Professional Documents

Culture Documents

DocScan 12 31 2021 PDF

DocScan 12 31 2021 PDF

Uploaded by

Abhishek J T0 ratings0% found this document useful (0 votes)

9 views5 pagesOriginal Title

DocScan_12_31_2021.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

9 views5 pagesDocScan 12 31 2021 PDF

DocScan 12 31 2021 PDF

Uploaded by

Abhishek J TCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 5

FORM NO. 10AC

(See rule [7/1 AA/2C)

Order for registration

1 PAN AAOTS8289H

2 Name SUPRABHA EDUCATIONAL

AND CHARITABLE TRUST

2a Address

FlavDoor/Building 12, 9th Cross, C/o Manjunatha

Provision Stores,

Name of premises/Building/Village Opp.Manjusri Kalyan Mantap, FF

Layout, Laggere

Road/Street/Post Office Peenya | Stage S.O.

Area/Locality Bangalore North

TownCity/Distriet BANGALORE

State Kamataka

Country INDIA

Pin Code/Zip Code 560058

3 Document Identification Number AAOTS8289HE2021401

4 Application Number 1492436001 11221

5 Unique Registration Number AAOTS8289HE20214

6 Section/sub-section/clause/sub-clause/proviso in | 01-Sub clause (i) of clause (ac) of

which registration is being granted sub -section (1) of section 12A

7 Date of registration 31-12-2021

8g Assessment year or years for which the trust or | From AY 2022-23 to AY 2026-

institution is registered 2027

9 Order for registration:

a. Affer considering the application of the applicant and the material available on

record, the applicant is hereby granted registration with effect from the assessment

year mentioned at serial no 8 above subject to the conditions mentioned in row

number 10.

b. The taxability, or otherwise, of the income of the applicant would be separately

considered as per the provisions of the Income Tax Act, 1961.

¢. This order is liable to be withdrawn by the prescribed authority if it is subsequently

found that the activities of the applicant are not genuine or if they are not carried out

in accordance with all or any of the conditions subject to which it is granted, if it is

found that the applicant has obtained the registration by fraud or misrepresentation of

facts or it is found that the assessee has violated any condition prescribed in the

Income Tax Act, 1961.

10

Conditions subject to which registration is being granted

‘The registration is granted subject to the following conditions:-

a. As and when there is a move to amend or alter the objects/rules and regulations of

the applicant, prior approval of the Commissioner of Income Tax shall be sought

along with the draft of the amended deed and no such amendment shall be effected

until and unless the approval is accorded.

ization,

», In the event of dissolution, surplus and assets shall be given to an or;

rectly to

which has similar objects and no part of the same will go directly or in

anybody specified in section 13(3) of the Income Tax Act, 1961.

c. In case the trusV/institution is converted into any form, merged into any other entity

or dissolved in any previous year in terms of provisions of section 115TD, the

applicant shal! be liable to pay tax and interest in respect of accreted income within

specified time as per provisions of section 11STD to 115TF of the Income Tax Act,

1961 unless the application for fresh registration under section 12AB for the said

previous year is granted by the Commissioner.

d. The Trust/ Institution should quote the PAN in al its communications with the

Department

¢. The registration u/s 12AB of the Income Tax Act, 1961 does not automatically

confer any right on the donors to claim deduction u/s 80G.

£. Order w/s 12AB read with section 12A does not confer any right of exemption upon

the applicant ws 11 and 12 of Income Tax Act, 1961. Such exemption from taxation —

will be available only afier the Assessing Officer is satisfied about the genuineness of

the activities promised or claimed to be carried on in each Financial Year relevant to

the Assessment Year and all the provisions of law acted upon. This will be further

subject to provisions of section 2(15) of the Income Tax Act, 1961,

g. No change in terms of Trust Deed/ Memorandum of Association shall be effected

without due procedure of law and its intimation shall be given immediately to Office

of the Jurisdictional Commissioner of Income Tax. The registering authority reserves

the right to consider whether any such alteration in objects would be consistent with

the definition of "charitable purpose" under the Act and in conformity with the

requirement of continuity of registration.

h. The Trust/ Society/ Non Profit Company shall maintain accounts regularly and

shall get these accounts audited in accordance with the provisions of the section

12A(1)(b) of the Income Tax Act, 1961. Seperate accounts in respect of each activity

| as specified in Trust Deed/ Memorandum of Association shall be maintained. A copy

of such account shall be submitted to the Assessing Officer. A public notice of the

activities carried on/ to be carried on and the target group(s) (intented beneficiaries)

shall be duly displayed at the Registered/ Designated Office of the Organisation.

i, The Trust/ Institution shall furnish a retum of income every year within the time

limit prescribed under the Income Tax Act, 1961.

4. Seperate accounts in respect of profits and gains of business incidental to

attainment of objects shall be maintained in compliance to section 11(4A) of Income

Tax Act, 1961.

k. The registered office or the principal place of activity of the applicant shouid not

be transferred outside the jurisdiction of Jurisdictional Commissioner of Income Tax

except with the prior approval.

L. No asset shall be transferred without the knowledge of Jurisdictional Commissioner

of Income Tax to anyone, including to any Trust/ Society/ Non Profit Company etc.

m. The registration so granted is liable to be cancelled at any point of time if the

registering authority is satisfied that activities of the Trust/ Institution/ Non Profit

Company are not genuine or are not being carried out in accordance with the objects

of the Trust/ Institution/ Non Profit Company.

1. If itis found later on that the registration has been obtained fraudulently by

misrepresentation or suppression of any fact, the registration so granted is liable to be

cancelled as per the provision w/s section 12AB(4) of the Act. J

0. This certificate cannot be used as a basis for claiming non-deduction of tax at

source in respect of investments etc. relating to the Trust Institution.

p. All the Public Money so received including for Corpus or any contribution shall be

outed through a Bank Account whose number shall be communicated to Office of

the Jurisdictional Commissioner of Income Tax.

4g. The applicant shall comply with the provisions of the Income Tax Act, 1961 read

with the Income Tax Rules, 1962.

+, The registration and the Unique registration number has been instantly granted and

if, at any point of time, it is noticed that form for registration has not been duly filled

in by not providing, fully or partly, or by providing false or incorrect information or

documents required to be provided under sub-rule (1) or (2) of | tule 17A or by not

complying with the requirements of sub- rule (3) or (4) of the said rule, the

registration and Unique Registration Number (URN), shall be cancelled and the

registration and URN shall be deemed to have never been granted or issued.

Name and Designation of the Registration _| Principal Commissioner of Income

Granting Authority ‘Tax/ Commissioner of Income Tax

(Digitally signed)

ages

Sate 143028

iF

FORM NO. 10AC

(See mle HAUTIAARC)

Onder for approval

AAOTSS289H

SUPRABHA EDUCATIONAL

AND CHARIT ‘AL b TRUS 1

2a Address a

FlaDoor/Building 12, 9th Cros Manjunatha:

Provision S _

Name of premises/Building/Village Opp. Manjusri Kalyan Mantap, PF

Layout, Logge! _

Road/StreevPost Office Peenya Ist —

Area/Locatity - Bangalore North _

Town/City/Distriet BANGALORE __

State | Ramataka

Country INDLA,

_| Pin Code/Zip Code ___|s60058

3 Document Identification Number AAOTSS289H

4 Application Number 14996921011 1221 _|

3 Unique Registration Number AAOTS8289H1

6 Section/sub-section/clause/sub-clause/proviso in | 11~Clause (i) of first proviso to

which approval is being granted sub-section (8) of section 80G___|

7 Date of approval 31-12-2021

3 ‘Assessment year or years for which the trust or | From AY 2022-23 to AY 2026-

institution is approved 2027 Seer!

9 Order for approval: _ ee

a. After considering the application of the applicant and the material available on

record, the applicant is hereby granted approval with effect from the assessment yeur

mentioned at serial no 8 above subject to the conditions mentioned in row number 10

:

b. The taxability, or otherwise, of the income of the applicant would be separately

considered as per the provisions of the Income Tex Act, 1961.

¢. This onder is liable to be withdrawn by the prescribed authority if it is subsequently

found that the activitics of the applicant are not genuine of if they are not carried out

in accordance with all or any of the conditions subject to which it is granted, it it is

found that the applicant has obtained the approval by faux! or mistepresentation of

facts or it is found that the assessee has violated any condition prescribed in the

Income Tax Act, 1961.

10 | Conditions subject to which approval is being granted

‘The approval is granted subject to the following conditior

1. No change in the deed of the applicant trusU/society/non profit comipany or any of

{ts byo-laws shall be affected without the due procedure of kaw and the approval of

the Competent Authority as per provisions of law and its intimation shall be given.

immediately to Office of the Jurisdictional Commissioner of Income Tax and to the

Assessing Officer.

b. Any change in the trustees or address of the applicant trustsociety non-profit

company shall be intimated forthwith to Office of the Jurisdictional Commissioner of

Income Tax and to the Assessing Officer.

&. The applicant trusUsociety/non profit company shall maintain its accounts

Tegularly and also get them audited as per the provisions of section 80G(5)(iv) read

vith section 124(7}(b)/10(23C) of the Income Tax Act, 1961,

[

| &. Certificate of donation shall be issued to the donor in form no LOBE, as per the

provisions of rule ISAB,

| &. No cess or fee or any other consideration shall be received in violation of section

| 2115) of the Income Tax Act, 1961

| £. The trust/society/non profit company shall file the return of income of its

rustsociety/non profit company as per the provisions of section 139(1)/(4A)/(4C) of

| the Income Tax Act, 1961.

&. The approval granted through this order shall apply to the donations received only

| tthe applicant trust society/non profit company, established in India for charitable

Purpose, fulfills the conditions laid down in section 80G(5) of the Income Tax Act,

1961 and the religious expenditure does not exceed the limit specified in section

80G(SB) of the said Act.

h. If the applicant trust’ society’ non-profit company derives any income, being

profits and gains of business, it shall maintain separate books of account in respect of

| such business as provided in section 80G(5\(i) of the Income Tax Act, 1961 Further,

any donation received by the applicant shall not be used, directly ot indirectly, for the

Purposes of such business and a certificate shall be issued to every person making

donation to the effeet that the applicant maintains separate books ‘ofa ‘count in

of the business and the donation received by it will not be used, directly or

iret, forthe purpose ofthe business

i. The applicant shall comply with the provisions of the Income Tax Act, 1961 read

[with the Income Tax Rules, 1962.

|. The approval and the Unique registration number has been instantly granted and if,

any point of time, it is noticed that form for approval has not been duly filled in by

not providing, fully or partly, or by providing false of incorrect information or

documents required to be provided under sub-rule (1) or (2) of rule LAA of by not

complying with the requirements of sub- nule (3) of (4) of the said rule, the approval

and Unique Registration Number (URN), shall be cancelled and the approval and

URN shall be deemed to have never been issued of granted,

Name and Designation of the Approving Principal Commissioner of Income

Authonty Tax’ Commissioner of Income Tax

__| Digitally signed)

=f

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Aadhar Card PDFDocument1 pageAadhar Card PDFAbhishek J TNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Lokesh 1 PDFDocument1 pageLokesh 1 PDFAbhishek J TNo ratings yet

- Sri Vidyalakshi Enterprises 1 PDFDocument3 pagesSri Vidyalakshi Enterprises 1 PDFAbhishek J TNo ratings yet

- SBI Manager Four4 Bill PDFDocument3 pagesSBI Manager Four4 Bill PDFAbhishek J TNo ratings yet

- Gururaj Advocate Doc - Compressed PDFDocument7 pagesGururaj Advocate Doc - Compressed PDFAbhishek J TNo ratings yet

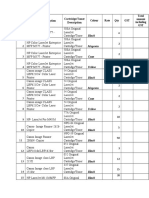

- Lakshmi Mobile Point 1 PDFDocument5 pagesLakshmi Mobile Point 1 PDFAbhishek J TNo ratings yet

- Program Doc Nag - Compressed PDFDocument5 pagesProgram Doc Nag - Compressed PDFAbhishek J TNo ratings yet

- Program Doc Nag PDFDocument5 pagesProgram Doc Nag PDFAbhishek J TNo ratings yet

- Gururaj Advocate PDFDocument7 pagesGururaj Advocate PDFAbhishek J TNo ratings yet

- SDA KRIDL 2023 Kannada Version PDFDocument19 pagesSDA KRIDL 2023 Kannada Version PDFAbhishek J TNo ratings yet

- Gururaj Advocate Doc - Compressed PDFDocument7 pagesGururaj Advocate Doc - Compressed PDFAbhishek J TNo ratings yet

- Shekhar Aadhhar PDFDocument1 pageShekhar Aadhhar PDFAbhishek J TNo ratings yet

- Funds PDFDocument1 pageFunds PDFAbhishek J TNo ratings yet

- Lakshmi Mobile Point PDFDocument5 pagesLakshmi Mobile Point PDFAbhishek J TNo ratings yet

- Trust Pan Card & 80G 12A Certificate PDFDocument3 pagesTrust Pan Card & 80G 12A Certificate PDFAbhishek J TNo ratings yet

- LWF PDFDocument1 pageLWF PDFAbhishek J TNo ratings yet

- SRS Tea Stall PDFDocument5 pagesSRS Tea Stall PDFAbhishek J TNo ratings yet

- Sri Vidhyalakshmi Enterprise 2 PDFDocument3 pagesSri Vidhyalakshmi Enterprise 2 PDFAbhishek J TNo ratings yet

- E Aasthi Circular Issued On Apr 2016 PDFDocument4 pagesE Aasthi Circular Issued On Apr 2016 PDFAbhishek J TNo ratings yet

- Mgnvy Nikethan Consultancy PDFDocument7 pagesMgnvy Nikethan Consultancy PDFAbhishek J TNo ratings yet

- Fda GK Kannada Version Question Paper 28 02 2021 PDFDocument21 pagesFda GK Kannada Version Question Paper 28 02 2021 PDFAbhishek J TNo ratings yet

- Rate Catridge PDFDocument2 pagesRate Catridge PDFAbhishek J TNo ratings yet

- Income Tax PDFDocument1 pageIncome Tax PDFAbhishek J TNo ratings yet

- HBL PDFDocument2 pagesHBL PDFAbhishek J TNo ratings yet

- Cess PDFDocument1 pageCess PDFAbhishek J TNo ratings yet

- Manjula N February-2023 Attendance Report PDFDocument1 pageManjula N February-2023 Attendance Report PDFAbhishek J TNo ratings yet

- k2 Bill DocumentDocument2 pagesk2 Bill DocumentAbhishek J TNo ratings yet

- GST 18 Percent PDFDocument1 pageGST 18 Percent PDFAbhishek J TNo ratings yet

- Account DetalsDocument1 pageAccount DetalsAbhishek J TNo ratings yet

- CBF PDFDocument1 pageCBF PDFAbhishek J TNo ratings yet