Professional Documents

Culture Documents

Que Stion No. 1

Que Stion No. 1

Uploaded by

Muhammad Saad UmarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Que Stion No. 1

Que Stion No. 1

Uploaded by

Muhammad Saad UmarCopyright:

Available Formats

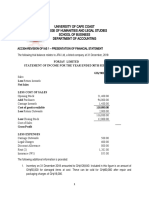

Question No.

The following trial balance has been extracted from the books of account of ABC Limited at 31

December 2019.

RS. 000 RS. 000

Administrative expenses 210

Share capital (ordinary shares of Rs.1 fully

paid) 600

Trade receivables 470

Bank overdraft 80

Other income 25

Long term loan 180

Distribution costs 420

Non-current asset investments 560

Investment income 75

Plant and equipment

At cost 750

Accumulated depreciation (at 01

January 2019) 220

Retained earnings (at 1 January 2019) 240

Purchases 960

Inventories (at 1 January 2019) 140

Trade payables 260

Revenue 1950

Dividend paid 120

3,630 3,630

Additional information

1. Inventories at 31 December 2019 were valued at Rs. 150,000.

2. The income tax expense based on the profit on ordinary activities is estimated to be Rs.

54,000.

3. Interest expense related to Long term Loan amounts Rs. 16,000 has not been recorded in

books to date. This should be charged to administrative expenses.

Required:

a) Prepare Statement of total comprehensive Income for the year ended 31 December

2019. (15 marks)

b) Prepare Statement of Changes in Equity. (5 marks)

Question No. 2

The trial balance of ABC at 31 December 2019 is as follows.

Rupees in million

Dr Cr

Administration charges 342

Bank account 89

Cash 2

Payables’ ledger 86

Accumulated amortisation on patents at 31 December 2018 5

Accumulated depreciation at 31 December 2018 918

Receivables’ ledger 189

Distribution expenses 175

Property, plant and equipment at cost 2,830

Interest received 20

Issued share capital 400

Loan 18

Patents at cost 26

Accumulated profits 1,562

Purchases 2,542

Sales 3,304

Inventories at 31 December 2018 118

6,313 6,313

The following information is also relevant.

1. Inventories on 31 December 2019 amounted to Rs. 127 million. Included in this balance

were goods that had cost Rs. 150,000. These goods had become damaged during the

year and it is considered that following remedial work the goods could be sold for Rs.

50,000.

2. Current tax of Rs. 75 million is to be provided.

3. The loan is repayable by equal annual instalments over three years.

4. Depreciation/ amortization for the year to 31 December 2019 is to be charged against

cost of sales as follows:

Property, plant and equipment - 10% reducing balance

Patent – 5% reducing balance

Required:

c) Prepare Statement of total comprehensive Income for the year ended 31 December

2019. (15 marks)

d) Prepare Statement of Changes in Equity. (5 marks)

You might also like

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- Worksheet On Accounting For Partnership - Admission of A Partner Board QuestionsDocument16 pagesWorksheet On Accounting For Partnership - Admission of A Partner Board QuestionsCfa Deepti Bindal100% (1)

- Great Zimbabwe University Faculty of CommerceDocument6 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- Review Questions Ias 1 & Ias 7Document7 pagesReview Questions Ias 1 & Ias 7hajiraj504No ratings yet

- Audit of IntangiblesDocument2 pagesAudit of IntangiblesJaycee FabriagNo ratings yet

- ACC402-Conso With IAS 21Document2 pagesACC402-Conso With IAS 21Billiee ButccherNo ratings yet

- 1819 IB124 Summer Exam PaperDocument6 pages1819 IB124 Summer Exam PaperHarry TaylorNo ratings yet

- Ap 9004-IntangiblesDocument5 pagesAp 9004-IntangiblesSirNo ratings yet

- FR Day 1Document9 pagesFR Day 1Fun DietNo ratings yet

- Cash Flow Statement UDpdfDocument18 pagesCash Flow Statement UDpdfrizwan ul hassanNo ratings yet

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- Lecture 2 PDFDocument62 pagesLecture 2 PDFsyingNo ratings yet

- f2 Financial Accounting August 2015Document18 pagesf2 Financial Accounting August 2015Saddam HusseinNo ratings yet

- Textbook Materials - ch3Document40 pagesTextbook Materials - ch3OZZYMANNo ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Ias 1 - Questions..Document8 pagesIas 1 - Questions..Timothy KawumaNo ratings yet

- IAS 1 Practice QuestionsDocument15 pagesIAS 1 Practice QuestionsMuhammad MukarramNo ratings yet

- Financial Accounting and Reporting-I: Page 1 of 7Document7 pagesFinancial Accounting and Reporting-I: Page 1 of 7Hareem AbbasiNo ratings yet

- Cashflow QuestionDocument2 pagesCashflow QuestionPrince Daniels TutorNo ratings yet

- Question 2 (30 Marks) : Sales 8000 Cost of Sales (6000)Document4 pagesQuestion 2 (30 Marks) : Sales 8000 Cost of Sales (6000)Chitradevi RamooNo ratings yet

- Activity - Chapter 6 - Statement of Cash FlowsDocument4 pagesActivity - Chapter 6 - Statement of Cash FlowsKaren RiraoNo ratings yet

- Group Activity 1 Aec 217Document5 pagesGroup Activity 1 Aec 217Enitsuj Eam EugarbalNo ratings yet

- Group Activity 1 Aec 217Document5 pagesGroup Activity 1 Aec 217Enitsuj Eam EugarbalNo ratings yet

- Name: Dao Mai Linh Class: F13B ID NUMBER: F13-127Document30 pagesName: Dao Mai Linh Class: F13B ID NUMBER: F13-127Linhzin LinhzinNo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- Ita MockDocument8 pagesIta MockAyyan SheikhNo ratings yet

- FFA MockDocument4 pagesFFA MockGeeta LalwaniNo ratings yet

- CH 21 in Class Exercises Day 2Document2 pagesCH 21 in Class Exercises Day 2Abdullah alhamaadNo ratings yet

- Financial Accounting and Reporting: Page 1 of 4Document4 pagesFinancial Accounting and Reporting: Page 1 of 4ebshuvoNo ratings yet

- AUDITOFINTANGIBLESDocument5 pagesAUDITOFINTANGIBLESPar Cor0% (1)

- B-BTAX313 Module 3 (Revenue Cycle) - Case StudyDocument5 pagesB-BTAX313 Module 3 (Revenue Cycle) - Case Studywill passNo ratings yet

- Week 3 NotesDocument8 pagesWeek 3 NotescalebNo ratings yet

- Citn & Icag-13Document1 pageCitn & Icag-13AKINROYEJE TEMITOPENo ratings yet

- LCC-L2 Saturday Class-4 Control Account (S)Document3 pagesLCC-L2 Saturday Class-4 Control Account (S)wu alanNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Financial Accounting 19 PDF FreeDocument6 pagesFinancial Accounting 19 PDF FreeLyka Kristine Jane PacardoNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Financial Accounting and Reporting Problems Freebie PDFDocument46 pagesFinancial Accounting and Reporting Problems Freebie PDFC/PVT DAET, SHAINA JOYNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/31caiexpertcontactNo ratings yet

- F1.3 Financial AccountingDocument8 pagesF1.3 Financial Accountingijustus61No ratings yet

- Vitrox q42019Document17 pagesVitrox q42019Dennis AngNo ratings yet

- CAF 1 FAR1 Spring 2024Document7 pagesCAF 1 FAR1 Spring 2024khalidumarkhan1973No ratings yet

- FIA132 - Supplementary and Special Assessment NOVEMBER 2022Document8 pagesFIA132 - Supplementary and Special Assessment NOVEMBER 2022kaityNo ratings yet

- FSA - Tutorial 2-Fall 2023 With SolutionsDocument6 pagesFSA - Tutorial 2-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- Acc401-202324 Ga2-Even GroupsDocument3 pagesAcc401-202324 Ga2-Even Groupsisaacbediako82No ratings yet

- Paper 32 - InsertDocument8 pagesPaper 32 - InserthtyhongNo ratings yet

- A222 SELF STUDY TOPIC 2 - QueDocument2 pagesA222 SELF STUDY TOPIC 2 - QueAdelene NengNo ratings yet

- 23apr23 - Exercise - Income StatementDocument1 page23apr23 - Exercise - Income Statementrayarizqi54No ratings yet

- Corporate Reporting (United Kingdom) : March/June 2018 - Sample QuestionsDocument7 pagesCorporate Reporting (United Kingdom) : March/June 2018 - Sample QuestionsMonirul Islam MoniirrNo ratings yet

- ACCT 2208 - Final Review (Ch. 18, 22, 23)Document16 pagesACCT 2208 - Final Review (Ch. 18, 22, 23)MitchieNo ratings yet

- 2019 Friendly Hills BankDocument36 pages2019 Friendly Hills BankNate TobikNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Assignment 1Document2 pagesAssignment 1Muhammad Saad UmarNo ratings yet

- Epidemic InvestigationDocument1 pageEpidemic InvestigationMuhammad Saad UmarNo ratings yet

- It 1Document1 pageIt 1Muhammad Saad UmarNo ratings yet

- Solution - EthicsDocument7 pagesSolution - EthicsMuhammad Saad UmarNo ratings yet

- Group 6, Case StudyDocument1 pageGroup 6, Case StudyMuhammad Saad UmarNo ratings yet

- Probability Distribution AnswersDocument2 pagesProbability Distribution AnswersMuhammad Saad UmarNo ratings yet

- Macroeconomics AssignmentDocument3 pagesMacroeconomics AssignmentMuhammad Saad UmarNo ratings yet

- Financial Management Course Outline - BSACF 2K21Document6 pagesFinancial Management Course Outline - BSACF 2K21Muhammad Saad UmarNo ratings yet

- Covariance & CorrelationDocument5 pagesCovariance & CorrelationMuhammad Saad UmarNo ratings yet

- GRAANA - Final Project Group 3Document11 pagesGRAANA - Final Project Group 3Muhammad Saad UmarNo ratings yet

- Macro Assignment 1Document10 pagesMacro Assignment 1Muhammad Saad Umar100% (1)

- Section B Group 2 Assignment 1 FMIDocument5 pagesSection B Group 2 Assignment 1 FMIMuhammad Saad UmarNo ratings yet

- Mini Case EthicsDocument1 pageMini Case EthicsMuhammad Saad UmarNo ratings yet

- 1ST QuestionDocument3 pages1ST QuestionMuhammad Saad UmarNo ratings yet

- Mini Case PurchasesDocument2 pagesMini Case PurchasesMuhammad Saad UmarNo ratings yet

- Project Description (ATSF)Document2 pagesProject Description (ATSF)Muhammad Saad UmarNo ratings yet

- 664998Document2 pages664998Muhammad Saad UmarNo ratings yet

- Accounting Equation: Day Description Assets Dr. Cash Van M. Stall InevntoryDocument5 pagesAccounting Equation: Day Description Assets Dr. Cash Van M. Stall InevntoryMuhammad Saad UmarNo ratings yet

- 1ST QuestionDocument2 pages1ST QuestionMuhammad Saad UmarNo ratings yet

- Appendix BDocument1 pageAppendix BMuhammad Saad UmarNo ratings yet

- DETERMINATIONDocument2 pagesDETERMINATIONMuhammad Saad UmarNo ratings yet

- Isl QuizDocument1 pageIsl QuizMuhammad Saad UmarNo ratings yet

- Chapter 16 - FinalDocument24 pagesChapter 16 - FinalMuhammad Saad UmarNo ratings yet

- Isl Quiz 1Document2 pagesIsl Quiz 1Muhammad Saad UmarNo ratings yet

- Pak Studies ReportDocument3 pagesPak Studies ReportMuhammad Saad UmarNo ratings yet

- Microeconomics Assignment 2Document4 pagesMicroeconomics Assignment 2Muhammad Saad UmarNo ratings yet

- Islam Is Complete Code of LifeDocument5 pagesIslam Is Complete Code of LifeMuhammad Saad UmarNo ratings yet

- Chap 13 - Income From BusinessDocument14 pagesChap 13 - Income From BusinessMuhammad Saad UmarNo ratings yet

- Chapter 17 - IT TheoryDocument7 pagesChapter 17 - IT TheoryMuhammad Saad UmarNo ratings yet

- Articles 62 & 63: Presented By: Muhammad Saad Umar FROM: BS (ACF) - B 2K20Document10 pagesArticles 62 & 63: Presented By: Muhammad Saad Umar FROM: BS (ACF) - B 2K20Muhammad Saad UmarNo ratings yet

- Portfolio ManagementDocument43 pagesPortfolio ManagementPrathyusha Reddy100% (1)

- Capital MarketDocument10 pagesCapital MarketEduar GranadaNo ratings yet

- Investment Centers and Transfer PricingDocument53 pagesInvestment Centers and Transfer PricingArlene DacpanoNo ratings yet

- Inv536 Group AssignmentDocument27 pagesInv536 Group AssignmentSHAHRUL IZZUDDIN AHMAD FAUZINo ratings yet

- Case: Cenabal (A) Time Period: 12 July 2006 Protagonist: Jennifer Macdonald, The Owner of CenabalDocument3 pagesCase: Cenabal (A) Time Period: 12 July 2006 Protagonist: Jennifer Macdonald, The Owner of CenabalROSE AUGUSTINE CHERUKARA 2227044No ratings yet

- Mergers FinanceDocument5 pagesMergers Financeveda20No ratings yet

- Financial Resources ManagementDocument6 pagesFinancial Resources ManagementroseNo ratings yet

- MSQ-08 Capital BudgetingDocument14 pagesMSQ-08 Capital BudgetingMarilou Olaguir Saño100% (3)

- Statement of Account: Brought Forward 12580.30crDocument31 pagesStatement of Account: Brought Forward 12580.30cr4ccrstkyddNo ratings yet

- HDFC AmcDocument9 pagesHDFC AmcSanjit SinhaNo ratings yet

- Strategic Cost Management Quiz No. 1Document5 pagesStrategic Cost Management Quiz No. 1Alexandra Nicole IsaacNo ratings yet

- Accounting Lesson 1 Bank Reconciliation NotesDocument9 pagesAccounting Lesson 1 Bank Reconciliation NotesKabelo SefaliNo ratings yet

- Fixed Assest Management-UltratechDocument6 pagesFixed Assest Management-UltratechMr SmartNo ratings yet

- IFRS 13 - Fair Value MeasurementDocument13 pagesIFRS 13 - Fair Value MeasurementPrincess EngresoNo ratings yet

- s6 Aceiteka Mock Ent 1 2017Document3 pagess6 Aceiteka Mock Ent 1 2017Murungi SincereNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 21Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 21Alli Tobba100% (1)

- Projectbyviveksaha 130303153621 Phpapp02Document66 pagesProjectbyviveksaha 130303153621 Phpapp02Aditya KudtarkarNo ratings yet

- Toa Pas 1 Financial StatementsDocument14 pagesToa Pas 1 Financial StatementsreinaNo ratings yet

- 4TH PROGRESS REPORT-sachinDocument9 pages4TH PROGRESS REPORT-sachinRishabh SinghNo ratings yet

- IDEAL RICE INDUSTRIES AccountsDocument89 pagesIDEAL RICE INDUSTRIES Accountsahmed.zjcNo ratings yet

- PowerPoint Ch7Document53 pagesPowerPoint Ch7Abir AllouchNo ratings yet

- Jenny Merchandising Common-Size Analysis'Document2 pagesJenny Merchandising Common-Size Analysis'Theang ʚĩɞNo ratings yet

- Acctg13 Midterm Exam TQ 2021 2022 2nd SemDocument6 pagesAcctg13 Midterm Exam TQ 2021 2022 2nd SemGarp BarrocaNo ratings yet

- Project Report On Indian IPODocument82 pagesProject Report On Indian IPOLalit MakwanaNo ratings yet

- Ecommerce Model - Complete: Strictly ConfidentialDocument3 pagesEcommerce Model - Complete: Strictly ConfidentialEmeka S. OkekeNo ratings yet

- Mas12 FS AnalysisDocument10 pagesMas12 FS Analysishatdognamaycheese123No ratings yet

- CH 1 Crvi BookDocument10 pagesCH 1 Crvi BookAbhijeetNo ratings yet

- Penerapan Peraturan Penghentian Sementara Perdagangan Saham (Suspensi) Oleh Bursa Efek Indonesia Kaitannya Terhadap Perlindungan Hukum InvestorDocument7 pagesPenerapan Peraturan Penghentian Sementara Perdagangan Saham (Suspensi) Oleh Bursa Efek Indonesia Kaitannya Terhadap Perlindungan Hukum InvestorAlexander AgungNo ratings yet