Juleth Licayan100% (1)

- Parliamentry Debate RulebookDocument7 pagesParliamentry Debate RulebookAshish RanjanNo ratings yet

- Local Gov't Code Tax2 FinalDocument3 pagesLocal Gov't Code Tax2 FinalJenny JspNo ratings yet

- 2.1. Definition of TaxDocument15 pages2.1. Definition of TaxAyalew TayeNo ratings yet

- Unenforceable Contracts Rescissible Contracts Voidable ContractsDocument13 pagesUnenforceable Contracts Rescissible Contracts Voidable ContractsJv FerminNo ratings yet

- Chapters 6 Possible Questions and Reviewer in Separation of PowersDocument6 pagesChapters 6 Possible Questions and Reviewer in Separation of PowersMay Elaine BelgadoNo ratings yet

- Introduction To Income TaxationDocument10 pagesIntroduction To Income TaxationArielNo ratings yet

- TaxationDocument9 pagesTaxationEnitsuj Eam EugarbalNo ratings yet

- Political Law Bar QuestionsDocument12 pagesPolitical Law Bar QuestionsDaveyNo ratings yet

- MCQ On TaxDocument14 pagesMCQ On TaxruthannongNo ratings yet

- Problem 2Document2 pagesProblem 2Rio De LeonNo ratings yet

- University of The Cordilleras College of Law Criminal ProcedureDocument4 pagesUniversity of The Cordilleras College of Law Criminal ProcedureRowena DumalnosNo ratings yet

- Donation of Movable Property (Personal)Document5 pagesDonation of Movable Property (Personal)Lilliane EstrellaNo ratings yet

- Module 1-Tax AdministrationDocument7 pagesModule 1-Tax AdministrationBella RonahNo ratings yet

- Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDocument59 pagesIntermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldSumon iqbalNo ratings yet

- Chapter 13 - Income TaxesDocument23 pagesChapter 13 - Income TaxesAhmed HussainNo ratings yet

- Income TaxationDocument28 pagesIncome TaxationHi HelloNo ratings yet

- Taxation Quiz 1Document3 pagesTaxation Quiz 1Lexden MendozaNo ratings yet

- Essential Characteristics of TaxDocument1 pageEssential Characteristics of TaxMarinelle MejiaNo ratings yet

- Managerial Accounting-QuizDocument11 pagesManagerial Accounting-QuizPrincessNo ratings yet

- 006 - Ganzon V CADocument3 pages006 - Ganzon V CAPatrick ManaloNo ratings yet

- Final Income Taxation,: As Amended by Train LawDocument29 pagesFinal Income Taxation,: As Amended by Train LawElle Vernez100% (1)

- Kaanib v. IglesiaDocument2 pagesKaanib v. Iglesiarhod leysonNo ratings yet

- Commissioner of Internal Revenue vs. Court of Tax Appeals, G.R. No. 106611 (July 21, 1994)Document6 pagesCommissioner of Internal Revenue vs. Court of Tax Appeals, G.R. No. 106611 (July 21, 1994)Lou AquinoNo ratings yet

- Abakada Guro Party List Vs Executive SecretaryDocument8 pagesAbakada Guro Party List Vs Executive SecretaryshelNo ratings yet

- Taxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDocument2 pagesTaxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDeyNo ratings yet

- RPH Quiz 3Document3 pagesRPH Quiz 3Loise MorenoNo ratings yet

- American Economic PolicyDocument1 pageAmerican Economic PolicyLoise MorenoNo ratings yet

- Construction Schedule - Pert CPM ProjectDocument1 pageConstruction Schedule - Pert CPM ProjectLoise MorenoNo ratings yet

- El FiliDocument21 pagesEl FiliLoise MorenoNo ratings yet

- Opman TQMDocument19 pagesOpman TQMLoise MorenoNo ratings yet

- Part 1 (Nature, Definition and Classes)Document4 pagesPart 1 (Nature, Definition and Classes)Loise MorenoNo ratings yet

- Online Interview W An OFWDocument4 pagesOnline Interview W An OFWLoise MorenoNo ratings yet

- Unclaimed Balances ActDocument2 pagesUnclaimed Balances ActLoise MorenoNo ratings yet

- Issue No. 2 - RevisedDocument2 pagesIssue No. 2 - RevisedLoise MorenoNo ratings yet

- PDIC LawDocument9 pagesPDIC LawLoise MorenoNo ratings yet

- CombinepdfDocument39 pagesCombinepdfLoise MorenoNo ratings yet

- Feelings and Moral Decision Making PDFDocument16 pagesFeelings and Moral Decision Making PDFLoise MorenoNo ratings yet

- Rizal OutlineDocument11 pagesRizal OutlineLoise MorenoNo ratings yet

- ECOMANDocument2 pagesECOMANLoise MorenoNo ratings yet

- Seasonal Variations in Data: Seasons Can Vary From Daily, Weekly, Monthly, Quarterly, EtcDocument7 pagesSeasonal Variations in Data: Seasons Can Vary From Daily, Weekly, Monthly, Quarterly, EtcLoise MorenoNo ratings yet

- Staso NotesDocument2 pagesStaso NotesLoise MorenoNo ratings yet

- Handout in Letters, Memos, and AgendaDocument11 pagesHandout in Letters, Memos, and AgendaLoise MorenoNo ratings yet

- October 17, 1946: Dr. Carol Susan DweckDocument3 pagesOctober 17, 1946: Dr. Carol Susan DweckLoise MorenoNo ratings yet

- A PARTNERSHIP Is A Contract of Two or More Persons Who Contribute MoneyDocument2 pagesA PARTNERSHIP Is A Contract of Two or More Persons Who Contribute MoneyLoise MorenoNo ratings yet

- Cout Heirship Certificate FormatDocument3 pagesCout Heirship Certificate FormattanmaystarNo ratings yet

- People v. Sekona: Not To Be Published in Official ReportsDocument29 pagesPeople v. Sekona: Not To Be Published in Official ReportsCarl Joshua RioNo ratings yet

- Motion To Reconsider Outside Circuit Judges in Bochra v. U.S. Department of EducationDocument35 pagesMotion To Reconsider Outside Circuit Judges in Bochra v. U.S. Department of EducationEvangelionNo ratings yet

- Chapter 1 ObligationsDocument8 pagesChapter 1 Obligationsjaanice iwaizumiNo ratings yet

- Valisno v. AdrianoDocument8 pagesValisno v. AdrianoArvy AgustinNo ratings yet

- Notes On Hierarchy & Functions of Courts in India Module One of Gen LawDocument11 pagesNotes On Hierarchy & Functions of Courts in India Module One of Gen LawPuneet AgarwalNo ratings yet

- Up Judiciary Notification 6 0255f8c2c9acdDocument1 pageUp Judiciary Notification 6 0255f8c2c9acdAnmol GoswamiNo ratings yet

- LAW 116 - Reyes v. Reyes (A.M. No. MTJ-06-1623)Document2 pagesLAW 116 - Reyes v. Reyes (A.M. No. MTJ-06-1623)Aaron Cade Carino100% (1)

- Gosling - V - Secretary of State For The Home DepartmentDocument28 pagesGosling - V - Secretary of State For The Home DepartmentFuzzy_Wood_PersonNo ratings yet

- ECtHR - Marina V Romania EnglishDocument15 pagesECtHR - Marina V Romania EnglishcrazysttrikerNo ratings yet

- Jimenez vs. FranciscoDocument26 pagesJimenez vs. FranciscoRhona MarasiganNo ratings yet

- Wa0011.Document23 pagesWa0011.sumantluoyi115No ratings yet

- Syllabus, Faculty of Law NEB (Grade 11 and 12) : Educational InformationDocument27 pagesSyllabus, Faculty of Law NEB (Grade 11 and 12) : Educational InformationTilakram LamsalNo ratings yet

- 6 Consunji Vs CA CassedDocument11 pages6 Consunji Vs CA CassedRexNo ratings yet

- Massachusetts-Residential-Lease-Agreement KEITHDocument7 pagesMassachusetts-Residential-Lease-Agreement KEITHjamesNo ratings yet

- Heirs of The Late Reinoso, Sr. v. CADocument1 pageHeirs of The Late Reinoso, Sr. v. CAKISSINGER REYESNo ratings yet

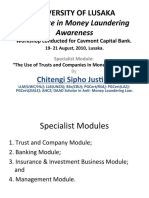

- The Use of Trusts and Corporations in Money LaunderingDocument15 pagesThe Use of Trusts and Corporations in Money LaunderingCHITENGI SIPHO JUSTINE, PhD Candidate- Law & PolicyNo ratings yet

- Chapter 4 Civil Liberties Vocabulary 22 23Document11 pagesChapter 4 Civil Liberties Vocabulary 22 23Caleb CNo ratings yet

- Pritax Prelim Bsa Summer 2021Document3 pagesPritax Prelim Bsa Summer 2021Sassy BitchNo ratings yet

- Crim Premidterms Book 1 PDFDocument94 pagesCrim Premidterms Book 1 PDFLynielle CrisologoNo ratings yet

- Law Paper 1Document7 pagesLaw Paper 1api-315607531No ratings yet

- Practice SAC 2021Document35 pagesPractice SAC 2021Edris ZamaryalNo ratings yet

- Comment To FOEDocument2 pagesComment To FOERuby Joyce TabbuNo ratings yet

- Odwin Gonzalez Pacheco - ATTWN Anticipation Guide Response Doc - 7013996 PDFDocument3 pagesOdwin Gonzalez Pacheco - ATTWN Anticipation Guide Response Doc - 7013996 PDFOdwin Gonzalez PachecoNo ratings yet

- Antonio B. Abinoja For Petitioner. Quijano, Arroyo & Padilla Law Office For RespondentsDocument3 pagesAntonio B. Abinoja For Petitioner. Quijano, Arroyo & Padilla Law Office For RespondentsJosef MacanasNo ratings yet

- Academic Freedom (Lecture 3)Document12 pagesAcademic Freedom (Lecture 3)Abay GeeNo ratings yet

- Mistake of Law and FactDocument13 pagesMistake of Law and Factठाकुर अनिकेत प्रताप सिंहNo ratings yet