Professional Documents

Culture Documents

Solution Slides PDF

Solution Slides PDF

Uploaded by

Joe MoretCopyright:

Available Formats

You might also like

- HSBC Private Banking Competition 2022 Case ExampleDocument6 pagesHSBC Private Banking Competition 2022 Case ExampleMavelaineNo ratings yet

- CASE 8.1 Shipping Wood To MarketDocument11 pagesCASE 8.1 Shipping Wood To MarketYanto Sandy TjangNo ratings yet

- Unit DNI Example Assignment: © Nebosh 1Document32 pagesUnit DNI Example Assignment: © Nebosh 1Rahul Krishnan80% (5)

- Work Sample - M&A Private Equity Buyside AdvisingDocument20 pagesWork Sample - M&A Private Equity Buyside AdvisingsunnybrsraoNo ratings yet

- Hydrocarbon Accounting Solutions For Upstream Oil & GasDocument40 pagesHydrocarbon Accounting Solutions For Upstream Oil & Gasasadnawaz100% (2)

- MFin Employment Report - 2021FT - 2022INT - 1Document8 pagesMFin Employment Report - 2021FT - 2022INT - 1Zack ZhangNo ratings yet

- Risk Return UploadDocument15 pagesRisk Return UploadGauri TyagiNo ratings yet

- Poonawalla Fincorp LTD ULJK BUY 180422Document7 pagesPoonawalla Fincorp LTD ULJK BUY 180422sameer bakshiNo ratings yet

- 5544group H Group AssignmentDocument33 pages5544group H Group Assignmentmelodysze210593No ratings yet

- Class Discussion - Risk ReturnDocument2 pagesClass Discussion - Risk Returnyingrou.upacNo ratings yet

- Bluebay Multi Asset Credit Jan23Document7 pagesBluebay Multi Asset Credit Jan23Ali ImranNo ratings yet

- ACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarDocument14 pagesACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarchimbanguraNo ratings yet

- 1 - SFM Test Papers & Suggested AnswersDocument18 pages1 - SFM Test Papers & Suggested AnswersUDESH DEBATANo ratings yet

- Q2 2022 LLIN CommentaryDocument6 pagesQ2 2022 LLIN CommentaryTay YisiongNo ratings yet

- (012821) (020421) Krakatau Steel (B) - Global CompetitionDocument6 pages(012821) (020421) Krakatau Steel (B) - Global CompetitionYani RahmaNo ratings yet

- USAA Growth and Tax Strategy Fund - 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund - 2Q '22ag rNo ratings yet

- Questions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyDocument22 pagesQuestions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyNoura ShamseddineNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- 2022 Investor Factsheet - ENDocument2 pages2022 Investor Factsheet - ENRas AltNo ratings yet

- AMC Sector - HDFC Sec-201901111558114702001 PDFDocument99 pagesAMC Sector - HDFC Sec-201901111558114702001 PDFmonikkapadiaNo ratings yet

- Saxo Asset Allocation - 20090804Document5 pagesSaxo Asset Allocation - 20090804Trading Floor100% (2)

- Paper - 2: Strategic Financial Management Questions Swap: Years Sales Revenue ($ Million)Document29 pagesPaper - 2: Strategic Financial Management Questions Swap: Years Sales Revenue ($ Million)Raul KarkyNo ratings yet

- Goldman Sachs Global Millennials Equity Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVDocument4 pagesGoldman Sachs Global Millennials Equity Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVMario FighetosteNo ratings yet

- SOA-All-COURSE-8-Others-Exams-For-QFIC-Fall-2014 - 副本Document18 pagesSOA-All-COURSE-8-Others-Exams-For-QFIC-Fall-2014 - 副本cnmouldplasticNo ratings yet

- Capital Structure StudyDocument27 pagesCapital Structure StudyVictor OsipenkovNo ratings yet

- Saxo Asset Allocation - 20090904Document5 pagesSaxo Asset Allocation - 20090904Trading FloorNo ratings yet

- Corporate Finance and Portfolio ValuationDocument8 pagesCorporate Finance and Portfolio Valuationkbbao22.sjsNo ratings yet

- LIC Housing Ltd. - InitiatingDocument7 pagesLIC Housing Ltd. - InitiatingAnantharaman RamasamyNo ratings yet

- TCS RR 12042022 - Retail 12 April 2022 1386121995Document13 pagesTCS RR 12042022 - Retail 12 April 2022 1386121995uefqyaufdQNo ratings yet

- Montu - Lanco InfratechDocument2 pagesMontu - Lanco InfratechMontu AdaniNo ratings yet

- 1.session - Christopher Hamilton - InvescoDocument33 pages1.session - Christopher Hamilton - InvescoBG CHOINo ratings yet

- The Effect of Profitability, Leverage and Liquidity On Dividend Policies For Construction Issuers in 2014-2019Document15 pagesThe Effect of Profitability, Leverage and Liquidity On Dividend Policies For Construction Issuers in 2014-2019Achmad ArdanuNo ratings yet

- Assignment 2: RemarksDocument10 pagesAssignment 2: RemarksWyatt Paxton0% (2)

- USAA Cornerstone Equity Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Equity Fund 2022 - 1Qag rNo ratings yet

- Submitted By: Submitted To: Prof. Vinod K. AgarwalDocument19 pagesSubmitted By: Submitted To: Prof. Vinod K. AgarwalRahul JainNo ratings yet

- Impact of Foreign Direct Investment On Living StandardDocument13 pagesImpact of Foreign Direct Investment On Living StandardNwigwe Promise ChukwuebukaNo ratings yet

- Shrinking To Grow: Evolving Trends in Corporate Spin-OffsDocument12 pagesShrinking To Grow: Evolving Trends in Corporate Spin-OffsmdorneanuNo ratings yet

- 2021-03-10-SQ.N-Block Inc-JPMorgan-Tactical Equity Derivatives Strategy SQ Current... - 91620110Document10 pages2021-03-10-SQ.N-Block Inc-JPMorgan-Tactical Equity Derivatives Strategy SQ Current... - 91620110brookpointNo ratings yet

- Ba ZG521 Ec-3r First Sem 2023-2024Document5 pagesBa ZG521 Ec-3r First Sem 2023-2024chandanNo ratings yet

- EW00142ARDocument236 pagesEW00142ARbudi handokoNo ratings yet

- Motilal Oswal SELL On Fine Organic With 19% DOWNSIDE The PromisedDocument8 pagesMotilal Oswal SELL On Fine Organic With 19% DOWNSIDE The PromisedChiru MukherjeeNo ratings yet

- Victory INTGY Discovery Fund 2022 - 1QDocument2 pagesVictory INTGY Discovery Fund 2022 - 1Qag rNo ratings yet

- The Construction Productivity ImperativeDocument10 pagesThe Construction Productivity ImperativeNugraha Eka SaputraNo ratings yet

- CH 4 - Portfolio Management (2024) - HandoutDocument21 pagesCH 4 - Portfolio Management (2024) - HandoutMayibongwe MpofuNo ratings yet

- USAA Cornerstone Moderate Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Moderate Fund 2022 - 1Qag rNo ratings yet

- A A U.S. Q M ETF: Lpha Rchitect Uantitative OmentumDocument3 pagesA A U.S. Q M ETF: Lpha Rchitect Uantitative OmentumMonchai PhaichitchanNo ratings yet

- AlphaIndicator ECOH 20201031Document11 pagesAlphaIndicator ECOH 20201031hajdahNo ratings yet

- Financial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranDocument8 pagesFinancial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranShreyansh JainNo ratings yet

- Barbell Income Fund BrochureDocument8 pagesBarbell Income Fund BrochurecsNo ratings yet

- II 60 40 Portfolios (En)Document7 pagesII 60 40 Portfolios (En)AlexNo ratings yet

- Axis Global Innovation FoF NFO LeafletDocument2 pagesAxis Global Innovation FoF NFO LeafletKamalnath SinghNo ratings yet

- Integrated Waveguide Technologies Iwt Is A 6 Year Old Company Founded byDocument3 pagesIntegrated Waveguide Technologies Iwt Is A 6 Year Old Company Founded byAmit PandeyNo ratings yet

- دليل المستثمر في التقنية العميقة- إنجليزيDocument20 pagesدليل المستثمر في التقنية العميقة- إنجليزيwadaq.factoryNo ratings yet

- Document Incorporated by Reference Annual Report 2012 2014 10 06Document277 pagesDocument Incorporated by Reference Annual Report 2012 2014 10 06VinishaSonawaneNo ratings yet

- Question and AnsDocument33 pagesQuestion and AnsHawa MudalaNo ratings yet

- Victory INTGY Small/MID Cap Value Fund 2022 - 1QDocument2 pagesVictory INTGY Small/MID Cap Value Fund 2022 - 1Qag rNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- Rockford Executive Summary Presentation 10.8.18Document54 pagesRockford Executive Summary Presentation 10.8.18Isaac GuerreroNo ratings yet

- Polen Growth Fund: Product Profile Investment ObjectiveDocument3 pagesPolen Growth Fund: Product Profile Investment Objectivekaya nathNo ratings yet

- Answer All QuestionsDocument2 pagesAnswer All QuestionsNh FiyyNo ratings yet

- Gujarat Technological UniversityDocument5 pagesGujarat Technological UniversityJack mazeNo ratings yet

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- Toward An Implied Cost of Capital (Gebhardt Et Al., 2001)Document42 pagesToward An Implied Cost of Capital (Gebhardt Et Al., 2001)Joe MoretNo ratings yet

- Replicating AnomaliesDocument116 pagesReplicating AnomaliesJoe MoretNo ratings yet

- JR Reading GuideDocument5 pagesJR Reading GuideJoe MoretNo ratings yet

- The Price of InnovationDocument7 pagesThe Price of InnovationJoe MoretNo ratings yet

- HintsDocument10 pagesHintsJoe MoretNo ratings yet

- Fixed Income Guest Lecture Maurice Meijers (New)Document27 pagesFixed Income Guest Lecture Maurice Meijers (New)Joe MoretNo ratings yet

- Formula SheetDocument1 pageFormula SheetJoe MoretNo ratings yet

- CaseheroDocument5 pagesCaseheroJoe MoretNo ratings yet

- Adobe Scan Jul 04, 2023Document2 pagesAdobe Scan Jul 04, 2023Karthick KumarNo ratings yet

- Learning Outcome TaxDocument2 pagesLearning Outcome TaxNiño Mendoza MabatoNo ratings yet

- Form 4506 TDocument2 pagesForm 4506 Tbhill07No ratings yet

- An Assessment On The Practice and Challenges of Project Monitoring and EvaluationDocument72 pagesAn Assessment On The Practice and Challenges of Project Monitoring and EvaluationbenNo ratings yet

- Moriah Business Plan PDFDocument5 pagesMoriah Business Plan PDFally dereNo ratings yet

- Dispute Details Form (DDF)Document6 pagesDispute Details Form (DDF)Russell SoperNo ratings yet

- Evergreen Sweet House vs. Ever Green and OthersDocument6 pagesEvergreen Sweet House vs. Ever Green and Otherspranav771vermaNo ratings yet

- Pastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesDocument2 pagesPastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesJeremiah Marvin ChuaNo ratings yet

- Symantec Endpoint Protection 50 CloudDocument6 pagesSymantec Endpoint Protection 50 CloudadminakNo ratings yet

- Case 4 Hrm520 GowinsDocument6 pagesCase 4 Hrm520 GowinsAliza PlacinoNo ratings yet

- Concept of Salary Under Income Tax ActDocument29 pagesConcept of Salary Under Income Tax ActMaaz Alam100% (2)

- Case No. 6Document3 pagesCase No. 6Casey Jean GOMEZNo ratings yet

- Account Statement: PrakashDocument1 pageAccount Statement: PrakashRny buriaNo ratings yet

- VanguardDocument2 pagesVanguardRobert CastilloNo ratings yet

- Modern Management: Concepts and Skills: Fifteenth Edition, Global EditionDocument29 pagesModern Management: Concepts and Skills: Fifteenth Edition, Global EditionnotsaudNo ratings yet

- 095 Priyanka TejwaniDocument19 pages095 Priyanka TejwaniNitin BasoyaNo ratings yet

- HLF525 DeedAbsoluteSale V02Document3 pagesHLF525 DeedAbsoluteSale V02Permits & LicensingNo ratings yet

- Sa BucuriaDocument10 pagesSa BucuriaLiliana VrabieNo ratings yet

- AFA 3e SM Chap05Document97 pagesAFA 3e SM Chap05Trang MinhNo ratings yet

- RRACKS CatalogueDocument52 pagesRRACKS CataloguehennrycaspersNo ratings yet

- ZoOm Pitch DeckDocument5 pagesZoOm Pitch DeckHakimuddin TinwalaNo ratings yet

- 2013 AACEi TransactionsDocument5 pages2013 AACEi TransactionsAnonymous 19hUyemNo ratings yet

- Tender Enquiry Document: Medical Gas Pipe Line SystemDocument108 pagesTender Enquiry Document: Medical Gas Pipe Line SystemVikas PatidarNo ratings yet

- Feasibility Study On Agriculture and Agro IndustryDocument3 pagesFeasibility Study On Agriculture and Agro IndustryOyadare sarah0% (1)

- What Was John Connelly's Role in CCS As A Leader?Document1 pageWhat Was John Connelly's Role in CCS As A Leader?karthikawarrierNo ratings yet

- Provident FormDocument2 pagesProvident FormRyahNeil Bohol MoralesNo ratings yet

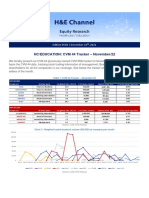

- HC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022Document4 pagesHC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022CAIO HENRIQUE FIORDELIZNo ratings yet

Solution Slides PDF

Solution Slides PDF

Uploaded by

Joe MoretOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution Slides PDF

Solution Slides PDF

Uploaded by

Joe MoretCopyright:

Available Formats

lOMoARcPSD|22802161

Strategic Asset Allocation - Harvard Endowment Fund Case -

full

Financial Analysis and Investor Behavior (Tilburg University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Harvard Management Company and

Inflation-Linked Bonds

September 2020

Lieven Baele, Tilburg University

This document provides an outline of class presentations. It is

incomplete without the accompanying commentary.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Harvard Management Company

Harvard Management Company manages the endowment fund of

Harvard University.

In 2000, the total assets under management was US$19 billion.

68 percent is managed internally, 32 percent by outside asset

managers.

Check https://www.hmc.harvard.edu/ for recent numbers…

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Harvard Management Company

Income from the endowment fund is important to the different

schools (25%, compared to 30 percent from tuition fees)

Real return growth objective between 6% - 7%:

Annual Distribution : 4% - 5%

- income (gifts) 1%

+ real spending growth 3%

Target real return : 6% - 7%

Their strategic asset allocation should help them accomplish this.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Strategic Asset Allocation

The Strategic Asset Allocation corresponds to the weights that the

investor allocates to various asset classes.

Example: long term target allocation of 60% equities and 40% bonds

The Tactical Asset Allocation: active strategy to (temporarily)

overweight/underweight asset classes or individual stocks/bonds,

depending on market circumstances.

Example 1: Given the recent surge in US equities and the uncertainty

surrounding the presidential elections, the stake in equities is reduced

from 60% to 40% (and hence the allocation to bonds increases to 60%)

Example 2: Within my equity portfolio, I underweight Tesla and

Facebook but overweight Johnson & Johnson.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Strategic Asset Allocation

Why is strategic asset allocation important?

Brinson et al. results (1986, 1996): Over 90% of the variability

in a typical pension fund’s performance over time is the result of

asset allocation policy.

Update by Ibbotson and Kaplan (FAJ, 2000) confirms this:

Time-Series Cross-Sectional

Variation Variation

Mutual Funds 81.4% 40%

Pension Funds 88.0% 35%

Endowments* 72.3% 12.8%

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Strategic Asset Allocation

Illustration for single mutual fund (from Ibbotson and Kaplan)

(time-series dimension)

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Strategic Asset Allocation

Across Mutual Fund Variation (from Ibbotson and Kaplan)

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HMC: Current Policy Portfolio

Minimum Policy Maximum Benchmark

1 Domestic Equity 22 32 42 80% S&P 500; 16% S&P Mid Cap;

4% Russell 2000

2 Foreign Equity 10 15 20 93% EAFEb; 7% Salomon Extended

Market Index (excluding US and EAFE overlap)

3 Emerging Markets 3 9 13 IFC Global Index and EMBI+ c

4 Private Equity 10 15 20 Cambridge Associates Weighted Composite

5 Absolute Return 0 4 8 LIBOR + 5%

6 High Yield 0 2 4 Salomon High Yield and Bankrupt

7 Commodities 2 5 8 60% GSCId; 40% NCREIFe Timber Index

8 Real Estate 4 7 10 NCREIF Property Index

9 Domestic Bonds 6 11 22 Lehman 5 + Year Treasury Index

10 Foreign Bonds 0 5 10 J.P. Morgan Non U.S.

11 Cash -10 -5 20 3-month LIBOR

Total 100

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Strategic Asset Allocation

What is the role of the policy portfolio for HMC?

1. Long-run (or ‘strategic’) asset allocation of the endowment over

main asset classes.

2. Benchmark for performance measurement

• Endowment

• Managers

3. How is the policy portfolio determined?

Quantitative techniques!

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Strategic Asset Allocation

Objectives

Inputs: Portfolio

-Data Allocation Constraints

-Analysis Model

Optimal

Portfolio

Weights

10

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Strategic Asset Allocation

Different steps:

1. Objective function specification (Utility Function)

2. Specify Asset Classes

3. Capital Market Assumptions (ER, Volatility, correlation,..)

4. Optimization

(1)-(4) : use mean-variance analysis

1. Backtesting – simulation

2. Implementation (portfolio manager selection)

3. Follow up (performance measurement)

11

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Lecture Structure

Main question is this case:

“Should HMC add inflation-linked bonds as an additional

asset class?”

Before trying to answer that question, let us reflect on the

rationale for the current allocation:

Importance of Equity Exposure

Importance of Diversification:

Across individual stocks

Across countries

Alternative Assets

12

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 1: Do not neglect Equities

Equities have consistently outperformed T-bills and bonds

EP= 5,5%

Source: Estrada, Javier. “Stocks, Bonds, Risk, and the Holding Period: An Real returns in local currency

International Perspective”, Dec. 2011. including dividends from

1900 till 2003

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 1: Do not neglect Equities

Percentage of households in PSID (Panel Study of Income Dynamics)

and SCF (Survey of Consumer Finances) holdings stocks:

=> Around 50% of US households with positive wealth do NOT hold stocks

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 1: Do not neglect Equities

… and it is even worse in Europe…

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 1: Do not neglect Equities

For standard preferences: Need unrealistically high risk aversion to

motivate “small stock allocations”

Mean-Variance Utility, risk-aversion of 2.5

Excess bond return = 1%, Market Risk premium of 5.5%

Eq vol: 20%, Bond vol: 11%, stock-bond correlation: +0,2

Optimization Problem:

Solution: ± 60% equity, 40 bonds

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 1: Do not neglect Equities

Even for (unrealistically) high risk risk aversion, we still get a 20%

allocation to equities.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 1: Do not neglect Equities

What about non-standard (“behavioral”) preferences?

(Myopic) Loss Aversion:

Investors feel relatively worse about losses than they feel good about gains.

Investors tend to check the value of their portfolio (far too) regularly

(‘vigilance’)

-> avoid assets with large negative tails, such as stocks.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 1: Do not neglect Equities

What about non-standard preferences?

(Myopic) Loss Aversion: Investors feel relatively worse about losses that

they feel good about gains -> avoid assets with large negative tails, such as

stocks.

Probability Overweighting: Investors tend to overweight extreme events

(relative to the ‘objective’ or ‘observed’ probablility).

Think over both overestimating the likelihood of winning the lottery and

dying in a plane crash.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 1: Do not neglect Equities

(Myopic) Loss Aversion & Probability Overweighting:

Probability overweighting inceases the perceived likelihood of both extreme positive

and negative events. For sufficiently loss aversion investors thought, only the increased

likelihood in the left tail will matter, and they will avoid equities all together.

Low objective probability

Utility Probability distorted upwards

Small marginal utility

Underweighting of

high probability events

Distorted Probability

Overweighting of

low probability events

Low objective probability Objective Probability

Probability distorted upwards

Very high marginal disutility

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2: Thou Shalt Diversify

(Review of Financial Studies)

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2: Thou Shalt Diversify

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2a: Diversify Idiosyncratic Risk

Harry Markowitz: Two types of Risks

Systematic Risk

Firm-specific or “Idiosyncratic Risk”

Key difference: firm-specific risk can be diversified, while systematic risk cannot.

between 30 and 50 different

stocks necessary to

eliminate most firm-

specific risk!

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2a: Diversify Idiosyncratic Risk

Examples of firm-specific risk?

Lernaut and Hauspie, a leader in speech technology, went bankrupt in 2001 following an accounting

scandal, ruining the savings of many (typically Belgian retail) investors.

Facebook after the Cambridge Analytica scandal lost $35 Billion

Danske Bank fell 15% in one week following a money laundering scandal

Bitcoin dropped with more than 70% in 2018

The Tweets by Elon Musk are a constant source of idiosyncratic risk for Tesla stock

August 2020: Biotech firm “Galapagos” stock price dropped from €192 to €140 following request for

additional tests by the US Food and Drug administration on side effects for its new medicine against

rheumatism.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2a: Diversify Idiosyncratic Risk

Portfolios with large amounts of idiosyncratic risk are “inefficient”

Stock index has volatility of 20%, and beta of 1 (by construction)

Individual stock has beta of 1, and total volatility of 38%

CAPM: both have same expected return! Yet, Individual stock has much larger total

risk.

Return Distribution, Market, Individual Stock

2,5

ER

market 1,5

Inefficiency

1

MRP

0,5

stock

1

0,1

0,2

0,3

0,4

0,5

0,6

0,7

0,8

0,9

1,1

1,2

1,3

-1

-0,9

-0,8

-0,7

-0,6

-0,5

-0,4

-0,3

-0,2

-0,1

20% Risk

Inefficiency

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2a: Diversify Idiosyncratic Risk

Idiosyncratic Volatility is large, varies substantially over time, and seems to have a

common component…

Average idiosyncratic

volatilty amongst the

20% smallest US stocks

Link to presentation: https://www.youtube.com/watch?v=3tOsCfs2j00

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2a: Diversify Idiosyncratic Risk

So everybody agrees we should diversify?

If you truly want to become

rich, you should do the exact

opposite of diversifying, and

concentrate all your wealth in

a single (positively skewed)

stock!

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2b: Diversify Internationally?

Diversifying between stocks within the same country may be sub-

optimal:

All stocks within a country may be exposed to the same local

economic shocks.

Nevertheless, evidence of extreme home bias in investment

portfolios (>80% in home stocks)

Local index may be concentrated in limited number of

industries (e.g. financial services)

(Indirect international diversification through multinationals)

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2b: Diversify Internationally?

Volatility of returns for country and the global market (1970-2018)

Volatility of the Global Equity Portfolio is lowest,

suggesting substantial benefits to international

diversification.

Link to source (“Global Equity Investing: The Benefits of

Diversification and sizing your allocation”):

https://www.vanguard.com/pdf/ISGGEB.pdf

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2b: Diversify Internationally?

How much should you allocate to foreign stocks?

An allocation of between 40-50% to

foreign stocks seems appropriate

Reduction in volatility is smaller for

the US than for other markets

Source: “Global Equity Investing: The Benefits of Diversification and sizing your allocation”

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2b: Diversify Internationally?

Results in previous slides are based on data from 1970 till 2018. But to

what extent do these alleged benefits still hold more recently?

International equity market returns have become more and more

correlated:

Economic Integration: economies have become more and more

economically interlinked (think about Netherlands and Germany), and hence also

firms’ cash flows.

Financial Integration: cross-country cash flows are discounted at the same

‘global discount rate’, set by a global representative investor (rather than by a

local discount rate)

Effect of financial integration stronger than that of economic integration (Baele

& Soriano, Review of World Economics, 2010)

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2b: Diversify Internationally?

Average within-region correlations

Source: E. Eiling & B. Gerard (2015). Emerging equity market comovements: trends and

macroeconomic fundamentals. Review of Finance, 19 (4), 1543-1585

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2b: Diversify Internationally?

Source: “Global Equity Investing: The Benefits of Diversification and sizing your allocation”

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2c: Emerging and Frontier Market as Diversifiers?

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2c: Emerging and Frontier Market as Diversifiers?

What makes emerging frontier markets interesting?

High expected growth? No! (it is likely already priced in)

Additional diversification at moderate risk

Source: Blackrock Report, “The Final Frontier”

Additional Risk Premiums (political risk; liquidity risk;…)

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2c: Emerging and Frontier Market as Diversifiers?

But: also correlations of frontier markets seems to be rapidly rising…

'Average' correlation with globlal equity market

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

Feb-01

Sep-01

Feb-08

Sep-08

Jan-97

Jan-04

Aug-97

Jul-00

Aug-04

Jul-07

Oct-98

Oct-05

Mar-98

Mar-05

Jun-03

Apr-02

Apr-09

Dec-99

Dec-06

May-99

May-06

Nov-02

Nov-09

-0.1

Frontier CEE Emerging CEE

Source: Baele, Bekaert, Schäfer (2015), “An Anatomy of CEE equity markets”

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 2c: Emerging and Frontier Market as Diversifiers?

If diversifying is on your mind, then maybe diversifying across styles (e.g. small

versus large caps) has more potential:

Cross-Asset Correlations – 1999-2018

Source: https://www.klanewealthmanagement.com/blog/revisiting-the-benefits-of-international-diversification

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 3: Diversify into other asset classes

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 3: Diversify into other asset classes

The Endowment model:

“a theory and practice of investing…[that] is characterized by highly-diversified,

long-term portfolios that differ from a traditional stock/bond mix in that they

include allocations to less-traditional and less-liquid asset categories, such as

private equity and real estate as well as absolute return strategies.”

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 3: Diversify into other asset classes

Most successful: the Yale Endowment Fund

• Huge out-performance

• Very high proportion of assets in alternative asset classes, such as hedge funds,

real estate, or private equity.

• Its manager, David F. Swensen, is considered a Star amongst investors

(https://en.wikipedia.org/wiki/David_F._Swensen)

• Returns have proven difficult to replicate, see

http://video.foxbusiness.com/v/1655227600001/the-yale-models-unmatched-

success/#sp=show-clips

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 3: Diversify into other asset classes

Yale’s Asset allocation over time…

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Rule 3: Diversify into other asset classes

Asset Allocations for U.S. College and University Endowments and Affiliated Foundations

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Hedge Funds

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Hedge Funds

• Economist August 2015: HF lost market share to ETF’s, and its performance is on a

downward trend

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Hedge Funds

• WSJ October 6, 2019: Hedge fund performance goes from bad to less bad…

https://www.wsj.com/articles/hedge-fund-performance-goes-from-bad-to-less-bad-11570413901

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Hedge Funds

• Hedge fund performance during crisis was very mixed

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Hedge Funds

• Hedge fund returns high correlation with 60/40 portfolio:

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Hedge Funds

• Hedge Fund performance during Flights-to-Safety

Source: Baele, Bekaert, Inghelbrecht, Wei (2018), Flights-to-Safety, Review of Financial Studies, 2019

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Hedge Funds

• Hedge Fund during Covid19 crisis (or at least first months)

Source: https://www.economist.com/finance-and-economics/2020/04/25/hedge-funds-hope-the-slump-will-make-them-relevant-again

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Private Equity

Private equity:

Equity of companies that is directly sold to investors (rather than on an organized

exchange).

Illiquid investment with horizon of 5 to 10 years (or more).

Private equity fund:

Buys stakes in private equity, typically using 1/3 own equity and 2/3 debt financing.

Like hedge funds, private equity (funds) are mostly held by sophisticated investors,

like pension funds or endowments, and are therefore less regulated.

…the selling story…

Investors earn an illiquidity premium (for locking their money for 5 to 10 years)

Because PE firms tend to own substantial stakes and longer investment horizons,

they have the capacity to better control firms, and to turn “sluggish businesses into

world-beaters”.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Private Equity

Do PE firms live up to the high expectations in terms of returns?

Difficult to assess, as with the absence of market prices (nonlisted firms, remember)

it is not straightforward to measure returns nor volatility.

Estimates vary widely across studies. There seems to be some consensus however

that:

PE outperforms standard public equity benchmarks, at least before costs…

Also: PE’s performance has gone down over the last decade, to levels that bring

it at par with the S&P500.

When PE performance is compared to more appropriate benchmarks (e.g. index

of small “value” firms), PE underperforms.

Despite decreasing returns, a lot of money has flown into

PE funds lately.

What could explain this?

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Private Equity

Despite decreasing returns, a lot of money has flown into PE funds lately. What could

explain this?

1. Investors seek Leverage:

You want to take on additional risk, but you are limited to do so (e.g.

because regulation or internal rules prevent you to do so)

You can implicitly take on leverage by investing in PE rather than in the

S&P500. Remember that of every $ a PE invest 0.67$ is borrowed.

2. Investors appreciate that PE returns are artificially smooth

As PE firms are not listed, and their valuation tends to rely on “self

appraisal”, PE returns do not move as much as public market returns.

A portfolio that mixes public with private equity will “look” less risky, at

least in the short run (except when entering a prolonged bear market)

The manager of such mixed fund is less likely to be forced to sell at rock-

bottom prices because of imposed risk constraints or solvency rules (which

tend to become binding when volatility goes up).

Read more: see https://www.economist.com/finance-and-economics/2019/02/21/why-private-equity-appeals;

https://www.aqr.com/Insights/Research/White-Papers/Demystifying-Illiquid-Assets-Expected-Returns-for-Private-Equity; and many papers by Ludovic

Phallippou.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Commodities

What are Commodities:

Basic goods (of comparable quality, no matter who produces them)

that are used in commerce or manufacturing

Four basic groups

1. Energy (crude oil, gas,…)

2. Metals (gold, platinum, copper, iron,…)

3. Livestock

4. Agriculture (wheat, rice, corn,…)

Who is trading them?

Before: trading mainly between producers and firms using

them as input in their production.

More recently: investors take exposure by means of futures

contract (without physical delivery)

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Commodities

Motivation to invest in commodities: Diversification power! Or not?

Low and High-Frequency Correlation between S&P GSCI Commodity Index and S&P500 Index returns

0.8

0.6

0.4

0.2

Start financialization of

commodity market

-0.2

-0.4

-0.6

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

Source: own calculations based on GSCI data

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Commodities

Looking at subcategories important (as main index is dominated by energy)

Source: own calculations based on GSCI data

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

What do you think about…

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Result from Class Poll

PS why don’t I see > 150 participants?????

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

What about gold?

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Gold

Two prominent perceived qualities of Gold:

1. Gold is an inflation hedge

2. Gold provides a hedge against “bad times”

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Gold as an Inflation Hedge

If gold were a good inflation hedge, then its real value should be constant

over time (known as the “golden constant”)

Source: Erb, Harvey, Viskanta (2020), Gold, the Golden Constant, COVID-19, “Massive Passives” and Déjà Vu

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Gold as an Inflation Hedge

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Gold as a Hedge against Bad Times

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Gold

Even if those two stories were true, it would not

explain why gold price is so high:

1. Medium-term inflation expectations are very much

under control (about 1.5%)

2. The very good performance of the equity market

since March is not consistent with a flight-to-

quality.

What is going on: see next video (as of min 5.28)

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Gold as a Hedge against Bad Times

Link: https://www.youtube.com/watch?v=7dpdbhOmODI

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Crypto Currencies

Extremely volatile, returns completely unpredictable, even ex-

post.

Collection of opinions, mostly by famous people:

https://www.bloomberg.com/features/bitcoin-bulls-bears/

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

What about Treasury Bonds?

A more mundane suggestion: Bonds!

• Offer a premium over T-bills

• Have low correlation with stocks

• Go up in value in crises

Caveats:

• Low return

• Attractive at current yields?

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Treasury Bonds as Diversifiers?

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Treasury Bonds as Diversifiers?

Sharpe Ratios

0.8

0.7

0.6

0.5

0.4 Stocks

0.3

P

0.2

0.1

0

1926 -2010 1960 -2010 1970 -2010 1985-2010 2000 -2010

-0.1

P = 40-60 portfolio of equity and bonds

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Keynes versus Markowitz

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Treasury Bonds as Diversifiers?

Whether Treasury Bonds serve as a hedge against equities or not depends on

the cyclical nature of inflation

1. Inflation is countercyclical

Positive inflation shock signals bad news about the future economy

– Equities drop in value because of lower than expected growth prospects

– Bonds drop because higher than expected inflation raises yields

» Positive stock-bond correlation

Examples:

– oil shocks both pushed up inflation and depressed the economy

– Food price shocks increase inflation but depress consumption

2. Inflation is procyclical

Positive inflation shock signals good news about the future economy

– Equities surge because of better than expected growth prospects

– Bonds drop because higher than expected inflation raises yields

» Negative stock-bond correlation

Example: Higher than expected inflation signals the economy picking up / lower likelihood

of deflationary nightmare regime.

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HMC: Current Policy Portfolio

Minimum Policy Maximum Benchmark

1 Domestic Equity 22 32 42 80% S&P 500; 16% S&P Mid Cap;

4% Russell 2000

2 Foreign Equity 10 15 20 93% EAFEb; 7% Salomon Extended

Market Index (excluding US and EAFE overlap)

3 Emerging Markets 3 9 13 IFC Global Index and EMBI+ c

4 Private Equity 10 15 20 Cambridge Associates Weighted Composite

5 Absolute Return 0 4 8 LIBOR + 5%

6 High Yield 0 2 4 Salomon High Yield and Bankrupt

7 Commodities 2 5 8 60% GSCId; 40% NCREIFe Timber Index

8 Real Estate 4 7 10 NCREIF Property Index

9 Domestic Bonds 6 11 22 Lehman 5 + Year Treasury Index

10 Foreign Bonds 0 5 10 J.P. Morgan Non U.S.

11 Cash -10 -5 20 3-month LIBOR

Total 100

71

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Proposed Change

Question: “Should HMC include inflation-protected

bonds (TIPS) as an additional asset class?”

What are the characteristics that would make this an

interesting asset to invest in?

Lets first try to understand the product

(useful background reading: https://www.pimco.be/en-be/resources/education/understanding-

inflation-linked-bonds/)

72

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Inflation-Protected Bonds

Consider 10-year nominal bond with annual coupon of 3%

Inflation increases to 5%

73

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Inflation-Protected Bonds

Consider 10-year inflation-linked bond with coupon of 3%

inflation increases to 5% -> 5% increase in notional amount

Fixed coupon rate on inflation-adjusted coupon

year nominal real

1 3.15 3 100 1 5% 3%

2 3.31 3

100 1 5% 3%

3 3.47 3

1 5%

4 3.65 3

5 3.83 3

6 4.02 3

7 4.22 3

8 4.43 3

9 4.65 3

10 167.78 103 100 1 5% 10 1 3%

100 1 5% 1 3%

10

1 5%

10

74

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Inflation-Protected Bonds

75

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Inflation-Protected Bonds

What happens in case of deflation?

Coupons will decrease with deflation

Principal is protected against deflation (issuer guarantees

sovereign will never decrease below par).

76

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Inflation-Protected Bonds

Break-even inflation

Inflation rate for which nominal and inflation-protected

bonds will do equally well.

Break-even inflation = T-bond yield to maturity – TIPS yield to maturity

TIPS will outperform T-bonds if realized inflation is larger

than break-even inflation

T-bonds will outperform TIPS in case realized inflation is

lower than break-even inflation.

Note: we assume a zero liquidity risk premium, which may be a heroic

assumption. 77

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Inflation-Protected Bonds

See https://fred.stlouisfed.org/series/T10YIE for most up-to-date figure 78

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Inflation-Protected Bonds

Are inflation-protected bonds ‘risk free’?

Issued by the government in own currency -> yes (but)

Perfectly predictable, certain return -> no, horizon dependent

Coupon reinvestment risk

Principal reinvestment risk

How does this compare to cash? Or to nominal bonds?

Keeps purchasing power intact -> perhaps

CPI may be ‘poor’ proxy for ‘your’ inflation risk

Tax issues

Deflation put

79

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Inflation-Protected Bonds

What criteria would you look at to determine whether TIPS should

be considered an additional asset class in Harvard’s policy

portfolio?

1. Relatively independent of other asset classes Maybe

2. Comprised of homogeneous investments Yes

3. Capitalization sufficient to absorb a meaningful fraction of

the investor’s portfolio. Yes

4. Does it raise utility? Maybe

We need to check (1) and (4) !

80

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Mean-Variance analysis of HCM

Find portfolio with a target return of 6.5% that has minimum

variance.

Capital market assumptions and constraints

EXPECTED STANDARD CONSTRAINTS

RETURN DEVIATION Lower Upper

Domestic Equity 0.0650 0.1600 0.2200 0.4200

Foreign Equity 0.0650 0.1700 0.0500 0.2500

Emerging Markets 0.0850 0.2000 -0.0100 0.1900

Private Equity 0.0950 0.2200 0.0500 0.2500

Absolute Return 0.0550 0.1200 -0.0600 0.1400

High Yield 0.0550 0.1200 -0.0800 0.1200

Commodities 0.0450 0.1200 -0.0500 0.1500

Real Estate 0.0550 0.1200 -0.0300 0.1700

Domestic Bonds 0.0430 0.0700 0.0100 0.2100

Foreign Bonds 0.0430 0.0800 -0.0500 0.1500

Cash 0.0350 0.0100 -0.1500 0.0500

TIPS 0.0400 0.0300 0.0000 1.0000

Correlations: see exhibit 4 After observing high return on TIPS, return on cash was raised from 2% to 3.5%

81

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Mean-Variance analysis of HCM

Correlation Matrix

Large but << 1

Small put positive -> additional diversification benefits

Increase (decrease) in real rates is over what is offered by nominal bonds

bad (good) both for TIPS and equities (as

real cash flows are discounted at a higher real rate)

Positive correlation between assets that all

Negative correlation between cash and TIPS

are considered “inflation hedgers”

Increasing real rates are bad for TIPS but

good for cash returns (reinvestment risk)

82

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Mean-Variance analysis of HCM

Un-constrained Constrained

Domestic Equity 0.05% 22.00%

Foreign Equity 5.03% 5.00%

Emerging Markets 17.06% 15.85%

Private Equity 18.80% 17.61%

Absolute Return -0.74% -6.00%

High Yield 3.40% -8.00%

Commodities 12.11% 15.00%

Real Estate 14.66% 12.63%

Domestic Bonds -17.75% 1.00%

Foreign Bonds 13.73% 3.53%

Cash -52.67% -15.00%

TIPS 86.33% 36.38%

Expected Return 6.50% 6.50%

Standard Deviation 7.78% 8.42%

83

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Mean-Variance analysis of HCM

Alternative set of constraints:

EXPECTED STANDARD CONSTRAINTS

RETURN DEVIATION Lower Upper

Domestic Equity 0.0650 0.1600 0.0000 1.0000

Foreign Equity 0.0650 0.1700 0.0000 1.0000

Emerging Markets 0.0850 0.2000 0.0000 1.0000

Private Equity 0.0950 0.2200 0.0000 1.0000

Absolute Return 0.0550 0.1200 0.0000 1.0000

High Yield 0.0550 0.1200 0.0000 1.0000

Commodities 0.0450 0.1200 0.0000 1.0000

Real Estate 0.0550 0.1200 0.0000 1.0000

Domestic Bonds 0.0430 0.0700 0.0000 1.0000

Foreign Bonds 0.0430 0.0800 0.0000 1.0000

TIPS 0.0400 0.0300 0.0000 1.0000

Cash 0.0350 0.0100 -0.5000 1.0000

84

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Mean-Variance analysis of HCM

Optimal weights under alternative constraints

Domestic Equity 0.04% 0.00%

Foreign Equity 5.03% 4.67%

Emerging Markets 17.06% 17.30%

Private Equity 18.80% 18.79%

Absolute Return -0.73% 0.00%

High Yield 3.41% 0.29%

Commodities 12.10% 14.76%

Real Estate 14.65% 14.24%

Domestic Bonds -17.75% 0.00%

Foreign Bonds 13.72% 9.70%

TIPS 86.34% 70.24%

Cash -52.67% -50.00%

Expected Return 6.50% 6.50%

Standard Deviation 7.78% 7.83%

85

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Mean-Variance analysis of HCM

Why are TIPS so attractive?

• High expected return and low risk relative to bonds!

• Low correlations with other assets

• Low volatility

Does it make sense for TIPS to be 50% of the portfolio?

• No, TIPS market capitalization is very small.

• Would make portfolio unbalanced

86

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

Mean-Variance analysis of HCM

Domestic Equities and Domestic Bonds are very

unattractive to the optimizer. Why?

Examine optimization results using original

assumptions

Can you replicate the original policy portfolio?

87

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Allocation: Original Assumptions

EXPECTED STANDARD CONSTRAINTS

RETURN DEVIATION Lower Upper

Domestic Equity 0.0650 0.1600 0.0000 1.0000

Foreign Equity 0.0650 0.1700 0.0000 1.0000

Emerging Markets 0.0850 0.2000 0.0000 1.0000

Private Equity 0.0950 0.2200 0.0000 1.0000

Absolute Return 0.0550 0.1200 0.0000 1.0000

High Yield 0.0550 0.1200 0.0000 1.0000

Commodities 0.0450 0.1200 0.0000 1.0000

Real Estate 0.0550 0.1200 0.0000 1.0000

Domestic Bonds 0.0430 0.0700 0.0000 1.0000

Foreign Bonds 0.0430 0.0800 0.0000 1.0000

Cash 0.0200 0.0100 0.0000 1.0000

Back to original assumption: cash yields 2%

88

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Allocation: Original Assumptions

OPTIMAL PORTFOLIO

Original

Un-constrained Constrained Policy

Portfolio

Domestic Equity -5.46% 0.00% 32%

Foreign Equity -1.94% 1.31% 15%

Emerging Markets 11.33% 17.44% 9%

Private Equity 13.18% 20.95% 15%

Absolute Return 8.93% 2.23% 4%

High Yield 4.10% 5.61% 2%

Commodities 26.95% 19.46% 5%

Real Estate 17.89% 18.03% 7%

Domestic Bonds 31.05% 1.09% 11%

Foreign Bonds 27.73% 13.87% 5%

Cash -33.76% 0.00% -5%

Expected Return 6.50% 6.50%

Standard Deviation 7.35% 8.10%

89

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Allocation: Original Assumptions

Do you agree with the capital market assumptions in the case?

1. Return on cash from 2% to 3.5%

2. Expected return on equity = target return

3. Expected return on private equity

4. Correlation domestic bonds and equities

5. Correlation commodities and other asset classes

6. Correlation private equity and other asset classes

90

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Allocation: Original Assumptions

The introduction of TIPS made the ‘experts’ change the real return on

cash from 2% to 3.5%

Implication I: this affects the implicit inflation/term premiums

Sources of Nominal Real Return Real Return

Risk/Return Cash on Cash Treasury Treasury TIPS

ST Real Rate

X X X X X

of Return

Expected

X X

Inflation

ST Inflation

X X

Risk Premium

Real Term

X X X

Premium

LT Inflation

X X

Risk Premium

91

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Allocation: Original Assumptions

Identify real and nominal components of expected

returns:

1. Real Return on Treasury – Real Return on Cash

≈ Term premium + Inflation Risk Premium

(Assume ST Inflation Risk premium = 0)

2. TIPS return – Real Return on Cash

≈ Real Term premium

3. Real return on Treasury – TIPS return

≈ Inflation Risk premium

92

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Allocation: Original Assumptions

HMC Assumptions:

Ang, Bekaert, Wei

(2008, JF)

Before TIPS After TIPS 1955-2005 data

ST Real Rate

of Return 2.00% 3.50% 1.24%

Real term 0.50%

premium ? (4.0%-3.5%) 0.08%

Inflation risk 0.30%

premium ? (4.3%-4%) 1.14%

Nominal Term 2.3% 0.80%

premium (4.3%-2%) (4.3%-3.5%) 1.22%

(= real term premium + Inflation risk premium)

Source: A. Ang, G. Bekaert, M. Wei (2008), "The Term Structure of Real Rates and Expected Inflation"

Journal of Finance, 63, 2, 797-849. 93

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Allocation: Original Assumptions

Implication 2: Implied Equity Premium de facto changed from 4.5% to 3%

Equity Premiums Around the World

Country Mean SD Country Mean SD

Australia 8.3 17.2 Netherlands 6.4 22.6

Belgium 4.4 23.1 South Africa 7.9 22.2

Canada 5.5 16.8 Spain 4.9 21.5

Denmark 3.8 19.6 Sweden 7.5 22.2

France 8.9 24.0 Switzerland 4.8 18.8

Germany 9.4 35.5 U.K. 5.9 20.1

Ireland 5.5 20.4 U.S.A. 7.2 19.8

Italy 10.3 32.5 Average 6.9 22.8

[1900-2002; arithmetic, over T-bills]

Source: E. Dimson, P Marsh and M Staunton (2003), Global evidence on the equity risk premium,

Journal of Applied Corporate Finance 2003, 15(4). 94

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Assumptions: An Experiment

An experiment: Change expected returns

1. Cash: 2%

2. Real Term premium: 0.25% TIPS = 2.25%

3. Inflation premium: 0.95% Dom. Bonds = 3.20%

4. Equity premium: 5.5% Dom. equity returns: 7.5%

5. Emerging market returns: -1%

6. Private Equity: -1%

7. Adjust other categories to keep premium relative to

bonds constant (except for foreign bonds; commodities

and real estate)

95

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Assumptions: An Experiment

EXPECTED STANDARD CONSTRAINTS

RETURN DEVIATION Lower Upper

Domestic Equity 0.0750 0.1600 0.0000 1.0000

Foreign Equity 0.0750 0.1700 0.0000 1.0000

Emerging Markets 0.0750 0.2000 0.0000 1.0000

Private Equity 0.0850 0.2200 0.0000 1.0000

Absolute Return 0.0440 0.1200 0.0000 1.0000

High Yield 0.0440 0.1200 0.0000 1.0000

Commodities 0.0320 0.1200 0.0000 1.0000

Real Estate 0.0420 0.1200 0.0000 1.0000

Domestic Bonds 0.0320 0.0700 0.0000 1.0000

Foreign Bonds 0.0300 0.0800 0.0000 1.0000

TIPS 0.0225 0.0300 0.0000 1.0000

Cash 0.0200 0.0100 -0.5000 1.0000

96

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HCM Assumptions: An Experiment

OPTIMAL PORTFOLIO

Un-

constrained Constrained Policy

Portfolio

Domestic Equity 26.72% 18.26% 22%

Foreign Equity 22.79% 19.02% 15%

Emerging Markets 12.42% 11.62% 9%

Private Equity 15.03% 15.71% 15%

Absolute Return -18.89% 0.00% 5%

High Yield -10.34% 0.00% 3%

Commodities 24.32% 24.26% 6%

Real Estate 13.79% 15.51% 7%

Domestic Bonds 10.88% 8.79% 7%

Foreign Bonds 3.08% 3.70% 4%

Cash -24.54% -22.97% 0%

Tips 24.74% 6.12% 7%

Expected Return 6.50% 6.50%

Standard Deviation 9.62% 9.82%

97

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HMC: Conclusions

Would you suggest to include TIPS in the policy portfolio?

• Provide hedge against inflation that no other asset can do.

• Offers diversification benefits

• Offered unusually high returns

What happened?

Proposal was accepted!

98

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HMC: Conclusions

Roll, Richard W., Empirical TIPS. Financial Analysts Journal, Vol. 60, No. 1, pp. 31-53, January/February 2004

99

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HMC: Conclusions

Volume in TIPS market Liquidity Risk Premium

100

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HMC: Conclusions

101

Downloaded by Joe Moret (morjo842@icloud.com)

lOMoARcPSD|22802161

HMC: Conclusions

102

Downloaded by Joe Moret (morjo842@icloud.com)

You might also like

- HSBC Private Banking Competition 2022 Case ExampleDocument6 pagesHSBC Private Banking Competition 2022 Case ExampleMavelaineNo ratings yet

- CASE 8.1 Shipping Wood To MarketDocument11 pagesCASE 8.1 Shipping Wood To MarketYanto Sandy TjangNo ratings yet

- Unit DNI Example Assignment: © Nebosh 1Document32 pagesUnit DNI Example Assignment: © Nebosh 1Rahul Krishnan80% (5)

- Work Sample - M&A Private Equity Buyside AdvisingDocument20 pagesWork Sample - M&A Private Equity Buyside AdvisingsunnybrsraoNo ratings yet

- Hydrocarbon Accounting Solutions For Upstream Oil & GasDocument40 pagesHydrocarbon Accounting Solutions For Upstream Oil & Gasasadnawaz100% (2)

- MFin Employment Report - 2021FT - 2022INT - 1Document8 pagesMFin Employment Report - 2021FT - 2022INT - 1Zack ZhangNo ratings yet

- Risk Return UploadDocument15 pagesRisk Return UploadGauri TyagiNo ratings yet

- Poonawalla Fincorp LTD ULJK BUY 180422Document7 pagesPoonawalla Fincorp LTD ULJK BUY 180422sameer bakshiNo ratings yet

- 5544group H Group AssignmentDocument33 pages5544group H Group Assignmentmelodysze210593No ratings yet

- Class Discussion - Risk ReturnDocument2 pagesClass Discussion - Risk Returnyingrou.upacNo ratings yet

- Bluebay Multi Asset Credit Jan23Document7 pagesBluebay Multi Asset Credit Jan23Ali ImranNo ratings yet

- ACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarDocument14 pagesACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarchimbanguraNo ratings yet

- 1 - SFM Test Papers & Suggested AnswersDocument18 pages1 - SFM Test Papers & Suggested AnswersUDESH DEBATANo ratings yet

- Q2 2022 LLIN CommentaryDocument6 pagesQ2 2022 LLIN CommentaryTay YisiongNo ratings yet

- (012821) (020421) Krakatau Steel (B) - Global CompetitionDocument6 pages(012821) (020421) Krakatau Steel (B) - Global CompetitionYani RahmaNo ratings yet

- USAA Growth and Tax Strategy Fund - 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund - 2Q '22ag rNo ratings yet

- Questions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyDocument22 pagesQuestions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyNoura ShamseddineNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- 2022 Investor Factsheet - ENDocument2 pages2022 Investor Factsheet - ENRas AltNo ratings yet

- AMC Sector - HDFC Sec-201901111558114702001 PDFDocument99 pagesAMC Sector - HDFC Sec-201901111558114702001 PDFmonikkapadiaNo ratings yet

- Saxo Asset Allocation - 20090804Document5 pagesSaxo Asset Allocation - 20090804Trading Floor100% (2)

- Paper - 2: Strategic Financial Management Questions Swap: Years Sales Revenue ($ Million)Document29 pagesPaper - 2: Strategic Financial Management Questions Swap: Years Sales Revenue ($ Million)Raul KarkyNo ratings yet

- Goldman Sachs Global Millennials Equity Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVDocument4 pagesGoldman Sachs Global Millennials Equity Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVMario FighetosteNo ratings yet

- SOA-All-COURSE-8-Others-Exams-For-QFIC-Fall-2014 - 副本Document18 pagesSOA-All-COURSE-8-Others-Exams-For-QFIC-Fall-2014 - 副本cnmouldplasticNo ratings yet

- Capital Structure StudyDocument27 pagesCapital Structure StudyVictor OsipenkovNo ratings yet

- Saxo Asset Allocation - 20090904Document5 pagesSaxo Asset Allocation - 20090904Trading FloorNo ratings yet

- Corporate Finance and Portfolio ValuationDocument8 pagesCorporate Finance and Portfolio Valuationkbbao22.sjsNo ratings yet

- LIC Housing Ltd. - InitiatingDocument7 pagesLIC Housing Ltd. - InitiatingAnantharaman RamasamyNo ratings yet

- TCS RR 12042022 - Retail 12 April 2022 1386121995Document13 pagesTCS RR 12042022 - Retail 12 April 2022 1386121995uefqyaufdQNo ratings yet

- Montu - Lanco InfratechDocument2 pagesMontu - Lanco InfratechMontu AdaniNo ratings yet

- 1.session - Christopher Hamilton - InvescoDocument33 pages1.session - Christopher Hamilton - InvescoBG CHOINo ratings yet

- The Effect of Profitability, Leverage and Liquidity On Dividend Policies For Construction Issuers in 2014-2019Document15 pagesThe Effect of Profitability, Leverage and Liquidity On Dividend Policies For Construction Issuers in 2014-2019Achmad ArdanuNo ratings yet

- Assignment 2: RemarksDocument10 pagesAssignment 2: RemarksWyatt Paxton0% (2)

- USAA Cornerstone Equity Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Equity Fund 2022 - 1Qag rNo ratings yet

- Submitted By: Submitted To: Prof. Vinod K. AgarwalDocument19 pagesSubmitted By: Submitted To: Prof. Vinod K. AgarwalRahul JainNo ratings yet

- Impact of Foreign Direct Investment On Living StandardDocument13 pagesImpact of Foreign Direct Investment On Living StandardNwigwe Promise ChukwuebukaNo ratings yet

- Shrinking To Grow: Evolving Trends in Corporate Spin-OffsDocument12 pagesShrinking To Grow: Evolving Trends in Corporate Spin-OffsmdorneanuNo ratings yet

- 2021-03-10-SQ.N-Block Inc-JPMorgan-Tactical Equity Derivatives Strategy SQ Current... - 91620110Document10 pages2021-03-10-SQ.N-Block Inc-JPMorgan-Tactical Equity Derivatives Strategy SQ Current... - 91620110brookpointNo ratings yet

- Ba ZG521 Ec-3r First Sem 2023-2024Document5 pagesBa ZG521 Ec-3r First Sem 2023-2024chandanNo ratings yet

- EW00142ARDocument236 pagesEW00142ARbudi handokoNo ratings yet

- Motilal Oswal SELL On Fine Organic With 19% DOWNSIDE The PromisedDocument8 pagesMotilal Oswal SELL On Fine Organic With 19% DOWNSIDE The PromisedChiru MukherjeeNo ratings yet

- Victory INTGY Discovery Fund 2022 - 1QDocument2 pagesVictory INTGY Discovery Fund 2022 - 1Qag rNo ratings yet

- The Construction Productivity ImperativeDocument10 pagesThe Construction Productivity ImperativeNugraha Eka SaputraNo ratings yet

- CH 4 - Portfolio Management (2024) - HandoutDocument21 pagesCH 4 - Portfolio Management (2024) - HandoutMayibongwe MpofuNo ratings yet

- USAA Cornerstone Moderate Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Moderate Fund 2022 - 1Qag rNo ratings yet

- A A U.S. Q M ETF: Lpha Rchitect Uantitative OmentumDocument3 pagesA A U.S. Q M ETF: Lpha Rchitect Uantitative OmentumMonchai PhaichitchanNo ratings yet

- AlphaIndicator ECOH 20201031Document11 pagesAlphaIndicator ECOH 20201031hajdahNo ratings yet

- Financial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranDocument8 pagesFinancial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranShreyansh JainNo ratings yet

- Barbell Income Fund BrochureDocument8 pagesBarbell Income Fund BrochurecsNo ratings yet

- II 60 40 Portfolios (En)Document7 pagesII 60 40 Portfolios (En)AlexNo ratings yet

- Axis Global Innovation FoF NFO LeafletDocument2 pagesAxis Global Innovation FoF NFO LeafletKamalnath SinghNo ratings yet

- Integrated Waveguide Technologies Iwt Is A 6 Year Old Company Founded byDocument3 pagesIntegrated Waveguide Technologies Iwt Is A 6 Year Old Company Founded byAmit PandeyNo ratings yet

- دليل المستثمر في التقنية العميقة- إنجليزيDocument20 pagesدليل المستثمر في التقنية العميقة- إنجليزيwadaq.factoryNo ratings yet

- Document Incorporated by Reference Annual Report 2012 2014 10 06Document277 pagesDocument Incorporated by Reference Annual Report 2012 2014 10 06VinishaSonawaneNo ratings yet

- Question and AnsDocument33 pagesQuestion and AnsHawa MudalaNo ratings yet

- Victory INTGY Small/MID Cap Value Fund 2022 - 1QDocument2 pagesVictory INTGY Small/MID Cap Value Fund 2022 - 1Qag rNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- Rockford Executive Summary Presentation 10.8.18Document54 pagesRockford Executive Summary Presentation 10.8.18Isaac GuerreroNo ratings yet

- Polen Growth Fund: Product Profile Investment ObjectiveDocument3 pagesPolen Growth Fund: Product Profile Investment Objectivekaya nathNo ratings yet

- Answer All QuestionsDocument2 pagesAnswer All QuestionsNh FiyyNo ratings yet

- Gujarat Technological UniversityDocument5 pagesGujarat Technological UniversityJack mazeNo ratings yet

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- Toward An Implied Cost of Capital (Gebhardt Et Al., 2001)Document42 pagesToward An Implied Cost of Capital (Gebhardt Et Al., 2001)Joe MoretNo ratings yet

- Replicating AnomaliesDocument116 pagesReplicating AnomaliesJoe MoretNo ratings yet

- JR Reading GuideDocument5 pagesJR Reading GuideJoe MoretNo ratings yet

- The Price of InnovationDocument7 pagesThe Price of InnovationJoe MoretNo ratings yet

- HintsDocument10 pagesHintsJoe MoretNo ratings yet

- Fixed Income Guest Lecture Maurice Meijers (New)Document27 pagesFixed Income Guest Lecture Maurice Meijers (New)Joe MoretNo ratings yet

- Formula SheetDocument1 pageFormula SheetJoe MoretNo ratings yet

- CaseheroDocument5 pagesCaseheroJoe MoretNo ratings yet

- Adobe Scan Jul 04, 2023Document2 pagesAdobe Scan Jul 04, 2023Karthick KumarNo ratings yet

- Learning Outcome TaxDocument2 pagesLearning Outcome TaxNiño Mendoza MabatoNo ratings yet

- Form 4506 TDocument2 pagesForm 4506 Tbhill07No ratings yet

- An Assessment On The Practice and Challenges of Project Monitoring and EvaluationDocument72 pagesAn Assessment On The Practice and Challenges of Project Monitoring and EvaluationbenNo ratings yet

- Moriah Business Plan PDFDocument5 pagesMoriah Business Plan PDFally dereNo ratings yet

- Dispute Details Form (DDF)Document6 pagesDispute Details Form (DDF)Russell SoperNo ratings yet

- Evergreen Sweet House vs. Ever Green and OthersDocument6 pagesEvergreen Sweet House vs. Ever Green and Otherspranav771vermaNo ratings yet

- Pastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesDocument2 pagesPastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesJeremiah Marvin ChuaNo ratings yet

- Symantec Endpoint Protection 50 CloudDocument6 pagesSymantec Endpoint Protection 50 CloudadminakNo ratings yet

- Case 4 Hrm520 GowinsDocument6 pagesCase 4 Hrm520 GowinsAliza PlacinoNo ratings yet

- Concept of Salary Under Income Tax ActDocument29 pagesConcept of Salary Under Income Tax ActMaaz Alam100% (2)

- Case No. 6Document3 pagesCase No. 6Casey Jean GOMEZNo ratings yet

- Account Statement: PrakashDocument1 pageAccount Statement: PrakashRny buriaNo ratings yet

- VanguardDocument2 pagesVanguardRobert CastilloNo ratings yet

- Modern Management: Concepts and Skills: Fifteenth Edition, Global EditionDocument29 pagesModern Management: Concepts and Skills: Fifteenth Edition, Global EditionnotsaudNo ratings yet

- 095 Priyanka TejwaniDocument19 pages095 Priyanka TejwaniNitin BasoyaNo ratings yet

- HLF525 DeedAbsoluteSale V02Document3 pagesHLF525 DeedAbsoluteSale V02Permits & LicensingNo ratings yet

- Sa BucuriaDocument10 pagesSa BucuriaLiliana VrabieNo ratings yet

- AFA 3e SM Chap05Document97 pagesAFA 3e SM Chap05Trang MinhNo ratings yet

- RRACKS CatalogueDocument52 pagesRRACKS CataloguehennrycaspersNo ratings yet

- ZoOm Pitch DeckDocument5 pagesZoOm Pitch DeckHakimuddin TinwalaNo ratings yet

- 2013 AACEi TransactionsDocument5 pages2013 AACEi TransactionsAnonymous 19hUyemNo ratings yet

- Tender Enquiry Document: Medical Gas Pipe Line SystemDocument108 pagesTender Enquiry Document: Medical Gas Pipe Line SystemVikas PatidarNo ratings yet

- Feasibility Study On Agriculture and Agro IndustryDocument3 pagesFeasibility Study On Agriculture and Agro IndustryOyadare sarah0% (1)

- What Was John Connelly's Role in CCS As A Leader?Document1 pageWhat Was John Connelly's Role in CCS As A Leader?karthikawarrierNo ratings yet

- Provident FormDocument2 pagesProvident FormRyahNeil Bohol MoralesNo ratings yet

- HC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022Document4 pagesHC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022CAIO HENRIQUE FIORDELIZNo ratings yet