Professional Documents

Culture Documents

Annexure Board Resolution PDF

Annexure Board Resolution PDF

Uploaded by

AbhishekShubhamGabrielOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure Board Resolution PDF

Annexure Board Resolution PDF

Uploaded by

AbhishekShubhamGabrielCopyright:

Available Formats

CERTIFIED TRUE COPY OF THE RESOLUTION PASSED BY THE BOARD OF DIRECTORS

(“BOARD”) OF CUREFOODS INDIA PRIVATE LIMITED (“COMPANY”) AT ITS MEETING

HELD ON AUGUST 20, 2021 AT NO. 72/4, ROOPENA AGRAHARA, HOSUR ROAD, MADIWALA

POST, BANGALORE, KARNATAKA, INDIA 560068 AT 1 PM

ITEM NO. 4: TO AUTHORISE AND RECOMMEND FOR SHAREHOLDERS’ APPROVAL THE

ISSUANCE OF SERIES A COMPULSORILY CONVERTIBLE PREFERENCE SHARES AND SERIES

A1 COMPULSORILY CONVERTIBLE PREFERENCE SHARES ON A PREFERENTIAL BASIS

“RESOLVED that pursuant to the provisions of Sections 42, 55 and 62 (1)(c) and all other applicable provisions,

if any, of the Companies Act, 2013 (“the Act") read with Rule 9 and Rule 13 of the Companies (Share Capital

and Debentures) Rules, 2014, Rule 14 of the Companies (Prospectus and Allotment of Securities) Rules, 2014 and

any other rules as may be applicable (including any statutory amendments or modifications or re-enactments

thereof, for the time being in force), the Foreign Exchange Management Act, 1999 (including any statutory

amendments or modifications or re-enactments thereof, for the time being in force) read with the Foreign Exchange

Management (Non Debt Instruments) Rules, 2019, as amended from time to time (“FEMA”) and enabling

provisions in the Memorandum of Association and Articles of Association of the Company and subject to the

approval of the members of the Company and such other approval, consent, permission, and/ or sanction of any

other authorities/ institutions and subject to such conditions as may be prescribed by any of them while granting

any such approval, consent, permission and sanction, the consent of the Board of the Company be and is hereby

given for issuing up to 28,002 (Twenty Eight Thousand and Two) Series A Compulsorily Convertible Preference

Shares (“Series A CCPS”) of Re.1/- (Rupee One) each and 5,958 (Five Thousand Nine Hundred and Fifty Eight)

Series A1 Compulsorily Convertible Preference Shares (“Series A1 CCPS”) of Re.1/- (Rupee One) each (Series

A CCPS and Series A1 CCPS shall be collectively referred to as “CCPS”) at an issue price of Rs. 24,842.12

(Rupees Twenty Four Thousand Eight Hundred Forty Two and Twelve Paise) per CCPS including a premium of

Rs. 24,841.12 (Rupees Twenty Four Thousand Eight Hundred Forty One and Twelve Paise) per CCPS for

consideration in cash on the terms provided as set out in: (i) Annexure A, for the Series A CCPS; and (ii)

Annexure B, for the Series A1 CCPS, on a preferential basis in one or more tranches to the following persons:

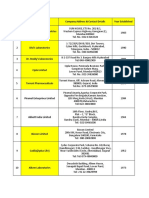

Sl. Name of the Proposed Address of the Proposed No. of CCPS CCPS Series

No. Allottee Allottee

1 Ankit Nagori Flat No. D 1205, St Johns 4,428 Series A CCPS

Wood Apartments, Taverekere

Main Road, Bangalore –

560029, Karnataka, India

2 Iron Pillar PCC C/o. Apex Fund & Corporate 14,894 Series A CCPS

Services (Mauritius) Ltd, Lot

15 A3, 1st Floor

Cybercity, Ebene 72201,

Mauritius

3 Global eCommerce C/o. IQ EQ Corporate Services 2,979 Series A CCPS

Consolidation Fund, L.P. (Cayman) Limited, Suite SW6 5,958 Series A1 CCPS

The Grand Pavilion

Commercial Centre,

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

Alamander Way, 802 West

Bay Road, George Town,

Grand Cayman, Cayman

Islands

4 Aniket Dey 43, Residency Road, Bangalore 125 Series A CCPS

– 560025, Karnataka, India

5 Not A Ski Bum LLC 19300 S Hamilton Ave Ste 285 149 Series A CCPS

Gardena CA 90248 USA

6 Rashmi Kwatra 38 Shanghai Road 15-04 149 Series A CCPS

Singapore 248201

7 Brennan Loh 36 Barton St, Ottawa, ON, K1S 149 Series A CCPS

4R7, Canada

8 UTPL Corporate Trustees C-13, First floor, SDA 403 Series A CCPS

Private Limited as a Trustee commercial Complex, Opp IIT

for Rukam Capital Trust Fund Delhi main gate, Hauz Khas,

New Delhi – 110016, New

Delhi, India

9 Allanasons Private Limited Allana House, 403 Series A CCPS

Allana Road,

Colaba,

Mumbai- 400 001,

Maharashtra, India

10 Jitender Kumar Bansal No. C 703, Mantri Classic 4,025 Series A CCPS

Apartments, 1st Main, 8th

Cross Koramangala, Bangalore

– 560034, Karnataka, India

11 QED Innovation Labs LLP 404, Uphar 2 Chs Ltd, Plot 149 Series A CCPS

No.5, Bhd Sanjeeva Enclave, 7

Bunglows, Near Juhu Circle,

Mumbai – 400061,

Maharashtra, India

12 Napatree Capital Advisors Northcliffe House, Derry 149 Series A CCPS

Street, London England W8

5TT

Total 33,960

RESOLVED FURTHER that pursuant to Rule 9 of the Companies (Share Capital and Debentures) Rules, 2014,

following are the particulars of the CCPS:

Priority with respect to payment of

Dividend or repayment of capital vis-

a-vis equity shares

Participation in Surplus Funds

Participation in Surplus Assets and

Profits on winding up which may

remain after the entire capital has As set out in: (i) Annexure A, for the Series A CCPS; and (ii)

been repaid Annexure B, for the Series A1 CCPS

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

Payment of dividend on cumulative

or non-cumulative basis

Conversion of Preference Shares into

equity shares

Voting Rights

Redemption of Preference Shares

Other Terms

RESOLVED FURTHER that subject to the approval of the shareholders of the Company, the terms of issue of

the above mentioned: (i) Series A CCPS, attached as Annexure A; and (ii) Series A1 CCPS, attached as Annexure

B, be and are hereby approved.

RESOLVED FURTHER that pursuant to section 42 read with rule 13 of the Companies (Share Capital and

Debenture) Rules, 2014 and Rule 14 of the Companies (Prospectus and Allotment of Securities) Rules, 2014 and

other applicable provisions, if any, of the Companies Act, 2013 and subsequent filing of the shareholders’

resolution in this regard with the Registrar of Companies pursuant to the Companies (Prospectus and Allotment of

Securities) Rules, 2014, the Board hereby accords its approval to the private placement offer letter (in Form PAS-

4), along with other documents and relevant annexures and the application form annexed thereto, drafts of which

have been placed before the Board and initialed by the Chairman for the purpose of identification and subject to

the receipt of the approval of the shareholders by a special resolution and the Board hereby authorises any of the

directors, to sign, issue and deliver the private placement offer letter (in Form PAS-4), along with other documents

and relevant annexures and the application form annexed thereto, to the identified persons mentioned above in the

table and to do all such actions, deeds, matters, writings and things as are necessary or expedient in this regard,

including, but not limited to, undertaking filing of requisite forms and documents with the concerned Registrar of

Companies / Ministry of Corporate Affairs / Reserve Bank of India.

RESOLVED FURTHER that subject to the approval of the shareholders, the authorisation of the Board be and

is hereby granted to commence the procedure for the preferential allotment of Series A CCPS and Series A1 CCPS

to the identified persons.

RESOLVED FURTHER that the Company do record the name of the identified persons and maintain such record

of private placement offer of the Series A CCPS and Series A1 CCPS in Form PAS-5 under the Companies

(Prospectus and Allotment of Securities) Rules, 2014.

RESOLVED FURTHER that monies received by the Company from the identified persons as application monies

to issue the Series A CCPS and Series A1 CCPS, shall be kept by the Company in a separate bank account opened

by the Company (Bank Account Number: 0547346009 and Bank Name: Citibank India) and shall be utilized by

the Company in accordance with section 42 of the Companies Act, 2013.

RESOLVED FURTHER that any of the directors of the Company be and is hereby severally authorised on behalf

of the Company, to execute such offer letter and do all such other acts, deeds, matters or things as may be necessary,

appropriate, expedient or desirable to give effect to these resolutions, including but not limited to filing of necessary

forms with the Registrar of Companies, the Form SMF-FC-GPR with the Reserve Bank of India and to comply

with all other requirements in this regard.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

RESOLVED FURTHER that any of the directors of the Company be and are hereby severally authorised to

certify a copy of this resolution and issue the same to all concerned parties.”

//Certified True Copy//

For Curefoods India Private Limited

ANKIT Digitally signed by

ANKIT NAGORI

NAGORI Date: 2021.08.20

18:39:14 +05'30'

Ankit Nagori

Director

DIN: 06672135

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

ANNEXURE A

PART A

TERMS OF ISSUANCE OF SERIES A CCPS

The Series A CCPS are issued with the following characteristics, including certain rights vested in the holders of

Series A CCPS which are in addition to, and without prejudice to, the other rights of such holders of Series A

CCPS set out in the Transaction Documents.

1. Equity Shares. The number of Equity Shares to be issued to the holder of Series A CCPS upon conversion

shall be, subject to the other terms and conditions set forth in these Articles, be as set out in paragraph 3 of

this Part A of Annexure A.

2. Dividends. The Series A CCPS shall carry a pre-determined cumulative dividend rate of 0.001% (zero point

zero zero one percent) per annum on an as converted basis. In addition to the same, if the holders of Equity

Shares are paid dividend in excess of 0.001% (zero point zero zero one percent), the holders of the Series A

CCPS shall be entitled to dividend at such higher rate. The dividend shall be payable, subject to cash flow

solvency, in the event the Board declares any dividend for the relevant year and shall be paid to holders of

Series A CCPS on a pari passu basis with the holders of Series A1 CCPS.

3. Conversion.

3.1. The Series A CCPS shall be compulsorily converted into Equity Shares of the Company after the expiry of

19 (Nineteen) years from the date of issuance. The holders of Series A CCPS may convert the Series A CCPS

in whole or in part into into Equity Shares at any time before 19 (Nineteen) years from the date of issuance

of the same. The conversion of Series A CCPS to Equity Shares shall be subject to the adjustments provided

in paragraphs 4, 5 and 6 of this Part A of Annexure A and other terms and conditions of these Articles. The

Series A CCPS will be convertible at INR 24,842.12 (Indian Rupees Twenty Four Thousand Eight Hundred

and Forty Two point One Two only) per Series A CCPS (“Series A Conversion Price”). The Series A

Conversion Price shall be adjusted in accordance with the terms specified under this Part A of Annexure A

and the Articles. The adjusted Series A Conversion Price shall be construed as the relevant Series A

Conversion Price for the purposes of these Articles and accordingly the conversion ratio for Series A CCPS

shall be determined (“Conversion Ratio”).

3.2. The holders of Series A CCPS shall, at any time prior to 19 (Nineteen) years from the date of issuance of the

same, be entitled to call upon the Company to convert all or any of the Series A CCPS by issuing a Notice to

the Company accompanied by a share certificate representing the Series A CCPS sought to be converted.

Immediately and no later than 21 (Twenty One) days from the receipt of such Notice, the Company shall

issue Equity Shares in respect of the Series A CCPS sought to be converted. The record date of conversion

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

of the Series A CCPS shall be deemed to be the date on which the holder of Series A CCPS issues a Notice

of conversion to the Company. The Series A CCPS, if not converted earlier, shall automatically convert into

Equity Shares at the then applicable Series A Conversion Price, upon the earlier of the following (a) on latest

permissible date prior to the issue of Shares to the public in connection with the occurrence of a Public Offer

under Applicable Law, or (b) on the day following the completion of 19 (Nineteen) years from the date of

issuance of the same.

3.3. As on the Closing Date each Series A CCPS shall be convertible into 1 (One) Equity Share. No fractional

Shares shall be issued upon conversion of Series A CCPS, and the number of Equity Shares to be issued shall

be rounded up to the nearest whole number.

3.4. It is hereby clarified that to give effect to the conversion of Series A CCPS into Equity Shares as contemplated

under this Paragraph 3, if the number of authorized but unissued Equity Shares is not sufficient to effect the

conversion of all then outstanding Series A CCPS, the Company will take such corporate action as may be

necessary to increase its authorized but unissued Equity Share capital to such number of Shares as shall be

sufficient for such purposes.

4. Valuation Protection.

If the Company undertakes a Dilutive Issuance, then the holders of Series A CCPS shall be entitled to a broad

based weighted-average basis anti-dilution protection as provided in Part B of this Annexure A.

5. Adjustments.

(a) If, whilst any Series A CCPS remain capable of being converted into Equity Shares, the Company

splits, sub-divides (stock split) or consolidates (reverse stock split) the Equity Shares into a different

number of securities of the same class, the number of Equity Shares issuable upon a conversion of the

Series A CCPS shall, subject to Applicable Law and receipt of requisite approvals, be proportionately

increased in the case of a split or sub-division (stock split), and likewise, the number of Equity Shares

issuable upon a conversion of Series A CCPS shall be proportionately decreased in the case of a

consolidation (reverse stock split).

(b) If, whilst any Series A CCPS remain capable of being converted into Equity Shares, the Company

makes or issues a dividend or other distribution of Equity Shares to the holders of Equity Shares then

the number of Equity Shares to be issued on any subsequent conversion of Series A CCPS shall, subject

to Applicable Law and receipt of requisite approvals, be increased proportionately and without

payment of additional consideration therefor by the holder of Series A CCPS.

(c) If the Company, by re-classification or conversion of Shares or otherwise, changes any of the Equity

Shares into the same or a different number of Shares of any other class or classes, the right to convert

the Series A CCPS into Equity Shares shall thereafter represent the right to acquire such number and

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

kind of Shares as would have been issuable as the result of such change with respect to the Equity

Shares that were subject to the conversion rights of the holder of Series A CCPS immediately prior to

the record date of such re-classification or conversion.

(d) If, whilst any Series A CCPS remain capable of being converted into Equity Shares, there is a

reorganisation (other than in the manner set out under sub-paragraphs (a), (b) or (c) above) or any form

of corporate restructuring (for instance, a merger, amalgamation, etc.), pursuant to which either the

Company is not the surviving entity or the Shares of the Company prior to such corporate restructuring

are converted into another form of property (whether securities, cash or otherwise), the right to convert

the Series A CCPS into Equity Shares shall thereafter represent the right to receive such number of

securities or other property as the holders of Series A CCPS would have been entitled to receive if the

right to convert the Series A CCPS into Equity Shares had been exercised in full immediately before

such corporate restructuring, subject to the adjustments provided in this Part A of Annexure A.

(e) If, whilst any Series A CCPS remain capable of being converted into Equity Shares, the Company shall

make or issue a rights issue of Shares, bonus Shares, conversion of stocks into Shares or other non-

cash dividends/distribution of Equity Shares to the holders of Equity Shares, the number of Equity

Shares to be issued on any subsequent conversion of Series A CCPS shall be increased proportionately

and without the payment of additional consideration therefore by the holder of Series A Preference

Share.

(f) The holder of Series A CCPS shall be entitled to the cumulative benefit of all adjustments referred to

herein.

6. Liquidation Preference. In any Liquidation Event, subject to Applicable Law, the liquidation preference of

the holders of Series A CCPS shall be as provided in Clause 11 of the Shareholders Agreement of the

Company.

7. Registration rights. Each holder of Series A CCPS shall receive typical and customary registration rights,

where available, in all global market(s) where the Company lists the Shares. Termination of the Transaction

Documents shall not affect the obligation of the Company to provide registration rights to the holder of Series

A CCPS.

8. Meeting and Voting rights. Subject to Applicable Laws, the holders of the Series A CCPS shall be entitled

to receive notice of and vote on all matters that are submitted to the vote of the Shareholders of the Company

(including the holders of Equity Shares). Each Shareholder and the Company hereby acknowledge that the

holders of the Series A CCPS have agreed to subscribe to the same on the basis that they will be able to

exercise voting rights on such Series A CCPS as if the same were converted into Equity Shares. To this effect,

each Shareholder holding Shares with voting rights agrees that, if Applicable Law does not permit any holder

of Series A CCPS to exercise voting rights on all or any Shareholder matters submitted to the vote of the

Shareholders of the Company (including the holders of Equity Shares) (the “Non-Voting Preference

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

Shares”), then until the conversion of all such Non-Voting Preference Shares into Equity Shares, each

Shareholder shall vote in accordance with the instructions of the holders of such Non-Voting Preference

Shares at a General Meeting or provide proxies without instructions to the holders of the Non-Voting

Preference Shares for the purposes of a General Meeting, in respect of such number of Equity Shares held by

each of them such that a Relevant Percentage of the Equity Shares of the Company are voted on in the manner

required by the holders of the Non-Voting Preference Shares. For the purposes of this Paragraph 8, the

“Relevant Percentage” in relation to a holder of the Non-Voting Preference Shares shall be equal to the

percentage of Equity Shares in the Company that the holder of such Non-Voting Preference Shares would

hold if such holder was to elect to convert its Non-Voting Preference Shares into Equity Shares based on the

then applicable Conversion Price. The obligation of the Shareholders to vote their Shares as aforesaid shall

be pro-rated in accordance with their inter se shareholding in the Company.

9. Amendment of Terms. Notwithstanding anything contained in these Articles, any amendment of the terms

of Series A CCPS set out in this Part A of Annexure A shall require the prior written consent of such Persons

holding at least 75% (Seventy-Five percent) of the Series A CCPS. It is clarified that the issuance of any

Dilution Instruments by the Company which are of a different series or class but have rights pari passu to

the rights of the Series A CCPS shall not be considered as an amendment to the terms of issuance of the

Series A CCPS and the approval of the holders of the Series A CCPS will not be required, in accordance with

this paragraph, for such issuance or for undertaking any consequential amendments to the terms of the Series

A CCPS.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

PART B

BROAD BASED WEIGHTED AVERAGE VALUATION PROTECTION FOR SERIES A CCPS

1. Definitions

For the purposes of this Part B of Annexure A and unless the context requires a different meaning, the

following terms have the meanings indicated.

(a) "Issue Date" shall have the meaning ascribed to it in Paragraph 2(a)(ii) of this Part B of Annexure A.

(b) "Lowest Permissible Price" in relation to a Shareholder shall mean the lowest possible price at which a

Share may be issued to/acquired by such Shareholder in accordance with Applicable Law.

(c) "New Issue Price" shall have the meaning ascribed to it in Paragraph 2(a)(i) of this Part B of Annexure

A.

(d) "Series A Conversion Price" shall have the meaning set forth in Part A of Annexure A (Terms of

Issuance of Series A CCPS).

2. Non-Dilution Protection

(a) Issuance below Series A CCPS Conversion Price.

(i) New Issues. If the Company shall at any time or from time to time issue or sell any Dilution

Instruments at a price per Dilution Instrument that is less than the Series A Conversion Price (the

“New Issue Price”), other than (a) issue of ordinary Shares to employees, officers or consultants

of the Company pursuant to the ESOP Plan or any other employee incentive plan adopted by the

Board; (b) issue of Dilution Instruments where the anti-dilution right is waived by the relevant

Shareholder; (c) issuance of the Entitled Shares to Curefit then, the holders of Series A CCPS shall

be issued additional Equity Shares, when requested by the holder of the Series A CCPS, for no

consideration or at the lowest value permitted under Applicable Laws, or the Conversion Price of

the Series A CCPS shall be adjusted as set out in Paragraph 2(a)(iii) of this Part B of Annexure

A (“Anti-Dilution Issuance”).

(ii) Timing for New Issues. Such Anti-Dilution Issuance shall be made whenever such Dilution

Instruments are issued in accordance with Paragraph 2(a)(i) of this Part B of Annexure A on the

date of such issuance (the "Issue Date"); provided, however, that the determination as to whether

an anti-dilution issuance is required to be made pursuant to this Paragraph 2(a) of this Part B of

Annexure A shall be made immediately or simultaneously upon the issuance of such Dilution

Instruments, and not upon the subsequent issuance of any security into which the Dilution

Instruments convert, exchange or may be exercised.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

(iii) Anti-Dilution Issuance. If an Anti-Dilution Issuance is to be undertaken pursuant to an occurrence

of any event described in Paragraph 2(a)(i) of this Part B of Annexure A, the Series A Conversion

Price shall be adjusted in accordance with the following formula:

(Q1) + (Q2)

NCP = (P1) x

(Q1) + (R)

For the purposes of this Paragraph, “NCP” is the new Purchase Price;

“P1” is the Series A CCPS Conversion Price;

“Q1” means the number of Equity Shares Outstanding immediately prior to the new issue;

“Q2” means such number of Equity Shares that the aggregate consideration received by the

Company for such issuance would purchase at the Series A Conversion Price;

“R” means the number of Equity Shares issuable / issued upon conversion of the Dilution

Instruments being issued.

For purposes of this Condition, the term “Equity Shares Outstanding” shall mean the aggregate number

of Equity Shares of the Company then outstanding (assuming for this purpose the exercise and/or

conversion of all then-outstanding securities exercisable for and/or convertible into Equity Shares

(including without limitation the conversion of all Series A CCPS)), and all shares reserved under the ESOP

Plan.

3. Reorganization, Reclassification: In case of any reconstruction or consolidation of the Company or any

capital reorganization, reclassification or other change of outstanding Shares or if the Company declares a

distribution (other than dividend for cash) on its Equity Shares or the Company authorizes the granting to

the holders of its Equity Shares rights or warrants to subscribe for or purchase any Equity Shares of any

class or of any other rights or warrants; or upon occurrence of any other similar transaction (each, a

"Transaction"):

(i) then the Company shall mail to each holder of Series A CCPS at such holder's address as it appears

on the books of the Company, as promptly as possible but in any event at least 21 (Twenty One)

days prior to the applicable date hereinafter specified, a Notice stating the date on which a record

is to be taken for the purpose of such dividend, distribution or granting of rights or warrants or, if

a record is not to be taken, the date as of which the holders of Equity Shares of record to be entitled

to such dividend, distribution or granting of rights or warrants are to be determined.

Notwithstanding the foregoing, in the case of any event to which this Paragraph is applicable, the

Company shall also deliver the certificate described in Paragraph 3(ii) below to each holder of

Series A CCPS at least 21 (Twenty One) Business Days' prior to effecting such reorganization or

reclassification as aforesaid.

(ii) the Company shall execute and deliver to each holder of Series A CCPS at least 7 (Seven) days

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

prior to effecting such Transaction a certificate, signed by (i) the chief executive officer of the

Company and (ii) the chief financial officer of the Company, stating that the holder of each Series

A CCPS shall have the right to receive in such Transaction, in exchange for each such Equity Share

a security identical to (and not less favourable than) each such Equity Share and no less favourable

than any security offered to any other Shareholder for or in relation to that Transaction, and

provision shall be made therefor in the Shareholders Agreement, if any, relating to such

Transaction.

4. Mode of Giving Effect to Valuation Protection: In the event adjustment of the conversion ratio or

conversion price of the Series A CCPS in the manner detailed in Paragraph 2 above of this Part B of

Annexure A results in the Series A Conversion Price going below the minimum price permitted under

Applicable Law or if Series A CCPS have been converted into Equity Shares, then such holders of Equity

Shares (pursuant to conversion of Series A CCPS) shall, in lieu of adjustment to Series A CCPS Conversion

Price, have the option to require the Company to do any of the following (a) Transfer Founder Equity Shares

held by the Founder to the holder of Series A CCPS at the lowest price permissible under Applicable Law;

(b) buy back of Founder Equity Shares held by the Founder; (c) reduce the sale proceeds receivable by the

Founder (as a holder of Founder Equity Shares) as a result of Liquidation Event; (d) issue of additional

Shares to holder of Series A CCPS at the lowest permissible price; (e) adjust the Conversion Ratio of the

Series A CCPS or (f) take such measures as may be necessary to give effect to the provisions of this Part

B of Annexure A.

5. Compliance with and Effectiveness of this Part B of Annexure A

(a) Waiver. If a Shareholder (other than a holder of Series A CCPS) is entitled under any contract, requirement

of Applicable Law or otherwise to participate in relation to any issue of Shares to Holder of Series A CCPS

under this Part B of Annexure A, then such Shareholder hereby waives all such rights and, to the extent it

cannot waive such rights it agrees and undertakes not to exercise them.

(b) Ensuring Economic Effect. If for any reason any part of this Part B of Annexure A is not fully effected

as a result of any change in Applicable Law (including a change in Applicable Law that affects the price at

which Holder of Series A CCPS may sell or be issued Shares) then each Shareholder and the Company

shall each use its best efforts to take all such actions (by corporate, director or shareholder action) as may

be necessary to provide to Holder of Series A CCPS the same economic benefits as are contemplated by

this Part B of Annexure A.

(c) Change in Applicable Law. If there is a change in any Applicable Law that makes it possible to implement

any part of this Part B of Annexure A so as to confer the economic benefits on Holder of Series A CCPS

that are contemplated by this Part B of Annexure A in a more effective manner then each Shareholder and

the Company shall co-operate and use its best efforts to implement this Part B of Annexure A in that more

effective manner.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

(d) Currency Exchange. If in calculating a price or any other amount under this Part B of Annexure A the

relevant variables for that calculation are expressed in different currencies then all such variables for the

purposes of that calculation shall be converted to INR.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

ANNEXURE B

PART A

TERMS OF ISSUANCE OF SERIES A1 CCPS

The Series A1 CCPS are issued with the following characteristics, including certain rights vested in the holders of

Series A1 CCPS which are in addition to, and without prejudice to, the other rights of such holders of Series A1

CCPS set out in the Transaction Documents.

1. Equity Shares. The number of Equity Shares to be issued to the holder of Series A1 CCPS upon conversion

shall be, subject to the other terms and conditions set forth in these Articles, be as set out in paragraph 3 of

this Part A of Annexure B.

2. Dividends. The Series A1 CCPS shall carry a pre-determined cumulative dividend rate of 0.001% (zero point

zero zero one percent) per annum on an as converted basis. In addition to the same, if the holders of Equity

Shares are paid dividend in excess of 0.001% (zero point zero zero one percent), the holders of the Series A1

CCPS shall be entitled to dividend at such higher rate. The dividend shall be payable, subject to cash flow

solvency, in the event the Board declares any dividend for the relevant year and shall be paid to holders of

Series A CCPS on a pari passu basis with the holders of Series A1 CCPS.

3. Conversion.

3.1. The Series A1 CCPS shall be compulsorily converted into Equity Shares of the Company after the expiry of

19 (Nineteen) years from the date of issuance. The conversion of Series A1 CCPS to Equity Shares shall be

subject to the adjustments provided in paragraphs 4, 5 and 6 of this Part A of Annexure B and other terms

and conditions of these Articles. The Series A1 CCPS will be convertible at INR 24842.12 (Indian Rupees

Twenty-Four Thousand Eight Hundred and Forty Two point One Two) per Series A1 CCPS (“Initial Series

A1 Conversion Price”). The Initial Series A1 Conversion Price shall be adjusted in accordance with the

terms specified under this Part A of Annexure B and the Articles (“Adjusted Series A1 Conversion

Price”). The Series A1 Conversion Price in effect at the relevant time (i.e., the Initial Series A1 Conversion

Price or the Adjusted Series A1 Conversion Price, as the case may be) shall be construed as the relevant

Series A1 Conversion Price (“Series A1 Conversion Price”) for the purposes of these Articles and

accordingly, the conversion ratio for Series A1 CCPS shall be determined (“Series A1 Conversion Ratio”).

3.2. The holders of Series A1 CCPS shall not convert the Series A1 CCPS until the earlier of (i) the date of

consummation of Subsequent Financing; and (ii) date of expiry of 24 (Twenty-Four) months from the Closing

Date, following which the holders of Series A1 CCPS shall be entitled to call upon the Company to convert

all or any of the Series A1 CCPS prior to completion of 19 (Nineteen) years from the Closing Date, by issuing

a Notice to the Company accompanied by a share certificate representing the Series A1 CCPS sought to be

converted. Immediately and no later than 21 (Twenty-One) days from the receipt of such Notice, the

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

Company shall issue Equity Shares in respect of the Series A1 CCPS sought to be converted. The record date

of conversion of the Series A1 CCPS shall be deemed to be the date on which the holder of Series A1 CCPS

issues a Notice of conversion to the Company. The Series A1 CCPS, if not converted earlier, shall

automatically convert into Equity Shares at the then applicable Series A1 Conversion Price, upon the earlier

of the following (a) on latest permissible date prior to the issue of Shares to the public in connection with the

occurrence of a Public Offer under Applicable Law, or (b) on the day following the completion of 19

(Nineteen) years from the date of issuance of the same.

3.3. It is hereby clarified that to give effect to the conversion of Series A1 CCPS into Equity Shares as

contemplated under this Paragraph 3, if the number of authorized but unissued Equity Shares is not sufficient

to effect the conversion of all then outstanding Series A1 CCPS, the Company will take such corporate action

as may be necessary to increase its authorized but unissued Equity Share capital to such number of Shares as

shall be sufficient for such purposes.

4. Valuation Protection.

If the Company undertakes a Dilutive Issuance, then the holders of Series A1 CCPS shall be entitled to a

broad based weighted-average basis anti-dilution protection as provided in Part B of this Annexure B.

5. Adjustments.

(a) If, whilst any Series A1 CCPS remain capable of being converted into Equity Shares, the Company splits,

sub-divides (stock split) or consolidates (reverse stock split) the Equity Shares into a different number of

securities of the same class, the number of Equity Shares issuable upon a conversion of the Series A1 CCPS

shall, subject to Applicable Law and receipt of requisite approvals, be proportionately increased in the case

of a split or sub-division (stock split), and likewise, the number of Equity Shares issuable upon a conversion

of Series A1 CCPS shall be proportionately decreased in the case of a consolidation (reverse stock split).

(b) If, whilst any Series A1 CCPS remain capable of being converted into Equity Shares, the Company makes

or issues a dividend or other distribution of Equity Shares to the holders of Equity Shares then the number

of Equity Shares to be issued on any subsequent conversion of Series A1 CCPS shall, subject to Applicable

Law and receipt of requisite approvals, be increased proportionately and without payment of additional

consideration therefor by the holder of Series A1 CCPS.

(c) If the Company, by re-classification or conversion of Shares or otherwise, changes any of the Equity Shares

into the same or a different number of Shares of any other class or classes, the right to convert the Series

A1 CCPS into Equity Shares shall thereafter represent the right to acquire such number and kind of Shares

as would have been issuable as the result of such change with respect to the Equity Shares that were subject

to the conversion rights of the holder of Series A1 CCPS immediately prior to the record date of such re-

classification or conversion.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

(d) Valuation Adjustment.

(i) In the event a Subsequent Financing is consummated before the expiry of 24 (Twenty-Four) months

from the Closing Date, the Adjusted Series A1 Conversion Price (subject to any adjustments previously

made under Part B of Annexure B) shall be determined on the basis of the pre-money valuation of

Series A1 CCPS being deemed to be the lower of (x) USD 125,000,000 (One Hundred and Twenty

Five Million US Dollars only); and (y) such pre-money valuation of Series A1 CCPS as calculated by

applying a discount of 20% (Twenty per cent) to the pre money valuation of the Subsequent Financing.

(ii) In the event the Subsequent Financing is not consummated by the Company within 24 (Twenty-Four)

months from the Closing Date, the Adjusted Series A1 Conversion Price (subject to any adjustments

previously made under Part B of Annexure B) shall be determined on the basis of the pre-money

valuation of Series A1 CCPS being deemed to be USD 100,000,000 (One Hundred Million US

Dollars).

(iii) Notwithstanding the foregoing, the Adjusted Series A1 Conversion Price under this Paragraph 3 shall

not, on account of the said adjustments, be lower than the Initial Series A1 Conversion Price.

(e) If, whilst any Series A1 CCPS remain capable of being converted into Equity Shares, there is a

reorganisation (other than in the manner set out under sub-paragraphs (a), (b) or (c) above) or any form of

corporate restructuring (for instance, a merger, amalgamation, etc.), pursuant to which either the Company

is not the surviving entity or the Shares of the Company prior to such corporate restructuring are converted

into another form of property (whether securities, cash or otherwise), the right to convert the Series A1

CCPS into Equity Shares shall thereafter represent the right to receive such number of securities or other

property as the holders of Series A1 CCPS would have been entitled to receive if the right to convert the

Series A1 CCPS into Equity Shares had been exercised in full immediately before such corporate

restructuring, subject to the adjustments provided in this Part A of Annexure B.

(f) If, whilst any Series A1 CCPS remain capable of being converted into Equity Shares, the Company shall

make or issue a rights issue of Shares, bonus Shares, conversion of stocks into Shares or other non-cash

dividends/distribution of Equity Shares to the holders of Equity Shares, the number of Equity Shares to be

issued on any subsequent conversion of Series A1 CCPS shall be increased proportionately and without the

payment of additional consideration therefore by the holder of Series A1 Preference Share.

(g) The holder of Series A1 CCPS shall be entitled to the cumulative benefit of all adjustments referred to

herein.

6. Liquidation Preference. In any Liquidation Event, subject to Applicable Law, the liquidation preference of

the holders of Series A1 CCPS shall be as provided in Clause 11 of the Shareholders Agreement of the

Company

7. Registration rights. Each holder of Series A1 CCPS shall receive typical and customary registration rights,

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

where available, in all global market(s) where the Company lists the Shares. Termination of the Transaction

Documents shall not affect the obligation of the Company to provide registration rights to the holder of Series

A1 CCPS.

8. Meeting and Voting rights. Subject to Applicable Laws, the holders of the Series A1 CCPS shall be entitled

to receive notice of and vote on all matters that are submitted to the vote of the Shareholders of the Company

(including the holders of Equity Shares). Each Shareholder and the Company hereby acknowledge that the

holders of the Series A1 CCPS have agreed to subscribe to the same on the basis that they will be able to

exercise voting rights on such Series A1 CCPS as if the same were converted into Equity Shares. To this

effect, each Shareholder holding Shares with voting rights agrees that, if Applicable Law does not permit any

holder of Series A1 CCPS to exercise voting rights on all or any Shareholder matters submitted to the vote

of the Shareholders of the Company (including the holders of Equity Shares) (the “Non-Voting Preference

Shares”), then until the conversion of all such Non-Voting Preference Shares into Equity Shares, each

Shareholder shall vote in accordance with the instructions of the holders of such Non-Voting Preference

Shares at a General Meeting or provide proxies without instructions to the holders of the Non-Voting

Preference Shares for the purposes of a General Meeting, in respect of such number of Equity Shares held by

each of them such that a Relevant Percentage of the Equity Shares of the Company are voted on in the manner

required by the holders of the Non-Voting Preference Shares. For the purposes of this Paragraph 8, the

“Relevant Percentage” in relation to a holder of the Non-Voting Preference Shares shall be equal to the

percentage of Equity Shares in the Company that the holder of such Non-Voting Preference Shares would

hold if such holder was to elect to convert its Non-Voting Preference Shares into Equity Shares based on the

then applicable Conversion Price. The obligation of the Shareholders to vote their Shares as aforesaid shall

be pro-rated in accordance with their inter se shareholding in the Company.

9. Amendment of Terms. Notwithstanding anything contained in these Articles, any amendment of the terms

of Series A1 CCPS set out in this Part A of Annexure B shall require the prior written consent of such

Persons holding at least 75% (Seventy Five percent) of the Series A1 CCPS. It is clarified that the issuance

of any Dilution Instruments by the Company which are of a different series or class but have rights pari passu

to the rights of the Series A1 CCPS shall not be considered as an amendment to the terms of issuance of the

Series A1 CCPS and the approval of the holders of the Series A1 CCPS will not be required, in accordance

with this paragraph, for such issuance or for undertaking any consequential amendments to the terms of the

Series A1 CCPS.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

PART B

BROAD BASED WEIGHTED AVERAGE VALUATION PROTECTION FOR SERIES A1 CCPS

1. Definitions

For the purposes of this Part B of Annexure B and unless the context requires a different meaning, the

following terms have the meanings indicated.

(a) "Issue Date" shall have the meaning ascribed to it in Paragraph 2(a)(ii) of this Part B of Annexure B.

(b) "Lowest Permissible Price" in relation to a Shareholder shall mean the lowest possible price at which a

Share may be issued to/acquired by such Shareholder in accordance with Applicable Law.

(c) "New Issue Price" shall have the meaning ascribed to it in Paragraph 2(a)(i) of this Part B of Annexure

B.

(d) "Series A1 Conversion Price" shall have the meaning set forth in Part A of Annexure B (Terms of

Issuance of Series A1 CCPS).

2. Non-Dilution Protection

(a) Issuance below Series A1 CCPS Conversion Price.

(i) New Issues. If the Company shall at any time or from time to time issue or sell any Dilution

Instruments at a price per Dilution Instrument that is less than the Series A1 Conversion Price (the

“New Issue Price”), other than (a) issue of ordinary Shares to employees, officers or consultants

of the Company pursuant to the ESOP Plan or any other employee incentive plan adopted by the

Board; (b) issue of Dilution Instruments where the anti-dilution right is waived by the relevant

Shareholder; (c) issuance of the Entitled Shares to Curefit then, the holders of Series A1 CCPS

shall be issued additional Equity Shares, when requested by the holder of the Series A1 CCPS, for

no consideration or at the lowest value permitted under Applicable Laws, the Conversion Price of

the Series A1 CCPS shall be adjusted as set out in Paragraph 2(a)(iii) of this Part B of Annexure

B (“Anti-Dilution Issuance”).

(ii) Timing for New Issues. Such Anti-Dilution Issuance shall be made whenever such Dilution

Instruments are issued in accordance with Paragraph 2(a)2(a)(i) of this Part B of Annexure B on

the date of such issuance (the "Issue Date"); provided, however, that the determination as to

whether an anti-dilution issuance is required to be made pursuant to this Paragraph 2(a) of this

Part B of Annexure B shall be made immediately or simultaneously upon the issuance of such

Dilution Instruments, and not upon the subsequent issuance of any security into which the Dilution

Instruments convert, exchange or may be exercised.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

(iii) Anti-Dilution Issuance. If an Anti-Dilution Issuance is to be undertaken pursuant to an occurrence

of any event described in Paragraph 2(a)2(a)(i) of this Part B of Annexure B, the Series A1

Conversion Price shall be adjusted in accordance with the following formula:

(Q1) + (Q2)

NCP = (P1) x

(Q1) + (R)

For the purposes of this Paragraph, “NCP” is the new Purchase Price;

“P1” is the Series A1 CCPS Conversion Price;

“Q1” means the number of Equity Shares Outstanding immediately prior to the new issue;

“Q2” means such number of Equity Shares that the aggregate consideration received by the

Company for such issuance would purchase at the Series A1 Conversion Price;

“R” means the number of Equity Shares issuable / issued upon conversion of the Dilution

Instruments being issued.

For purposes of this Condition, the term “Equity Shares Outstanding” shall mean the aggregate number

of Equity Shares of the Company then outstanding (assuming for this purpose the exercise and/or

conversion of all then-outstanding securities exercisable for and/or convertible into Equity Shares

(including without limitation the conversion of all Series A1 CCPS)), and all shares reserved under the

ESOP Plan.

3. Reorganization, Reclassification: In case of any reconstruction or consolidation of the Company or any

capital reorganization, reclassification or other change of outstanding Shares or if the Company declares a

distribution (other than dividend for cash) on its Equity Shares or the Company authorizes the granting to

the holders of its Equity Shares rights or warrants to subscribe for or purchase any Equity Shares of any

class or of any other rights or warrants; or upon occurrence of any other similar transaction (each, a

"Transaction"):

(i) then the Company shall mail to each holder of Series A1 CCPS at such holder's address as it appears

on the books of the Company, as promptly as possible but in any event at least 21 (Twenty One)

days prior to the applicable date hereinafter specified, a Notice stating the date on which a record

is to be taken for the purpose of such dividend, distribution or granting of rights or warrants or, if

a record is not to be taken, the date as of which the holders of Equity Shares of record to be entitled

to such dividend, distribution or granting of rights or warrants are to be determined.

Notwithstanding the foregoing, in the case of any event to which this Paragraph is applicable, the

Company shall also deliver the certificate described in Paragraph 33(ii) below to each holder of

Series A1 CCPS at least 21 (Twenty One) Business Days' prior to effecting such reorganization or

reclassification as aforesaid.

(ii) the Company shall execute and deliver to each holder of Series A1 CCPS at least 7 (Seven) days

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

prior to effecting such Transaction a certificate, signed by (i) the chief executive officer of the

Company and (ii) the chief financial officer of the Company, stating that the holder of each Series

A1 CCPS shall have the right to receive in such Transaction, in exchange for each such Equity

Share a security identical to (and not less favourable than) each such Equity Share and no less

favourable than any security offered to any other Shareholder for or in relation to that Transaction,

and provision shall be made therefor in the Shareholders Agreement, if any, relating to such

Transaction.

4. Mode of Giving Effect to Valuation Protection: In the event adjustment of the conversion ratio or

conversion price of the Series A1 CCPS in the manner detailed in Paragraph 2 above of this Part B of

Annexure B results in the Series A1 Conversion Price going below the minimum price permitted under

Applicable Law or if Series A1 CCPS have been converted into Equity Shares, then such holders of Equity

Shares (pursuant to conversion of Series A1 CCPS) shall, in lieu of adjustment to Series A1 CCPS

Conversion Price, have the option to require the Company to do any of the following (a) Transfer Founder

Equity Shares held by the Founder to holder of Series A1 CCPS at lowest price permissible under

Applicable Law; (b) buy back of Founder Equity Shares held by the Founder; (c) reduce the sale proceeds

receivable by the Founder (as a holder of Founder Equity Shares) as a result of Liquidation Event; (d) issue

of additional Shares to holder of Series A1 CCPS at the lowest permissible price; or (e) adjust the

Conversion Ratio of the Series A1 CCPS; or (f) take such measures as may be necessary to give effect to

the provisions of this Part B of Annexure B.

5. Compliance with and Effectiveness of this Part B of Annexure B

(a) Waiver. If a Shareholder (other than a holder of Series A1 CCPS) is entitled under any contract, requirement

of Applicable Law or otherwise to participate in relation to any issue of Shares to Holder of Series A1

CCPS under this Part B of Annexure B, then such Shareholder hereby waives all such rights and, to the

extent it cannot waive such rights it agrees and undertakes not to exercise them.

(b) Ensuring Economic Effect. If for any reason any part of this Part B of Annexure B is not fully effected

as a result of any change in Applicable Law (including a change in Applicable Law that affects the price at

which Holder of Series A1 CCPS may sell or be issued Shares) then each Shareholder and the Company

shall each use its best efforts to take all such actions (by corporate, director or shareholder action) as may

be necessary to provide to Holder of Series A1 CCPS the same economic benefits as are contemplated by

this Part B of Annexure B.

(c) Change in Applicable Law. If there is a change in any Applicable Law that makes it possible to implement

any part of this Part B of Annexure B so as to confer the economic benefits on Holder of Series A1 CCPS

that are contemplated by this Part B of Annexure B in a more effective manner then each Shareholder and

the Company shall co-operate and use its best efforts to implement this Part B of Annexure B in that more

effective manner.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

(d) Currency Exchange. If in calculating a price or any other amount under this Part B of Annexure B the

relevant variables for that calculation are expressed in different currencies then all such variables for the

purposes of that calculation shall be converted to INR.

CUREFOODS INDIA PRIVATE LIMITED

Corporate office: Sparkplug Coworks,42,2nd Floor,100 Feet Rd, Koramangala 4th Block, Bengaluru, Karnataka 560034

Registered Office: No.72/4, Roopena Agrahara, Hosur Road, Madiwala Post, Bangalore, Karnataka, India, 560068

Website: www.eatfit.in , Email: contact@eatfit.in, Ph: +91 8951393420

CIN: U55209KA2020PTC139614

You might also like

- Cfi Fmva Exam Questions and AnswersDocument77 pagesCfi Fmva Exam Questions and AnswerssalaanNo ratings yet

- CMA+Part+2+Formula+Guide+ +CMA+Exam+AcademyDocument57 pagesCMA+Part+2+Formula+Guide+ +CMA+Exam+AcademyMonica D’SilvaNo ratings yet

- Term Sheet Mezzanine DebtDocument9 pagesTerm Sheet Mezzanine Debtbuckybad2No ratings yet

- Vendors 2Document100 pagesVendors 2anjum100% (1)

- Corporate Finance Math SheetDocument19 pagesCorporate Finance Math Sheetmweaveruga100% (3)

- Hal Nasik Division Registered Vendor List SL NoDocument26 pagesHal Nasik Division Registered Vendor List SL NoDelta PayNo ratings yet

- Names of Industries in Pakistan PDFDocument3 pagesNames of Industries in Pakistan PDFIlyas Faiz100% (2)

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg LagartejaNo ratings yet

- Curefoods - CTC Resolution and Explanatory Statement PDFDocument27 pagesCurefoods - CTC Resolution and Explanatory Statement PDFAbhishekShubhamGabrielNo ratings yet

- Non Banking Financial CompaniesDocument5 pagesNon Banking Financial Companiespramodh2704No ratings yet

- Curefoods Board CTC Allotment of CCPS PDFDocument18 pagesCurefoods Board CTC Allotment of CCPS PDFAbhishekShubhamGabrielNo ratings yet

- Top 250 Public-Sector CompaniesDocument12 pagesTop 250 Public-Sector Companieskief01No ratings yet

- ISO 9001:2015, ISO 14001:2015 & ISO 45001:2018: JSW Steel LimitedDocument2 pagesISO 9001:2015, ISO 14001:2015 & ISO 45001:2018: JSW Steel Limitedmuhammad nuh harahapNo ratings yet

- ISO Certifying AgencyDocument11 pagesISO Certifying Agencynishan2503No ratings yet

- SataDocument8 pagesSataYogesh ChhaprooNo ratings yet

- ECIL Vendor List Part 4Document11 pagesECIL Vendor List Part 4Kanika DasNo ratings yet

- Bis Data 3Document165 pagesBis Data 3pratikNo ratings yet

- Companies (Acceptance of Deposits) Rules, 2014 Amended To Provide Relaxation of Acceptance of Deposits by Start-UpsDocument2 pagesCompanies (Acceptance of Deposits) Rules, 2014 Amended To Provide Relaxation of Acceptance of Deposits by Start-UpsRishabh Sen GuptaNo ratings yet

- Amal+Sricity+ OragadamDocument20 pagesAmal+Sricity+ OragadamVinodh0% (1)

- Survey On Industry and Technologies For Water and WastewaterDocument160 pagesSurvey On Industry and Technologies For Water and WastewaterMERINNo ratings yet

- ANNEXURESDocument8 pagesANNEXURESfinancialbondingNo ratings yet

- BBR India - Credentials - BuildingsDocument52 pagesBBR India - Credentials - BuildingsrahulNo ratings yet

- FinTech Data 1Document52 pagesFinTech Data 1Aprajita KansaraNo ratings yet

- Curefoods Board CTC Rukam Fund Rectification PDFDocument2 pagesCurefoods Board CTC Rukam Fund Rectification PDFAbhishekShubhamGabrielNo ratings yet

- 20161021113545PC_LIST_BFILDocument1 page20161021113545PC_LIST_BFILmajhibenu6No ratings yet

- BAL MO Kerala/PUR/34107: Purchase OrderDocument7 pagesBAL MO Kerala/PUR/34107: Purchase OrderSanjeev KumarNo ratings yet

- AdBlue Players in IndiaDocument1 pageAdBlue Players in IndiaRajendranNo ratings yet

- BBTC 2022Document296 pagesBBTC 2022siva kNo ratings yet

- Reg30 Award13122019 PDFDocument1 pageReg30 Award13122019 PDFTesthdjNo ratings yet

- S Poddar and Co ProfileDocument35 pagesS Poddar and Co ProfileasassasaaNo ratings yet

- List of Construction Companies in Bangalore COMPLETEDDocument8 pagesList of Construction Companies in Bangalore COMPLETEDSachin GoyalNo ratings yet

- Book 1Document6 pagesBook 1saravanan.govindNo ratings yet

- PumpsDocument17 pagesPumpscecertificateqvc1No ratings yet

- Annual Report Final March 2009Document192 pagesAnnual Report Final March 2009townmakerNo ratings yet

- Details of CompaniesDocument12 pagesDetails of CompaniesPranav Dagar0% (1)

- Container OfficeDocument8 pagesContainer Officevanchi254870No ratings yet

- Absolute Infotech PVT LTD: S.No. Company Address 1545, 1st Cross, 10th Main 1Document36 pagesAbsolute Infotech PVT LTD: S.No. Company Address 1545, 1st Cross, 10th Main 1FPeria SolutionsNo ratings yet

- Alok Industries Full Annual Report-FY2018-19Document244 pagesAlok Industries Full Annual Report-FY2018-19Kshitij SrivastavaNo ratings yet

- Marketing Data Final ListDocument37 pagesMarketing Data Final ListYashwanthNo ratings yet

- Marketing Data Final ListDocument55 pagesMarketing Data Final ListYashwanthNo ratings yet

- New Association List1Document2 pagesNew Association List1Kpraveen Kumarkpk02No ratings yet

- NBFCsandARCsCancelled23012023Document160 pagesNBFCsandARCsCancelled23012023Praveen JangraNo ratings yet

- HAL Mission Combat System Research Design CentreDocument4 pagesHAL Mission Combat System Research Design CentrewinmanjuNo ratings yet

- Florida Electrical Industries Limited: Instrument Amount Rating Action As On September 2016Document3 pagesFlorida Electrical Industries Limited: Instrument Amount Rating Action As On September 2016Anonymous bdUhUNm7JNo ratings yet

- Fintech Data 1 PDF FreeDocument51 pagesFintech Data 1 PDF Freeaarizk1124No ratings yet

- S No Company Name AddressDocument63 pagesS No Company Name AddressTruck Trailer & Tyre ExpoNo ratings yet

- Membership Form IPPLDocument2 pagesMembership Form IPPLGaurav PawarNo ratings yet

- Dear Sir/ Madam,: Limit of Rs. 715 CroreDocument1 pageDear Sir/ Madam,: Limit of Rs. 715 CroredNo ratings yet

- UntitledDocument6 pagesUntitledProjectinsightNo ratings yet

- Epack Durable Limited: Esha GuptaDocument3 pagesEpack Durable Limited: Esha GuptaSumitNo ratings yet

- Client List - STP O&M - Ms - Eco Green - Jan 2021Document3 pagesClient List - STP O&M - Ms - Eco Green - Jan 2021Kasiv72No ratings yet

- Tec Previous ExperianceDocument1 pageTec Previous ExperiancesaadNo ratings yet

- Hindalco Production & Operations DepartmentDocument7 pagesHindalco Production & Operations DepartmentJaydeep SolankiNo ratings yet

- Fdocuments - in - Total FMCG DatabaseDocument443 pagesFdocuments - in - Total FMCG DatabaseAmit DesaiNo ratings yet

- DeputyNodalOfficersList 22102021Document21 pagesDeputyNodalOfficersList 22102021Nidhi ShahNo ratings yet

- Nabard Members List PDFDocument412 pagesNabard Members List PDFSanket AiyaNo ratings yet

- NCC Corp BrochureDocument32 pagesNCC Corp BrochurebalajisuraksNo ratings yet

- Ayk Company ProfileDocument14 pagesAyk Company Profileamadtalal29No ratings yet

- TIMETECHNO 14102022141151 UpdateDocument1 pageTIMETECHNO 14102022141151 Updatejameelk786No ratings yet

- Acceptance Agents - India - Internal Revenue ServiceDocument3 pagesAcceptance Agents - India - Internal Revenue Serviceusataxconsultant14No ratings yet

- Top NBFCDocument3 pagesTop NBFCshaanNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Potential Exports and Nontariff Barriers to Trade: Sri Lanka National StudyFrom EverandPotential Exports and Nontariff Barriers to Trade: Sri Lanka National StudyNo ratings yet

- 1 - Curefoods - EGM Notice - October 9, 2021 PDFDocument9 pages1 - Curefoods - EGM Notice - October 9, 2021 PDFAbhishekShubhamGabrielNo ratings yet

- 2 - Curefoods - Members CTC PDFDocument4 pages2 - Curefoods - Members CTC PDFAbhishekShubhamGabrielNo ratings yet

- Curefoods Board CTC Rukam Fund Rectification PDFDocument2 pagesCurefoods Board CTC Rukam Fund Rectification PDFAbhishekShubhamGabrielNo ratings yet

- 6.shorter Consent Notice - EGM - Ankit NagoriDocument1 page6.shorter Consent Notice - EGM - Ankit NagoriAbhishekShubhamGabrielNo ratings yet

- 3 - Curefoods - MOA - Altered - October 9, 2021 PDFDocument4 pages3 - Curefoods - MOA - Altered - October 9, 2021 PDFAbhishekShubhamGabrielNo ratings yet

- Curefoods - CTC Resolution and Explanatory Statement PDFDocument27 pagesCurefoods - CTC Resolution and Explanatory Statement PDFAbhishekShubhamGabrielNo ratings yet

- Curefoods Board CTC Allotment of CCPS PDFDocument18 pagesCurefoods Board CTC Allotment of CCPS PDFAbhishekShubhamGabrielNo ratings yet

- Consent For Shorter Notice - Ankit Nagori PDFDocument1 pageConsent For Shorter Notice - Ankit Nagori PDFAbhishekShubhamGabrielNo ratings yet

- Consent For Shorter Notice - Umayorubhagan Gokulkandhi PDFDocument1 pageConsent For Shorter Notice - Umayorubhagan Gokulkandhi PDFAbhishekShubhamGabrielNo ratings yet

- Form No. Adt-3: Notice of Resignation by The AuditorDocument2 pagesForm No. Adt-3: Notice of Resignation by The AuditorAbhishekShubhamGabrielNo ratings yet

- ST - John's Water ConservationDocument19 pagesST - John's Water ConservationAbhishekShubhamGabrielNo ratings yet

- Kerrisdale Capital Prime Office REIT AG ReportDocument19 pagesKerrisdale Capital Prime Office REIT AG ReportCanadianValueNo ratings yet

- Retained Earnings: Appropriation May Be A Result ofDocument5 pagesRetained Earnings: Appropriation May Be A Result ofLane HerreraNo ratings yet

- Mintpond Consulting: Enerkem IncDocument41 pagesMintpond Consulting: Enerkem IncmothermonkNo ratings yet

- Negotiating A Venture Capital Term SheetDocument2 pagesNegotiating A Venture Capital Term SheetmikeslackenernyNo ratings yet

- Cap Table Cheat SheetDocument5 pagesCap Table Cheat SheetNasrul SalmanNo ratings yet

- FM3.3 - CS &div PolicyDocument21 pagesFM3.3 - CS &div PolicyAbdulraqeeb AlareqiNo ratings yet

- Earnings Per Share (Loi Nhuan Tren CP)Document34 pagesEarnings Per Share (Loi Nhuan Tren CP)Chi HoàngNo ratings yet

- Company AnalysisDocument11 pagesCompany AnalysisRamesh Chandra DasNo ratings yet

- Sec Form 12-1 Registration Statement With Prospectus PDFDocument53 pagesSec Form 12-1 Registration Statement With Prospectus PDFIrwin Ariel D. MielNo ratings yet

- Sample Series A TermsheetDocument13 pagesSample Series A TermsheetAnonymous 4rMVkArNo ratings yet

- Unit VI Takeover Code and DefensesDocument36 pagesUnit VI Takeover Code and Defensesravi kumarNo ratings yet

- 50 13 Pasting in Excel Full Model After HHDocument64 pages50 13 Pasting in Excel Full Model After HHcfang_2005No ratings yet

- Week 4 - ch16Document52 pagesWeek 4 - ch16bafsvideo4No ratings yet

- Ross 7 e CH 24Document26 pagesRoss 7 e CH 24Zainul KismanNo ratings yet

- 6932 - Diluted Earnings Per ShareDocument3 pages6932 - Diluted Earnings Per ShareJennifer Ruelo100% (1)

- Draft Term Sheet - RajulDocument8 pagesDraft Term Sheet - RajuljdfscgfmbxNo ratings yet

- Hom WworkDocument29 pagesHom WworkAshish BhallaNo ratings yet

- FRFSA Final Theory Suggestion With Answer For 2024Document35 pagesFRFSA Final Theory Suggestion With Answer For 2024subhagoswami100No ratings yet

- Analyzing Financing Activities: ReviewDocument64 pagesAnalyzing Financing Activities: ReviewNisaNo ratings yet

- Solutions (Chapter14)Document7 pagesSolutions (Chapter14)Engr Fizza AkbarNo ratings yet

- Ranbaxy Laboratories LTD.: Accounting For Managers ProjectDocument7 pagesRanbaxy Laboratories LTD.: Accounting For Managers ProjectAnmol SinghviNo ratings yet

- Diluted EPS SolutionDocument2 pagesDiluted EPS SolutiontaliaferomwasNo ratings yet

- Theory of Accounts-ReviewerDocument27 pagesTheory of Accounts-ReviewerJeane BongalanNo ratings yet

- Diluted Earnings Per ShareDocument2 pagesDiluted Earnings Per ShareGletzmar IgcasamaNo ratings yet

- Ordinary Share CapitalDocument7 pagesOrdinary Share CapitalKenneth RonoNo ratings yet